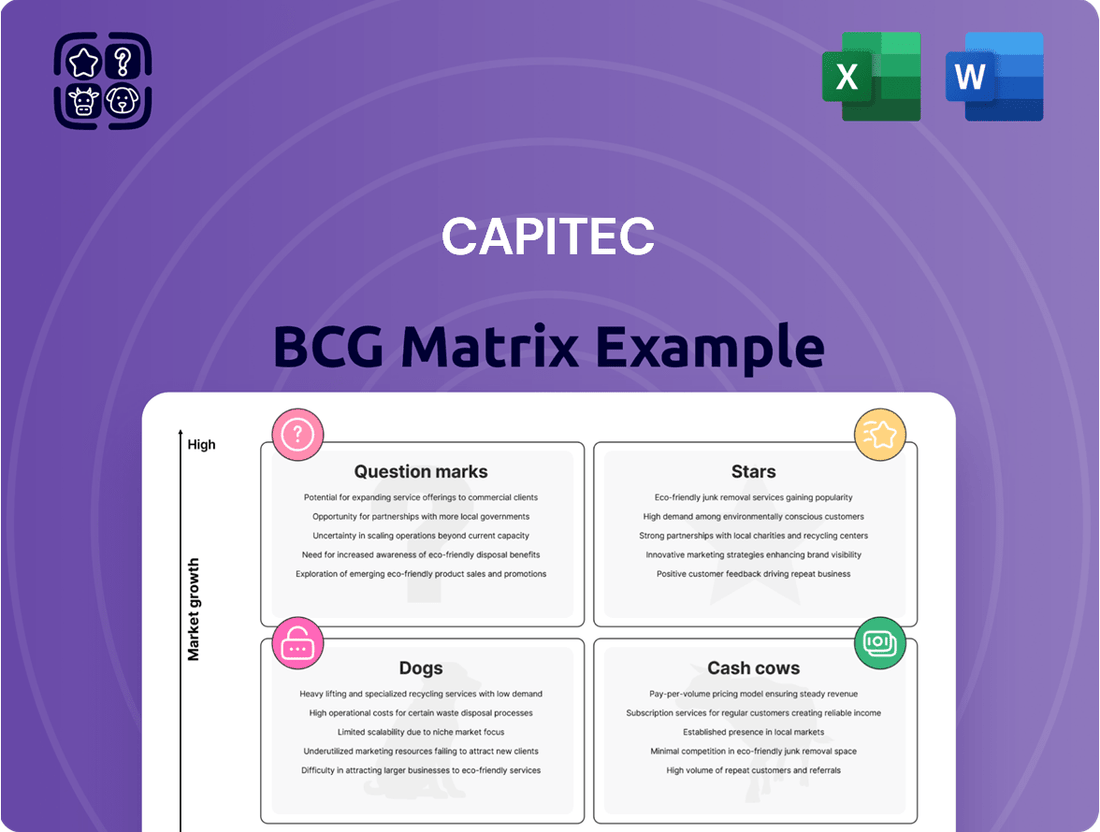

CAPITEC Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CAPITEC Bundle

Curious about Capitec's strategic product positioning? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, offering vital clues to their market performance.

Unlock the full potential of this analysis by purchasing the complete Capitec BCG Matrix report. Gain a comprehensive understanding of each product's quadrant placement, backed by data-driven insights and actionable strategic recommendations to guide your investment decisions.

Don't miss out on the complete picture; secure your copy today and equip yourself with the knowledge to navigate Capitec's market landscape with confidence.

Stars

Capitec's digital banking platform and its popular app are undoubtedly its stars. They show both a strong hold on the market and impressive growth. By February 2025, the number of active banking app users jumped by 15%, reaching 12.9 million. This means more than half of Capitec's entire customer base is now using the app.

This high level of digital engagement firmly places Capitec at the forefront of digital banking in South Africa. The bank has seen substantial increases in digital and card payment volumes. In fact, by February 2025, these digital transactions made up a massive 90% of all transaction volumes, underscoring the success of their digital strategy.

Capitec's Value-Added Services (VAS), encompassing offerings like prepaid vouchers and bill payments, are demonstrating robust expansion. These services, alongside Capitec Connect, saw their net income jump by an impressive 61% to R4.4 billion in the fiscal year concluding February 2025.

The widespread adoption of the Capitec app for these VAS is a key indicator of their success. With over 11 million clients actively using the app for these transactions, Capitec has firmly established a substantial and expanding market presence in this area.

Capitec Connect, the bank's mobile virtual network operator (MVNO), is a shining star in the portfolio. Its active SIM subscriber base surged by an impressive 74%, reaching 1.6 million by February 2025. This rapid expansion translated into a substantial net income contribution of R193 million.

The MVNO's success is further underscored by its significant market penetration, capturing over 40% of South Africa's airtime and data transactions. This demonstrates Capitec Connect's ability to thrive and gain market share within the dynamic and high-growth telecommunications sector.

Credit Card Offerings

Capitec's credit card offerings are experiencing robust expansion. By February 2024, the bank saw a significant 28% rise in its credit card customer base. This growth is further fueled by strategic adjustments to credit approval processes, which have broadened access for key customer segments.

The bank's proactive approach to credit lending has yielded impressive results. By February 2025, overall loan disbursements surged by 28%. This aggressive market penetration, combined with rising consumer demand for credit facilities, firmly establishes credit cards as a star performer within Capitec's product portfolio, actively capturing increased market share.

- Credit Card Growth: 28% increase in credit cards by February 2024.

- Loan Disbursement Surge: 28% increase in overall loan disbursements by February 2025.

- Strategic Easing: Eased credit-granting criteria for specific client segments.

- Market Position: Credit cards are a high-growth product actively gaining market share.

Higher Income Client Segment Penetration

Capitec is seeing significant success in attracting clients with higher incomes. By February 2024, the bank reported a 17% increase in clients with monthly inflows exceeding R15,000. This demonstrates a strong penetration into a segment that offers substantial growth potential.

This expansion into a more affluent client base is driven by Capitec's evolving product suite. The bank's competitive offerings, including credit cards, fixed-term savings accounts, and advanced digital payment solutions, are resonating well with this demographic. These products are key to capturing market share beyond Capitec's historically more mass-market appeal.

- Increased High-Income Client Acquisition: 17% growth in clients with R15,000+ monthly inflows by Feb 2024.

- Product Appeal to Affluent Segment: Credit cards, fixed-term savings, and digital payments attract higher-income earners.

- Market Share Expansion: Capitec is successfully broadening its reach beyond its traditional customer base.

- Growth Opportunity: This segment represents a key area for future revenue and market share gains.

Capitec's digital offerings, particularly its banking app, are significant stars. The app boasts 12.9 million active users as of February 2025, representing over half of its customer base, and digital transactions now account for 90% of all volumes.

Capitec Connect, its MVNO, is another star, with a 74% surge in active SIM subscribers to 1.6 million by February 2025, capturing over 40% of South Africa's airtime and data transactions.

The bank's credit card portfolio is also a star, showing a 28% increase in customers by February 2024 and contributing to a 28% rise in overall loan disbursements by February 2025.

Furthermore, Capitec is successfully attracting higher-income clients, with a 17% growth in those earning over R15,000 monthly by February 2024, indicating strong performance in a lucrative segment.

| Product/Service | Key Performance Indicator | Data Point (as of Feb 2025 unless stated) | Growth/Performance |

|---|---|---|---|

| Digital Banking App | Active Users | 12.9 million | 15% increase |

| Digital Transactions | % of Total Volumes | 90% | Significant increase |

| Capitec Connect (MVNO) | Active SIM Subscribers | 1.6 million | 74% increase |

| Credit Cards | Customer Base Growth | 28% increase (as of Feb 2024) | Strong expansion |

| Overall Loan Disbursements | Growth | 28% increase | Aggressive market penetration |

| High-Income Clients | Growth (R15k+ monthly inflow) | 17% increase (as of Feb 2024) | Successful segment penetration |

What is included in the product

This analysis highlights Capitec's strategic positioning of its offerings within the BCG Matrix, identifying growth opportunities and areas for resource allocation.

The CAPITEC BCG Matrix offers a clear, quadrant-based overview of business units, alleviating the pain of strategic uncertainty.

Cash Cows

Capitec's core retail transactional accounts are undeniably its cash cow. With an impressive 24.1 million active clients as of February 2025, making it South Africa's largest retail bank by client numbers, this segment generates consistent net transaction and commission income through its simplified and affordable banking offerings.

This business unit thrives in a mature market, yet Capitec maintains a dominant, high-market-share position. This stability ensures a reliable and substantial cash flow, underscoring its role as a foundational element of the bank's success.

Capitec's basic savings and deposit products, the bedrock of its funding strategy, saw a healthy 6% expansion, reaching R156 billion by February 2024. This growth, while perhaps not as explosive as some newer digital ventures, highlights the enduring strength of its core offerings.

These foundational products, encompassing both retail deposits and wholesale funding, tap into Capitec's extensive client network, ensuring a reliable and substantial funding base. They are crucial for generating consistent net interest income, underscoring the bank's significant penetration in a well-established savings market.

Capitec's established funeral plan offerings represent a classic cash cow within its business portfolio. By August 2024, this segment impressively covered 13.6 million lives with active policies, demonstrating a strong and mature market penetration.

This mature business line consistently fuels the bank's financial performance, evident in its net insurance result. For the period ending August 2024, this result saw a healthy 14% growth, reaching R727 million, underscoring its reliable income-generating capacity.

The substantial customer base and consistent revenue streams firmly position Capitec's funeral insurance as a stable cash cow, providing dependable financial contributions to the bank.

Widespread Branch Network Services

Capitec's extensive branch network, numbering 880 locations as of early 2024, continues to be a cornerstone of its operations, even with a significant digital transformation underway. This physical footprint is crucial for serving its substantial existing client base, fostering loyalty and driving consistent transactional activity.

These branches are vital for maintaining client retention and supporting a broad range of banking services, contributing significantly to Capitec's overall market share in a mature banking environment. While growth in this segment might be more moderate, the network provides a stable and reliable channel for service delivery.

- Extensive Physical Footprint: 880 branches across South Africa as of early 2024.

- Client Base Support: Serves a large, established client base for diverse banking needs.

- Transactional Volume Driver: Contributes significantly to overall transaction volumes.

- Market Share Stabilizer: Acts as a high-market-share channel in a mature banking sector, ensuring client retention.

Debit Order Services

Debit order services are a cornerstone of Capitec's operations, deeply embedded in their client's daily financial management. These services are a significant driver of consistent fee income, reflecting Capitec's strategy of high-volume, low-margin transactions within a well-established market.

The enduring appeal of Capitec's debit order services lies in their user-friendliness and cost-effectiveness. This simplicity translates into sustained high adoption rates among their broad customer base, ensuring a reliable and steady stream of revenue.

- Consistent Fee Income: Debit orders contribute a predictable revenue stream through service fees.

- High Volume, Low Margin: Aligns with Capitec's core business model, leveraging scale.

- Mature Market Dominance: Reflects strong customer reliance in a stable segment.

- Customer Stickiness: Integral service fosters continued client engagement.

Capitec's core transactional accounts, serving over 24.1 million clients by February 2025, are a prime example of a cash cow. This segment generates consistent net transaction and commission income, benefiting from a dominant market share in a mature retail banking landscape.

The bank's basic savings and deposit products, which grew to R156 billion by February 2024, are also cash cows. They provide a stable funding base and contribute reliably to net interest income.

Capitec's funeral insurance, covering 13.6 million lives by August 2024, is another cash cow, delivering a consistent R727 million net insurance result in the same period.

Debit order services, integral to client financial management, generate steady fee income, exemplifying the high-volume, low-margin strategy that defines Capitec's cash cows.

| Business Segment | BCG Matrix Category | Key Metric (as of Feb 2025 unless stated) | Financial Contribution | Market Position |

|---|---|---|---|---|

| Retail Transactional Accounts | Cash Cow | 24.1 million active clients | Net Transaction & Commission Income | Dominant, High Market Share |

| Basic Savings & Deposits | Cash Cow | R156 billion (as of Feb 2024) | Net Interest Income | Stable, Significant Penetration |

| Funeral Insurance | Cash Cow | 13.6 million lives covered (as of Aug 2024) | R727 million net insurance result (as of Aug 2024) | Mature Market Penetration |

| Debit Order Services | Cash Cow | High Volume, Low Margin | Consistent Fee Income | Mature Market Dominance |

Delivered as Shown

CAPITEC BCG Matrix

The CAPITEC BCG Matrix document you are previewing is the complete, unwatermarked report you will receive immediately after your purchase. This strategic tool, designed for clarity and professional application, will be delivered in its final, ready-to-use format, enabling you to conduct in-depth analysis and make informed business decisions.

Dogs

Capitec's approach to high-risk unsecured personal loans, particularly in specific legacy segments, places them in the 'dog' category of the BCG matrix. These segments previously saw tightened credit criteria due to significant credit impairment charges, indicating past underperformance. For instance, in the fiscal year ending February 2024, Capitec reported a credit impairment charge increase, though the specific allocation to these legacy segments isn't detailed publicly, the overall trend highlights the risk associated with such portfolios.

While Capitec is now selectively easing some lending criteria, these particular legacy unsecured loan segments are likely to remain under strict management. This cautious approach is due to their continued exhibition of higher risk profiles and potentially lower returns when compared to the bank's more successful lending products. The focus here is on managing existing exposure rather than actively seeking growth, as these segments may consume valuable resources without generating substantial market share or profitability.

Traditional in-branch cash transactions represent a segment with relatively low growth for Capitec. By February 2025, cash volumes saw an increase of only 3%.

This growth rate is notably slower compared to the bank's digital and card payment channels, which experienced a surge of 18-47%. The diminished growth in cash transactions highlights a decreasing strategic importance and potentially lower efficiency in managing these operations as Capitec continues to heavily invest in its digital ecosystem.

Capitec's commitment to modernization is evident in its substantial investment of R6.3 billion since 2020, focused on upgrading IT infrastructure and cloud migration. This significant outlay aims to replace or enhance older systems, positioning the bank for future growth.

Any remaining outdated physical infrastructure or legacy IT systems within Capitec would likely be categorized as a low-growth asset. These older components typically demand higher maintenance expenditures and yield progressively lower returns, diverting valuable resources from more promising digital innovation efforts.

Niche, Undifferentiated Savings Products

Capitec's older, basic savings products might be considered niche and undifferentiated. While they serve a purpose, they may not be capturing significant new deposits or growing market share, especially as more competitive or specialized options emerge. These products could be essentially breaking even, not driving substantial growth for the bank.

- Market Share Stagnation: Some basic savings accounts may see minimal growth in market share, potentially indicating they are not keeping pace with evolving customer needs or competitor offerings.

- Low Growth Potential: These products might offer limited flexibility or returns, leading to slow deposit growth and a lack of significant contribution to Capitec's overall balance sheet expansion.

- Break-Even Contribution: The primary role of these offerings could be to retain existing, less active customers rather than actively attracting new capital, thus operating at a break-even point without substantial profitability.

Less Efficient Non-Digital Customer Service Channels

Capitec's strategic shift towards digital customer service has highlighted the declining efficiency of its traditional channels. By February 2024, a substantial 65% of client care interactions were managed through WhatsApp, demonstrating a clear preference and operational advantage for digital solutions.

This success means that older, less automated customer service methods, like traditional call centers for simple queries or in-branch support for routine tasks, are now seen as less efficient. These channels often require more resources for the value they deliver, especially when compared to the scalability and cost-effectiveness of digital platforms.

- Declining Growth: Less efficient channels are experiencing slower growth in client engagement.

- Resource Drain: These channels can consume disproportionate operational resources.

- Lower Value Interactions: They are less effective for high-value client acquisition or complex problem-solving.

- Digital Dominance: Capitec's 65% WhatsApp interaction rate by Feb 2024 underscores the shift.

Capitec's legacy unsecured personal loan segments, characterized by past credit impairments and tightened criteria, represent their 'dogs'. While selective easing of credit criteria is occurring, these specific portfolios are likely to remain under strict management due to their higher risk and lower potential returns. Traditional in-branch cash transactions also fall into this category, showing significantly slower growth compared to digital channels.

| Category | Description | Capitec Example | Growth | Market Share |

|---|---|---|---|---|

| Dogs | Low market share, low growth businesses. Often require cash to maintain their market share but generate little cash. | Legacy unsecured personal loans; Traditional in-branch cash transactions; Outdated IT infrastructure; Basic savings products; Less automated customer service channels. | Low (e.g., 3% for cash transactions FY24 vs. 18-47% for digital) | Stagnant or declining |

Question Marks

Capitec Business, rebranded in 2024, is making significant strides in the SME sector, a segment identified as a key growth area. This strategic focus is reflected in their client acquisition numbers, with active business clients seeing a substantial 30% increase by August 2024 and a further 15% rise to 218,207 by February 2025.

Although Capitec is experiencing rapid growth within the SME market, its overall market share in the wider business banking landscape remains modest compared to incumbent institutions. This necessitates ongoing, substantial investment to effectively penetrate the market and capture a larger share.

Capitec's acquisition of AvaFin, an online consumer lender with operations in several international markets, positions the company in high-growth global territories where its current market share is minimal. This strategic move into new geographies is characteristic of a Question Mark in the BCG Matrix, demanding significant investment to cultivate a stronger market position.

AvaFin’s performance is already showing promise, contributing R66 million in profit between May and August 2024. This early success highlights the potential for substantial returns, but also underscores the need for continued capital allocation to fuel further expansion and solidify market penetration in these developing international ventures.

Capitec's new life cover product, launched in June 2024, is positioned as a 'Question Mark' in the BCG Matrix. By August 2024, it had secured 38,526 active policies, generating R8 million in insurance revenue. This indicates strong initial uptake in a market with significant growth potential but currently a low market share.

Secured Home Loans

Capitec's strategic move into secured home loans signifies a bold expansion into a lucrative, albeit competitive, market. This initiative aims to tap into a significant segment of the financial services industry where the bank currently holds minimal presence. The introduction of these products in 2024 marks a pivotal moment for Capitec, potentially reshaping its product portfolio and customer base.

Entering the secured home loan market requires substantial capital outlay. Capitec anticipates significant investment in several key areas to ensure successful market penetration. This includes:

- Product Development: Creating robust and competitive home loan offerings tailored to market needs.

- Marketing and Sales: Building brand awareness and customer acquisition strategies for this new segment.

- Infrastructure and Risk Management: Establishing the necessary operational frameworks and risk controls for mortgage lending.

The South African mortgage market is substantial, with total mortgage advances reaching approximately R1.7 trillion by the end of 2023. Capitec's entry, while starting from a low base, positions it to capture a share of this high-value market, potentially diversifying its revenue streams beyond its traditional unsecured lending focus.

Stokvel Product

Capitec's new stokvel product is positioned as a question mark in the BCG matrix. While stokvels traditionally cater to a mass market, Capitec is seeing interest from more affluent segments, indicating potential for broader appeal.

This new offering targets the communal savings market, a significant but fragmented sector. The overall stokvel market in South Africa is substantial, with estimates suggesting it plays a vital role in household savings, but Capitec's current penetration in this specific niche is low, requiring significant investment to gain traction and grow its market share.

- Market Size: The stokvel market in South Africa is estimated to manage billions of Rands annually, providing substantial potential for financial institutions.

- Growth Potential: The increasing interest from diverse income segments suggests a high growth trajectory for a well-executed stokvel product.

- Current Share: Capitec's market share within the formal stokvel product sector is currently minimal, reflecting the need for strategic development and marketing.

- Investment Need: Significant investment in product development, marketing, and distribution is required to convert this question mark into a star.

Capitec's international expansion via AvaFin and its new life cover product are classic 'Question Marks.' These ventures are in high-growth markets or segments where Capitec's current market share is low, demanding substantial investment to build a strong position.

The secured home loan market and the new stokvel product also represent 'Question Marks.' While the overall market potential is significant, Capitec's entry is from a low base, necessitating considerable capital for product development, marketing, and operational setup.

These 'Question Marks' require careful management and strategic resource allocation. Success hinges on converting initial interest, like the 38,526 life cover policies secured by August 2024, into sustainable market leadership.

The R66 million profit contribution from AvaFin between May and August 2024 demonstrates early promise, but continued investment is crucial to capitalize on this potential and move these ventures towards becoming 'Stars' in Capitec's portfolio.

| Initiative | Market Characteristics | Capitec's Position | Investment Need | Potential |

|---|---|---|---|---|

| AvaFin (International Expansion) | High-growth global territories | Minimal current market share | Significant for market penetration | Substantial returns (e.g., R66m profit May-Aug 2024) |

| New Life Cover Product | High growth potential insurance market | Low current market share | Ongoing for growth | Strong initial uptake (38,526 policies by Aug 2024) |

| Secured Home Loans | Lucrative, competitive mortgage market (R1.7 trillion total advances end-2023) | Minimal presence | Substantial for product dev, marketing, infrastructure | Diversification into high-value market |

| New Stokvel Product | Significant, fragmented communal savings market | Minimal penetration in formal sector | Significant for product dev, marketing, distribution | Access to billions managed annually |

BCG Matrix Data Sources

Our CAPITEC BCG Matrix leverages a robust blend of internal financial statements, Capitec's annual reports, and publicly available market share data to accurately position each business unit.