CAPITEC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CAPITEC Bundle

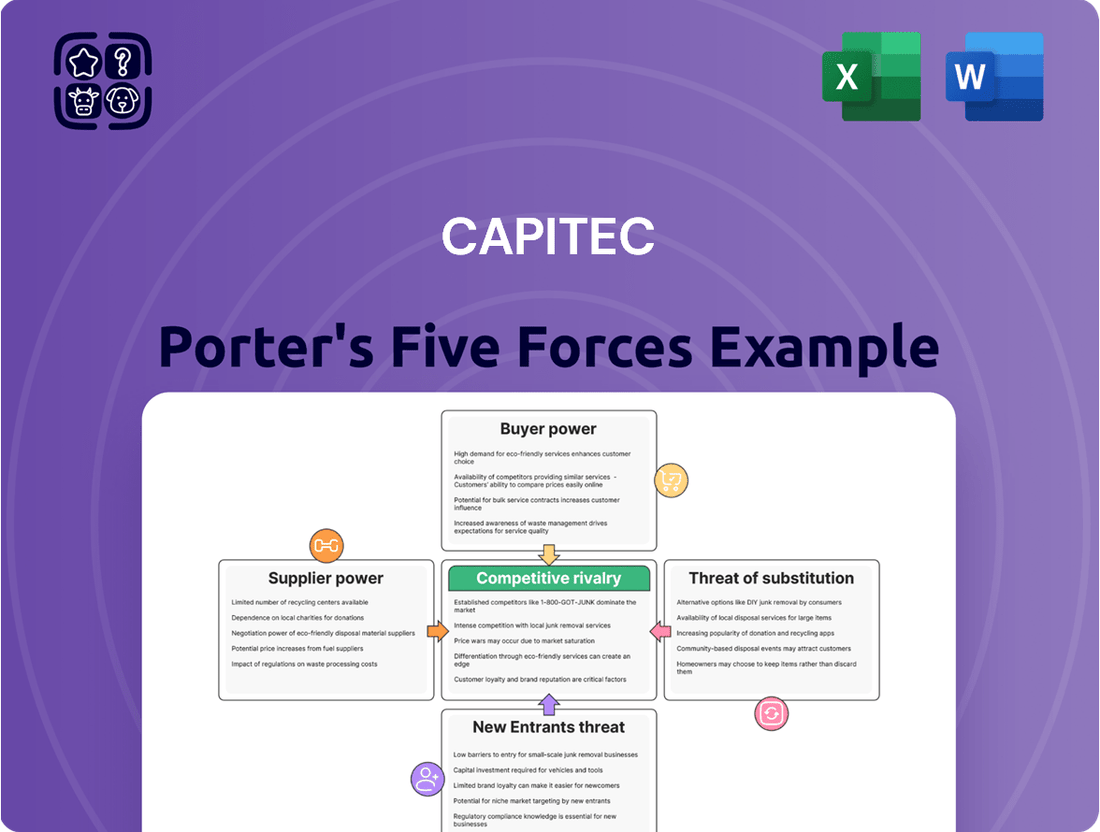

CAPITEC's competitive landscape is shaped by intense rivalry and the ever-present threat of new entrants, but their innovative digital model significantly mitigates these forces. Understanding the subtle influence of suppliers and the power of buyers is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore CAPITEC’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Capitec's significant reliance on technology, including its substantial investment in AWS Cloud services and various enterprise applications, grants considerable bargaining power to specialized software and cloud providers. These suppliers hold leverage, particularly concerning the mission-critical systems that underpin Capitec's digital-first banking model.

The introduction of the Joint Standard for IT Governance and Risk Management in November 2024 underscores this dependence. This new standard highlights the crucial role of third-party software and the inherent risks involved, likely boosting demand for providers offering compliant and secure technological solutions, thereby enhancing their bargaining position.

Capitec's R1.9 billion investment in IT during FY2024 highlights the crucial need for skilled IT talent. The demand for expertise in AI, machine learning, and cloud computing is particularly intense, creating a competitive landscape for acquiring these professionals.

This specialized IT talent can command premium salaries and benefits, directly impacting Capitec's operational expenditures. When the supply of such skills is constrained, or when competition for these individuals intensifies, the bargaining power of these suppliers increases significantly.

Financial infrastructure providers, like those offering core banking systems and payment gateways, hold significant bargaining power. Capitec relies heavily on these specialized services, and the cost and complexity of switching to a new provider can be substantial, especially given the critical nature of these operations. For instance, the South African Reserve Bank's ongoing focus on financial sector resilience, highlighted by the upcoming Cybersecurity and Cyber Resilience Requirements effective June 2025, further entrenches the need for dependable, albeit potentially costly, infrastructure partners.

Data and Analytics Service Providers

Capitec's extensive use of data, accumulating nearly 2 trillion data points, underscores the significant bargaining power of data and analytics service providers. These suppliers are crucial for the bank's ability to derive insights and develop innovative products. The bank's strategic move towards cloud-based data storage and its ambition to boost predictive and machine learning model utilization further amplify the importance of these specialized service providers.

The reliance on advanced analytics tools, robust data security, and expert knowledge means these suppliers can command higher prices or favorable terms. Capitec's commitment to expanding its data-driven capabilities, as evidenced by its ongoing investments in technology and talent, positions these providers as key strategic partners rather than mere vendors.

- Data Volume: Capitec processes close to 2 trillion data points, highlighting the scale of its data operations.

- Cloud Infrastructure: All of Capitec's data is stored in the cloud, increasing dependency on cloud service providers.

- AI/ML Focus: The bank intends to significantly increase its use of predictive and machine learning models, boosting demand for specialized analytics talent and tools.

Regulatory Compliance and Consulting Services

Capitec, like other South African banks, faces significant supplier power from regulatory compliance and consulting services. The banking sector is continuously shaped by evolving and stringent regulations, covering areas like IT governance, cybersecurity, and Environmental, Social, and Governance (ESG) standards. For instance, the ongoing amendments to banking regulations and the introduction of new acts, such as the Conduct of Financial Institutions (COFI) Bill, underscore the critical need for specialized expertise in navigating these complex frameworks.

This reliance on external knowledge makes regulatory compliance consultants a powerful supplier. Their insights are essential for banks like Capitec to ensure adherence to new standards, thereby mitigating risks and avoiding penalties. The dynamic nature of these regulations means that the demand for such specialized consulting remains consistently high, granting these service providers considerable influence over pricing and service delivery.

Furthermore, the need for specialized IT governance and cybersecurity consulting services is particularly pronounced. As cyber threats become more sophisticated, banks must invest heavily in robust security measures, often requiring external expertise to implement and manage these systems effectively. This dependence on specialized skills amplifies the bargaining power of these consulting firms.

The bargaining power of suppliers in this segment is further highlighted by the continuous need for adaptation. For example, the South African Reserve Bank (SARB) regularly updates its Prudential Standards, requiring banks to adjust their operational and compliance procedures. This creates a recurring demand for consulting services, solidifying the suppliers' influential position.

Capitec's significant reliance on specialized technology, including cloud services and enterprise applications, grants considerable bargaining power to these providers. The bank's R1.9 billion IT investment in FY2024 and its nearly 2 trillion data points processed highlight this dependence, particularly for mission-critical systems and advanced analytics.

The increasing demand for specialized IT talent, especially in AI and cloud computing, further amplifies the bargaining power of these skilled professionals and the firms that supply them. This intense competition for expertise means these suppliers can command premium terms.

Financial infrastructure providers, such as core banking system and payment gateway suppliers, also hold significant leverage due to the high cost and complexity of switching. This is amplified by regulatory pressures like the upcoming Cybersecurity and Cyber Resilience Requirements effective June 2025.

Moreover, regulatory compliance and consulting services represent a powerful supplier segment. Evolving regulations, like the COFI Bill, necessitate specialized expertise, granting consultants considerable influence over pricing and terms as banks like Capitec strive to maintain compliance and mitigate risks.

| Supplier Category | Key Dependence Factors | Impact on Capitec | Example Data/Fact |

|---|---|---|---|

| Technology Providers (Cloud, Software) | Digital-first model, mission-critical systems | High; limited switching options | R1.9 billion IT investment (FY2024) |

| Specialized IT Talent | AI, ML, Cloud expertise | Moderate to High; competitive market | Intense demand for AI/ML skills |

| Financial Infrastructure | Core banking, payment gateways | High; high switching costs | SARB's Cybersecurity Requirements (June 2025) |

| Regulatory Consulting | Compliance, IT governance, cybersecurity | High; evolving regulatory landscape | COFI Bill, SARB Prudential Standards |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to CAPITEC's unique position in the South African banking sector.

Instantly identify and address competitive threats by visualizing CAPITEC's market position across all five forces.

Customers Bargaining Power

Capitec's position as South Africa's largest retail bank, with 23 million active customers as of August 2024, grants it significant market reach. This vast customer base, exceeding a third of the nation's population, suggests broad appeal and a strong market presence.

While a large number of individual customers might dilute the bargaining power of any single client, the collective strength of Capitec's 23 million customers cannot be overlooked. Their aggregated sentiment and potential for coordinated switching behavior represent a considerable force that can influence the bank's strategies and offerings.

Capitec's foundation lies in its commitment to affordability, a strategy that resonated strongly with customers seeking lower banking fees compared to established institutions. This historical pricing advantage has cultivated a customer base that is highly attuned to cost, making competitive pricing a persistent driver for both attracting new clients and keeping existing ones. As of early 2024, Capitec continued to emphasize its low-fee structure, aiming to broaden its reach into previously underserved market segments by harmonizing its pricing across different banking offerings.

Capitec's customer base is increasingly digital, with its banking app boasting 12.4 million active users by August 2024. This digital-first approach means clients expect seamless, intuitive experiences and high-quality features.

While Capitec has a strong reputation for ease of use and clear communication about app updates, the widespread adoption of digital banking empowers customers. They can readily compare Capitec's offerings with those of competitors and switch if their demands for convenience and advanced functionality aren't consistently met.

Diversified Service Expectations

As Capitec expands its financial services, including credit cards and insurance, customers now expect a more integrated and personalized experience. This diversification means clients are looking for a one-stop shop for all their financial needs, increasing their leverage. If Capitec doesn't meet these evolving, broader demands, customers can easily switch providers for a more comprehensive offering.

Capitec's move into areas like business banking and value-added services such as Capitec Connect signals a shift in customer expectations. They are no longer content with just basic banking; they want a full spectrum of financial solutions from a single, trusted institution. This broadens the touchpoints and raises the stakes for customer satisfaction.

- Diversified Offerings: Capitec now provides credit cards, insurance, and business banking, moving beyond its traditional transactional accounts.

- Customer Expectations: Clients increasingly desire a holistic suite of financial products and integrated services from one provider.

- Increased Touchpoints: With more services offered, customers have more interactions with Capitec, amplifying their potential influence.

- Demand for Personalization: Customers expect tailored solutions across these diverse offerings, putting pressure on Capitec to deliver.

Ease of Switching Banks

The ease with which customers can switch banks significantly influences their bargaining power. While historically, switching banks in South Africa presented challenges, Capitec's success in attracting clients through its straightforward and transparent offerings highlights a shift. This ease of transition is further amplified by the emergence of digital-only banks and streamlined onboarding procedures, effectively reducing customer inertia.

In 2024, this trend continues to empower consumers. For instance, Capitec reported a substantial increase in client acquisitions, indicating that its value proposition is resonating with individuals seeking simpler banking solutions. This growing comfort with changing financial providers means customers can more readily seek out and demand better terms and services, putting pressure on established institutions.

- Customer Inertia Reduction: Digital platforms and simplified processes are making it easier than ever for South Africans to switch banking providers.

- Capitec's Success: Capitec's business model, focused on simplicity and transparency, has proven effective in attracting customers from traditional banks, demonstrating a willingness to switch.

- Digital Bank Growth: The proliferation of neobanks and mobile-first banking solutions further lowers switching costs and increases customer choice.

- Enhanced Customer Leverage: This increased ease of switching grants customers greater power to negotiate better rates, fees, and service levels from their chosen financial institutions.

Capitec's vast customer base, exceeding 23 million active users by August 2024, means individual bargaining power is diluted. However, the collective switching potential of this large group, coupled with Capitec's historical focus on affordability, creates a significant customer influence. As the bank expands its offerings, customers expect more, increasing their leverage if these broader needs aren't met.

The ease of switching banks in South Africa has increased, particularly with digital advancements, empowering customers to demand better terms. Capitec's own success in attracting clients through simplicity highlights this trend, as customers are more willing to move for improved value. This reduces customer inertia and amplifies their power to negotiate better services and pricing.

| Factor | Impact on Capitec | Customer Bargaining Power |

| Customer Base Size | 23 million active clients (Aug 2024) | Low individual power, high collective switching potential |

| Brand Loyalty Drivers | Affordability, ease of use | High sensitivity to price changes and service quality |

| Digital Adoption | 12.4 million active app users (Aug 2024) | Facilitates easy comparison and switching |

| Service Diversification | Credit cards, insurance, business banking | Increased expectations for integrated, personalized solutions |

| Switching Costs | Reduced due to digital platforms and Capitec's simple model | High, enabling customers to easily move for better offers |

Preview Before You Purchase

CAPITEC Porter's Five Forces Analysis

This preview showcases the complete CAPITEC Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the banking sector. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning.

Rivalry Among Competitors

South Africa's banking landscape is heavily influenced by the established 'Big Four' – Standard Bank, FNB, Absa, and Nedbank. These giants collectively manage billions in assets and possess a deeply entrenched market presence, creating a formidable competitive environment.

In response to Capitec's disruptive growth, these traditional banks have aggressively introduced their own budget-friendly accounts and poured resources into digital innovation. This strategic shift aims to recapture market share and cater to the digitally-savvy consumer base that Capitec has successfully attracted.

Capitec's impressive growth, even surpassing some incumbents in market capitalization and customer acquisition, has significantly heightened the competitive intensity. The rivalry now spans across diverse income segments, with all players vying for greater market share.

New digital-only banks are a significant competitive force. TymeBank, for example, saw impressive growth, onboarding over 1.2 million customers in the latter half of 2024, bringing its total to 10.7 million in South Africa. These agile, tech-focused players are attracting customers with innovative, often lower-cost offerings.

Capitec's move into business banking and insurance intensifies rivalry, as these sectors are already populated by established players. For instance, Capitec reported a 20% increase in its headline earnings for the six months ending August 2023, partly driven by growth in its credit and transaction solutions, indicating successful diversification efforts that directly challenge incumbents.

Major banks are not standing still; they are also expanding their offerings, particularly in areas like ESG-focused products and AI-driven customer service. This broadens the competitive landscape, meaning Capitec faces multi-pronged attacks from rivals who are simultaneously improving their core offerings and venturing into new growth areas.

Focus on Digital Experience and Innovation

Competitive rivalry in the banking sector is intensely focused on digital experience and innovation. Banks are locked in a battle to provide superior user interfaces, advanced functionalities, and effective customer communication through their digital platforms. This means the competition isn't just about offering accounts, but about crafting the most intuitive and feature-rich digital journey for customers.

While Capitec is widely acknowledged for its digital prowess, the competitive landscape includes formidable players. For instance, FNB and Nedbank consistently rank highly in digital satisfaction surveys, indicating their significant investments and success in this area. This constant push for digital advancement means banks must continually invest in technology and user experience to stay relevant and attract customers. The drive for seamless digital interactions is a key battleground, pushing all participants to innovate at a rapid pace.

- Digital Satisfaction Leaders: FNB and Nedbank are frequently cited as leaders in customer satisfaction with their digital banking platforms, challenging Capitec's dominance.

- Innovation Investment: The ongoing need to enhance digital offerings necessitates substantial and continuous investment in technology and user experience development across the industry.

- User Experience as a Differentiator: Banks are increasingly differentiating themselves not just on price or product, but on the quality and ease of use of their digital channels.

Regulatory Environment and Compliance Costs

The banking sector faces an increasingly stringent regulatory environment. New standards for IT governance, cybersecurity, and anti-money laundering, for instance, are continually being introduced, adding to the compliance burden for all financial institutions. Capitec, as an incumbent bank, must dedicate significant resources to staying abreast of these evolving requirements, which directly impacts its operational costs and ability to offer competitive pricing.

These mandated investments in compliance can affect profitability. For example, in 2024, South African banks, including Capitec, are expected to continue substantial spending on cybersecurity measures to meet global benchmarks and local regulations. This ongoing expenditure can limit the capital available for other strategic initiatives or price reductions.

- Increased IT Governance Spending: Banks are investing heavily in robust IT governance frameworks to ensure data integrity and operational resilience.

- Cybersecurity Investment: Cybersecurity remains a top priority, with significant budget allocation towards threat detection, prevention, and response systems.

- Anti-Money Laundering (AML) Compliance: Enhanced AML and Know Your Customer (KYC) protocols require ongoing system upgrades and personnel training.

- Regulatory Burden Disparity: The compliance costs can create an uneven playing field, as less-regulated fintech companies may not face the same level of expenditure.

The competitive rivalry within South Africa's banking sector is fierce, driven by both established giants and agile digital disruptors. Capitec faces intense pressure from the 'Big Four' banks (Standard Bank, FNB, Absa, Nedbank), who are actively enhancing their digital offerings and introducing budget-friendly products to counter Capitec's success. Furthermore, new digital-only banks like TymeBank are rapidly gaining traction, onboarding millions of customers with innovative, often lower-cost solutions, intensifying the battle for market share across all customer segments.

This heightened competition necessitates continuous investment in technology and user experience, with banks like FNB and Nedbank recognized for their strong digital satisfaction ratings. Capitec's expansion into business banking and insurance also escalates rivalry, directly challenging incumbents in these established markets. The industry's focus is sharply on digital innovation, making user experience a critical differentiator.

The regulatory environment adds another layer of complexity, requiring significant investment in IT governance, cybersecurity, and anti-money laundering compliance. These mandated expenditures can impact operational costs and pricing strategies, potentially creating an uneven playing field compared to less regulated fintech competitors.

SSubstitutes Threaten

Mobile money and digital payment platforms represent a significant threat of substitutes for traditional banking services, including those offered by Capitec. Services like M-Pesa in other African markets, and the growing array of digital wallets and payment apps globally, allow consumers to conduct financial transactions without needing a full bank account. These platforms offer convenience and accessibility, particularly for unbanked or underbanked populations.

Capitec has proactively addressed this threat by developing its own digital payment solutions, such as Capitec Pay, and embedding a range of value-added services within its mobile banking app. This strategy aims to retain customers by offering competitive and convenient digital alternatives. However, the broader ecosystem of mobile money and fintech payment providers continues to present a persistent challenge, as these platforms often cater to specific needs or offer lower transaction costs for certain services.

Specialized fintech firms are increasingly offering niche lending and savings products, such as peer-to-peer platforms and digital savings accounts. These alternatives can draw customers seeking tailored financial solutions away from traditional banking services. For instance, in 2023, the global fintech market size was valued at over $11.8 trillion, demonstrating the significant appeal of these specialized offerings.

The rise of cryptocurrencies and blockchain-based services presents a potential threat of substitutes for traditional banking. These decentralized platforms offer alternative avenues for value storage, fund transfers, and financial services, bypassing conventional institutions.

While cryptocurrencies are not legal tender in South Africa, their adoption as digital payment methods is growing. For instance, in 2024, the global cryptocurrency market capitalization fluctuated, demonstrating increasing investor interest despite inherent volatility.

This evolving digital financial landscape poses a long-term substitute threat. However, significant barriers such as regulatory ambiguity and price instability currently limit widespread adoption and impact their direct substitutability for core banking functions.

Informal Financial Channels

Informal financial channels, such as stokvels and peer-to-peer lending, continue to serve a segment of the population, particularly those who are unbanked or underbanked. These methods offer accessible alternatives to traditional banking, especially for individuals seeking quick, community-based financial solutions. Capitec's strategy of financial inclusion aims to draw these users into formal banking, but the persistent appeal of informal networks presents an ongoing competitive threat.

For instance, in South Africa, stokvels represent a significant informal financial sector, with estimates suggesting they manage billions of Rands annually. While Capitec actively works to onboard these participants, the ease and familiarity of informal arrangements mean they remain a viable substitute for a portion of the market. This highlights the need for Capitec to continually innovate its offerings to provide superior value compared to these established informal systems.

- Informal Lending Networks: These operate outside regulated financial institutions, offering loans often based on trust and community ties.

- Stokvels: Traditional savings clubs where members contribute regularly, with funds disbursed to members in rotation or for specific purposes, acting as a form of informal savings and investment.

- Cash-Based Transactions: For many, especially in lower-income segments, cash remains the primary medium of exchange, bypassing formal banking infrastructure entirely.

Value-Added Services from Non-Banking Entities

Telecommunication companies and even large retailers are increasingly stepping into the financial services arena, offering products that directly compete with traditional banking. Think of mobile virtual network operators (MVNOs) like Capitec Connect, which bundles data with financial services, or retailers providing in-store credit and payment solutions. These non-banking players can tap into their vast existing customer bases and established distribution channels, making it easier for consumers to access convenient alternatives for everyday financial needs.

This trend presents a significant threat of substitutes for banks like Capitec. For instance, in 2023, South Africa's mobile penetration rate stood at approximately 85%, indicating a massive potential customer base for telcos to onboard onto their financial offerings. Retailers, leveraging their physical presence and loyalty programs, can also offer attractive payment and credit options that bypass traditional banking channels, potentially eroding market share for core banking services.

The key advantage these substitutes possess is convenience and integration into existing customer journeys. For example:

- Mobile Wallets: Telcos are enhancing their mobile money platforms, offering P2P transfers, bill payments, and even micro-loans, directly competing with bank accounts and digital banking apps.

- Retail Credit: Major retailers often provide point-of-sale financing or store cards, allowing customers to make purchases on credit without needing a traditional bank loan or credit card.

- Bundled Services: The convergence of mobile data, entertainment, and financial services into single packages makes these offerings highly attractive, especially for younger demographics.

The threat of substitutes for Capitec is significant, driven by a diverse range of non-traditional financial service providers. Mobile money platforms and fintech solutions offer convenient, often lower-cost alternatives for payments and basic financial transactions, directly challenging core banking services. For example, the global fintech market's substantial valuation underscores the appeal of these specialized offerings.

Informal financial channels like stokvels and peer-to-peer lending also present a persistent substitute threat, particularly for unbanked or underbanked populations who value familiarity and accessibility. These systems manage substantial sums annually, indicating their continued relevance as alternatives to formal banking.

Furthermore, telecommunication companies and retailers are increasingly integrating financial services into their existing offerings, leveraging their vast customer bases and distribution networks. This convergence provides integrated convenience that can draw customers away from traditional banking models.

| Substitute Category | Examples | Key Advantages | Market Penetration Indicator (2023/2024) |

|---|---|---|---|

| Digital Payment Platforms | Mobile Wallets (e.g., Capitec Pay), Digital Payment Apps | Convenience, Accessibility, Lower Transaction Costs | Global Fintech Market: Over $11.8 Trillion (2023) |

| Informal Financial Channels | Stokvels, Peer-to-Peer Lending | Community Trust, Familiarity, Accessibility | Stokvels manage billions of Rands annually in South Africa |

| Non-Banking Financial Providers | Telcos' Mobile Money, Retailer Credit/Payment Solutions | Bundled Services, Integrated Customer Journeys, Existing Customer Base | South Africa Mobile Penetration: ~85% (2023) |

| Cryptocurrencies | Decentralized Digital Currencies | Alternative Value Storage, Decentralization | Global Crypto Market Cap Fluctuated (2024), showing increasing interest |

Entrants Threaten

The South African banking landscape presents a formidable challenge for new entrants due to significant capital and regulatory hurdles. Establishing a bank requires immense financial backing, and navigating the complex web of regulations set by the South African Reserve Bank (SARB) is a critical barrier.

New and evolving regulations, particularly those related to IT governance, cyber resilience, and robust capital adequacy frameworks like Basel III, further elevate the entry cost and compliance burden. For instance, the SARB's ongoing focus on strengthening financial sector resilience means substantial ongoing investment in technology and risk management systems.

These high upfront costs and the continuous need for sophisticated compliance infrastructure effectively deter many potential competitors from entering the market, thereby protecting established players like Capitec.

While Capitec has made strides in attracting customers, many South Africans remain loyal to traditional banks due to established relationships and the perceived effort involved in switching. Newcomers must overcome this inertia, which demands significant investment in marketing and a truly compelling offer to win over customers. For instance, in 2024, the South African banking sector saw continued customer acquisition efforts, but the ingrained habits of consumers present a persistent barrier for new entrants aiming to disrupt the market.

Capitec, like other established banks, leverages significant economies of scale. This means their per-unit costs for technology, operations, and marketing are lower due to their large customer base and transaction volumes. For instance, in 2023, Capitec reported over 21 million clients, a scale that allows for efficient distribution of fixed costs.

New entrants face a substantial hurdle in replicating these economies of scale. Building a comparable technological infrastructure, a widespread branch or ATM network, and a large customer base requires immense capital investment. This upfront cost makes it challenging for newcomers to match the pricing and service breadth that incumbents can offer.

Furthermore, incumbent banks benefit from strong network effects. Capitec's extensive ATM network and partnerships with merchants create a valuable ecosystem for its customers. New entrants must overcome the inertia of these established networks, as customers are often reluctant to switch if it means losing convenient access to cash or a wide range of payment options.

Rapid Innovation by Incumbents and Fintechs

The threat of new entrants in South Africa's banking sector is tempered by the rapid pace of innovation from established players and fintech firms. Both traditional banks and digital challengers are constantly enhancing their digital services, leveraging AI, and expanding their product suites. This necessitates substantial and continuous investment in technology and product development for any new player aiming to compete.

New entrants face the dual challenge of overcoming existing market entry barriers while simultaneously matching the accelerated innovation cycle. For instance, Capitec Bank, a significant player, consistently invests heavily in its IT infrastructure to support future growth and maintain its competitive edge. In 2023, Capitec reported a 10% increase in its IT expenditure, reflecting this commitment to staying ahead.

- Incumbent banks are investing in digital transformation: Traditional banks are allocating billions to upgrade their digital platforms and customer experiences.

- Fintechs are disrupting with niche offerings: Agile fintech startups are rapidly introducing specialized digital financial products, forcing incumbents to respond.

- High technology investment is a barrier: Keeping pace with advancements in AI, cybersecurity, and data analytics requires significant capital outlay, deterring many potential new entrants.

- Regulatory compliance adds complexity: Navigating South Africa's stringent banking regulations also presents a substantial hurdle for new market participants.

Targeted Market Entry by Niche Players

Even with significant barriers to entry in the banking sector, new players are finding ways to compete by focusing on specific, underserved customer groups or specialized services, often powered by innovative technology. Old Mutual's OM Bank, for instance, is making a strategic move to capture the upper mass market and lower affluent segments, directly challenging Capitec's established customer base.

This strategy of targeted market entry allows these new competitors to build a presence and gain traction by offering tailored solutions to specific needs that might be overlooked by larger, more generalized institutions. This approach intensifies the competitive landscape, particularly within these identified niche areas.

- Targeted Market Entry: Niche players are entering by focusing on specific customer segments or services.

- Technological Leverage: New entrants frequently utilize technology to gain a competitive edge.

- Example: Old Mutual's OM Bank: This entity is specifically targeting Capitec's core market, aiming for the upper mass and lower affluent customer segments.

- Impact: Increased Competition: Such focused strategies allow new entrants to establish a foothold, thereby raising the overall threat of new competition in particular banking areas.

The threat of new entrants in South Africa's banking sector, while generally low due to substantial capital requirements and stringent regulatory hurdles, is evolving. New players must overcome significant upfront investments in technology, compliance, and customer acquisition to challenge established players like Capitec, which benefits from economies of scale and network effects. For instance, in 2024, the ongoing digital transformation across the industry means any newcomer must possess advanced technological capabilities from the outset.

While traditional barriers remain, innovative fintechs and strategically focused entities, such as Old Mutual's OM Bank targeting Capitec's customer base, are emerging. These entrants leverage technology and niche strategies to carve out market share, increasing competitive pressure in specific segments.

The high cost of regulatory compliance, including evolving frameworks like Basel III, coupled with the need for continuous technological investment to match incumbents' digital offerings, acts as a significant deterrent. Capitec's reported 10% increase in IT expenditure in 2023 highlights the substantial ongoing investment required to maintain competitiveness.

New entrants face the challenge of attracting customers away from established relationships and overcoming inertia, necessitating substantial marketing investment and compelling value propositions. Despite these challenges, the dynamic nature of the financial services landscape means that innovative, well-capitalized entrants can still pose a threat.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Capitec is built upon a foundation of publicly available financial statements, investor relations disclosures, and reputable industry research reports. We also incorporate data from macroeconomic indicators and regulatory filings to provide a comprehensive view of the competitive landscape.