CAPITEC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CAPITEC Bundle

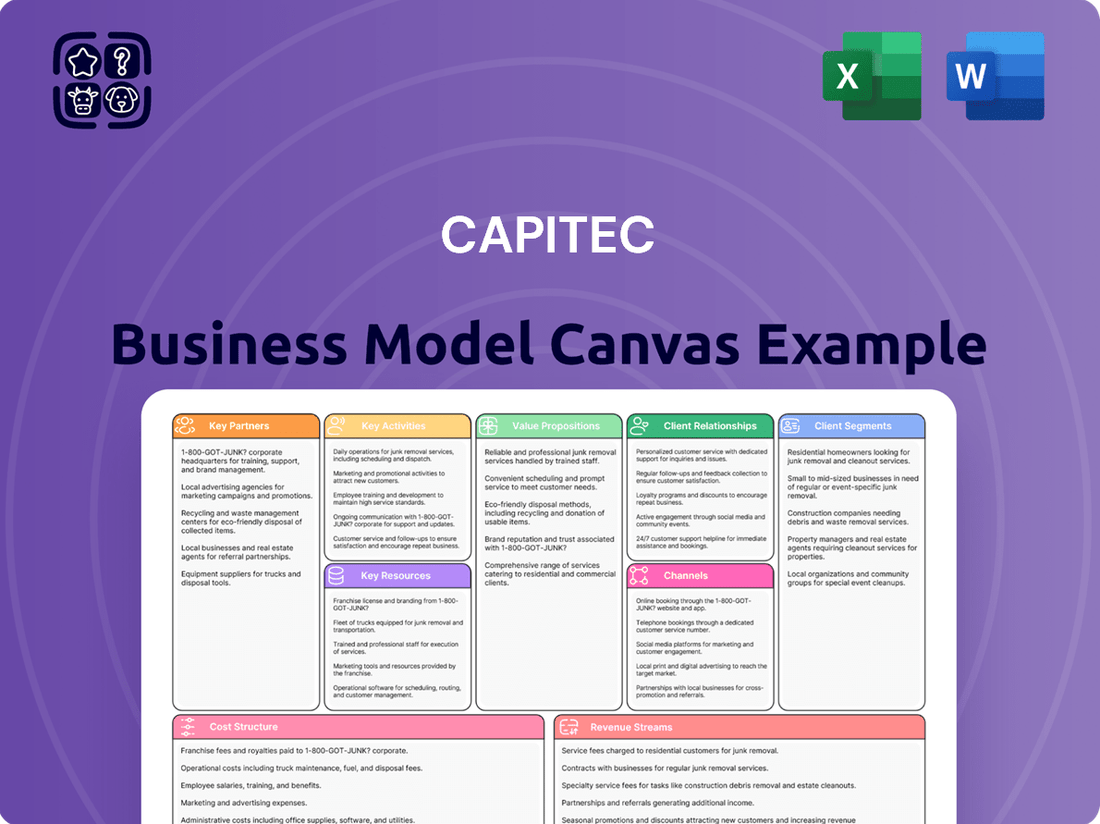

Unlock the strategic DNA of CAPITEC's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer-centric approach, innovative value propositions, and efficient cost structure, offering invaluable insights for your own business ventures. Discover how CAPITEC dominates the market and gain a competitive edge by downloading the full, actionable blueprint today.

Partnerships

Capitec’s strategic alliances with technology providers are foundational to its operational excellence and digital innovation. Collaborations with firms like Cisco are instrumental in fortifying its digital infrastructure and optimizing network performance across its extensive branch network, a critical element in serving its vast customer base and advancing financial inclusion. In 2024, Capitec continued to invest heavily in cloud migration, leveraging services from providers such as Amazon Web Services (AWS), underscoring a commitment to scalable and secure data management.

The bank also relies on robust platforms from industry leaders like Salesforce, SAP, and Microsoft for its core banking systems and customer relationship management. These partnerships are not merely transactional; they are integral to Capitec's overarching digital-first strategy, enabling the continuous refinement of its innovative offerings and ensuring the delivery of frictionless, user-friendly banking experiences for its millions of clients.

Capitec's strategic alliances with other financial institutions and major payment networks are foundational to its operational efficiency and customer reach. These partnerships are critical for enabling seamless interbank transactions and supporting a wide array of card services, including integration with mobile payment platforms like Apple Pay, Google Pay, and Samsung Pay. This ensures Capitec clients enjoy broad transaction capabilities.

Further expanding its payment ecosystem, Capitec collaborates with entities to offer innovative solutions such as PayShap, a real-time payment system launched in South Africa in 2023. This move enhances transaction speed and accessibility for users. Additionally, the bank's partnership with HPS is a key initiative aimed at consolidating and modernizing its payment processing infrastructure, a crucial step in maintaining a competitive edge in the digital financial landscape.

Capitec collaborates with a wide array of retailers and service providers, embedding essential everyday transactions directly into its banking app. This includes facilitating purchases of prepaid electricity, airtime, and data, alongside services like vehicle license renewals. This approach makes banking a seamless part of daily routines, encouraging greater digital engagement and opening up new revenue avenues for the bank.

These partnerships are crucial for Capitec's strategy of offering integrated financial solutions. For instance, in 2024, Capitec continued to expand its reach by enabling customers to access a variety of digital services through its platform, enhancing customer stickiness and transaction volumes. This integration not only benefits customers by offering convenience but also strengthens Capitec's position as a central hub for their financial and transactional needs.

Insurance Underwriters/Reinsurers

Capitec's insurance arm, Capitec Ins and Capitec Life, relies heavily on partnerships with insurance underwriters and reinsurers. These relationships are crucial for managing the inherent risks associated with providing life and funeral cover to a broad customer base. By engaging reinsurers, Capitec can offload a portion of its risk, ensuring the long-term solvency and scalability of its insurance products.

These strategic alliances allow Capitec to offer competitive and accessible insurance solutions, enhancing its value proposition to millions of clients. For instance, in 2024, Capitec continued to leverage these partnerships to underwrite a significant volume of policies, demonstrating the critical role reinsurers play in their operational model. This allows them to maintain robust capital reserves while expanding their market reach.

- Risk Management: Reinsurers absorb a portion of the claims risk, protecting Capitec's balance sheet from large, unexpected payouts.

- Scalability: Partnerships enable Capitec to underwrite more policies than its own capital might otherwise permit, facilitating growth.

- Product Development: Reinsurers often provide expertise that aids in the development of new and improved insurance products.

- Financial Stability: By sharing risk, these partnerships ensure the continued financial health and stability of Capitec's insurance offerings.

International Online Lending Groups

Capitec's strategic expansion into international online lending is exemplified by its increased ownership in AvaFin, a significant player in the consumer online lending space. This move diversifies Capitec's revenue streams beyond its domestic market, tapping into new customer segments and geographical regions.

This partnership allows Capitec to leverage its established expertise in the lending sector within these foreign markets. By integrating AvaFin’s operations, Capitec aims to enhance its global reach and contribute to a more robust and diversified financial ecosystem.

- International Expansion: Capitec increased its stake in AvaFin, an international online lending group, broadening its geographical presence.

- Diversified Income: This partnership is designed to create new income sources, reducing reliance on its core South African market.

- Leveraging Expertise: Capitec applies its lending experience to new markets through AvaFin, fostering growth and synergy.

Capitec's key partnerships are vital for its digital infrastructure, customer relationship management, and payment processing capabilities. Collaborations with tech giants like AWS, Salesforce, SAP, and Microsoft are foundational to its innovative digital-first strategy, ensuring seamless and user-friendly banking experiences. These alliances are critical for maintaining a competitive edge in the rapidly evolving digital financial landscape.

What is included in the product

This Business Model Canvas outlines Capitec's strategy of providing accessible and affordable banking to the mass market through a digital-first approach and a focus on customer experience.

It details Capitec's customer segments, value propositions, and channels, highlighting their competitive advantages in low-cost service delivery and innovative digital solutions.

The CAPITEC Business Model Canvas acts as a pain point reliever by visually mapping out how the bank addresses customer frustrations with traditional banking, such as high fees and complex processes.

It offers a clear, one-page snapshot of CAPITEC's strategy to overcome these banking pain points through accessible technology and transparent pricing.

Activities

Capitec’s core banking operations revolve around simplifying retail banking. This includes managing everyday transactional accounts, processing payments efficiently, and handling customer deposits and withdrawals with ease. The bank prioritizes making these essential services affordable and readily accessible to a wide range of customers.

The bank’s robust digital infrastructure is a key enabler, designed to handle a very high volume of transactions smoothly. In the financial year 2024, Capitec reported a significant increase in its digital transaction volumes, demonstrating the effectiveness of its streamlined core operations in serving its growing customer base.

Capitec's credit and lending activities are central to its business, offering a diverse portfolio of credit solutions. These include personal loans, access facilities, credit cards, and specialized lending for education, vehicles, and home improvements. This broad range aims to meet the varied financial needs of its client base.

The core of these operations involves rigorous risk assessment, efficient loan origination processes, and effective debt collection strategies. Capitec emphasizes responsible lending, ensuring that its credit products are offered in a sustainable manner. For instance, in the fiscal year ending February 2024, Capitec reported a net loan book growth of 10%, reflecting continued expansion in its lending operations.

Capitec's digital product development is a core activity, focusing on its app and Capitec Pay. This commitment to innovation is evident in their substantial investments in technology, aiming to streamline banking experiences for their clients.

In 2024, Capitec continued to prioritize these digital enhancements. The bank reported that its digital channels, particularly the Capitec App, are central to its growth strategy, with a significant portion of client interactions occurring through these platforms, reinforcing its position as a leading digital bank in South Africa.

Branch Network Management and Service Delivery

Capitec strategically manages its nationwide branch network, ensuring each location serves as a crucial customer interaction point. These branches are designed to handle customer onboarding, provide support for more complex banking transactions, and offer a human touch that complements their robust digital offerings. This approach allows Capitec to blend the convenience of digital banking with accessible, in-person service.

In 2024, Capitec continued to leverage its extensive branch footprint, which remains a cornerstone of its customer-centric strategy. While digital engagement is paramount, the physical presence of branches reinforces trust and accessibility, particularly for customers who prefer or require face-to-face assistance. This dual focus ensures a comprehensive banking experience that caters to a broad customer base.

- Branch Optimization: Capitec actively optimizes its branch network to ensure efficient operations and effective customer service delivery.

- Customer Touchpoints: Branches serve as vital touchpoints for onboarding new clients and addressing more intricate banking needs.

- Digital-Physical Integration: The network supports Capitec's strategy of seamlessly integrating digital banking with competitive branch-based service.

- Accessibility: In 2024, branches continued to provide essential accessibility for customers across South Africa, reinforcing the brand's commitment to convenience.

Insurance Product Sales and Management

Capitec actively engages in the sale and management of a range of insurance products, with a particular focus on funeral and life cover, operating under its own banking licenses. This comprehensive approach encompasses the entire product lifecycle, from initial development and underwriting to ongoing policy administration and efficient claims processing, all while adhering strictly to regulatory mandates.

The bank's insurance division represents a significant and expanding element of its diversified income streams. For instance, in the financial year 2024, Capitec reported that its insurance business contributed substantially to its overall earnings, demonstrating a clear upward trend in this segment's financial performance.

- Product Development: Capitec designs and refines insurance offerings to meet evolving customer needs.

- Policy Administration: Efficient systems manage policy details, renewals, and customer inquiries.

- Claims Processing: Streamlined processes ensure timely and fair settlement of insurance claims.

- Regulatory Compliance: Adherence to all relevant insurance and financial regulations is paramount.

Capitec's wholesale banking activities focus on providing financial services to businesses, including transaction accounts, lending, and payment solutions. These services are designed to support the operational and growth needs of various enterprises. The bank aims to be a reliable financial partner for its business clients.

In 2024, Capitec continued to expand its reach within the business sector, building on its established retail banking strengths. This expansion leverages the bank's efficient operational model and digital capabilities to serve a broader market. The bank reported growth in its business client base, indicating successful penetration into this segment.

| Activity | Description | 2024 Data/Impact |

|---|---|---|

| Business Accounts | Offering specialized transaction accounts for businesses. | Increased uptake of business transactional accounts, supporting operational cash flow for SMEs. |

| Business Lending | Providing credit facilities and loans to businesses. | Net loan book growth in the business segment, reflecting increased lending to support business expansion. |

| Payment Solutions | Facilitating business payments and collections. | Enhanced digital payment platforms for businesses, leading to more efficient transaction processing. |

Preview Before You Purchase

Business Model Canvas

The CAPITEC Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this exact document, allowing you to immediately leverage its insights for your business strategy.

Resources

Capitec's technology and digital infrastructure are foundational to its business model, featuring robust IT platforms and extensive use of cloud services, including Amazon Web Services (AWS). These capabilities are crucial for managing high transaction volumes and delivering a seamless digital experience to millions of clients.

Significant investments in re-platforming systems and cloud migration underscore Capitec's digital-first strategy. In 2024, the bank continued to prioritize enhancing its digital capabilities, which are essential for developing innovative products and maintaining operational efficiency.

The Capitec App, a central component of its digital infrastructure, facilitates a user-friendly banking experience. Its data analytics capabilities, powered by this advanced technology, allow for personalized services and effective risk management, supporting the bank's growth and client acquisition targets.

Capitec's human capital is a cornerstone of its business model, encompassing a diverse range of talent from banking professionals and IT specialists to data scientists and customer service staff. Their collective expertise is vital for the bank's innovation and its ability to deliver on its core value propositions of accessible and affordable banking.

The bank actively invests in its employees, recognizing that their skills and dedication are crucial for maintaining its competitive edge. This investment often translates into training and development programs designed to empower staff, particularly through the effective use of technology, ensuring they can meet evolving customer needs.

As of the financial year ending February 2024, Capitec reported having over 15,000 employees, a testament to the scale of its human resource operations. This workforce is instrumental in managing the bank's extensive customer base and its technologically driven service delivery, underpinning its success in the South African market.

Capitec's extensive customer data is a cornerstone of its business model. By processing trillions of data points, the bank gains deep insights into client behaviors and preferences. This allows them to proactively anticipate future needs and craft highly personalized financial products and services.

This data-driven strategy translates into tangible benefits for customers. Capitec uses this information to deliver tailored communication and identify 'next best actions' for clients, guiding them towards more effective financial management. For instance, in 2024, their focus on data analytics contributed to a significant increase in customer engagement with their digital platforms.

Brand Reputation and Trust

Capitec's brand reputation is a cornerstone of its business model, built on a foundation of simplicity, affordability, and transparency. This has cultivated a deeply loyal customer base, acting as a powerful magnet for new clients, especially within the mass market and, more recently, attracting individuals with higher income levels.

This strong trust translates directly into customer acquisition and retention, significantly reducing marketing costs. For instance, Capitec consistently reports high Net Promoter Scores (NPS), a testament to customer satisfaction and brand advocacy. In the fiscal year ending February 2024, Capitec reported a 15% increase in headline earnings per share, partly driven by its ability to attract and retain a growing client base, exceeding 22 million active clients by that time.

- Brand Strength: Capitec is recognized for its straightforward banking solutions, making financial services accessible to a broad audience.

- Customer Loyalty: The bank's commitment to transparency and low fees has fostered a strong sense of trust, leading to high customer retention rates.

- Market Attraction: This positive reputation is a key differentiator, enabling Capitec to effectively penetrate both mass-market and increasingly affluent customer segments.

- Financial Impact: The trust and loyalty built translate into consistent client growth and improved financial performance, as evidenced by its sustained earnings growth.

Physical Branch Network

Capitec's physical branch network, comprising over 880 locations throughout South Africa as of early 2024, serves as a crucial element in its business model. This extensive footprint ensures broad accessibility for clients, particularly for those who may not be fully comfortable with digital-only banking services.

These branches are instrumental in facilitating more complex financial transactions that might be challenging to execute solely through a mobile app or online platform. They also offer a vital touchpoint for personal interaction, fostering customer relationships and trust, which helps differentiate Capitec from many purely digital competitors.

- Extensive Reach: Over 880 branches across South Africa provide widespread accessibility.

- Complex Transactions: Branches support intricate financial dealings beyond basic digital capabilities.

- Personal Interaction: Offers a human element for customer support and relationship building.

Capitec's proprietary technology and digital infrastructure are its most critical resources, encompassing advanced IT platforms and extensive cloud services, notably AWS. These systems are engineered to handle massive transaction volumes efficiently, ensuring a seamless digital banking experience for its vast client base.

The bank's ongoing investment in re-platforming and cloud migration in 2024 highlights its commitment to a digital-first strategy. This technological backbone is essential for developing innovative financial products and maintaining operational excellence, supporting Capitec's competitive edge.

The Capitec App, central to its digital ecosystem, offers a user-friendly interface and leverages sophisticated data analytics. This enables personalized client services and robust risk management, directly contributing to the bank's sustained growth and client acquisition goals.

Value Propositions

Capitec’s core value proposition is offering banking that is refreshingly simple and affordable. They focus on clear, easy-to-understand products with transparent, low fees, making financial services accessible to a wide range of South Africans. This approach directly tackles the complexity and high costs often associated with traditional banking.

The success of this simplified model is evident in Capitec's customer growth. As of early 2024, Capitec reported serving over 22 million clients, a testament to how well their value proposition resonates with the market. Their flagship Global One account exemplifies this by consolidating savings, credit, and transaction facilities into a single, user-friendly platform.

Capitec's digital convenience is a cornerstone of its value proposition, driven by its highly utilized banking app. This app facilitates a seamless and secure digital banking experience for millions of users.

Innovative payment solutions, such as Capitec Pay, further enhance this digital offering. These solutions are designed for ease of use and security, reflecting the bank's commitment to modern financial transactions.

Features integrated directly into the app, like vehicle license renewals and international payments, underscore Capitec's focus on delivering significant convenience. By addressing these everyday needs digitally, Capitec caters directly to the evolving expectations of today's consumers.

Capitec's core value proposition is financial inclusivity, aiming to empower all South Africans with accessible banking and credit solutions. They offer a spectrum of products, from basic savings accounts to tailored credit options, specifically designed to assist individuals in managing their money and pursuing their financial aspirations, thereby promoting financial literacy across diverse income brackets.

In 2024, Capitec continued its mission to broaden financial access, reporting over 22 million clients. This extensive reach underscores their commitment to serving a wide demographic, including those previously underserved by traditional banking institutions. Their focus on simple, transparent pricing and user-friendly digital platforms further supports this goal of empowering individuals to take control of their financial well-being.

Diversified Financial Services Ecosystem

Capitec's value proposition extends well beyond standard banking by cultivating a broad financial services ecosystem. This approach aims to consolidate a client's financial life onto a single, user-friendly platform.

This diversification is evident in their expansion into areas like business banking, offering tailored solutions for entrepreneurs and SMEs. Furthermore, Capitec is actively building its presence in the insurance sector, providing clients with accessible protection options. For the fiscal year ending February 2024, Capitec reported a 22% increase in headline earnings per share, reaching 2,408 cents, underscoring the success of their diversified strategy.

A key element of this ecosystem is Capitec Connect, their mobile virtual network operator (MVNO) service. This venture taps into the everyday needs of their customer base, offering affordable mobile solutions. By integrating these varied services, Capitec seeks to create a sticky customer relationship, meeting a wider array of financial and lifestyle requirements.

- Expanded Service Offering: Includes business banking, insurance, and MVNO services (Capitec Connect).

- Integrated Platform: Enables clients to manage multiple financial needs within a single ecosystem.

- Customer Centricity: Focuses on providing comprehensive and accessible financial solutions.

- Growth Trajectory: Demonstrated by a 22% increase in headline earnings per share for FY24.

Personalized and Data-Driven Insights

Capitec's value proposition centers on delivering personalized and data-driven insights, a key component of its business model. By analyzing vast amounts of customer data, the bank offers tailored financial guidance and suggests actionable steps, often referred to as 'next best actions'. This proactive strategy empowers clients to make more informed financial choices.

This approach not only enhances customer financial well-being but also cultivates a stronger, more supportive relationship between Capitec and its clientele. For instance, Capitec's digital platform actively guides users, a strategy that contributed to their significant growth. In 2024, Capitec reported a substantial increase in active digital clients, demonstrating the effectiveness of these personalized digital interactions.

- Data Utilization: Extensive customer data is leveraged to generate unique financial advice.

- Proactive Guidance: 'Next best action' suggestions help clients improve their financial habits.

- Enhanced Decision-Making: Personalized insights lead to better financial outcomes for customers.

- Relationship Building: This supportive approach strengthens customer loyalty and trust.

Capitec's value proposition is built on simplicity, affordability, and accessibility, offering banking that is easy to understand and manage. This focus is supported by transparent, low fees and a user-friendly digital experience, primarily through its highly utilized app. As of early 2024, Capitec served over 22 million clients, highlighting the broad appeal of its straightforward approach to financial services.

Customer Relationships

Capitec's digital self-service model thrives on its user-friendly banking app, enabling customers to manage accounts, make payments, and access various services without human intervention. This digital-first approach empowers clients, reducing the need for traditional branch visits.

The bank actively engages customers through digital channels, notably WhatsApp, providing accessible support. In 2024, Capitec continued to leverage personalized communication, sending millions of targeted messages monthly to guide users, offer financial insights, and promote new features, thereby deepening customer loyalty and understanding.

Capitec excels by using its extensive customer data to provide personalized financial guidance. This includes offering tailored advice and suggesting 'next best actions' to help clients manage their money more effectively and boost their financial understanding.

In 2024, this data-driven strategy translated into proactive engagement, with Capitec reporting a significant increase in digital channel usage for personalized financial advice, indicating strong customer adoption of these tailored services.

Capitec strategically balances its digital-first approach with a robust physical presence. While digital channels handle the bulk of transactions, their extensive branch network, boasting over 1,100 branches as of early 2024, ensures customers have access to in-person support for complex needs like account opening or detailed product inquiries. This hybrid model caters to a broad customer base, acknowledging that some prefer face-to-face interaction for critical financial matters.

Community Engagement and Brand Loyalty

Capitec fosters deep customer loyalty through active community engagement and support for local initiatives. By sponsoring events like the Rocking the Daisies music festival, Capitec not only enhances its brand visibility but also cultivates a personal connection with its customer base, reinforcing its image as a community-oriented financial institution.

This strategy translates into tangible results, as evidenced by Capitec's consistent growth and strong customer retention. For instance, Capitec reported a significant increase in active clients, reaching over 22 million by the end of February 2024, underscoring the effectiveness of their relationship-building approach.

- Community Sponsorships: Supporting events like Rocking the Daisies strengthens brand affinity.

- Customer Growth: Over 22 million active clients by February 2024 highlights strong loyalty.

- Brand Perception: Personal connections foster a positive and relatable brand image.

- Loyalty Programs: Initiatives designed to reward and retain customers are key.

Transparent Communication

Capitec prioritizes crystal-clear communication about its offerings, including fees and services. This open approach fosters a strong sense of trust, empowering customers to manage their money with confidence. It directly reflects the bank's commitment to making banking simple and affordable for everyone.

This transparency is a cornerstone of their customer relationships, ensuring clients understand exactly what they are paying for and how their accounts work. For instance, in 2024, Capitec continued to highlight its fee structure, which often compares favorably to traditional banks, reinforcing this commitment to clarity.

- Clear Fee Structures: Capitec's fee disclosures are designed to be easily understood, avoiding hidden charges.

- Product Simplicity: The bank focuses on offering a limited range of core products, making them less confusing for customers.

- Customer Education: Through various channels, Capitec educates its clients on financial management and product benefits.

- Trust Building: Open communication about terms and conditions cultivates long-term customer loyalty and reduces potential disputes.

Capitec cultivates strong customer relationships through a blend of accessible digital tools and personalized support. Their user-friendly banking app and proactive communication via channels like WhatsApp in 2024 allow for efficient self-service and tailored financial guidance, fostering loyalty and understanding.

The bank's commitment to transparency, particularly regarding its clear fee structures, builds significant trust with its customer base. This open approach, coupled with a strong physical branch network for complex needs, ensures a comprehensive and supportive banking experience.

Community engagement through sponsorships further solidifies Capitec's brand perception, creating personal connections that resonate with clients. This multifaceted strategy has driven substantial customer growth, with over 22 million active clients by February 2024.

| Relationship Aspect | Key Initiatives | Impact (as of early 2024) |

|---|---|---|

| Digital Engagement | User-friendly banking app, WhatsApp support | Millions of targeted messages sent monthly for guidance and feature promotion. |

| Personalization | Data-driven financial advice, 'next best actions' | Significant increase in digital channel usage for personalized advice. |

| Physical Presence | Over 1,100 branches | Provides in-person support for complex needs, complementing digital services. |

| Community Connection | Event sponsorships (e.g., Rocking the Daisies) | Enhanced brand visibility and fostered personal connections. |

| Transparency | Clear fee structures, simple product offerings | Cultivates trust and empowers customers in financial management. |

Channels

The Capitec App acts as the core digital gateway, facilitating everything from everyday transactions and payments to accessing a range of value-added services and engaging with the bank. This app is the engine of Capitec's digital-first approach, evidenced by its millions of daily logins.

Capitec's nationwide branch network is a cornerstone of its accessibility strategy, with over 1,000 branches across South Africa as of early 2024. These physical locations offer vital services like cash withdrawals, deposits, and personalized assistance, catering to customers who prefer or require in-person interactions. This network is particularly important for financial inclusion, reaching a broad demographic.

ATMs and self-service terminals are crucial touchpoints for Capitec clients, offering 24/7 access to essential banking functions like cash withdrawals and deposits. This channel significantly enhances convenience, allowing customers to manage their finances outside of traditional banking hours and reducing reliance on physical branches. In 2024, Capitec reported a substantial number of transactions processed through its extensive ATM network, underscoring its importance in the customer experience and operational efficiency.

Digital Payment Solutions (Capitec Pay, Apple Pay, Google Pay)

Capitec actively integrates digital payment solutions, including its own Capitec Pay, alongside popular mobile wallets like Apple Pay and Google Pay. This multi-channel approach enhances transaction convenience and security for its customer base, promoting cashless commerce.

These digital payment channels are crucial for Capitec's customer value proposition, offering seamless and secure ways for clients to conduct financial transactions. By supporting platforms like Apple Pay and Google Pay, Capitec expands its reach and caters to evolving consumer preferences for mobile-first banking.

- Capitec Pay: Proprietary digital payment solution.

- Mobile Wallet Integration: Supports Apple Pay, Google Pay, and Samsung Pay.

- Transaction Facilitation: Enables secure and convenient cashless payments.

- Market Adoption: Digital payments continue to grow, with South Africa seeing significant uptake in mobile payment solutions. For instance, by the end of 2023, mobile payment transactions in South Africa were projected to reach substantial figures, indicating a strong shift towards digital.

Partnership Networks and Merchant Terminals

Capitec leverages strategic partnerships with retailers and other businesses to expand its service accessibility. These collaborations allow Capitec clients to perform essential transactions like prepaid electricity and airtime purchases directly at merchant locations. This network also facilitates seamless card payments, broadening the utility of Capitec's offerings.

A key component of Capitec's business banking strategy involves equipping merchants with advanced point-of-sale (POS) solutions. These smart card machines are crucial for enabling secure and efficient transaction processing, thereby supporting the growth of small and medium-sized enterprises (SMEs).

- Merchant Terminal Deployment: Capitec aims to increase its merchant terminal footprint, facilitating wider acceptance of its payment solutions.

- Partnership Growth: The bank actively seeks new retail and business partnerships to enhance service delivery and customer convenience.

- Transaction Volume: In 2024, Capitec reported a significant increase in digital transactions processed through its merchant channels, reflecting the success of its terminal strategy.

Capitec's channels are a blend of digital and physical touchpoints designed for broad accessibility and convenience. The Capitec App serves as the primary digital hub, handling millions of daily transactions and offering a full suite of banking services. Complementing this, a network of over 1,000 branches across South Africa provides essential in-person support, particularly for cash services and personalized assistance. ATMs and self-service terminals offer 24/7 access to core banking functions, enhancing customer flexibility and reducing branch dependency. Strategic partnerships with retailers and the deployment of POS terminals further extend Capitec's reach, enabling everyday transactions like airtime purchases and facilitating seamless card payments for a growing number of businesses.

| Channel | Description | Key Features/Data (as of early 2024) |

|---|---|---|

| Capitec App | Core digital banking platform | Millions of daily logins, comprehensive transaction and service access |

| Branch Network | Physical banking locations | Over 1,000 branches nationwide, offering cash services and personal assistance |

| ATMs & Self-Service Terminals | 24/7 access points | Facilitates cash withdrawals and deposits, enhancing customer convenience |

| Digital Payments (Capitec Pay, Mobile Wallets) | Contactless and online payment solutions | Supports Apple Pay, Google Pay, Samsung Pay; growing adoption in South Africa |

| Retail Partnerships & POS Terminals | Extended service points and merchant solutions | Enables prepaid purchases, facilitates card payments, supports SMEs with POS devices |

Customer Segments

Capitec Bank's mass market segment encompasses the vast majority of South Africans, irrespective of their income bracket. This focus on broad accessibility is a cornerstone of their strategy, aiming to bring affordable and user-friendly banking to nearly everyone. In 2024, Capitec continued to solidify its position by serving millions of South Africans, demonstrating its commitment to this expansive customer base.

A significant and growing portion of Capitec's clientele are digitally savvy individuals who primarily interact with the bank through the Capitec App and other online platforms. These clients prioritize the ease and speed of digital banking, seeking out innovative solutions and seamless online experiences.

Capitec has witnessed substantial growth in its app user base, with the Capitec App boasting over 10 million active users by the end of 2023. This digital engagement highlights the segment's preference for self-service banking, demonstrating a clear demand for efficient digital channels to manage their finances.

Capitec is actively broadening its appeal to higher-income clients, a segment traditionally served by established private banks. This is evidenced by their competitive product offerings, such as credit cards that eliminate foreign currency conversion fees, a significant draw for internationally mobile individuals.

Furthermore, Capitec's attractive interest rates on fixed-term savings accounts are compelling even for those with substantial assets. In 2024, Capitec reported a notable increase in its affluent customer base, with a 15% year-on-year growth in clients earning over R30,000 per month.

Small and Medium Enterprises (SMEs)

Capitec Business, following its rebranding from Mercantile Bank, is making a significant push to serve Small and Medium Enterprises (SMEs). This segment is crucial, and Capitec is focusing on digitally-driven, personalized banking experiences. They aim to provide solutions that are both accessible and cost-effective for these businesses.

The bank is rolling out a suite of offerings specifically designed for SMEs. These include competitive pricing structures, robust online banking platforms for seamless transactions, and credit products that are tailored to the unique needs and growth stages of smaller businesses. This strategic shift acknowledges the vital role SMEs play in the economy.

- Digitally-led Solutions: Capitec emphasizes its online banking capabilities, offering features like real-time transaction monitoring and easy payment processing.

- Relationship-Based Approach: Despite the digital focus, Capitec aims to foster strong relationships, offering dedicated support to help SMEs navigate their financial needs.

- Tailored Credit Products: Understanding that SMEs often require flexible financing, Capitec is developing credit solutions that adapt to their specific cash flow and expansion plans.

- Competitive Pricing: Capitec is known for its transparent and often lower fee structures, which is a significant draw for cost-conscious SMEs.

Clients Seeking Value-Added Services

This customer segment actively leverages Capitec’s broader ecosystem, moving beyond core banking to embrace services like Capitec Connect, their mobile virtual network operator (MVNO) offering. These clients are looking for convenience and integration, using the app for everything from managing their mobile data to paying for essential services.

They appreciate the bundled value, seeing Capitec as a one-stop shop for financial and everyday needs. For instance, in 2024, Capitec reported significant uptake in its non-banking services, with millions of clients utilizing features like prepaid electricity purchases and vehicle license renewals directly through the app, demonstrating a clear demand for these integrated solutions.

- Integrated Convenience: Clients value the ability to manage multiple aspects of their lives through a single platform.

- Beyond Traditional Banking: This group actively seeks and utilizes services like MVNO offerings and insurance.

- Digital Engagement: They are digitally savvy and prefer app-based solutions for efficiency and ease of use.

- Cost-Conscious Value Seekers: While seeking value, they are also mindful of costs, appreciating competitive pricing on bundled services.

Capitec's customer segments are diverse, ranging from the mass market to digitally adept individuals and increasingly, affluent clients and SMEs. Their strategy centers on providing accessible, affordable, and user-friendly banking solutions across these groups. By 2024, Capitec had cemented its position as a leading bank in South Africa, serving millions of clients through a combination of digital innovation and broad market reach.

| Customer Segment | Key Characteristics | 2024 Insights/Data |

|---|---|---|

| Mass Market | Broad accessibility, affordability, user-friendliness | Continued to serve millions of South Africans, reinforcing its core strategy. |

| Digitally Savvy | App and online platform users, prioritize speed and ease | Over 10 million active app users by end of 2023, indicating strong digital engagement. |

| Affluent Clients | Higher income, seek competitive offerings and international benefits | Reported 15% year-on-year growth in clients earning over R30,000 per month. |

| Small and Medium Enterprises (SMEs) | Digitally-driven, personalized banking, tailored credit products | Significant push with rebranding of Mercantile Bank, focusing on digital solutions and competitive pricing for businesses. |

| Ecosystem Users | Leverage broader services like MVNO (Capitec Connect) | Millions of clients utilized non-banking services like prepaid electricity and license renewals via the app in 2024. |

Cost Structure

Capitec's cost structure heavily features significant expenditure on its technology and digital infrastructure. This encompasses the ongoing development, maintenance, and crucial upgrades of its core IT platforms, cloud services, and its highly popular banking application.

These investments are substantial, covering essential activities like re-platforming existing systems, managing complex data migration processes, and actively exploring cutting-edge technologies such as generative artificial intelligence to enhance customer experience and operational efficiency.

In recent years, Capitec has demonstrably committed billions of South African Rand to bolster its IT and technology capabilities, underscoring its strategic focus on digital innovation as a key driver of its business model and competitive advantage.

Staff and personnel costs are a significant expense for Capitec, primarily driven by employee salaries, benefits, and ongoing training. These costs are particularly elevated for crucial IT and customer service departments, reflecting the bank's commitment to digital innovation and client support.

In 2024, Capitec continued its strategic expansion of its workforce, with a notable emphasis on bolstering its digital capabilities. This investment in human capital is essential for maintaining its competitive edge in the rapidly evolving fintech landscape.

Capitec's extensive branch network, while crucial for customer accessibility, represents a significant operational cost. In 2024, expenses associated with rent, utilities, and the upkeep of these physical locations continue to be a major factor in their cost structure, even as digital channels grow.

Maintaining this footprint involves substantial outlays for security personnel and equipment to ensure customer safety and asset protection at each branch. Furthermore, staffing costs for branch employees, including tellers, customer service representatives, and managers, contribute directly to the operational expenses of this segment.

Marketing and Customer Acquisition

Capitec's marketing and customer acquisition costs are significant, focusing on broad reach and digital engagement. These expenses cover everything from advertising campaigns to building brand loyalty among their diverse customer base.

In 2024, Capitec continued its investment in digital channels, recognizing their efficiency in reaching a wide audience. This includes spending on social media, search engine marketing, and targeted online advertising to attract new clients and retain existing ones.

- Digital Marketing: Significant allocation towards online advertising, social media campaigns, and content creation to drive customer acquisition and engagement.

- Brand Building: Investments in brand awareness initiatives and sponsorships to enhance market presence and customer trust.

- Community Engagement: Costs associated with programs and initiatives aimed at building relationships and fostering loyalty within various customer segments.

- Customer Retention: Expenditure on loyalty programs and personalized communication strategies to minimize churn and maximize customer lifetime value.

Regulatory Compliance and Risk Management

Adhering to stringent banking regulations and managing inherent risks are significant cost drivers for Capitec. These expenses cover investments in robust systems, ongoing training, and specialized personnel to ensure compliance with financial laws and mitigate potential losses. For instance, in 2024, the banking sector globally saw increased spending on compliance technology, with projections indicating continued growth as regulatory landscapes evolve.

Key cost components within this category include:

- Regulatory Compliance: Costs associated with meeting requirements from bodies like the South African Reserve Bank (SARB), including capital adequacy ratios and reporting obligations.

- Credit Risk Management: Expenses for credit scoring models, provisioning for bad debts, and collections processes. In 2023, South African banks generally reported stable but closely monitored non-performing loan ratios, reflecting ongoing management efforts.

- Data Security and Cybersecurity: Investments in protecting customer data and digital infrastructure against cyber threats, a growing concern across the financial industry. This includes advanced firewalls, encryption, and regular security audits.

Capitec's cost structure is heavily influenced by its significant investments in technology and digital infrastructure, including platform development and maintenance. Staffing costs, particularly for IT and customer service, are also a major expense, reflecting the bank's focus on digital innovation and client support. The extensive branch network, while vital for accessibility, incurs substantial operational costs related to rent, utilities, security, and personnel.

Marketing and customer acquisition, especially through digital channels, represent another key expenditure area. Furthermore, the bank incurs significant costs to ensure regulatory compliance, manage credit risk, and maintain robust cybersecurity measures, all critical for operating within the financial sector.

| Cost Category | Description | 2024 Focus/Data Point |

| Technology & Digital Infrastructure | Platform development, maintenance, cloud services, app upgrades | Billions of ZAR invested in IT capabilities; ongoing generative AI exploration. |

| Staff & Personnel Costs | Salaries, benefits, training for IT and customer service | Investment in human capital to bolster digital capabilities. |

| Branch Network Operations | Rent, utilities, security, branch staff | Continued expenses for upkeep and staffing of physical locations. |

| Marketing & Customer Acquisition | Digital advertising, social media, brand building | Investment in digital channels for broad reach and engagement. |

| Regulatory Compliance & Risk Management | Compliance systems, training, credit risk, cybersecurity | Increased global spending on compliance tech; stable non-performing loan ratios in SA banks (2023). |

Revenue Streams

Net transaction and commission income forms a cornerstone of Capitec's revenue generation strategy. This stream is built upon fees collected from a wide array of customer activities, encompassing digital payment processing, debit and credit card usage, and various other service-related charges.

Capitec's operational philosophy, characterized by a high volume of transactions processed at a low margin per transaction, makes this income source particularly vital. For instance, in the fiscal year 2024, Capitec reported a substantial increase in transaction and commission income, reflecting the growing adoption of its digital platforms and the consistent use of its banking services by a large customer base.

Net Interest Income from Lending is Capitec's primary revenue driver, stemming from the interest charged on a wide array of credit products offered to both individuals and businesses. This includes personal loans, credit card interest, and other forms of credit facilities.

Lending, while a diversified income source for Capitec, remains fundamentally central to its financial model. For the financial year ending February 2024, Capitec reported net interest income of R27.4 billion, highlighting the significant contribution of its lending activities to its overall profitability.

Capitec's Value-Added Services (VAS) income is a key driver of its non-interest revenue, encompassing everyday transactions like prepaid electricity, airtime, and data sales, as well as bill payments and vehicle license renewals facilitated through their app.

In the financial year ending February 2024, Capitec reported a substantial increase in transaction and commission income, which includes these VAS. This segment saw a notable growth, contributing significantly to the bank's overall profitability and demonstrating the increasing reliance of clients on digital platforms for essential services.

Insurance Premiums and Related Income

Capitec generates significant revenue through its insurance offerings, primarily funeral and life cover policies. This segment has experienced robust expansion, becoming a key contributor to the company's financial performance.

- Insurance Premiums: Revenue derived from the direct sale of funeral and life insurance policies.

- Related Income: This includes income from reinsurance arrangements and other insurance-related services.

- Growth Driver: In the fiscal year ending February 2024, Capitec reported that its insurance business contributed R3.8 billion in gross written premiums, a notable increase from the previous year.

- Profitability: The insurance segment's profitability is a substantial part of Capitec's overall earnings, demonstrating its strategic importance.

Business Banking Income

Capitec's business banking income is a key driver of its diversified revenue. This segment serves small and medium-sized enterprises (SMEs) with a range of financial services. Revenue streams include transactional fees for account management and payments, interest earned on business loans, and income from merchant services, which facilitate card payments for businesses.

This area is experiencing significant growth for Capitec, reflecting its strategic expansion beyond individual retail banking. The bank aims to capture a larger share of the SME market by offering competitive and accessible banking solutions tailored to business needs. This diversification helps to stabilize overall revenue and reduce reliance on any single income source.

- Transactional Fees: Income derived from daily banking operations, such as account maintenance, electronic funds transfers, and other payment processing fees.

- Loan Interest: Revenue generated from interest charged on loans provided to SMEs, a critical component of supporting business growth.

- Merchant Services: Fees earned from providing point-of-sale (POS) terminals and payment processing services to businesses, enabling them to accept card payments.

- Growing SME Segment: Capitec's focus on this sector is a deliberate strategy to broaden its customer base and income streams, contributing to a more robust financial profile.

Capitec's revenue streams are diversified, with net interest income from lending forming the primary driver, generating R27.4 billion in the financial year ending February 2024. Net transaction and commission income, boosted by digital platform adoption, also plays a crucial role, encompassing fees from payments and card usage. Value-added services like prepaid electricity and bill payments, alongside significant insurance premiums (R3.8 billion in gross written premiums for FY24), further bolster non-interest revenue. The growing business banking segment, with transactional fees, loan interest, and merchant services, adds another vital layer to Capitec's income generation strategy.

| Revenue Stream | Description | FY2024 Contribution (Illustrative) |

|---|---|---|

| Net Interest Income | Interest earned on loans and credit facilities. | R27.4 billion |

| Transaction & Commission Income | Fees from digital payments, card usage, and other services. | Significant growth reported |

| Value-Added Services (VAS) | Income from prepaid services and bill payments. | Included in Transaction & Commission Income growth |

| Insurance Premiums | Revenue from funeral and life cover policies. | R3.8 billion (Gross Written Premiums) |

| Business Banking Income | Fees, loan interest, and merchant services for SMEs. | Growing segment, diversified income |

Business Model Canvas Data Sources

The CAPITEC Business Model Canvas is informed by a blend of internal financial statements, extensive market research on banking trends and consumer behavior, and strategic analyses of competitor offerings. These data sources provide a comprehensive foundation for understanding CAPITEC's operational landscape and strategic direction.