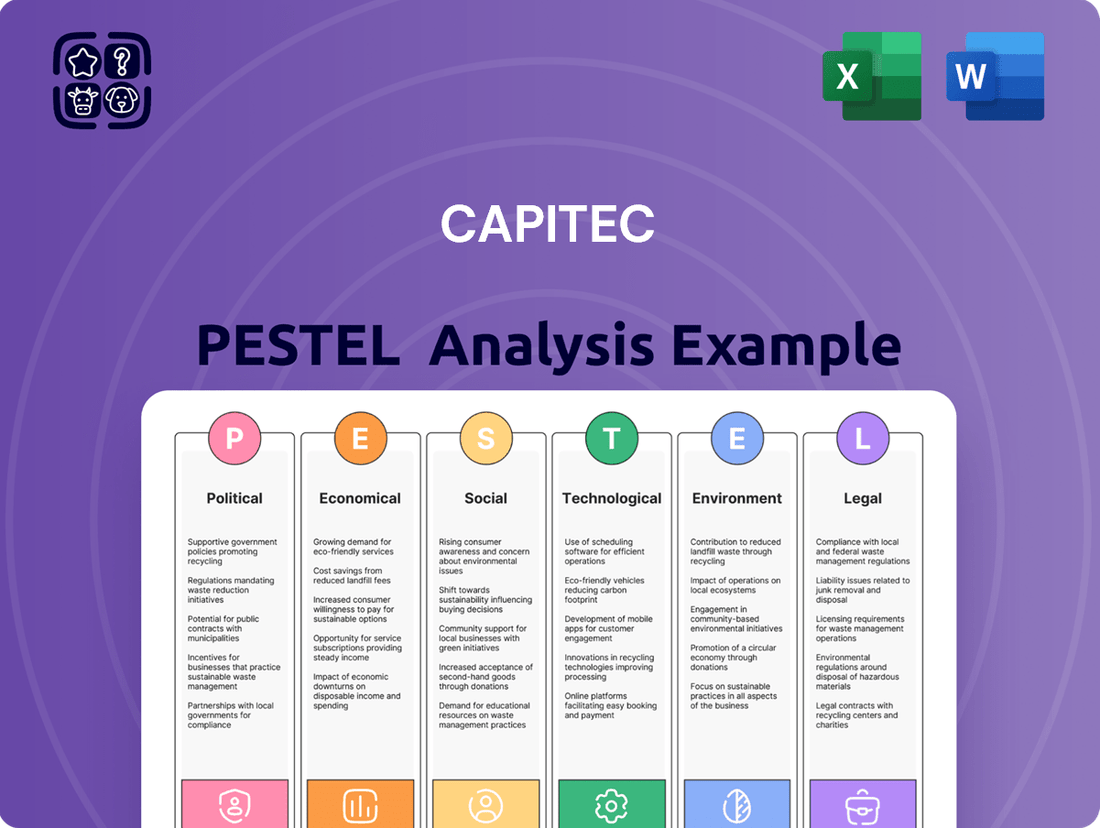

CAPITEC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CAPITEC Bundle

Uncover the critical political, economic, and social factors shaping Capitec's journey. Our meticulously researched PESTLE analysis provides the essential external context for understanding their strategic landscape. Equip yourself with this vital intelligence to anticipate market shifts and drive informed decisions. Download the full version now and gain a decisive advantage.

Political factors

South Africa's National Development Plan (NDP) Vision 2030 targets a significant increase in financial inclusion, aiming for 90% by 2030. Capitec's business model, focused on accessible and affordable banking, directly aligns with and supports this national goal, bringing more citizens into the formal financial system.

By providing simplified banking solutions, Capitec empowers individuals who were previously excluded from traditional financial services. This focus on accessibility is crucial for achieving the NDP's ambitious financial inclusion targets, as evidenced by the growing number of South Africans now engaging with formal banking channels.

The South African banking sector, including Capitec, is governed by the South African Reserve Bank (SARB), with ongoing implementation of Basel III capital requirements through 2025. These regulations ensure financial stability and robust capital buffers.

A stable political climate, particularly with the formation of the Government of National Unity, is anticipated to foster economic reforms. This stability is crucial for creating a predictable operating environment, which is beneficial for financial institutions like Capitec.

South Africa's grey-listing by the Financial Action Task Force (FATF) in February 2023, stemming from identified weaknesses in its anti-money laundering and counter-terrorist financing (AML/CTF) frameworks, significantly heightens regulatory pressures on financial institutions like Capitec.

This designation necessitates a robust enhancement of Capitec's AML/CTF systems and compliance protocols, a critical step for the nation to be removed from the grey list, a goal targeted for October 2025.

The FATF's evaluation highlighted specific areas requiring improvement, pushing banks to invest more in transaction monitoring, customer due diligence, and suspicious activity reporting to meet international standards and regain investor confidence.

Political Stability and Investor Confidence

South Africa's political landscape is crucial for Capitec's operational environment. An improving political climate, coupled with a government actively addressing infrastructure gaps like energy and transportation, directly enhances the nation's economic outlook. This, in turn, is a significant draw for both domestic and international investors looking at the banking sector.

This enhanced investor confidence translates into a more favorable environment for Capitec's strategic objectives. When the political framework is perceived as stable and supportive of economic development, it reduces perceived risk for financial institutions. This allows Capitec to pursue growth and expansion initiatives with greater certainty.

For instance, the South African government's commitment to resolving the energy crisis, a key infrastructure deficiency, is vital. Progress in this area, such as the increased capacity from renewable energy projects coming online, directly impacts business operating costs and consumer spending power, both of which are fundamental to Capitec's retail banking model. The National Treasury projected in its February 2024 budget review that significant private sector investment, partly driven by policy reforms, would be channeled into energy infrastructure.

Key political factors influencing Capitec include:

- Government's focus on economic reforms: Policies aimed at boosting growth and reducing unemployment create a more robust consumer base for banking services.

- Regulatory stability: Predictable and fair banking regulations foster a secure environment for Capitec's operations and product development.

- Public sector efficiency: Improvements in the delivery of public services and infrastructure reduce operational costs for businesses and improve overall economic activity.

Consumer Protection and Banking Practices

Government and regulatory bodies are increasingly prioritizing consumer protection within the financial sector, aiming to ensure fair treatment and transparent practices. Capitec's business model, characterized by its simplified fee structure and clear communication, directly supports these governmental objectives. This alignment can significantly reduce regulatory scrutiny and foster greater customer confidence, a critical factor in the banking industry.

For instance, the National Credit Regulator (NCR) in South Africa, which oversees credit agreements, plays a vital role in safeguarding consumers. Capitec's commitment to clear and understandable credit terms, as evidenced by its consistent customer satisfaction ratings, positions it favorably against potential regulatory interventions. In 2023, Capitec reported a 9% increase in its headline earnings, partly attributed to its strong customer base, which benefits from its transparent approach.

- Consumer Protection Focus: Regulators are actively pushing for clearer fee structures and enhanced customer disclosures in banking.

- Capitec's Alignment: The bank's simplified fee model and commitment to transparency align well with these consumer protection mandates.

- Reduced Regulatory Risk: This alignment can lead to fewer compliance issues and a lower risk of penalties.

- Enhanced Customer Trust: Transparent practices build trust, contributing to customer loyalty and business growth, as seen in Capitec's financial performance.

South Africa's political stability, particularly the formation of a Government of National Unity, is pivotal for economic reforms and investor confidence. The nation's grey-listing by the FATF in February 2023, and the targeted October 2025 removal, necessitates robust AML/CTF compliance, directly impacting institutions like Capitec. Government initiatives to address infrastructure, such as energy, also influence operational costs and consumer spending, key for Capitec's retail model.

The government's focus on financial inclusion, aiming for 90% by 2030 through the NDP, aligns perfectly with Capitec's accessible banking model. Furthermore, increased emphasis on consumer protection by regulators, such as the NCR, favors Capitec's transparent fee structures and clear communication, contributing to its 9% headline earnings growth in 2023.

| Political Factor | Impact on Capitec | Supporting Data/Context |

| Government of National Unity | Fosters economic reforms and enhances investor confidence. | A stable political environment reduces operational uncertainty for financial institutions. |

| FATF Grey-listing | Increases regulatory pressure for enhanced AML/CTF systems. | Target for removal from grey-list is October 2025; requires significant compliance investment. |

| National Development Plan (NDP) Vision 2030 | Supports Capitec's mission of financial inclusion. | Aims for 90% financial inclusion by 2030; Capitec's model directly addresses this. |

| Consumer Protection Mandates | Benefits Capitec's transparent fee structures and clear communication. | Contributed to Capitec's 9% headline earnings growth in 2023; reduces regulatory risk. |

What is included in the product

This CAPITEC PESTLE analysis delves into how external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—shape opportunities and threats.

It provides actionable insights for strategic decision-making, enabling stakeholders to navigate the dynamic landscape effectively.

Provides a concise version of Capitec's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors.

Helps support discussions on external risks and market positioning by offering a clear overview of the political, economic, social, technological, environmental, and legal factors impacting Capitec.

Economic factors

South Africa's interest rate environment is shifting, with moderating inflation paving the way for anticipated rate cuts through 2025. This easing of borrowing costs is a positive sign for households, potentially boosting their disposable income and making it easier to manage existing debt. For instance, if the South African Reserve Bank (SARB) were to cut its policy rate by 50 basis points in 2025, it could translate to significant savings for consumers with variable-rate loans.

While lower interest rates can put some pressure on banks' net interest margins (NIMs), the expected increase in credit uptake and growth in non-interest revenue streams are projected to offset this. Banks like Capitec, which rely heavily on transaction fees and other service charges, are well-positioned to benefit from increased customer activity that often accompanies a more favorable economic climate, thereby supporting overall profitability.

Credit conditions are anticipated to loosen progressively through 2025, which should spur faster growth in private sector credit. This includes both consumer and business loans. This trend offers a significant avenue for Capitec to increase its loan disbursements, particularly as the bank is strategically positioned to cater to the credit needs of individuals and enterprises.

Household debt levels, while a consideration, are often managed through responsible lending practices. For instance, as of early 2025, South Africa's household debt-to-income ratio remained a key economic indicator, with analysts projecting a stable or slightly declining trend due to prudent monetary policy and a focus on financial literacy initiatives, which aligns with Capitec's customer-centric approach.

South Africa's economic growth is anticipated to reach 1.7% in 2025, a positive outlook driven by improvements in electricity supply and broader economic stabilization measures. This growth is crucial for sectors like banking, as it often translates to increased economic activity and opportunities.

Consumer spending is also expected to see a healthy increase of 1.9% in 2025. Coupled with moderating inflation, this will likely put more disposable income back into the hands of households and businesses, potentially boosting demand for financial products and services offered by institutions like Capitec.

Employment and Disposable Income

While real take-home pay in South Africa experienced a slight rise in July 2024, it lagged behind inflation, suggesting ongoing pressure on consumers. This situation directly impacts Capitec's customer spending power and ability to service debt.

However, a more optimistic economic outlook for 2024/2025, coupled with the introduction of the two-pot retirement system, could lead to increased disposable incomes. This access to retirement funds might provide a much-needed boost to Capitec's client base, potentially driving higher transaction volumes and loan uptake.

- Consumer Strain: Real wages in South Africa remained below inflation in July 2024, limiting discretionary spending.

- Economic Improvement: Projections for 2024/2025 suggest a more favorable economic environment.

- Retirement Fund Access: The new two-pot retirement system allows individuals to access a portion of their savings, potentially increasing available funds.

- Impact on Capitec: Higher disposable income could translate to increased banking activity and credit demand for Capitec.

Competition in the Banking Sector

The South African banking landscape is intensely competitive, with established players and agile fintech disruptors constantly innovating to capture customer loyalty. Capitec's success hinges on its commitment to affordability and accessibility, key differentiators in this dynamic market.

Capitec's strategic expansion into business banking and its robust insurance and value-added services portfolio further strengthen its competitive stance. This diversification allows it to cater to a broader customer base and offer a more comprehensive financial ecosystem.

- Market Share Dynamics: Traditional banks like Standard Bank and FNB continue to hold significant market share, but Capitec has steadily grown its customer base, reaching over 21 million clients by early 2024, demonstrating its ability to attract and retain customers with its value proposition.

- Fintech Innovation: The rise of digital-only banks and payment solutions presents a constant challenge, forcing all players to invest heavily in technology and user experience to remain relevant.

- Pricing Sensitivity: South African consumers are highly price-sensitive, making Capitec's low-fee model a powerful competitive advantage, especially among lower to middle-income segments.

- Regulatory Environment: While not directly a competitive factor, regulatory changes can impact how banks operate and compete, influencing the pace of innovation and market entry for new players.

South Africa's economic outlook for 2024/2025 shows positive signs, with projected GDP growth of 1.7% in 2025 and a 1.9% increase in consumer spending. This is supported by anticipated interest rate cuts through 2025, which should boost household disposable income and credit uptake, benefiting banks like Capitec.

Despite some consumer strain due to real wages lagging inflation in mid-2024, the introduction of the two-pot retirement system could further enhance disposable incomes. This economic environment, characterized by moderating inflation and potentially looser credit conditions, presents opportunities for Capitec to expand its loan disbursements and transaction volumes.

Capitec's competitive edge is its focus on affordability and accessibility, evident in its customer base exceeding 21 million by early 2024. While facing competition from traditional banks and fintechs, its diversified services and value-added offerings position it well to capitalize on the anticipated economic improvements and increased consumer spending power.

Full Version Awaits

CAPITEC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive CAPITEC PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the strategic landscape with this detailed report.

Sociological factors

Capitec's commitment to accessible and affordable banking directly tackles the sociological imperative for financial inclusion in South Africa. Their model is particularly effective in reaching previously underserved populations, including those in townships.

The bank's impressive growth, with over 24 million clients as of early 2024, underscores its success in penetrating diverse socioeconomic strata and making financial services a reality for a significant portion of the South African populace.

South African consumers are increasingly embracing digital channels for their financial needs, a trend Capitec has adeptly leveraged. The bank reported a significant 15% surge in active app clients, reaching 12.9 million by February 2025, demonstrating a strong preference for mobile banking solutions.

This digital shift is evident in transaction volumes, with a substantial portion now conducted through Capitec's digital platforms. This heightened digital adoption reflects a broader societal move towards convenience and accessibility in financial services.

Capitec's commitment to transparent and simple banking fees, highlighted by its streamlined fee structure introduced in early 2025, directly addresses consumer demand for predictable costs. This focus on clarity is fundamental to building trust, a vital sociological element in fostering strong banking relationships.

Demographics and Market Segmentation

Capitec's strategic focus on serving individuals and, more recently, small and medium enterprises (SMEs) through its business banking initiatives directly mirrors South Africa's demographic landscape. The bank's product development, including tailored credit solutions for various income brackets, demonstrates a keen awareness of the varied needs within the population.

This approach is particularly relevant given South Africa's income disparities. For instance, Capitec's accessible banking model appeals to a broad base, and its expansion into business banking in 2023 aims to capture a significant portion of the SME market, which is a crucial driver of employment. By mid-2024, Capitec reported a substantial increase in its business client base, indicating successful market penetration.

- Targeting a broad consumer base: Capitec's core offering caters to the majority of South Africans seeking affordable and user-friendly banking services.

- Expansion into SME banking: The bank's recent push into business banking addresses the needs of a growing segment of entrepreneurs and small businesses.

- Product customization: Offering credit and savings products designed for different income levels ensures relevance across diverse demographic segments.

- Alignment with economic realities: Capitec's model resonates with the financial realities of many South Africans, fostering financial inclusion.

Impact of Load Shedding and Infrastructure Deficiencies

Persistent load shedding in South Africa, a recurring issue throughout 2024 and into early 2025, significantly disrupts daily life and business continuity. This can directly affect customer access to Capitec's banking services, particularly those relying on consistent digital infrastructure and electricity for transactions.

While there are ongoing government initiatives and private sector investments aimed at improving South Africa's electricity infrastructure, the immediate impact of power outages remains a considerable challenge. Banks like Capitec need to maintain robust service resilience, ensuring their digital platforms and physical branches can operate effectively even during periods of load shedding.

- Service Interruption Risk: Load shedding can lead to temporary outages of ATMs, online banking, and mobile app services, impacting customer transactions and satisfaction.

- Operational Costs: Increased reliance on backup power solutions like generators and UPS systems for branches and data centers adds to operational expenses.

- Customer Behavior Shifts: Extended power disruptions might encourage customers to shift towards cash-based transactions or seek services from institutions with more resilient infrastructure.

- Digital Dependence: As Capitec's model heavily relies on digital channels, infrastructure deficiencies pose a direct threat to its core operational efficiency and customer reach.

Capitec's success is deeply intertwined with South Africa's societal shifts towards digital convenience and financial inclusion. The bank's strategy of offering simple, affordable banking resonates strongly with a population seeking accessible financial tools.

With over 24 million clients by early 2024, Capitec demonstrates its ability to cater to a wide demographic. The significant increase to 12.9 million active app clients by February 2025 highlights the growing preference for mobile banking solutions among South Africans.

Capitec's expansion into SME banking in 2023 and its subsequent growth in business clients by mid-2024 reflects an understanding of the entrepreneurial spirit within the nation. This move aligns with the societal need to support small and medium enterprises as key economic drivers.

The bank's focus on transparent fee structures, reinforced in early 2025, directly addresses consumer demand for clarity and trust in financial services, a crucial sociological factor in customer loyalty.

| Metric | Value (as of early 2024/Feb 2025) | Sociological Implication |

|---|---|---|

| Total Clients | Over 24 million (early 2024) | Broad financial inclusion across diverse socioeconomic groups. |

| Active App Clients | 12.9 million (Feb 2025) | High adoption of digital banking, reflecting a preference for convenience. |

| SME Banking Expansion | Launched 2023, growing client base by mid-2024 | Addressing the entrepreneurial segment and its role in employment. |

| Fee Structure Focus | Streamlined early 2025 | Meeting consumer demand for transparency and building trust. |

Technological factors

Capitec has aggressively pursued digital transformation, with a notable surge in its digital banking capabilities since 2020. This strategic focus has fueled substantial growth in its online and mobile banking channels, solidifying its position in the digital financial landscape.

The Capitec app has become the cornerstone of its transactional strategy. By February 2025, the bank reported an impressive 12.9 million active app clients, underscoring the effectiveness of its mobile-first approach and its ability to attract and retain users on its digital platform.

Capitec is actively innovating in payment solutions, with features like Capitec Pay and real-time card payments enhancing user experience. This focus on digital payment innovation is crucial for staying competitive in the rapidly evolving financial landscape.

The bank's introduction of an International Payments solution within its app is a significant development. This feature allows for fast and affordable money transfers to more than 50 countries, directly addressing a growing customer need for convenient cross-border transactions and expanding Capitec's service reach.

Capitec is heavily invested in data analytics and artificial intelligence, using these technologies to understand its customer base more deeply. By processing vast amounts of client data, the bank aims to tailor financial solutions and improve the overall client experience. This focus on data allows for more personalized product offerings and service delivery.

The bank’s commitment to AI is evident in its continuous development of digital platforms. For instance, Capitec’s app, which saw a significant increase in active users, is a prime example of how technology is used to engage clients. In the first half of fiscal year 2025, digital transactions continued to grow, underscoring the success of this data-driven strategy in meeting evolving customer demands.

Cybersecurity and Data Protection

As digital banking continues its rapid expansion, the imperative for strong cybersecurity and data protection intensifies for institutions like Capitec. The bank is actively enhancing its defenses, notably investing in advanced fraud prevention tools. These include sophisticated facial biometric verification and in-app call authentication, designed to safeguard client data and transactional integrity. This strategic focus aligns directly with the escalating regulatory emphasis on cyber resilience across the financial sector.

Capitec's commitment to cybersecurity is evident in its ongoing investments. For instance, in the 2024 financial year, the bank reported a significant increase in spending on technology infrastructure, a portion of which is directly allocated to bolstering its digital security. This proactive approach is essential as cyber threats become more sophisticated, aiming to protect customer information and maintain trust in their digital banking services.

- Investment in Fraud Prevention: Capitec is implementing advanced technologies like facial biometrics and in-app call authentication.

- Regulatory Alignment: These measures are in response to growing regulatory requirements for cyber resilience.

- Client Data Protection: The primary goal is to secure sensitive client information and transaction details.

- Digital Banking Growth: The increasing reliance on digital platforms necessitates robust cybersecurity frameworks.

Cloud Computing and IT Infrastructure

Capitec's strategic migration of its data to the cloud, leveraging best-of-class technology platforms, significantly enhances its operational agility. This move allows their IT teams to dedicate more resources to innovating and developing new products and services, directly supporting the bank's digital transformation goals. For instance, by Q1 2024, Capitec reported a 15% increase in digital transaction volumes, a testament to their robust IT infrastructure.

This investment in a scalable and secure IT infrastructure is foundational to Capitec's ambitious growth trajectory and its commitment to digital-first banking. The cloud enables the bank to efficiently manage increasing data loads and adapt quickly to evolving market demands. In 2024, Capitec allocated approximately ZAR 2.5 billion to technology and digital initiatives, underscoring the critical role of IT in their strategy.

- Cloud Migration Benefits: Enhanced scalability, improved data security, and increased IT team focus on innovation.

- Digital Growth Support: Robust IT infrastructure underpins the expansion of digital banking services and customer engagement.

- Investment in Technology: Significant capital allocation towards IT and digital platforms demonstrates a commitment to future-proofing operations.

- Operational Efficiency: Leveraging advanced technology platforms optimizes resource allocation and operational processes.

Capitec's technological advancements are central to its strategy, with a significant push towards digital banking. The bank's app, a key driver of client engagement, boasted 12.9 million active clients by February 2025. Innovations like Capitec Pay and international payment solutions within the app are enhancing user experience and expanding service offerings. Furthermore, substantial investments in data analytics and AI are enabling personalized financial solutions, with digital transactions showing continued growth in the first half of fiscal year 2025.

Cybersecurity is a paramount concern, with Capitec investing heavily in advanced fraud prevention. Technologies such as facial biometrics and in-app call authentication are being implemented to protect client data, aligning with increasing regulatory demands for cyber resilience. The bank's strategic cloud migration, supported by a ZAR 2.5 billion allocation to technology and digital initiatives in 2024, enhances operational agility and supports its digital-first banking model.

| Technology Area | Key Development/Investment | Impact/Metric (as of early 2025) |

|---|---|---|

| Digital Banking Platform | Capitec App Enhancements | 12.9 million active app clients (Feb 2025) |

| Payment Solutions | Capitec Pay, International Payments | Facilitating cross-border transactions to over 50 countries |

| Data & AI | Customer Data Analytics | Driving personalized financial solutions and service delivery |

| Cybersecurity | Facial Biometrics, In-App Authentication | Bolstering fraud prevention and data protection |

| IT Infrastructure | Cloud Migration | ZAR 2.5 billion allocated to tech/digital in FY2024; 15% increase in digital transactions (Q1 2024) |

Legal factors

South African banks, including Capitec, must adhere to Basel III's evolving risk-based capital and liquidity standards, with key provisions extending through 2025. These regulations are critical for ensuring the financial sector's stability and maintaining operational licenses.

As of the latest available data, South African banks are generally well-capitalized, with aggregate Common Equity Tier 1 (CET1) ratios exceeding regulatory minimums, providing a buffer against potential economic shocks. Capitec, like its peers, must continually monitor and manage its capital adequacy to meet these stringent requirements.

The Financial Sector Conduct Authority (FSCA) is a crucial regulator for South Africa's financial institutions, including Capitec. Its primary role is to ensure fair market conduct and protect consumers. Capitec's operations are therefore heavily influenced by FSCA guidelines, particularly those focused on responsible lending and transparent product offerings, aiming to foster an inclusive financial sector.

Capitec, like all financial institutions in South Africa, must navigate the stringent requirements of the Financial Intelligence Centre Act (FICA), the cornerstone of anti-money laundering (AML) and counter-terrorist financing (CTF) efforts. This legislation mandates that banks register with the Financial Intelligence Centre (FIC), appoint dedicated compliance officers, and establish robust risk management compliance programs to prevent illicit financial activities.

South Africa's commitment to exiting the Financial Action Task Force (FATF) grey list underscores the critical importance of rigorous adherence to these AML/CTF regulations. Failure to comply can result in significant penalties and reputational damage, impacting Capitec's operational stability and market standing. Recent reports in late 2023 and early 2024 highlight increased scrutiny on financial institutions' AML/CTF frameworks as the country strives to meet international standards.

Data Privacy and Protection Laws

Capitec's growing digital footprint necessitates strict adherence to data privacy regulations like South Africa's Protection of Personal Information Act (POPIA). Failure to comply can result in significant penalties and reputational damage. In 2023, the Information Regulator reported a substantial increase in data breach notifications, highlighting the evolving landscape of data protection enforcement.

Ensuring the security of customer data against cyber threats and maintaining transparent data handling practices are paramount legal obligations for Capitec. This involves robust data governance frameworks and regular audits to confirm compliance with evolving privacy standards.

- POPIA Compliance: Implementing and maintaining systems that align with the Protection of Personal Information Act is a core legal requirement.

- Data Breach Prevention: Investing in advanced cybersecurity measures to safeguard sensitive customer information from unauthorized access is critical.

- Transparent Data Handling: Clearly communicating data usage policies to customers and obtaining necessary consents are legal imperatives.

- Regulatory Scrutiny: Staying abreast of and responding to directives from regulatory bodies like the Information Regulator is essential for ongoing operations.

Consumer Credit Legislation

Capitec, as a credit provider, is significantly shaped by the National Credit Act (NCA) in South Africa. This legislation sets the framework for all credit agreements, with a core objective of safeguarding consumers against predatory and reckless lending practices. The bank's entire credit lifecycle, from how it assesses applicants to how it disburses funds, must adhere strictly to these NCA stipulations.

Compliance with the NCA means Capitec must ensure its credit granting criteria are fair and transparent, and its loan disbursement processes prevent over-indebtedness. Recent regulatory focus in 2024 and projections for 2025 continue to emphasize consumer protection, potentially leading to stricter affordability assessments and disclosure requirements for credit providers like Capitec.

- National Credit Act (NCA) Compliance: Governs credit agreements and consumer protection.

- Reckless Lending Prevention: Mandates responsible credit granting and disbursement.

- Regulatory Scrutiny: Ongoing focus on affordability assessments and disclosure in 2024/2025.

Capitec's operations are deeply intertwined with South Africa's legal and regulatory landscape, particularly concerning consumer protection and financial stability. The National Credit Act (NCA) mandates responsible lending practices, influencing Capitec's credit assessment and disbursement processes, with continued emphasis on affordability in 2024-2025.

Adherence to the Protection of Personal Information Act (POPIA) is critical, especially given Capitec's digital services, with the Information Regulator reporting increased data breach notifications in 2023, underscoring the need for robust data security.

Furthermore, compliance with Basel III capital and liquidity standards, extending through 2025, is essential for maintaining operational licenses, with South African banks, including Capitec, generally demonstrating strong capital adequacy ratios.

The Financial Sector Conduct Authority (FSCA) oversees fair market conduct and consumer protection, impacting Capitec's product offerings and lending transparency, while the Financial Intelligence Centre Act (FICA) governs anti-money laundering efforts, a key focus as South Africa works to exit the FATF grey list.

Environmental factors

Capitec actively pursues energy efficiency, responsible water usage, and waste reduction to lessen its environmental footprint. The bank's commitment is further evidenced by its annual Sustainability Report, which includes detailed Climate-related Financial Disclosures, aligning with robust Environmental, Social, and Governance (ESG) principles.

While Capitec hasn't heavily emphasized sustainable finance as a core strategy, the South African banking landscape is shifting. There's a growing trend towards climate-resilient investments and sustainable finance across the sector, driven by both regulatory pressures and investor demand. For instance, by the end of 2023, South African banks were actively exploring opportunities in green bonds and sustainable lending, with several major institutions launching dedicated ESG (Environmental, Social, and Governance) frameworks.

This evolving environment presents Capitec with potential future opportunities and challenges. The bank might need to adapt its lending practices to incorporate environmental considerations, potentially offering green financing options or integrating climate risk assessments into its credit processes. As of early 2025, the South African Reserve Bank continues to encourage financial institutions to enhance their climate-related financial disclosures, signaling a clear direction for the industry.

Capitec's growing presence, with a significant increase in branches and digital services, naturally leads to an environmental footprint. This includes energy consumed by its physical locations and data centers, as well as waste generated from operations.

In 2024, Capitec continued its focus on sustainability, implementing initiatives to reduce energy consumption across its network. For instance, upgrades to energy-efficient lighting and HVAC systems in its branches are ongoing projects aimed at lowering its carbon output.

The bank's commitment extends to responsible waste management, with programs in place for recycling and reducing single-use materials. These efforts are crucial in mitigating the environmental impact associated with its expanding operational scale and customer reach.

Physical Risks of Climate Change

South Africa faces significant physical risks from climate change, including increased frequency and intensity of droughts, floods, and extreme weather events. These impacts, while not directly affecting Capitec's digital banking operations, can destabilize the economic well-being of its diverse client base. For instance, agricultural clients heavily reliant on predictable weather patterns could experience crop failures, impacting their ability to repay loans, thereby increasing credit risk for the bank.

The economic ripple effects of these physical risks are considerable. A severe drought in 2023, for example, led to widespread agricultural losses, affecting employment and disposable income for many South Africans. This economic strain on individuals and small businesses can translate into higher default rates on loans and other financial products offered by Capitec, necessitating robust risk management strategies.

- Increased Credit Risk: Climate-induced economic hardship for clients can lead to higher loan defaults.

- Impact on Client Spending: Extreme weather events can disrupt economic activity, reducing clients' capacity for savings and investment.

- Operational Disruptions: While less direct, severe weather could impact infrastructure, indirectly affecting client access to services or the bank's own operational continuity in certain regions.

Regulatory and Stakeholder Pressure for Environmental Responsibility

Financial institutions like Capitec face increasing scrutiny from regulators, investors, and customers regarding their environmental impact. This pressure is driving demand for transparent Environmental, Social, and Governance (ESG) reporting and tangible sustainability initiatives. For instance, by mid-2024, a significant portion of global institutional investors were actively integrating ESG factors into their investment decisions, often favoring companies with strong sustainability credentials.

Capitec's commitment to sustainability, as evidenced by its ESG reporting, directly addresses these growing expectations. This proactive approach not only bolsters its corporate reputation but can also improve its standing with environmentally conscious investors. Such alignment can translate into better access to capital and more favorable financing terms, crucial for continued growth and operational efficiency in the evolving financial landscape.

- Regulatory Scrutiny: Governments worldwide are implementing stricter environmental regulations for financial services, impacting lending practices and investment portfolios.

- Investor Demand: By Q1 2025, ESG-focused funds are projected to manage over $50 trillion globally, making environmental performance a key consideration for capital allocation.

- Stakeholder Expectations: Customers and employees are increasingly choosing brands that demonstrate genuine environmental responsibility, influencing corporate strategy and brand loyalty.

- Reputational Benefits: Strong ESG performance can enhance Capitec's brand image, potentially attracting new customers and talent, and mitigating reputational risks associated with climate change.

Capitec's environmental strategy focuses on operational efficiency, aiming to reduce its carbon footprint through energy-saving initiatives and responsible waste management across its expanding network. The bank's commitment is underscored by its annual Sustainability Report, which details its climate-related financial disclosures and adherence to ESG principles.

South Africa's vulnerability to climate change poses indirect risks to Capitec, as extreme weather events can impact clients' economic stability and loan repayment capacity. For instance, agricultural sector disruptions due to drought can heighten credit risk for the bank.

The global financial sector, including South Africa, is experiencing a significant shift towards sustainable finance, driven by regulatory pressure and investor demand for ESG integration. By early 2025, the South African Reserve Bank continues to promote enhanced climate-related financial disclosures among financial institutions.

Capitec's proactive approach to ESG reporting and sustainability initiatives is crucial for meeting stakeholder expectations and maintaining a positive brand image in an increasingly environmentally conscious market. This alignment can also lead to improved access to capital and more favorable financing terms.

| Environmental Factor | Capitec's Response/Impact | Data/Trend (2024-2025) |

|---|---|---|

| Energy Consumption | Focus on energy efficiency in branches and data centers. | Ongoing upgrades to energy-efficient lighting and HVAC systems. |

| Waste Management | Implementation of recycling and waste reduction programs. | Efforts to reduce single-use materials in operations. |

| Climate Risk Exposure | Indirect impact via client economic stability (e.g., agriculture). | Increased credit risk potential due to climate-induced economic hardship for clients. |

| Sustainable Finance Trend | Growing sector demand for ESG integration. | South African Reserve Bank encouraging enhanced climate-related financial disclosures. |

PESTLE Analysis Data Sources

Our CAPITEC PESTLE Analysis is meticulously crafted using data from reputable financial institutions, regulatory bodies, and industry-specific reports. We integrate economic indicators, technological advancements, and socio-political trends from credible sources to provide a comprehensive overview.