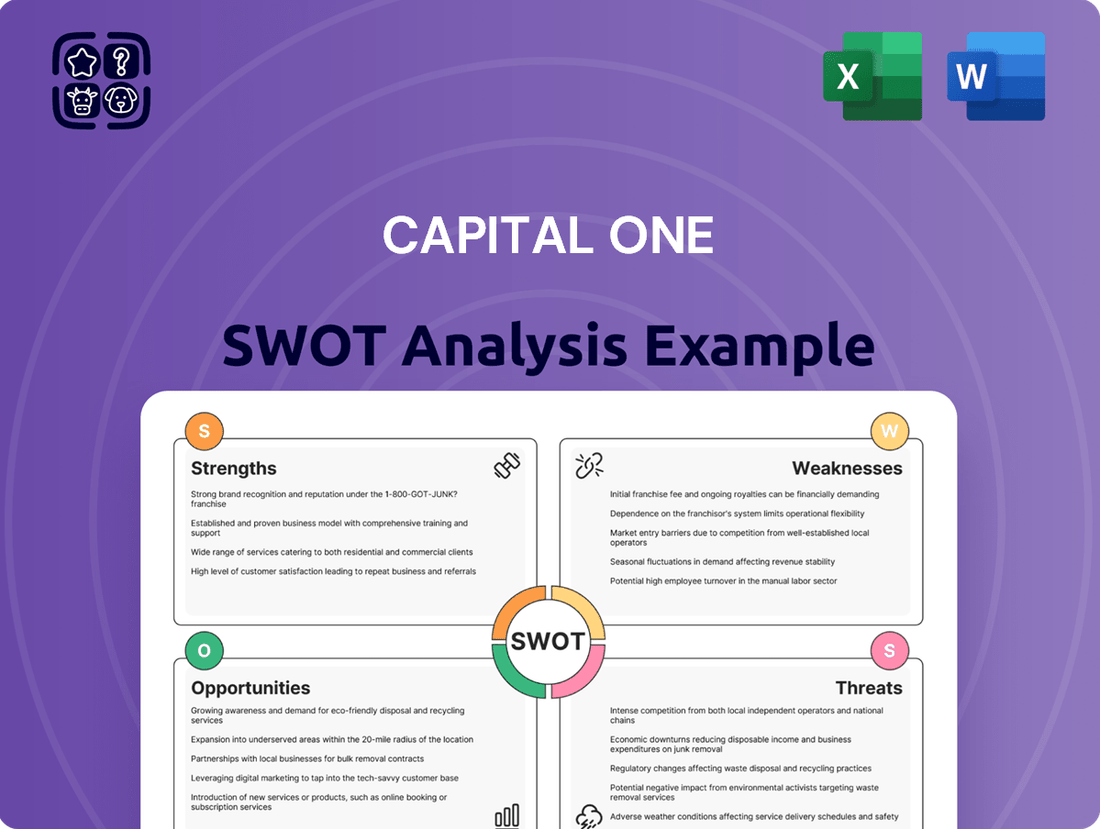

Capital One SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capital One Bundle

Capital One leverages its strong brand recognition and technological innovation to compete effectively in the financial services sector. However, understanding the nuances of its market position, potential threats, and untapped opportunities is crucial for strategic decision-making.

Want the full story behind Capital One’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Capital One boasts a powerful brand identity, deeply ingrained in the financial services landscape. This recognition is a significant asset, helping them attract and keep a vast number of customers. As of early 2024, the company proudly serves over 100 million customers across its diverse range of financial products, a testament to its enduring appeal and competitive edge.

Capital One boasts a robust and diversified product portfolio, encompassing credit cards, auto loans, checking and savings accounts, and commercial banking. This broad offering shields the company from over-reliance on any single financial product, fostering greater stability. For instance, as of the first quarter of 2024, Capital One reported total assets exceeding $470 billion, a testament to the breadth of its financial operations.

Capital One's commitment to technological innovation is a significant strength, with substantial investments in artificial intelligence and machine learning. These advanced technologies are crucial for improving customer interactions, bolstering fraud detection capabilities, and refining credit risk assessments. For instance, by Q1 2024, Capital One reported a 14% year-over-year increase in digital sales, underscoring the effectiveness of its tech-driven customer experience.

The company's digital platforms, notably its mobile app and online banking services, are recognized for their intuitive design and ease of use. This focus on user-friendly interfaces not only enhances customer satisfaction but also drives operational efficiencies across the organization. In 2024, Capital One continued to see strong engagement on its digital channels, with mobile active users growing by 8% compared to the previous year.

Robust Capital Position and Financial Performance

Capital One demonstrates a robust capital position, consistently delivering strong profits. For example, in the first quarter of 2025, the company announced a net income of $1.4 billion. This financial strength is further evidenced by its common equity Tier 1 (CET1) capital ratio, which stood at a healthy 13.6% as of March 31, 2025. This solid capital base is crucial for supporting ongoing strategic growth and ensuring stability during economic downturns.

This strong financial performance translates into key advantages:

- Consistent Profitability: Capital One has a track record of generating substantial profits, indicating effective operational management.

- Healthy Capital Ratios: A CET1 ratio of 13.6% in Q1 2025 signifies a strong buffer against potential credit losses and regulatory requirements.

- Strategic Agility: The robust capital position allows Capital One to pursue strategic investments and acquisitions without undue financial strain.

- Resilience: A well-capitalized institution is better equipped to weather economic volatility and maintain lending activities.

Strategic Acquisition of Discover

The strategic acquisition of Discover Financial Services, finalized in May 2025, marks a pivotal moment for Capital One, significantly bolstering its market standing. This integration is poised to grant Capital One ownership of Discover's payment network, a crucial asset that will diversify revenue streams and unlock substantial cost synergies.

This move allows Capital One to move beyond its traditional card issuing model, creating a more integrated financial ecosystem. The anticipated benefits include enhanced customer offerings and a stronger competitive edge against rivals.

- Network Ownership: Capital One gains control of Discover's extensive payment network, reducing reliance on third-party processors.

- Revenue Diversification: The acquisition is expected to broaden Capital One's income sources beyond traditional lending.

- Cost Synergies: Significant operational efficiencies are projected through the integration of Discover's infrastructure and operations.

- Enhanced Product Innovation: The combined entity is positioned to develop and launch more comprehensive financial products for consumers.

Capital One's brand recognition is a significant strength, fostering customer loyalty and attracting new business. The company's diversified product suite, from credit cards to auto loans, provides a stable revenue base. Technological innovation, particularly in AI and machine learning, enhances customer experience and operational efficiency, as evidenced by an 8% growth in mobile active users in 2024.

| Metric | Value (Q1 2025) | Year-over-Year Growth (Digital Sales) |

|---|---|---|

| Net Income | $1.4 billion | N/A |

| CET1 Ratio | 13.6% | N/A |

| Digital Sales Growth | N/A | 14% |

What is included in the product

Analyzes Capital One’s competitive position through key internal and external factors, detailing its strengths in technology and brand, weaknesses in customer service, opportunities in digital expansion, and threats from fintech competition.

Offers a clear, actionable SWOT framework to identify and address Capital One's competitive challenges.

Weaknesses

While Capital One has made strides in diversifying its offerings, its credit card business continues to be the bedrock of its revenue. This concentration, though a historical strength, inherently creates a vulnerability. During economic slowdowns, consumers often face financial strain, leading to a rise in credit card defaults, which directly impacts Capital One's bottom line.

For instance, in the first quarter of 2024, Capital One reported that its credit card segment generated approximately $7.3 billion in revenue, underscoring its significance. However, a significant increase in net charge-offs, which reached 3.37% in Q1 2024, highlights the sensitivity of this segment to economic headwinds and potential credit losses.

Capital One, as a major financial institution, navigates a complex web of regulatory requirements. This oversight, while standard, can necessitate significant investment in compliance infrastructure and personnel, impacting operational efficiency. For instance, reports in early 2024 indicated ongoing scrutiny from the Consumer Financial Protection Bureau (CFPB) concerning certain savings account practices, potentially leading to further compliance burdens and legal expenses.

Capital One's financial health is significantly influenced by macroeconomic trends. During periods of economic contraction, such as the potential slowdown anticipated in late 2024 or early 2025, the company faces increased risks of higher loan delinquencies and charge-offs, especially within its substantial credit card and auto loan segments. For instance, while Capital One reported a net charge-off rate of 3.06% in Q1 2024, a worsening economic climate could push this figure higher, impacting profitability.

High Marketing and Operating Expenses

Capital One's pursuit of growth has led to a substantial increase in marketing expenditures, particularly as it aims to capture market share in competitive areas like the premium credit card segment. This aggressive marketing strategy, while crucial for brand visibility and customer acquisition, directly impacts profitability.

Furthermore, the company is experiencing elevated operating expenses due to ongoing strategic investments in technology infrastructure. These investments are vital for staying competitive and enhancing digital capabilities, but they represent a significant cost center.

The recent acquisition of Discover, a major undertaking, is also contributing to higher operating costs. Integration expenses, necessary to merge operations and systems, are expected to keep these costs elevated throughout the near term, presenting a short-term drag on financial performance.

- Increased Marketing Spend: Capital One has notably ramped up its marketing budget to compete in lucrative segments, including the luxury card market.

- Technology Investments: Significant capital is being allocated to technology upgrades and digital transformation initiatives, which are essential for future growth but currently increase operating expenses.

- Acquisition Integration Costs: Expenses related to integrating the Discover acquisition are a primary driver of higher operating costs in the current financial period.

Potential Integration Challenges with Discover

The integration of Discover into Capital One's operations, while strategically advantageous, presents inherent complexities. Merging two substantial financial institutions involves significant undertaking, including the harmonization of distinct IT systems and operational frameworks. This process could introduce unforeseen disruptions and incur additional costs beyond initial projections.

Cultural alignment also represents a key hurdle. Bridging the different corporate cultures of Capital One and Discover is crucial for a smooth transition and to maintain employee morale and productivity. Failure to address these cultural nuances effectively could impede the realization of synergy benefits.

Furthermore, the consolidation of product portfolios and customer bases requires meticulous planning. Capital One will need to navigate the integration of Discover's credit card, banking, and payment network services, ensuring minimal disruption for existing customers. For instance, as of Q1 2024, Discover reported approximately $128 billion in total loans, highlighting the scale of the integration challenge.

- System Integration: Combining disparate IT infrastructures and platforms from both Capital One and Discover is a complex and potentially costly endeavor.

- Cultural Harmonization: Aligning the distinct corporate cultures of the two companies is vital to prevent internal friction and ensure operational efficiency post-acquisition.

- Product and Customer Migration: Seamlessly integrating Discover's diverse product offerings and customer base into Capital One's existing structure requires careful management to avoid service interruptions.

Capital One's significant reliance on its credit card segment, which accounted for approximately $7.3 billion in revenue in Q1 2024, exposes it to economic downturns. The company's net charge-off rate rose to 3.37% in Q1 2024, indicating increased credit risk during periods of consumer financial strain.

The company faces substantial operating expenses driven by aggressive marketing campaigns and crucial technology investments aimed at enhancing digital capabilities. Furthermore, the ongoing integration of the Discover acquisition is adding to these costs, with integration expenses expected to remain elevated in the near term.

| Metric | Q1 2024 | Significance |

|---|---|---|

| Credit Card Revenue | ~$7.3 billion | Highlights reliance on credit cards |

| Net Charge-off Rate | 3.37% | Indicates increasing credit risk |

| Discover Loans (as of Q1 2024) | ~$128 billion | Illustrates integration complexity |

Same Document Delivered

Capital One SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout. This ensures you know exactly what you're getting: a professional and comprehensive assessment of Capital One's strategic position.

Opportunities

Capital One's acquisition of Discover Financial Services in February 2024, a deal valued at approximately $35 billion, significantly bolsters its payment network capabilities. This move allows Capital One to operate its own payment network, directly challenging established players like Visa and Mastercard.

This strategic integration presents a substantial opportunity for vertical integration, potentially leading to reduced funding costs and the creation of new revenue streams through network fees. By controlling its own network, Capital One can streamline operations and offer more competitive pricing and innovative payment solutions to its customers.

Capital One is well-positioned to capitalize on the growing trend of digital banking. By further integrating advanced AI, the company can significantly enhance its digital offerings, providing more personalized customer experiences and streamlining operations. This focus on technology is crucial as consumers increasingly favor digital financial interactions.

The company's existing strengths in data analytics provide a solid foundation for AI-driven innovation. For instance, as of Q1 2024, Capital One reported a 12% year-over-year increase in digital customer engagement, highlighting the demand for their digital services. Continued investment in AI can unlock new avenues for growth and efficiency, allowing them to better serve a digitally-native customer base.

Capital One sees a chance to grow its auto lending, even with recent pricing adjustments. This is supported by rising average household incomes, which reached an estimated $84,000 in 2024, and a projected 3.5% increase in consumer spending for the same year, signaling a healthy market for vehicle financing.

The bank also has opportunities to further expand its consumer banking services. With consumer spending expected to continue its upward trend, Capital One can leverage this environment to attract new customers and deepen relationships through its checking, savings, and credit card products.

Leveraging Data for Enhanced Risk Management and Product Development

Capital One is well-positioned to leverage its extensive data analytics capabilities, now amplified by the Discover acquisition, to significantly enhance risk management. By analyzing the combined datasets, the company can refine its credit risk models, potentially leading to more accurate assessments and reduced default rates. This deeper understanding of customer behavior and creditworthiness is crucial in the evolving financial landscape of 2024-2025.

The integration of Discover's network provides Capital One with a wealth of new data, creating a powerful opportunity for product innovation. This allows for the identification of emerging market trends and the development of highly tailored financial products that cater to specific customer segments. For instance, analyzing spending patterns across both networks could reveal unmet needs for specialized credit cards or savings accounts.

Capital One can capitalize on this data advantage to create more personalized customer experiences and develop innovative financial solutions. This includes:

- Refining credit scoring algorithms: Utilizing a larger, more diverse dataset to improve predictive accuracy for loan approvals and pricing.

- Identifying unmet customer needs: Analyzing spending and saving habits to pinpoint opportunities for new product offerings, such as specialized rewards programs or investment vehicles.

- Developing personalized marketing campaigns: Using data insights to deliver targeted offers and financial advice, increasing customer engagement and loyalty.

- Enhancing fraud detection capabilities: Leveraging advanced analytics on the combined transaction data to identify and mitigate fraudulent activities more effectively.

Strategic Partnerships and Acquisitions

Capital One's strategic partnership and acquisition opportunities extend beyond its significant Discover deal. The company can pursue smaller, bolt-on acquisitions to enhance its technological capabilities or broaden its product portfolio in the dynamic financial services sector. For instance, acquiring fintech firms specializing in AI-driven customer service or personalized financial planning could bolster its competitive edge.

These strategic moves are crucial for maintaining market share and driving innovation. In 2023, Capital One invested approximately $4.5 billion in technology, a figure that underscores its commitment to digital transformation. Further targeted acquisitions in areas like embedded finance or data analytics could unlock new revenue streams and customer segments, particularly as the digital banking landscape continues to evolve rapidly.

Key areas for potential strategic alliances or acquisitions include:

- Fintech Integration: Acquiring or partnering with companies offering advanced AI, machine learning, or blockchain solutions to enhance customer experience and operational efficiency.

- Niche Market Expansion: Targeting smaller institutions or platforms that serve specific demographics or offer specialized financial products, thereby diversifying Capital One's customer base.

- Data Analytics and Security: Investing in or acquiring firms with robust data analytics capabilities or advanced cybersecurity measures to better understand customer behavior and protect sensitive information.

Capital One's acquisition of Discover Financial Services in February 2024 for approximately $35 billion creates a significant opportunity to operate its own payment network, directly competing with Visa and Mastercard. This vertical integration can lead to lower funding costs and new revenue streams from network fees, enhancing its competitive positioning.

The company is poised to leverage its strong data analytics, now augmented by Discover's data, to refine credit risk models and improve loan approval accuracy. This enhanced data capability is crucial for navigating the financial landscape of 2024-2025, potentially reducing default rates.

Capital One can capitalize on the growing digital banking trend by further integrating AI, offering more personalized customer experiences and streamlining operations, as evidenced by a 12% year-over-year increase in digital customer engagement in Q1 2024.

Opportunities also exist in expanding auto lending, supported by an estimated average household income of $84,000 in 2024 and a projected 3.5% increase in consumer spending, indicating a robust market for vehicle financing.

Threats

Capital One operates in a fiercely competitive financial services landscape. Major banks such as JPMorgan Chase, Bank of America, and Wells Fargo, along with agile fintech disruptors, are constantly vying for customer acquisition and market share across all of Capital One's core offerings, including credit cards, banking, and auto loans.

A significant economic downturn poses a substantial threat, potentially increasing loan defaults and net charge-offs, especially within Capital One's core credit card and auto loan segments. While the company has demonstrated resilience, its exposure to these portfolios makes it susceptible to deteriorating economic conditions.

For instance, during periods of economic stress, consumer spending often contracts, impacting the ability of individuals to repay credit obligations. This can directly translate into higher delinquency rates and, consequently, increased losses for financial institutions like Capital One. The company's robust risk management frameworks are crucial in navigating these potential headwinds, but the sheer scale of its credit operations means that widespread economic weakness can still present significant challenges.

Capital One faces significant threats from an evolving regulatory landscape. Changes in financial regulations, particularly those impacting consumer protection and data privacy, could necessitate costly adjustments to its business model and operations. For instance, ongoing scrutiny from bodies like the Consumer Financial Protection Bureau (CFPB) highlights the potential for increased compliance burdens and the risk of enforcement actions, which could affect profitability and market perception.

Cybersecurity Risks and Data Breaches

Capital One, as a leading technology-driven financial institution, faces significant cybersecurity risks. The sheer volume of sensitive customer data it manages makes it a prime target for cyberattacks. A successful breach could result in substantial financial penalties, severe reputational damage, and a critical loss of customer confidence.

- Increased Sophistication of Cyber Threats: Cybercriminals are continuously developing more advanced methods to infiltrate systems, posing an ongoing challenge to data protection.

- Regulatory Fines and Legal Ramifications: In 2023, the financial services sector continued to see significant fines for data protection failures, with regulatory bodies like the SEC and FTC imposing penalties that can reach millions of dollars.

- Impact on Customer Trust: A data breach can erode the trust customers place in Capital One to safeguard their personal and financial information, potentially leading to customer attrition.

- Operational Disruption: Cyberattacks can disrupt critical business operations, affecting service availability and the ability to conduct transactions, leading to direct revenue loss.

Technological Disruption and Fintech Innovation

Technological disruption, particularly from fintech innovators, presents a significant threat to Capital One. These nimble companies are rapidly developing specialized financial services that can chip away at traditional banking revenue streams. For instance, the growth of buy-now-pay-later services, often offered by fintechs, directly competes with credit card products, a core offering for Capital One.

Capital One must contend with the accelerating pace of innovation driven by these new entrants. Fintechs are leveraging technologies like AI and blockchain to offer more personalized and efficient customer experiences, forcing established players to invest heavily in their own digital transformation. By early 2025, the global fintech market is projected to reach over $33 billion, underscoring the scale of this competitive landscape.

- Fintech Disruption: Specialized fintech services, like digital payment platforms and alternative lending, directly challenge Capital One's core business.

- Customer Migration: Innovative user experiences offered by fintechs could attract a significant portion of Capital One's customer base, particularly younger demographics.

- Innovation Pressure: The need to match or exceed fintech offerings necessitates substantial and ongoing investment in technology and digital capabilities for Capital One.

Capital One faces intense competition from both traditional banks and nimble fintech companies, all vying for market share in credit cards, banking, and auto loans. An economic downturn poses a significant risk, potentially increasing loan defaults and impacting profitability, especially in its credit card and auto loan portfolios. Evolving regulations, particularly around consumer protection and data privacy, could lead to costly operational adjustments and compliance burdens. Furthermore, sophisticated cyber threats present a constant danger, with the potential for severe financial penalties, reputational damage, and loss of customer trust due to data breaches.

| Threat Category | Description | 2024/2025 Relevance |

|---|---|---|

| Intense Competition | Rivalry from large banks and fintechs | Ongoing, with fintechs capturing market share through innovative offerings. |

| Economic Downturn | Increased loan defaults and charge-offs | A potential slowdown in consumer spending in late 2024 could increase delinquency rates. |

| Regulatory Changes | New consumer protection and data privacy rules | Continued regulatory scrutiny, with potential for increased compliance costs and fines. |

| Cybersecurity Risks | Data breaches and sophisticated cyberattacks | As of early 2025, the cost of data breaches for financial institutions averages over $5 million per incident. |

| Fintech Disruption | Emergence of specialized financial services | Fintechs are projected to continue gaining traction, particularly in areas like digital payments and alternative lending. |

SWOT Analysis Data Sources

This Capital One SWOT analysis is built upon a foundation of comprehensive data, including publicly available financial statements, detailed market research reports, and expert industry analyses to provide a robust and informed strategic overview.