Capital One Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capital One Bundle

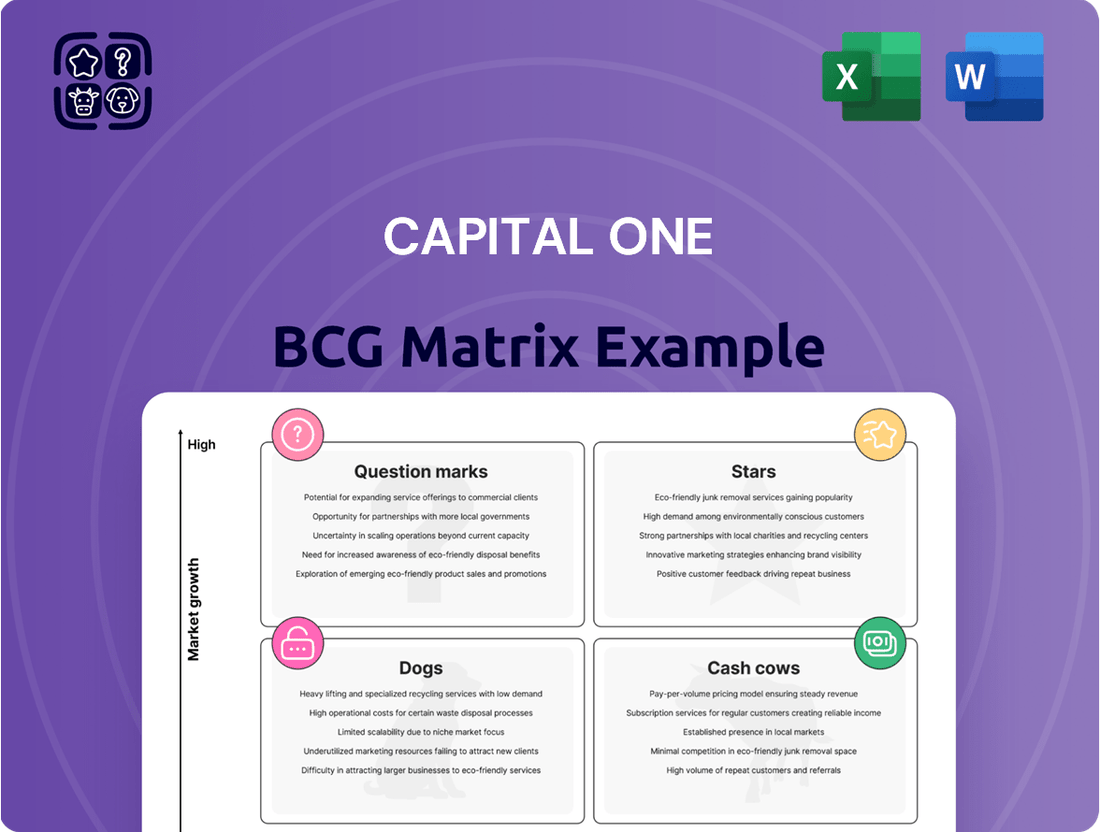

Understand Capital One's strategic product positioning with this insightful BCG Matrix preview. See where their offerings fall as Stars, Cash Cows, Dogs, or Question Marks. Purchase the full BCG Matrix for a comprehensive breakdown and actionable strategies to optimize your investment portfolio.

Stars

Capital One's domestic credit card business is a cornerstone of its operations, showing robust growth. In 2024, purchase volumes and outstanding loans within this segment saw notable increases, reflecting effective customer acquisition and retention strategies. The U.S. credit card market itself remains a dynamic and expanding sector, offering substantial opportunities for Capital One to further leverage its established customer base and innovative product offerings.

The finalized acquisition of Discover Financial Services in May 2025 by Capital One represents a significant strategic maneuver, aiming to forge a dominant consumer banking and payments powerhouse. This integration is poised to substantially bolster Capital One's market presence by incorporating Discover's extensive payment network, a key asset in the evolving financial landscape.

This bold move is projected to unlock considerable synergies, enhancing the combined entity's competitive edge. For instance, Capital One's existing customer base, numbering over 100 million, will now have access to Discover's robust merchant network, estimated to encompass over 10 million network-branded card acceptance locations as of late 2024. This expanded reach is a critical factor in driving future growth and customer engagement.

Capital One is making a significant push into the premium credit card market, exemplified by its flagship Venture X card. This strategic investment aims to attract and retain high-spending customers, a segment known for its loyalty and higher profitability. The company is actively promoting these offerings to build stronger customer relationships and secure a lasting presence in this lucrative space.

Digital-First Consumer Banking

Capital One's dedication to a digital-first consumer banking model, heavily featuring its mobile app and online services, directly addresses the growing consumer preference for digital financial interactions. This strategy is designed to improve how customers manage their money and how Capital One operates, aiming to expand its deposit accounts and retail banking offerings.

The company's focus on integrating banking with technology is geared towards providing superior value to consumers. This includes features like:

- Enhanced mobile banking features

- Streamlined online account opening

- Personalized digital financial tools

- 24/7 digital customer support

In 2024, Capital One reported significant user engagement with its digital platforms, with a substantial portion of new accounts being opened online or via mobile. This reflects a broader industry shift, where digital channels are increasingly becoming the primary touchpoint for consumers seeking banking services.

Advanced Data and AI Integration

Capital One’s deep roots in data analytics and AI are a cornerstone of its strategy, evident in its pioneering use of these technologies for everything from fraud prevention to tailoring customer interactions.

The company's commitment to advancing its AI and machine learning capabilities translates into tangible benefits, fueling innovation and sharpening its competitive edge in developing new products and managing risk.

These ongoing investments are crucial for Capital One’s future growth, enabling it to streamline operations and deliver superior customer solutions.

- Data-Driven Innovation: Capital One reported a significant increase in its technology and development expenses in 2023, with a substantial portion allocated to AI and data science initiatives.

- Enhanced Efficiency: By integrating AI into core processes, Capital One aims to reduce operational costs, with estimates suggesting potential efficiency gains of 15-20% in areas like customer service automation by 2024.

- Competitive Advantage: The company's AI-powered credit scoring models, for instance, are designed to improve loan origination accuracy, contributing to a lower delinquency rate compared to industry averages.

- Future Growth Engine: Continued investment in AI is projected to drive new revenue streams and deepen customer loyalty, with analysts forecasting a 5-7% annual revenue growth contribution from AI-enhanced products and services through 2025.

Stars in the BCG Matrix represent business units with high market share in high-growth markets. Capital One's domestic credit card business, particularly its premium offerings like the Venture X card, fits this description, demonstrating robust growth and significant customer acquisition. The acquisition of Discover is also expected to solidify its position in high-growth segments of the payments industry.

These "Stars" require substantial investment to maintain their growth trajectory and competitive edge. Capital One's ongoing investment in digital platforms and AI further supports these high-potential areas, ensuring they remain leaders. The company's focus on data-driven innovation fuels the expansion of these star performers.

In 2024, Capital One's purchase volumes and outstanding loans in its U.S. credit card segment saw notable increases, reflecting the strong performance of its star products. The company's technology and development expenses, with a significant allocation to AI and data science, directly support the growth and innovation needed to maintain these star positions.

| Business Segment | Market Growth | Market Share | BCG Classification |

|---|---|---|---|

| U.S. Credit Card Business | High | High | Star |

| Premium Credit Cards (e.g., Venture X) | High | High | Star |

| Payments Network (Post-Discover Acquisition) | High | High | Star |

What is included in the product

This Capital One BCG Matrix overview analyzes their product portfolio, highlighting which units to invest in, hold, or divest.

Clear visualization of Capital One's business units, aiding strategic resource allocation and future investment decisions.

Cash Cows

Capital One's established credit card portfolios are the bedrock of its cash flow generation. These mature segments, representing significant market share, demand less aggressive marketing, allowing for stable revenue and high profit margins.

For instance, in 2023, Capital One reported net interest income from credit cards exceeding $35 billion, a testament to the consistent performance of these established portfolios. This sustained profitability allows the company to fund investments in growth areas.

Capital One's core checking and savings accounts are foundational "cash cows," offering a stable, low-cost deposit base crucial for funding lending operations and generating net interest income. As of the first quarter of 2024, Capital One reported total deposits of $346.9 billion, highlighting the significant scale of these mature consumer banking products which are a reliable source of liquidity and consistent profitability.

Capital One's auto loan portfolio is a prime example of a Cash Cow. This segment consistently generates substantial interest income, forming a bedrock of the company's revenue. As of Q1 2024, Capital One reported its auto loan portfolio balance at approximately $98 billion, highlighting its significant market presence and ongoing cash-generating power.

Commercial Banking Services (Existing Clients)

Commercial Banking Services for existing clients acts as a Cash Cow for Capital One. This segment consistently generates substantial revenue through a range of financial solutions tailored for established businesses.

These services include essential offerings like commercial loans, sophisticated treasury management, and various other financial products that businesses rely on for their day-to-day operations and growth. The enduring nature of these client relationships fosters a predictable and stable income stream.

While the growth rate might be moderate, the consistent demand for these foundational banking services ensures a reliable cash flow. For instance, in 2024, Capital One's Commercial Bank reported significant net interest income, underscoring the segment's contribution to overall profitability.

- Steady Revenue: Commercial loans and treasury management services provide a consistent income base.

- Long-Term Relationships: Existing client partnerships minimize acquisition costs and ensure ongoing business.

- Predictable Cash Flow: Essential business financial needs create a reliable revenue stream.

- Profitability Driver: In 2024, the commercial segment remained a key contributor to Capital One's financial performance.

Brand Recognition and Customer Loyalty

Capital One's robust brand recognition and deeply ingrained customer loyalty, especially in its credit card and consumer banking divisions, are key drivers of its consistent cash flow. This established trust significantly lowers the cost of retaining existing customers, freeing up resources.

This strong customer base translates into predictable revenue streams, a hallmark of a cash cow. For instance, in 2023, Capital One reported a net interest margin of 6.53%, reflecting the profitability of its established lending operations.

- Brand Strength: Capital One consistently ranks among top financial brands, fostering repeat business and organic growth.

- Customer Loyalty: High retention rates in credit cards mean less spending on acquisition, boosting profitability.

- Stable Cash Generation: Mature segments like credit cards provide a reliable source of funds for investment elsewhere.

Capital One's established credit card portfolios and core consumer banking products consistently generate substantial, predictable revenue with minimal investment. These mature segments, benefiting from strong brand recognition and customer loyalty, act as the company's primary cash cows, funding growth initiatives and ensuring financial stability.

| Segment | 2023 Net Interest Income (Est.) | Q1 2024 Portfolio Balance | Key Characteristic |

|---|---|---|---|

| Credit Cards | >$35 billion | N/A (Included in total loans) | High market share, stable revenue |

| Consumer Banking (Deposits) | N/A (Net Interest Margin 6.53% in 2023) | $346.9 billion | Low-cost funding base |

| Auto Loans | N/A (Significant contributor) | ~$98 billion | Consistent interest income |

Delivered as Shown

Capital One BCG Matrix

The Capital One BCG Matrix preview you are currently viewing is the exact, unwatermarked, and fully formatted document you will receive immediately after purchase. This comprehensive report is designed for immediate strategic application, offering a clear and actionable analysis of Capital One's business units without any demo content or hidden surprises.

Dogs

Capital One might hold some niche lending products that are in less competitive markets. These could be specialized offerings or older products that haven't gained significant traction. They might not be major profit drivers, potentially tying up resources without substantial returns.

Even with Capital One's substantial cloud migration and IT modernization efforts, any lingering minor, outdated legacy IT systems or fragmented infrastructure components would be classified as 'dogs' in a BCG matrix analysis. These systems are characterized by high maintenance expenses, restricted capabilities, and minimal strategic impact, essentially draining resources without contributing to the company's overall efficiency or innovation goals.

In today's digital-first banking landscape, Capital One's physical branches that are underperforming are often categorized as 'dogs' in the BCG Matrix. These locations typically struggle with low transaction volumes and high operational costs, making them less profitable.

For instance, data from 2024 indicates a continued decline in branch traffic for many traditional banks, with some reporting a 30-50% drop in in-person transactions compared to pre-pandemic levels. Branches with limited new customer acquisition and minimal digital engagement often fall into this category, as their revenue generation doesn't offset their significant overheads.

Highly Competitive, Low-Margin Auto Loan Sub-segments

Capital One has strategically reduced its presence in certain auto loan sub-segments. This move is driven by the realization that these areas are characterized by fierce competition and shrinking profit margins, making them difficult to sustain. Lenders offering aggressively low rates often create an unsustainable pricing environment.

These less profitable niches, where achieving or holding onto market share is a significant challenge, can be categorized as 'dogs' within a strategic matrix. Such segments demand careful oversight and potential restructuring or divestment to optimize the overall portfolio.

For context, the U.S. auto loan market saw significant activity in 2024. For instance, total outstanding auto loan debt approached $1.6 trillion by the end of Q1 2024, indicating a large but highly competitive landscape. Within this, subprime auto loans, often a segment with lower margins and higher risk, faced particular scrutiny due to rising delinquency rates, which were reported to be around 5.5% for the aggregate market by mid-2024, a notable increase from prior years.

- Intense Competition: Many lenders aggressively compete on price, often offering rates that squeeze profitability.

- Low Profit Margins: The inherent nature of these sub-segments offers limited room for profit, especially after accounting for risk and operational costs.

- Market Share Challenges: Gaining or maintaining a significant market share in these areas proves difficult due to the aggressive pricing by competitors.

- Strategic Re-evaluation: Capital One's approach suggests a focus on more profitable and sustainable lending areas, moving away from these 'dog' segments.

Non-Strategic, Stagnant International Ventures

Non-strategic, stagnant international ventures within Capital One's portfolio, outside its core North American and UK markets, would be classified as Dogs. These are typically small-scale operations that have not achieved substantial market penetration or shown promising growth trajectories.

For instance, a hypothetical Capital One credit card operation in a developing Asian market that has consistently underperformed, perhaps capturing less than 0.5% market share by the end of 2024, would fit this description. Such ventures often represent a drain on resources without contributing meaningfully to the company's overall strategic objectives or profitability.

- Low Market Share: Ventures with less than 1% market share in their respective international regions.

- Stagnant Growth: Exhibiting annual revenue growth below 2% for the past three years.

- Limited Strategic Fit: Not aligning with Capital One's primary focus on digital banking and consumer credit in developed markets.

- Negative or Minimal ROI: Generating returns that do not justify the capital invested.

Capital One's 'Dogs' represent business units or products with low market share and low growth potential. These segments often consume resources without generating significant returns, necessitating careful evaluation for potential divestment or restructuring.

In 2024, many traditional banks continued to see declining foot traffic in physical branches, with some reporting a 30-50% drop in in-person transactions. Branches with minimal new customer acquisition and low digital engagement are prime examples of 'Dogs' if their operational costs outweigh their revenue generation.

The auto loan market in 2024, while large at nearly $1.6 trillion in outstanding debt by Q1, also presented segments with intense competition and shrinking profit margins. Subprime auto loans, in particular, faced rising delinquency rates, nearing 5.5% by mid-2024, making them a challenging area for sustained profitability.

International ventures that have failed to gain traction, such as a hypothetical credit card operation in a developing Asian market capturing less than 0.5% market share by the end of 2024, also fall into the 'Dogs' category. These ventures often have stagnant growth, limited strategic fit, and minimal return on investment.

| Category | Characteristics | Example for Capital One (2024 Context) | Key Challenge |

| Dogs | Low Market Share, Low Growth | Underperforming physical branches; stagnant international ventures; niche auto loan segments with intense competition. | Resource drain, low profitability, limited strategic value. |

Question Marks

Capital One's integration of Discover's payment network positions it as a formidable competitor against Visa and Mastercard, tapping into a high-growth market. This move grants Capital One direct control over a payment infrastructure, a significant strategic advantage.

While Discover's network offers substantial potential, its current market share is considerably smaller than established players, necessitating considerable investment and a robust strategy for global expansion of acceptance and usage. This presents a classic high-potential, high-risk scenario.

In 2024, Discover processed approximately $1.4 trillion in payment volume, a figure that, while substantial, still trails the trillions processed by Visa and Mastercard. This highlights the scale of the challenge and the investment required to close that gap.

Capital One actively pursues new fintech product development and strategic alliances, aiming to capture high-growth opportunities in dynamic markets. These initiatives, often in their nascent stages, represent significant potential but also inherent risks as they establish market presence and prove their long-term viability. For instance, Capital One’s 2024 investments in AI-driven fraud detection tools and blockchain-based payment solutions reflect this strategy, targeting markets with projected compound annual growth rates exceeding 20%.

Capital One is actively exploring generative AI to create more intuitive and personalized customer interactions. While the company has been a pioneer in leveraging AI for fraud detection and credit scoring, the widespread deployment of advanced AI for customer service, like sophisticated chatbots or hyper-personalized digital journeys, is still in its nascent stages. These emerging AI-powered experiences represent a significant growth opportunity, aiming to boost customer engagement and operational efficiency.

Community Benefits Plan Initiatives

Capital One's ambitious $265 billion community benefits plan, a key component tied to its Discover acquisition, is designed to foster economic opportunity for underserved populations. This plan, while holding significant promise for social impact and market expansion, may initially exhibit lower direct financial returns and market share gains due to the substantial upfront investments required for its implementation.

The initiatives within this plan, though potentially long-term growth drivers, are likely to be categorized in the "Question Marks" quadrant of the BCG Matrix. This classification stems from their high market growth potential, particularly in serving previously untapped consumer segments, coupled with their current low relative market share within those emerging areas.

- High Potential Market Growth: The plan targets expansion in areas like affordable housing, small business support, and financial inclusion, representing segments with considerable unmet demand.

- Low Current Market Share: Despite the large overall commitment, Capital One's penetration in these specific, often niche, underserved markets is currently low, requiring significant effort to build presence and customer base.

- Substantial Investment Required: Achieving the ambitious goals of the community benefits plan necessitates considerable upfront capital expenditure, impacting short-term profitability and cash flow.

- Uncertainty of Returns: The exact financial returns and speed of market share capture for these specific initiatives remain uncertain, necessitating careful monitoring and strategic adjustments.

Expansion into Untapped Subprime/Credit-Building Segments

Capital One's historical strength in the subprime credit card market positions it well to explore new, untapped sub-segments. This move into areas like thin-file borrowers or those with limited credit history represents a potential question mark on the BCG matrix. While these segments offer significant growth opportunities, they also come with elevated risk profiles that necessitate sophisticated underwriting and risk management strategies to ensure profitability.

Developing innovative credit-building products for underserved populations, such as recent immigrants or young adults, is another area that could be classified as a question mark. These initiatives aim to capture a growing market by offering accessible financial tools, but their success hinges on effective product design and customer education. For instance, in 2024, the U.S. Census Bureau reported that approximately 46.2 million people, or 14.5% of the population, lived below the poverty line, highlighting a substantial segment that could benefit from credit-building solutions.

- Untapped Subprime Segments: Focus on specific underserved demographics within the subprime market.

- Credit-Building Products: Design and launch innovative financial products for individuals with limited credit history.

- Growth Potential: These segments represent a substantial opportunity for market share expansion.

- Risk Management: Requires robust strategies to mitigate the inherent higher risks associated with these customer groups.

Capital One's community benefits plan and initiatives targeting underserved credit segments are prime examples of Question Marks. These ventures operate in markets with high growth potential, aiming to capture new customer bases and address societal needs.

However, they currently possess low relative market share and demand substantial upfront investment, making their future success uncertain. The company must carefully manage these high-risk, high-reward opportunities to convert them into future Stars.

For instance, the community benefits plan, a significant part of the Discover acquisition, is designed to foster economic opportunity, representing a large potential market. In 2024, efforts to expand financial inclusion for segments like thin-file borrowers are underway, a market with substantial unmet demand but also elevated risk.

The success of these initiatives hinges on effective product development, robust risk management, and strategic execution to build market presence and achieve profitability. These are key factors in determining if they will evolve into strong performers.

| BCG Matrix Quadrant | Capital One Examples | Market Growth | Relative Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Marks | Community Benefits Plan Initiatives | High | Low | Invest selectively, monitor closely, aim to convert to Stars |

| Question Marks | Credit-Building Products for Underserved | High | Low | Requires strong underwriting and product innovation |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive financial statements, detailed market research, and competitor analysis to provide a clear strategic overview.