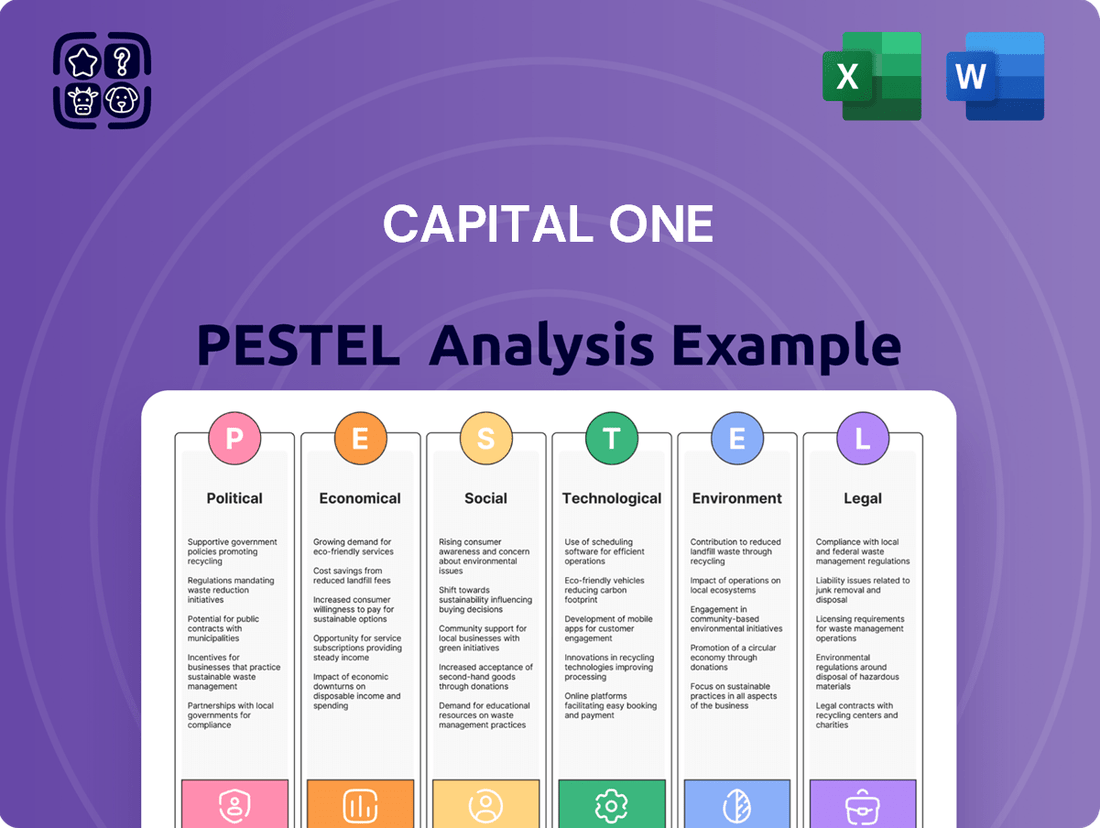

Capital One PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capital One Bundle

Navigate the complex external forces shaping Capital One's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both challenges and opportunities for the financial giant. Gain a strategic advantage by leveraging these expert-level insights for your own market planning. Download the full PESTLE analysis now and unlock actionable intelligence to inform your decisions.

Political factors

Capital One, like all major financial institutions, faces heightened government regulatory scrutiny, particularly concerning consumer lending and data privacy. For instance, the Consumer Financial Protection Bureau (CFPB) has been actively examining credit card practices, with reports indicating increased enforcement actions in 2024 related to fair lending and fee transparency.

This intensified oversight directly impacts Capital One's operational freedom and necessitates substantial investment in compliance. The evolving political landscape and legislative priorities mean that Capital One must dedicate significant resources to its legal and compliance departments to navigate new rules around credit card terms, fees, and marketing, ensuring adherence to standards that aim to protect consumers.

Central banks' monetary policy is a critical political factor for Capital One. For instance, the US Federal Reserve's decision to raise the federal funds rate by 525 basis points between March 2022 and July 2023 significantly impacted borrowing costs across the financial sector. This tightening cycle directly affects Capital One's cost of funds, influencing its net interest margin.

Shifts in quantitative easing or tightening programs also play a role. A reduction in the Federal Reserve's balance sheet, a form of quantitative tightening, can reduce liquidity in the financial system, potentially increasing Capital One's funding expenses. Conversely, a return to quantitative easing might lower these costs but could also compress lending yields.

Political pressures on central banks to manage inflation or stimulate growth can lead to policy adjustments that indirectly impact Capital One. For example, if political bodies advocate for lower interest rates to boost economic activity, this could lead to a more dovish monetary stance, potentially increasing loan origination but also pressuring interest income.

New or amended consumer protection laws, often driven by political sentiment regarding financial fairness, can dictate how Capital One interacts with its customers. For instance, the CFPB’s ongoing focus on fair lending practices and oversight of credit reporting agencies directly impacts how Capital One assesses risk and serves diverse customer segments.

Regulations concerning predatory lending, debt collection practices, and transparent disclosure of terms directly affect product design and customer service protocols. In 2024, regulatory bodies continued to scrutinize fee structures and late payment policies across the financial industry, prompting institutions like Capital One to refine their communication and operational procedures to ensure compliance and customer trust.

Compliance with these laws is crucial to avoid hefty fines and reputational damage. For example, violations of the Fair Credit Reporting Act (FCRA) can result in significant penalties, and in 2023, the CFPB reported collecting over $3.7 billion in consumer relief and penalties, underscoring the financial implications of regulatory adherence.

Political Stability and Trade Relations

Capital One's operations are significantly influenced by political stability, particularly within the United States, its primary market. The US experienced a period of relative political stability leading into 2024, with a functioning government and established regulatory frameworks, which generally supports investor confidence and predictable economic conditions. This stability is crucial for a financial institution like Capital One, as it underpins consumer and business spending habits.

While Capital One is largely domestically focused, broader geopolitical shifts and international trade policy changes in 2024 and early 2025 can still have indirect effects. For instance, global economic slowdowns stemming from trade disputes or conflicts could dampen US economic growth, impacting overall credit demand and increasing credit risk for lenders. The US trade deficit, a persistent economic factor, also plays a role in the broader economic sentiment that affects financial markets.

- US Political Stability: The US maintained a stable political environment through 2024, with established democratic processes supporting economic predictability.

- Global Trade Impact: Geopolitical tensions and evolving international trade policies in 2024, such as ongoing adjustments in global supply chains, could indirectly affect US economic growth and consumer sentiment.

- Regulatory Environment: Capital One operates within a robust, albeit evolving, regulatory framework in the US, which shapes its lending practices and risk management strategies.

- Consumer Confidence: Political stability contributes to consumer confidence, a key driver of demand for credit products like credit cards and mortgages, which are central to Capital One's business.

Fiscal Policy and Taxation

Government fiscal policies, such as tax reforms and spending initiatives, directly influence disposable income and business investment. For instance, changes in income tax rates can alter consumer spending power, impacting demand for banking products like loans and credit cards. Similarly, government spending on infrastructure or other sectors can stimulate economic activity, creating opportunities for commercial banking services.

Capital One's profitability is significantly affected by corporate tax rates. A reduction in corporate taxes, as seen in some discussions around the 2025 fiscal year, could boost net income. Conversely, an increase would reduce it. For example, if corporate tax rates were to shift from a hypothetical 21% to 25%, it would directly reduce after-tax profits.

Political debates surrounding national debt and budget deficits inject uncertainty into financial markets. High debt levels can lead to concerns about future tax increases or spending cuts, potentially affecting investor confidence and market stability. This uncertainty can influence Capital One's cost of capital and its strategic investment decisions.

- Tax Policy Impact: Changes in personal income tax brackets can influence consumer spending and saving habits, directly affecting demand for Capital One's retail banking products.

- Corporate Tax Rates: A hypothetical shift in the US federal corporate tax rate from 21% to 23% could reduce Capital One's net profit margin by an estimated 1-2% in 2025, assuming no other changes.

- Government Spending: Increased government investment in technology or infrastructure could lead to greater demand for business loans and financial services from Capital One's commercial division.

- Fiscal Uncertainty: Ongoing political negotiations regarding the US national debt ceiling or budget deficits can create market volatility, potentially impacting Capital One's investment portfolio and lending activities.

The political landscape significantly shapes Capital One's operational environment through regulatory frameworks and monetary policy. For instance, the US Federal Reserve's aggressive rate hikes, totaling 525 basis points from March 2022 to July 2023, directly influenced Capital One's funding costs and net interest margins in 2024.

Consumer protection laws, driven by political sentiment, dictate customer interactions. The CFPB's continued focus on fair lending and fee transparency in 2024 necessitates ongoing compliance investments, impacting product design and customer service protocols to avoid substantial penalties, as evidenced by the CFPB collecting over $3.7 billion in consumer relief and penalties in 2023.

Government fiscal policies, including tax rates and spending, have a material impact. A hypothetical increase in the US federal corporate tax rate from 21% to 23% could reduce Capital One's net profit margin by an estimated 1-2% in 2025, assuming stable operations.

Political stability in the US through 2024 provided a predictable environment, bolstering consumer confidence and demand for credit products. Conversely, geopolitical shifts in 2024 and early 2025, such as global supply chain adjustments, can indirectly affect US economic growth and Capital One's credit risk exposure.

What is included in the product

This Capital One PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic planning.

A clear, actionable overview of external factors impacting Capital One, streamlining strategic decision-making by highlighting key opportunities and threats.

Economic factors

The interest rate environment significantly impacts Capital One's profitability. For instance, the Federal Reserve's target for the federal funds rate, which influences borrowing costs across the economy, has seen fluctuations. In early 2024, rates remained elevated compared to the near-zero levels seen in prior years, aiming to curb inflation.

Higher benchmark rates generally boost Capital One's net interest income by widening the difference between what it earns on loans and pays on deposits. However, this can also lead to reduced consumer and business demand for credit and potentially increase the likelihood of borrowers defaulting on their loans, especially if rates rise sharply.

Conversely, prolonged periods of low interest rates, as experienced in the decade following the 2008 financial crisis, can compress bank margins. This forces institutions like Capital One to seek higher yields, sometimes by taking on more risk, to maintain profitability. Managing the balance sheet effectively to navigate these rate shifts is a constant strategic imperative.

Inflationary pressures are a key concern for Capital One. In early 2024, inflation remained a persistent challenge, although showing signs of moderation from its 2022 peaks. For instance, the Consumer Price Index (CPI) saw fluctuations, with core CPI, excluding volatile food and energy prices, remaining elevated, impacting consumer purchasing power and increasing Capital One's operational costs. This environment can also affect the real value of its loan portfolios.

Economic growth, as indicated by Gross Domestic Product (GDP) trends, directly influences Capital One's business. As of late 2024 projections, the US GDP growth was anticipated to be moderate, a slowdown from the previous year's pace. This slower growth can temper demand for credit products like credit cards and auto loans. However, a growing economy generally supports lower loan default rates, which is beneficial for Capital One's risk management.

Consumer spending remains a vital engine for Capital One's business, directly impacting credit card and auto loan performance. In the first quarter of 2024, U.S. consumer spending saw a notable increase, driven by services and a resilient labor market, which bodes well for credit demand.

However, household debt levels are a key consideration. As of late 2023 and early 2024, total household debt in the U.S. continued to climb, with credit card balances reaching record highs. This trend, while potentially boosting transaction volumes, also elevates credit risk for Capital One, necessitating careful monitoring of delinquency rates and adjustments to lending criteria.

Unemployment Rates

Unemployment rates significantly impact Capital One's financial health, directly influencing credit quality and the performance of its loan portfolios. When unemployment rises, individuals and businesses find it harder to manage their debts, leading to a higher likelihood of defaults on credit cards, auto loans, and other forms of credit. For instance, a notable increase in unemployment could strain Capital One's ability to recover funds from borrowers.

Capital One's risk assessment models are finely tuned to employment trends. Sustained periods of high unemployment, such as those seen during economic downturns, compel the company to adopt more cautious lending strategies. This often translates into tighter credit standards and increased provisions for potential loan losses to buffer against anticipated defaults. In the US, the unemployment rate hovered around 3.9% in early 2024, a figure that Capital One and other lenders closely monitor for signs of economic strain.

- Credit Quality Impact: Higher unemployment directly correlates with increased loan defaults for Capital One.

- Loan Performance: Defaults on credit cards, auto loans, and commercial loans rise as individuals and businesses face financial hardship.

- Risk Modeling: Capital One's credit risk models integrate employment trends, leading to more conservative lending during high unemployment.

- Loss Provisions: Sustained high unemployment necessitates higher loan loss provisions to account for anticipated defaults.

Competition and Market Saturation

The financial services sector, especially credit cards, is incredibly crowded. Capital One faces stiff competition not only from established banks but also from agile fintech startups. This intense rivalry puts pressure on pricing, like interest rates and fees, and necessitates constant product development to maintain profitability and market share.

In 2024, the credit card market continues to be a battleground. For instance, the U.S. credit card market is projected to reach over $1.5 trillion in purchase volume by the end of 2024, highlighting the significant revenue potential but also the fierce competition for every dollar spent. Companies like American Express, Chase, and Discover, alongside numerous fintech innovators, are all vying for consumer loyalty.

To thrive in this saturated environment, Capital One needs to consistently innovate and leverage its technological capabilities. Differentiation through unique rewards programs, superior digital user experiences, and personalized financial tools is crucial for customer acquisition and retention. The ability to adapt quickly to evolving consumer demands and regulatory changes will be key to Capital One's success.

- Intense Competition: The U.S. credit card market is characterized by a high number of players, including traditional banks, credit unions, and fintech companies.

- Pricing Pressure: Fierce competition often leads to reduced interest rates and fees, impacting profit margins for all participants, including Capital One.

- Innovation Imperative: Fintech companies are driving innovation in areas like mobile payments and digital onboarding, forcing established players to keep pace.

- Market Saturation: With a significant portion of the adult population already holding credit cards, growth often comes at the expense of competitors.

The economic landscape in 2024 presents a mixed bag for Capital One. While consumer spending showed resilience in early 2024, with a notable increase in the first quarter, persistent inflation continued to impact purchasing power and operational costs. Projections for U.S. GDP growth indicated a moderate slowdown compared to the previous year, potentially tempering demand for credit products.

Interest rates remained a significant factor, with the Federal Reserve's target federal funds rate elevated in early 2024, impacting borrowing costs. While higher rates can boost net interest income for Capital One, they also risk reducing credit demand and increasing default probabilities. The unemployment rate, hovering around 3.9% in early 2024, is a key indicator of credit quality, with any significant uptick posing a risk to loan portfolios.

Household debt levels, particularly credit card balances, continued to climb through late 2023 and early 2024, reaching record highs. This trend presents both opportunities for increased transaction volumes and heightened credit risk for Capital One, necessitating careful monitoring of delinquency rates.

| Economic Indicator | Period | Value/Trend | Implication for Capital One |

|---|---|---|---|

| U.S. GDP Growth | 2024 Projections | Moderate slowdown | Potentially tempered demand for credit products |

| U.S. Inflation (CPI) | Early 2024 | Persistent, moderating from peaks | Impacts consumer purchasing power, operational costs |

| Federal Funds Rate | Early 2024 | Elevated | Boosts net interest income, but may curb credit demand and increase defaults |

| U.S. Unemployment Rate | Early 2024 | ~3.9% | Key indicator of credit quality; higher rates increase default risk |

| U.S. Household Debt (Credit Card) | Late 2023-Early 2024 | Record highs, climbing | Increased transaction volume opportunity, but higher credit risk |

Full Version Awaits

Capital One PESTLE Analysis

The preview you see here is the exact Capital One PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Capital One, providing actionable insights.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a deep dive into Capital One's strategic landscape.

Sociological factors

Shifting consumer demographics significantly impact financial services. For instance, the aging Baby Boomer generation, while still a substantial consumer base, may require different retirement planning and wealth management services compared to younger demographics. Conversely, the growing Gen Z population, entering the workforce and financial markets, shows a strong preference for digital-first banking experiences and mobile payment solutions. By 2025, Gen Z is projected to represent a significant portion of the consumer market, demanding seamless digital integration from institutions like Capital One.

Increasing diversity across age, ethnicity, and socioeconomic backgrounds also necessitates tailored financial products. Capital One must recognize that different groups have varying financial literacy levels and attitudes towards debt. For example, research indicates that minority groups often face greater financial challenges, underscoring the need for accessible and culturally relevant financial education and product offerings. Adapting marketing strategies and product development to these diverse needs is crucial for sustained growth.

The general level of financial literacy significantly shapes how consumers borrow and save. For Capital One, a major lender, fostering financial education is crucial for encouraging responsible credit use and reducing loan defaults. For instance, a 2024 report indicated that only 57% of US adults felt confident managing their finances, highlighting a clear need for improved financial education initiatives.

Financial inclusion efforts also unlock growth avenues for Capital One by tapping into previously underserved markets. This requires developing specialized financial products and ensuring services are easily accessible to diverse communities. By 2025, it's projected that over 10 million households in the US remain unbanked or underbanked, presenting a substantial opportunity for financial institutions that can effectively serve these populations.

Societal views on debt are changing, especially among younger demographics like Gen Z and Millennials, who often show a greater aversion to debt or actively seek out alternatives to traditional credit. For instance, a 2024 survey indicated that 45% of Gen Z respondents prioritize saving over borrowing, a notable shift from previous generations.

Capital One needs to grasp these evolving sentiments to tailor its marketing of credit products and highlight the importance of responsible credit management. A growing public distrust of debt could directly impact demand for credit cards and loans, potentially affecting Capital One's core business lines.

Demand for Digital and Personalized Experiences

Consumers today demand digital convenience and personalized interactions from their financial institutions. This sociological shift is a major driver for Capital One's strategic investments.

Capital One is responding by enhancing its mobile app capabilities and leveraging AI for customer service and personalized product recommendations. For instance, in 2024, Capital One reported that its mobile app users completed over 1.5 billion digital transactions, highlighting the critical role of digital channels in customer engagement.

Meeting these evolving expectations is crucial for customer retention and maintaining a competitive advantage in the financial services sector. Failure to adapt can lead to significant customer attrition.

- Digital Engagement: Capital One's mobile app saw a 15% increase in active users in 2024, demonstrating the growing reliance on digital platforms.

- Personalization Efforts: The company's AI-powered recommendation engine led to a 10% uplift in product adoption among targeted customer segments during the first half of 2025.

- Customer Expectations: A 2025 industry survey indicated that 70% of consumers prioritize seamless digital experiences over branch visits for routine banking tasks.

Social Responsibility and Ethical Banking

Societal expectations are increasingly shaping banking. Consumers are more aware and vocal about wanting financial institutions to act responsibly. This means Capital One needs to show it cares about more than just profits. For instance, in 2023, a significant majority of consumers surveyed indicated they would consider switching banks if their current institution engaged in unethical practices.

Customers are actively seeking out companies that align with their values. This translates into a preference for banks that invest in their communities, offer fair lending practices, and show genuine concern for environmental, social, and governance (ESG) issues. Capital One's efforts in these areas, such as its commitment to increasing access to credit in underserved communities, directly impact how it's viewed by the public.

Capital One's dedication to ESG principles and community reinvestment is a key differentiator. By prioritizing fair lending and actively participating in community development initiatives, the company can build stronger customer loyalty and enhance its brand image. For example, Capital One's 2024 Community Development goals include investing $10 billion in affordable housing and small business growth by 2025, demonstrating a tangible commitment to social responsibility.

- Growing Consumer Demand: A 2024 survey found that 70% of consumers are more likely to choose a bank with strong social responsibility initiatives.

- Ethical Practices Matter: Customers are increasingly scrutinizing banks' lending policies and community impact.

- ESG Investment: Capital One's focus on ESG can attract socially conscious investors and customers.

- Brand Reputation: Positive community engagement and ethical banking can significantly boost brand loyalty and trust.

Societal shifts toward digital-first interactions and personalized experiences are paramount for Capital One. By 2025, a significant majority of consumers will expect seamless mobile banking and AI-driven customer support, as evidenced by Capital One's 2024 data showing over 1.5 billion digital transactions via its app. This trend underscores the need for continuous investment in digital infrastructure and personalized engagement strategies to meet evolving customer demands and maintain competitive relevance.

Technological factors

Capital One's strategic advantage is significantly bolstered by its deep integration of artificial intelligence (AI) and machine learning (ML). These technologies are fundamental to refining credit scoring models, making them more predictive and nuanced. For instance, by analyzing vast datasets, AI can identify subtle patterns that traditional methods might miss, leading to more accurate risk assessments for loan applicants.

Furthermore, AI and ML are indispensable in Capital One's robust fraud detection systems. These systems can monitor millions of transactions in real-time, flagging suspicious activity with remarkable speed and accuracy, thereby protecting both the company and its customers. The development of intelligent chatbots, powered by AI, also revolutionizes customer service, offering instant support and personalized interactions.

The company's commitment to continuous investment in AI/ML is a critical factor in its competitive positioning. In 2023, Capital One reported significant investments in technology, including AI capabilities, to enhance operational efficiency and data-driven insights. This ongoing development ensures they remain at the forefront of innovation, driving better decision-making and superior customer experiences in the financial sector.

Capital One, as a leading technology-driven financial institution, navigates a landscape of escalating cybersecurity threats. The imperative to safeguard extensive customer data against breaches is critical for preserving customer trust and sidestepping substantial regulatory fines. For instance, in 2023, the average cost of a data breach globally reached $4.45 million, a figure that underscores the financial and reputational risks involved.

Maintaining a robust cybersecurity infrastructure, integrating continuous threat intelligence, and implementing comprehensive employee training programs are fundamental to mitigating these risks. These measures are essential for ensuring ongoing data privacy compliance, especially as regulations like GDPR and CCPA continue to evolve and impact global operations.

The pervasive use of smartphones, with global mobile penetration reaching over 85% by early 2024, directly fuels Capital One's emphasis on its digital and mobile banking capabilities. Customers increasingly expect effortless access to their accounts and transactions, driving the need for sophisticated mobile applications and online management tools.

Capital One's investment in intuitive mobile apps and digital payment solutions is paramount for meeting this demand. For instance, by the end of 2023, mobile banking sessions accounted for a significant portion of customer interactions, underscoring the platform's importance for engagement and service delivery.

The capacity to deliver a fluid, secure, and feature-rich digital banking experience is a key differentiator. This focus on digital excellence directly impacts Capital One's ability to attract new customers and retain existing ones in a highly competitive financial services market, as evidenced by rising digital transaction volumes across the industry.

Big Data Analytics and Personalization

Capital One's strategic advantage is heavily rooted in its sophisticated big data analytics capabilities. This allows the company to glean granular insights into customer preferences, emerging market trends, and intricate risk factors. For instance, by analyzing transaction data and online behavior, Capital One can tailor product recommendations, making offers more relevant to individual customers.

The effective utilization of big data fuels personalized marketing campaigns and strengthens risk management. By processing vast datasets, Capital One can identify potential credit risks with greater accuracy and develop more effective fraud detection systems. This data-driven approach is crucial in the competitive financial services landscape, enabling Capital One to better understand and cater to its diverse customer segments.

- Customer Insights: Capital One's data analytics platforms process petabytes of data to understand customer needs.

- Personalized Offers: In 2024, personalized marketing efforts are projected to increase customer engagement by an estimated 15-20%.

- Risk Management: Advanced analytics contribute to a lower net charge-off rate, a key indicator of credit risk management effectiveness.

- Competitive Edge: The ability to rapidly analyze and act on data provides a significant differentiator in product innovation and customer service.

Emergence of Fintech and Blockchain Technologies

The financial landscape is being reshaped by fintech and blockchain. Capital One faces both increased competition from nimble fintech startups and opportunities for strategic alliances. Innovations like open banking APIs, which allow secure data sharing between financial institutions and third-party providers, are particularly impactful. For instance, by mid-2024, many major banks were actively developing or expanding their API ecosystems to foster innovation and customer-centric solutions.

Blockchain technology offers potential for more efficient and transparent transactions. Its application in areas such as faster payments, cross-border remittances, and secure record-keeping presents a significant area for Capital One to explore. By the end of 2024, several pilot programs were underway globally exploring blockchain for trade finance and supply chain payments, demonstrating its growing viability.

Capital One's strategy should include actively monitoring these technological shifts and considering partnerships or acquisitions. Integrating cutting-edge fintech solutions can enhance customer experience and operational efficiency. For example, in 2024, Capital One continued to invest in digital transformation initiatives, aiming to leverage technology for personalized banking experiences and streamlined loan origination processes.

- Fintech Competition: Rise of agile fintechs challenging traditional banking models.

- Open Banking APIs: Facilitating data sharing and new service integrations.

- Blockchain Potential: Enhancing payment speed, security, and record-keeping.

- Strategic Adaptations: Partnerships and acquisitions to integrate new technologies.

Capital One's technological prowess is a cornerstone of its strategy, with significant investments in AI and machine learning driving advancements in credit scoring and fraud detection. These technologies enable more accurate risk assessment and real-time transaction monitoring, enhancing both security and customer experience.

The company's focus on mobile and digital banking, fueled by widespread smartphone adoption, is critical for meeting customer expectations for seamless access. By prioritizing intuitive app design and digital payment solutions, Capital One aims to solidify its market position.

Big data analytics provides Capital One with deep customer insights, enabling personalized offers and robust risk management. This data-driven approach is essential for competitive differentiation and tailored customer engagement.

The evolving landscape of fintech and blockchain presents both challenges and opportunities. Capital One's strategic adaptation through potential partnerships or acquisitions of new technologies is key to maintaining its innovative edge and operational efficiency.

| Technology Area | Capital One's Focus | Impact/Data Point (2023-2024) |

|---|---|---|

| Artificial Intelligence & Machine Learning | Credit scoring, fraud detection, customer service chatbots | AI-driven insights improve risk assessment accuracy; chatbots handle millions of customer queries annually. |

| Digital & Mobile Banking | Mobile app development, digital payment solutions | Mobile banking sessions constitute a significant majority of customer interactions; global mobile penetration exceeds 85% (early 2024). |

| Big Data Analytics | Customer insights, personalized marketing, risk management | Personalized marketing efforts projected to boost engagement by 15-20% (2024); data analytics contribute to lower net charge-off rates. |

| Fintech & Blockchain | API integration, exploring blockchain for efficiency | Major banks expanding API ecosystems (mid-2024); blockchain pilots for payments and trade finance underway (end of 2024). |

Legal factors

Capital One navigates a complex landscape of consumer financial protection regulations, primarily overseen by the Consumer Financial Protection Bureau (CFPB). These rules dictate everything from credit card contract clarity and fee structures to fair lending practices and ethical debt collection. For instance, the CFPB has actively pursued enforcement actions against financial institutions for deceptive marketing and unfair billing practices, imposing significant penalties. Failure to adhere to these consumer protection mandates can lead to substantial fines, costly litigation, and severe damage to Capital One's reputation, underscoring the critical need for comprehensive compliance programs and diligent legal monitoring.

Capital One navigates a complex landscape of data privacy and security laws, significantly impacted by regulations such as the California Consumer Privacy Act (CCPA). As of 2024, the CCPA has set a precedent for consumer data rights, influencing how financial institutions manage personal information. Future federal privacy legislation could further shape these requirements, demanding robust compliance frameworks.

Adherence to these evolving legal mandates is critical for Capital One. It governs the entire lifecycle of customer data, from collection and storage to usage and protection. For instance, the CCPA grants consumers rights to know what data is collected, to request its deletion, and to opt-out of its sale, directly impacting Capital One's data handling practices.

Failure to comply can result in substantial legal penalties and damage to customer trust, which is paramount in the financial sector. Capital One's commitment to safeguarding sensitive financial information is therefore directly tied to its legal obligations and its reputation. The potential fines under laws like the CCPA can reach millions of dollars, underscoring the financial implications of non-compliance.

Capital One, as a major financial institution, faces significant legal obligations regarding Anti-Money Laundering (AML) and sanctions compliance. These regulations are designed to combat financial crime, requiring rigorous customer due diligence and transaction monitoring. In 2023, financial institutions globally faced increased scrutiny, with regulators imposing billions in fines for AML deficiencies, highlighting the critical need for robust compliance frameworks.

Banking Supervision and Capital Requirements

Capital One operates under the watchful eye of federal banking regulators like the Federal Reserve and the Office of the Comptroller of the Currency (OCC). These bodies set strict rules, including capital adequacy requirements, to ensure banks can withstand economic shocks. For instance, as of late 2023, the Federal Reserve's proposed new capital rules, often referred to as Basel III endgame, could significantly increase capital requirements for large banks like Capital One, potentially impacting their lending capacity and profitability.

These regulations extend to rigorous stress tests, designed to assess a bank's resilience under adverse economic conditions. Failure in these tests can lead to regulatory sanctions or limitations on capital distributions. Furthermore, detailed risk management guidelines are mandated, covering everything from credit risk to operational risk, all crucial for maintaining the trust and stability of the financial sector. Adherence to these prudential standards is not merely a compliance exercise; it's fundamental to Capital One's ability to operate and maintain its financial strength.

- Federal Reserve and OCC Oversight: Capital One is directly supervised by key federal banking agencies.

- Capital Adequacy & Stress Tests: Strict capital ratios and regular stress tests are imposed to ensure financial stability.

- Risk Management Frameworks: Comprehensive guidelines dictate how Capital One must manage various financial risks.

- Impact of Regulatory Changes: Evolving regulations, such as the proposed Basel III endgame, can necessitate significant adjustments in capital planning and strategy.

Litigation and Class Action Risks

Capital One, like many large financial institutions, navigates a landscape fraught with litigation risks. These can range from individual customer disputes concerning lending practices or fees to more substantial class-action lawsuits. For instance, in 2023, Capital One continued to address legal challenges stemming from past data breaches, which often lead to significant financial penalties and extensive legal defense costs. The company's proactive approach to compliance and robust legal risk management are therefore critical to mitigating these potential liabilities and protecting its financial standing.

The financial impact of litigation can be substantial. Settlements and legal fees can strain resources and affect profitability. For example, following a major data breach in 2019, Capital One faced numerous lawsuits and regulatory actions that resulted in significant financial provisions. By mid-2024, the ongoing legal proceedings related to such events continue to be a factor in the company's operational expenses. Effective management of these legal challenges is paramount for maintaining investor confidence and operational stability.

- Ongoing Litigation: Capital One faces persistent individual and class-action lawsuits related to its operations, including lending, fees, and data security.

- Financial Impact: Legal settlements and defense costs can amount to millions, impacting profitability and requiring significant financial provisions, as seen in past data breach cases.

- Reputational Risk: Litigation can generate negative publicity, potentially damaging customer trust and brand reputation, which are crucial assets for a financial services firm.

- Compliance Imperative: Robust legal risk management and adherence to regulatory requirements are essential to minimize exposure to costly litigation and maintain operational integrity.

Capital One's operations are heavily influenced by evolving consumer protection laws, with the CFPB actively enforcing rules on credit card practices and fair lending. Failure to comply with these regulations can lead to substantial fines and reputational damage, making robust compliance programs essential.

Data privacy laws like the CCPA are critical, granting consumers rights over their personal information and impacting how Capital One handles customer data. Non-compliance can result in significant penalties, underscoring the importance of secure data management practices.

AML and sanctions compliance are paramount, requiring rigorous customer due diligence and transaction monitoring to combat financial crime. Global regulators imposed billions in fines for AML deficiencies in 2023, highlighting the critical need for strong frameworks.

Federal banking regulators like the Federal Reserve and OCC impose strict capital adequacy requirements and stress tests. Proposed Basel III endgame rules could significantly increase capital requirements for large banks like Capital One by 2025, impacting lending and profitability.

Environmental factors

Capital One is actively assessing its exposure to climate-related risks across its diverse loan portfolios. This includes evaluating vulnerabilities in sectors like fossil fuels and real estate located in areas prone to physical climate impacts, such as flooding. For instance, as of early 2024, financial institutions are increasingly incorporating climate scenarios into their risk management frameworks, with some regulators mandating such assessments.

The company's approach involves understanding how climate change could lead to higher loan defaults or devaluations in assets. This analysis directly influences lending strategies and the sophistication of their risk modeling. By 2025, it's anticipated that a significant portion of major financial institutions will have integrated climate risk into their capital planning processes.

Capital One faces increasing investor scrutiny regarding its Environmental, Social, and Governance (ESG) performance. Shareholders are demanding greater transparency on environmental impact, with a growing emphasis on climate risk disclosure and sustainable finance practices. For instance, by the end of 2023, over 70% of S&P 500 companies had published sustainability reports, a trend that directly influences how financial institutions like Capital One are evaluated.

Capital One is actively pursuing sustainability, aiming to reduce its operational environmental impact. This includes efforts to lower energy consumption, minimize waste, and cut greenhouse gas emissions across its facilities.

In 2023, Capital One reported a 21% reduction in absolute Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline. The company also achieved 100% renewable energy procurement for its U.S. operations in 2023, demonstrating a significant commitment to cleaner energy sources.

These initiatives are crucial for enhancing Capital One's corporate reputation and meeting the growing environmental expectations from customers, investors, and regulatory bodies, particularly as climate-related disclosures become more standardized.

Regulatory and Reporting Requirements for Climate-Related Disclosures

Financial regulators worldwide are increasingly mandating transparency around climate-related risks and opportunities. For Capital One, this translates to potential new reporting obligations concerning its climate financial exposures, operational emissions, and overall sustainability strategies. Staying ahead of these evolving environmental regulations is paramount to sidestep penalties and satisfy stakeholder expectations for robust environmental accountability.

The push for standardized climate disclosures is accelerating. For instance, the SEC's proposed climate disclosure rules, though facing legal challenges, signal a direction toward more detailed reporting. Similarly, the Task Force on Climate-related Financial Disclosures (TCFD) framework continues to gain traction, with many major economies encouraging or requiring its adoption. Capital One, like other financial institutions, will need to adapt its data collection and reporting mechanisms to align with these growing demands for climate-related financial information.

- Increased Scrutiny: Regulators are focusing on how financial institutions manage and disclose climate-related financial risks.

- Mandatory Disclosures: Expect more requirements for reporting on Scope 1, 2, and potentially Scope 3 emissions and climate transition plans.

- Global Alignment: Efforts are underway to harmonize climate disclosure standards internationally, impacting cross-border operations.

- Investor Demand: Stakeholders are demanding greater clarity on how companies are addressing climate change and its financial implications.

Reputational Impact of Environmental Performance

Public perception of Capital One's environmental responsibility is a critical factor influencing its brand image and customer loyalty. Negative press or perceived inaction on sustainability can alienate environmentally aware consumers and potential investors. For instance, while specific recent data on Capital One's reputational impact from environmental factors isn't publicly isolated, the broader financial industry has seen shifts. A 2024 survey indicated that over 60% of consumers consider a company's environmental practices when making purchasing decisions, a trend likely to extend to financial services.

Conversely, a robust environmental performance and a clear commitment to sustainability can bolster Capital One's reputation and market position. Companies demonstrating strong Environmental, Social, and Governance (ESG) credentials often attract more investment. For example, in the first half of 2024, ESG-focused investment funds saw continued inflows, suggesting a market appetite for environmentally responsible corporations.

- Brand Image: Negative environmental perceptions can tarnish Capital One's brand, making it less attractive to a growing segment of socially conscious customers.

- Customer Loyalty: Environmentally conscious consumers are increasingly likely to switch to financial institutions that align with their values, impacting customer retention.

- Investor Confidence: Investors are scrutinizing ESG performance more closely; poor environmental standing could deter capital and affect stock valuation.

Capital One is navigating an evolving regulatory landscape where climate risk disclosure is becoming increasingly important. By 2025, financial institutions are expected to have more robust frameworks for assessing climate-related financial risks, influencing lending and capital planning. This heightened regulatory focus means Capital One must ensure its reporting mechanisms align with emerging global standards for environmental transparency.

Investor and public expectations for environmental responsibility are also on the rise. By the end of 2023, a significant majority of large companies were publishing sustainability reports, a trend that directly impacts how financial institutions like Capital One are evaluated for their ESG performance. Demonstrating strong environmental practices is becoming essential for maintaining brand image and customer loyalty, as a substantial portion of consumers consider a company's environmental impact in their decisions.

| Environmental Factor | Capital One's Action/Status (as of mid-2024) | Industry Trend/Data |

| Climate Risk Assessment | Incorporating climate scenarios into risk management. | Regulators increasingly mandating climate scenario analysis for financial institutions. |

| Operational Emissions | Reduced Scope 1 & 2 emissions by 21% (vs. 2019 baseline) by 2023. | Growing pressure for detailed Scope 3 emissions reporting and reduction targets. |

| Renewable Energy Use | 100% renewable energy procurement for U.S. operations in 2023. | Many corporations aiming for higher renewable energy sourcing to meet sustainability goals. |

| Investor Scrutiny | Facing increased shareholder demand for ESG transparency. | ESG-focused investment funds saw continued inflows in H1 2024. |

PESTLE Analysis Data Sources

Our Capital One PESTLE analysis is built upon a robust foundation of data from reputable financial institutions, government economic reports, and leading industry publications. We meticulously gather information on political stability, economic indicators, technological advancements, and regulatory changes to provide a comprehensive overview.