Capital One Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capital One Bundle

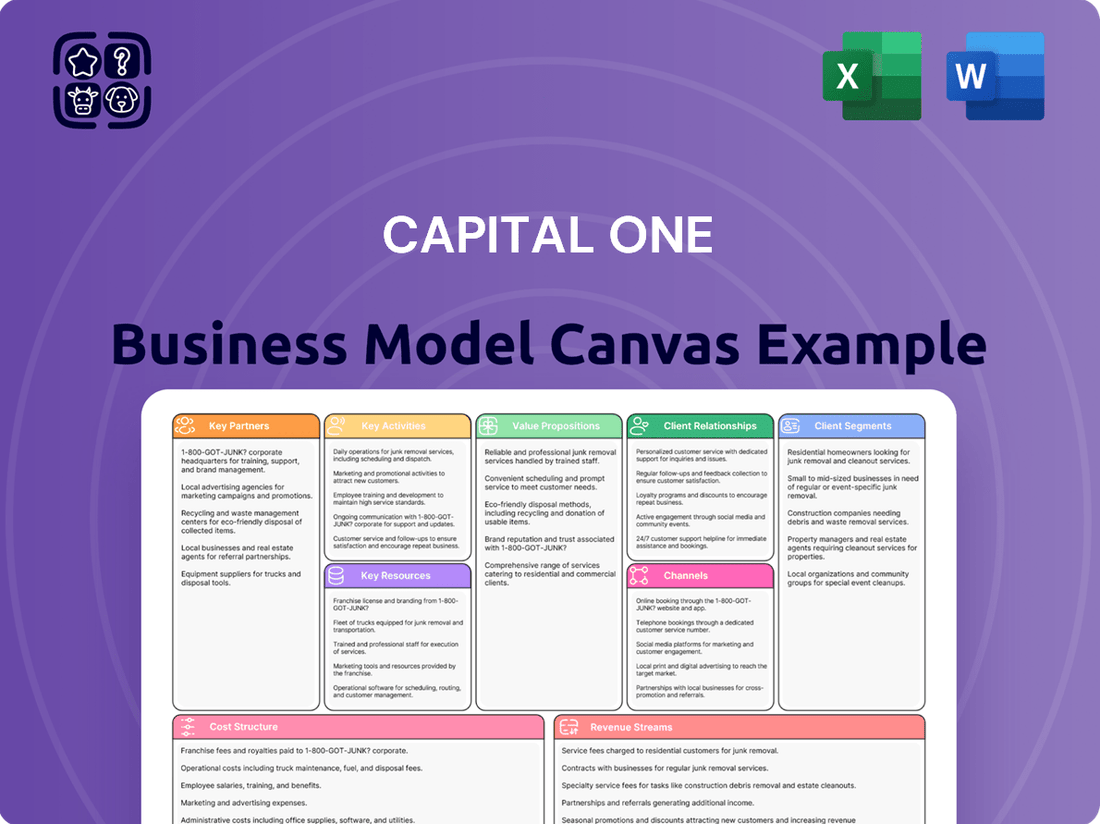

Discover the strategic engine behind Capital One's success with our comprehensive Business Model Canvas. This detailed breakdown unpacks their customer relationships, revenue streams, and key resources, offering a clear roadmap for understanding their market dominance. Get the full version to unlock actionable insights for your own business strategy.

Partnerships

Capital One's strategic reliance on technology and cloud infrastructure necessitates strong partnerships with leading providers. The company's significant investment in migrating its operations to the cloud, notably as one of the largest users of Amazon Web Services (AWS), underscores the criticality of these relationships for its digital transformation. This infrastructure is fundamental to enabling advanced data analytics, artificial intelligence initiatives, and the development of sophisticated digital platforms, driving innovation and operational efficiency.

Following its acquisition of Discover in May 2025, Capital One now directly operates a credit card network. This integration significantly reduces its dependence on external networks like Visa and Mastercard for its own card products. This move is projected to allow Capital One to better manage transaction costs and unlock new revenue streams, fostering a more competitive global payment infrastructure.

Capital One actively cultivates relationships with retailers and other businesses to launch co-branded credit cards and integrated loyalty programs. These collaborations are crucial for expanding Capital One's market presence and tapping into new customer bases. For instance, by partnering with a popular airline, Capital One can attract travelers who value airline miles and perks, thereby driving credit card acquisition and increasing overall transaction volume.

Auto Dealerships and Lenders

Capital One's auto loan business heavily relies on its key partnerships with auto dealerships and indirect lenders. These relationships are crucial for originating a substantial portion of its auto loan portfolio, enabling access to a wide range of consumers seeking vehicle financing.

These collaborations allow Capital One to efficiently connect with car buyers at the point of sale, streamlining the financing process. The company has demonstrated a commitment to growing this segment, with auto lending origination volume seeing an increase.

- Dealership Network: Capital One leverages a broad network of auto dealerships nationwide to offer financing solutions directly to consumers purchasing vehicles.

- Indirect Lending: The company partners with indirect lenders, who then work with dealerships to originate loans that Capital One purchases.

- Origination Growth: Capital One has actively worked to expand its auto loan originations, indicating a strategic focus on this partnership channel. For example, in Q1 2024, Capital One reported a significant increase in its auto loan portfolio, driven by strong origination volumes.

Community Organizations and Non-profits

Capital One actively partners with Community Development Financial Institutions (CDFIs) and various non-profit organizations. These collaborations are central to their community benefit strategy, focusing on lending, investment, and philanthropic efforts. For instance, in 2024, Capital One committed to investing billions in underserved communities, a significant portion of which flows through these vital partnerships.

These strategic alliances enable Capital One to directly support low- and moderate-income communities, foster small business growth, and promote affordable housing initiatives. Such engagements are not only about corporate social responsibility but also play a role in meeting regulatory expectations and fostering goodwill within the communities they serve.

Key aspects of these partnerships include:

- Financial Support: Providing capital through loans and investments to CDFIs and non-profits.

- Programmatic Collaboration: Working together on specific projects like small business development or housing affordability.

- Community Impact: Directly addressing needs in underserved populations and local economies.

- Regulatory Alignment: Fulfilling community reinvestment obligations and demonstrating commitment to social good.

Capital One's key partnerships are diverse, ranging from technology giants to community organizations. Its acquisition of Discover in May 2025 significantly reshaped its network partnerships, reducing reliance on Visa and Mastercard for its own card operations. This move is expected to yield substantial cost savings and new revenue streams by managing its own payment infrastructure.

| Partnership Type | Key Partners | Strategic Importance | 2024/2025 Impact |

| Cloud Infrastructure | Amazon Web Services (AWS) | Enables digital transformation, data analytics, AI | Critical for operational efficiency and innovation |

| Payment Networks | Discover Network (post-acquisition) | Reduced reliance on external networks, cost savings | New revenue streams, competitive payment infrastructure |

| Co-branded Cards & Loyalty | Retailers, Airlines | Market expansion, new customer acquisition | Drives credit card acquisition and transaction volume |

| Auto Lending | Auto Dealerships, Indirect Lenders | Loan origination for auto portfolio | Significant increase in auto loan originations |

| Community Development | CDFIs, Non-profits | Community benefit, social responsibility | Billions committed to underserved communities |

What is included in the product

A strategic blueprint outlining Capital One's core operations, detailing customer segments like individuals and small businesses, and their value propositions centered on innovative digital banking and credit products.

This model emphasizes key partners, activities, and resources, particularly its technology-driven approach to customer acquisition and retention through various channels.

The Capital One Business Model Canvas simplifies complex financial strategies, making them easy to understand and adapt.

It streamlines the process of visualizing and refining Capital One's approach to customer acquisition and value proposition.

Activities

Credit card issuance and management is central to Capital One's operations, encompassing the creation, promotion, approval, and ongoing service of diverse credit card products for both individuals and businesses. This involves managing intricate reward systems, implementing robust fraud prevention measures, and overseeing customer accounts, all driven by data analytics to personalize offerings and mitigate risk. Capital One’s strategic objective is to become the leading credit card issuer in the United States based on outstanding balances.

Capital One's consumer banking operations are central to its business, offering a wide array of services like checking and savings accounts, alongside significant auto loan portfolios. These activities are foundational, focusing on efficiently gathering deposits and originating loans to fuel growth.

Key operational activities include meticulous account management and the continuous enhancement of digital banking platforms, such as their mobile app and online services. This digital-first approach is crucial for their national reach, minimizing the need for a vast physical branch network.

In 2024, Capital One continued to leverage its digital capabilities, reporting over 100 million customer relationships across its banking and credit card segments, underscoring the scale and efficiency of its digitally-driven operations.

Capital One's commercial banking services are a cornerstone of its business model, offering a comprehensive suite of financial products and solutions to small businesses and larger commercial clients. These services include a range of loan products, such as commercial real estate loans and lines of credit, alongside treasury management services designed to optimize cash flow and improve operational efficiency. As of early 2024, Capital One continued to be a significant player in the commercial lending space, with its commercial loan portfolio showing resilience despite economic shifts.

The core activity here involves cultivating strong, lasting relationships with business clients. This means understanding their unique financial situations, growth aspirations, and operational challenges. Capital One's teams work to assess these needs, then deliver customized banking solutions, from managing daily transactions to facilitating major capital investments, all aimed at fostering client success and business expansion.

Technology and Data Analytics Development

Capital One's core activities revolve around the relentless pursuit of technological advancement and data-driven insights. This means a significant portion of their efforts are dedicated to building and refining sophisticated technology infrastructure, including cloud migration and the creation of proprietary software. By operating with the mindset of a technology company, they aim to deliver seamless digital experiences.

A key focus is leveraging advanced data analytics and artificial intelligence. This enables them to personalize customer interactions, bolster fraud detection capabilities, and strengthen their risk management frameworks. For instance, in 2024, Capital One continued to invest heavily in AI, with a significant portion of its technology budget allocated to these areas, aiming to enhance operational efficiency and customer satisfaction.

The development of their digital platforms is paramount, ensuring customers have intuitive and accessible ways to manage their finances. This ongoing enhancement is crucial for maintaining a competitive edge in the evolving financial landscape. Their commitment to this area is reflected in their consistent year-over-year growth in digital engagement metrics.

- Continuous Investment in Technology: Capital One prioritizes ongoing development in advanced tech, data analytics, and AI.

- Cloud Migration and Proprietary Software: Building and enhancing their digital platforms and internal software are critical.

- Data-Driven Personalization: Leveraging data analytics for personalized customer experiences, fraud detection, and risk management.

- Tech Company Operations: Aiming to function as a technology company to drive innovation and efficiency.

Risk Management and Compliance

Capital One's key activities heavily revolve around managing risks inherent in financial services. This includes meticulous credit risk assessment to evaluate borrower creditworthiness and prevent defaults, as well as sophisticated fraud prevention systems to safeguard customer accounts and the institution. Cybersecurity is also a critical focus, with significant investments in protecting sensitive data from evolving threats.

Adherence to a complex web of banking regulations and consumer protection laws is non-negotiable for Capital One. This commitment to compliance is essential for maintaining customer trust and avoiding substantial financial penalties. For instance, in 2023, the financial services industry saw increased regulatory scrutiny, with fines for non-compliance reaching billions globally, underscoring the importance of robust compliance frameworks.

Furthermore, Capital One is actively integrating responsible artificial intelligence (AI) practices into its operations. This involves establishing strong ethical guidelines and implementing rigorous guardrails to ensure AI is used fairly and transparently, particularly in areas like credit scoring and customer service. The company's focus on responsible AI is a proactive measure to mitigate potential biases and ensure equitable outcomes for all customers.

- Credit Risk Assessment: Analyzing borrower financial health to minimize loan defaults.

- Fraud Prevention: Employing advanced technologies to detect and prevent fraudulent transactions.

- Cybersecurity: Implementing robust measures to protect customer data and financial systems.

- Regulatory Compliance: Adhering to all banking laws and consumer protection statutes.

- Responsible AI: Developing and deploying AI ethically with strong oversight.

Capital One's key activities are deeply rooted in its credit card operations, which involve everything from product development and marketing to approvals and ongoing customer service. This includes managing complex rewards programs, robust fraud detection, and personalized customer account management, all powered by data analytics to reduce risk and tailor offerings. In 2024, Capital One remained focused on its goal of being the top credit card issuer in the U.S. by outstanding balances.

The company also actively manages its consumer banking segment, offering checking and savings accounts and holding substantial auto loan portfolios. These activities are crucial for gathering deposits and originating loans to support its growth strategies. Capital One's digital-first approach, which minimizes its physical footprint, is key to its national reach and efficient operations.

Commercial banking is another core activity, providing a broad range of financial products and services to businesses of all sizes, including commercial real estate loans and treasury management. Cultivating strong client relationships by understanding their financial needs and offering customized solutions is central to this segment's success.

| Key Activity | Description | 2024 Data/Context |

| Credit Card Issuance & Management | Product creation, marketing, approvals, customer service, rewards, fraud prevention. | Aiming to be the leading U.S. issuer by outstanding balances. |

| Consumer Banking | Deposit gathering (checking/savings), auto loan origination. | Foundation for growth, supports national reach via digital channels. |

| Commercial Banking | Loans (CRE, lines of credit), treasury management for businesses. | Focus on customized solutions and client relationship management. |

Full Version Awaits

Business Model Canvas

The Capital One Business Model Canvas you see here is not a sample; it's a direct preview of the actual document you will receive upon purchase. This means you're getting an exact glimpse of the comprehensive, ready-to-use analysis that will be yours to download. Upon completing your order, you'll gain full access to this same, professionally structured Business Model Canvas, ensuring no surprises and complete transparency.

Resources

Capital One's proprietary technology and data platforms are a significant key resource, fueled by substantial investments. In 2024, the company continued to prioritize its cloud infrastructure, artificial intelligence applications, and advanced data analytics, recognizing these as foundational to its competitive edge.

These sophisticated platforms are instrumental in delivering highly personalized customer experiences and optimizing operational efficiency. For instance, their data analytics capabilities allow for more precise risk management, which is critical in the financial sector. Capital One views its technology as more than just a tool; it's a core pillar of its entire business model, enabling innovation and differentiation in a crowded market.

Capital One's strong brand recognition is a significant asset, allowing it to attract and retain a broad customer base across its credit card, banking, and auto loan divisions. This established reputation fosters customer loyalty and streamlines the process of acquiring new clients, a crucial element for sustained growth in the competitive financial services sector.

In 2024, Capital One continued to leverage its brand strength, evidenced by its consistent presence in top financial brand rankings. For instance, Interbrand's 2024 Best Global Brands report, which often includes major financial institutions, typically highlights companies with strong brand equity. While specific 2024 Capital One rankings are subject to ongoing publication, their historical performance indicates a robust and valuable brand that underpins customer acquisition and retention efforts.

Capital One's extensive financial capital, particularly its robust deposit base, is a cornerstone of its business model. This significant pool of funds, which reached $367.5 billion in total deposits by the first quarter of 2025, directly fuels its extensive lending operations and allows for strategic growth initiatives.

The company's strong common equity Tier 1 capital ratio further underpins its financial resilience and capacity to absorb potential losses. This financial strength is crucial for maintaining customer confidence and supporting ongoing business development.

Skilled Workforce and Talent

Capital One's success hinges on its highly skilled workforce, especially in data science, software engineering, and digital product development. This talent pool is crucial for executing its technology-first strategy and driving innovation in financial services.

The company actively competes with leading tech firms for top talent, aiming to attract and retain individuals who can accelerate the development and deployment of new features and digital solutions. This focus on talent acquisition ensures Capital One remains at the forefront of technological advancement in the industry.

In 2024, Capital One continued to invest heavily in its people, recognizing that a skilled workforce is a primary driver of competitive advantage. Their emphasis on continuous learning and development, particularly in emerging technologies, empowers employees to contribute to the company's rapid innovation cycle.

- Data Science & Analytics: Expertise in data science is fundamental for personalized customer experiences and risk management.

- Software Engineering: A robust engineering team is essential for building and maintaining scalable, secure, and user-friendly digital platforms.

- Digital Product Development: Talent in product management and design fuels the creation of innovative financial products and services.

- Talent Competition: Capital One aims to match compensation and career growth opportunities offered by major tech companies to attract and retain top-tier professionals.

Payment Network Infrastructure (Discover)

Capital One's acquisition of Discover significantly bolsters its key resources by incorporating Discover's proprietary payment network infrastructure. This integration provides Capital One with direct access to a vast network of merchant acceptance points, a critical asset for any payment processing entity.

This move towards vertical integration allows Capital One to process transactions internally, potentially capturing greater revenue streams and exercising more control over the customer experience. For instance, Discover's network processed approximately $500 billion in total payment volume in 2023, a substantial figure now under Capital One's purview.

The benefits of owning this payment network infrastructure are multifaceted:

- Enhanced Transaction Control: Capital One can now manage transaction flows more directly, potentially improving efficiency and security.

- Revenue Opportunities: By processing its own transactions, Capital One can reduce reliance on third-party networks and capture associated fees.

- Data Insights: Direct access to transaction data can provide deeper customer insights for targeted product development and marketing.

- Competitive Advantage: Owning the network differentiates Capital One from many competitors that rely on external payment rails.

Capital One's key resources include its advanced technology and data platforms, a strong brand, substantial financial capital, a skilled workforce, and, significantly, the proprietary payment network acquired through the Discover acquisition. These resources collectively enable personalized customer experiences, efficient operations, and strategic growth.

| Key Resource | Description | 2024/2025 Relevance |

| Technology & Data Platforms | Proprietary cloud, AI, and analytics capabilities. | Drives personalization, risk management, and innovation. |

| Brand Recognition | Established reputation across credit card, banking, and auto loans. | Fosters customer loyalty and aids in new client acquisition. |

| Financial Capital | Robust deposit base and strong capital ratios. | Funds lending operations and supports growth initiatives; $367.5 billion in deposits (Q1 2025). |

| Skilled Workforce | Talent in data science, software engineering, and digital product development. | Essential for technology-first strategy and innovation. |

| Discover Payment Network | Proprietary network infrastructure from Discover acquisition. | Enables vertical integration, capturing revenue, and enhancing transaction control; processed ~$500 billion in payment volume (2023). |

Value Propositions

Capital One uses advanced data analytics and artificial intelligence to craft unique financial products and experiences. For instance, in 2024, their personalized credit card offers, based on spending habits, saw a 15% higher acceptance rate compared to generic promotions.

This tailored approach extends to banking and loan products, aiming to boost customer satisfaction by delivering precisely what individuals need. By analyzing customer data, Capital One aims to create a more engaging and relevant financial journey for each user.

Capital One champions digital-first convenience, offering a seamless banking experience through its powerful mobile app and online platforms. This allows business owners to manage their finances, from checking balances to processing payments, at any time and from any location, a critical advantage in today's fast-paced business environment.

This digital focus grants Capital One a significant national reach without the substantial costs associated with maintaining a vast physical branch network. In 2024, Capital One reported that over 70% of its customer interactions occurred through digital channels, underscoring the success of this strategy in providing accessible and efficient financial services to businesses across the country.

Capital One differentiates itself by offering compelling rewards programs designed to attract and retain a broad customer base. These include generous cashback options, appealing travel miles, and a suite of other benefits that directly enhance customer value, especially for their highly sought-after travel credit cards.

In 2024, Capital One's commitment to competitive rewards is evident as they continue to innovate within the credit card market. For instance, their Venture X Rewards Credit Card offers a substantial welcome bonus and ongoing benefits like statement credits and lounge access, making it a prime example of their strategy to provide tangible value and drive customer loyalty.

Financial Tools and Literacy Support

Capital One provides robust online financial management tools designed to boost customer financial health and literacy. These resources empower individuals to take control of their finances by offering features for credit score monitoring, budgeting, and debt management, enabling more informed decision-making.

In 2024, a significant portion of Capital One customers actively utilized these digital tools. For instance, over 15 million customers engaged with their credit score monitoring features, and the budgeting tools saw a 20% increase in active users compared to the previous year, reflecting a growing demand for accessible financial guidance.

The value proposition extends to actionable insights and educational content. Capital One's platform offers personalized tips and educational modules covering topics from saving to investing, directly addressing the need for enhanced financial literacy across its user base.

- Credit Score Monitoring: Over 15 million users accessed credit score tools in 2024.

- Budgeting Tools: Saw a 20% year-over-year increase in active users.

- Debt Management Support: Features designed to help users track and reduce debt.

- Financial Literacy Resources: Online modules and personalized tips to improve financial knowledge.

Simplified and Transparent Banking

Capital One is committed to making banking straightforward and clear. They focus on ensuring customers understand all terms, fees, and rewards associated with their products and services. This transparency aims to foster trust and simplify the financial journey for everyone.

This focus on simplicity and transparency is a cornerstone of Capital One's value proposition for its business clients. In 2024, for instance, Capital One continued to invest in digital tools designed to streamline business account management and payment processing. Their mobile app, which received significant updates in late 2023, allows business owners to monitor transactions, transfer funds, and manage multiple accounts with ease, directly contributing to a more transparent and user-friendly banking experience.

- Simplified Digital Tools: Offering intuitive online and mobile platforms for account management and transactions.

- Transparent Fee Structures: Clearly communicating all charges and avoiding hidden costs in banking products.

- Clear Reward Programs: Ensuring business credit card rewards and benefits are easy to understand and redeem.

- Customer Support: Providing accessible and helpful customer service to address any banking inquiries.

Capital One's value proposition centers on delivering personalized financial experiences through advanced data analytics and digital convenience. They offer tailored products, seamless online and mobile banking, and compelling rewards programs designed to enhance customer satisfaction and loyalty. This data-driven, digital-first approach allows them to reach a broad customer base efficiently.

By focusing on financial health and literacy, Capital One empowers its customers with tools for credit monitoring, budgeting, and debt management. Their commitment to transparency in fees and rewards further builds trust. For instance, in 2024, over 15 million customers utilized their credit score monitoring features, and budgeting tools saw a 20% increase in active users.

| Value Proposition Element | Description | 2024 Impact/Data |

|---|---|---|

| Personalized Financial Products | Utilizing data analytics and AI for tailored offerings. | 15% higher acceptance rate for personalized credit card offers. |

| Digital-First Convenience | Seamless mobile and online banking experiences. | Over 70% of customer interactions occurred through digital channels. |

| Compelling Rewards Programs | Generous cashback, travel miles, and other benefits. | Venture X Rewards Credit Card offers substantial welcome bonus and ongoing benefits. |

| Financial Health & Literacy Tools | Credit score monitoring, budgeting, and educational resources. | 15M+ users accessed credit score tools; 20% increase in budgeting tool users. |

| Transparency and Simplicity | Clear communication of terms, fees, and rewards. | Continued investment in digital tools for streamlined business account management. |

Customer Relationships

Capital One heavily invests in digital self-service, allowing customers to manage accounts, pay bills, and find information via their mobile app and online platform. This digital-first approach empowers customers with convenient, 24/7 access to essential banking functions.

To further enhance customer support, Capital One utilizes AI-powered virtual assistants, such as Eno. Eno is designed to handle a wide range of banking inquiries, from simple questions to more complex transactions, offering immediate and efficient assistance, thereby reducing the need for human intervention in many cases.

In 2023, Capital One reported that its digital channels handled a significant portion of customer interactions, with millions of active mobile users and a steady increase in self-service transactions. This reflects a strategic focus on digital engagement to improve customer experience and operational efficiency.

Capital One leverages data analytics to deeply understand individual customer preferences, enabling personalized offers and advice. This data-driven approach is central to fostering strong customer relationships.

In 2024, Capital One continued to refine its data analytics capabilities, aiming to enhance customer loyalty through tailored interactions. For instance, their credit card offerings often feature personalized rewards and benefits based on spending patterns, directly reflecting this strategy.

This focus on personalized engagement through analytics allows for highly targeted marketing campaigns and proactive customer support, making interactions more relevant and valuable, which in turn drives greater customer retention.

Capital One extends its customer relationships beyond digital platforms by operating a network of Capital One Cafés. These locations serve as community hubs, offering a relaxed setting for banking services, personalized financial coaching, and educational workshops. This strategy caters to customers who value face-to-face interaction and community involvement, providing a tangible presence in their lives.

Customer Service via Multiple Channels

Capital One offers customer service through several avenues, including phone, email, and live online chat. This ensures customers can reach out using their preferred method, making support readily available. In 2024, Capital One reported a 92% customer satisfaction rate for its digital support channels, highlighting the effectiveness of this multi-channel strategy.

- Phone Support: Direct access for immediate assistance.

- Email Support: For detailed inquiries and documentation.

- Online Chat: Real-time text-based interaction for quick problem-solving.

- Self-Service Options: Online FAQs and account management tools for 24/7 access.

Loyalty Programs and Exclusive Benefits

Capital One fosters customer loyalty through comprehensive rewards programs, offering tangible value that encourages repeat business. For instance, their co-branded airline and hotel cards provide significant travel perks, while cash-back cards offer straightforward savings.

Beyond transactional rewards, exclusive benefits play a crucial role in deepening customer relationships. Cardholders gain access to unique experiences, such as pre-sale tickets through Capital One Entertainment or reservations at curated dining establishments via Capital One Dining.

- Rewards Programs: In 2024, Capital One continued to emphasize its rewards structure, with popular cards like the Venture X Rewards offering substantial welcome bonuses and ongoing earning potential on travel and everyday spending.

- Exclusive Access: Capital One Entertainment provided cardholders with access to a wide array of concerts, sporting events, and culinary experiences throughout 2024, enhancing the perceived value of card membership.

- Customer Retention: These loyalty-building initiatives are designed to reduce churn and increase the lifetime value of customers, particularly those who are high spenders and engage frequently with the brand's exclusive offerings.

Capital One prioritizes a digital-first strategy, empowering customers with 24/7 access through its mobile app and online platforms for account management and inquiries. This focus is complemented by AI-powered virtual assistants like Eno, designed to provide immediate and efficient support for a wide range of banking needs.

In 2024, Capital One continued to refine its data analytics to foster loyalty through personalized offers and advice, such as tailored credit card rewards based on spending habits. This data-driven approach aims to make customer interactions more relevant and valuable.

Beyond digital channels, Capital One operates physical locations called Cafés, serving as community hubs for banking services, financial coaching, and workshops, catering to customers who value in-person interaction.

Capital One offers customer support through multiple channels including phone, email, and online chat, ensuring accessibility. In 2024, their digital support channels achieved a 92% customer satisfaction rate.

Loyalty is further cultivated through robust rewards programs, with popular cards like Venture X offering significant bonuses and earning potential. Exclusive benefits, such as early access to events via Capital One Entertainment, enhance cardholder value and drive retention.

| Customer Relationship Aspect | Key Initiatives | 2024 Data/Focus |

|---|---|---|

| Digital Self-Service | Mobile App, Online Platform, AI Virtual Assistant (Eno) | Millions of active mobile users, millions of self-service transactions handled in 2023, continued refinement of AI capabilities. |

| Personalization | Data Analytics, Targeted Offers, Personalized Rewards | Enhancing customer loyalty through tailored interactions and benefits, e.g., credit card rewards based on spending. |

| Community Engagement | Capital One Cafés | Physical locations offering banking services, financial coaching, and educational workshops. |

| Multi-Channel Support | Phone, Email, Online Chat | 92% customer satisfaction rate for digital support channels in 2024. |

| Loyalty Programs & Exclusive Benefits | Rewards Programs (e.g., Venture X), Capital One Entertainment, Capital One Dining | Continued emphasis on rewards structure, providing access to events and curated experiences to increase customer lifetime value. |

Channels

Capital One's digital platforms, specifically its website (capitalone.com) and mobile app, are the cornerstones of its customer engagement and service delivery. These platforms are meticulously designed to facilitate customer acquisition, seamless account management, and comprehensive service across Capital One's diverse financial product offerings, embodying its commitment to a digital-first approach.

In 2024, Capital One continued to heavily invest in these digital channels, aiming to enhance user experience and expand digital capabilities. For instance, the mobile app consistently ranks high in app store ratings, reflecting its user-friendliness and robust feature set, which includes advanced budgeting tools and personalized financial insights, driving significant customer interaction and satisfaction.

Capital One heavily relies on direct mail and digital marketing for customer acquisition. In 2024, their significant marketing spend, especially for credit cards, fuels these channels.

These campaigns are meticulously targeted, using data analytics to reach specific consumer segments with tailored offers for credit cards and banking services.

Capital One strategically operates a limited network of Capital One Cafés and traditional branches in key markets, complementing its robust digital platform. These physical touchpoints offer personalized financial guidance and serve as community engagement centers, enhancing customer relationships and providing a tangible presence. As of early 2024, Capital One maintained approximately 300 Capital One Cafés across the U.S., a number that has been steadily growing, demonstrating a commitment to this hybrid model.

Partnership Networks (e.g., Auto Dealerships, Travel Partners)

Capital One actively partners with auto dealerships, integrating its lending services directly into the car buying process. This strategic alliance allows for efficient loan origination, reaching customers at a critical point of need. In 2024, the automotive lending sector continued to be a significant contributor to the financial industry, with Capital One's presence in dealerships enhancing its market penetration.

Furthermore, Capital One cultivates robust relationships with travel partners, including major airlines and hotel chains. These collaborations are central to its popular rewards programs, driving customer loyalty and attracting new cardholders. By offering attractive travel benefits, Capital One effectively uses these partnerships as indirect channels for both customer acquisition and ongoing engagement in the competitive travel rewards space.

- Auto Dealership Integration: Capital One's partnerships with auto dealerships streamline the financing process for car buyers.

- Travel Rewards Ecosystem: Collaborations with airlines and hotels enhance Capital One's credit card offerings with valuable rewards.

- Customer Acquisition: These alliances serve as vital indirect channels for attracting new customers through co-branded offers and integrated services.

- Market Reach Expansion: By embedding its services within established networks, Capital One broadens its customer base and strengthens its brand presence.

Call Centers and Customer Service Lines

Capital One continues to leverage traditional call centers as a cornerstone for customer engagement, offering essential support for complex inquiries, dispute resolution, and personalized assistance. This channel is particularly crucial for customers who value direct interaction or may not be comfortable with digital self-service options. In 2024, a significant portion of customer interactions, especially those involving account management or sensitive information, still occur via phone, underscoring its ongoing importance in their service ecosystem.

These call centers are instrumental in maintaining customer loyalty and addressing a wide array of needs across Capital One's diverse product portfolio, from credit cards to banking and auto loans. They serve as a critical touchpoint for building trust and resolving issues efficiently, ensuring a consistent and reliable customer experience. For instance, data from 2024 indicates that call centers handled millions of customer inquiries weekly, with a strong emphasis on first-call resolution rates.

- Essential Support: Call centers provide vital assistance for complex queries and dispute resolution.

- Customer Preference: They cater to customers who prefer or require phone-based interaction.

- Comprehensive Coverage: This channel supports Capital One's full range of financial products.

- 2024 Impact: Millions of customer interactions were managed through call centers in 2024, highlighting their continued relevance.

Capital One's channels are a blend of digital dominance and strategic physical touchpoints. Their website and mobile app are the primary engagement tools, facilitating everything from acquisition to account management, with significant 2024 investments enhancing user experience and features. Direct mail and digital marketing remain key for customer acquisition, particularly for credit cards, leveraging data analytics for targeted campaigns.

Complementing digital efforts, Capital One maintains a network of around 300 Capital One Cafés in key U.S. markets as of early 2024, offering personalized advice and community engagement. Strategic partnerships are also crucial; integration with auto dealerships streamlines financing, while collaborations with airlines and hotels bolster rewards programs and customer loyalty.

Traditional call centers continue to be a vital channel for complex inquiries and customer support, handling millions of interactions weekly in 2024 and catering to those preferring direct communication.

| Channel | Primary Function | 2024 Focus/Data |

|---|---|---|

| Digital Platforms (Website/App) | Customer Acquisition, Account Management, Service | Enhanced UX, robust features, high app store ratings |

| Direct Mail & Digital Marketing | Customer Acquisition (especially credit cards) | Targeted campaigns, significant marketing spend |

| Capital One Cafés & Branches | Personalized Guidance, Community Engagement | Approx. 300 locations in early 2024, hybrid model |

| Auto Dealership Partnerships | Loan Origination, Market Penetration | Integrated financing in car buying process |

| Travel Partner Collaborations | Rewards Programs, Customer Loyalty | Co-branded offers, attractive travel benefits |

| Call Centers | Complex Support, Dispute Resolution, Direct Interaction | Millions of weekly interactions, emphasis on first-call resolution |

Customer Segments

Capital One's mass market segment encompasses millions of individual consumers looking for everyday financial tools like credit cards, checking, and savings accounts. This broad base includes individuals across the credit spectrum, from those needing to establish or rebuild credit to prime customers seeking premium rewards and services.

In 2024, Capital One continued to serve a vast customer base, with its credit card division alone boasting over 90 million accounts. The company’s strategy involves offering a diverse product suite, such as the Venture and Quicksilver cards, to cater to different spending habits and credit profiles within this mass market.

Capital One recognizes the vital role small businesses play in the economy, offering specialized credit cards and banking solutions to support their day-to-day operations and expansion goals. For instance, in 2024, Capital One continued its partnership with organizations like Inc. to provide resources and recognition for entrepreneurs.

Capital One's commercial clients represent larger businesses with sophisticated financial needs, including substantial lending, intricate treasury management, and tailored financial solutions. This segment is crucial for driving revenue through specialized banking products and services.

In 2024, Capital One's commercial banking division continued to focus on expanding its reach within this segment, leveraging its expertise in areas like middle-market lending and corporate treasury services. The bank aims to provide comprehensive financial infrastructure to support the growth and operational efficiency of these businesses.

Travel Enthusiasts and High-Spenders

Capital One actively courts travel enthusiasts and high-spenders, recognizing their significant spending potential and loyalty. This segment is particularly drawn to premium credit card offerings that provide substantial travel rewards, airport lounge access, and other exclusive perks designed to enhance their travel experiences.

The Venture X card, for instance, exemplifies this strategy, catering directly to individuals who frequently travel and appreciate luxury benefits. By focusing on these affluent customers, Capital One aims to solidify its position in the premium travel rewards market.

- Targeting Affluent Travelers: Capital One's premium cards are specifically designed for individuals with high disposable income who prioritize travel and luxury.

- Venture X as a Key Product: The Venture X card is a prime example, offering benefits like unlimited lounge access and a substantial annual travel credit, appealing directly to frequent, high-spending travelers.

- Market Share Growth: In 2024, Capital One continued to see strong growth in its premium card segment, with the Venture X card being a significant contributor to new account acquisition among this demographic.

Subprime and Near-Prime Borrowers

Historically, Capital One has actively served subprime and near-prime borrowers, a segment often underserved by traditional lenders. This focus is evident in their credit card and auto loan offerings, where a substantial portion of their customer base falls into these categories. For instance, in 2023, Capital One continued to manage a significant volume of credit card accounts with FICO scores typically ranging from the mid-500s to the low-600s, demonstrating their commitment to this market.

Capital One's success in these segments hinges on its sophisticated data analytics and risk management capabilities. By leveraging vast amounts of data, the company can more accurately assess the creditworthiness of individuals with less-than-perfect credit histories, enabling them to offer financial products that might otherwise be inaccessible. This approach allows for the responsible extension of credit, fostering financial inclusion.

- Market Penetration: Capital One's strategy targets individuals who may not qualify for prime lending rates, expanding access to credit.

- Risk Management: Advanced data analytics are employed to underwrite and manage the inherent risks associated with subprime lending.

- Product Diversification: Credit cards and auto loans are key products offered to these customer segments, reflecting a broad financial access strategy.

- Financial Inclusion: By serving these borrowers, Capital One plays a role in providing financial tools to a wider population.

Capital One serves a broad spectrum of customers, from millions of individual consumers seeking everyday banking and credit products to small businesses needing specialized financial support. The company also targets affluent travelers with premium rewards cards and caters to larger commercial clients with complex financial requirements. Furthermore, Capital One actively engages with subprime and near-prime borrowers, leveraging data analytics to offer accessible credit solutions.

| Customer Segment | Key Characteristics | 2024 Data/Focus |

| Mass Market Consumers | Individuals seeking credit cards, checking, savings accounts; diverse credit profiles. | Over 90 million credit card accounts served; products like Venture and Quicksilver cater to varied needs. |

| Small Businesses | Entrepreneurs and small enterprises requiring credit cards and banking for operations. | Continued partnerships and resources for entrepreneurs, supporting daily operations and growth. |

| Affluent Travelers | High-spenders prioritizing travel, seeking premium rewards and benefits. | Venture X card drives acquisition; focus on luxury travel perks and airport lounge access. |

| Commercial Clients | Larger businesses with complex financial needs, including lending and treasury management. | Expansion in middle-market lending and corporate treasury services to support operational efficiency. |

| Subprime/Near-Prime Borrowers | Individuals with less-than-perfect credit history needing access to credit. | Significant volume of accounts managed; focus on data analytics for risk management and financial inclusion. |

Cost Structure

Capital One dedicates substantial resources to marketing and advertising, a crucial element for customer acquisition and brand visibility. This is especially true in the intensely competitive credit card sector where capturing market share demands aggressive outreach. In 2024, the company's marketing expenditures saw a notable increase, rising by 55% compared to 2021 figures, underscoring a strategic push to expand its customer base and product offerings.

Capital One makes significant investments in its technology and digital transformation initiatives. These include substantial outlays for cloud computing, artificial intelligence, and the ongoing development of its digital platforms.

These investments are vital for boosting operational efficiency, fostering innovation, and ensuring Capital One remains competitive in the rapidly evolving financial services landscape. For instance, the company's commitment to AI is evident in its efforts to personalize customer experiences and streamline internal processes.

Looking ahead, these technology-driven expenditures are a primary driver of projected financial changes. Total non-interest expenses for Capital One are anticipated to rise by approximately 12.5% in 2025, largely attributable to these crucial technology and digital transformation investments.

As a prominent lender, Capital One incurs substantial costs related to its provision for credit losses. This accounts for anticipated defaults across its diverse loan offerings, including credit cards, auto loans, and commercial lending.

For 2025, credit card net charge-offs are projected to continue at an elevated level, reflecting ongoing economic conditions and their impact on borrower repayment capabilities.

Personnel and Operational Expenses

Capital One's cost structure is significantly influenced by personnel and operational expenses. This includes the substantial costs of employee salaries, comprehensive benefits packages, and the day-to-day running of its banking services. These operational costs encompass managing its digital infrastructure, customer service call centers, and its relatively lean branch network.

The company prioritizes operating efficiency, largely driven by its strategic focus on digital channels. This digital-first approach aims to reduce the overhead associated with traditional brick-and-mortar banking. For instance, as of the first quarter of 2024, Capital One reported total operating expenses of $6.4 billion, a figure reflecting these personnel and operational outlays.

- Salaries and Benefits: A major component, covering compensation for its workforce across technology, customer service, and corporate functions.

- Technology and Infrastructure: Costs related to maintaining and enhancing its digital platforms, data analytics, and cybersecurity.

- Customer Service Operations: Expenses for call centers and other support channels that manage customer interactions.

- Branch Network: While limited, costs associated with maintaining and operating physical locations are still a factor.

Interchange Fees and Network Costs

Before acquiring Discover, Capital One incurred significant interchange fees and network costs to process transactions through external payment networks like Visa and Mastercard. These fees are a standard operational expense for any financial institution relying on established payment infrastructure.

The acquisition of Discover in late 2024 is poised to alter Capital One's cost structure dramatically. By bringing Discover's payment network in-house, Capital One anticipates internalizing many of these previously outsourced network and interchange costs for transactions processed on the Discover network.

- Interchange Fees: These are fees paid by merchants to banks for processing credit card transactions.

- Network Costs: Fees paid to payment networks (e.g., Visa, Mastercard, Discover) for using their infrastructure to facilitate transactions.

- Internalization of Costs: Capital One expects to reduce direct payments to third-party networks for Discover transactions post-acquisition.

- Potential Cost Savings: While specific projections for 2025 are still developing, the internalization of these costs is a key driver for the acquisition's financial rationale.

Capital One's cost structure is heavily influenced by its significant investments in marketing and technology. The company's commitment to digital transformation, including AI and cloud computing, is a primary driver of its operational expenses, with total non-interest expenses projected to increase by about 12.5% in 2025 due to these initiatives.

The provision for credit losses remains a substantial cost, reflecting anticipated defaults across its lending portfolio, particularly in credit cards and auto loans. Elevated credit card net charge-offs are expected to persist into 2025, influenced by prevailing economic conditions.

Personnel and operational expenses, including salaries, benefits, and the management of its digital infrastructure and customer service operations, form another core part of Capital One's cost base. For example, Q1 2024 operating expenses were $6.4 billion.

The acquisition of Discover in late 2024 is expected to significantly reshape Capital One's cost structure by internalizing interchange and network costs previously paid to third-party payment networks.

| Cost Category | Description | 2024 Impact/Projection | Notes |

|---|---|---|---|

| Marketing & Advertising | Customer acquisition and brand visibility | 55% increase vs. 2021 | Aggressive outreach in competitive credit card market |

| Technology & Digital Transformation | Cloud, AI, platform development | Key driver of 12.5% projected non-interest expense increase in 2025 | Enhances efficiency and innovation |

| Provision for Credit Losses | Anticipated loan defaults | Elevated credit card net charge-offs projected for 2025 | Reflects economic conditions and borrower repayment |

| Personnel & Operations | Salaries, benefits, digital infrastructure, customer service | $6.4 billion total operating expenses in Q1 2024 | Focus on digital channels to reduce traditional banking overhead |

| Interchange & Network Costs | Transaction processing fees (pre-acquisition) | Significant costs paid to Visa/Mastercard | Expected to decrease for Discover transactions post-acquisition |

Revenue Streams

Capital One's core revenue engine is net interest income. This is the profit earned from the difference between the interest charged on loans like credit cards, auto loans, and commercial loans, and the interest paid out on customer deposits.

The domestic card business, a significant contributor, demonstrated robust performance, with revenue increasing by 7% year-over-year in the first quarter of 2025. This growth highlights the continued strength of their lending operations.

Capital One generates significant revenue through interchange fees, which are charged to merchants for processing credit and debit card transactions. These fees are a fundamental component of the payment ecosystem.

The acquisition of Discover in 2024 is a game-changer for Capital One's revenue streams. By bringing Discover's payment network in-house, Capital One can now directly capture a larger portion of these interchange fees, rather than relying on third-party processors.

In 2023, the total value of credit card transactions processed in the U.S. exceeded $5 trillion, with interchange fees typically ranging from 1% to 3% of each transaction's value. This strategic move positions Capital One to significantly boost its earnings from these fees.

Capital One earns income from annual fees charged on specific credit card offerings, a common practice for premium or rewards-focused cards. Beyond these recurring charges, the company also collects revenue from a variety of other fees associated with credit card usage.

These additional revenue streams include charges for late payments, cash advances, and transactions made in foreign currencies. For instance, in 2023, Capital One reported that its non-interest income, which includes these various fees, contributed significantly to its overall financial performance, reflecting the diverse ways it monetizes its credit products.

Deposit Service Charges and Banking Fees

Capital One generates substantial revenue from deposit service charges and banking fees across its consumer and commercial banking operations. These fees are a consistent income source, stemming from everyday banking activities.

These revenue streams encompass a wide array of charges, including those for maintaining checking and savings accounts, overdraft protection, ATM usage, wire transfers, and other transactional services. For instance, in 2024, the banking industry as a whole continued to see significant income from these types of fees, reflecting customer reliance on traditional banking products.

- Checking and Savings Account Fees: Charges for account maintenance, minimum balance requirements, and inactivity.

- Overdraft and Non-Sufficient Funds (NSF) Fees: Penalties applied when account holders exceed their available balance.

- Transaction-Based Fees: Costs associated with specific banking activities like wire transfers, ATM withdrawals at non-network machines, and stop payments.

- Other Service Charges: Fees for services such as paper statements, cashier's checks, and account research.

Other Non-Interest Income

Capital One's "Other Non-Interest Income" encompasses a range of revenue beyond traditional interest. This includes gains realized from selling off loan portfolios, investment earnings, and a variety of service fees generated across its diverse financial offerings. For instance, in 2023, Capital One reported non-interest income of $12.2 billion, a significant portion of which would stem from these varied sources.

These diverse revenue streams contribute to the company's overall financial resilience. They often represent income derived from activities that are less directly tied to the fluctuating interest rate environment.

- Gains on Sale of Loans: Revenue generated from selling loans to other entities.

- Investment Income: Returns from the company's investments in securities and other financial instruments.

- Miscellaneous Fees: Income from various service charges, account fees, and other administrative charges.

- Other Fee Income: This can include income from credit card interchange fees, servicing fees, and other transactional charges.

Capital One's revenue is primarily driven by net interest income from its lending activities, including credit cards and auto loans, alongside fees generated from interchange on card transactions. The strategic acquisition of Discover in 2024 significantly enhances its ability to capture these interchange fees, as the U.S. credit card market processed over $5 trillion in 2023, with interchange fees typically between 1-3%. Additionally, Capital One earns from various account and service fees within its banking operations and from gains on loan sales and investment income, which contributed to its $12.2 billion in non-interest income in 2023.

| Revenue Stream | Description | 2023 Data/Impact |

|---|---|---|

| Net Interest Income | Profit from loans minus interest paid on deposits. | Core revenue driver; robust performance in domestic card business. |

| Interchange Fees | Fees charged to merchants for card transactions. | Discover acquisition (2024) expected to boost capture of these fees from a $5T+ market. |

| Cardholder Fees | Annual fees, late fees, cash advance fees, foreign transaction fees. | Significant contributor to non-interest income. |

| Banking Fees | Account maintenance, overdraft, ATM, wire transfer fees. | Consistent income from consumer and commercial banking. |

| Other Non-Interest Income | Gains on loan sales, investment income, miscellaneous service fees. | Totalled $12.2 billion in 2023, providing diversification. |

Business Model Canvas Data Sources

The Capital One Business Model Canvas is informed by a blend of internal financial performance data, extensive market research on consumer and business banking trends, and strategic analyses of competitive landscapes. These sources ensure a comprehensive and data-driven representation of our business operations and strategic direction.