Campari Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Campari Group Bundle

Campari Group boasts a powerful global brand portfolio and a strong presence in the booming aperitif market, showcasing significant strengths in its premium offerings. However, potential vulnerabilities lie in its reliance on specific distribution channels and the ever-evolving consumer preferences in the beverage industry.

Want the full story behind Campari Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Campari Group's strength lies in its robust portfolio of over 50 premium and super premium brands. This collection includes globally recognized names such as Campari, Aperol, and Grand Marnier, underscoring the company's strong brand equity.

This diverse and high-quality brand offering provides a significant competitive advantage. It effectively appeals to the growing consumer preference for premium spirits, a trend that continued to drive sales in 2024, with Aperol and Campari demonstrating solid growth.

Campari Group boasts an extensive global distribution network, touching over 190 countries. This broad reach is a significant advantage, enabling the company to capitalize on growth opportunities across diverse international markets.

In 2024, key regions like the Americas and Germany demonstrated particularly strong sales performance, underscoring the effectiveness of Campari's established market presence. This widespread operational footprint allows for resilience and sustained positive sales trends, even amidst global economic headwinds.

Campari Group demonstrated remarkable resilience in 2024, navigating a landscape marked by macroeconomic and geopolitical uncertainties. The company achieved a notable 2.4% organic net sales growth, a clear indicator of its ability to perform well even when conditions are tough.

This outperformance against competitors is largely attributed to Campari's strong brand portfolio, especially in key categories like Aperitifs and Tequila. The sustained momentum in these areas, coupled with effective cost management strategies, highlights the group's adaptability and robust operational framework.

Commitment to Sustainability and Responsible Practices

Campari Group demonstrates a strong commitment to sustainability, embedding its 2024 Sustainability Statement within its Annual Report, adhering to European Sustainability Reporting Standards. This structured approach highlights their dedication to responsible business operations and environmental stewardship.

The company has established ambitious goals for reducing its environmental footprint, specifically targeting greenhouse gas emissions and water consumption. For instance, Campari aims to cut its absolute Scope 1 and 2 GHG emissions by 21% by 2030 from a 2021 baseline and reduce water intensity in water-stressed areas by 15% by 2025.

- Sustainability Integrated: Campari's 2024 Sustainability Statement is a core part of its Annual Report, aligning with ESRS.

- Emission Reduction Targets: Aims for a 21% reduction in absolute Scope 1 and 2 GHG emissions by 2030 (vs. 2021).

- Water Conservation Goals: Targets a 15% reduction in water intensity in water-stressed areas by 2025.

- Corporate Social Responsibility: These initiatives underscore a deep commitment to environmental protection and social responsibility.

Strategic Acquisitions and Focus on Premiumization

Campari Group has a proven track record of strategic acquisitions, notably the acquisition of Courvoisier Cognac in 2024. This move significantly bolstered its presence in the high-margin premium spirits market, particularly within the burgeoning Cognac category.

The company's strategic pivot towards a 'Houses of Brands' operating model underscores a deliberate focus on premiumization. This approach concentrates on enhancing brand equity and profitability within key segments such as Aperitifs, Whiskey, Rum, and Tequila, aligning with evolving consumer preferences for higher-quality offerings.

This strategic direction is supported by financial performance, with Campari Group reporting a 15.2% organic sales growth in the first quarter of 2024, driven by its premium portfolio. The company's commitment to premiumization is expected to continue driving profitable growth in the coming years.

Key strengths in this area include:

- Strategic Acquisitions: Successful integration of premium brands like Courvoisier enhances market position and profitability.

- Focus on Premiumization: Shift towards high-margin categories like Cognac, Whiskey, and Tequila caters to growing consumer demand for premium products.

- 'Houses of Brands' Model: This structure allows for specialized brand management and targeted marketing, optimizing performance within each category.

- Strong Organic Growth: Q1 2024 organic sales growth of 15.2% demonstrates the effectiveness of its premiumization strategy.

Campari Group's financial performance in 2024 was robust, with organic net sales growth of 2.4% despite challenging economic conditions. This resilience is a testament to its strong brand portfolio, particularly in high-growth categories like Aperitifs and Tequila, which saw continued momentum. The company’s strategic focus on premiumization, exemplified by the 2024 acquisition of Courvoisier Cognac, has further solidified its market position and profitability.

| Brand Strength | Key Brands | 2024 Performance Indicator |

| Premium Portfolio | Campari, Aperol, Grand Marnier, Courvoisier | Continued sales growth in premium segments |

| Global Reach | Distribution in over 190 countries | Strong performance in Americas and Germany |

| Strategic Acquisitions | Courvoisier Cognac (2024) | Enhanced presence in high-margin Cognac category |

| Operational Model | 'Houses of Brands' | Optimized brand management and targeted marketing |

What is included in the product

Offers a full breakdown of Campari Group’s strategic business environment by examining its brand portfolio, market presence, and potential for expansion, alongside competitive pressures and regulatory challenges.

Offers a clear, actionable framework for identifying and addressing Campari Group's strategic challenges.

Weaknesses

Campari Group faced a notable dip in profitability, with its net profit-adjusted declining by 3.7% in 2024. This was exacerbated by an unadjusted net profit drop of 39%, largely attributed to a significant €213 million charge for a cost containment program.

Further illustrating these challenges, profit before tax saw a substantial decrease of 26.1% in the first quarter of 2025. These figures suggest that despite efforts to grow sales, the company is struggling to maintain its profit margins, partly due to continued investment needs and rising selling, general, and administrative expenses.

Campari Group's 2024 performance faced headwinds from a volatile macroeconomic and geopolitical landscape, alongside shifts in consumer preferences. These external pressures, including trade destocking, notably impacted sales, particularly in the crucial US market.

A significant factor was the slowdown in Cognac, a category where Campari has exposure, and a decline in Skyy Vodka's performance, directly linked to unfavorable category trends in the United States during the period.

Campari Group experienced significant supply chain challenges in 2024, including a hurricane in Jamaica that impacted rum production. This event, coupled with adverse weather conditions across Europe, directly affected the availability and cost of high-margin aperitifs, hindering gross margin growth during the first half of the year.

These disruptions continued to weigh on performance into early 2025, with logistic delays contributing to a softened Q1 2025. Such vulnerabilities highlight Campari's susceptibility to external factors impacting its ability to consistently deliver products and maintain profitability.

Challenges with Recent Acquisitions and Debt Levels

Campari's acquisition of Courvoisier in 2024, a significant move, has unfortunately coincided with a slowdown in Cognac sales. This, combined with the premium price paid for the brand, has placed considerable strain on the company's finances. The increased financial leverage is a clear concern for the group.

The impact of the Courvoisier deal, alongside other investments, is evident in Campari's financial structure. By the close of 2024, the group's net debt had climbed to 3.2 times its basic profit. This elevated debt level has necessitated a strategic pause on further acquisitions, prioritizing debt reduction.

- Acquisition Strain: The 2024 Courvoisier acquisition, while strategically aligned, has added financial pressure due to a Cognac market slowdown and a high acquisition multiple.

- Increased Leverage: By the end of 2024, Campari's net debt stood at 3.2 times its basic profit, a direct consequence of recent investments.

- Strategic Pause: To address the heightened debt levels, Campari has temporarily suspended new acquisition activities.

Organizational Restructuring and Potential Workforce Reductions

Campari Group embarked on a significant global restructuring initiative spanning late 2024 and early 2025. This strategic move includes a comprehensive cost containment program and a thorough review of its entire employee structure.

The restructuring is anticipated to involve a reduction of approximately 10% in its global workforce, potentially impacting around 500 positions. This signals underlying internal challenges within the organization.

Such workforce adjustments can create apprehension and potentially affect employee morale and the overall stability of operations during the transition period.

- Restructuring Period: Late 2024 - Early 2025

- Potential Workforce Reduction: ~10% globally

- Estimated Job Impact: Approximately 500 roles

- Key Initiatives: Cost containment and employee base review

Campari's profitability has been under pressure, with net profit-adjusted decreasing by 3.7% in 2024, and profit before tax dropping 26.1% in Q1 2025, indicating challenges in maintaining margins despite sales growth efforts.

The acquisition of Courvoisier in 2024, while strategic, has increased financial leverage, with net debt reaching 3.2 times basic profit by year-end 2024, leading to a pause in further acquisitions to focus on debt reduction.

A significant global restructuring initiative, spanning late 2024 and early 2025, includes a cost containment program and a potential workforce reduction of around 10%, impacting approximately 500 roles, which could affect employee morale and operational stability.

| Financial Metric | 2024 (Reported/Estimate) | Q1 2025 (Reported) |

|---|---|---|

| Net Profit-Adjusted Change | -3.7% | N/A |

| Profit Before Tax Change | N/A | -26.1% |

| Net Debt to Basic Profit Ratio | 3.2x | N/A |

What You See Is What You Get

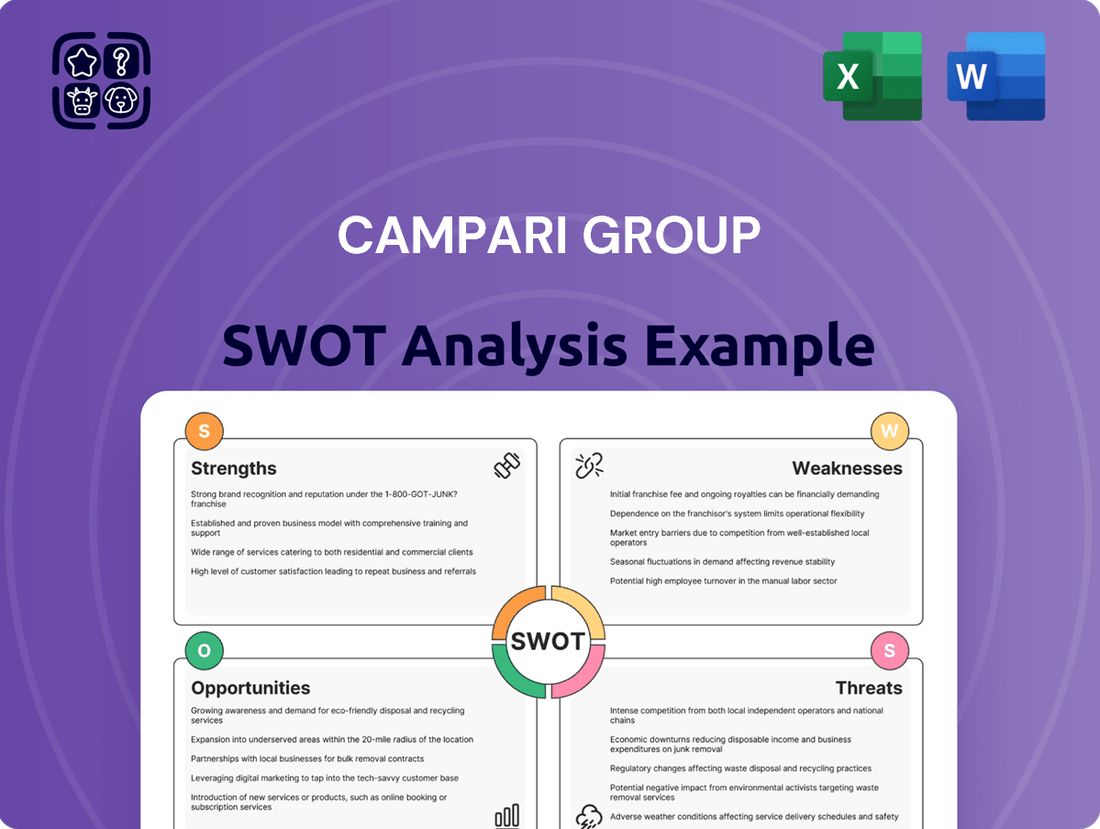

Campari Group SWOT Analysis

You are viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering a comprehensive look at Campari Group's strategic positioning.

This preview reflects the real document you'll receive—professional, structured, and ready to use, detailing Campari Group's Strengths, Weaknesses, Opportunities, and Threats.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail, providing actionable insights for your business strategy.

Opportunities

Campari Group has a significant opportunity to leverage its portfolio in fast-growing and trendy spirit categories. The company can capitalize on the increasing consumer demand for premium and artisanal products, particularly in emerging markets.

The success of Espolòn Tequila exemplifies this potential. In 2024, Espolòn achieved double-digit growth and became Campari's largest brand in the United States, demonstrating strong consumer adoption and a clear pathway for further expansion into new geographies and consumer segments.

Campari's position as the 'House of Aperitifs,' anchored by the enduring strength of Aperol and Campari, represents a significant growth avenue. Aperol, in particular, has demonstrated consistent upward momentum, solidifying its status as a key revenue driver.

The burgeoning popularity of aperitif-style cocktails, such as the Spritz, in markets like the United States offers a prime opportunity. This trend allows Campari to capitalize on its dominant aperitif portfolio, driving further brand penetration and expanding the global footprint of Aperol and Campari.

Campari Group is actively pursuing a strategy to streamline its extensive brand portfolio, aiming to divest non-core assets. This move is designed to simplify management and reduce operational costs. For instance, the group has been evaluating its smaller regional brands, potentially leading to their sale in 2024 or 2025.

By shedding less profitable or non-strategic brands, Campari can concentrate its investments and marketing efforts on its global priority brands, such as Aperol and Skyy Vodka. This focus is expected to boost efficiency and enhance overall profitability, allowing for better resource allocation towards high-growth areas.

Increased Advertising and Promotion Spend for Brand Building

Campari Group is strategically increasing its advertising and promotion (A&P) expenditure, aiming for 17-17.5% of sales in 2025. This significant investment is designed to bolster brand equity and drive demand for its portfolio.

This heightened focus on brand building is crucial for strengthening Campari's market position and supporting the growth of its key brands, particularly in a dynamic and competitive global spirits market.

The increased A&P spend is expected to yield several benefits:

- Enhanced Brand Recognition: Greater visibility and impactful campaigns will solidify Campari's brands in the minds of consumers.

- Improved Market Penetration: Targeted promotions and advertising will help introduce and grow market share for specific products.

- Stronger Competitive Advantage: A robust brand presence is essential to stand out against competitors and capture consumer loyalty.

- Sustained Sales Growth: By stimulating demand and reinforcing brand value, the A&P investment aims to contribute directly to top-line growth.

Potential for Improved Free Cash Flow Post-Investment Cycle

Campari Group has made substantial investments in expanding its plant capacity throughout 2024. This significant capital expenditure cycle is expected to taper off from 2025. The anticipated decrease in future capital spending presents a clear opportunity for enhanced free cash flow generation.

This potential improvement in free cash flow offers Campari Group increased financial maneuverability. It could be strategically deployed towards accelerated debt reduction or funding new growth opportunities.

- Reduced Capital Expenditures: Forecasted decrease in CapEx from 2025 following 2024 expansion efforts.

- Enhanced Free Cash Flow: Potential for stronger cash generation due to lower investment needs.

- Financial Flexibility: Increased capacity for debt repayment or pursuing strategic acquisitions and initiatives.

Campari Group can capitalize on the growing demand for premium and artisanal spirits, particularly in emerging markets, as demonstrated by Espolòn Tequila's double-digit growth in 2024, making it Campari's largest US brand.

The company's strong position in aperitifs, led by Aperol and Campari, offers significant growth potential, especially with the rising popularity of aperitif-style cocktails like the Spritz in the US market.

Divesting non-core assets and focusing investments on global priority brands like Aperol and Skyy Vodka streamlines operations and enhances profitability.

Increased advertising and promotion (A&P) expenditure, targeting 17-17.5% of sales in 2025, aims to boost brand equity and drive demand.

A projected decrease in capital expenditures from 2025 onwards, following 2024 expansion, is expected to enhance free cash flow, providing greater financial flexibility for debt reduction or strategic growth initiatives.

| Opportunity Area | Key Driver | Supporting Data/Example |

|---|---|---|

| Premium & Artisanal Spirits Growth | Increasing consumer demand | Espolòn Tequila achieved double-digit growth in 2024, becoming Campari's largest US brand. |

| Aperitif Category Dominance | Popularity of aperitif cocktails (e.g., Spritz) | Strong performance of Aperol and Campari brands in key markets. |

| Portfolio Optimization | Divestment of non-core assets | Focus on global priority brands like Aperol and Skyy Vodka. |

| Enhanced Brand Building | Increased A&P investment | Targeting 17-17.5% of sales for A&P in 2025. |

| Improved Free Cash Flow | Reduced capital expenditures | Anticipated decrease in CapEx from 2025 after 2024 expansion. |

Threats

The potential imposition of 25% tariffs on imports from Europe, Mexico, and Canada into the United States presents a substantial financial threat to Campari. This policy could directly impact Campari's profitability, with estimates suggesting an annual hit of €90-100 million.

Such tariffs would significantly reduce earnings and introduce considerable uncertainty into Campari's most crucial markets, affecting sales and potentially requiring price adjustments.

The spirits industry is currently facing softer market dynamics, leading to intensified price competition in key regions. This environment, coupled with a volatile consumer landscape, poses a significant challenge to Campari's established pricing strategies and its capacity to retain market share, particularly for brands like Skyy Vodka that are experiencing declining trends. For instance, in 2023, the global spirits market saw growth rates moderate compared to previous years, with some developed markets exhibiting near-stagnant volume expansion, intensifying the need for competitive pricing.

The ongoing complex and uncertain global economic landscape, marked by persistent inflation, poses a significant threat to Campari. Rising input costs for raw materials and packaging, coupled with higher interest rates impacting borrowing costs, directly squeeze profit margins. For instance, the Eurozone experienced an inflation rate of 2.4% in April 2024, a slight decrease but still elevated, directly affecting Campari's cost of goods sold.

Declining Demand in Specific Categories and Regions

Campari Group is facing headwinds from declining demand in certain product categories and geographical markets. For instance, the US market has seen a drop in demand for Cognac, a segment where Campari has significant presence. This trend highlights the importance of staying attuned to evolving consumer preferences and the potential impact on established brands.

The Asia-Pacific region presents another area of concern, with notable sales contractions in key markets such as Australia, India, and South Korea. These regional challenges suggest that a one-size-fits-all approach to market strategy may not be effective, necessitating tailored approaches to address local economic conditions and consumer behaviors.

Furthermore, specific brands within Campari's portfolio, including Grand Marnier and Skyy Vodka, have experienced sales declines. This indicates that the challenges are not solely confined to broad regional trends but also affect individual brand performance, underscoring the need for strategic brand management and potential repositioning or innovation to reignite growth.

- US Cognac Market: Witnessed a downturn, impacting brands like Grand Marnier.

- Asia-Pacific Sales Decline: Experienced contraction in Australia, India, and South Korea.

- Brand-Specific Challenges: Skyy Vodka also faced reduced demand, requiring focused attention.

- Need for Adaptation: Demonstrates the necessity of adjusting strategies to specific regional and category market shifts.

Leadership Transitions and Organizational Instability

Campari Group navigated a period of significant leadership change, with a CEO transition occurring in late 2024 and early 2025. This shift, alongside ongoing organizational restructuring and potential workforce adjustments, introduces a risk of temporary instability. Such instability could hinder the effective execution of Campari's strategic initiatives.

The consequences of these leadership transitions and restructuring efforts could manifest in several ways:

- Disruption to Strategic Execution: New leadership may require time to fully integrate and align with existing strategies, potentially slowing down key projects and market responses.

- Impact on Employee Morale: Organizational restructuring and potential workforce reductions, if implemented, can create uncertainty among remaining employees, affecting productivity and engagement.

- Investor Confidence: Frequent leadership changes or perceived instability can sometimes lead to a dip in investor confidence, impacting stock performance. For example, during periods of significant leadership change in the broader consumer staples sector in 2024, companies experienced an average stock price volatility increase of 8-12% in the quarter following the announcement.

- Operational Inefficiencies: The process of integrating new leadership and restructuring can lead to temporary operational inefficiencies as new processes are implemented and roles are redefined.

Campari faces significant threats from a volatile global economic landscape, characterized by persistent inflation that drives up raw material and packaging costs, directly impacting profit margins. For example, Eurozone inflation stood at 2.4% in April 2024, a figure that still elevates operational expenses. Intensified price competition in key markets, exacerbated by softer overall spirits industry dynamics, also pressures Campari's established pricing strategies and market share retention, particularly for brands like Skyy Vodka experiencing declining demand.

SWOT Analysis Data Sources

This Campari Group SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial statements, comprehensive market research reports, and expert industry analyses to ensure a well-informed and accurate assessment.