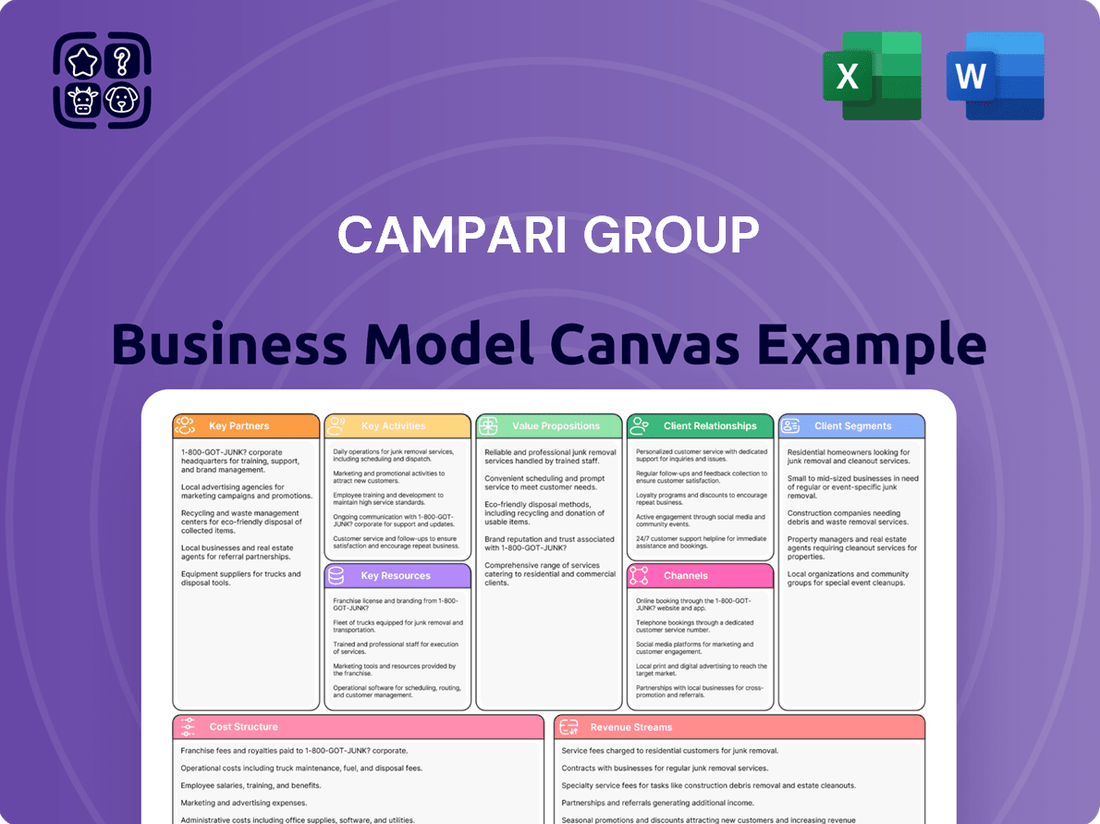

Campari Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Campari Group Bundle

Unlock the full strategic blueprint behind Campari Group's business model. This in-depth Business Model Canvas reveals how the company drives value through its premium brand portfolio, captures market share via strategic acquisitions and distribution, and stays ahead in a competitive landscape by focusing on innovation and consumer engagement. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a global spirits leader.

Partnerships

Campari Group's global distribution network thrives on strategic alliances, notably with major players like Southern Glazer's Wine & Spirits. These collaborations are fundamental to Campari's ability to efficiently deliver its extensive product range to over 190 countries worldwide.

These vital partnerships are instrumental in achieving deep market penetration and ensuring broad consumer access, particularly within significant markets such as North America and Europe. For instance, in 2023, Campari reported a significant increase in net sales, driven in part by the strength of its distribution channels in these key regions.

Campari Group’s success hinges on strong partnerships across both on-trade and off-trade channels. Collaborations with bars, restaurants, and hotels (on-trade) are crucial for brand building and driving trial, while liquor stores and supermarkets (off-trade) are essential for widespread availability and driving volume.

The off-trade segment is particularly significant, representing a substantial portion of Campari’s sales and catering to the growing consumer preference for at-home consumption. In 2024, the global spirits market saw continued growth in off-trade sales, with premiumization trends boosting demand for Campari's diverse portfolio.

Campari Group cultivates robust relationships with its raw material suppliers, crucial for maintaining the consistent quality of its iconic products. For instance, securing high-grade agave is vital for its tequila brands, while a reliable supply of diverse botanicals underpins the flavor profiles of its renowned aperitifs.

These partnerships are designed to build supply chain resilience, a critical factor given the potential for disruptions. Events like adverse weather patterns can significantly impact agricultural yields, making strong supplier ties essential for mitigating these risks and ensuring uninterrupted production throughout 2024.

Marketing and Promotion Agencies

Campari Group collaborates with marketing and advertising agencies to craft impactful campaigns that strengthen brand recognition and connect with consumers. These partnerships are crucial for developing and implementing strategies across diverse channels, ensuring a consistent and compelling brand message. For instance, in 2024, Campari continued to invest in digital marketing, leveraging social media and influencer collaborations to reach younger demographics.

The company's promotional efforts extend beyond digital, encompassing in-store activations and experiential marketing. These initiatives aim to create memorable consumer experiences and drive sales at the point of purchase. Campari's focus on building brand equity through these partnerships is a cornerstone of its strategy for sustained growth in the competitive spirits market.

- Brand Equity Enhancement Agencies help craft campaigns that build and maintain strong brand identities.

- Targeted Consumer Engagement Partnerships enable precise targeting of specific consumer segments through various media.

- Digital and In-Store Integration Agencies assist in creating seamless promotional experiences across online and offline touchpoints.

- Campaign ROI Optimization Collaboration aims to maximize the return on investment for marketing expenditures.

Acquisition Targets and Integration Partners

Campari Group actively pursues strategic acquisitions to expand its brand portfolio and market reach. For instance, the significant acquisition of Courvoisier in late 2023, valued at €1.2 billion, highlights this approach. This necessitates strong partnerships with specialized firms for thorough due diligence, ensuring financial and operational soundness of target companies.

Integration partners are crucial for seamlessly incorporating newly acquired brands into Campari's existing structure. This includes expertise in supply chain management, marketing alignment, and distribution network harmonization. Such collaborations are vital for realizing the full potential of these acquisitions, as seen in the ongoing integration of Courvoisier’s premium cognac portfolio into Campari’s global operations.

- Due Diligence Partners: Financial advisory firms and legal experts specializing in M&A to assess target company valuations and risks.

- Integration Specialists: Consultants and technology providers for smooth operational and systems integration post-acquisition.

- Brand Portfolio Leverage: Marketing and distribution agencies to maximize the reach and appeal of acquired brands.

Campari Group's distribution network relies heavily on key partnerships with major distributors like Southern Glazer's Wine & Spirits, ensuring its products reach over 190 markets. These alliances are critical for market penetration, especially in North America and Europe, where Campari saw strong net sales growth in 2023, partly due to these robust channels.

The company also fosters deep relationships with raw material suppliers to maintain product quality, such as securing high-grade agave for its tequila. Supply chain resilience is paramount, with strong supplier ties helping to mitigate risks from potential disruptions, a crucial consideration throughout 2024.

Furthermore, Campari collaborates with marketing and advertising agencies to create impactful campaigns, leveraging digital channels and influencer partnerships to engage younger consumers, a strategy evident in its 2024 digital marketing investments.

Strategic acquisitions, like the €1.2 billion purchase of Courvoisier in late 2023, necessitate partnerships with specialized firms for due diligence and integration specialists to ensure seamless operational alignment, maximizing the value of these brand additions.

What is included in the product

This Business Model Canvas provides a strategic overview of Campari Group's operations, detailing its premium brand portfolio, global distribution network, and focus on premiumization and innovation to target discerning consumers worldwide.

Campari Group's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex global operations, simplifying strategic understanding for stakeholders.

It efficiently distills Campari's value proposition, customer segments, and revenue streams, offering a digestible format that alleviates the pain of deciphering intricate business strategies.

Activities

Campari Group dedicates significant resources to brand building, employing a multi-faceted marketing approach. This includes robust digital campaigns, engaging in-store promotions, and strategic partnerships to elevate its portfolio of premium and super-premium brands, such as Aperol and Campari.

In 2023, Campari Group's marketing investments contributed to a strong performance, with net sales growing by 5.1% organically. This focus on brand equity is crucial for maintaining premium pricing and driving consumer loyalty in a competitive market.

Campari Group's production and manufacturing operations are the backbone of its global reach, encompassing 25 strategically located production sites. These facilities are dedicated to the efficient and sustainable creation of its extensive portfolio of spirits and liqueurs, ensuring consistent quality across all brands.

The company actively invests in expanding and modernizing its manufacturing capabilities to meet growing consumer demand. A prime example is the significant investment to double Aperol's production capacity at the Novi Ligure plant, demonstrating a proactive approach to scaling operations for key growth drivers.

Campari Group's global distribution and sales efforts are paramount, managing a complex network spanning over 190 countries. This requires sophisticated logistics and inventory management to ensure timely product availability. In 2023, Campari reported a significant increase in net sales, reaching €2,958.8 million, underscoring the effectiveness of their extensive reach.

Strategic partnerships with local distributors are crucial for optimizing market penetration and consumer access. These collaborations allow Campari to navigate diverse regulatory environments and consumer preferences across its vast operational footprint. This global sales infrastructure is a key driver of their consistent revenue growth.

Product Innovation and Portfolio Management

Campari Group's product innovation and portfolio management are central to its strategy. This involves a continuous cycle of developing new products and actively managing its extensive collection of over 50 brands. The company actively monitors market trends to ensure its offerings remain relevant and appealing to consumers.

A key aspect of this is the introduction of limited-time offerings, which generate excitement and cater to evolving consumer preferences. Furthermore, Campari Group strategically streamlines its portfolio by divesting non-core brands. This focused approach allows the company to concentrate resources on high-growth categories and brands with significant potential.

- Brand Portfolio Management: Campari Group oversees a diverse portfolio exceeding 50 brands, including well-known names like Aperol and Campari.

- Market Trend Analysis: The company invests in understanding emerging consumer tastes and market dynamics to guide product development.

- Strategic Divestitures: In 2023, Campari Group completed the divestment of its Italian wine business, Sassicaia, for €330 million, demonstrating its commitment to portfolio optimization.

- Focus on Growth Categories: This strategic pruning enables a sharper focus on high-growth segments within the spirits market.

Strategic Acquisitions and Integration

Campari Group's growth hinges on strategically identifying, acquiring, and integrating new brands and businesses. This key activity involves meticulous due diligence and efficient post-acquisition integration to maximize value. For instance, in 2023, Campari completed the acquisition of a majority stake in P.I.W.E. S.r.l. (Teisseire), a move that significantly bolstered its non-alcoholic ready-to-drink portfolio.

The successful integration of acquired entities is paramount. This process ensures that new brands are seamlessly incorporated into Campari's existing operational structure and marketing strategies. This allows for the realization of synergies and the unlocking of the full potential of these new assets. The company's ability to effectively manage these integrations directly impacts its overall market position and financial performance.

- Strategic Acquisitions: Campari Group actively seeks brands that complement its existing portfolio and geographic presence, driving organic and inorganic growth.

- Brand Integration: Post-acquisition, Campari focuses on integrating new brands into its distribution networks and marketing initiatives to leverage existing strengths.

- Synergy Realization: The company aims to achieve operational and commercial synergies from acquisitions, enhancing profitability and market share.

- Portfolio Expansion: Acquisitions are a core component of Campari's strategy to diversify its product offerings and enter new, high-growth categories.

Campari Group's key activities revolve around robust brand building through diverse marketing channels, efficient global production leveraging 25 sites, and extensive distribution across over 190 countries. Product innovation and strategic portfolio management, including acquisitions and divestitures, are also central, as seen with the 2023 acquisition of Teisseire and the divestment of Sassicaia.

| Key Activity | Description | 2023 Impact/Data |

| Brand Building & Marketing | Multi-faceted campaigns (digital, in-store, partnerships) for premium brands. | 5.1% organic net sales growth. |

| Production & Manufacturing | Efficient and sustainable creation of spirits and liqueurs across 25 sites. | Investment to double Aperol production capacity. |

| Global Distribution & Sales | Managing a complex network spanning over 190 countries. | Net sales reached €2,958.8 million. |

| Product Innovation & Portfolio Management | Developing new products and managing over 50 brands, including divestitures. | Divested Sassicaia for €330 million. |

| Strategic Acquisitions | Identifying, acquiring, and integrating new brands to expand the portfolio. | Acquired majority stake in Teisseire. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas for Campari Group that you are previewing is the actual, complete document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the professional, ready-to-use file you'll download. You'll gain full access to this meticulously structured analysis, ensuring exactly what you see is what you get.

Resources

Campari Group's strong brand portfolio, featuring over 50 premium and super-premium names, is its most significant asset. This collection includes globally recognized powerhouses like Campari, Aperol, and Grand Marnier, which are central to the company's market presence and sales generation across diverse international markets.

These iconic brands are the engine driving Campari Group's success, contributing substantially to its revenue streams. For instance, in 2023, the company reported net sales of €2,963.6 million, with its premium and super-premium brands forming the backbone of this performance, underscoring their critical role in the business model.

Campari Group's global production facilities are the backbone of its operations, with 25 sites strategically located worldwide. These facilities are instrumental in manufacturing the company's diverse portfolio, which includes well-known spirits, wines, and aperitifs. The Novi Ligure plant in Italy, for instance, is a significant hub for producing key brands, ensuring both consistent supply and the high quality consumers expect.

Campari Group's extensive distribution network is a cornerstone of its business, reaching consumers in over 190 countries. This vast reach is crucial for its global brand presence and market penetration. In 2023, the group reported that its brands were available in approximately 190 markets worldwide, highlighting the sheer scale of this operation.

The company further strengthens its market access through direct distribution in 26 key markets. This direct approach allows for greater control over brand presentation and customer engagement, optimizing sales and marketing efforts where it matters most.

Skilled Workforce and Management

Campari Group's success hinges on its approximately 4,900 employees, the heart of its operations. This skilled workforce embodies the unique 'Camparista culture,' a blend of passion and expertise that drives the company forward.

Their collective talent spans critical areas such as brand building, sophisticated production processes, and astute market management. This deep well of knowledge is instrumental in maintaining Campari's competitive edge and fostering its global brand recognition.

- Skilled Workforce: Approximately 4,900 employees form the backbone of Campari Group.

- 'Camparista Culture': This unique ethos fosters a dedicated and expert team.

- Key Expertise: Employees possess specialized skills in brand building, production, and market management.

- Performance Contribution: Their collective abilities directly impact the company's financial results and market standing.

Intellectual Property and Recipes

Campari Group's proprietary recipes and iconic brand trademarks are foundational intellectual property assets. These elements are crucial for maintaining product distinctiveness and brand recognition in the global spirits market, directly contributing to their competitive advantage.

The value of these intangible assets is underscored by Campari Group's consistent brand investment. For instance, in 2023, the company continued to focus on brand building, which directly leverages its unique recipes and established trademarks to drive sales and market share.

- Proprietary Recipes: The secret formulations for flagship brands like Campari, Aperol, and SKYY Vodka are protected and form the core of product differentiation.

- Trademarks: The distinctive names, logos, and packaging associated with these brands are legally protected, ensuring brand integrity and preventing counterfeiting.

- Intellectual Property Portfolio: This encompasses not only recipes and trademarks but also any associated patents or design rights that protect the unique characteristics of their products.

- Market Differentiation: These intellectual assets allow Campari Group to command premium pricing and foster strong consumer loyalty by offering a clearly defined and unique product experience.

Campari Group's key resources are its robust brand portfolio, global production capabilities, extensive distribution network, skilled workforce, and valuable intellectual property. These elements collectively enable the company to create, produce, and deliver its premium spirits and aperitifs to consumers worldwide, driving its market position and financial performance.

The company's 25 production facilities, including the significant Novi Ligure plant, ensure the consistent quality and supply of its diverse product range. This operational infrastructure is vital for meeting global demand and maintaining the integrity of its premium brands.

Campari Group's intellectual property, including proprietary recipes and iconic trademarks, provides a critical competitive advantage. These assets differentiate its products, allowing for premium pricing and fostering strong consumer loyalty, as demonstrated by consistent brand investment.

| Key Resource | Description | 2023 Data/Impact |

|---|---|---|

| Brand Portfolio | Over 50 premium and super-premium brands | Central to net sales of €2,963.6 million |

| Production Facilities | 25 global sites | Ensuring consistent supply and quality of diverse portfolio |

| Distribution Network | Presence in over 190 countries | Facilitating global market penetration and brand accessibility |

| Skilled Workforce | Approximately 4,900 employees | Driving expertise in brand building, production, and market management |

| Intellectual Property | Proprietary recipes and trademarks | Underpinning product distinctiveness and brand recognition |

Value Propositions

Campari Group boasts a premium and diverse brand portfolio, encompassing over 50 distinct spirits, wines, and aperitifs. This extensive range ensures a high-quality offering for a broad spectrum of consumer tastes and preferences, catering to various drinking occasions and market segments.

The strategic acquisition and development of these premium brands, such as Aperol and Skyy Vodka, contribute significantly to Campari's market positioning. For instance, in 2023, the company reported organic sales growth driven by its key premium brands, highlighting the success of this value proposition.

Campari Group's brands, with roots stretching back to 1860, embody authentic Italian craftsmanship and a rich heritage. This deep history allows them to offer consumers a genuine connection to tradition, a powerful draw in today's market. For instance, the iconic Campari itself, first created in 1860, continues to be a symbol of Italian aperitivo culture.

Campari Group masterfully crafts its brand identity around the creation of enjoyable social occasions and memorable experiences. A prime example is the widely recognized Aperol Spritz ritual, which has become synonymous with relaxed, shared moments.

This deliberate emphasis on 'moments to enjoy' fosters a deep emotional connection with consumers, transforming simple consumption into a valued social activity. By highlighting these experiences, Campari encourages its brands to be central to gatherings and celebrations.

For instance, in 2023, Campari reported a net sales increase of 8.1% to €2,965.5 million, underscoring the success of their strategy in driving consumer engagement and purchase through these experiential value propositions.

Global Availability and Accessibility

Campari Group's commitment to global availability means its diverse portfolio of spirits and beverages can be found in over 190 countries. This expansive reach is a cornerstone of their business model, ensuring consumers across the globe have easy access to their favorite Campari, Aperol, and SKYY Vodka products.

This widespread accessibility is facilitated by a robust and efficient global distribution network. It allows Campari Group to cater to a vast international customer base, making their brands readily available whether a consumer is in a major metropolitan area or a more remote location.

- Global Reach: Available in over 190 countries.

- Distribution Network: Extensive and efficient global supply chain.

- Consumer Convenience: Easy access to premium beverage brands worldwide.

- Market Penetration: Strong presence in both developed and emerging markets.

Commitment to Sustainability and Responsible Practices

Campari Group actively champions environmental sustainability and responsible consumption, weaving these principles into its core operations. This commitment is not merely aspirational; it translates into tangible actions that resonate deeply with today's consumers who increasingly prioritize brands demonstrating social consciousness. By focusing on these areas, Campari Group cultivates a positive brand image, fostering stronger connections with its customer base.

In 2024, Campari Group continued to advance its sustainability agenda. For instance, the company has set ambitious targets for reducing its carbon footprint across its value chain. This includes investing in renewable energy sources for its production facilities and optimizing logistics to minimize emissions. Their dedication extends to water stewardship, with programs aimed at reducing water consumption and ensuring responsible water management in water-scarce regions where they operate.

Community involvement is another cornerstone of Campari Group's responsible practices. They engage in initiatives that support local communities, focusing on education, social welfare, and cultural preservation. These efforts not only contribute to the well-being of the areas where Campari operates but also reinforce the brand's role as a responsible corporate citizen. This holistic approach to sustainability and community engagement is a key differentiator in the competitive beverage market.

- Environmental Stewardship: Focus on reducing greenhouse gas emissions and improving water efficiency in production.

- Responsible Consumption Advocacy: Promoting moderation and providing clear product information to consumers.

- Community Engagement Programs: Supporting local initiatives and fostering positive relationships with stakeholders.

- Sustainable Sourcing Practices: Working with suppliers to ensure ethically and sustainably sourced ingredients.

Campari Group's value proposition centers on its premium, diverse brand portfolio, including iconic names like Aperol and SKYY Vodka. This curated selection caters to a wide range of consumer preferences and occasions, driving strong market performance. The company's historical roots, dating back to 1860, imbue its brands with authenticity and a rich heritage, fostering deep consumer connections through shared experiences and rituals.

Their global reach, extending to over 190 countries, is supported by an efficient distribution network, ensuring convenient access to their premium products worldwide. Furthermore, Campari Group actively integrates environmental sustainability and responsible consumption into its operations, enhancing brand reputation and consumer loyalty. In 2023, Campari reported net sales of €2,965.5 million, a testament to the effectiveness of these value propositions in driving growth and engagement.

Customer Relationships

Campari Group actively cultivates brand communities, strengthening consumer connections and loyalty. For instance, their engagement through social media and exclusive events for brands like Aperol fosters a shared experience, turning customers into brand advocates.

Campari Group leverages digital platforms like its website and social media, including TikTok, to foster direct consumer engagement. This approach allows for personalized experiences and immediate customer service, significantly boosting satisfaction and brand loyalty.

Campari Group cultivates robust relationships with its on-trade and off-trade partners, recognizing them as vital channels for brand visibility and sales. These partnerships are the backbone of their market presence, ensuring brands reach consumers effectively.

To foster these connections, Campari Group actively provides support, including marketing assistance and training for bar and restaurant staff. For instance, their brand ambassador programs offer valuable expertise to on-trade partners, enhancing product knowledge and sales techniques.

Joint promotional activities are a key strategy, with Campari Group collaborating with retailers and hospitality venues on campaigns and events. In 2023, such initiatives contributed to strong performance across key markets, reflecting the value of these collaborative efforts in driving brand engagement and sales volume.

Educational and Experiential Marketing

Campari Group actively fosters consumer connection through educational marketing, sharing cocktail recipes and brand narratives to enhance product appreciation. In 2024, this educational approach is crucial as the premium spirits market continues to grow, with consumers seeking deeper engagement beyond the purchase.

Experiential marketing initiatives are key to immersing consumers in the Campari essence. These events, ranging from tasting sessions to immersive brand experiences, create memorable interactions that build loyalty and brand advocacy. For instance, the company's continued investment in on-trade activations in 2024 aims to directly engage bartenders and consumers in key markets.

- Brand Storytelling: Campari educates consumers on the heritage and craftsmanship behind its brands, fostering a deeper emotional connection.

- Cocktail Education: Providing accessible recipes and techniques empowers consumers to recreate brand experiences at home, increasing product usage.

- Experiential Events: Immersive brand activations and tastings in 2024 create memorable moments, driving trial and preference.

- Digital Engagement: Online platforms share educational content, extending reach and accessibility for brand learning.

Investor Relations and Transparency

Campari Group prioritizes open and honest communication with its investors, fostering a strong sense of trust. This commitment is evident through their consistent delivery of detailed financial reports and engaging earnings calls. For instance, in their 2024 first-quarter results, Campari highlighted a 9.4% organic sales growth, demonstrating a healthy performance and providing clear insights into their operational successes.

Their investor relations strategy also includes regular investor presentations, offering a platform for deeper dives into company performance and future outlook. This proactive approach ensures that financial stakeholders are well-informed and confident in Campari's strategic direction. The company’s dedication to transparency is a cornerstone of building and maintaining robust, long-term relationships within the financial community.

- Regular Financial Reporting: Campari Group consistently publishes comprehensive financial reports, providing investors with up-to-date performance data.

- Earnings Calls and Presentations: The company actively engages with investors through scheduled earnings calls and presentations, facilitating direct dialogue and clarification.

- Building Investor Confidence: This transparent communication strategy is crucial for building and maintaining trust and confidence among Campari's financial stakeholders.

- Demonstrated Performance: For example, the 9.4% organic sales growth reported in Q1 2024 showcases the tangible results of their strategic initiatives and transparently shared with the market.

Campari Group fosters strong relationships with its on-trade and off-trade partners, viewing them as essential for brand visibility and sales. These partnerships are critical for market penetration, ensuring effective consumer reach. In 2024, their continued investment in on-trade activations aims to directly engage bartenders and consumers in key markets.

The company actively supports partners through marketing assistance and training, exemplified by brand ambassador programs that enhance product knowledge and sales techniques. Joint promotional activities with retailers and hospitality venues are a core strategy, contributing to strong performance and brand engagement.

| Customer Relationship Type | Description | Key Activities/Examples | Impact/Focus (2024) |

|---|---|---|---|

| Consumer Engagement | Building brand communities and loyalty. | Social media, exclusive events (e.g., Aperol), digital platforms. | Fostering shared experiences, brand advocacy. |

| Partner Relationships (On-trade/Off-trade) | Vital channels for brand visibility and sales. | Marketing support, training, brand ambassador programs. | Enhancing product knowledge and sales techniques. |

| Joint Promotions | Collaborating on campaigns and events. | Retailer and hospitality venue partnerships. | Driving brand engagement and sales volume. |

| Investor Relations | Maintaining trust and confidence with financial stakeholders. | Detailed financial reports, earnings calls, investor presentations. | Ensuring informed stakeholders, transparency in performance. |

Channels

Campari Group's global reach is powered by a robust distribution network. They directly manage distribution in 26 key markets, ensuring tight control over brand presentation and market strategy. This direct approach is complemented by strategic partnerships with third-party distributors, extending their presence to over 190 countries worldwide.

This dual strategy is crucial for ensuring widespread product availability and capturing diverse consumer segments across the globe. For instance, in 2023, Campari Group's net sales reached €2,958.8 million, a testament to the effectiveness of their expansive distribution channels in driving revenue and market penetration.

Campari Group's products find their way to consumers primarily through the on-trade channel. This includes a wide array of establishments like bars, restaurants, hotels, and clubs, where beverages are enjoyed in social and experiential settings.

These on-trade venues are absolutely vital for Campari's brand building and driving immediate sales. In 2023, Campari Group's net sales grew by 10.7% to €2,578.7 million, with the on-trade channel playing a significant role in this performance, particularly in key European markets.

Off-trade channels, encompassing liquor stores, supermarkets, and convenience stores, are crucial for Campari Group's sales, facilitating consumer purchases for at-home enjoyment. These retail environments typically offer a broad spectrum of products and often present competitive pricing, making them key points of access for consumers.

In 2024, the off-trade segment continued to be the dominant channel for spirits sales globally. For instance, the U.S. off-trade market for spirits saw consistent growth, with major retailers reporting strong performance in premium and super-premium categories, aligning with Campari's brand portfolio.

E-commerce and Online Retailers

Campari Group actively utilizes e-commerce, partnering with platforms like Uber Eats and Instacart to offer direct-to-consumer delivery. This strategy enhances convenience for customers seeking their premium beverage products. In 2023, the global e-commerce share for alcoholic beverages continued its upward trend, with many markets seeing double-digit growth in online sales, reflecting Campari's strategic focus.

These digital channels allow Campari to reach a broader consumer base and provide a seamless purchasing experience. The company's investment in online presence and delivery partnerships is crucial for adapting to evolving consumer shopping habits. For instance, in the United States, online grocery sales, which often include alcoholic beverages, saw significant increases in the early 2020s, a trend that is largely sustained.

- Direct-to-Consumer Sales: Leveraging e-commerce for direct sales bypasses traditional retail intermediaries, potentially improving margins.

- Partnerships with Delivery Services: Collaborations with Uber Eats and Instacart expand reach and offer rapid delivery options.

- Market Adaptation: Responding to the growing consumer preference for online shopping, especially for convenience-driven purchases like beverages.

- Data Analytics: E-commerce platforms provide valuable data on consumer behavior, enabling more targeted marketing and product development.

Global Travel Retail (GTR)

Global Travel Retail (GTR) represents a vital channel for Campari Group, leveraging premium spirits sales in duty-free environments like airports. This segment is crucial for brand visibility and reaching a global consumer base. In 2024, GTR continued to be a significant growth driver for the premium spirits market.

Campari Group strategically invests in GTR to enhance brand presence and drive sales, often featuring its flagship brands like Campari and Aperol. The channel's unique passenger demographic allows for targeted marketing and premium product placement. Data from 2023 indicated strong performance in GTR for premium categories.

- Channel Focus: Global Travel Retail (GTR) is a key distribution and marketing channel for Campari Group's premium and super-premium brands.

- Sales Contribution: GTR significantly contributes to overall sales growth, particularly for brands with strong international recognition.

- Brand Visibility: Airports and other travel hubs offer high visibility to a diverse, international audience, ideal for brand building.

- Market Trends: In 2024, the recovery of international travel boosted GTR sales, with premiumization remaining a dominant trend.

Campari Group's distribution strategy is multifaceted, aiming for broad market penetration and brand visibility. They manage direct distribution in 26 key markets, while partnering with third parties to reach over 190 countries. This ensures their products are available where consumers shop and socialize.

The on-trade channel, including bars and restaurants, is a primary focus for sales and brand building, with Campari Group reporting 10.7% net sales growth in 2023. Off-trade channels like supermarkets are equally vital for at-home consumption, with the U.S. off-trade spirits market showing consistent growth in premium categories in 2024.

E-commerce partnerships with platforms like Uber Eats and Instacart enhance convenience and reach, tapping into the growing online beverage sales trend, which saw double-digit growth in many markets in 2023. Global Travel Retail also serves as a significant channel for premium brand visibility and sales, benefiting from the 2024 recovery in international travel.

| Channel | Description | Key Role | 2023/2024 Relevance |

|---|---|---|---|

| Direct Distribution | In 26 key markets | Brand control, market strategy | Foundation for global presence |

| Third-Party Distribution | In over 190 countries | Market reach expansion | Ensures global product availability |

| On-Trade | Bars, restaurants, hotels | Brand building, immediate sales | Drove significant net sales growth in 2023 |

| Off-Trade | Liquor stores, supermarkets | At-home consumption sales | Dominant channel globally, premium growth in 2024 |

| E-commerce | Direct-to-consumer delivery platforms | Convenience, broader reach | Tapping into growing online sales trends |

| Global Travel Retail (GTR) | Duty-free environments | Brand visibility, premium sales | Significant growth driver in 2024 |

Customer Segments

Premium spirits consumers are individuals who actively seek out high-quality, often super-premium, alcoholic beverages. They are discerning buyers who prioritize craftsmanship, the story behind a brand, and distinctive flavor profiles. This segment is characterized by a willingness to invest more for an elevated drinking experience.

In 2024, the global premium spirits market continued its robust growth, with categories like luxury whiskey and artisanal gin showing particularly strong demand. For instance, the super-premium vodka segment alone was projected to reach over $25 billion globally by the end of 2024, reflecting the significant spending power and preference for quality within this demographic.

This segment includes both home enthusiasts eager to craft sophisticated drinks and professional mixologists seeking premium ingredients. Brands like Campari and Aperol are central to their passion, forming the base of countless classic and modern cocktails, from the Negroni to the Aperol Spritz.

This segment comprises individuals who relish alcoholic beverages as a social lubricant, especially during the pre-dinner aperitif ritual. Campari Group's strategic focus on its 'House of Aperitifs', featuring iconic brands like Aperol, directly caters to this lifestyle and consumption occasion.

In 2023, the global aperitif market showed robust growth, with Campari Group's aperitif portfolio, led by Aperol, experiencing significant uplift. Aperol, in particular, continued its strong performance, driven by its popularity in social gatherings and its association with the vibrant Italian aperitivo culture, a trend that shows no signs of slowing down in 2024.

Geographic Markets (Americas, EMEA, APAC)

Campari Group strategically targets distinct geographic markets, with a significant portion of its revenue generated in EMEA and the Americas. In 2024, the EMEA region represented the largest share of sales, accounting for 48% of the group's total revenue. This demonstrates a strong presence and consumer adoption across Europe, the Middle East, and Africa, where diverse local tastes and established distribution networks play a crucial role.

The Americas follow closely, contributing 45% to Campari Group's sales in 2024. This substantial figure highlights the brand's success in North and South America, driven by evolving consumer preferences for premium spirits and effective marketing strategies tailored to these dynamic markets.

The APAC region, while smaller, represents a growing opportunity for Campari Group, making up 7% of sales in 2024. This segment is characterized by rapidly expanding economies and a burgeoning middle class with increasing disposable income, creating potential for future growth as the company adapts its product offerings and distribution to local demands.

- EMEA: 48% of sales in 2024, reflecting strong established markets.

- Americas: 45% of sales in 2024, indicating robust performance in diverse economies.

- APAC: 7% of sales in 2024, showcasing emerging market potential and future growth avenues.

Specific Spirit Category Enthusiasts

Specific spirit category enthusiasts are consumers deeply loyal to particular types of spirits, like tequila aficionados who gravitate towards brands such as Espolòn, or whiskey drinkers who prefer the heritage of Wild Turkey. Cognac lovers, for instance, often seek out the distinct profile of Courvoisier.

Campari Group's strategic approach, often referred to as its 'Houses of Brands' structure, is designed to cater precisely to these specialized preferences. This model allows for focused marketing and brand development within each distinct spirit category, nurturing the loyalty of these dedicated consumer segments.

For example, in 2023, Campari Group reported strong performance in its premium and super premium brand portfolio, which includes many of these category-specific brands. This segment growth often outpaces that of the broader market, highlighting the value of targeting these enthusiastic consumers.

- Espolòn: A premium tequila brand experiencing significant growth, appealing to consumers seeking authentic Mexican spirits.

- Wild Turkey: A well-established American whiskey brand with a dedicated following, known for its bold flavor profiles.

- Courvoisier: A prestigious cognac house, attracting consumers who appreciate the craftsmanship and heritage of fine spirits.

Campari Group's customer segments are diverse, encompassing premium spirits consumers who value quality and experience, and those who enjoy spirits as part of a social ritual, particularly the aperitif occasion. The company also caters to enthusiasts deeply loyal to specific spirit categories like tequila, whiskey, and cognac.

Geographically, the group sees significant sales in EMEA (48% in 2024) and the Americas (45% in 2024), with the APAC region showing strong growth potential (7% in 2024). This broad reach highlights Campari's strategy to engage a global audience with varied preferences.

| Customer Segment | Key Characteristics | 2024 Sales Contribution |

|---|---|---|

| Premium Spirits Consumers | Seek high-quality, crafted beverages; prioritize brand story and flavor. | N/A (Integrated across categories) |

| Aperitif Occasion Enthusiasts | Enjoy spirits as social lubricants, especially pre-dinner. | N/A (Driven by specific brands like Aperol) |

| Category-Specific Enthusiasts | Loyal to particular spirits (e.g., tequila, whiskey, cognac). | N/A (Catered to via 'Houses of Brands') |

| Geographic Markets | EMEA (48%), Americas (45%), APAC (7%) | Regional sales breakdown |

Cost Structure

Campari Group's production and manufacturing costs are substantial, driven by the procurement of key ingredients like agave for tequila and various botanicals for its aperitifs and liqueurs. In 2023, the company reported that cost of sales, which includes production expenses, amounted to €1.4 billion. This figure reflects the complexities of managing a global supply chain and maintaining quality across its 25 production facilities worldwide.

Significant investments are continuously made to optimize and expand manufacturing capabilities. For example, the group has been investing in increasing production capacity for high-demand products such as Aperol, ensuring they can meet growing consumer interest. These capital expenditures, while increasing upfront costs, are crucial for long-term growth and market responsiveness.

Packaging also represents a notable cost component, encompassing bottles, labels, and secondary packaging materials, all designed to maintain brand integrity and appeal. The scale of Campari's operations means that even small efficiencies in production and packaging can have a material impact on the overall cost structure.

Sales, General, and Administrative (SG&A) expenses are crucial for Campari Group’s global operations. These costs encompass everything from executive salaries and marketing personnel to office rent and IT infrastructure, supporting the vast network of brands and distribution channels.

Campari Group has actively pursued efficiency and cost containment within its SG&A structure. For instance, in 2023, the company reported SG&A expenses of €1,197.8 million, representing a slight increase from €1,150.5 million in 2022, reflecting ongoing investments in brand building and global reach while maintaining a focus on operational optimization.

Campari Group dedicates significant resources to marketing and advertising, a core component of its cost structure. In 2023, marketing and advertising expenses amounted to €471.2 million, reflecting a substantial investment in brand building and global reach.

These expenditures are strategically allocated across diverse channels, encompassing digital marketing campaigns, impactful in-store promotions, and high-profile event sponsorships. This multi-faceted approach aims to enhance brand visibility and consumer engagement worldwide.

Distribution and Logistics Costs

Managing Campari Group's extensive global distribution network is a substantial cost driver, encompassing transportation, warehousing, and the complexities of inventory management across numerous markets. These expenses are incurred whether through direct operational control or by leveraging third-party logistics providers to ensure product availability worldwide.

- Transportation: Costs associated with shipping finished goods from production facilities to distribution centers and then to retailers or distributors globally, including sea freight, air freight, and road transport.

- Warehousing: Expenses for maintaining storage facilities, including rent, utilities, labor for handling and storage, and insurance for inventory.

- Inventory Management: Costs related to tracking, managing, and optimizing stock levels to meet demand while minimizing holding costs and potential obsolescence.

- Third-Party Logistics (3PL): Fees paid to external companies for services such as warehousing, transportation, and order fulfillment, which can offer scalability and specialized expertise.

In 2024, the beverage industry, including players like Campari, continued to face elevated logistics costs due to ongoing global supply chain pressures and fluctuating fuel prices, impacting the overall distribution expenses. For instance, shipping costs remained a significant factor, with freight rates for key routes showing volatility throughout the year.

Acquisition and Integration Costs

Campari Group's expansion strategy heavily relies on acquisitions, which directly impact its cost structure through significant acquisition and integration expenses. These costs encompass the financial outlay for purchasing new brands and businesses, as well as the considerable resources needed to merge these acquired entities into Campari's existing operational framework.

In 2023, Campari Group completed the acquisition of Courvoisier Cognac for €525 million. This significant investment highlights the substantial capital commitment required for strategic brand acquisitions, a key driver of their growth model.

The integration process itself involves costs associated with aligning IT systems, supply chains, marketing efforts, and personnel. These are crucial for realizing the full potential and synergies of the acquired assets, ensuring they contribute effectively to the group's overall performance.

- Acquisition Outlay: Direct purchase price of target companies and brands.

- Integration Expenses: Costs for merging operations, IT systems, and personnel.

- Due Diligence: Fees for legal, financial, and operational reviews prior to acquisition.

- Brand Harmonization: Expenses related to aligning marketing, branding, and product portfolios.

Campari Group's cost structure is heavily influenced by its production and ingredient sourcing, with cost of sales reaching €1.4 billion in 2023. This reflects the global nature of its operations and the quality of raw materials like agave and botanicals. Investments in manufacturing capacity, such as for Aperol, and packaging materials are also significant cost drivers.

Revenue Streams

Campari Group's main income source is the sale of its premium and super-premium spirits. Brands like Campari, Aperol, and Wild Turkey are central to this, contributing substantially to their overall revenue. In 2023, the Group's net sales reached €2,964.5 million, with the premium portfolio being a significant driver of this growth.

Campari Group's revenue streams significantly benefit from the sale of wines and aperitifs. For instance, in 2024, aperitifs like Aperol and Campari continued to show robust growth, contributing substantially to the company's top line.

While the Cinzano brand's vermouth and sparkling wine segments were divested in June 2025, the ongoing sales of other wines within their portfolio still represent a valuable revenue component, bolstering their market presence.

Global Travel Retail sales, encompassing duty-free outlets in airports and on cruise ships, represent a significant revenue stream for Campari Group, particularly for its premium spirit offerings. This channel has demonstrated robust performance, experiencing double-digit growth in recent years, underscoring its importance in reaching international consumers.

Geographic Market Sales

Campari Group's revenue streams are significantly shaped by its geographic market sales, demonstrating a robust global presence. The Americas and EMEA regions are particularly dominant, collectively accounting for a substantial majority of the company's total sales.

In 2023, the Americas represented 45% of Campari Group's total sales, highlighting its strong footing in North and South America. The EMEA (Europe, Middle East, and Africa) region was even larger, contributing 48% to the group's overall revenue, underscoring its critical importance to Campari's financial performance.

The performance within these broad geographic segments is not uniform; it varies considerably based on specific regional dynamics and the strength of individual brands in those markets. This regional performance variation is a key factor in Campari's overall sales strategy and brand management.

- Americas: 45% of total sales in 2023.

- EMEA: 48% of total sales in 2023.

- Regional Performance: Sales vary significantly by specific country and brand within these major geographic areas.

Innovation and New Product Launches

Campari Group generates revenue through its commitment to innovation and the introduction of new products. These launches are strategically designed to capture evolving consumer preferences and capitalize on emerging market trends, thereby boosting sales and increasing market penetration.

Limited-edition offerings also play a crucial role, creating excitement and urgency among consumers. This approach not only drives immediate revenue but also strengthens brand loyalty and encourages repeat purchases, contributing to sustained growth.

- New Product Development: Campari Group consistently invests in R&D to launch innovative spirits and aperitifs, appealing to diverse consumer palates.

- Limited Editions: The company frequently releases special, time-bound products, often in collaboration with artists or designers, to create buzz and drive short-term sales spikes.

- Market Responsiveness: Revenue is directly linked to the group's ability to quickly adapt to and lead in new beverage categories and flavor profiles, as seen in the growing demand for premium and artisanal spirits.

Campari Group's revenue is primarily driven by the sale of its premium and super-premium spirits, with brands like Campari, Aperol, and Wild Turkey being key contributors. The company also generates income from wine sales, though certain segments like Cinzano vermouth and sparkling wine were divested in June 2025. Global Travel Retail represents a significant channel, experiencing strong growth, particularly for premium spirits.

Geographically, the Americas and EMEA regions are the largest revenue generators. In 2023, the Americas accounted for 45% of total sales, while EMEA contributed 48%. Performance varies by specific market and brand within these regions.

Innovation through new product development and limited-edition offerings also fuels revenue, capturing evolving consumer preferences and driving sales spikes. This responsiveness to market trends is crucial for sustained growth.

| Revenue Stream | Key Brands/Channels | 2023 Contribution |

| Premium Spirits Sales | Campari, Aperol, Wild Turkey | Primary driver of net sales (€2,964.5 million in 2023) |

| Wine Sales | Various wine brands (excluding divested Cinzano) | Valuable component, bolstering market presence |

| Global Travel Retail | Premium spirits in duty-free outlets | Double-digit growth, important for international reach |

| Geographic Markets | Americas (45% of sales in 2023), EMEA (48% of sales in 2023) | Dominant revenue sources, with regional variations |

| New Products & Limited Editions | Product innovation and special releases | Drives immediate revenue and brand loyalty |

Business Model Canvas Data Sources

The Campari Group Business Model Canvas is constructed using a blend of financial disclosures, extensive market research on consumer trends and competitor strategies, and internal operational data. These sources provide a comprehensive view of the company's current and future business landscape.