Campari Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Campari Group Bundle

Uncover the external forces shaping Campari Group's destiny with our comprehensive PESTLE analysis. From evolving consumer preferences to shifting global regulations, understand the landscape your investments or strategies must navigate. Gain a critical edge by downloading the full version for actionable intelligence.

Political factors

Governments globally implement a complex web of rules for alcohol, covering everything from how it's made to how it's sold. For Campari Group, this means navigating licensing hurdles, advertising limitations, and even minimum price floors, all of which shape how they operate and reach consumers. For instance, in 2024, the UK's alcohol duty system saw adjustments, impacting pricing strategies for imported spirits.

Campari Group's global operations are significantly influenced by international trade policies and the potential for tariffs. For instance, the ongoing trade discussions between the European Union and the United States could lead to new tariffs on spirits, directly impacting Campari's cost of goods and pricing strategies in key markets. The company's reliance on imports and exports means that shifts in trade agreements can create considerable cost volatility and affect its competitive positioning.

Geopolitical tensions and protectionist measures in major economies, such as China, also present challenges. Trade barriers or retaliatory tariffs could impede Campari's market access and growth in these regions, impacting sales volumes and revenue streams. For example, a hypothetical 10% tariff on imported spirits into China could add millions in costs for Campari, affecting its profitability in that market.

The political stability of countries where Campari Group operates is a critical factor. Geopolitical shifts can disrupt supply chains, alter consumer spending habits, and foster an unpredictable operating landscape. For instance, Campari's 2024 financial performance demonstrated resilience, achieving positive outcomes even amidst significant macroeconomic and geopolitical turbulence, underscoring the company's ability to navigate such challenges.

Public Health Policies

Governments worldwide are increasingly focusing on public health, which directly impacts the beverage alcohol industry. Policies aimed at reducing alcohol consumption, such as higher taxes or stricter advertising regulations, are becoming more common. For instance, in 2024, several European countries continued to debate or implement measures to curb excessive drinking, a trend expected to persist into 2025.

This push for moderation is also fueled by a growing health-conscious consumer base. Campari Group, like its competitors, must adapt by potentially expanding its range of low- and no-alcohol (LNA) products. The global LNA market was valued at over $10 billion in 2023 and is projected to grow significantly, indicating a clear consumer shift that companies need to address through portfolio adjustments and targeted marketing.

- Government Health Initiatives: Increased public health campaigns promoting responsible drinking and moderation.

- Regulatory Landscape: Potential for stricter regulations on alcohol advertising and sales, particularly impacting high-ABV products.

- Consumer Behavior Shift: Growing consumer demand for low- and no-alcohol alternatives, influencing product development and marketing strategies.

Excise Duties and Taxation

Excise duties and taxation on alcoholic beverages are significant political factors impacting Campari Group. Changes in these duties directly influence product pricing, which in turn can affect consumer purchasing decisions and overall demand for Campari's extensive portfolio. For example, the European Union is currently reviewing its directives on minimum excise duty rates for alcoholic products. This review could potentially lead to increased tax burdens on beverages like wine, a category Campari participates in.

Such potential tax hikes necessitate careful consideration of Campari's pricing strategies. Increased excise duties could force the company to raise prices, potentially impacting sales volumes, especially in price-sensitive markets. Conversely, if competitors are more resilient to these changes, Campari's market share could be affected. The company must remain agile in its financial planning to absorb or pass on these tax-related costs effectively to maintain profitability and competitive positioning.

- EU Excise Duty Review: The European Union is examining minimum excise duty rates for alcoholic beverages, potentially increasing taxes on products like wine.

- Impact on Pricing: Higher excise duties can force Campari to adjust its pricing strategies, influencing consumer demand and sales volumes.

- Revenue Implications: Changes in taxation directly affect Campari's revenue streams and overall profitability, requiring strategic financial management.

- Market Competitiveness: The ability to manage increased tax costs will be crucial for maintaining Campari's competitive edge against other beverage producers.

Government policies on alcohol taxation and public health initiatives continue to shape the industry. For 2024, several European nations have debated or implemented stricter rules on alcohol advertising and consumption, a trend anticipated to continue into 2025, potentially impacting Campari's marketing and sales strategies.

The global low- and no-alcohol (LNA) market, valued at over $10 billion in 2023, is experiencing substantial growth, driven by health-conscious consumers and government health campaigns. Campari must adapt by expanding its LNA product range to meet this evolving demand.

The European Union's ongoing review of minimum excise duty rates for alcoholic products could lead to increased taxes on categories like wine, directly affecting Campari's pricing and profitability. For instance, a 5% increase in excise duty on wine in a key market could add millions to Campari's operating costs.

| Factor | 2024/2025 Trend | Impact on Campari |

| Alcohol Taxation | Potential EU excise duty increases on wine; UK duty adjustments | Requires pricing strategy adjustments, potential impact on sales volume and profitability |

| Public Health Initiatives | Increased focus on responsible drinking and moderation | Drives demand for LNA products; necessitates portfolio adaptation and targeted marketing |

| Advertising Regulations | Potential for stricter rules on alcohol advertising | May limit marketing reach and require creative advertising solutions |

What is included in the product

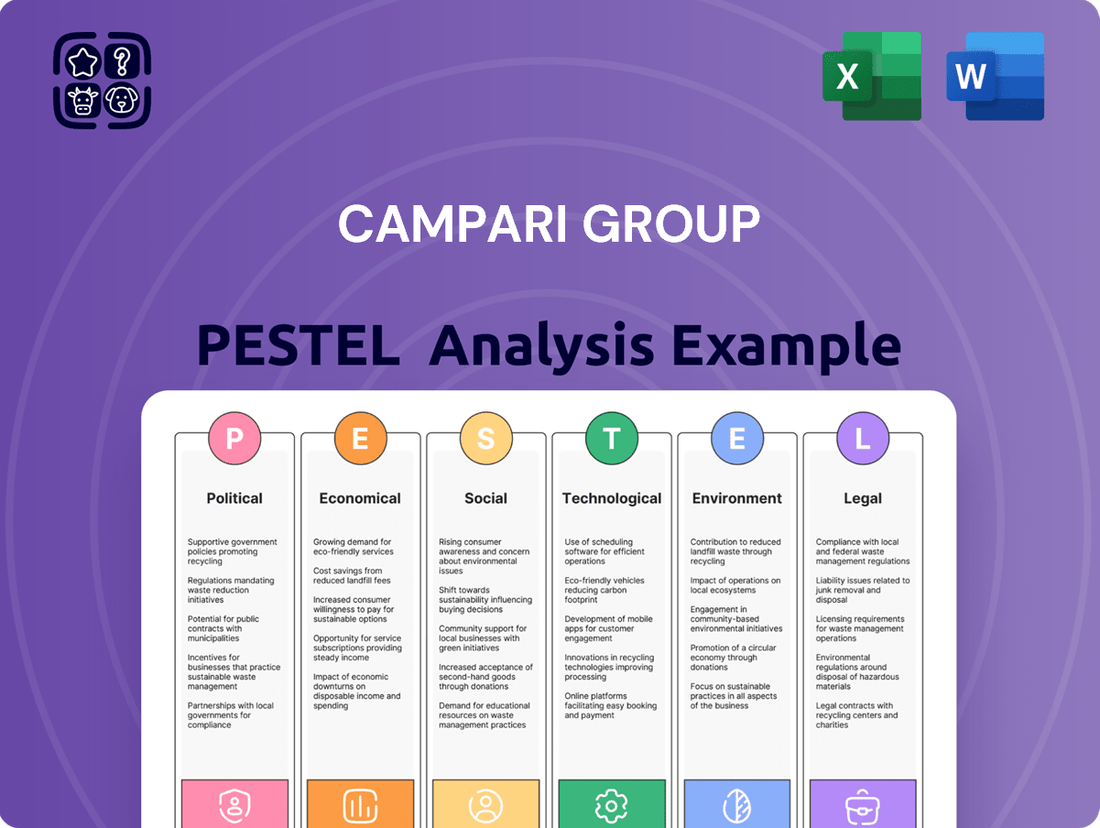

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting the Campari Group, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making, highlighting how global trends and regional specifics shape Campari's operational landscape and competitive positioning.

A concise PESTLE analysis for Campari Group, offering a clear overview of external factors to proactively address potential challenges and inform strategic decisions.

Economic factors

Global economic growth is a key driver for Campari Group, as it directly impacts consumer disposable income and, consequently, spending on premium spirits. A robust global economy, characterized by rising incomes and consumer confidence, typically translates to higher demand for discretionary goods, including Campari's portfolio of aperitifs, liqueurs, and premium spirits. For instance, in 2024, the International Monetary Fund (IMF) projected global growth to reach 3.2%, a steady rate that supports consumer spending on such items.

Conversely, economic downturns, inflation, or recessions can significantly affect Campari's sales. When consumers face tighter budgets, they may opt for less expensive alternatives or reduce their overall consumption of premium beverages. The inflationary pressures experienced globally in late 2023 and continuing into 2024, while showing signs of easing, still necessitate careful consumer spending, potentially impacting the volume of premium spirit sales.

Inflation, especially concerning raw materials and production, directly affects Campari Group's bottom line. Rising input costs can squeeze profit margins if not effectively passed on to consumers.

Campari Group's 2024 financial outlook specifically flagged inflationary pressures on input costs and interest rates as potential headwinds. This highlights the company's awareness of these economic challenges impacting its performance.

For instance, the cost of key ingredients like agave for tequila or grapes for wine can fluctuate significantly due to weather and global supply dynamics, directly influencing Campari's Cost of Goods Sold (COGS).

Effectively managing these escalating costs is paramount for Campari to sustain and grow its gross profit margins in the current economic climate.

Campari Group, with its extensive global operations, is significantly exposed to the volatility of exchange rates. When the company translates its earnings from various foreign markets back into its reporting currency, typically the Euro, fluctuations can materially affect reported sales and profitability. For instance, a stronger Euro can reduce the value of revenues earned in weaker currencies, while a weaker Euro can have the opposite effect.

The financial performance of Campari Group can be substantially influenced by these currency movements. A notable example from recent years, such as the period leading into 2024, saw periods of significant Euro strength against certain emerging market currencies, which could have presented headwinds for reported growth. Conversely, periods of Euro weakness would typically provide a tailwind.

Managing this currency risk is a critical aspect of Campari's financial strategy. The company may employ hedging strategies, such as forward contracts or options, to mitigate the impact of adverse exchange rate movements. For example, if Campari anticipates significant revenue in a currency expected to depreciate against the Euro, it might enter into a forward contract to sell that currency at a predetermined rate, thereby locking in the Euro value of its future earnings.

Premiumization Trend

The global spirits market is seeing a pronounced shift towards premium and super-premium offerings. Consumers are increasingly prioritizing quality and unique experiences, leading them to spend more on higher-end beverages. This trend directly supports Campari Group's strategic focus on its well-established premium brands.

This premiumization is evident in market growth figures. For instance, the premium spirits segment in the US grew by an estimated 8% in 2024, outpacing the overall spirits market growth. This indicates a strong consumer willingness to trade up for perceived value and superior taste profiles.

- Growing Demand for Craft and Artisanal Spirits: Consumers are actively seeking out unique, smaller-batch products with interesting backstories, which aligns with Campari's premium brand positioning.

- Increased Spending on Experiences: The desire for elevated social occasions and at-home entertaining drives spending on higher-quality spirits that enhance these moments.

- Brand Loyalty in Premium Segments: Once consumers find a premium brand that resonates with them, they often exhibit strong loyalty, providing a stable revenue base for companies like Campari.

- Impact on Profit Margins: The premiumization trend generally allows for higher profit margins, as consumers are willing to pay a premium for perceived quality and brand prestige.

E-commerce Growth in Alcohol Sales

The economic landscape for alcohol sales is being reshaped by the accelerating growth of e-commerce. This digital channel is not just a trend but a fundamental shift, offering substantial opportunities for companies like Campari Group. By embracing online platforms, Campari can tap into a burgeoning market fueled by consumer demand for convenience and accessibility.

Projections indicate this rapid expansion will persist, with the global online alcohol market expected to reach significant valuations. For instance, some analyses suggest the market could surpass $100 billion by 2025, highlighting the immense economic potential. Campari Group is well-positioned to capitalize on this by enhancing its direct-to-consumer strategies and digital engagement.

- Projected Market Growth: The global online alcohol sales market is anticipated to see continued robust growth, potentially reaching over $100 billion by 2025.

- Consumer Behavior Shift: Increased preference for convenience and digital purchasing is a primary driver for e-commerce expansion in the beverage alcohol sector.

- Campari's Opportunity: Leveraging online sales platforms and targeted digital marketing allows Campari to expand its reach and connect with a broader consumer base.

- Digital Investment: Companies investing in their e-commerce infrastructure and digital marketing capabilities are likely to gain a competitive advantage in this evolving economic environment.

Global economic growth directly impacts Campari's sales by influencing consumer disposable income and spending on premium spirits. In 2024, the IMF projected global growth at 3.2%, supporting discretionary spending. However, inflation and economic downturns can reduce demand for premium beverages, as seen with ongoing inflationary pressures affecting consumer budgets.

Inflation also squeezes Campari's profit margins by increasing input costs for raw materials like agave and grapes. The company's 2024 outlook acknowledged these cost pressures and interest rate impacts as potential challenges, underscoring the need for effective cost management to maintain gross profit.

Campari's international operations expose it to currency exchange rate volatility. For instance, a stronger Euro in early 2024 could have negatively impacted reported earnings from weaker currency markets. Managing this risk through hedging strategies is crucial for financial stability.

The spirits market is increasingly driven by premiumization, with consumers prioritizing quality and unique experiences, benefiting Campari's brand portfolio. The US premium spirits segment, for example, grew an estimated 8% in 2024, demonstrating a willingness to pay more for perceived value.

E-commerce is reshaping alcohol sales, offering significant opportunities for Campari through convenience and accessibility. The global online alcohol market is projected to exceed $100 billion by 2025, highlighting the importance of digital investment and direct-to-consumer strategies.

What You See Is What You Get

Campari Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Campari Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its global operations and strategic decisions. Understand the intricate landscape influencing this leading spirits company.

Sociological factors

A significant shift towards moderation and health is reshaping the beverage industry, especially among younger demographics. Globally, consumers, particularly Gen Z and Millennials, are increasingly opting for low- and no-alcohol alternatives or embracing periods of temporary abstinence. This trend directly impacts how beverage companies like Campari Group must innovate.

For instance, the global market for non-alcoholic beverages is projected to see substantial growth, with some reports estimating it to reach over $1.2 trillion by 2030, indicating a clear consumer demand for healthier options. Campari Group's strategic response needs to involve robust product development in this burgeoning category and marketing strategies that resonate with health-aware consumers.

The resurgence of cocktail culture is a significant driver for premium spirit brands like Campari. Consumers are increasingly interested in crafting sophisticated drinks at home, boosting demand for high-quality liqueurs and aperitifs. This trend is evident in the continued growth of the global premium spirits market, which was valued at approximately $300 billion in 2023 and is projected to expand further.

Furthermore, the convenience offered by alcohol delivery services has amplified at-home consumption. This shift means more consumers are purchasing spirits for personal enjoyment or smaller social gatherings, directly benefiting brands that cater to at-home mixology. For instance, online alcohol sales saw substantial growth, with some platforms reporting double-digit increases in user orders throughout 2024.

Social media platforms are fundamentally altering how consumers discover and purchase alcoholic beverages. For instance, in 2024, platforms like Instagram and TikTok saw a significant rise in alcohol brand advertising and influencer marketing, reaching millions of younger consumers. This digital engagement is crucial for brands like Campari to connect with a tech-savvy demographic.

The trend towards social commerce, where purchasing directly through social media channels is becoming more common, presents a new avenue for sales. By 2025, projections indicate that social commerce sales will continue to grow substantially, offering Campari opportunities to streamline the path from discovery to purchase for its products.

Demographic Shifts and Generational Preferences

Demographic shifts significantly impact Campari Group's market. Gen Z, for example, born between 1997 and 2012, shows a marked preference for brands that align with their values, including health consciousness and environmental sustainability. This generation is driving demand for lower-alcohol options and transparent ingredient sourcing, influencing Campari's product development and marketing strategies.

Generational preferences also play a crucial role in consumption patterns. While older generations might favor traditional spirits, younger consumers are more open to exploring new categories and ready-to-drink (RTD) formats. Campari's portfolio, which includes both established brands and newer, trend-aligned offerings, needs to cater to these evolving tastes to maintain market share.

- Gen Z's Influence: This demographic prioritizes health, transparency, and eco-friendly products, impacting demand for specific beverage types and brand messaging.

- Evolving Consumption: Younger consumers are increasingly drawn to RTDs and innovative spirit categories, requiring Campari to adapt its product pipeline and marketing.

- Market Segmentation: Understanding the distinct preferences of different age groups is vital for Campari to implement effective, targeted marketing campaigns and drive sales across its diverse brand portfolio.

Cultural Significance of Aperitifs and Spirits

The cultural significance of aperitifs, like Campari and Aperol, is a key sociological factor for Campari Group. These brands are deeply ingrained in social rituals, particularly in Europe, acting as more than just beverages but as facilitators of social connection and tradition.

This cultural embedding translates directly into sustained consumer demand. For instance, the Aperol Spritz has seen remarkable growth, becoming a symbol of relaxed social gatherings. In 2023, Aperol's net sales grew by 12.6% globally, highlighting the enduring appeal of this aperitif culture.

- Cultural Rituals: Aperitifs are central to pre-meal social customs in many countries, fostering community and shared experiences.

- Brand Loyalty: Deep cultural roots build strong brand loyalty, ensuring consistent sales for brands like Campari and Aperol.

- Market Penetration: The strong cultural acceptance in key markets like Italy and Germany provides a solid base for continued sales growth.

- Evolving Traditions: While traditional, aperitif culture also adapts, with new serving suggestions and occasions contributing to ongoing relevance.

Sociological factors significantly shape Campari Group's market landscape, driven by evolving consumer attitudes towards health and social interaction. The increasing preference for low- and no-alcohol options, particularly among younger demographics like Gen Z, necessitates innovation in product development and targeted marketing. This trend is supported by the projected growth of the non-alcoholic beverage market, expected to exceed $1.2 trillion by 2030.

The resurgence of home mixology and the convenience of alcohol delivery services further influence consumption patterns, boosting demand for premium spirits. In 2023, the global premium spirits market was valued at approximately $300 billion, with online sales continuing to see strong growth in 2024, indicating a shift towards at-home enjoyment.

Social media's role in discovery and purchasing is paramount, with platforms like Instagram and TikTok seeing increased alcohol brand engagement in 2024. Furthermore, the deep cultural integration of aperitifs, such as Aperol, as facilitators of social connection, as evidenced by Aperol's 12.6% global net sales growth in 2023, underscores the importance of tradition in driving brand loyalty.

| Sociological Factor | Impact on Campari Group | Supporting Data/Trend |

| Health and Moderation Trend | Increased demand for low/no-alcohol products. | Non-alcoholic beverage market projected over $1.2T by 2030. |

| Home Consumption & Mixology | Growth in premium spirit sales for at-home use. | Premium spirits market valued at ~$300B in 2023. |

| Social Media Influence | Key channel for brand discovery and engagement. | Significant rise in alcohol brand advertising on platforms like Instagram and TikTok in 2024. |

| Cultural Significance of Aperitifs | Strong brand loyalty and consistent demand. | Aperol net sales grew 12.6% globally in 2023. |

Technological factors

The digital marketplace is rapidly reshaping alcoholic beverage sales, with e-commerce platforms and direct-to-consumer (DTC) channels becoming increasingly vital. Campari Group is strategically enhancing its online presence, utilizing its own digital storefronts and partnering with major delivery apps to offer consumers greater convenience and access to its diverse portfolio. This shift is evident in the growing online sales figures; for instance, the global e-commerce market for alcoholic beverages was projected to reach over $60 billion by 2024, a significant jump from previous years.

Campari's embrace of digital distribution, including subscription services and targeted online marketing, allows for more personalized consumer engagement and broader market reach. This approach not only streamlines the purchasing process but also provides valuable data insights into consumer preferences, enabling more effective product development and promotional strategies. The company's investment in these digital capabilities is crucial for staying competitive in a landscape where online channels are projected to account for a substantial portion of future beverage sales growth.

Technological advancements are reshaping how spirits are made, enabling Campari Group to explore novel distillation and blending techniques. This allows for the development of unique flavor profiles and the expansion of their low- and no-alcohol portfolio, a growing segment. For instance, the company has been investing in R&D to enhance ingredient sourcing and production efficiency, aiming to meet the increasing consumer demand for healthier and more diverse beverage options.

Campari Group is actively implementing digital solutions across its supply chain, from production to final distribution. This strategic focus aims to boost efficiency, cut operational costs, and sharpen its ability to react quickly to shifting market demands. By embracing technologies like advanced data analytics for inventory control and logistics, Campari is positioning itself for greater agility in a dynamic global market.

Data Analytics and Consumer Insights

Campari Group leverages sophisticated data analytics to understand consumer preferences and purchasing habits, a critical technological factor in today's market. This allows for the development of highly targeted marketing strategies and personalized product assortments, enhancing customer engagement and driving sales. For instance, by analyzing digital footprints and purchase histories, Campari can identify emerging taste profiles and adapt its product development pipeline accordingly.

The increasing availability of big data and advanced analytical tools empowers Campari to gain deeper insights into market trends and competitive landscapes. This data-driven approach informs crucial business decisions, from supply chain optimization to new market entry strategies. In 2024, the beverage industry saw a significant increase in personalized marketing efforts, with companies reporting higher ROI on campaigns informed by granular consumer data.

Campari's commitment to data analytics translates into more efficient resource allocation and a stronger competitive edge. The ability to predict consumer demand and tailor offerings based on real-time insights is paramount. By 2025, it's projected that over 70% of leading consumer goods companies will have integrated advanced analytics into their core business operations, highlighting the growing importance of this technological factor.

- Data-driven marketing: Campari utilizes analytics to refine campaigns, leading to more effective consumer outreach.

- Personalized offerings: Insights from data enable customized product development and promotions.

- Market trend identification: Advanced analytics help Campari stay ahead of evolving consumer tastes and market dynamics.

- Operational efficiency: Data informs decisions across the value chain, from production to distribution.

Automation in Manufacturing and Packaging

Automation in manufacturing and packaging offers Campari Group significant advantages. By implementing advanced robotics and AI, the company can boost production efficiency and ensure greater product consistency, a key factor in maintaining brand quality across its diverse portfolio. This also translates to a reduction in labor costs, which can improve overall profitability. For instance, the global industrial automation market was valued at approximately $200 billion in 2023 and is projected to grow substantially, indicating a strong trend towards increased adoption by major players like Campari.

Furthermore, the drive towards automation aligns with growing consumer demand for sustainable practices. Innovations in eco-friendly packaging solutions, often facilitated by automated processes, allow Campari to respond to these market expectations. This includes advancements in biodegradable materials and optimized packaging designs that minimize waste. Companies are investing heavily in this area; for example, the sustainable packaging market is expected to reach over $400 billion by 2027, highlighting the strategic importance of these technological shifts.

Key technological factors impacting Campari Group include:

- Increased operational efficiency through robotic process automation in bottling and labeling lines.

- Enhanced product quality and safety via automated quality control systems.

- Adoption of smart manufacturing technologies for real-time production monitoring and optimization.

- Integration of automated systems for sustainable packaging material handling and production.

Campari Group is leveraging advanced analytics and AI to refine its marketing strategies, leading to more personalized consumer engagement and increased campaign effectiveness. For example, in 2024, companies utilizing AI in marketing saw an average increase of 20% in customer conversion rates. This data-driven approach allows Campari to better understand evolving consumer tastes and adapt its product development pipeline, ensuring it stays ahead of market trends.

Technological advancements are also enhancing Campari's operational efficiency. The adoption of smart manufacturing technologies and automation in production and packaging lines, such as robotic process automation in bottling, boosts output and product consistency. By 2025, it's projected that over 70% of leading consumer goods companies will have integrated advanced analytics into their core operations, underscoring the competitive necessity of these investments.

| Technological Factor | Impact on Campari Group | Supporting Data/Trend (2024/2025) |

| Data Analytics & AI | Personalized marketing, trend identification, improved ROI | 20% average increase in customer conversion rates for AI-driven marketing (2024) |

| Digitalization & E-commerce | Expanded market reach, enhanced consumer convenience, DTC growth | Global alcoholic beverage e-commerce market projected to exceed $60 billion (2024) |

| Automation & Smart Manufacturing | Increased production efficiency, enhanced product quality, cost reduction | Industrial automation market valued at approx. $200 billion (2023), with significant growth expected |

| Sustainable Technology Integration | Response to consumer demand for eco-friendly practices, optimized packaging | Sustainable packaging market expected to reach over $400 billion by 2027 |

Legal factors

Campari Group operates under a complex web of alcohol advertising regulations globally, which dictate everything from where ads can appear to the messages they convey. For instance, in 2024, many European Union countries continue to enforce strict rules on alcohol marketing, with some nations like France having particularly stringent laws regarding television advertising slots and health warnings. Failure to adhere to these diverse legal frameworks can result in significant fines and reputational damage, impacting Campari's ability to reach consumers effectively.

Product labeling is a critical legal area for Campari Group, with mandates covering alcohol content, ingredients, nutritional values, and health warnings. These requirements are not static; for instance, the European Union is actively reviewing alcohol labeling regulations. This review, potentially impacting Campari's operations in the EU market, could require significant adjustments to packaging and information disclosure practices to comply with new standards by 2024-2025.

Changes in global excise tax laws and duty structures present a significant challenge for Campari Group. For instance, in 2024, several European countries, including Italy and Spain, considered or implemented adjustments to alcohol excise duties, potentially increasing the cost of Campari's key brands like Aperol and Campari. These shifts directly affect product pricing and consumer affordability.

Furthermore, the increasing adoption of digital platforms for excise duty management by governments necessitates substantial investment in technological infrastructure and process adaptation for Campari. By 2025, many tax authorities are expected to mandate digital reporting and payment systems, requiring Campari to integrate these new requirements into its financial and operational frameworks to ensure compliance and efficiency.

Intellectual Property and Brand Protection

Campari Group's extensive portfolio, boasting over 50 premium and super premium brands, relies heavily on robust intellectual property protection. This includes safeguarding trademarks, copyrights, and proprietary formulations against infringement and counterfeiting. In 2024, the company actively pursued legal avenues to protect its brand integrity and exclusivity across its global markets, a critical element for maintaining premium positioning and consumer trust.

Combating counterfeit products is a significant legal challenge for Campari. The group invests in monitoring and enforcement strategies to prevent the illicit trade of fake goods, which can dilute brand value and mislead consumers. For instance, in 2024, Campari reported successful actions against counterfeit operations in key European markets, reinforcing its commitment to brand authenticity.

- Trademark Enforcement: Campari Group actively monitors for and litigates against unauthorized use of its brand names and logos, ensuring brand distinctiveness.

- Copyright Protection: The group protects original creative works, such as advertising campaigns and unique bottle designs, from unauthorized reproduction.

- Anti-Counterfeiting Initiatives: Campari collaborates with law enforcement and customs agencies globally to disrupt the supply chain of counterfeit products.

- Formulation Secrecy: While not always patentable, the secrecy of unique spirit formulations is legally protected through trade secret laws and contractual agreements.

Acquisition and Merger Regulations

Campari Group's growth strategy heavily relies on acquisitions, making adherence to antitrust and merger regulations crucial. These regulations, which vary significantly across countries, govern market concentration and fair competition, directly impacting Campari's ability to expand its portfolio. For instance, the acquisition of Courvoisier in 2024 required navigating these complex legal landscapes to ensure compliance and avoid market dominance concerns.

Navigating these legal frameworks involves thorough due diligence and engagement with regulatory bodies worldwide. Failure to comply can lead to significant fines, divestitures, or even the blockage of deals, as seen in other industries where merger reviews have intensified. Campari's ongoing success is thus tied to its capacity to successfully manage these legal hurdles.

- Antitrust Scrutiny: Campari must ensure its acquisitions do not create monopolies or unduly restrict competition in key markets.

- Jurisdictional Differences: Merger regulations differ greatly between the EU, US, and other major markets, requiring tailored legal strategies.

- Post-Acquisition Integration: Legal compliance extends beyond the deal closing, encompassing integration processes and ongoing market conduct.

- Regulatory Approvals: Obtaining approval from competition authorities is a critical, often lengthy, step in any significant acquisition.

Campari Group's global operations are significantly shaped by evolving advertising and marketing laws, particularly concerning alcohol. In 2024, many EU nations maintained strict rules on alcohol promotion, with France's stringent regulations on television advertising and health warnings being a prime example. Non-compliance with these varied legal requirements can lead to substantial penalties and damage Campari's brand image.

Environmental factors

Consumers and regulators increasingly demand sustainable practices, pushing companies like Campari Group to prioritize environmental responsibility. This shift directly influences market perception and operational strategies.

Campari Group actively works to shrink its environmental impact, focusing on areas like greenhouse gas emissions. For instance, in its 2023 sustainability report, the company highlighted a reduction in Scope 1 and 2 emissions by 12.9% compared to the 2021 baseline, demonstrating a tangible commitment to this goal.

Sustainability is woven into Campari's core business, evident in its annual reporting where environmental performance is a key component. This integration ensures accountability and transparency, aligning business objectives with ecological stewardship.

Water scarcity and quality are significant environmental factors for Campari Group. As a beverage producer, water is a core ingredient, and its availability and purity directly affect production. Regions facing drought or water pollution can lead to increased operational costs due to sourcing or treatment needs.

Campari Group's commitment to sustainable water management is crucial for mitigating these risks. For instance, in 2023, the company reported progress in reducing water consumption intensity across its operations, aiming to further enhance efficiency. This focus ensures business continuity and reduces the environmental footprint.

Climate change poses a significant threat to Campari Group's supply chain by impacting the availability and quality of key agricultural inputs. For instance, shifts in weather patterns can affect agave yields for tequila production or the quality of grapes essential for its wine and aperitif portfolio. This instability can lead to supply chain disruptions and upward pressure on ingredient costs.

The Intergovernmental Panel on Climate Change (IPCC) has highlighted increasing risks to global agriculture, with projections indicating that by 2050, yields for staple crops could decline by 10-25% in certain regions due to rising temperatures and altered precipitation patterns. Such changes directly translate to higher raw material expenses for Campari, potentially impacting their cost of goods sold and profit margins.

Waste Management and Packaging

The environmental impact of packaging, especially single-use plastics and glass, is a significant and growing concern for consumers and regulators alike. Campari Group, like many in the beverage industry, faces increasing pressure to adopt more sustainable packaging strategies. This includes a focus on recyclable materials and innovative, lighter-weight designs to reduce their carbon footprint and meet evolving market expectations.

Campari has been actively working on reducing its packaging footprint. For instance, by the end of 2023, the group achieved a 10% reduction in the weight of glass used for its bottles compared to a 2018 baseline. Furthermore, they are exploring alternative materials and increased recycled content across their product lines, aiming for higher percentages of recycled materials in their glass bottles and exploring paper-based solutions where feasible.

Key initiatives and targets include:

- Increasing the use of recycled glass: Campari aims to incorporate a higher percentage of recycled glass in its bottle production, contributing to a circular economy.

- Reducing plastic in packaging: Efforts are underway to minimize or eliminate single-use plastics, with a focus on recyclable alternatives and lightweighting.

- Exploring sustainable secondary packaging: This involves looking at cardboard and other materials for multipacks and shipping, prioritizing recyclability and reduced material usage.

Energy Consumption and Renewable Energy Adoption

Reducing energy consumption and shifting towards renewable energy sources in manufacturing plants are critical environmental priorities for Campari Group. This focus directly addresses the growing pressure to minimize the company's carbon footprint.

Campari Group has demonstrated a commitment to reducing its greenhouse gas (GHG) emissions intensity, a move that mirrors widespread industry trends aimed at environmental sustainability. For instance, in 2023, the company reported a reduction in its Scope 1 and 2 GHG emissions intensity by 15.7% compared to a 2019 baseline. This progress is supported by initiatives like increasing the share of renewable electricity used in its operations, which reached 65% by the end of 2023.

- GHG Emissions Intensity Reduction: Campari Group aims to decrease GHG emissions intensity by 25% by 2030 against a 2019 baseline.

- Renewable Energy Usage: The company is working towards sourcing 100% of its electricity from renewable sources by 2030.

- Energy Efficiency Projects: Investments in energy efficiency measures across production sites are ongoing to lower overall energy demand.

Campari Group's environmental strategy is deeply intertwined with its operational realities, particularly concerning water usage and climate change impacts on agriculture. The company's 2023 sustainability report details a 15.7% reduction in GHG emissions intensity against a 2019 baseline, showcasing progress in its environmental stewardship. Furthermore, Campari is actively increasing its use of renewable electricity, reaching 65% by the end of 2023, with a goal of 100% by 2030.

Packaging sustainability is another critical focus, with Campari achieving a 10% reduction in glass bottle weight by the end of 2023 compared to 2018. These efforts are crucial given increasing consumer and regulatory demands for reduced environmental impact, especially concerning single-use plastics and the carbon footprint of packaging materials.

| Environmental Factor | Campari Group Action/Impact | Key Data/Target (as of 2023/2025 projections) |

|---|---|---|

| Greenhouse Gas Emissions | Reducing Scope 1 & 2 emissions intensity | 15.7% reduction vs. 2019 baseline (by end of 2023) |

| Renewable Energy | Increasing use of renewable electricity | 65% of electricity sourced from renewables (by end of 2023) |

| Packaging | Reducing glass weight in bottles | 10% reduction vs. 2018 baseline (by end of 2023) |

| Water Management | Improving water consumption efficiency | Progress reported in reducing water intensity (2023) |

| Climate Change Impact | Mitigating supply chain risks from weather patterns | Focus on securing key agricultural inputs like agave and grapes |

PESTLE Analysis Data Sources

Our PESTLE analysis for Campari Group is grounded in a comprehensive review of data from official government publications, reputable financial news outlets, and leading market research firms. This ensures that insights into political, economic, social, technological, legal, and environmental factors are derived from credible and current information.