Campari Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Campari Group Bundle

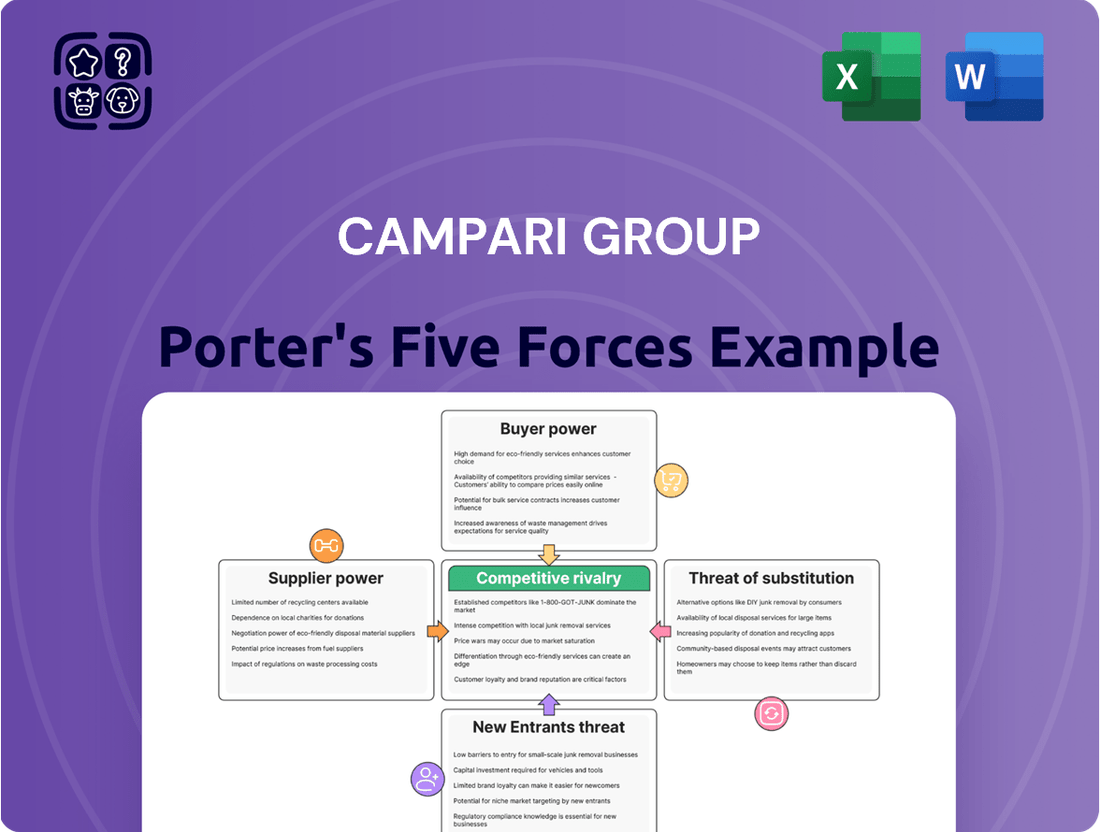

Campari Group navigates a competitive landscape shaped by moderate buyer power and intense rivalry among established spirit brands. The threat of new entrants is somewhat mitigated by high capital requirements and brand loyalty, but substitutes in the beverage industry present a persistent challenge.

The complete report reveals the real forces shaping Campari Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Campari Group's reliance on specific agricultural inputs like agave for tequila and grapes for its wine portfolio means that concentrated raw material suppliers can wield significant influence. When only a few suppliers provide these essential botanicals or base spirits, they can dictate terms, impacting Campari's production costs and availability. For instance, a severe hurricane in Jamaica in 2024 led to significant supply constraints for rum, directly affecting producers who depend on that region's output.

Campari Group's iconic brands, such as Campari and Aperol, rely on unique and often proprietary recipes. This dependence on specific ingredients, which may be difficult to source or replicate, can significantly enhance the bargaining power of their suppliers. For instance, the distinctive bitter orange and rhubarb notes in Campari are achieved through carefully guarded formulations, making ingredient suppliers crucial for maintaining brand integrity and taste profiles.

Campari Group, despite its extensive global reach, remains dependent on external partners for crucial packaging materials like bottles and labels, as well as for its distribution network. This reliance grants suppliers of these essential components and logistics services a degree of bargaining power.

For instance, the US experienced significant logistics delays in the first quarter of 2025, highlighting how disruptions in these areas can directly affect Campari's operational efficiency and profitability. Consequently, suppliers who can consistently offer reliable and cost-effective packaging and distribution solutions gain leverage.

Labor and Energy Costs

Suppliers in the agricultural and manufacturing sectors, crucial for Campari Group's raw materials, are subject to volatile labor and energy costs. For instance, in 2024, global energy prices experienced significant fluctuations, impacting production expenses across many industries. These rising input costs can be directly passed on to Campari, especially if suppliers are concentrated in regions with increasing wage pressures or unstable energy markets.

This dynamic directly affects Campari's profitability. As global spirits production grapples with escalating input costs, the bargaining power of suppliers increases. This can squeeze Campari's profit margins, as seen in the broader consumer staples sector where companies have reported challenges in absorbing higher operational expenses throughout 2024.

- Rising Labor Costs: Many agricultural regions supplying key ingredients for spirits production have seen wage increases in 2024, impacting supplier pricing.

- Energy Price Volatility: Fluctuations in oil and natural gas prices in 2024 directly translate to higher manufacturing and transportation costs for suppliers.

- Impact on Margins: Increased supplier costs can force Campari to either absorb these expenses, reducing margins, or pass them on to consumers, potentially affecting sales volume.

Brand-Specific Ingredient Sourcing

For premium brands within Campari Group's portfolio, such as Grand Marnier, which depends on specific Curaçao oranges, or Appleton Estate rum, intrinsically linked to Jamaican sugarcane, the reliance on unique, core ingredients can significantly restrict the available pool of suppliers. This dependence on a limited number of specialized providers inherently strengthens their bargaining position when negotiating with Campari Group.

Campari Group's stated commitment to sustainability and responsible sourcing further influences this dynamic. These ethical considerations often necessitate working with a select group of suppliers who meet stringent environmental and social standards, thereby potentially narrowing sourcing options and amplifying supplier leverage.

- Brand-Specific Ingredients: Brands like Grand Marnier (Curaçao oranges) and Appleton Estate (Jamaican sugarcane) rely on distinctive, often geographically specific, ingredients.

- Supplier Dependency: This specialization limits Campari Group's options, creating a dependency on a smaller set of suppliers for critical components.

- Increased Supplier Leverage: A concentrated supplier base for unique ingredients grants these suppliers greater power in price and term negotiations with Campari Group.

- Sustainability Impact: Campari's commitment to responsible sourcing may further restrict supplier choices, reinforcing the bargaining power of compliant providers.

Campari Group's reliance on specialized agricultural inputs and unique brand-specific ingredients grants suppliers significant bargaining power. This is amplified by its commitment to sustainability, which can limit sourcing options. For instance, the 2024 energy price volatility directly increased supplier costs, impacting Campari's margins.

| Factor | Impact on Campari | Example (2024/2025) |

|---|---|---|

| Concentrated Suppliers (Agave, Grapes) | Higher input costs, potential supply disruptions | Rum supply constraints due to Jamaican hurricane (2024) |

| Proprietary Ingredients | Dependence on specific suppliers for brand integrity | Bitter orange and rhubarb for Campari/Aperol |

| Packaging & Distribution | Leverage for reliable logistics providers | US logistics delays affecting operations (Q1 2025) |

| Volatile Input Costs (Energy, Labor) | Increased supplier pricing passed to Campari | Global energy price fluctuations impacting production costs (2024) |

| Sustainability Commitments | Narrowed sourcing options, amplified supplier leverage | Working with select compliant providers |

What is included in the product

This analysis uncovers the competitive landscape for Campari Group, detailing the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the spirits industry.

Instantly visualize the competitive landscape for Campari Group, identifying key threats and opportunities to inform strategic decisions and mitigate potential risks.

Customers Bargaining Power

Campari Group's broad customer base, spanning individual consumers, large retailers, and hospitality businesses, inherently limits the bargaining power of any single customer segment. This wide reach across diverse distribution channels, including on-premise, off-premise, and global travel retail, means that no single buyer holds significant leverage over Campari's pricing or terms. For instance, while major retail chains are important, their individual sales volume is a small fraction of Campari's overall global revenue, which reached €2.58 billion in 2023, underscoring the company's diversified market presence.

Campari's strategic focus on premium and super-premium brands like Campari, Aperol, and Grand Marnier cultivates significant brand loyalty. This loyalty allows Campari to command higher prices, as consumers associate these brands with quality and unique experiences.

The ongoing trend in 2024 and into 2025 sees consumers increasingly willing to invest in premium spirits and novel consumption occasions. This preference for quality and experience over price inherently diminishes the bargaining power of individual customers, as they are less likely to switch brands based solely on minor price fluctuations.

Economic conditions significantly influence consumer spending, especially on premium goods. In 2024, persistent inflation and squeezed disposable incomes have made many consumers more mindful of their budgets. This heightened price sensitivity can empower customers, prompting them to seek better value or postpone discretionary purchases.

While the trend towards premiumization continues, challenging economic environments can temper this. For instance, if consumers perceive a significant gap between the price of premium spirits and their perceived value due to economic pressures, their willingness to pay a premium diminishes. This can lead to a subtle but important shift, where value propositions become more critical in purchasing decisions, thereby increasing customer bargaining power.

Rise of Ready-to-Drink (RTD) and No-Low Alcohol Options

The expanding market for ready-to-drink (RTD) spirits and no- and low-alcohol (NoLo) beverages significantly bolsters consumer bargaining power. This surge, fueled by health-aware consumers and younger demographics like millennials, presents readily available alternatives to Campari's traditional offerings.

This shift offers consumers greater convenience and a wider array of choices, diminishing their reliance on any single traditional spirit brand. For instance, the global RTD market was valued at approximately USD 29.3 billion in 2023 and is projected to grow substantially, indicating a strong consumer preference for these convenient formats.

- Increased Consumer Choice: The proliferation of RTD and NoLo options provides consumers with a broader selection of beverage types and flavor profiles, directly impacting their ability to negotiate or switch brands.

- Health and Wellness Trends: Growing consumer interest in healthier lifestyle choices drives demand for NoLo alternatives, offering a powerful substitute for traditional alcoholic beverages and increasing consumer leverage.

- Convenience Factor: The ready-to-drink format appeals to consumers seeking immediate consumption without the need for preparation, making these options highly attractive and enhancing their bargaining position.

- Market Growth in RTD and NoLo: The RTD segment alone saw significant growth, with projections indicating continued expansion, underscoring the increasing consumer demand and bargaining power within these categories.

Retailer and Distributor Influence

Large retailers and distributors hold considerable sway, especially in concentrated markets like the United States. Their ability to purchase in massive volumes and dictate shelf placement gives them significant leverage over Campari Group. For instance, in 2023, the top 10 US beverage alcohol distributors accounted for over 70% of off-premise sales, highlighting their market control.

Campari Group's reliance on key distribution partners, such as Southern Glazer's Wine and Spirits, underscores this dynamic. Navigating the complexities of the US three-tier system, where distributors act as intermediaries, can present challenges that directly affect sales volumes and the efficiency of product distribution.

- Volume Purchases: Major retailers can negotiate better terms due to the sheer quantity of product they buy.

- Shelf Space Control: Access to prime shelf space is a critical factor influenced by retailer relationships.

- Distribution Network: The efficiency of Campari's sales is heavily dependent on the strength of its distribution partners.

- Market Consolidation: In consolidated markets, the bargaining power of a few large players increases significantly.

While Campari's diverse customer base generally limits individual customer power, economic pressures in 2024 have amplified consumer price sensitivity, potentially increasing their bargaining leverage. Furthermore, the rapid growth of convenient RTD and health-conscious NoLo alternatives provides consumers with readily available substitutes, further diminishing their dependence on traditional spirits and strengthening their negotiating position.

| Customer Segment | Bargaining Power Factor | Impact on Campari |

|---|---|---|

| Individual Consumers | Price Sensitivity (Heightened in 2024) | May seek value or delay purchases, slightly increasing power. |

| RTD & NoLo Consumers | Availability of Substitutes | Stronger ability to switch, increasing bargaining power. |

| Major Retailers (US) | Volume Purchases & Shelf Space Control | Significant leverage due to market consolidation (e.g., top 10 distributors >70% of US off-premise sales in 2023). |

Same Document Delivered

Campari Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the competitive landscape for Campari Group, analyzing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes within the global spirits market. This comprehensive Porter's Five Forces analysis provides actionable insights into Campari's strategic positioning and potential challenges.

Rivalry Among Competitors

The global spirits market is a battleground, characterized by intense competition and a highly fragmented landscape. While giants like Diageo and Pernod Ricard dominate, Campari Group, as the sixth-largest player, faces pressure from these behemoths, alongside a vast array of regional brands and an ever-growing number of craft distilleries. This means constant innovation and strategic maneuvering are essential to capture and maintain market share.

Campari Group's extensive product portfolio, boasting over 50 premium and super-premium brands in spirits, wines, and aperitifs, is a significant competitive advantage. This 'House of Brands' strategy allows them to cater to diverse consumer preferences and compete effectively across multiple market segments. Brands like Campari and Aperol have strong brand equity, reinforcing their market position.

The spirits industry thrives on a constant stream of new ideas, from exciting flavor combinations to entirely new product types like ready-to-drink (RTD) options and non-alcoholic beverages. This relentless innovation means Campari must consistently invest in research and development, alongside significant marketing efforts, to keep pace and capture consumer attention against rivals.

Geographic Presence and Distribution Networks

Campari Group boasts a formidable global distribution network, holding leading positions particularly in Europe and the Americas. This extensive reach is a key competitive advantage, enabling efficient market penetration and strong relationships with local distributors. In 2023, Campari's net sales reached €2.95 billion, underscoring the power of its established distribution channels.

However, the competitive landscape is fierce. Rivals like Pernod Ricard and Diageo also possess vast and well-entrenched distribution networks, often with deep roots in specific markets. For Campari, maintaining and expanding its market presence hinges on continued investment in these relationships and optimizing its supply chain for maximum efficiency.

The effectiveness of these networks is directly tied to market share. For instance, Campari is a top player in the global aperitif market, a segment heavily reliant on broad availability and visibility. The group's strategic acquisitions, such as the 2023 acquisition of Courvoisier cognac, further bolster its distribution capabilities by integrating new brands into its existing infrastructure.

- Global Reach: Campari's net sales in 2023 were €2.95 billion, highlighting the scale of its operations.

- Competitive Networks: Rivals like Pernod Ricard and Diageo also have extensive global distribution.

- Strategic Importance: Strong local distributor relationships are crucial for market penetration and growth.

- Market Position: Campari's leading role in segments like aperitifs relies on its distribution strength.

Marketing and Advertising Intensity

The spirits industry is characterized by intense competition, with companies heavily investing in marketing and advertising to capture consumer attention and foster brand loyalty. These significant expenditures directly influence profitability, as demonstrated by Campari Group's Q1 2025 performance, where the timing of Advertising & Promotional (A&P) costs impacted their bottom line.

Campari Group's strategic approach to marketing is crucial given the crowded spirits market. The company's ability to effectively allocate its A&P budget is a key determinant of its market share and revenue growth. For instance, in the first quarter of 2025, the phasing of these essential marketing investments played a role in the reported profitability metrics.

- High A&P Spend: The spirits sector demands substantial marketing and advertising outlays to build brand equity and drive sales.

- Impact on Profitability: Fluctuations in A&P spending directly affect a company's short-term profitability, as seen in Campari's Q1 2025 results.

- Brand Building: Effective marketing campaigns are vital for differentiating brands and cultivating enduring customer relationships in a competitive landscape.

Competitive rivalry within the spirits industry is fierce, with Campari Group facing strong competition from major players like Diageo and Pernod Ricard, as well as a growing number of craft distilleries. This intense competition necessitates continuous innovation and significant investment in marketing and distribution to maintain and grow market share. In 2023, Campari's net sales reached €2.95 billion, a testament to its ability to compete effectively despite the crowded market.

Campari's strategy of building a 'House of Brands' with over 50 premium and super-premium brands allows it to compete across various segments, from aperitifs where it holds a leading position, to spirits and wines. However, rivals also possess extensive portfolios and deep market penetration, particularly in Europe and the Americas where Campari is strong. The group's 2023 acquisition of Courvoisier cognac further highlights its strategic moves to bolster its competitive standing.

The industry's reliance on substantial Advertising & Promotional (A&P) spending to build brand equity means that managing these costs is crucial for profitability. Campari's Q1 2025 results indicated how the timing of these essential marketing investments can impact short-term financial performance, underscoring the delicate balance required to stay ahead of competitors.

| Key Competitors | 2023 Net Sales (Approx.) | Key Strengths |

| Diageo | £17.1 billion (FY23) | Vast portfolio, strong global distribution, premium brand equity |

| Pernod Ricard | €10.7 billion (FY23) | Diverse brand offerings, significant presence in key markets, strong marketing |

| Campari Group | €2.95 billion (2023) | Leading aperitif position, growing premium portfolio, strategic acquisitions |

SSubstitutes Threaten

The most direct substitutes for Campari Group's spirits are other alcoholic beverages such as beer, wine, and cider. These alternatives offer consumers a different way to enjoy an alcoholic beverage, and the choice often depends on the occasion and personal preference. For instance, beer and wine are frequently chosen for more casual social gatherings or meals.

Consumers can readily switch to these substitutes, especially when economic factors come into play. In 2023, global beer sales volume was estimated to be around 1.77 billion hectoliters, indicating its strong market presence and affordability as a substitute. Similarly, the wine market is substantial, with global wine consumption reaching approximately 221 million hectoliters in 2023. These figures highlight the significant appeal and accessibility of beer and wine as alternatives to spirits.

The burgeoning non-alcoholic and low-alcohol (NoLo) beverage market presents a considerable threat to Campari Group. Consumer demand for healthier options is fueling the growth of sophisticated non-alcoholic spirits, beers, and mocktails, directly challenging Campari's core product lines.

This shift is significant, with the global NoLo market expected to reach approximately $1.9 trillion by 2028, according to some projections, indicating a substantial and growing competitive landscape for Campari.

The burgeoning market for cannabis-infused beverages poses a potential long-term substitute threat to Campari Group, especially in jurisdictions where cannabis is legally available. As consumer tastes shift towards novel recreational choices, these products could siphon off demand from established alcoholic drinks.

This evolving consumer landscape is a significant factor, with the global legal cannabis market projected to reach over $130 billion by 2029 according to some industry forecasts, indicating a substantial addressable market for these emerging substitutes.

Soft Drinks and Other Non-Alcoholic Options

Everyday soft drinks, juices, and other non-alcoholic beverages are significant substitutes for Campari Group's products. Their broad accessibility and often lower cost make them an easy choice for consumers, particularly younger demographics who are increasingly reducing alcohol consumption. For instance, the global non-alcoholic beverage market was valued at approximately $1.2 trillion in 2023, showcasing its substantial scale.

These alternatives can impact Campari's market share by diverting consumer spending, especially for occasions where a refreshing drink is desired but alcohol isn't a priority. While not direct competitors in terms of specific product categories, their sheer volume and variety offer a constant alternative. Reports from 2024 indicate a continued trend of declining alcohol consumption in many developed markets, further bolstering the appeal of non-alcoholic options.

- Widespread Availability: Non-alcoholic beverages are available in virtually all retail and hospitality channels.

- Lower Price Points: Many soft drinks and juices are considerably cheaper than Campari's spirits and aperitifs.

- Health and Lifestyle Trends: Growing consumer focus on health and wellness favors non-alcoholic choices.

- Younger Consumer Preferences: Younger generations are showing a marked preference for non-alcoholic or low-alcohol options.

Home Cocktails and DIY Beverages

The growing popularity of home cocktail creation and the broader do-it-yourself beverage trend presents a significant threat of substitution for Campari Group. Consumers are increasingly opting to craft their own drinks, using a variety of spirits, mixers, and garnishes, which can directly reduce their need for Campari's pre-made products or discourage spending at establishments that serve them. This shift impacts both on-premise (bars, restaurants) and off-premise (retail) sales channels.

Data from 2024 indicates a continued surge in home entertaining and a heightened interest in mixology. For example, searches for cocktail recipes and home bar equipment saw a substantial increase throughout the year. This DIY movement means consumers can achieve a similar experience to purchasing a branded cocktail by assembling ingredients themselves, potentially at a lower cost or with greater customization.

- DIY Beverage Trend: Consumers are actively engaging in home-based beverage preparation, including cocktails, mocktails, and infused drinks.

- Cost-Effectiveness: Creating cocktails at home can be more economical than purchasing them at bars or restaurants, especially for frequent consumers.

- Customization and Control: The home environment allows for precise control over ingredients, alcohol content, and flavor profiles, catering to individual preferences.

- Impact on On-Premise and Off-Premise: This trend can lead to reduced foot traffic in bars and restaurants and a potential decrease in sales of pre-mixed or ready-to-drink beverages from retail outlets.

The threat of substitutes for Campari Group is substantial, encompassing a wide array of alcoholic and non-alcoholic beverages. Beer and wine remain significant alternatives, with global beer sales volume around 1.77 billion hectoliters and wine consumption at 221 million hectoliters in 2023, respectively, highlighting their widespread appeal and affordability.

The burgeoning non-alcoholic and low-alcohol (NoLo) beverage market, projected to reach $1.9 trillion by 2028, presents a growing challenge as consumers increasingly seek healthier options. Similarly, everyday soft drinks and juices, valued at approximately $1.2 trillion globally in 2023, offer accessible and often cheaper alternatives, particularly appealing to younger demographics showing declining alcohol consumption trends in 2024.

Emerging substitutes like cannabis-infused beverages, with a legal market projected to exceed $130 billion by 2029, also pose a potential long-term threat. Furthermore, the DIY cocktail trend, fueled by home entertaining and mixology interest in 2024, allows consumers to replicate branded experiences cost-effectively, impacting both on-premise and off-premise sales.

| Substitute Category | 2023/2024 Data Point | Key Characteristic |

|---|---|---|

| Beer | 1.77 billion hectoliters (sales volume) | Widespread availability, affordability |

| Wine | 221 million hectoliters (consumption) | Established market, diverse offerings |

| NoLo Beverages | Projected $1.9 trillion by 2028 | Health-conscious trend, growing sophistication |

| Soft Drinks/Juices | $1.2 trillion (market value) | High accessibility, low cost, younger demographic appeal |

| Cannabis Beverages | Projected >$130 billion by 2029 | Emerging recreational choice, legal market growth |

| DIY Cocktails | Increased searches for recipes/equipment (2024) | Cost-effectiveness, customization, home-based consumption |

Entrants Threaten

Entering the spirits industry, particularly at the global scale Campari operates, demands immense capital. Think significant investments in distilleries, warehousing for aging, and sophisticated manufacturing equipment. For instance, establishing a new premium distillery can easily cost tens of millions of dollars before a single bottle is sold.

The production itself is a major hurdle. Crafting high-quality spirits often involves lengthy aging processes, proprietary fermentation techniques, and strict quality control measures. This complexity, combined with the time lag for maturation, creates a substantial barrier, deterring many potential new entrants who lack the necessary expertise and patience.

Campari Group benefits from deeply entrenched brand equity and significant consumer loyalty, exemplified by iconic names like Campari and Aperol. These brands have cultivated trust and preference over many years, making it a substantial hurdle for newcomers to replicate this level of connection. For instance, Aperol's global sales reached €353.5 million in 2023, showcasing its strong market penetration, a testament to years of brand building that new entrants would struggle to match quickly.

The threat of new entrants for Campari Group is significantly mitigated by the immense challenge of establishing extensive distribution networks. Building a global reach requires substantial investment in logistics, warehousing, and relationships with retailers and distributors, a barrier that new players often struggle to overcome. For instance, navigating the complex three-tier system in the United States, where producers, distributors, and retailers operate separately, demands considerable expertise and capital to secure market access.

Furthermore, stringent regulatory environments across the spirits industry present a formidable obstacle. Compliance with diverse national and regional laws governing production, marketing, advertising, and sales necessitates specialized legal and administrative resources. In 2024, the global alcoholic beverage market continues to be shaped by these regulatory frameworks, making it difficult for newcomers to compete with established companies like Campari that have long-standing relationships and in-depth knowledge of these compliance requirements.

Access to Raw Materials and Specialized Expertise

New entrants face significant hurdles in securing consistent access to premium raw materials, especially for spirits requiring specific agricultural inputs or unique proprietary ingredients. For instance, Campari's iconic bitter liqueur relies on a complex blend of botanicals, the sourcing of which demands established relationships and quality control.

The spirits industry also necessitates deep, specialized expertise in areas like distillation, aging, blending, and sophisticated brand building. This technical know-how and accumulated experience, often passed down through generations or built over decades, create a substantial barrier for newcomers. In 2024, the premium spirits market continued to reward brands with authentic heritage and proven craftsmanship, making it challenging for unproven entities to gain traction.

- Raw Material Sourcing: Securing reliable, high-quality sources for key ingredients like specific grape varietals for wine or unique botanicals for gin can be difficult and costly for new players.

- Technical Expertise: The complex processes of distillation, fermentation, and aging require specialized knowledge and skilled labor, which are not readily available.

- Brand Heritage: Established brands benefit from decades of marketing and consumer trust, making it hard for new entrants to build comparable brand equity quickly.

Intense Marketing and Advertising Costs

New companies entering the spirits market face a significant hurdle in marketing and advertising expenses. To even get noticed against established brands like Campari Group, they must allocate substantial budgets to build brand recognition and carve out a niche. This is particularly true in 2024, with increased competition and the need to stand out in a crowded marketplace.

The sheer cost of effective marketing campaigns, from digital advertising to sponsorships and in-store promotions, can be a major deterrent. Consider that global advertising spending was projected to reach over $670 billion in 2024, with a significant portion dedicated to consumer goods and beverages. For a new entrant, matching the marketing reach of a company like Campari, which boasts a diverse portfolio and global presence, requires immense capital investment.

- High Marketing Spend: New entrants must invest heavily in advertising to build brand awareness, estimated to be a significant percentage of initial revenue.

- Brand Differentiation: Creating a distinct brand identity in a mature market requires substantial creative and media expenditure.

- Competitive Landscape: Established players like Campari have existing brand equity and marketing infrastructure, making it harder for newcomers to gain traction without comparable investment.

- Economic Headwinds: In 2024, tighter economic conditions can make securing the necessary funding for aggressive marketing campaigns more challenging.

The threat of new entrants into the spirits market, where Campari Group operates, is generally low due to substantial barriers. These include the massive capital required for production facilities, the intricate and time-consuming nature of spirit production and aging, and the difficulty in replicating established brand loyalty and heritage. Furthermore, navigating complex global distribution networks and stringent regulatory environments presents significant obstacles that deter most potential newcomers.

New entrants face immense capital requirements, with distillery setup alone costing tens of millions. Building brand equity comparable to Campari's established names like Aperol, which saw €353.5 million in sales in 2023, demands years of investment and consumer trust. The complex global distribution, particularly the US three-tier system, and compliance with diverse 2024 regulations further solidify these barriers.

The industry demands specialized expertise in distillation and aging, alongside significant marketing budgets. In 2024, with global advertising spending projected to exceed $670 billion, new entrants must invest heavily to gain visibility against established players like Campari. Securing premium raw materials and building brand differentiation in a crowded market are also considerable challenges.

Porter's Five Forces Analysis Data Sources

Our analysis of the spirits industry utilizes data from Campari Group's annual reports, investor presentations, and SEC filings. We supplement this with industry-specific market research reports from firms like Euromonitor and Statista, as well as broader economic indicators.