Campari Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Campari Group Bundle

The Campari Group BCG Matrix offers a fascinating glimpse into the strategic positioning of its diverse portfolio. Understanding which brands are market leaders (Stars), which reliably generate cash (Cash Cows), which are underperforming (Dogs), and which hold future potential (Question Marks) is crucial for any investor or strategist.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Campari Group.

Stars

Aperol is a shining star within Campari Group's portfolio, consistently delivering impressive growth. In 2024, it saw a significant 5% increase in sales, building on a remarkable 23.1% surge in 2023. This performance is fueled by its strong global brand presence and the enduring popularity of the Aperol Spritz, solidifying its leadership in the expanding aperitif market.

Espolòn Tequila is a shining example of a 'Star' within Campari Group's portfolio, demonstrating robust growth and market dominance. In 2024, it achieved a notable 12% increase in sales within the crucial US market, building on an even more impressive 35.7% surge in 2023.

This remarkable performance has propelled Espolòn to become Campari's largest brand in the US for 2024, overtaking Skyy. Its strategic positioning within the rapidly expanding tequila category allows it to capture consumers across different spending levels, solidifying its status as a high-growth, high-market-share brand.

The namesake Campari brand is a star performer within the Campari Group's portfolio. In 2024, it achieved a robust 9% growth, fueled by strong sales in vital markets like Brazil, Global Travel Retail, France, and Greece. This growth underscores its position as a leading aperitif, benefiting from the overall category's positive momentum.

Grand Marnier

Grand Marnier has demonstrated impressive double-digit growth in the United States during the first half of 2024, signaling a strong comeback for the premium liqueur. This performance is particularly noteworthy given its struggles with destocking in 2023, suggesting a successful turnaround strategy. The brand's resurgence points to its potential to regain significant market share and contribute positively to the Campari Group's portfolio.

The renewed momentum for Grand Marnier is likely a result of targeted marketing efforts and a favorable shift in consumer preferences towards high-quality spirits. Its ability to achieve double-digit growth in a competitive market highlights its enduring appeal and strategic positioning. This positive trajectory positions Grand Marnier as a key player within the Campari Group's business units.

- Grand Marnier's US sales growth in H1 2024: Double-digit percentage increase.

- Previous year's performance: Experienced declines in 2023 due to destocking.

- Current market perception: Renewed momentum and potential resurgence.

- Strategic implication: Indicates a strong recovery and potential as a star product.

The Glen Grant

The Glen Grant Scotch whisky is performing exceptionally well, showcasing double-digit growth. This impressive expansion is largely fueled by its robust performance in Asian markets, highlighting a significant trend of increasing demand for premium Scotch in that region.

This strong market penetration and consistent growth trajectory firmly position The Glen Grant as a star performer within the Campari Group's diverse portfolio. The brand is capitalizing on the growing consumer preference for aged and high-quality spirits.

- Double-digit growth for The Glen Grant.

- Asia is a key growth driver, especially for premium Scotch.

- The Glen Grant is a "Star" in Campari's BCG Matrix.

- Rising demand for aged spirits benefits The Glen Grant.

Several Campari Group brands are performing as Stars, indicating high growth and market share. Aperol, for instance, saw a 5% sales increase in 2024, following a 23.1% jump in 2023. Espolòn Tequila is another star, with a 12% US sales increase in 2024 and becoming Campari's top US brand, surpassing Skyy. The namesake Campari brand also achieved robust 9% growth in 2024, driven by key markets.

| Brand | 2024 Sales Growth | Key Market/Driver | BCG Status |

|---|---|---|---|

| Aperol | 5% | Global brand presence, Aperol Spritz popularity | Star |

| Espolòn Tequila | 12% (US) | US market expansion, premiumization trend | Star |

| Campari | 9% | Brazil, Global Travel Retail, France, Greece | Star |

| The Glen Grant | Double-digit | Asian markets, premium Scotch demand | Star |

| Grand Marnier | Double-digit (US H1) | US market resurgence, premium liqueur appeal | Star |

What is included in the product

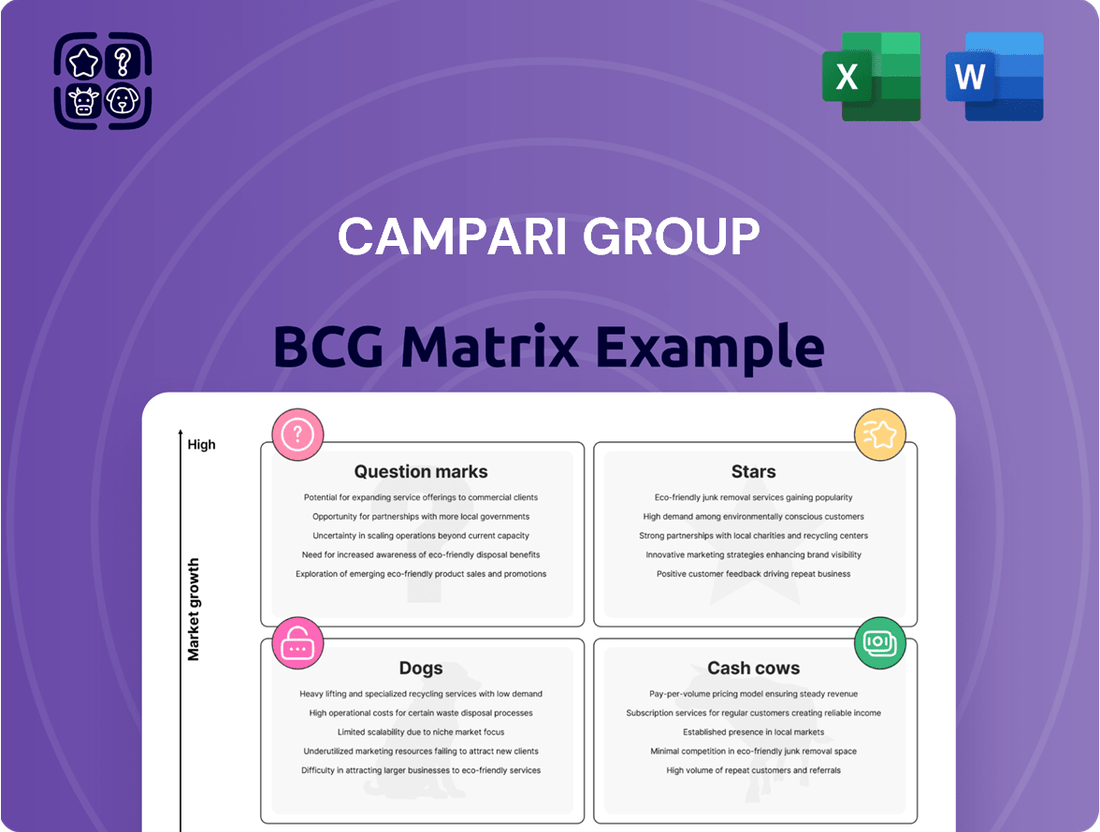

The Campari Group BCG Matrix offers a strategic overview of its brand portfolio, categorizing them as Stars, Cash Cows, Question Marks, and Dogs.

A clear BCG Matrix visualizes Campari's portfolio, easing the pain of strategic uncertainty.

Cash Cows

Wild Turkey Bourbon, a cornerstone of the Campari Group's portfolio, operates as a classic Cash Cow within the BCG Matrix. Despite facing some market headwinds in the US and Australia during 2024, it commands a substantial market share in the mature bourbon segment. This strong position allows it to consistently generate significant cash flow for the parent company.

Historically, Wild Turkey has demonstrated robust growth, particularly in crucial markets such as the United States, Australia, and Japan. Its consistent performance has made it a reliable contributor to Campari Group's overall profitability, underscoring its value as a mature, high-volume brand.

Skyy Vodka, a prominent brand within the Campari Group's portfolio, currently sits as a Cash Cow in their BCG Matrix. Despite facing headwinds, particularly in the United States market due to evolving consumer preferences within the broader spirits category, Skyy maintains a strong position in terms of market share within the vodka segment. This indicates its established presence and continued relevance.

Campari Group's strategic focus on implementing new pricing strategies for Skyy Vodka underscores its significance as a reliable revenue generator. These efforts are aimed at bolstering its competitive edge in a dynamic market, suggesting that even with recent sales pressures, Skyy is expected to continue providing consistent cash flow to the company.

Campari's Jamaican rum brands, such as Appleton Estate and Wray & Nephew Overproof, are considered cash cows. These brands benefit from a well-established market presence, particularly in key markets like the United Kingdom, where they have a loyal following.

Despite facing some supply chain disruptions in 2024, notably due to hurricane impacts, the portfolio generally delivers consistent and reliable cash flow. This stability stems from their mature market position and enduring consumer demand.

Cinzano (Sparkling Wine and Vermouth)

Cinzano, a historic brand within the Campari Group's portfolio, has traditionally been categorized as a Cash Cow. This classification stems from its established presence in mature markets, particularly in Europe, for sparkling wines and vermouth. These categories, while not experiencing rapid growth, benefit from consistent consumer demand, allowing brands like Cinzano to generate reliable cash flow without significant investment.

While Campari Group is actively divesting Cinzano's vermouth and sparkling wine segments, the brand's historical role as a Cash Cow is noteworthy. Its consistent sales in established markets meant it generated more cash than was needed for its maintenance and growth. This surplus cash could then be reinvested in other parts of Campari's portfolio, such as their Stars or Question Marks.

For instance, in 2023, the global vermouth market was valued at approximately $1.8 billion, with a projected compound annual growth rate (CAGR) of around 4.5% through 2030. Similarly, the sparkling wine market, valued at over $35 billion in 2023, also shows steady growth. Cinzano's historical performance within these segments would have reflected this stable demand, contributing to its Cash Cow status.

- Historical Market Position: Strong presence in mature European markets for vermouth and sparkling wine.

- Cash Flow Generation: Provided consistent, stable cash flow due to established demand in its product categories.

- Strategic Divestment: Campari Group's decision to divest Cinzano indicates a portfolio shift, moving away from mature, lower-growth segments.

- Contribution to Portfolio: Historically, Cinzano's surplus cash likely supported investments in higher-growth brands within the Campari Group.

Averna

Averna, a prominent Italian amaro, is positioned as a Cash Cow within Campari Group's portfolio, reflecting its strong market standing and consistent revenue generation. Its status as a regional priority brand indicates significant investment and focus, contributing to its good momentum.

As a mature product with deep roots in its core markets, Averna benefits from established consumer loyalty and a consistent demand for its traditional digestif profile. This maturity translates into predictable and substantial cash flow, often requiring less aggressive marketing spend compared to emerging or high-growth categories.

- Brand Status: Averna is a regional priority brand for Campari Group.

- Market Position: It exhibits good momentum in its core Italian market as a well-established digestif.

- Cash Flow Generation: Its mature market presence and consumer loyalty contribute to steady, reliable cash flow.

- Investment Needs: Averna likely requires lower promotional investment due to its established demand.

Campari Group's Cash Cows, like Wild Turkey, Skyy Vodka, and its Jamaican rum brands, are vital for consistent revenue. These established brands, despite some market challenges in 2024, maintain strong market shares in mature segments, generating reliable cash flow. Averna, an Italian amaro, also fits this category, benefiting from deep consumer loyalty and requiring less investment. Historically, Cinzano, though now being divested, also served as a cash cow, its stable sales in European markets providing surplus funds for other ventures.

| Brand | Category | BCG Status | Key Markets | 2024 Notes |

|---|---|---|---|---|

| Wild Turkey | Bourbon | Cash Cow | USA, Australia, Japan | Market headwinds in US & Australia, strong market share |

| Skyy Vodka | Vodka | Cash Cow | Global (strong in US) | Headwinds in US due to evolving preferences, strong market share |

| Jamaican Rum Brands (Appleton, Wray & Nephew) | Rum | Cash Cow | UK, Global | Supply chain disruptions (hurricanes), consistent demand |

| Averna | Amaro | Cash Cow | Italy | Regional priority, good momentum, mature product |

| Cinzano | Sparkling Wine/Vermouth | Historical Cash Cow (divested) | Europe | Stable demand, consistent cash generation, now divested |

Preview = Final Product

Campari Group BCG Matrix

The Campari Group BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, crafted by industry experts, provides an in-depth look at Campari's product portfolio, categorizing each brand into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth potential. You can confidently use this exact report for your strategic planning, confident that it's ready for immediate application and decision-making.

Dogs

Bisquit & Dubouché Cognac's performance, particularly its decline in South Africa, positions it as a potential 'Dog' in Campari's BCG Matrix. This suggests a low market share within a market that may not be growing robustly, or is facing significant headwinds. For instance, the global cognac market, while generally strong, can exhibit regional variations in growth. In 2024, while premium spirits saw continued demand, specific emerging markets might present challenges impacting brands with established but perhaps aging appeal.

Campari's 'local priority' brands experienced a collective 1% sales dip in 2024, signaling potential challenges. This downturn suggests some brands within this category might be operating in stagnant markets with limited consumer appeal.

Brands falling into the 'Dog' quadrant of the BCG matrix are characterized by low market share and low market growth. The overall decline for local priority brands in 2024 indicates that a portion of these brands likely fit this profile, possibly indicating a need for strategic review or divestment.

Magnum Tonic Wine, a regional priority brand for Campari Group, saw negative performance in the first half of 2024. This decline was attributed to challenging year-over-year comparisons and ongoing supply chain issues.

If brands like Magnum Tonic Wine continue to face difficulties with low market share and restricted growth potential within their specific regions, they would likely be categorized as 'Dogs' in the BCG matrix. This classification signals a need for careful evaluation of their future viability within the company's overall brand portfolio.

Older, Less Strategic Acquisitions

Older, less strategic acquisitions within Campari Group might be categorized as Dogs in a BCG Matrix. These are typically brands acquired historically that haven't demonstrated strong market growth or significant market share, often operating in mature or declining segments. Campari's ongoing strategy involves portfolio simplification, which naturally leads to the evaluation and potential divestment of such underperforming assets.

For instance, if a brand acquired years ago in a category like traditional aperitifs saw its market share stagnate or decline against newer, more dynamic competitors, it would likely be a candidate for the Dog quadrant. Such brands require ongoing investment without generating substantial returns, hindering the group's overall strategic focus and capital allocation efficiency.

- Stagnant Market Share: Brands acquired that have failed to gain or maintain a significant share in their respective categories.

- Low Growth Categories: Businesses operating in industries with minimal expansion prospects.

- Divestment Potential: These brands often become candidates for sale as part of portfolio optimization.

- Resource Drain: They can consume management attention and capital without contributing proportionally to growth.

Brands Impacted by Persistent Negative Category Trends

While Skyy Vodka is a strong performer for Campari Group, certain other brands within categories facing persistent headwinds could become 'Dogs'. For instance, if specific rum segments continue to grapple with supply chain disruptions or if particular vodka sub-categories fail to innovate and capture consumer interest, their market share and growth potential could erode significantly.

These struggling brands, if they don't see a turnaround, risk falling into the 'Dog' quadrant of the BCG Matrix. This means they would have low market share in a low-growth market, requiring careful management to avoid becoming a drain on resources. For example, in 2023, the global rum market experienced mixed performance, with some premium segments showing resilience while others faced challenges due to ingredient sourcing and production costs, impacting brands that couldn't adapt their pricing or product offerings.

- Potential 'Dog' Candidates: Brands in rum segments affected by ongoing supply chain issues or specific vodka sub-categories with declining consumer preference.

- Risk Factors: Failure to adapt to market changes, inability to innovate, and continued erosion of market share in slow-growing or declining categories.

- BCG Matrix Implication: Brands moving into the 'Dog' quadrant indicate low market share and low market growth, necessitating strategic decisions regarding divestment or revitalization efforts.

- Market Context (2023 Data): Some rum segments faced challenges due to ingredient sourcing and production costs, potentially impacting brands unable to adjust their strategies effectively.

Brands in the 'Dog' quadrant of the BCG matrix for Campari Group are those with low market share in low-growth markets. The company's 2024 performance, with a 1% dip in local priority brands, suggests some of these may fit this profile. For instance, Magnum Tonic Wine's negative performance in early 2024, attributed to challenging comparisons and supply issues, could place it in this category if its market share and growth remain constrained.

| Brand/Category Example | BCG Quadrant | Rationale | 2024 Performance Indicator |

|---|---|---|---|

| Bisquit & Dubouché (South Africa) | Potential Dog | Low market share in a potentially slow-growing or challenged regional cognac market. | Reported decline in South Africa. |

| Certain Local Priority Brands | Potential Dog | Low market share in stagnant or low-growth segments. | Collective 1% sales dip in 2024. |

| Magnum Tonic Wine | Potential Dog | Negative performance and potential for low market share/growth in its specific region. | Negative performance in H1 2024. |

Question Marks

Courvoisier Cognac, acquired by Campari Group in May 2024 for over €1.2 billion, fits the 'Question Mark' category in the BCG matrix. This acquisition marks a strategic move into the high-growth premium Cognac segment, offering significant potential.

Despite its strategic importance, Courvoisier represented only 1% of Campari's total sales in 2024. This relatively small market share within the larger group necessitates focused investment and strategic execution to increase its penetration and capitalize on growth opportunities, particularly in the United States and Asia.

Campari's acquisition of Ancho Reyes and Montelobos in 2024 signals a strategic push into the booming agave spirits market. These brands, though currently modest in contribution, are well-positioned within the high-growth tequila and mezcal sector, classifying them as Question Marks.

Their potential to ascend to Star status hinges on significant investment from Campari. This investment would aim to bolster market penetration and capture a larger share of the expanding agave spirits category, which saw global sales reach approximately $12 billion in 2023.

Espolòn RTD fits into the Question Mark category within Campari Group's BCG Matrix. While the Espolòn brand itself is well-established, its ready-to-drink (RTD) iteration is a newer entrant in a rapidly expanding market. This means it has high growth potential but currently holds a relatively low market share, necessitating strategic investment to climb the growth curve.

The RTD beverage market is booming, with global sales projected to reach over $1.5 trillion by 2027, presenting a significant opportunity for Espolòn RTD. However, to capitalize on this growth, Campari Group must invest heavily in marketing and distribution to build brand awareness and secure shelf space against established competitors. This investment is crucial for transforming Espolòn RTD from a question mark into a star performer.

New Route-to-Market Brands in China

Campari's strategic establishment of a new route to market in China, especially for premium brands like The Glen Grant, signals a clear intent to capture greater market share in a rapidly expanding premium spirits segment. This move is crucial for brands aiming for significant consumer adoption and effective penetration within China's competitive beverage market.

The success of brands like The Glen Grant within this new distribution framework hinges on targeted marketing and building strong consumer relationships. By 2024, China's premium spirits market continued its robust growth, with imported whisky categories showing particular strength, driven by evolving consumer preferences and increasing disposable incomes.

- The Glen Grant's Focus: This single malt Scotch whisky is a prime example of a brand being strategically positioned to leverage Campari's new Chinese distribution channels, aiming to enhance its visibility and accessibility to discerning consumers.

- Market Potential: China's spirits market is projected to reach over $170 billion by 2025, with the premium and super-premium segments experiencing the fastest growth, making new routes to market essential for brands like Campari.

- Distribution Strategy: Campari's investment in a direct-to-consumer or enhanced wholesale network aims to bypass traditional, potentially less efficient, distribution layers, allowing for better brand control and consumer engagement.

Emerging Brands from Recent Acquisitions

Emerging brands from recent Campari Group acquisitions, particularly those in burgeoning or specialized markets, would initially be classified as Question Marks in the BCG Matrix. These brands often possess substantial growth potential, reflecting the strategic intent behind their acquisition, but currently hold a minor market share. For instance, Campari Group's acquisition of Courvoisier in late 2023 for €1.2 billion positions it as a significant, albeit initially a Question Mark, investment in the premium cognac segment.

The path forward for these Question Marks involves considerable investment in marketing, distribution, and brand development. Campari's strategy typically involves integrating these brands into its portfolio, leveraging existing synergies while allowing for independent growth trajectories. The success of this nurturing process will determine whether these brands can ascend to become Stars, generating significant revenue and market dominance in the future.

- Acquisition Strategy: Campari Group has a proven track record of strategic acquisitions, evidenced by the €1.2 billion acquisition of Courvoisier in 2023.

- Initial Classification: Newly acquired, smaller brands, especially those in niche or rapidly evolving categories, are initially categorized as Question Marks.

- Growth Potential vs. Market Share: These brands exhibit high growth potential but currently have a low market share, necessitating strategic investment.

- Future Trajectory: Significant investment and nurturing are required to determine if these Question Marks can evolve into Stars within Campari's portfolio.

Question Marks within Campari Group's portfolio represent brands with high growth potential but currently low market share. These are often newer acquisitions or brands entering rapidly expanding, competitive markets, requiring significant investment to gain traction. Their classification highlights Campari's strategic focus on nurturing future growth drivers.

Brands like Courvoisier Cognac, acquired for over €1.2 billion in May 2024, exemplify this category. Despite its strategic importance in the premium Cognac segment, Courvoisier represented only 1% of Campari's total sales in 2024, underscoring the need for focused investment to boost its market penetration, particularly in key regions like the United States and Asia.

Similarly, Campari's 2024 acquisitions of Ancho Reyes and Montelobos target the booming agave spirits market. These brands, while small contributors currently, are positioned in a high-growth sector where significant investment can elevate them from Question Marks to Stars, capitalizing on a market that reached approximately $12 billion globally in 2023.

Espolòn RTD also falls into this category, being a new entrant in the rapidly growing ready-to-drink market. With global RTD sales projected to exceed $1.5 trillion by 2027, substantial marketing and distribution investment is crucial for Espolòn RTD to build awareness and compete effectively, aiming to transition into a star performer.

| Brand Example | Category | Growth Potential | Market Share (2024 Est.) | Strategic Focus |

| Courvoisier Cognac | Question Mark | High (Premium Cognac) | Low (1% of Group Sales) | Market penetration in US & Asia |

| Ancho Reyes / Montelobos | Question Mark | High (Agave Spirits) | Low | Capturing share in expanding agave market |

| Espolòn RTD | Question Mark | High (RTD Beverages) | Low | Brand awareness & distribution in booming RTD market |

BCG Matrix Data Sources

Our Campari Group BCG Matrix is informed by a blend of financial disclosures, market research reports, and internal sales data to accurately assess product performance and market share.