CACI SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CACI Bundle

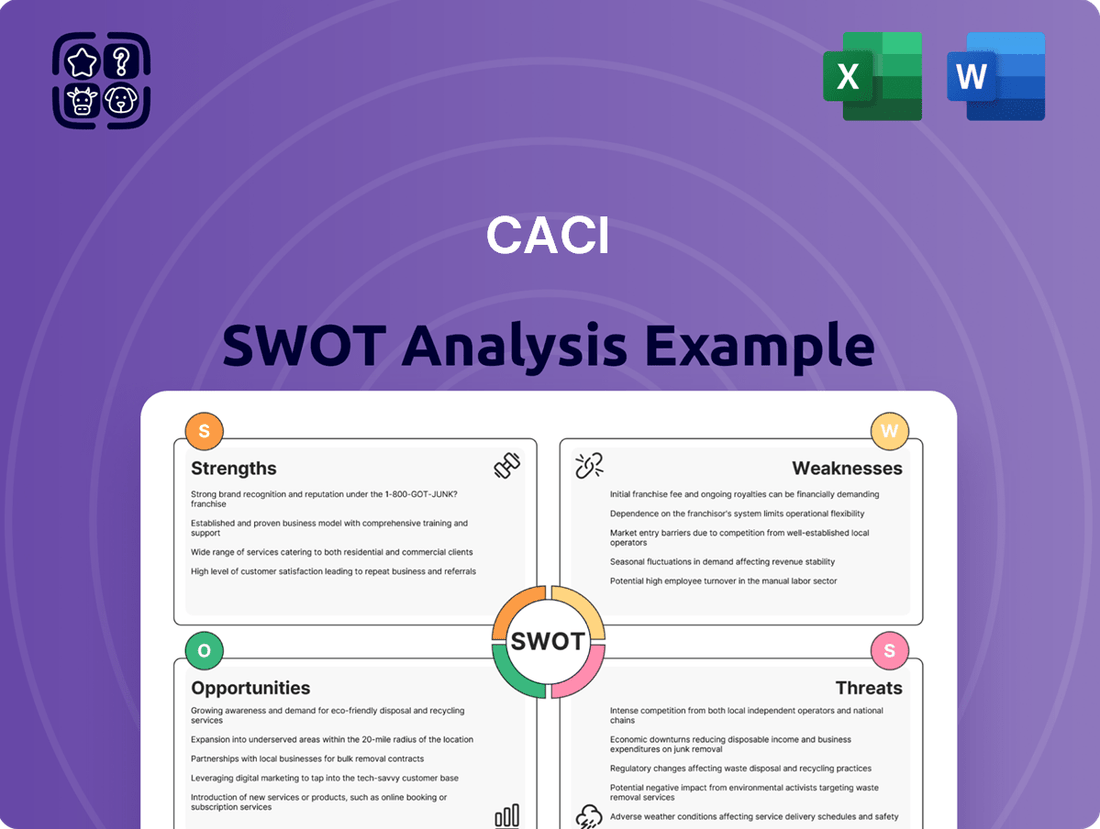

CACI's robust government contracting strengths are evident, but understanding their specific vulnerabilities and emerging opportunities is crucial for strategic advantage. Our comprehensive SWOT analysis delves deep into these internal capabilities and external market dynamics, providing actionable intelligence.

Want the full story behind CACI's competitive edge, potential risks, and avenues for future growth? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning, pitches, and in-depth research.

Strengths

CACI International Inc's primary strength lies in its deep and established relationships with the U.S. federal government, particularly within defense, intelligence, and civilian sectors. This client base offers a remarkably stable and predictable revenue stream, insulating the company from many broader economic downturns. For instance, in fiscal year 2023, approximately 91% of CACI's revenue came from federal government contracts, underscoring this crucial dependency and stability.

The company's strategic focus on national security and critical government missions ensures a persistent demand for its specialized services and advanced technology solutions. These are areas that consistently receive substantial government funding, often prioritized even during periods of fiscal constraint. This alignment with enduring national security imperatives makes CACI an indispensable partner for government agencies.

CACI International has showcased remarkable financial strength, consistently exceeding both revenue and earnings forecasts. The company experienced robust revenue expansion throughout fiscal year 2024 and into the first two quarters of fiscal year 2025, accompanied by improved profitability and strong cash generation.

A key indicator of CACI's stability is its substantial and expanding backlog. This backlog stood at an impressive $32.4 billion as of the first quarter of fiscal year 2025, and remained strong at $31.8 billion in the second quarter of fiscal year 2025, offering significant long-term revenue visibility.

CACI's strength lies in its highly specialized expertise across critical government sectors, including agile development, cybersecurity, and signals intelligence. This deep technical knowledge, coupled with a software-defined approach, allows them to tackle complex challenges. For instance, CACI's focus on advanced technology, such as artificial intelligence and machine learning, positions them to win contracts requiring cutting-edge solutions.

Strategic Acquisitions and Market Expansion

CACI's strategic acquisitions have been a significant driver of its growth, notably in fiscal year 2024 with the integration of Azure Summit Technology and Applied Insight. These moves bolstered CACI's expertise in crucial sectors like RF technology and cloud migration, directly expanding its service offerings to government clients.

These acquisitions not only broaden CACI's technological capabilities but also solidify its market position. By integrating new technologies and talent, CACI can deliver more comprehensive solutions, thereby increasing its competitive edge and revenue streams.

- Strategic Acquisitions: CACI successfully acquired Azure Summit Technology and Applied Insight in FY24.

- Capability Enhancement: These acquisitions strengthened CACI's offerings in RF technology, cloud migration, and ISR.

- Market Expansion: The integrations are designed to increase market share and broaden the company's solution portfolio for government clients.

- Growth Strategy: Acquisitions are a core component of CACI's overall business expansion and revenue growth strategy.

Consistent Contract Wins and High Book-to-Bill Ratio

CACI International consistently demonstrates robust growth through significant contract wins across key federal sectors like the Department of Defense and intelligence agencies. This strong pipeline is reflected in its impressive book-to-bill ratio, which has been notably above 1.0, signaling that new contract awards outpace revenue recognition from completed work. For instance, in fiscal year 2023, CACI reported a book-to-bill ratio of approximately 1.3, highlighting its ability to secure future revenue streams.

This sustained influx of new business, often comprising multi-year and substantial dollar-value awards, provides CACI with a predictable and growing revenue base. The company's success in securing these contracts underscores its competitive positioning and the ongoing demand for its advanced technology and services within the federal government landscape.

- Consistent Federal Contract Awards: CACI regularly secures major contracts from agencies such as the Department of Defense, intelligence community, and NASA.

- High Book-to-Bill Ratio: The company maintains a book-to-bill ratio exceeding 1.0, indicating strong new business acquisition.

- Sustained Revenue Generation: A continuous flow of multi-year and significant dollar-value contracts ensures predictable and growing revenue.

CACI's deep relationships with the U.S. federal government, particularly in defense and intelligence, provide a stable revenue base. In fiscal year 2023, federal contracts accounted for about 91% of CACI's revenue, highlighting this critical strength and the predictable income it generates.

The company's focus on national security and critical government missions ensures consistent demand for its specialized services and advanced technology. These areas are prioritized for funding, making CACI a vital partner for government agencies.

CACI has demonstrated strong financial performance, exceeding revenue and earnings expectations. Fiscal years 2024 and the first half of 2025 saw significant revenue growth, improved profitability, and robust cash flow.

A substantial and growing backlog, reaching $32.4 billion in Q1 FY25 and $31.8 billion in Q2 FY25, offers CACI excellent long-term revenue visibility.

CACI's specialized expertise in areas like agile development, cybersecurity, and signals intelligence, combined with a software-defined approach, enables them to tackle complex challenges. Their investment in AI and machine learning positions them well for contracts requiring advanced solutions.

Strategic acquisitions, such as Azure Summit Technology and Applied Insight in FY24, have boosted CACI's capabilities in RF technology and cloud migration, directly enhancing their offerings to government clients and solidifying their market position.

CACI consistently wins significant federal contracts, evidenced by a book-to-bill ratio above 1.0, meaning new contract awards exceed revenue from completed work. For example, FY23 saw a book-to-bill ratio of approximately 1.3, demonstrating strong future revenue potential.

| Metric | FY23 | Q1 FY25 | Q2 FY25 |

|---|---|---|---|

| Federal Revenue % | ~91% | N/A | N/A |

| Backlog | N/A | $32.4 Billion | $31.8 Billion |

| Book-to-Bill Ratio | ~1.3 | N/A | N/A |

What is included in the product

Delivers a strategic overview of CACI’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, structured framework to identify and address strategic weaknesses, alleviating the pain of uncertainty.

Weaknesses

CACI's significant dependence on U.S. federal government contracts, representing over 95% of its revenue in fiscal year 2024, presents a considerable weakness. This concentration makes the company highly susceptible to shifts in government spending priorities and budget allocations.

Any contraction in federal IT or defense budgets, driven by political or economic factors, could directly and substantially impact CACI's top-line performance and overall financial health. Such fluctuations pose a direct risk to revenue streams and profitability.

CACI's reliance on government contracts exposes it to the complexities of the federal budget cycle. Delays in appropriations or the implementation of continuing resolutions (CRs) can directly impact the company's ability to recognize revenue from its substantial backlog. For instance, in fiscal year 2023, CACI reported a backlog of $25.7 billion, a significant portion of which is tied to government funding.

These budgetary uncertainties can hinder the conversion of this backlog into actual revenue, potentially slowing down project starts and impacting CACI's short-cycle revenue streams. This unpredictability also makes it more challenging for CACI to forecast operational needs and resource allocation effectively, as the timing of new contract awards can be significantly affected by government spending patterns.

The government contracting arena is crowded, with many companies competing for the same projects. This intense rivalry often forces companies like CACI to lower their prices to win bids, which can squeeze profit margins on these deals.

For instance, in fiscal year 2023, CACI reported a net profit margin of 5.6%, a figure that underscores the impact of competitive pricing in securing government work. To thrive, CACI must consistently highlight its unique capabilities and manage its costs effectively to stay ahead and safeguard its earnings.

Talent Acquisition and Retention Challenges

CACI grapples with significant talent acquisition and retention hurdles, especially in securing professionals with vital security clearances and cutting-edge skills in areas like AI and cybersecurity. The government contracting landscape is intensely competitive for these specialized roles.

The shrinking pool of prime-age workers and the swift obsolescence of technical proficiencies exacerbate these challenges, potentially hindering CACI's capacity to fulfill contract obligations and drive innovation. For instance, the U.S. Bureau of Labor Statistics projects a 33% growth in information security analyst roles from 2022 to 2032, a rate far exceeding the average for all occupations, underscoring the intense demand CACI faces.

- High Demand for Specialized Skills: CACI needs professionals with security clearances and expertise in AI, cloud computing, and cybersecurity.

- Demographic Shifts: Declining prime-age worker populations create a smaller talent pool.

- Skill Obsolescence: Rapid technological advancements require continuous upskilling, making some existing skills outdated quickly.

- Competitive Market: Government contracting firms compete fiercely for a limited supply of qualified candidates.

Increased Debt from Acquisitions and Working Capital Demands

CACI's aggressive acquisition strategy, while fueling expansion, has notably increased its debt burden. For instance, the company's pro forma leverage ratio saw an uptick following significant acquisitions, reflecting a higher reliance on borrowed funds to finance growth initiatives.

This elevated debt level could pose challenges, particularly if interest rates rise or if the company faces unexpected downturns. The financial flexibility to pursue future opportunities or manage economic volatility might be constrained by this increased leverage.

Furthermore, the evolving composition of CACI's business portfolio is creating greater demands on its working capital. This means more cash is tied up in day-to-day operations, potentially impacting its ability to generate free cash flow and manage its financial guidance effectively.

- Increased Debt Load: Acquisitions have led to a higher pro forma leverage ratio, indicating a greater proportion of debt in its capital structure.

- Working Capital Strain: Changes in its business mix are demanding more working capital, potentially affecting cash flow generation.

- Financial Flexibility Concerns: The combination of higher debt and working capital needs could limit future strategic maneuverability.

CACI's significant dependence on U.S. federal government contracts, representing over 95% of its revenue in fiscal year 2024, presents a considerable weakness. This concentration makes the company highly susceptible to shifts in government spending priorities and budget allocations.

Any contraction in federal IT or defense budgets, driven by political or economic factors, could directly and substantially impact CACI's top-line performance and overall financial health. Such fluctuations pose a direct risk to revenue streams and profitability.

CACI's reliance on government contracts exposes it to the complexities of the federal budget cycle. Delays in appropriations or the implementation of continuing resolutions (CRs) can directly impact the company's ability to recognize revenue from its substantial backlog. For instance, in fiscal year 2023, CACI reported a backlog of $25.7 billion, a significant portion of which is tied to government funding.

These budgetary uncertainties can hinder the conversion of this backlog into actual revenue, potentially slowing down project starts and impacting CACI's short-cycle revenue streams. This unpredictability also makes it more challenging for CACI to forecast operational needs and resource allocation effectively, as the timing of new contract awards can be significantly affected by government spending patterns.

The government contracting arena is crowded, with many companies competing for the same projects. This intense rivalry often forces companies like CACI to lower their prices to win bids, which can squeeze profit margins on these deals.

For instance, in fiscal year 2023, CACI reported a net profit margin of 5.6%, a figure that underscores the impact of competitive pricing in securing government work. To thrive, CACI must consistently highlight its unique capabilities and manage its costs effectively to stay ahead and safeguard its earnings.

CACI grapples with significant talent acquisition and retention hurdles, especially in securing professionals with vital security clearances and cutting-edge skills in areas like AI and cybersecurity. The government contracting landscape is intensely competitive for these specialized roles.

The shrinking pool of prime-age workers and the swift obsolescence of technical proficiencies exacerbate these challenges, potentially hindering CACI's capacity to fulfill contract obligations and drive innovation. For instance, the U.S. Bureau of Labor Statistics projects a 33% growth in information security analyst roles from 2022 to 2032, a rate far exceeding the average for all occupations, underscoring the intense demand CACI faces.

CACI's aggressive acquisition strategy, while fueling expansion, has notably increased its debt burden. For instance, the company's pro forma leverage ratio saw an uptick following significant acquisitions, reflecting a higher reliance on borrowed funds to finance growth initiatives.

This elevated debt level could pose challenges, particularly if interest rates rise or if the company faces unexpected downturns. The financial flexibility to pursue future opportunities or manage economic volatility might be constrained by this increased leverage.

Furthermore, the evolving composition of CACI's business portfolio is creating greater demands on its working capital. This means more cash is tied up in day-to-day operations, potentially impacting its ability to generate free cash flow and manage its financial guidance effectively.

| Weakness | Description | Impact | Supporting Data (FY23/FY24) |

| Revenue Concentration | Over-reliance on U.S. federal government contracts. | Susceptibility to government budget changes and priorities. | >95% of revenue from U.S. federal government (FY24). |

| Competitive Pricing Pressure | Intense competition in government contracting bids. | Potential for squeezed profit margins. | 5.6% net profit margin (FY23). |

| Talent Acquisition & Retention | Difficulty in securing cleared professionals with specialized skills (AI, cybersecurity). | Hindered ability to fulfill contracts and drive innovation. | 33% projected growth in Information Security Analyst roles (2022-2032). |

| Increased Debt Load | Higher leverage ratio due to aggressive acquisition strategy. | Reduced financial flexibility and increased sensitivity to interest rate changes. | Increased pro forma leverage ratio post-acquisitions. |

| Working Capital Demands | Evolving business portfolio requires more cash in operations. | Potential impact on free cash flow generation and financial management. | Increased working capital needs due to business mix changes. |

Full Version Awaits

CACI SWOT Analysis

This is the actual CACI SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full CACI SWOT report you'll get. Purchase unlocks the entire in-depth version.

This preview reflects the real CACI SWOT analysis document you'll receive—professional, structured, and ready to use.

Opportunities

The U.S. federal government's sustained focus on IT modernization and digital transformation offers significant avenues for growth. CACI's established capabilities in agile development and enterprise IT position it well to capitalize on these initiatives, which aim to enhance public digital services and upgrade outdated government systems.

For instance, the Biden-Harris administration's push for digital government, including the President's Management Agenda, highlights a commitment to modernizing federal IT infrastructure. This translates into a robust pipeline of opportunities for companies like CACI that can deliver advanced digital solutions and support the transition from legacy systems to more efficient, cloud-based platforms.

Federal IT spending is heavily focused on cybersecurity and AI for fiscal year 2025 and into the future, with substantial budget increases planned. This trend highlights a significant market opportunity for companies like CACI.

CACI's established expertise in cybersecurity, data analytics, and AI development aligns perfectly with these government priorities. The company is well-positioned to benefit from increased investment in areas such as zero trust architectures and government AI talent acquisition initiatives.

CACI is well-positioned to capitalize on the growing demand for advanced optical communications, counter-unmanned aircraft systems (C-UAS), and space technology operations. These emerging areas represent significant growth avenues for the company.

By strategically investing in and developing differentiated technologies within these critical national security domains, CACI can unlock new contract opportunities. This proactive approach is key to strengthening its market presence as these sectors evolve.

For instance, the global C-UAS market is projected to reach substantial figures, with some estimates placing it in the tens of billions of dollars by the late 2020s, highlighting the immense potential for companies like CACI that offer robust solutions.

Leveraging Software-Defined Solutions for Enhanced Capabilities

CACI's strategic emphasis on software-defined solutions, exemplified by its work on the TLS Manpack and Navy spectrum programs, directly addresses federal agencies' growing need for agility and modernization. This focus positions the company to capitalize on the increasing demand for adaptable, software-enabled capabilities.

Accelerating the development and deployment of these flexible technologies presents a significant scaling opportunity for CACI. The market continues to show a strong preference for solutions that can be easily updated and tailored to evolving operational requirements.

- Federal Modernization Push: Agencies are actively seeking software-centric approaches to upgrade legacy systems and enhance operational flexibility, aligning with CACI's core offerings.

- TLS Manpack Success: CACI's involvement in programs like the Tactical Network Solutions (TLS) Manpack demonstrates its ability to deliver advanced, software-defined communication capabilities.

- Spectrum Dominance: The company's work in Navy spectrum programs highlights its expertise in managing and optimizing critical radio frequency environments through software.

Strategic Partnerships and Collaborations

Strategic partnerships offer CACI significant opportunities to expand its technological edge and market presence. By teaming up with other tech firms or academic bodies, CACI can access new innovations and broaden its client base. A prime example is its Cooperative Research Agreement with West Point, focused on developing advanced electronic warfare capabilities, directly aligning with key Pentagon objectives and paving the way for future contract awards.

These collaborations are crucial for staying ahead in the rapidly evolving defense and technology sectors. They allow CACI to leverage external expertise and resources, accelerating the development of cutting-edge solutions. Such alliances can also lead to:

- Access to specialized research and development.

- Joint bidding for larger, more complex government contracts.

- Enhanced credibility and market validation through association with reputable partners.

- Opportunities to integrate complementary technologies, creating more comprehensive offerings.

The ongoing federal drive for IT modernization and digital transformation presents a substantial growth runway for CACI. The company's established strengths in agile development and enterprise IT are perfectly suited to support government initiatives aimed at upgrading legacy systems and improving digital services. Federal IT spending for fiscal year 2025 shows a pronounced emphasis on cybersecurity and AI, with significant budget increases anticipated, directly benefiting companies like CACI with expertise in these critical areas.

Threats

Geopolitical uncertainties and ongoing macroeconomic tensions pose a significant threat to CACI. These factors can cause government agencies to reduce spending, creating unpredictability in the federal budget. This instability directly impacts CACI's shorter revenue cycles and overall financial health as funding priorities can quickly change due to global events.

CACI operates in a fiercely competitive federal contracting landscape. The market is crowded with both long-standing industry giants and agile newcomers, all vying for government projects. This intense rivalry often leads to significant pricing pressures, which can directly impact CACI's profit margins on awarded contracts.

Securing new business and retaining existing contracts, particularly during re-competition cycles, becomes a considerable challenge due to this high level of competition. For instance, the U.S. federal government awarded approximately $700 billion in prime contracts in fiscal year 2023, illustrating the vastness but also the intense competition for these opportunities.

Changes in U.S. federal agencies and shifts in presidential administrations can directly impact government contract opportunities. For instance, a new administration might re-prioritize defense or intelligence spending, potentially affecting CACI's existing programs and future contract awards. The Bipartisan Budget Act of 2024, for example, set discretionary spending caps that could influence the overall size of government IT and defense contracts available.

Cybersecurity and Data Breaches

As a key player in national security solutions, CACI faces a significant threat from sophisticated cyberattacks. The nature of its work, handling sensitive government data, makes it a prime target for malicious actors. A successful breach could have devastating consequences.

The potential fallout from a cybersecurity incident is substantial. CACI could experience severe reputational damage, impacting its ability to secure future contracts. Financial penalties and a significant loss of customer trust are also highly probable outcomes, directly affecting its bottom line and market position.

- Cybersecurity Threats: CACI's role in national security makes it a target for advanced persistent threats (APTs) and nation-state sponsored attacks.

- Data Breach Impact: A breach involving classified or sensitive government data could result in catastrophic reputational damage and loss of contracts, as seen with industry peers facing significant penalties.

- Financial Repercussions: Beyond direct penalties, the cost of remediation, legal fees, and lost business opportunities following a breach can run into millions, impacting profitability.

- Customer Trust Erosion: For clients in the national security sector, trust is paramount. A failure to protect data can irrevocably damage this trust, leading to a swift loss of business.

Challenges in Attracting and Retaining Cleared Personnel

Attracting and keeping personnel with security clearances is a significant hurdle for CACI, especially in the national security and intelligence sectors. These roles demand a specialized workforce, and the competition for cleared talent is fierce.

The broader demographic trend of a shrinking prime-age workforce, coupled with the government’s stringent experience and education prerequisites, further complicates CACI's ability to recruit and retain the skilled cleared individuals it needs. This scarcity directly impacts CACI's capacity to staff critical projects and meet its contractual commitments effectively.

In 2023, the cybersecurity talent gap in the US was estimated to be over 500,000 professionals, many of whom require security clearances for government work. This highlights the intense competition CACI faces. Furthermore, the average time to obtain a security clearance can extend for months, creating a bottleneck in onboarding new hires.

- Shrinking Talent Pool: A declining number of prime-age workers impacts the overall availability of cleared personnel.

- Specialized Requirements: Government contracts demand specific security clearances and often unique experience/education, narrowing the candidate pool.

- Retention Challenges: High demand for cleared professionals means CACI must compete aggressively on compensation and benefits to retain its existing workforce.

- Project Staffing Impact: Difficulty in attracting and retaining cleared staff can directly hinder CACI's ability to staff projects and fulfill its contractual obligations.

The intense competition within the federal contracting sector presents a significant threat to CACI. With numerous established players and emerging companies vying for government projects, pricing pressures are amplified, potentially squeezing profit margins on awarded contracts.

Changes in U.S. federal administration and policy shifts can directly impact CACI's contract pipeline. For example, the Bipartisan Budget Act of 2024's spending caps could influence the overall size and availability of government IT and defense contracts.

CACI's reliance on government contracts makes it vulnerable to budget uncertainties and shifting federal priorities, especially given the approximately $700 billion in prime contracts awarded by the U.S. federal government in fiscal year 2023. This environment demands constant adaptation to evolving funding landscapes.

SWOT Analysis Data Sources

This SWOT analysis leverages a robust combination of CACI's official financial filings, comprehensive market intelligence reports, and insights from industry experts to provide a well-rounded and accurate strategic overview.