CACI Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CACI Bundle

Curious about the engine driving CACI's success? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Ready to unlock these strategic insights?

Partnerships

CACI International's key partnerships are deeply rooted within the U.S. federal government, forming the bedrock of its business operations. These collaborations span critical sectors, including the Department of Defense, various intelligence agencies, and numerous civilian government bodies.

These government agencies are not just partners; they are CACI's primary customer base, driving the vast majority of its revenue. For instance, in fiscal year 2023, the U.S. federal government accounted for approximately 90% of CACI's total revenue, highlighting the indispensable nature of these relationships.

CACI actively partners with a diverse range of technology providers and system integrators to enhance its service offerings. These collaborations are crucial for CACI to incorporate advanced, best-in-class technologies into its solutions, addressing the sophisticated needs of its government clientele. For instance, in 2024, CACI continued to leverage partnerships with cloud providers and cybersecurity firms to bolster its digital transformation services for defense agencies.

CACI actively collaborates with academic and research institutions to drive innovation and develop cutting-edge technologies. These partnerships often include joint R&D projects and talent development initiatives, allowing CACI to explore new technological frontiers. For example, a Cooperative Research and Development Agreement (CRADA) with the U.S. Military Academy (USMA) focuses on advancing electronic warfare capabilities.

Acquired Companies and their Ecosystems

CACI's strategic acquisitions, including Azure Summit Technology and Applied Insight in recent years, are pivotal to its partnership ecosystem. These moves bring not just new technologies but also established client bases and valuable partner networks. For example, the acquisition of Azure Summit Technology in 2023 bolstered CACI's expertise in cloud solutions and data analytics, integrating its existing relationships within the federal government sector.

These integrations significantly broaden CACI's market access and deepen its capabilities in critical areas. The acquired entities' established customer relationships and partner networks are absorbed, creating immediate synergy and expanding CACI's footprint. This strategy directly enhances CACI's competitive edge by incorporating specialized knowledge and market penetration from its newly acquired partners.

The impact of these acquisitions is evident in CACI's expanded service offerings. By bringing Azure Summit Technology and Applied Insight into the fold, CACI has strengthened its position in high-demand fields such as:

- Cloud migration and modernization

- Electronic warfare and signals intelligence

- Cybersecurity solutions

- Data analytics and artificial intelligence

Defense Contractors and Subcontractors

CACI's success hinges on its ability to forge strong alliances with prime defense contractors and specialized subcontractors. These partnerships are critical for securing and delivering on massive government contracts, often exceeding billions of dollars. For instance, in fiscal year 2023, CACI reported significant contract wins, many of which involved collaborative efforts with other industry leaders.

These collaborations are not just about winning bids; they are about effectively executing complex projects. By teaming up, CACI can tap into a broader pool of expertise and resources, ensuring they meet the stringent requirements of government clients. This strategic approach allows CACI to offer comprehensive solutions that might be beyond the scope of a single entity.

The benefits of these key partnerships are multifaceted:

- Access to Larger Contracts: Partnering enables CACI to bid on and win larger, more complex government programs that require a consortium of capabilities.

- Leveraging Complementary Strengths: CACI can integrate specialized technologies or services from partners, enhancing its overall offering and competitive edge.

- Risk Mitigation: Sharing the responsibility and resources on major projects helps distribute risk, making large-scale government contracts more manageable.

- Enhanced Market Reach: Collaborations can open doors to new government agencies or program areas where CACI might not have a direct presence.

CACI's key partnerships are primarily with the U.S. federal government, which constitutes about 90% of its revenue in fiscal year 2023. These critical alliances extend to technology providers and academic institutions for innovation, as well as strategic acquisitions like Azure Summit Technology to expand capabilities and market reach. These collaborations are essential for securing and executing large government contracts, leveraging complementary strengths, and mitigating risk.

| Partner Type | Example | Significance |

|---|---|---|

| Government Agencies | Department of Defense, Intelligence Agencies | Primary customer base, driving ~90% of revenue |

| Technology Providers | Cloud providers, Cybersecurity firms | Enhancing service offerings with advanced tech (e.g., digital transformation in 2024) |

| Academic/Research Institutions | U.S. Military Academy (USMA) | Driving innovation via R&D (e.g., electronic warfare) |

| Acquired Companies | Azure Summit Technology (2023) | Expanding cloud and data analytics capabilities |

| Prime Contractors/Subcontractors | Defense industry leaders | Securing and executing large government contracts |

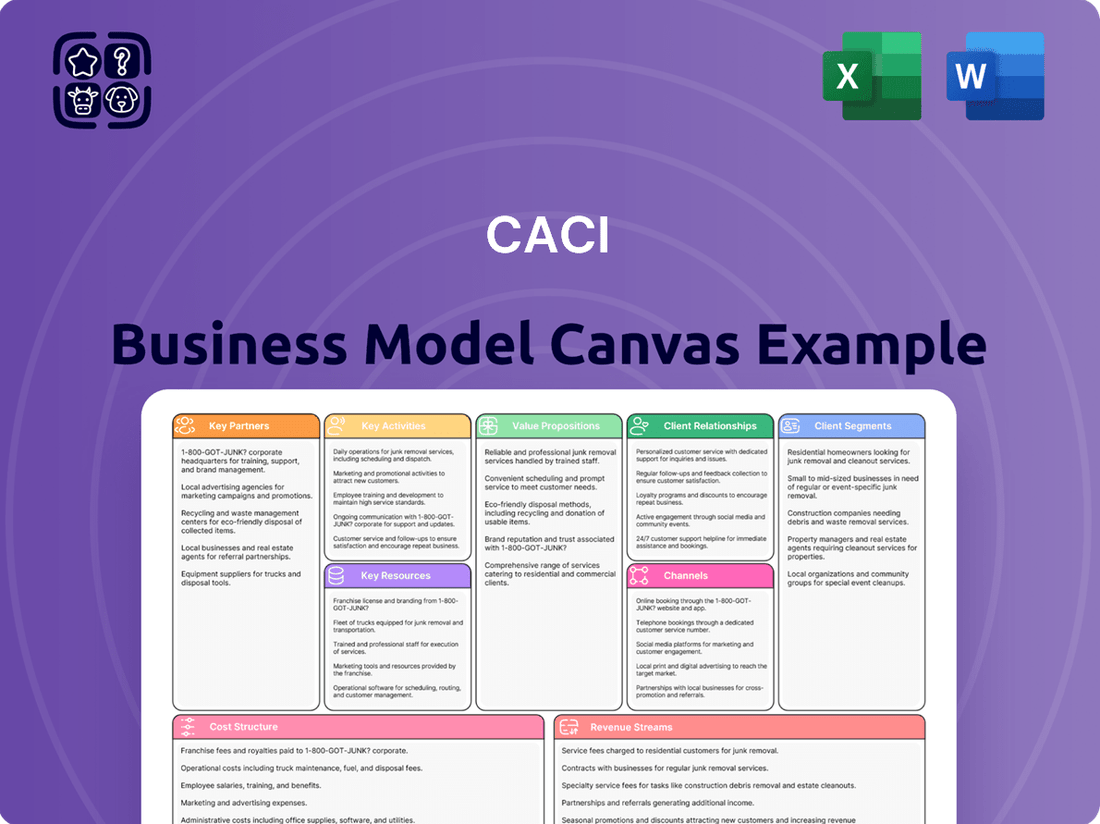

What is included in the product

A visual representation of CACI's strategic approach, detailing customer segments, value propositions, and key resources.

Organized into the 9 classic Business Model Canvas blocks, it offers a clear overview of CACI's operational framework and revenue streams.

The CACI Business Model Canvas offers a structured, visual approach to dissecting and refining business strategies, alleviating the pain of complex planning and communication.

It provides a clear, actionable framework to identify and address strategic gaps, making business model development more efficient and less overwhelming.

Activities

CACI's core activities revolve around delivering sophisticated information solutions and services, a critical function for its government clients. This involves leveraging deep expertise and cutting-edge technology across domains like agile development, robust cybersecurity, insightful data analytics, and comprehensive enterprise IT. For instance, in fiscal year 2024, CACI reported significant growth in its IT solutions segment, reflecting strong demand for these capabilities.

Contract bidding and management are central to CACI's operations, focusing on securing and executing large, long-term government contracts. This requires robust business development and proposal writing to navigate complex procurement systems.

In fiscal year 2023, CACI reported a backlog of $23.3 billion, highlighting the importance of its contract acquisition success. Winning new work and expanding existing agreements directly fuels the company's growth trajectory and financial results.

CACI's commitment to Research, Development, and Innovation is central to its business model, focusing on creating and refining technology-driven solutions and proprietary products. This involves significant investment in cutting-edge fields such as optical communications, signals intelligence, and electronic warfare. For instance, in fiscal year 2023, CACI reported $6.1 billion in revenue, with a substantial portion allocated to R&D to maintain its competitive edge.

The company's innovation efforts are geared towards addressing complex national security challenges, ensuring its offerings remain relevant and advanced. CACI actively develops advanced software capabilities, a critical component in modern defense and intelligence operations. This dedication to continuous improvement allows CACI to anticipate and respond to the dynamic needs of its government clients.

Strategic Acquisitions and Integration

CACI's strategic acquisitions are a cornerstone of its growth, focusing on companies that expand its technological prowess and market reach. This involves a rigorous process of identifying, acquiring, and integrating target businesses to bolster capabilities in areas like artificial intelligence, cybersecurity, and cloud computing. For instance, the 2023 acquisition of Azure Summit Technology significantly strengthened CACI's expertise in advanced analytics and AI, while the acquisition of Applied Insight in early 2024 further enhanced its position in cloud solutions and data analytics. These moves are crucial for staying ahead in the rapidly evolving defense and intelligence sectors.

The successful integration of acquired entities is paramount to unlocking their full strategic value. CACI emphasizes a methodical approach to merging operations, cultures, and technologies to ensure seamless transitions and immediate contribution to the company's overall objectives. This focus on integration helps CACI leverage new talent, intellectual property, and customer bases efficiently. The company's commitment to this key activity underpins its ability to deliver comprehensive solutions and maintain a competitive edge.

- Strategic Acquisitions: CACI actively pursues acquisitions to enhance its technology offerings and expand market share, as seen with Azure Summit Technology and Applied Insight.

- Integration Focus: Effective integration of acquired companies is critical for realizing the strategic benefits and ensuring operational synergy.

- Capability Enhancement: Acquisitions are strategically chosen to bolster CACI's expertise in key domains like AI, cybersecurity, and cloud computing.

- Market Expansion: These activities aim to broaden CACI's customer relationships and solidify its position in the defense and intelligence markets.

Talent Acquisition and Development

CACI's commitment to maintaining its over 25,000-strong workforce necessitates robust talent acquisition and development. This involves actively seeking out and recruiting top-tier professionals, particularly in highly specialized technical and scientific fields crucial for government contracting. For instance, in fiscal year 2023, CACI continued to invest heavily in its people, recognizing that a skilled workforce is the bedrock of its service delivery.

Ongoing training and development are equally critical. CACI implements comprehensive programs to ensure its employees remain at the forefront of technological advancements and possess the necessary skills to tackle complex client challenges. This continuous learning approach is vital for adapting to evolving market demands and maintaining a competitive edge in the dynamic government contracting landscape.

Key activities in talent acquisition and development include:

- Strategic Recruitment: Targeting and attracting specialized talent in areas like cybersecurity, cloud computing, and data analytics to meet client needs.

- Continuous Learning Programs: Offering extensive training, certifications, and professional development opportunities to upskill the existing workforce.

- Performance Management: Implementing systems to identify high performers and provide them with advanced career growth opportunities.

- Knowledge Management: Fostering an environment where expertise is shared and leveraged across the organization to enhance service delivery.

CACI's key activities are centered around delivering information technology solutions and services to government clients. This includes developing and implementing advanced software, providing robust cybersecurity, and offering comprehensive data analytics. The company also focuses on winning and managing large government contracts, which is crucial for sustained growth.

Preview Before You Purchase

Business Model Canvas

The CACI Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means the structure, content, and formatting are precisely what you can expect in the final deliverable. You are seeing a direct representation of the professional, ready-to-use canvas that will be yours to download and utilize immediately after completing your transaction.

Resources

CACI's most crucial asset is its extensive team of over 25,000 skilled professionals. This dynamic workforce brings deep expertise in fields vital for national security, such as cybersecurity, data analytics, and intelligence analysis.

These individuals are the backbone of CACI's ability to provide sophisticated information technology solutions and services to government agencies. Their collective knowledge is indispensable for tackling complex challenges and delivering value to clients.

CACI's proprietary technology and intellectual property are cornerstones of its competitive advantage, particularly in areas like optical communications, signals intelligence, and electronic warfare. These advanced capabilities are not static; they are continually refined through substantial investments in research and development and bolstered by strategic acquisitions. For instance, in fiscal year 2023, CACI reported $6.6 billion in revenue, underscoring the market demand for its technologically advanced solutions. This intellectual capital directly translates into a unique ability to address complex government needs, setting CACI apart in a demanding sector.

CACI's extensive government contract backlog is a vital financial resource, offering significant revenue visibility and stability. As of December 31, 2024, this backlog reached an impressive $31.8 billion, marking a substantial 18.2% increase year-over-year. This robust pipeline of awarded contracts translates directly into predictable future revenue streams, underpinning CACI's capacity for long-term strategic planning and investment.

Strong Customer Relationships and Trust

CACI's decades of providing reliable service have cultivated deep, trusted relationships with major U.S. federal government agencies, notably the Department of Defense and the Intelligence Community. This established trust is a vital intangible asset that drives repeat business, facilitates sole-source contract awards, and leads to the expansion of existing engagements.

The company’s strong reputation for character, integrity, and ethical conduct serves as a significant competitive advantage in securing and maintaining government contracts.

- Customer Loyalty: CACI's long-standing relationships translate into high customer retention rates, a crucial factor in the government contracting sector.

- Sole-Source Opportunities: Trust and proven performance often lead to sole-source contract awards, reducing competitive pressures and ensuring revenue streams.

- Reputational Capital: CACI's commitment to ethics and integrity builds invaluable reputational capital, differentiating it from competitors and fostering long-term partnerships.

Financial Capital and Robust Balance Sheet

CACI's financial capital is a cornerstone of its business model, enabling significant investments and strategic flexibility. For fiscal year 2023, CACI reported total revenue of $6.5 billion, demonstrating substantial operational scale and market presence.

This financial strength directly fuels CACI's ability to fund ongoing operations, invest heavily in research and development to maintain a competitive edge, and pursue strategic acquisitions that enhance its capabilities and market reach. The company's commitment to profitability and healthy cash flow generation underpins these investment activities.

A robust balance sheet is critical for CACI, providing the capacity for agile capital deployment. This allows the company to effectively pursue its long-term growth objectives, including expanding into new markets and developing innovative solutions for its clients.

- Revenue Generation: CACI's fiscal year 2023 revenue reached $6.5 billion, highlighting its significant market share and operational capacity.

- Investment Capability: Financial capital supports R&D, acquisitions, and operational funding, crucial for innovation and expansion.

- Balance Sheet Strength: A healthy balance sheet enables flexible capital allocation and underpins long-term strategic growth initiatives.

- Profitability and Cash Flow: Consistent profitability and strong cash flow generation are vital for sustaining and growing these key resources.

CACI's intellectual property includes proprietary technologies in areas like optical communications and signals intelligence, developed through continuous R&D and acquisitions. This advanced capability, supported by $6.6 billion in fiscal year 2023 revenue, allows CACI to address complex government needs effectively.

The company's substantial government contract backlog, reaching $31.8 billion as of December 31, 2024, provides significant revenue visibility and stability. This robust pipeline, an 18.2% increase year-over-year, ensures predictable future revenue streams for long-term strategic planning and investment.

CACI's key resources also encompass its strong financial capital, evidenced by $6.5 billion in fiscal year 2023 revenue, which fuels R&D, acquisitions, and operational funding. This financial strength supports agile capital deployment for growth initiatives and maintains consistent profitability.

| Key Resource | Description | Financial Year/Date | Value/Metric |

|---|---|---|---|

| Skilled Professionals | Over 25,000 experts in cybersecurity, data analytics, intelligence analysis. | Ongoing | N/A (Human Capital) |

| Proprietary Technology & IP | Advanced solutions in optical communications, signals intelligence, EW. | FY2023 | $6.6 billion (Revenue) |

| Contract Backlog | Future revenue from awarded government contracts. | December 31, 2024 | $31.8 billion (18.2% YoY increase) |

| Financial Capital | Funds for operations, R&D, and strategic investments. | FY2023 | $6.5 billion (Total Revenue) |

Value Propositions

CACI delivers vital expertise and advanced technology that directly bolsters national security missions for the U.S. federal government. This encompasses providing sophisticated solutions across intelligence, defense, and homeland security sectors, empowering agencies to confront and neutralize emerging threats with greater efficacy.

In 2024, CACI's commitment to national security is evident in its continued investment in research and development, focusing on areas like artificial intelligence and cyber warfare to stay ahead of evolving threats. The company's solutions are designed to accelerate mission outcomes and ensure positive results in a constantly shifting global security environment.

CACI provides critical solutions that propel government modernization, focusing on digital transformation, robust enterprise IT, and seamless cloud migration. The company's expertise helps agencies consolidate IT services, automate workflows, and significantly boost overall efficiency and productivity.

This value proposition directly tackles the pressing demand for government entities to implement modern, agile, and secure technological frameworks. For instance, CACI's work with the U.S. Department of Homeland Security in 2024 exemplifies this, where they are enhancing cybersecurity and modernizing critical infrastructure to better protect national interests.

CACI offers unique expertise and advanced technology in crucial areas like agile software development, cybersecurity, and data analytics. This specialization allows them to tackle complex, mission-critical challenges that others can't.

Their deep capabilities in electronic warfare and signals intelligence further differentiate them, enabling the delivery of top-tier solutions. For instance, CACI's focus on these specialized domains directly supports national security objectives, a key value proposition for their government clients.

Reliable and Proven Execution

CACI's commitment to reliable and proven execution is a cornerstone of its value proposition. The company consistently delivers superior performance on its government contracts, fostering a deep sense of trust with its clients.

This operational discipline translates into tangible benefits for customers, ensuring their critical missions are supported with unwavering efficiency and effectiveness. This reliability often paves the way for sole-source contract extensions and expanded re-competes, showcasing customer confidence.

- Proven Track Record: CACI has a history of successfully completing complex projects for government agencies, demonstrating consistent delivery excellence.

- Customer Trust: Their reliable execution builds strong relationships, leading to repeat business and expanded opportunities.

- Mission Support: Government clients depend on CACI for the dependable support needed to achieve their strategic objectives.

- Contractual Success: In fiscal year 2023, CACI reported a significant win rate on recompete contracts, underscoring their proven execution capabilities.

Tailored Solutions for Complex Requirements

CACI truly shines by crafting solutions that precisely fit the intricate needs of government clients. This means their technology and know-how are perfectly matched to what each agency needs to accomplish its mission. For instance, in 2024, CACI secured a significant contract to modernize IT infrastructure for a major defense department, a project valued at over $500 million, specifically addressing their complex legacy system integration challenges.

This focus on customization is what sets CACI apart in the government sector. They don't offer one-size-fits-all answers; instead, they dive deep to understand unique operational demands. This adaptability allows them to deliver highly effective and targeted results, ensuring client satisfaction and mission success. Their ability to pivot and tailor offerings was highlighted in a 2024 cybersecurity initiative where they developed a bespoke threat detection system for a federal agency, which reportedly reduced critical incident response times by 30%.

The company’s value proposition centers on this client-centric methodology, ensuring that every solution is not just functional but optimally aligned with specific objectives. This deep understanding of government complexities leads to robust and efficient outcomes. CACI’s commitment to tailored solutions is a cornerstone of its success, enabling them to tackle some of the most demanding technological challenges faced by public sector organizations.

CACI provides tailored solutions that precisely address the unique and complex needs of government clients, ensuring technology and expertise are perfectly aligned with mission objectives. This client-centric approach allows them to deliver highly effective and targeted results, as demonstrated by a 2024 contract to modernize a defense department's IT infrastructure, valued at over $500 million, specifically to overcome legacy system integration challenges.

Customer Relationships

CACI builds enduring connections with government clients, acting as a trusted advisor by deeply understanding their missions and challenges. This approach fosters long-term partnerships and repeat business, evidenced by their consistent contract wins and renewals.

CACI's commitment to customer relationships is exemplified by its dedicated program and account management teams. These specialists ensure close collaboration and prompt responses to client needs, fostering a strong partnership throughout the entire contract duration.

This hands-on engagement model is crucial for maintaining open communication channels, enabling proactive identification and resolution of potential issues, and ensuring CACI's services remain perfectly aligned with a client's evolving operational requirements. For instance, in fiscal year 2023, CACI reported a customer retention rate exceeding 90%, a testament to the effectiveness of this approach.

By providing direct, personalized support, CACI strengthens customer loyalty and drives satisfaction. This focus on building lasting relationships is a cornerstone of their strategy, contributing to repeat business and positive client testimonials, which are vital for sustained growth in the competitive government contracting sector.

CACI's customer relationships are deeply rooted in a performance-driven engagement model, where the primary focus is on delivering measurable results and demonstrating tangible value to clients. This commitment translates into a consistent effort to achieve successful mission outcomes and enhance operational efficiency for the organizations they serve.

This dedication to performance is a cornerstone of CACI's strategy, reinforcing its standing as a dependable and highly effective partner in the complex landscape of government and commercial contracting. For instance, in fiscal year 2023, CACI reported significant contract wins and successful project completions that directly contributed to client mission success, underscoring this core relationship tenet.

Proactive Solution Development

CACI actively partners with government clients to foresee evolving requirements, developing cutting-edge solutions before they become critical needs. This forward-looking strategy, evidenced by their consistent investment in research and development, ensures agencies remain at the forefront of technological progress and threat mitigation.

This proactive stance fosters enduring relationships by demonstrating CACI's dedication to shared success and client advancement. For instance, CACI's focus on emerging technologies like artificial intelligence and cybersecurity is directly aligned with anticipated government needs in these rapidly changing domains.

- Anticipatory Solution Design CACI invests in R&D to create solutions that address future government challenges, not just current ones.

- Strategic Partnerships This proactive approach solidifies CACI's role as a long-term partner, essential for government modernization efforts.

- Technological Foresight By staying ahead of technological curves, CACI enables government agencies to maintain operational superiority.

- Commitment to Mutual Success Developing solutions ahead of demand underscores CACI's dedication to the long-term success and effectiveness of its clients.

Ethical and Transparent Dealings

CACI prioritizes ethical and transparent dealings in its customer relationships, a crucial element when serving the government sector. This unwavering commitment to integrity is a cornerstone of their business, contributing to their recognition on Forbes' America's Most Trusted Companies list. This trust is not just a badge of honor; it directly impacts their ability to secure and maintain significant government contracts.

- Ethical Foundation: CACI builds its customer relationships on a bedrock of ethical conduct and complete transparency.

- Trusted Reputation: This dedication to integrity earned CACI a place on Forbes' America's Most Trusted Companies list.

- Contractual Advantage: A strong reputation for trustworthiness is essential for winning and keeping lucrative government contracts.

- Client Confidence: Transparency fosters deep client confidence, leading to long-term partnerships and repeat business.

CACI cultivates deep, long-term relationships with government clients by acting as a trusted advisor, understanding their missions, and proactively developing solutions. This focus on partnership, exemplified by a customer retention rate exceeding 90% in fiscal year 2023, ensures client satisfaction and repeat business.

Their approach emphasizes performance, delivering measurable results and tangible value to clients, which solidifies their reputation as a dependable partner. In fiscal year 2023, CACI secured significant contract wins and completed projects that directly contributed to client mission success.

CACI’s commitment to ethical and transparent dealings is paramount, earning them a spot on Forbes' America's Most Trusted Companies list, which is critical for securing and maintaining government contracts.

These strong relationships are built on a foundation of integrity, proactive problem-solving, and a dedication to the shared success of their government partners.

Channels

CACI's primary channel involves direct engagement with U.S. federal government agencies. This is achieved through competitive bidding for new contracts and task orders, as well as sole-source awards. In fiscal year 2023, CACI secured approximately $6.2 billion in net contract awards.

CACI's business development teams are instrumental in this channel, actively identifying opportunities and crafting compelling proposals. This direct interaction fosters a deep understanding of specific agency requirements and challenges, enabling tailored solutions.

CACI heavily utilizes Government-Wide Acquisition Contracts (GWACs) and Indefinite Delivery/Indefinite Quantity (IDIQ) vehicles. These established contract types simplify and accelerate the government's ability to procure CACI's diverse range of technology and services. For instance, CACI's participation in SeaPort Next Generation and the DoD Information Analysis Center's MAC vehicle allows agencies to quickly access CACI's expertise.

Strategic acquisitions are a key channel for CACI to grow its customer base and market presence. By acquiring companies, CACI instantly gains access to their existing contracts and client relationships, speeding up market entry and broadening its client roster.

For instance, CACI's acquisition of Azure Summit Technology in 2022 for $325 million immediately expanded its capabilities in areas like cloud solutions and cyber operations, bringing with it a significant portfolio of government contracts and a skilled workforce.

Similarly, the acquisition of Applied Insight in 2021, for an undisclosed sum, bolstered CACI's position in the intelligence community and provided access to advanced data analytics and cyber solutions, further diversifying its service offerings and client base.

Industry Conferences and Events

CACI leverages industry conferences and events as a critical channel for engaging with the government and defense sectors. These gatherings provide a platform to showcase CACI's technological prowess and solutions directly to key decision-makers and potential clients.

Participation in these events is vital for building relationships and understanding evolving government needs. For instance, CACI actively participates in events like the annual Association of the United States Army (AUSA) Annual Meeting and Exposition, a major defense industry event. In 2023, AUSA reported over 33,000 attendees, offering significant networking opportunities.

These interactions allow CACI to:

- Network with government officials and prime contractors

- Demonstrate advanced capabilities in areas like cyber and digital transformation

- Identify and pursue new contract opportunities

- Gather market intelligence on competitor activities and emerging trends

Referrals and Past Performance

CACI's track record of successful project delivery and a strong reputation within the government sector are key drivers for its referral business. This organic growth channel is fueled by satisfied clients who actively recommend CACI for new opportunities, reinforcing its credibility in competitive procurements.

In fiscal year 2023, CACI reported a significant increase in its backlog, reaching $27.2 billion as of June 30, 2023. This growth is indicative of the trust and reliance placed upon the company by its government clients, a direct result of consistent past performance.

- Proven Track Record: CACI's history of delivering complex solutions on time and within budget fosters client confidence.

- Client Satisfaction: High levels of customer satisfaction translate into strong word-of-mouth referrals.

- Industry Credibility: Consistent positive performance builds a reputation that attracts new business through recommendations.

- Repeat Business: Successful past engagements often lead to clients seeking CACI for follow-on work or new projects.

CACI's primary channels involve direct engagement with U.S. federal government agencies through competitive bidding and sole-source awards, securing approximately $6.2 billion in net contract awards in fiscal year 2023. They also leverage strategic acquisitions to expand their customer base and market presence, as seen with the 2022 acquisition of Azure Summit Technology for $325 million. Industry conferences and events serve as vital platforms for showcasing capabilities and building relationships with key decision-makers.

| Channel | Description | Key Metrics/Examples |

|---|---|---|

| Direct Government Engagement | Bidding on contracts and task orders, sole-source awards. | $6.2 billion in net contract awards (FY23). |

| Strategic Acquisitions | Purchasing companies to gain contracts and clients. | Azure Summit Technology acquisition ($325M in 2022). |

| Industry Events | Showcasing solutions at conferences like AUSA. | AUSA reported over 33,000 attendees in 2023. |

| Referral Business | Organic growth from satisfied clients. | $27.2 billion backlog as of June 30, 2023. |

Customer Segments

The U.S. Department of Defense (DoD) represents CACI's most substantial customer segment, a critical partnership that underpins a significant portion of the company's business. This segment includes major branches like the U.S. Army, U.S. Navy, and various combatant commands such as U.S. European Command and U.S. Space Command.

CACI delivers essential mission-critical expertise and advanced technology solutions to these defense entities, focusing on supporting defense operations, intelligence gathering, and modernization initiatives. For instance, in fiscal year 2023, CACI reported that approximately 80% of its revenue was derived from its federal government customers, with the DoD being the dominant contributor.

CACI's U.S. Intelligence Community segment is a cornerstone, delivering specialized solutions for national security. These services are crucial for agencies focused on signals intelligence, advanced data analytics, and robust cybersecurity, areas vital for safeguarding national interests.

In 2023, CACI secured significant contracts with intelligence agencies, including a notable award for enterprise IT and cyber services valued at over $1 billion. This demonstrates the deep trust and reliance these customers place on CACI's mission knowledge and technical expertise.

CACI's U.S. Federal Civilian Agencies segment targets non-defense government bodies needing IT upgrades and digital services. For instance, CACI supports NASA in streamlining and centralizing their IT operations through advanced digital solutions.

This focus aims to boost efficiency and modernize how these agencies serve the public. In fiscal year 2023, CACI reported significant revenue from its U.S. Public Sector segment, which includes these civilian agencies, highlighting their importance to CACI's business.

International Government and Commercial Entities

While CACI's core business is with the U.S. federal government, it actively pursues opportunities with international government bodies and commercial enterprises. This strategic diversification is evident in projects like their work with the U.K. Home Office, demonstrating their capability to serve foreign governmental needs.

Furthermore, CACI's engagement extends to the commercial sector, as seen in their development of a real-time communications program for the airline easyJet. These international and commercial ventures, though representing a smaller portion of their overall revenue, are crucial for expanding CACI's global footprint and creating new avenues for growth.

- International Government Engagement: CACI has secured contracts with entities such as the U.K. Home Office, showcasing their ability to deliver solutions beyond the U.S. market.

- Commercial Sector Expansion: Projects like the real-time communications program for easyJet highlight CACI's growing presence in commercial aviation and related technology solutions.

- Revenue Diversification: This segment, while smaller, contributes to CACI's strategy of broadening its customer base and reducing reliance on any single market.

Specialized Mission-Specific Groups

CACI specifically targets government entities with highly specialized mission requirements, moving beyond broad defense categories. This focus includes critical areas such as navigation warfare, where precise positioning and timing are paramount, and support for unmanned systems, a rapidly growing domain in defense operations.

Within this segment, CACI's expertise is crucial for organizations engaged in electronic warfare, a field demanding advanced capabilities to detect, analyze, and counter enemy electronic signals. The company’s tailored solutions address these niche, complex operational needs, demonstrating a deep understanding of unique military challenges.

- Navigation Warfare: CACI provides solutions to ensure accurate and secure navigation, vital for all military operations, especially in contested environments.

- Unmanned Systems Support: The company offers advanced technologies and services for the development, integration, and operation of unmanned platforms across land, sea, and air.

- Electronic Warfare: CACI delivers cutting-edge systems and expertise to enhance situational awareness and provide a decisive advantage in the electromagnetic spectrum.

CACI's customer base is primarily concentrated within the U.S. federal government, with the Department of Defense (DoD) and the Intelligence Community representing the largest segments. These entities rely on CACI for mission-critical technology and expertise, particularly in areas like advanced analytics, cybersecurity, and IT modernization. Fiscal year 2023 data shows that approximately 80% of CACI's revenue came from federal government customers, underscoring the significance of these relationships.

| Customer Segment | Key Focus Areas | FY23 Revenue Contribution (Approx.) |

|---|---|---|

| U.S. Department of Defense (DoD) | Defense operations, intelligence, modernization, navigation warfare, unmanned systems, electronic warfare | ~60-70% of federal revenue |

| U.S. Intelligence Community | National security, signals intelligence, data analytics, cybersecurity | ~10-20% of federal revenue |

| U.S. Federal Civilian Agencies | IT upgrades, digital services, operational efficiency (e.g., NASA) | Remainder of federal revenue |

| International Government & Commercial | Diversification, global footprint expansion (e.g., U.K. Home Office, easyJet) | Smaller, growing segment |

Cost Structure

CACI's cost structure is heavily influenced by its personnel and labor expenses. With a workforce exceeding 25,000 individuals, the company dedicates a substantial portion of its budget to salaries, comprehensive benefits packages, and ongoing training programs. This investment in human capital is critical for maintaining its competitive edge as a professional services and technology provider.

Attracting and retaining highly skilled professionals is paramount for CACI, necessitating competitive compensation and development opportunities. These personnel costs are directly linked to the company's ability to deliver its core expertise and services, forming a foundational element of its operational expenses.

CACI invests heavily in Research and Development (R&D) to stay ahead in technology. These costs are essential for developing new and improving existing proprietary solutions, particularly in areas like artificial intelligence, cybersecurity, and advanced analytics, which are critical for their government clients.

In fiscal year 2023, CACI reported $308 million in R&D expenses. This significant investment underscores their commitment to innovation, enabling them to offer cutting-edge capabilities that meet the dynamic and often complex requirements of national security and government modernization efforts.

CACI's growth strategy heavily relies on acquisitions, which incur substantial upfront costs for company purchases. These include expenses for due diligence, legal services, and the complex process of integrating acquired businesses into CACI's existing operations and IT systems.

Ongoing integration expenses are also significant, covering the harmonization of business processes, employee assimilation, and system upgrades. For instance, CACI's 2023 fiscal year saw substantial investment in integrating recent acquisitions such as Azure Summit Technology and Applied Insight, impacting their overall cost structure.

Operational and Overhead Costs

CACI's operational and overhead costs encompass a broad range of expenditures essential for supporting its extensive government contracting operations. These include the upkeep of numerous facilities, the maintenance and upgrading of sophisticated IT infrastructure necessary for secure data handling, and the costs associated with administrative functions like human resources, legal, and finance. General corporate overhead, such as executive salaries and corporate-level marketing, also falls into this category.

The significant investment in maintaining a robust operational framework to support widespread government contracts across diverse locations is a key driver of these costs. CACI's presence in multiple geographic areas, often requiring specialized infrastructure and personnel, directly contributes to its operational expenditure. For instance, the need for secure facilities and specialized IT systems to comply with government security requirements adds to the overall cost base.

Efficient management of these operational and overhead costs is paramount for CACI's profitability. In fiscal year 2023, CACI reported total operating expenses of $6.0 billion, with a significant portion attributable to these overhead and operational elements. The company's ability to streamline processes, leverage technology, and optimize its facility footprint directly impacts its bottom line.

- Facilities Management: Costs associated with maintaining a distributed network of offices and secure operational centers.

- IT Infrastructure: Expenses for hardware, software, cybersecurity, and network maintenance supporting extensive government contracts.

- Administrative Functions: Expenditures on human resources, legal, finance, and compliance departments.

- General Corporate Overhead: Costs related to executive leadership, corporate strategy, and enterprise-wide support services.

Contract-Specific Costs and Subcontractor Expenses

For large government contracts, CACI incurs direct costs for project execution, including specialized equipment, software licenses, and materials. For instance, in fiscal year 2023, CACI's cost of revenue was $5.6 billion, reflecting these direct project-related expenditures.

The company frequently engages subcontractors for specific tasks or specialized capabilities, resulting in substantial subcontractor expenses. These outlays are variable and directly correlate with the scale and requirements of the contracts secured.

- Direct Project Costs: Includes specialized equipment, software licenses, and materials essential for contract fulfillment.

- Subcontractor Expenses: Significant costs arise from utilizing third-party providers for specific expertise or services.

- Variability: These costs are directly tied to the volume and nature of awarded government contracts.

CACI's cost structure is predominantly driven by its significant investment in personnel, with salaries, benefits, and training representing a major expenditure. The company also allocates substantial funds to Research and Development (R&D) to maintain technological leadership, as evidenced by its $308 million R&D spend in fiscal year 2023. Furthermore, acquisition integration and the ongoing operational costs of supporting extensive government contracts, including facilities and IT infrastructure, are key components of its cost base.

| Cost Category | Fiscal Year 2023 (in millions USD) | Key Drivers |

|---|---|---|

| Personnel Costs | (Not explicitly itemized, but a significant portion of Operating Expenses) | Salaries, benefits, training for 25,000+ employees |

| Research & Development (R&D) | $308 | Developing new solutions in AI, cybersecurity, advanced analytics |

| Acquisition Integration | (Included within operating expenses) | Due diligence, legal, IT integration, employee assimilation |

| Operational & Overhead Costs | (Significant portion of Operating Expenses) | Facilities, IT infrastructure, administrative functions, corporate overhead |

| Direct Project Costs & Subcontractors | $5,600 (Cost of Revenue) | Specialized equipment, software licenses, materials, third-party services |

Revenue Streams

Government service contracts represent CACI's core revenue engine, primarily through engagements with the U.S. federal government. These long-term agreements focus on delivering specialized information solutions and professional services, spanning critical areas such as cybersecurity, advanced data analytics, and comprehensive enterprise IT support. CACI's demonstrated ability to consistently win and execute these vital contracts directly fuels its overall revenue growth.

CACI's revenue engine is significantly fueled by securing new business opportunities and growing its existing client relationships. This strategy is evident in their consistent performance, demonstrating an ability to attract and retain valuable contracts.

In fiscal year 2024, CACI achieved a notable milestone, recording $14 billion in contract awards. A considerable portion of these awards represented new business wins, underscoring the company's success in expanding its market footprint and acquiring fresh projects.

This ongoing success in both new contract acquisition and the expansion of current programs creates a strong and dependable pipeline for future revenue generation. It highlights CACI's strategic focus on sustainable growth through a dynamic approach to client engagement and project development.

Revenue from acquired entities is a significant driver for CACI, as these strategic purchases immediately inject their existing revenue streams into the company. For instance, the acquisition of Azure Summit Technology and Applied Insight in 2021 brought with them established contracts and ongoing programs, contributing to CACI's top line.

This approach allows CACI to rapidly scale its operations and market presence by absorbing the revenue-generating capabilities of acquired businesses. It's a key strategy for diversifying its service offerings and expanding into new market segments, bolstering overall financial performance.

Technology and Product Sales

While CACI is widely recognized for its extensive services, a significant portion of its revenue also stems from the sale of technology and product offerings. This segment includes specialized hardware and software solutions, often developed internally or through strategic acquisitions. These products are particularly strong in niche areas such as signals intelligence and electronic warfare.

These technology sales frequently act as a crucial complement to CACI's larger, integrated service contracts. For instance, in fiscal year 2023, CACI reported total revenue of $6.5 billion, with its technology solutions contributing to this overall performance. The company's focus on innovation means these product lines are continuously evolving to meet advanced defense and intelligence needs.

- Technology Sales: Revenue generated from the sale of specialized hardware and software.

- Product Integration: Products often enhance or are bundled with broader service offerings.

- Market Focus: Key areas include signals intelligence and electronic warfare solutions.

- Fiscal Year 2023 Performance: CACI's overall revenue reached $6.5 billion, with technology products playing a supporting role.

Long-Term Contract Backlog Conversion

CACI's significant contract backlog, standing at $31.8 billion as of December 31, 2024, is a key revenue stream. This backlog represents contracted work yet to be performed, providing a clear line of sight into future earnings.

The conversion of this backlog into recognized revenue is a predictable and substantial component of CACI's financial model. As services are delivered according to contract terms, the backlog is steadily drawn down, directly translating into earned income.

- $31.8 Billion: Total contract backlog as of December 31, 2024.

- Revenue Visibility: Provides strong predictability for future financial performance.

- Stable Foundation: Underpins CACI's financial planning and operational stability.

- Service Delivery Conversion: Revenue is realized as services are rendered over contract durations.

CACI's revenue streams are robust, primarily driven by government service contracts, new business wins, and strategic acquisitions. The company also generates income from technology and product sales, often integrated with its service offerings. A substantial contract backlog provides significant visibility into future revenue.

| Revenue Stream | Description | Fiscal Year 2024 Impact |

|---|---|---|

| Government Service Contracts | Core business, providing specialized IT and professional services to the U.S. federal government. | $14 billion in contract awards, indicating strong demand. |

| New Business & Client Growth | Securing new contracts and expanding existing client relationships. | Key driver for consistent revenue performance and pipeline. |

| Acquisitions | Integrating revenue from acquired companies like Azure Summit Technology. | Rapidly scales operations and diversifies service offerings. |

| Technology & Product Sales | Sale of specialized hardware and software, particularly in signals intelligence. | Complements service contracts; contributed to $6.5 billion total revenue in FY23. |

| Contract Backlog | Unperformed contracted work, providing future revenue certainty. | $31.8 billion backlog as of December 31, 2024, ensures predictable earnings. |

Business Model Canvas Data Sources

The CACI Business Model Canvas is populated with data from CACI's internal financial reports, market research studies, and strategic planning documents. This comprehensive approach ensures each component accurately reflects CACI's operational realities and future direction.