CACI PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CACI Bundle

Understand how political, economic, and technological forces impact CACI's performance. This ready-made PESTEL Analysis delivers expert-level insights—perfect for investors, consultants, and business planners. Buy the full version to get the complete breakdown instantly.

Political factors

CACI International's revenue is heavily tied to U.S. federal government spending, especially defense and intelligence budgets. Changes in these allocations directly influence CACI's financial health.

For fiscal year 2025, CACI projects revenues between $8.45 billion and $8.65 billion. A substantial portion of this revenue is expected to come from ongoing government programs, suggesting a degree of resilience against immediate shifts in budgetary focus.

CACI's core business directly supports U.S. national security and defense, with significant investments flowing into cybersecurity, space, and electronic warfare. The 2024 National Defense Authorization Act (NDAA) allocated over $886 billion, signaling robust government spending in these critical areas where CACI excels. This alignment with enduring, well-funded national priorities ensures consistent demand for CACI's specialized solutions.

Changes in federal contracting policies, such as a potential shift towards fixed-price contracts from cost-plus arrangements, could impact CACI's profitability. For instance, the U.S. federal government's fiscal year 2023 saw continued emphasis on efficiency, with approximately $700 billion allocated to federal contracting, representing a significant portion of government spending that CACI aims to secure.

CACI's management remains optimistic, highlighting the predictable nature of its revenue, particularly from its software and IT solutions. Initiatives like the Biden administration's focus on cybersecurity and digital modernization in 2024 are expected to drive demand for CACI's services, even amidst broader discussions about federal budget constraints.

Geopolitical Landscape and International Relations

Global geopolitical tensions are a significant driver for CACI International. Increased demand for defense and intelligence solutions, especially in signals intelligence and electronic warfare, directly correlates with heightened international instability. CACI's existing contracts with organizations like NATO Allied Special Operations Forces Command and U.S. European and Africa Commands underscore its strategic positioning in addressing these global security needs.

CACI's revenue from its Defense Solutions segment was approximately $2.3 billion for the fiscal year ending June 30, 2023, reflecting the substantial market for its services amidst ongoing global security challenges. This segment represents a significant portion of the company's overall business, demonstrating the direct impact of the geopolitical landscape on its financial performance.

- Increased demand for CACI's advanced intelligence and cyber solutions in regions experiencing heightened geopolitical risk.

- CACI's role in supporting allied military operations and intelligence sharing directly benefits from collaborative defense initiatives.

- The company's ability to adapt to evolving threat landscapes is crucial for maintaining its competitive edge in the defense sector.

Regulatory and Compliance Environment

CACI International Inc. navigates a complex web of government regulations as a primary contractor, impacting everything from data handling to ethical business practices. Compliance is paramount for securing and performing on federal contracts, with significant penalties for violations. For instance, in fiscal year 2023, CACI reported that a substantial portion of its revenue was derived from U.S. government contracts, underscoring the critical nature of maintaining a clean compliance record.

The company actively engages in lobbying to influence policies affecting its core business areas. In 2024, CACI has been vocal in advocating for advancements in photonics and electronic warfare systems, seeking to shape legislation that supports technological development and procurement in these sectors. This proactive approach aims to create a more favorable operating environment and secure future opportunities.

- Data Privacy and Cybersecurity: CACI must adhere to stringent regulations like the Federal Information Security Modernization Act (FISMA) and various data protection mandates, crucial for handling sensitive government information.

- Ethical Conduct and Contract Compliance: Maintaining high ethical standards and strict adherence to contract terms are non-negotiable, directly influencing CACI's eligibility for government work.

- Lobbying Focus: CACI's lobbying efforts in 2024 concentrate on photonics and electronic warfare, seeking to align government policy with its strategic growth areas.

- Government Contract Dependency: The significant reliance on government contracts means regulatory changes and shifts in government spending priorities pose direct risks and opportunities.

Political stability and government spending priorities are paramount for CACI. The company's significant reliance on U.S. federal contracts means that shifts in administration, legislative agendas, and budgetary allocations directly impact its revenue streams and growth prospects. For instance, CACI's projected revenue of $8.45 billion to $8.65 billion for fiscal year 2025 is heavily influenced by the continuity of defense and intelligence spending.

Government policies on technology procurement, cybersecurity standards, and outsourcing also shape CACI's operational landscape. The 2024 National Defense Authorization Act, with its over $886 billion allocation, highlights areas like cybersecurity and electronic warfare where CACI is strategically positioned, demonstrating how legislative support can translate into tangible business opportunities.

CACI's engagement in lobbying efforts, particularly concerning advancements in photonics and electronic warfare in 2024, underscores its proactive approach to influencing policy. This direct involvement aims to align government priorities with the company's expertise, thereby securing future contracts and fostering innovation in critical national security sectors.

| Factor | Impact on CACI | 2024/2025 Data/Trend |

|---|---|---|

| Government Spending Priorities | Directly influences revenue and contract awards. | Continued strong focus on defense, intelligence, and cybersecurity budgets. |

| Regulatory Environment | Affects compliance costs, data handling, and contract eligibility. | Stringent adherence to FISMA and data protection mandates is critical. |

| Lobbying and Policy Influence | Shapes future government technology investments and procurement. | CACI advocates for photonics and electronic warfare advancements in 2024. |

| Geopolitical Landscape | Drives demand for defense and intelligence solutions. | Global tensions increase need for CACI's signals intelligence and EW capabilities. |

What is included in the product

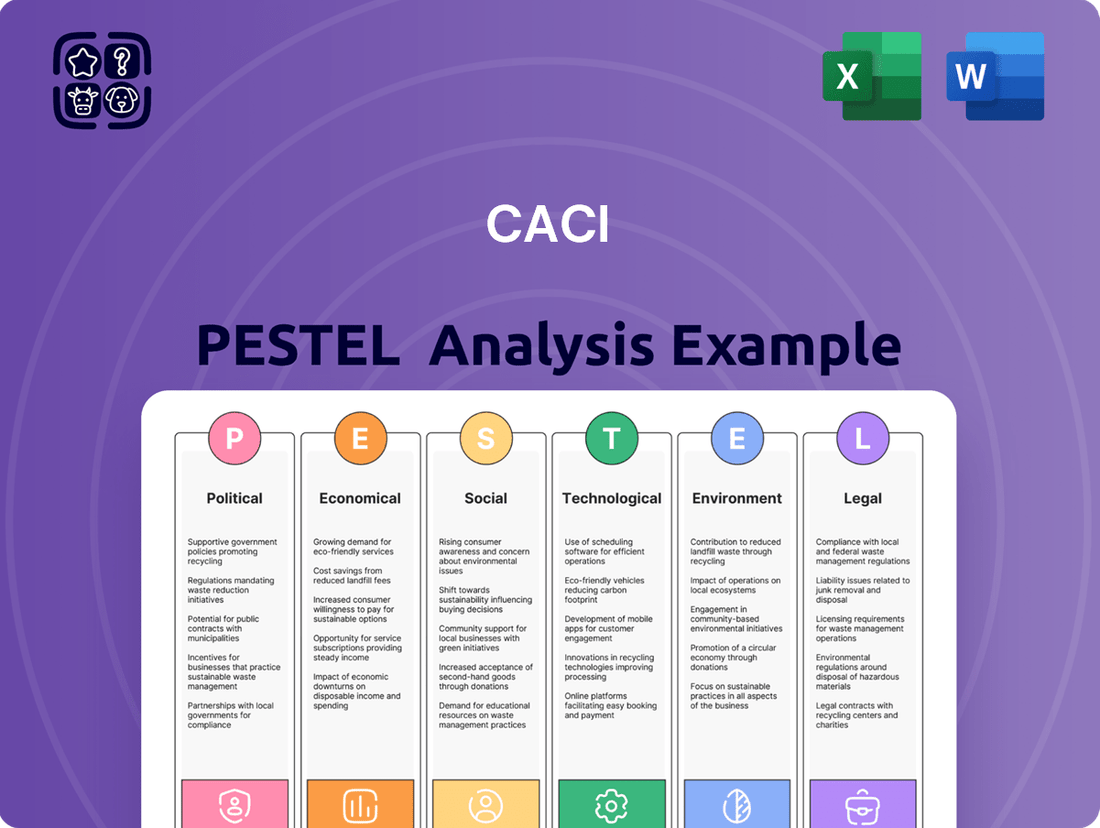

The CACI PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting CACI, providing a comprehensive understanding of the external landscape.

Provides a clear, actionable framework that simplifies complex external factors, enabling teams to quickly identify and address potential market challenges and opportunities.

Economic factors

CACI's financial health is closely tied to U.S. federal spending, especially within defense and intelligence sectors. The company's fiscal year 2024 saw robust revenue growth, and it boosted its fiscal year 2025 outlook. This positive trajectory is fueled by substantial contract wins and an expanding backlog, signaling continued strong government investment in CACI's core capabilities.

Inflationary pressures can directly impact CACI's operational costs. For instance, rising labor expenses, a significant component for a services company, and increased costs for materials or technology could squeeze profit margins if not effectively passed on to clients. The US CPI rose 3.4% year-over-year in April 2024, indicating persistent, though moderating, inflation.

Furthermore, changes in interest rates significantly affect CACI's financial strategy. Higher borrowing costs, as interest rates climb, can make debt-financed activities like share buybacks or strategic acquisitions more expensive, potentially altering capital allocation decisions. The Federal Reserve kept its benchmark interest rate steady in the 5.25%-5.50% range as of May 2024, but future adjustments will remain a key consideration.

The U.S. economy's trajectory directly impacts government budgets and, by extension, CACI's contract opportunities. A robust economic environment typically translates to sustained or elevated government expenditure, a positive indicator for CACI's revenue streams.

For instance, the U.S. GDP grew by an estimated 2.5% in 2023, signaling a healthy economic climate that can support continued federal investment in technology and defense sectors, CACI's core markets. This growth underpins the government's capacity to award and fund contracts.

Competition and Market Dynamics

CACI operates within a fiercely competitive landscape, facing numerous rivals, many of which possess superior financial backing and scale. Its success in securing new contracts and preserving its market standing hinges on its unique strengths and strategic maneuvers, including acquisitions aimed at bolstering its cloud migration or electronic warfare capabilities.

The defense and IT services sector saw significant activity in 2024. For instance, in the first half of 2024, the IT services market, which includes many of CACI's operational areas, experienced consolidation with several mid-sized players being acquired. This trend underscores the importance of strategic M&A for maintaining competitive advantage.

- Increased Competition: CACI contends with established giants and agile niche players, demanding continuous innovation.

- Strategic Acquisitions: Recent acquisitions in 2024, such as those focusing on AI and cybersecurity, highlight CACI's strategy to differentiate and expand its service portfolio.

- Market Share Defense: Maintaining market share requires CACI to consistently demonstrate superior technological solutions and cost-effectiveness against competitors.

- Customer Retention: Deepening relationships with existing government clients is crucial, as contract renewals are a significant revenue driver amidst intense bidding processes.

Labor Market and Wage Trends

The availability of skilled talent, especially in high-demand sectors like cybersecurity, artificial intelligence, and data analytics, directly influences CACI's capacity to innovate and deliver sophisticated government solutions. The US unemployment rate remained low in early 2024, hovering around 3.7%, indicating a tight labor market where specialized skills are at a premium.

Wage trends and the competitive environment for acquiring and keeping top talent are significant factors affecting CACI's operational expenses and its ability to secure the expertise needed for complex projects. For instance, average salaries for cybersecurity analysts in the US saw an increase of approximately 5-8% in 2023 compared to the previous year, reflecting the intense demand.

- Skilled Talent Demand: CACI relies heavily on professionals proficient in cybersecurity, AI, and data analytics to meet government contract requirements.

- Wage Pressures: Rising wages in specialized tech fields impact CACI's labor costs and its competitive edge in talent acquisition.

- Talent Retention: Maintaining a highly skilled workforce is crucial for CACI's consistent delivery of advanced technological services to its clients.

Economic factors significantly shape CACI's operating environment, particularly its reliance on U.S. government spending. A robust economy generally supports higher defense and intelligence budgets, which directly benefit CACI's revenue streams. The projected U.S. GDP growth for 2024 and 2025 will therefore be a key indicator of future contract opportunities and government investment capacity.

Preview the Actual Deliverable

CACI PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive CACI PESTLE analysis delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing valuable strategic insights.

Sociological factors

CACI's success hinges on its ability to attract and retain a highly skilled workforce, particularly in specialized technical fields like cybersecurity and IT. As of fiscal year 2023, CACI reported a workforce of approximately 24,000 employees, underscoring the scale of its talent needs. The company's commitment to developing this talent pool, through continuous training and development programs, is critical for maintaining its competitive edge in the national security sector.

To address future talent demands, CACI actively engages in initiatives aimed at bolstering STEM education. These programs are designed to inspire the next generation of engineers and IT professionals, ensuring a robust pipeline of qualified candidates for the company. This forward-thinking approach to workforce development is essential for CACI to adapt to evolving technological landscapes and client requirements.

CACI's corporate culture, emphasizing character, integrity, and innovation, is a significant factor in its success and desirability as an employer. This strong internal environment is evidenced by CACI being named a 'Top Workplace USA' for five consecutive years and a 'Fortune World's Most Admired Company' for eight consecutive years, reflecting high employee engagement and satisfaction.

Public perception and trust are critical for CACI, especially as a government contractor focused on national security. Maintaining a strong reputation for ethics and integrity is not just good practice; it's essential for securing and retaining government contracts. For instance, CACI's 2023 Corporate Responsibility Report highlights their dedication to ethical conduct and transparency, which directly influences how government agencies and the public view their operations.

Community Engagement and Social Responsibility

CACI actively demonstrates its commitment to community engagement and social responsibility. In 2023, the company continued its long-standing support for military service members, veterans, and their families through various programs. This focus aligns with societal expectations for businesses to contribute positively to the well-being of those who serve.

Beyond military support, CACI also engages in environmental initiatives. Their partnerships with non-profit organizations highlight a dedication to sustainability and the health of the communities where their employees operate. This proactive approach to corporate citizenship builds goodwill and strengthens the company's social license to operate.

Key aspects of CACI's social responsibility include:

- Support for Military Families: Continued investment in programs aiding military families, reflecting a deep respect for their sacrifices.

- Environmental Partnerships: Collaborations with environmental non-profits to promote sustainability and conservation efforts.

- Employee Volunteerism: Encouraging and facilitating employee participation in local community service and charitable activities.

Diversity, Equity, and Inclusion (DEI)

CACI, like many large corporations, is increasingly prioritizing Diversity, Equity, and Inclusion (DEI) to attract a wide range of talent and cultivate an inclusive workplace. This focus is crucial for building a stronger workforce and fostering a more resilient corporate culture.

While specific CACI DEI metrics for 2024/2025 aren't publicly detailed in the provided context, industry trends show a significant push. For instance, in 2023, the U.S. workforce reported that 57% of employees believed their company was committed to DEI, a number that continues to grow as companies recognize its strategic advantage.

- Talent Acquisition: A strong DEI commitment helps CACI attract a diverse pool of candidates, essential for innovation and problem-solving in the technology and consulting sectors.

- Employee Engagement: Inclusive environments boost morale and productivity, leading to higher retention rates. Companies with strong DEI programs often see higher employee engagement scores.

- Reputation and Brand Image: Demonstrating a commitment to DEI enhances CACI's reputation among customers, partners, and potential employees, aligning with societal expectations.

- Innovation: Diverse teams bring varied perspectives, which is vital for CACI's innovation in areas like cybersecurity and digital transformation. Research indicates diverse teams are more likely to outperform their less diverse counterparts.

Societal trends significantly influence CACI's operational landscape, particularly concerning workforce expectations and corporate responsibility. As of fiscal year 2023, CACI employed around 24,000 individuals, highlighting the importance of attracting and retaining talent in a competitive market. The company's emphasis on character, integrity, and innovation, recognized by accolades like Fortune World's Most Admired Company for eight consecutive years, directly impacts its ability to draw and keep skilled professionals.

Technological factors

CACI is significantly investing in AI and machine learning to bolster its capabilities, especially for critical clients like the Department of Defense and the Intelligence Community. This focus is evident in their strategic acquisitions and internal development efforts, aiming to integrate cutting-edge AI solutions across their service portfolio.

The company utilizes AI for sophisticated data analysis, pinpointing objects and detecting anomalies with greater accuracy. Furthermore, CACI employs natural language processing to understand and interpret vast amounts of textual data, and automates cyber defense mechanisms to provide rapid threat response. For instance, in 2023, CACI reported substantial growth in its AI-driven solutions, contributing to a significant portion of its new contract wins, reflecting the increasing demand for intelligent automation in defense and intelligence sectors.

CACI's core business thrives on advancements in cybersecurity and data analytics. The company actively develops and integrates solutions designed to safeguard critical government information networks and modernize cyber infrastructure. This focus is paramount for national security, especially given the increasing sophistication of cyber threats.

In 2024, the global cybersecurity market was projected to reach over $230 billion, highlighting the immense demand for CACI's expertise. Furthermore, the company's investment in advanced data visualization technology directly addresses the growing need for actionable intelligence derived from complex datasets, a crucial element for effective decision-making in defense and intelligence sectors.

CACI's commitment to agile development and software-defined solutions is a key technological driver. This allows them to quickly adapt and deliver new capabilities to government clients, a critical advantage in a rapidly changing environment. For instance, their work in modernizing legacy systems often involves iterative development cycles, enabling faster deployment of enhanced functionalities.

Space Technology and Optical Communications

CACI's deep involvement in space technology, particularly in optical communications, positions it at the forefront of a rapidly evolving technological landscape. The company's contributions to NASA's deep space optical communications initiatives underscore its advanced capabilities. For instance, CACI's technology was integral to NASA's Laser Communications Relay Demonstration (LCRD), which successfully transmitted data at significantly higher rates than traditional radio frequencies. This showcases the potential for faster, more efficient data transfer in space, a critical factor for future exploration and operations.

Furthermore, CACI's support for classified national security customers in space technology operations highlights its crucial role in secure and advanced communication systems. The global space economy is projected to reach $1.7 trillion by 2040, according to Morgan Stanley, with optical communications expected to be a significant growth driver. CACI's expertise in this area, demonstrated by its work with government agencies, aligns with this market expansion, suggesting strong future demand for its specialized services.

Key technological factors impacting CACI include:

- Advancements in Optical Communications: CACI's expertise in this area supports higher bandwidth and faster data transmission for space-based applications, crucial for increasing data volumes from Earth observation and deep space missions.

- National Security Space Systems: The company's involvement in classified programs demonstrates its capacity to develop and support highly secure and advanced communication technologies vital for national defense and intelligence.

- Growth of the Space Economy: CACI's capabilities are well-positioned to capitalize on the expanding global space sector, which is increasingly reliant on sophisticated communication infrastructure.

Electronic Warfare (EW) and Signals Intelligence (SIGINT)

CACI International is a significant contributor to the advancement of Electronic Warfare (EW) and Signals Intelligence (SIGINT) capabilities, particularly for the U.S. Army and other defense organizations. Their expertise and technological solutions are crucial for modern defense operations. For instance, CACI's work in this domain supports the Army's efforts to gain information superiority and counter evolving threats in contested electromagnetic spectrums.

Recent strategic moves, like the acquisition of Azure Summit Technology in late 2023, underscore CACI's commitment to bolstering its EW and SIGINT portfolio. This acquisition, valued at approximately $300 million, brought specialized expertise in areas like advanced EW systems and artificial intelligence-driven SIGINT analysis, further enhancing CACI's ability to deliver cutting-edge solutions.

- Enhanced SIGINT Capabilities: CACI's integration of Azure Summit Technology's AI-powered analytics is designed to improve the speed and accuracy of processing vast amounts of intelligence data.

- Advanced EW Solutions: The company provides critical EW systems that enable forces to detect, identify, and disrupt enemy electronic activities, ensuring operational effectiveness.

- Market Growth: The global EW market is projected to grow significantly, with estimates suggesting it could reach over $30 billion by 2028, indicating a strong demand for CACI's specialized services.

- U.S. Army Focus: CACI plays a vital role in supporting the U.S. Army's modernization efforts, including its initiatives to develop next-generation EW and SIGINT platforms.

CACI is deeply invested in artificial intelligence and machine learning, particularly for its government clients, enhancing data analysis and threat detection capabilities. Their strategic acquisitions and internal development in 2023 and 2024 focused on integrating AI across their service offerings, leading to significant new contract wins in defense and intelligence sectors.

The company's commitment to cybersecurity and data analytics is a core technological driver, with active development of solutions to protect critical government networks against increasingly sophisticated threats. The global cybersecurity market's projected growth to over $230 billion in 2024 underscores the high demand for CACI's expertise in this area.

CACI's technological edge is further sharpened by its expertise in optical communications for space applications and its significant contributions to electronic warfare (EW) and signals intelligence (SIGINT). The acquisition of Azure Summit Technology in late 2023, for approximately $300 million, significantly bolstered its EW and SIGINT capabilities, particularly through AI-driven analysis.

| Technological Factor | Description | Impact on CACI | Market Data/Projections |

|---|---|---|---|

| AI & Machine Learning | Enhancing data analysis, object detection, and anomaly identification. | Drives new contract wins and strengthens service portfolio for defense and intelligence. | Significant growth in AI-driven solutions contribution to new contracts in 2023. |

| Cybersecurity & Data Analytics | Developing solutions to safeguard critical networks and modernize cyber infrastructure. | Addresses increasing sophistication of cyber threats, a core business area. | Global cybersecurity market projected over $230 billion in 2024. |

| Optical Communications | Enabling higher bandwidth and faster data transmission for space applications. | Positions CACI at the forefront of the expanding space economy. | Space economy projected to reach $1.7 trillion by 2040 (Morgan Stanley). |

| Electronic Warfare (EW) & SIGINT | Improving intelligence data processing and providing advanced EW systems. | Strengthened through acquisitions like Azure Summit Technology (late 2023, ~$300M). | Global EW market projected over $30 billion by 2028. |

Legal factors

CACI's extensive work with the U.S. federal government means its operations are heavily influenced by stringent contracting regulations like the Federal Acquisition Regulation (FAR) and the Defense Federal Acquisition Regulation Supplement (DFARS). Staying compliant with these rules is absolutely critical for winning and fulfilling government contracts, ensuring CACI can continue to secure its significant revenue streams from this sector. For instance, in fiscal year 2023, CACI reported that approximately 85% of its revenue was derived from federal government contracts, highlighting the immense importance of adhering to these complex legal frameworks.

CACI's operations are heavily influenced by data privacy and security laws, particularly given its work with sensitive government information. Regulations like the Federal Information Security Management Act (FISMA) and the Privacy Act of 1974 mandate stringent controls for protecting classified and personally identifiable information. Failure to comply can result in significant penalties and reputational damage, impacting CACI's ability to secure future contracts, especially in the current climate where data breaches are a major concern for federal agencies.

CACI's reliance on proprietary technology and specialized expertise underscores the critical importance of safeguarding its intellectual property rights. These rights, encompassing patents, copyrights, and trade secrets, are fundamental to preserving CACI's competitive edge and its ability to offer unique solutions to government clients.

In 2023, CACI reported approximately $6.2 billion in revenue, a significant portion of which is driven by its innovative technology and software solutions. Protecting these assets through robust IP strategies is paramount to maintaining this revenue stream and preventing competitors from replicating its core offerings.

Employment Laws and Labor Regulations

CACI International, a significant employer, navigates a complex landscape of federal and state employment laws. These regulations cover everything from minimum wage and overtime to anti-discrimination statutes like Title VII of the Civil Rights Act. For instance, in 2024, the Department of Labor continued to enforce wage and hour laws, with penalties for violations often reaching substantial figures, impacting companies like CACI that employ tens of thousands of individuals across various sectors.

Compliance with equal employment opportunity (EEO) laws is paramount for CACI to foster a diverse and inclusive workforce. This includes adhering to regulations that prohibit discrimination based on race, color, religion, sex, and national origin, as well as those addressing disability and age discrimination. The Equal Employment Opportunity Commission (EEOC) reported a significant number of workplace discrimination charges filed annually, underscoring the importance of robust internal policies and training for companies like CACI to mitigate legal risks.

Workplace safety is another critical legal factor, governed by the Occupational Safety and Health Administration (OSHA). CACI must ensure a safe working environment for all its employees, particularly those in roles that may involve specific hazards. OSHA's enforcement actions and updated safety standards, including those relevant to office environments and remote work setups, directly influence CACI's operational procedures and liability management.

- Fair Labor Standards Act (FLSA): CACI must ensure compliance with minimum wage, overtime pay, recordkeeping, and child labor standards.

- Equal Employment Opportunity Commission (EEOC) Guidelines: Adherence to laws prohibiting workplace discrimination based on protected characteristics is essential for CACI's reputation and talent acquisition.

- Occupational Safety and Health Administration (OSHA) Standards: CACI is responsible for providing a safe and healthy workplace, with potential penalties for non-compliance.

- State-Specific Labor Laws: CACI must also navigate varying state regulations regarding employment, which can include paid sick leave, family leave, and specific hiring practices.

Acquisition and Merger Regulations

CACI International's growth strategy heavily relies on mergers and acquisitions, making compliance with acquisition and merger regulations a critical legal factor. These regulations ensure fair competition and prevent monopolistic practices.

The company must navigate antitrust laws, such as those enforced by the U.S. Department of Justice and the Federal Trade Commission, which scrutinize deals for potential market impact. For instance, in 2023, the FTC continued its robust enforcement of antitrust laws, reviewing numerous transactions across various sectors.

Compliance involves thorough due diligence, notification requirements, and potentially divestitures to gain regulatory approval. Failure to adhere to these regulations can result in significant fines, deal termination, and reputational damage, impacting CACI's ability to expand its technological and service offerings.

Key regulatory considerations include:

- Antitrust Review: Ensuring acquisitions do not substantially lessen competition.

- Merger Notification: Complying with premerger notification requirements, like the Hart-Scott-Rodino Act in the U.S.

- Foreign Investment Review: Addressing regulations like CFIUS for deals involving foreign entities.

- Industry-Specific Regulations: Adhering to any sector-specific M&A rules relevant to CACI's operations.

CACI's extensive government contracting necessitates strict adherence to procurement laws, including the Federal Acquisition Regulation (FAR) and its supplements. In fiscal year 2023, approximately 85% of CACI's revenue stemmed from federal contracts, underscoring the critical need for compliance with these complex legal frameworks to maintain its substantial revenue streams.

Data privacy and security laws like FISMA and the Privacy Act are paramount due to CACI's handling of sensitive government information. Non-compliance risks severe penalties and reputational harm, jeopardizing future contract awards, especially as data breaches remain a significant concern for federal agencies.

CACI operates under a multitude of federal and state employment laws, including the Fair Labor Standards Act (FLSA) and equal employment opportunity (EEO) statutes. The Equal Employment Opportunity Commission (EEOC) consistently addresses numerous workplace discrimination charges annually, highlighting the importance of robust internal policies for companies like CACI.

CACI's growth through mergers and acquisitions demands compliance with antitrust and merger regulations, overseen by bodies like the U.S. Department of Justice and the Federal Trade Commission. In 2023, these agencies actively reviewed transactions to ensure fair competition, making adherence to rules like the Hart-Scott-Rodino Act crucial for CACI's expansion.

Environmental factors

CACI prioritizes Environmental, Social, and Governance (ESG) initiatives, as highlighted in its Corporate Responsibility Report. The company is committed to improving sustainability across its operations and providing clear reporting on its environmental footprint.

In 2023, CACI reported a 20% reduction in its Scope 1 and Scope 2 greenhouse gas emissions compared to its 2019 baseline, demonstrating tangible progress in its environmental stewardship. This focus on sustainability extends to its supply chain, with ongoing efforts to engage suppliers on their own ESG performance.

CACI recognizes its environmental impact and is actively working to improve its sustainability practices. While concrete emissions reduction targets haven't been publicly disclosed, the company's engagement with CDP (Carbon Disclosure Project) demonstrates a dedication to being transparent about its climate-related performance and challenges.

CACI's commitment to sustainability is evident in its resource management and waste reduction initiatives. For instance, in fiscal year 2023, the company reported a 15% reduction in its overall waste generation compared to the previous year, demonstrating a tangible effort to minimize its environmental footprint.

This focus on efficiency not only addresses environmental concerns but also translates into operational advantages. By optimizing resource utilization and minimizing waste, CACI can achieve significant cost savings, enhancing its profitability and competitive edge in the market.

Climate Change and Resilience

Climate change presents indirect operational risks for CACI, potentially impacting its infrastructure and supply chains through extreme weather events or resource scarcity. Though not a primary emitter, CACI's commitment to transparency, as evidenced by its CDP reporting, signals an understanding of these broader environmental challenges.

CACI's engagement with climate risk management is further underscored by its participation in sustainability initiatives and its focus on building resilient operations. For instance, in its 2023 sustainability report, the company highlighted efforts to assess climate-related risks and opportunities, aligning with global frameworks like the Task Force on Climate-related Financial Disclosures (TCFD).

- Climate Risk Assessment: CACI actively assesses the physical and transitional risks associated with climate change across its business operations.

- Supply Chain Resilience: The company evaluates and works to enhance the resilience of its supply chains against climate-related disruptions.

- CDP Disclosure: CACI's consistent disclosure through the CDP (formerly the Carbon Disclosure Project) demonstrates its commitment to transparency regarding climate change performance and strategy.

- Operational Adaptability: Efforts are underway to ensure CACI's operations and infrastructure can adapt to evolving climate conditions and regulatory landscapes.

Sustainability in Supply Chain

CACI, like many major corporations, is increasingly focused on sustainability within its supply chain. This involves encouraging or mandating that its suppliers meet specific environmental benchmarks, such as reducing carbon emissions or waste. For instance, in 2023, the U.S. government, a significant client for CACI, issued executive orders emphasizing sustainable procurement practices, pushing companies like CACI to integrate these principles.

This commitment to a greener supply chain not only enhances CACI's corporate social responsibility but also mitigates risks associated with environmental regulations and resource scarcity. Such initiatives can lead to more efficient operations and a stronger brand reputation.

- Supplier Environmental Audits: CACI likely conducts audits to ensure suppliers comply with environmental standards.

- Carbon Footprint Reduction Goals: Encouraging suppliers to set and achieve targets for reducing greenhouse gas emissions.

- Waste Management and Circular Economy: Promoting practices that minimize waste and encourage recycling or reuse within the supply chain.

- Sustainable Sourcing: Prioritizing suppliers who use environmentally friendly materials and production methods.

CACI is actively managing its environmental impact, evidenced by a 20% reduction in Scope 1 and 2 greenhouse gas emissions by 2023, relative to a 2019 baseline. The company also achieved a 15% decrease in waste generation in fiscal year 2023. CACI's commitment extends to its supply chain, with initiatives focused on promoting sustainable procurement practices, aligning with government mandates and client expectations.

| Environmental Metric | 2022 Data | 2023 Data | Change |

|---|---|---|---|

| Scope 1 & 2 GHG Emissions Reduction (vs. 2019 baseline) | 15% | 20% | +5% |

| Waste Generation Reduction (vs. prior year) | 12% | 15% | +3% |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built upon a robust foundation of data sourced from reputable international organizations, government publications, and leading market research firms. This comprehensive approach ensures that every aspect of the macro-environment, from political stability to technological advancements, is informed by credible and current information.