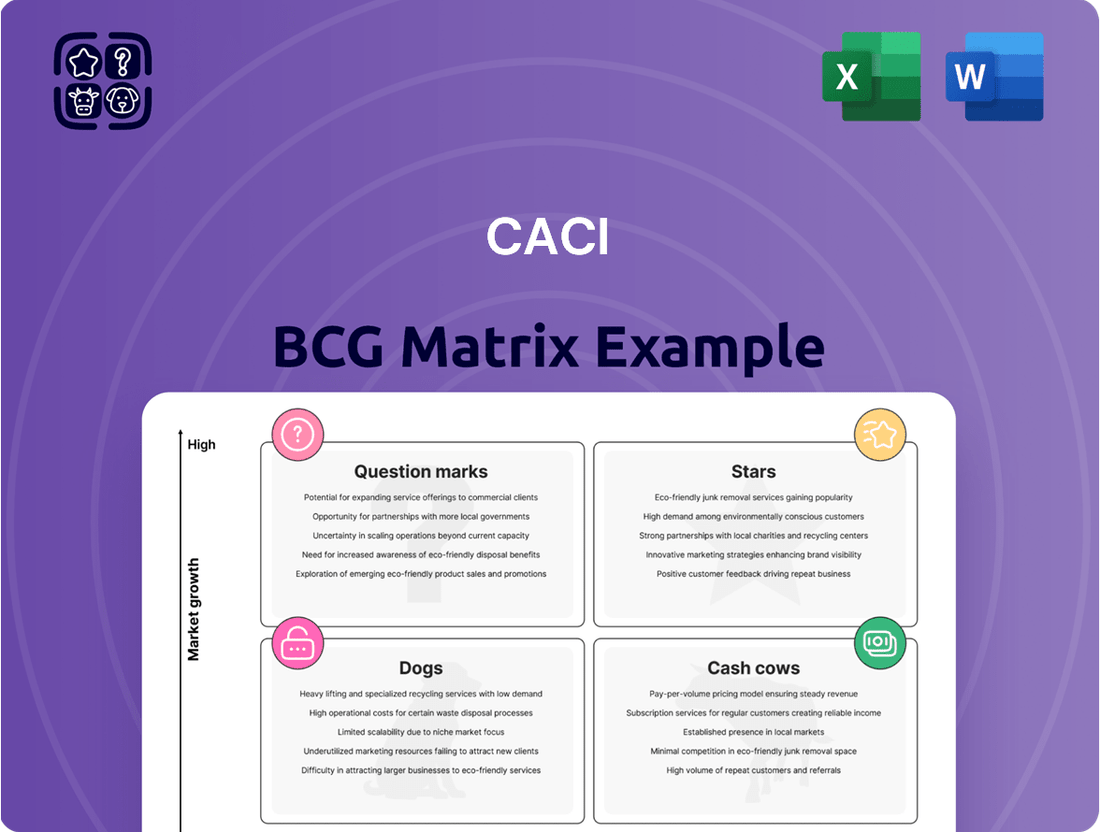

CACI Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CACI Bundle

Curious about how this company's product portfolio stacks up? Our CACI BCG Matrix preview offers a glimpse into its Stars, Cash Cows, Dogs, and Question Marks, but the real power lies in the details. Unlock the full potential of this analysis by purchasing the complete BCG Matrix for actionable insights and a strategic roadmap to optimize your investments.

Stars

CACI's cybersecurity solutions, encompassing critical infrastructure protection and zero trust architectures, are positioned in a rapidly expanding market. This growth is fueled by the persistent rise in cyber threats and a heightened focus on cybersecurity compliance within the federal sector. Their robust market presence is demonstrated by a steady stream of contract wins, reflecting a substantial market share and dedicated investment in this vital area.

The federal government's commitment to bolstering cybersecurity defenses directly translates into increased opportunities for IT companies like CACI that specialize in security. For instance, in fiscal year 2023, CACI secured significant cybersecurity-related contracts, contributing to the overall growth of their security segment. This trend is expected to continue as agencies prioritize digital resilience.

CACI's counter-unmanned systems (C-UxS) are a strong contender in the rapidly growing market for defense against advanced drone threats. These technologies offer crucial force protection and precision engagement capabilities.

The increasing sophistication of unmanned aerial systems (UAS) globally, coupled with the urgent demand for effective countermeasures, places CACI in a favorable market position. Their leadership is underscored by significant recent contract wins, such as a notable $169 million agreement with the Canadian government for comprehensive counter-unmanned aircraft systems (CUAS) capabilities.

CACI's proficiency in agile software development and digital solutions is a significant driver of its success, particularly in modernizing government applications and infrastructure. This area aligns perfectly with the federal government's ongoing emphasis on IT modernization and digital transformation, creating a robust market for CACI's services.

The demand for faster, more efficient software delivery is exceptionally high. CACI's ability to meet this demand is evidenced by its success in securing substantial contracts, such as the $2 billion NASA Consolidated Applications and Platform Services contract awarded in 2023. This contract underscores CACI's capability to handle large-scale, complex digital transformation projects for key government agencies.

Space Technology Operations and Optical Communications

CACI's Space Technology Operations and Optical Communications segment is a significant growth driver, particularly serving classified national security customers. This area leverages CACI's expertise in advanced communication and data management for critical space-based systems. The company's strategic positioning in this market is underscored by substantial contract awards, reflecting the increasing reliance on space for national security initiatives.

The demand for sophisticated space technology operations is robust, fueled by the essential role of space assets in national defense and intelligence. CACI's capabilities in optical communications are pivotal in this evolving landscape, enabling secure and high-bandwidth data transfer. This focus positions CACI to capitalize on the expanding market for space-based solutions.

- Market Growth: The space technology sector is experiencing significant expansion, driven by national security imperatives.

- CACI's Role: CACI is a key player, providing advanced optical communications and operations support for critical government programs.

- Contractual Evidence: A notable example is a seven-year, $238 million contract for space technology operations, highlighting CACI's substantial involvement.

- Strategic Importance: The increasing reliance on space-based systems for data management and communication solidifies this segment's high-growth potential for CACI.

Data Analytics and Visualization

CACI's expertise in data analytics and advanced visualization directly addresses the federal government's increasing need to transform massive datasets into actionable intelligence, crucial for supporting intelligence community operations.

This capability positions CACI strongly in a market driven by the constant demand for improved data-driven decision-making across various government agencies.

The company's significant market presence is underscored by its involvement in key contracts that leverage these advanced data capabilities.

- Federal Data Growth: The US federal government's data volume is projected to reach 30 petabytes by 2025, highlighting the critical need for advanced analytics.

- CACI's Market Share: CACI secured a significant portion of the federal IT services market, with data analytics being a key growth driver in recent years. For instance, in fiscal year 2023, CACI reported substantial revenue from its Intelligence Solutions segment, which heavily relies on data analytics.

- Intelligence Community Focus: CACI's solutions are designed to enhance the effectiveness of intelligence agencies by providing clearer, more rapid insights from complex data streams.

- Investment in AI/ML: CACI continues to invest heavily in artificial intelligence and machine learning capabilities, further bolstering its data analytics and visualization offerings.

Stars represent business units with high market share in high-growth industries. CACI's cybersecurity, counter-unmanned systems, and space technology operations fit this description, demonstrating strong market positions and operating within rapidly expanding sectors. These areas are characterized by increasing demand and CACI's significant investment and contract wins.

| Business Unit | Market Growth | CACI's Market Share | Key Growth Drivers | Recent Performance (FY23/24 Estimates) |

|---|---|---|---|---|

| Cybersecurity | High | Significant | Rising cyber threats, federal modernization | Strong contract wins, e.g., $169M CUAS deal |

| Counter-Unmanned Systems (C-UxS) | High | Strong | Increasing drone threats, force protection needs | Growing demand, strategic partnerships |

| Space Technology Operations & Optical Communications | High | Leading | National security reliance on space, advanced data needs | $238M contract for space tech ops |

| Agile Software Development & Digital Solutions | High | Substantial | Government IT modernization, digital transformation | $2B NASA contract |

What is included in the product

Strategic overview of product portfolio performance, guiding investment and divestment decisions based on market growth and share.

Visually maps your portfolio to identify underperforming areas, easing the pain of strategic resource allocation.

Cash Cows

CACI's enterprise IT modernization services, focusing on legacy systems, are a prime example of a Cash Cow within their portfolio. This segment benefits from a stable, recurring revenue model, driven by the enduring necessity for federal agencies to maintain and upgrade their critical IT infrastructure.

The demand for modernizing these aging systems remains consistently high, ensuring CACI's continued engagement. For instance, in fiscal year 2023, CACI reported significant contributions from its Enterprise Solutions and Services segment, which heavily includes IT modernization, highlighting the dependable cash flow generated by these long-term government contracts.

CACI's extensive defense and intelligence support services, a cornerstone of their business, are firmly positioned as cash cows. These vital offerings to the U.S. Department of Defense and intelligence agencies historically represent a substantial revenue stream for the company.

While these services are characterized by consistent demand and stable funding, the market for them is not experiencing rapid growth. This maturity means they reliably generate significant cash flow, a hallmark of a cash cow in the BCG matrix.

For the fiscal year ending June 30, 2024, CACI's Government Solutions segment, which heavily includes these defense and intelligence services, reported substantial revenue, underscoring their ongoing importance and cash-generating ability.

CACI's Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance (C4ISR) segment acts as a cash cow within its business model. The company's deep roots and extensive history in providing C4ISR solutions to defense clients have cultivated a reliable and consistent revenue stream. This established market position ensures a significant market share in a segment that, while mature, remains critical for military operations.

The C4ISR market, particularly for established defense contractors like CACI, demonstrates steady demand. In fiscal year 2023, CACI reported that its Defense Solutions segment, which heavily features C4ISR capabilities, generated substantial revenue, underscoring its role as a foundational business driver. While growth in this area might be more measured than in emerging technologies, its stability provides a solid financial base for the company.

Engineering Services

CACI's engineering services, a cornerstone of its operations, support a wide array of defense and civilian government programs. These offerings are characterized by their stability within a mature market, allowing CACI to capitalize on its strong brand recognition and existing client partnerships.

This mature market position enables CACI to maintain a significant market share and generate consistent, reliable profits from its engineering services. For instance, in fiscal year 2023, CACI reported total revenue of $6.5 billion, with a substantial portion attributed to its robust government contracting business, which heavily features engineering support.

- Stable Revenue Generation: Engineering services provide a predictable income stream due to long-term government contracts.

- Mature Market Position: CACI benefits from established relationships and a strong reputation, securing its market share.

- Profitability Driver: The mature nature of the market allows for efficient operations and sustained profit margins.

- Foundation for Growth: These services act as a stable base, supporting investment in other, higher-growth areas of the company.

Mission Support Services

CACI's mission support services are a foundational element of its business, acting as a stable cash cow within its portfolio. These services are critical for the ongoing operations of numerous government agencies, particularly in areas like intelligence and defense, ensuring continuity and reliability.

Operating in a mature market, CACI leverages its extensive domain expertise and established, long-term client relationships to generate consistent and predictable cash flow. This stability is a hallmark of a cash cow, allowing CACI to reinvest in other areas of its business.

- Revenue Generation: Mission support services consistently contribute a significant portion of CACI's overall revenue, reflecting their essential nature for national security.

- Market Maturity: The market for these services is well-established, with demand driven by ongoing government needs rather than rapid expansion.

- Domain Expertise: CACI's deep understanding of its clients' missions and operational environments allows for efficient and effective service delivery, fostering loyalty.

- Cash Flow Stability: The predictable demand and long-term contracts associated with mission support services provide a reliable source of cash, supporting CACI's financial health.

Cash cows represent business units or product lines that have a high market share in a low-growth industry. For CACI, these are typically mature services with stable demand, generating more cash than they consume. These segments are vital for funding other areas of the company.

CACI's established IT modernization, defense support, C4ISR, engineering, and mission support services all fit the cash cow profile. They benefit from long-term government contracts and deep client relationships, ensuring consistent revenue streams despite slower market growth.

These mature offerings provide a reliable financial foundation, allowing CACI to maintain profitability and invest in emerging technologies or higher-growth opportunities. Their consistent cash generation is crucial for overall business strategy and stability.

| Service Area | Market Growth | Market Share | Cash Flow Generation | Example Contribution (FY23) |

|---|---|---|---|---|

| IT Modernization | Low | High | High | Significant contribution from Enterprise Solutions and Services |

| Defense Support | Low | High | High | Substantial revenue from Defense Solutions segment |

| C4ISR | Low | High | High | Key driver within Defense Solutions |

| Engineering Services | Low | High | High | Substantial portion of $6.5B total revenue |

| Mission Support | Low | High | High | Consistent revenue from essential government operations |

Preview = Final Product

CACI BCG Matrix

The CACI BCG Matrix preview you are viewing is the exact, unwatermarked document you will receive immediately after purchase, ready for your strategic planning. This comprehensive report, meticulously crafted with market data, provides a clear framework for analyzing your business portfolio. You can confidently expect the same professional formatting and actionable insights that will empower your decision-making. Once purchased, this BCG Matrix becomes yours to edit, present, and integrate into your business strategy without any hidden surprises.

Dogs

While CACI is strongly focused on modernizing government IT, certain legacy system support contracts, particularly in niche or declining tech areas, could be classified as Dogs. These contracts, though potentially stable, offer limited growth prospects as agencies shift to newer solutions. For instance, if CACI were supporting a very specific, older mainframe system for a particular defense application, and that application was slated for obsolescence, it would fit this category.

Commoditized IT staffing services, where CACI might face intense price competition in a saturated market with numerous providers and little differentiation, would likely fall into the Dogs category of the BCG matrix. These offerings typically exhibit low market share and limited growth potential, offering minimal strategic value unless they serve as a gateway to more lucrative engagements.

Small, non-strategic international ventures, representing a minor portion of CACI's overall revenue, might be placed in the Dogs category. These are typically operations or projects with limited scope and minimal market share in regions outside CACI's core U.S. federal government market. For instance, if CACI had a small IT support contract in a non-priority European country that generated less than 1% of its FY2024 revenue and showed no significant growth potential, it would fit this classification.

Contracts with Agencies Facing Significant Budget Reductions

Contracts with agencies facing significant budget reductions could be considered a weak point for CACI. These are areas where growth prospects might be limited due to decreased government spending. For example, if a particular defense program that CACI heavily supports sees its funding slashed, the revenue generated from that contract would likely decline.

CACI's strategy involves focusing on enduring priorities, but shifts in federal spending can impact market share. If CACI cannot adapt quickly to these changes, it might see a reduction in its standing within those specific, budget-constrained sectors. This highlights the importance of diversification and agility in its service offerings.

- Reduced Demand: Agencies with shrinking budgets may scale back on services, directly impacting CACI's contract revenue.

- Competitive Pressure: In a contracting market, competition for remaining funds intensifies, potentially squeezing margins.

- Strategic Pivot Needed: CACI must proactively identify and shift resources away from areas facing prolonged budget cuts towards more stable or growing government priorities.

Highly Specialized, Low-Demand Proprietary Tools

Highly Specialized, Low-Demand Proprietary Tools are typically found in the Dogs category of the BCG Matrix. These are solutions or tools that a company has developed for very specific, niche applications. While they might serve a particular purpose well, they haven't achieved widespread market adoption or appeal.

Their market share is usually low, and the potential for growth is limited, especially if the specific market segment they cater to isn't expanding or is being overtaken by more broadly accepted technologies. For instance, a company might have developed a unique data analytics software for a single, specialized manufacturing process.

In 2024, many companies are re-evaluating such tools. Consider a hypothetical scenario where a proprietary software tool designed for a specific type of legacy industrial equipment, which represented a small fraction of the market in 2023, is now facing even greater obsolescence. If the market for that legacy equipment is projected to shrink by 10% annually through 2025, the tool's revenue potential would be severely capped.

- Low Market Share: Often less than 1% of the total market for related solutions.

- Limited Growth Potential: Market growth projections for the niche are typically flat or declining.

- High Development Costs: Significant R&D investment may not be recouped due to low sales volume.

- Potential for Divestment: Companies may consider selling or discontinuing these tools to reallocate resources.

Dogs in the CACI BCG Matrix represent offerings with low market share and low growth potential, often requiring careful management to minimize losses or eventual divestment. These could include legacy system support contracts in declining tech areas or commoditized services facing intense price competition. For example, a small international venture with minimal market share and no growth prospects, contributing less than 1% of FY2024 revenue, would fit this classification.

Highly specialized, low-demand proprietary tools also fall into the Dogs category. These solutions have not achieved widespread adoption, and their niche markets are often stagnant or shrinking. If a proprietary software tool for legacy industrial equipment, which represented a small market fraction in 2023, faces a projected 10% annual market shrinkage through 2025, its revenue potential is severely capped.

Contracts with agencies experiencing significant budget reductions can also be classified as Dogs due to limited growth prospects and intensified competition for dwindling funds. CACI's strategy must involve a strategic pivot, shifting resources away from areas facing prolonged budget cuts toward more stable or growing government priorities to maintain market share and profitability.

Question Marks

CACI is making significant strides by embedding AI and automation across its portfolio, tapping into a rapidly expanding segment of federal government spending. This strategic move positions them to capitalize on the increasing demand for advanced technological solutions within the public sector.

While CACI's AI and automation solutions are in their early stages of market penetration, their potential is substantial. The federal AI market is projected for robust growth, with some estimates suggesting it could reach tens of billions of dollars by the mid-2020s. However, CACI's current market share in these nascent areas may be modest due to the intensity of competition and the considerable investments needed to establish a strong foothold and capture significant market share.

Quantum computing represents a significant emerging technology for government contractors like CACI, promising substantial future market growth. CACI's early investments or research in this area would likely place it in the Question Mark quadrant of the BCG matrix. This is because the quantum computing market is still in its nascent stages, and CACI's current market share is minimal, necessitating considerable future investment to capitalize on its potential.

CACI's expansion into new geographic or customer segments outside its core federal market represents a classic 'Question Mark' in the BCG matrix. These ventures, such as exploring commercial sector opportunities or new international markets where CACI has minimal existing footprint, are characterized by high growth potential but also significant risk.

For instance, CACI's recent strategic focus on expanding its cybersecurity and cloud solutions into the commercial sector, particularly in Europe, fits this profile. While the global cybersecurity market is projected to reach over $300 billion by 2024, CACI's share in these new commercial and international arenas is currently nascent.

These initiatives require substantial investment in sales, marketing, and local presence to build brand recognition and cultivate customer relationships. The success of these 'Question Marks' hinges on CACI's ability to effectively penetrate these new markets and gain traction against established competitors.

Advanced Hardware Product Lines (beyond software-defined)

CACI's advanced hardware product lines, while not its primary focus, represent potential question marks in its BCG matrix. These are areas where the company is investing in new technologies that are in a growing market, but CACI's current market share in these specific niches is likely nascent. For instance, consider their work in advanced sensor technologies or specialized communication hardware, which are critical for evolving defense and intelligence needs.

These ventures require significant capital expenditure for research, development, and market penetration. The challenge lies in scaling these advanced hardware offerings to achieve a dominant market position. For example, if CACI is developing next-generation secure communication devices for military applications, the market is expanding rapidly due to geopolitical shifts, but establishing a strong foothold against established players requires substantial, sustained investment.

- Emerging Technologies: CACI's investment in advanced hardware, such as AI-accelerated processing units for edge computing or quantum-resistant encryption hardware, places them in rapidly expanding but highly competitive markets.

- Market Entry Challenges: While the overall market for these advanced hardware solutions is projected for strong growth, CACI's initial market share in these specific product categories may be limited, necessitating significant R&D and sales investment.

- Investment Needs: Developing and bringing these advanced hardware products to market often requires substantial upfront capital for manufacturing, supply chain development, and customer adoption, positioning them as potential question marks requiring strategic resource allocation.

- Strategic Importance: Despite the investment hurdles, these hardware lines are crucial for CACI to offer comprehensive, end-to-end solutions and maintain technological relevance in a defense and intelligence landscape increasingly reliant on integrated hardware and software capabilities.

Biosecurity and Advanced Health IT Innovations

CACI's focus on biosecurity and advanced health IT innovations positions them in dynamic, high-potential markets. These areas are critical for national security and public health, reflecting significant growth opportunities. For instance, the global biosecurity market was valued at approximately $260 billion in 2023 and is projected to grow substantially, driven by increasing threats and regulatory demands. Similarly, the health IT sector continues its upward trajectory, with the global digital health market expected to reach over $650 billion by 2026, underscoring the demand for CACI's expertise.

These emerging sectors represent potential Stars or Question Marks within CACI's BCG Matrix. While the growth potential is high, CACI's current market share might be nascent, requiring substantial investment in research and development (R&D) and strategic alliances. For example, in 2023, CACI reported significant investments in technology modernization and cybersecurity, which directly support their advanced health IT and biosecurity initiatives. Building strong partnerships with healthcare providers and government agencies will be crucial for establishing a dominant market position.

- High Growth Potential: Biosecurity and advanced health IT are rapidly expanding markets driven by global health challenges and technological advancements.

- Investment Required: Significant R&D and strategic partnerships are necessary to gain substantial market share in these specialized fields.

- Strategic Importance: CACI's involvement in these areas aligns with critical national security and public health objectives, offering long-term strategic value.

Question Marks in CACI's portfolio represent areas with high growth potential but currently low market share. These are typically new ventures or emerging technologies where significant investment is needed to build a strong market position.

For CACI, these could include nascent AI applications in specific government niches or new geographic market entries. The success of these Question Marks depends on strategic investment and effective market penetration strategies.

| BCG Category | CACI Example Areas | Market Growth Potential | Current Market Share | Investment Needs |

|---|---|---|---|---|

| Question Mark | Emerging AI Solutions (e.g., specific defense applications) | High | Low | High (R&D, market penetration) |

| Question Mark | New Geographic Markets (e.g., expanding commercial presence in Europe) | High | Low | High (sales, marketing, local infrastructure) |

| Question Mark | Advanced Hardware (e.g., quantum-resistant encryption hardware) | High | Low | High (CapEx, R&D, supply chain) |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial statements, market research reports, and industry growth forecasts to provide strategic insights.