CACI Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CACI Bundle

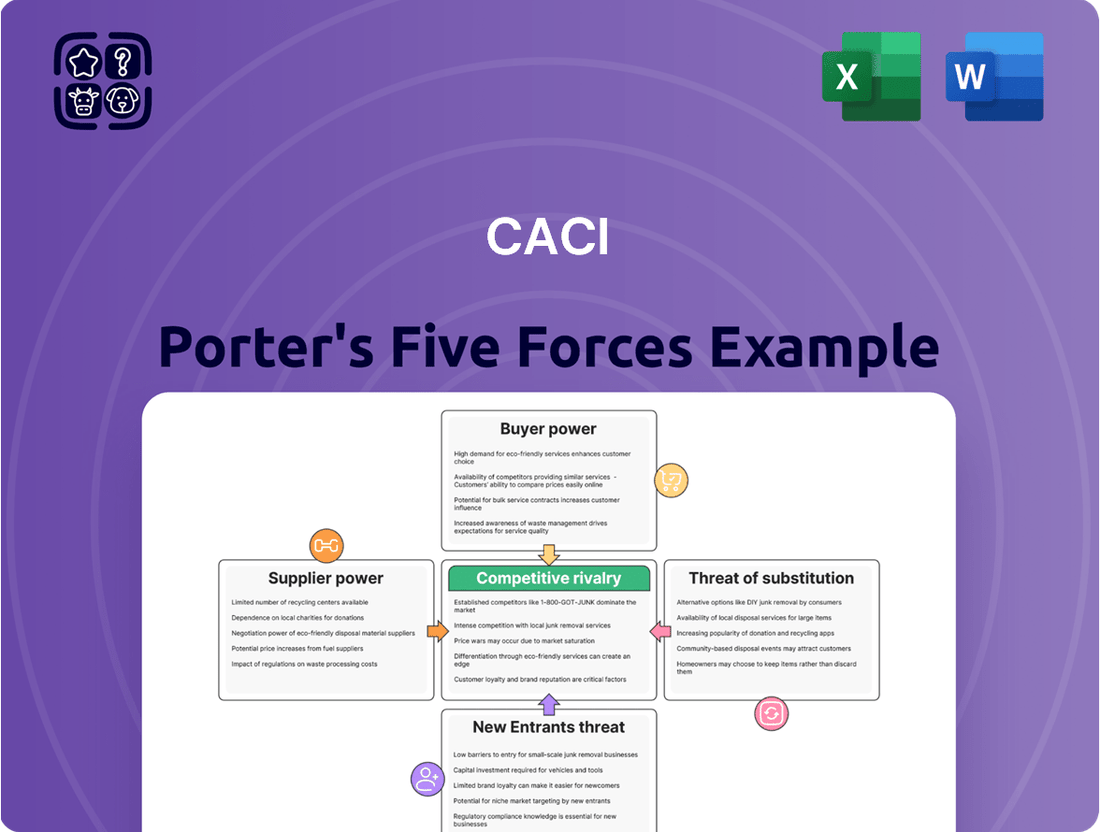

A Porter's Five Forces analysis for CACI reveals the intricate web of competitive pressures shaping its market. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of substitutes and new entrants is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore CACI’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

CACI generally faces a low concentration of suppliers for its core IT services and solutions. This is because the market offers a wide array of vendors for foundational technologies and skilled labor, preventing any single supplier from holding significant sway. For instance, in 2023, the global IT services market was valued at over $1.3 trillion, indicating a highly fragmented supplier base.

However, the bargaining power can increase for CACI if it requires highly specialized components or unique intellectual property. In such niche areas, a limited number of suppliers might exist, allowing them to command better terms. For example, if CACI needs a proprietary cybersecurity algorithm or a highly specialized hardware component, the supplier's concentration in that specific segment could be a factor.

The availability of substitutes for CACI's inputs is generally moderate to high. While CACI leverages proprietary expertise, many of the foundational IT components, software platforms, and general professional services it utilizes have readily available alternatives in the market. For example, in 2024, the IT services market saw continued growth in cloud computing solutions, offering numerous providers for infrastructure and software needs, which CACI could leverage.

This abundance of alternatives significantly curtails the bargaining power of CACI's suppliers. If a supplier attempts to impose unfavorable terms or price increases, CACI possesses the flexibility to seek out alternative providers for those specific inputs. This competitive landscape among suppliers, particularly for commoditized IT services and components, means suppliers have less leverage to dictate terms.

Switching costs for CACI vary considerably based on the specific input. For readily available items like standard IT hardware or common software licenses, the expense and effort to change suppliers are generally minimal.

However, CACI faces higher supplier bargaining power when dealing with deeply integrated systems, specialized cybersecurity solutions, or unique, hard-to-find talent. In these instances, the financial and operational disruption involved in switching providers can be substantial, giving those suppliers more leverage.

Uniqueness of Supplier Offerings

The uniqueness of supplier offerings significantly impacts CACI's bargaining power. While many suppliers offer standard services, others provide highly specialized technologies, like advanced AI or proprietary cybersecurity solutions. In these niches, CACI may face limited alternatives, giving those suppliers more leverage.

The increasing demand for cutting-edge technologies, particularly in artificial intelligence and cybersecurity, is a key factor. Suppliers who can deliver these specialized capabilities are likely to see their bargaining power grow. For instance, companies offering unique AI algorithms or advanced threat intelligence platforms could command higher prices or more favorable terms from CACI.

- Specialized AI and Cybersecurity: Suppliers with unique AI or cybersecurity technologies possess greater bargaining power.

- Limited Alternatives: When CACI has few substitutes for a supplier's specialized offering, that supplier's leverage increases.

- Market Demand: Growing market demand for AI and cybersecurity expertise strengthens the position of suppliers in these fields.

- Potential Impact on CACI: This can lead to higher costs or less favorable contract terms for CACI if they rely heavily on such unique suppliers.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into CACI's business is generally low. CACI's suppliers are primarily technology firms and specialized talent providers. These entities would face substantial hurdles, including significant capital investment and navigating complex U.S. federal government contracting regulations, to directly compete with CACI.

For instance, a typical cybersecurity solutions provider supplying CACI would need to develop extensive expertise in government procurement processes, security clearances, and program management to bid on similar large-scale contracts. This makes forward integration a financially and operationally demanding strategy for most of CACI's supplier base.

Key barriers to forward integration for CACI's suppliers include:

- High Capital Requirements: Entering the federal contracting space often necessitates substantial upfront investment in infrastructure, personnel, and compliance.

- Complex Regulatory Environment: Navigating the intricate web of federal regulations, security protocols, and compliance standards is a significant deterrent.

- Established Relationships and Brand Recognition: CACI has built long-standing relationships and a strong reputation within the federal government sector, which are difficult for new entrants to replicate.

The bargaining power of suppliers for CACI is generally moderate, influenced by the availability of alternatives and the specialization of offerings. While many IT services and components have numerous providers, increasing supplier competition, the need for unique technologies like advanced AI or specialized cybersecurity solutions can elevate supplier leverage. For example, the global IT services market's substantial size in 2023, exceeding $1.3 trillion, points to a broad supplier base for many of CACI's needs.

Suppliers gain more power when CACI requires highly specialized or proprietary inputs, as the pool of alternatives shrinks. This is particularly true for cutting-edge AI and cybersecurity capabilities, where demand is high and the number of expert providers is limited. In 2024, the continued growth in cloud computing solutions offers CACI many options for foundational needs, thereby reducing supplier power in those segments.

Switching costs also play a role; while changing providers for standard hardware is easy, transitioning away from deeply integrated specialized systems can be costly and disruptive, granting those suppliers greater influence.

The threat of suppliers integrating forward into CACI's business is low due to the high capital, regulatory, and relationship barriers inherent in CACI's federal government contracting niche.

What is included in the product

CACI's Porter's Five Forces analysis provides a comprehensive framework to understand the competitive intensity and attractiveness of its operating environment, examining threats from new entrants, the power of buyers and suppliers, and the impact of substitutes and existing rivals.

Instantly identify and address competitive threats with a visual breakdown of market pressures, simplifying complex strategic planning.

Customers Bargaining Power

CACI's customer base is heavily concentrated, with the U.S. federal government being its primary client. This singular, dominant customer wields substantial bargaining power. In fiscal year 2023, approximately 90% of CACI's revenue came from federal government contracts, highlighting this extreme concentration.

CACI's services are deeply integrated into the national security and government modernization efforts of its clients. These aren't just nice-to-haves; they are often mission-critical. For instance, in fiscal year 2023, CACI reported that 85% of its revenue came from federal government contracts, highlighting the essential nature of its offerings to government operations.

Because these solutions are so vital to their customers' core functions, clients often have less leverage to demand lower prices or better terms. The specialized nature of CACI's expertise in areas like cybersecurity and cloud computing, coupled with a demonstrated track record of reliable delivery, means customers are less likely to switch providers for minor concessions, as doing so could jeopardize critical operations.

Switching costs for CACI's customers, particularly within the U.S. federal government, are substantial. These high switching costs significantly limit the bargaining power of customers. For instance, the U.S. federal government often operates intricate IT systems that are deeply integrated with contractor services. The process of moving these complex systems, migrating sensitive data, or shifting large-scale projects to a different vendor is not only time-consuming and expensive but also carries the risk of disrupting critical government operations. This inherent difficulty in changing providers reduces the government's ability to exert immediate pressure on CACI through threats of switching.

Customer Price Sensitivity

Customer price sensitivity for CACI, primarily the U.S. federal government, is nuanced. While budget constraints and a drive for cost-effectiveness are present, the critical nature of national security and defense missions often elevates the importance of performance, security, and reliability. This means that the lowest price is not always the deciding factor.

In 2024, government IT and consulting contracts, like those CACI pursues, frequently emphasize mission success and specialized capabilities. For instance, a report by Bloomberg Government in early 2024 indicated that while agencies aim for savings, contracts with high security requirements or unique technical needs saw less intense price competition. CACI's focus on advanced technology and secure solutions positions it to command premiums where these factors are paramount.

- Government agencies balance cost with critical mission needs.

- Performance, security, and specialized capabilities often outweigh price alone.

- CACI's focus on advanced and secure solutions aligns with these priorities.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly the U.S. federal government, for companies like CACI is generally low. The government typically prefers to outsource specialized IT and professional services rather than build these complex capabilities internally across the board. While some government functions are indeed handled in-house, the highly specialized and intricate nature of CACI's service portfolio makes complete backward integration by government entities impractical and inefficient.

This low threat is further supported by the government's procurement strategies, which often focus on leveraging external expertise for specific, advanced technological needs. For instance, in 2023, the U.S. federal government’s spending on IT services and outsourcing continued to be substantial, indicating a reliance on external providers for many specialized functions. CACI's own 2023 fiscal year revenue, reaching $6.5 billion, demonstrates the scale of government demand for such outsourced services, reinforcing the limited incentive for them to develop these capabilities internally.

- Low Threat: The U.S. federal government's capacity and inclination to develop CACI's specialized IT and professional services in-house are limited.

- Outsourcing Preference: Government agencies consistently opt to outsource complex and niche technological requirements.

- Impracticality: The specialized nature of CACI's offerings makes full backward integration by the government an inefficient proposition.

- Market Reliance: Government spending on outsourced IT services, exceeding billions annually, highlights a continued dependence on external providers.

CACI's customer base, predominantly the U.S. federal government, exhibits limited bargaining power due to the mission-critical nature of its services and high switching costs. The government's reliance on CACI's specialized expertise in areas like cybersecurity and cloud computing, coupled with the complexity and expense of transitioning these systems, reduces their leverage. While cost is a consideration, performance and security often take precedence, as evidenced by government IT contract trends in 2024 that favored specialized capabilities over pure price competition.

| Factor | Assessment for CACI | Impact on Bargaining Power |

|---|---|---|

| Customer Concentration | Very High (U.S. Federal Government ~90% revenue FY23) | Lowers bargaining power for individual customers, but concentrates power with the dominant client. |

| Switching Costs | High (Integrated mission-critical systems) | Significantly reduces customer bargaining power due to cost, time, and operational risk. |

| Price Sensitivity | Moderate to Low (Performance & security prioritized) | Limits the ability of customers to drive down prices based solely on cost. |

| Threat of Backward Integration | Low (Specialized services impractical for in-house development) | Customers are unlikely to bring CACI's core services in-house, preserving CACI's market position. |

Preview Before You Purchase

CACI Porter's Five Forces Analysis

This preview displays the complete CACI Porter's Five Forces Analysis, offering an in-depth examination of competitive and market forces impacting the company. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after completing your purchase, ensuring no surprises.

Rivalry Among Competitors

The U.S. federal government contracting landscape, especially within IT and defense sectors, is intensely competitive. CACI faces a broad spectrum of rivals, from massive, well-established prime contractors to niche, specialized businesses vying for the same opportunities.

Major players like Lockheed Martin, Northrop Grumman, and Leidos are significant competitors, often bidding on large, complex contracts that CACI also targets. These giants possess substantial resources and existing government relationships, making them formidable rivals.

In 2024, the federal IT market alone is projected to reach hundreds of billions of dollars, with a significant portion allocated to defense-related technology and services. This vast market attracts a multitude of companies, intensifying the competitive pressure on CACI.

The government IT services and defense spending sectors generally exhibit a positive growth trajectory. This upward trend is fueled by ongoing modernization initiatives within government agencies, a heightened focus on cybersecurity, and evolving geopolitical landscapes. For instance, the U.S. Department of Defense's IT budget for fiscal year 2024 was projected to be around $45 billion, reflecting a commitment to technological advancement.

While this overall industry expansion can temper the intensity of competitive rivalry by creating a larger pie for all participants, the competition for specific, high-value contracts remains exceptionally sharp. Companies are vying for lucrative opportunities, leading to concentrated competition in areas promising significant revenue and strategic advantage.

CACI's competitive edge stems from its deep specialization in high-demand areas such as agile software development, advanced cybersecurity solutions, and sophisticated data analytics. This strategic focus on niche expertise allows the company to offer services that are not easily replicated by competitors, thereby mitigating direct confrontation on more commoditized offerings.

By proactively investing in cutting-edge technologies and developing unique capabilities, CACI positions itself as a leader in specialized fields. This forward-thinking approach to technology adoption and service innovation, evident in their continued expansion of cloud and artificial intelligence offerings, helps to create a distinct market presence and reduce the intensity of rivalry.

Switching Costs for Customers Among Competitors

Switching costs for government clients when moving between competing contractors are significant, mirroring general customer switching costs. The inherent complexity and ongoing nature of government projects mean that transitioning to a new provider involves considerable effort, potential disruption, and inherent risks. This can lead to a stabilization of market shares for incumbent contractors like CACI.

These high switching costs are a key factor in the competitive rivalry landscape. For instance, a government agency deeply integrated with a contractor's systems for cybersecurity or IT infrastructure management would face substantial costs and potential operational delays in migrating to a different vendor. This inertia benefits established players by creating a barrier to entry for new competitors and fostering customer loyalty among existing clients.

- High Transition Expenses: Government contracts often involve bespoke software, specialized hardware, and deeply embedded processes, making a complete overhaul for a new vendor costly and time-consuming.

- Operational Risk: Switching providers on critical government functions, such as national defense systems or public health databases, carries a significant risk of service interruption or performance degradation during the transition period.

- Learning Curve and Training: New contractors require time and resources to understand the specific requirements, security protocols, and operational nuances of a government agency, adding to the overall switching cost.

- Contractual Lock-ins: Long-term contracts with specific performance metrics and penalties for early termination can further increase the financial burden of switching for government entities.

Exit Barriers for Competitors

Exit barriers for competitors in the government contracting sector, where CACI operates, are notably high. These barriers stem from the significant investments companies make in specialized assets, such as secure facilities and advanced technology, which have limited alternative uses. For instance, many government contractors must maintain specific security clearances and infrastructure, representing sunk costs that are difficult to recoup upon exiting the market.

Furthermore, long-term, multi-year contracts awarded by government agencies create a sticky environment. Companies like CACI are often locked into these agreements, making a swift exit financially unviable without incurring penalties or substantial write-offs. By 2024, the average duration of major government IT contracts can extend over five years, underscoring this commitment.

Established relationships with government agencies also act as a powerful exit barrier. Building trust and a proven track record with entities like the Department of Defense or other federal bodies takes years, and these relationships are crucial for securing future business. Losing these established ties upon exiting makes it exceedingly difficult for a company to pivot to other industries or even sell its government contracting division without a significant valuation discount.

- Specialized Assets: High costs associated with security clearances, secure infrastructure, and proprietary technology.

- Long-Term Contracts: Significant financial penalties or losses often incurred for early termination of government agreements.

- Established Relationships: Deeply ingrained trust and past performance records with government agencies are hard to replicate or transfer.

- Skilled Workforce: Investments in personnel with specific government sector expertise and security clearances are difficult to redeploy.

Competitive rivalry in the government contracting space, particularly for IT and defense services, is fierce. CACI contends with numerous established giants and specialized firms, all seeking a share of a vast and growing market. The federal IT sector alone is a multi-hundred-billion-dollar arena in 2024, with defense spending contributing significantly, creating intense competition for lucrative contracts.

CACI differentiates itself through deep expertise in areas like advanced cybersecurity and agile development, mitigating direct competition. High switching costs for government clients, due to project complexity and integration, create a degree of customer stickiness, benefiting incumbents. However, exit barriers for competitors are also substantial, involving specialized assets and long-term contracts, which can influence market dynamics.

| Competitor Type | Key Characteristics | Impact on CACI |

|---|---|---|

| Major Prime Contractors | Large scale, broad capabilities, established relationships (e.g., Lockheed Martin, Northrop Grumman) | Direct competition for large, complex contracts; significant resource advantage. |

| Niche/Specialized Firms | Deep expertise in specific technologies or services (e.g., cybersecurity, AI) | Compete for specialized segments; CACI's specialization aims to counter this. |

| Emerging Players | Agile, innovative, often focus on new technologies | Can disrupt markets; CACI's investment in R&D is key to staying ahead. |

SSubstitutes Threaten

While government agencies can develop some IT and professional services in-house or leverage open-source alternatives, the sheer scale and complexity of many federal contracts often make outsourcing to specialized firms like CACI more practical. For instance, CACI's extensive experience in areas like cybersecurity and cloud migration for defense agencies presents a significant barrier to entry for purely in-house solutions. In 2023, CACI reported approximately $6.2 billion in revenue, underscoring the substantial demand for its specialized services that internal government resources may struggle to match efficiently.

The price-performance trade-off of substitutes generally favors CACI's specialized solutions, particularly for intricate and vital government operations. While in-house government teams or more generic, off-the-shelf alternatives might seem more budget-friendly initially, they often fall short in delivering the specific expertise, cutting-edge technology, or the agility needed for rapid scaling that CACI offers. This can translate into greater overall expenses or a reduction in how effectively missions are accomplished over time.

Customer propensity to substitute CACI's core, high-security, and technologically advanced services is generally low. This is due to CACI's established reputation and proven track record in delivering specialized solutions that are difficult for customers to replicate internally or source from less experienced providers.

For more commoditized IT support functions, the threat of substitution can be higher. However, CACI actively mitigates this by focusing on differentiated expertise and value-added services, making it less appealing for customers to switch to generic alternatives.

In 2024, CACI's continued investment in areas like cloud modernization and cybersecurity, which represent critical and often complex needs for government and commercial clients, further solidifies customer loyalty and reduces the likelihood of substitution for these vital services.

Technological Advancements Enabling Substitutes

Technological advancements, particularly in automation and artificial intelligence, present a potential avenue for government agencies to bring certain functions in-house, thereby creating substitutes for CACI's services. However, these same technological shifts concurrently generate new, complex demands for specialized integration and robust cybersecurity solutions. CACI is strategically positioned to capitalize on these emerging needs, leveraging its expertise to offer integrated solutions that many agencies may find challenging to develop internally.

For instance, the increasing adoption of AI in government operations, projected to grow significantly, could theoretically lead to some internal task performance. Yet, the complexity of integrating these AI tools securely and efficiently into existing government IT infrastructures often requires specialized external support. CACI's reported focus on areas like cloud modernization and cybersecurity in its fiscal year 2024 performance, where it secured significant contract wins, highlights its ability to adapt and thrive amidst these technological evolutions.

- AI Adoption: Government spending on AI is expected to reach tens of billions annually by 2026, creating both substitution and demand opportunities.

- Cybersecurity Needs: The increasing sophistication of cyber threats necessitates specialized services, a core offering for CACI.

- Integration Complexity: Implementing new technologies often requires expertise that many agencies lack, driving demand for external partners like CACI.

- CACI's Strengths: CACI's strategic investments in advanced technology solutions and its strong track record in government contracting position it to manage these evolving threats and opportunities.

Regulatory or Policy Changes Encouraging Substitution

While government initiatives aim to boost small business participation in federal contracting, significant regulatory shifts steering away from established large contractors like CACI for complex IT and national security services are not anticipated. The current policy landscape leans towards refining existing procurement methods rather than a radical overhaul that would favor substitutes for CACI's core offerings.

For instance, in fiscal year 2023, the U.S. government awarded approximately $167.7 billion to small businesses, representing 26.3% of all federal contracting dollars. This demonstrates a commitment to small business growth, but it doesn't necessarily translate into a direct threat of substitution for CACI's specialized, large-scale services.

- Focus on Process Optimization: Government policies are more likely to streamline existing procurement, making it easier for various sizes of businesses to compete, rather than mandating a shift away from large prime contractors.

- Limited Impact on Core Services: Substitutes for CACI's complex IT solutions and national security services, which often require deep expertise, security clearances, and proven track records, are not readily available or easily scalable to replace incumbent large providers.

- Continued Demand for Scale: The nature of many federal IT and defense contracts necessitates the scale, resources, and established infrastructure that large companies like CACI possess, making direct substitution by smaller or alternative entities challenging.

The threat of substitutes for CACI's services is generally low to moderate. While government agencies can develop some IT and professional services in-house or use open-source alternatives, the complexity and scale of many federal contracts make outsourcing to specialized firms like CACI more practical. CACI's 2023 revenue of approximately $6.2 billion highlights the substantial demand for its specialized services, which internal government resources may struggle to match efficiently.

The price-performance trade-off often favors CACI's specialized solutions, particularly for intricate government operations. While in-house teams or generic alternatives might seem cheaper initially, they often lack the specific expertise, cutting-edge technology, or agility that CACI provides, leading to higher overall costs or reduced mission effectiveness over time.

Customer propensity to substitute CACI's core, high-security, and technologically advanced services is low due to its established reputation and proven track record. For more commoditized IT support, substitution risk is higher, but CACI mitigates this by focusing on differentiated expertise and value-added services.

In 2024, CACI's continued investment in cloud modernization and cybersecurity, critical areas for government and commercial clients, further solidifies customer loyalty and reduces substitution for these vital services.

| Factor | Impact on CACI | Notes |

| In-house Capabilities | Low Threat | Complexity and scale of contracts favor outsourcing. |

| Open-Source Alternatives | Moderate Threat (for commoditized services) | Less effective for specialized, high-security needs. |

| Technological Advancements (AI/Automation) | Dual Impact (Threat & Opportunity) | Can enable in-house tasks but also create demand for integration/cybersecurity expertise. |

| Government Procurement Policies | Low Threat | Focus on process optimization, not radical shifts away from large contractors. |

Entrants Threaten

Entering the U.S. federal government IT and services market demands significant upfront capital. New companies must invest heavily in advanced technology, robust infrastructure, and obtaining necessary security clearances for personnel, which can easily run into millions of dollars. For instance, securing top-tier cybersecurity certifications and clearances alone can cost hundreds of thousands per employee.

Access to government contracts presents a significant hurdle for potential new entrants. The procurement process is notoriously complex and time-consuming, often demanding established relationships, a proven track record, and specific certifications. For instance, in 2024, the U.S. federal government awarded over $700 billion in contracts, a substantial market that is difficult for newcomers to penetrate against established players like CACI who have honed their expertise and built trust over years of successful delivery.

Established players like CACI leverage significant economies of scale, allowing them to spread costs across a larger operational base. This translates to lower per-unit costs for services and the ability to absorb larger investments in research and development. For instance, CACI's substantial revenue, which reached $6.7 billion in fiscal year 2023, underscores its ability to operate at a scale difficult for newcomers to replicate.

Furthermore, CACI's decades of experience in the federal contracting sector have cultivated deep expertise in managing complex, large-scale projects and adhering to stringent compliance and security mandates. This accumulated knowledge base creates a substantial barrier to entry, as new entrants would face a steep learning curve and significant upfront investment to achieve comparable operational efficiency and regulatory proficiency.

Government Regulations and Policies

Government regulations and policies, while sometimes designed to foster competition, often erect significant barriers to entry for new players in the IT and technology services sector. These can include extensive compliance mandates, rigorous data security protocols, and complex reporting obligations. For instance, in 2024, the European Union's Digital Services Act (DSA) and Digital Markets Act (DMA) impose substantial requirements on online platforms, impacting how they operate and potentially increasing costs for new entrants seeking to establish a significant presence.

The financial and operational burden of navigating these regulatory landscapes can be particularly daunting for smaller or emerging companies. Adhering to standards like GDPR for data privacy or specific cybersecurity certifications can demand considerable investment in technology, legal counsel, and skilled personnel. This was highlighted in 2023 when many businesses faced increased scrutiny and compliance costs related to AI governance frameworks being developed globally.

- Stringent Compliance: New entrants must invest heavily in understanding and implementing complex regulatory frameworks, such as data protection laws and industry-specific standards.

- Security Requirements: Meeting robust cybersecurity mandates, often driven by government initiatives and international agreements, necessitates significant upfront and ongoing technology investment.

- Reporting Obligations: The need for regular and detailed reporting to regulatory bodies adds administrative overhead and can require specialized expertise, increasing operational costs for new firms.

- Impact on Innovation: While intended to ensure fair play and consumer protection, overly burdensome regulations can stifle innovation by diverting resources away from research and development towards compliance efforts.

Brand Loyalty and Differentiation

Brand loyalty in government contracting is less about consumer preference and more about a proven track record, trust, and specialized capabilities. CACI's long-standing reputation for delivering on national security missions, evidenced by its consistent contract wins, creates a significant competitive advantage. For instance, CACI secured over $6 billion in new contract awards in fiscal year 2023, demonstrating sustained client confidence.

New entrants would find it difficult to replicate CACI's established relationships and deep understanding of complex government requirements. This differentiation in expertise, particularly in areas like cybersecurity and IT modernization for defense agencies, acts as a substantial barrier.

- Proven Track Record: CACI’s history of successful project execution builds trust with government agencies.

- Specialized Capabilities: Deep expertise in niche areas like intelligence analysis and digital transformation is hard to match.

- Established Relationships: Long-term partnerships with key government departments create loyalty.

- High Switching Costs: The complexity and security implications of changing contractors deter new entrants.

The threat of new entrants into the U.S. federal government IT and services market is significantly constrained by high capital requirements for technology and security clearances, with costs easily reaching millions. Accessing government contracts is also a major hurdle due to complex procurement processes and the need for established relationships, a market where CACI secured over $6 billion in new contract awards in fiscal year 2023.

Economies of scale enjoyed by incumbents like CACI, which reported $6.7 billion in revenue for fiscal year 2023, create lower per-unit costs and greater R&D capacity, making it difficult for newcomers to compete on price and innovation.

Government regulations and stringent cybersecurity mandates, alongside deep-seated customer loyalty built on proven track records and specialized capabilities, further erect substantial barriers to entry.

| Barrier Type | Description | Example/Data Point |

|---|---|---|

| Capital Requirements | High upfront investment in technology and security clearances. | Millions of dollars for advanced tech and clearances. |

| Contract Access | Complex procurement, need for relationships and track record. | U.S. federal government awarded over $700 billion in contracts in 2024. |

| Economies of Scale | Lower per-unit costs and greater R&D capacity for incumbents. | CACI's FY2023 revenue of $6.7 billion. |

| Regulatory & Compliance | Adherence to data security, reporting, and industry standards. | Significant investment in legal counsel and specialized personnel. |

| Customer Loyalty & Switching Costs | Trust, proven track record, and specialized expertise. | CACI's FY2023 new contract awards exceeded $6 billion. |

Porter's Five Forces Analysis Data Sources

Our CACI Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from company annual reports, industry-specific market research, and regulatory filings. This comprehensive approach ensures a thorough understanding of competitive dynamics.