BW Offshore SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BW Offshore Bundle

BW Offshore's unique position in the offshore energy sector presents a compelling case for a deep dive into its strategic landscape. While their strong operational track record and expertise in floating production storage and offloading (FPSO) units are clear strengths, understanding the full extent of their market opportunities and potential threats is crucial for any informed decision.

Beyond these initial observations, a comprehensive SWOT analysis reveals the nuanced interplay of BW Offshore's internal capabilities against external market forces. This includes a closer look at their financial health, their competitive positioning, and the evolving regulatory environment impacting offshore operations.

Want to truly grasp the drivers of BW Offshore's success and the challenges they face? Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

BW Offshore's strength as an integrated service provider is a significant advantage. They manage the entire lifecycle of FPSO (Floating Production, Storage, and Offloading) units, from initial design and engineering through to construction, installation, and ongoing operation. This end-to-end capability allows for enhanced control over project timelines, quality standards, and overall costs, giving them a competitive edge.

This integrated model translates into tangible benefits for clients, fostering stronger relationships and driving operational efficiencies. For instance, their ability to seamlessly transition from project delivery to long-term operational support reduces complexity and risk for their customers. In 2023, BW Offshore reported a robust order backlog, reflecting the market's confidence in their comprehensive service offering.

BW Offshore's operational performance is a significant strength, highlighted by impressive fleet uptime. In the fourth quarter of 2024, this metric reached over 99%, and in the first quarter of 2025, it hit a perfect 100%. This consistent reliability ensures maximum asset utilization and revenue generation.

The company also possesses a robust firm contract backlog, valued at approximately USD 5.3 billion as of the close of 2024. This substantial backlog provides excellent revenue visibility and predictable cash flow for the foreseeable future, offering a strong foundation for financial stability and strategic planning.

BW Offshore's strength lies in its deep expertise with complex projects, particularly in newbuilds, gas Floating Production Storage and Offloading (FPSO) units, and operating in demanding, harsh environments. A prime example is their involvement with the Barossa FPSO, delivered as the BW Opal, showcasing their ability to manage and execute highly technical undertakings.

This specialized know-how in challenging offshore projects sets BW Offshore apart, enabling them to tackle ventures that demand sophisticated engineering and stringent operational oversight. Their track record in these areas provides a significant competitive advantage, attracting clients seeking reliable partners for intricate developments.

Strategic Diversification into Energy Transition

BW Offshore is strategically diversifying into the energy transition, a significant strength. The company is actively involved in developing offshore wind projects, notably through its 64% stake in BW Ideol, a recognized leader in floating offshore wind technology. This positions them at the forefront of a rapidly growing renewable energy sector.

Further strengthening their position, BW Offshore is actively exploring other low-emission solutions. This includes initiatives in carbon capture and storage (CCS) and the development of floating ammonia production. These ventures are crucial for future growth, tapping into emerging markets for renewable and low-carbon energy solutions.

- Active Role in Energy Transition: BW Offshore is not just observing the energy transition; it's actively participating by investing in and developing renewable energy infrastructure.

- BW Ideol's Expertise: Their 64% ownership in BW Ideol provides access to cutting-edge floating offshore wind technology, a key differentiator in this nascent market.

- Portfolio Expansion: The exploration of CCS and floating ammonia production demonstrates a forward-thinking approach, broadening their offerings beyond traditional offshore services.

- Future Growth Potential: These strategic moves are designed to secure future revenue streams and market share in the evolving global energy landscape.

Robust Financial Position and Shareholder Returns

BW Offshore demonstrates a robust financial position, highlighted by a full-year net profit of USD 120 million for 2024. This profitability is underpinned by a strong balance sheet featuring USD 540 million in available liquidity as of December 2024, allowing the company to achieve a net cash positive status.

The company's commitment to shareholder returns is evident in its consistent value distribution. For 2024, BW Offshore distributed a total cash dividend of USD 59 million, representing a significant 22% increase year-on-year. This dividend payout aligns with the company's policy of distributing up to its maximum allowed level, signaling confidence in its ongoing financial performance.

- Strong Profitability: USD 120 million net profit in 2024.

- Healthy Liquidity: USD 540 million available liquidity as of December 2024.

- Net Cash Positive: Achieved a net cash positive position.

- Growing Shareholder Returns: 22% year-on-year increase in cash dividends for 2024, totaling USD 59 million.

BW Offshore's integrated service model is a key strength, managing the full FPSO lifecycle from concept to operation. This end-to-end control enhances project delivery, quality, and cost management, fostering strong client relationships and operational efficiencies. Their 2023 order backlog demonstrated market confidence in this comprehensive approach.

Exceptional fleet uptime, exceeding 99% in Q4 2024 and reaching 100% in Q1 2025, signifies BW Offshore's operational reliability and maximizes asset utilization. This consistent performance is backed by a robust firm contract backlog of approximately USD 5.3 billion as of the end of 2024, ensuring predictable revenue and financial stability.

The company excels in complex offshore projects, including newbuilds and gas FPSOs, particularly in challenging environments, as shown by the Barossa FPSO project. Furthermore, BW Offshore is strategically expanding into the energy transition, holding a 64% stake in BW Ideol, a leader in floating offshore wind technology, and exploring CCS and floating ammonia production for future growth.

Financially, BW Offshore reported a net profit of USD 120 million for 2024, supported by USD 540 million in available liquidity in December 2024, leading to a net cash positive position. They also increased shareholder returns, distributing USD 59 million in cash dividends for 2024, a 22% rise year-on-year.

| Metric | Value (2024/2025) | Significance |

|---|---|---|

| Fleet Uptime | >99% (Q4 2024), 100% (Q1 2025) | Maximizes asset utilization and revenue generation. |

| Firm Contract Backlog | ~USD 5.3 billion (End of 2024) | Provides revenue visibility and financial stability. |

| Net Profit | USD 120 million (Full Year 2024) | Demonstrates strong profitability. |

| Available Liquidity | USD 540 million (December 2024) | Ensures financial flexibility and net cash positive status. |

| Cash Dividends | USD 59 million (2024) | Indicates commitment to shareholder returns with a 22% YoY increase. |

| BW Ideol Stake | 64% | Positions the company in the growing floating offshore wind market. |

What is included in the product

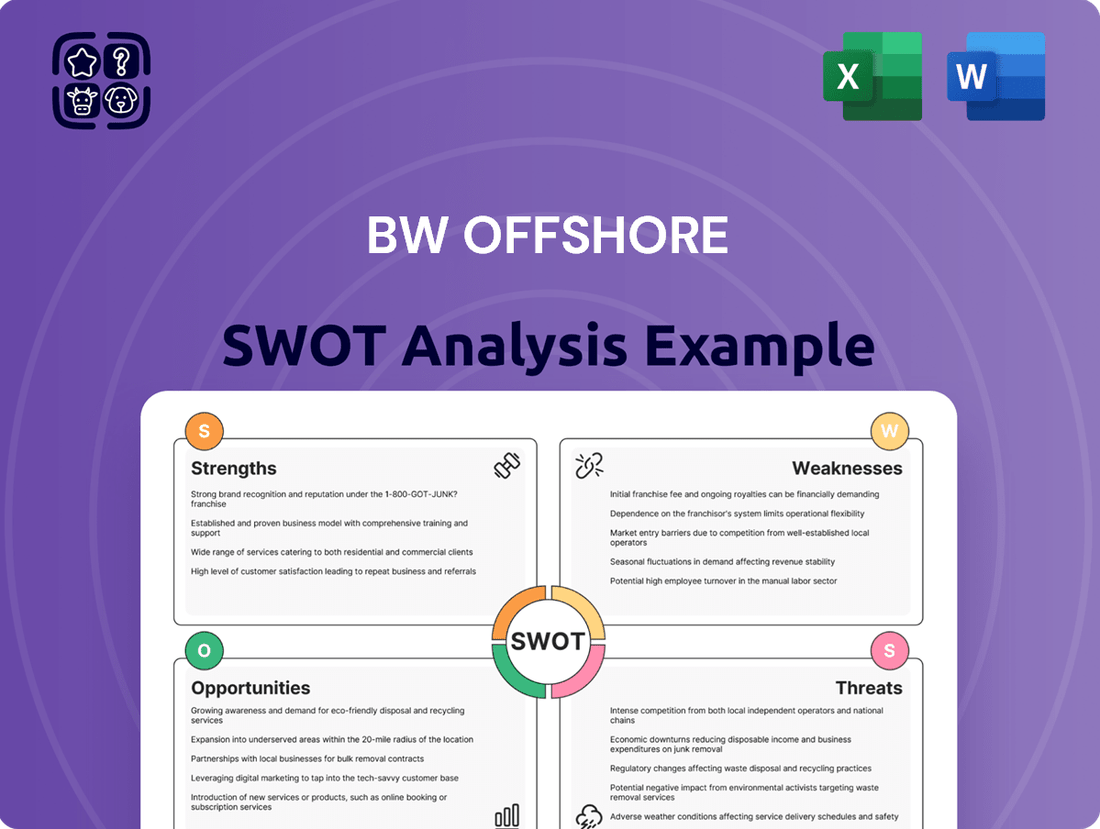

Analyzes BW Offshore’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

Offers a clear, structured view of BW Offshore's strategic landscape, pinpointing key areas for improvement and risk mitigation.

Weaknesses

BW Offshore's inherent vulnerability to the oil and gas market's ups and downs is a significant weakness. Even with its efforts to broaden its business scope, a substantial chunk of its earnings and financial success is still linked to the energy sector's unpredictable nature. This dependence means that shifts in energy prices and investment patterns can directly affect the demand for their Floating Production Storage and Offloading (FPSO) services, how easily projects can be funded, and the company's bottom line, introducing considerable market risk.

For instance, during periods of low oil prices, such as those seen in 2020 and parts of 2021, which averaged around $41.27 per barrel for Brent crude, BW Offshore would likely experience reduced demand for new projects and potential pressure on existing contracts. While the market has recovered, with Brent crude prices averaging approximately $77.50 per barrel in 2024, the underlying volatility remains a persistent concern. This cyclicality can lead to lumpy revenue streams and make long-term financial planning more challenging.

The design, engineering, construction, and operation of Floating Production Storage and Offloading (FPSO) vessels are inherently capital-intensive. This necessitates substantial upfront investment, potentially straining liquidity even for financially sound companies, particularly when managing multiple large projects or facing cost escalations.

For example, the construction of a single FPSO can easily cost upwards of $1 billion, and BW Offshore's project pipeline reflects this significant capital outlay. As of early 2024, the company continued to manage ongoing construction and upgrade projects, demanding consistent and substantial capital allocation, which can impact financial flexibility.

BW Offshore faces significant project execution risks, particularly with large-scale Floating Production Storage and Offloading (FPSO) units. The inherent complexity of these projects, exemplified by the Barossa FPSO (BW Opal), makes them prone to delays and unexpected cost increases.

The Barossa project serves as a prime example, having recently required additional net investments estimated between USD 100 million and USD 150 million as it approaches its final stages. This underscores the substantial financial exposure BW Offshore undertakes with complex newbuild FPSO developments.

Aging Fleet and Divestment Program Impact

BW Offshore's completion of its fleet divestment program, while a strategic move to streamline operations, has resulted in a smaller operational fleet. This reduction could impact immediate revenue generation from its conventional business, as older, less efficient units are removed from service. The company will need to focus on acquiring or upgrading assets to maintain its market presence and capacity.

The consequences of this divestment mean a constrained operational capacity in the short term. This limitation could affect the company's ability to capitalize on all available market opportunities, particularly those requiring a larger fleet. Continuous investment in new, more efficient assets is therefore crucial for BW Offshore to sustain its competitive edge.

- Reduced Operational Fleet: The divestment program has led to a smaller fleet, potentially limiting immediate revenue from older units.

- Capacity Constraints: A smaller fleet may restrict BW Offshore's ability to take on all potential projects.

- Need for Reinvestment: Ongoing investment in new or upgraded assets is essential to compensate for divested capacity and maintain market share.

- Impact on Revenue Streams: The phasing out of older vessels could temporarily affect revenue generation from those specific assets.

Intense Competition in FPSO and Renewable Markets

BW Offshore operates in highly competitive sectors. The Floating Production, Storage, and Offloading (FPSO) market sees numerous established global players actively bidding on new projects, putting pressure on contract awards and pricing. For instance, in 2024, the global FPSO market was estimated to be worth around $10 billion, with significant competition among the top five providers for newbuild and conversion contracts.

The offshore wind sector, though experiencing rapid growth, is also characterized by intense rivalry. Established energy majors and specialized offshore wind developers are aggressively pursuing market share. This necessitates BW Offshore to maintain a competitive edge through technological advancements and cost-effective solutions to secure its position in this expanding market. By the end of 2024, the global offshore wind capacity was projected to reach over 100 GW, indicating substantial growth but also a crowded competitive landscape.

- Intense bidding for FPSO contracts from major oil and gas companies.

- Established and emerging players in the offshore wind sector create pricing pressure.

- Need for continuous innovation to differentiate services in both markets.

- Securing new projects requires demonstrating cost competitiveness against a broad field of rivals.

BW Offshore's reliance on the volatile oil and gas market remains a core weakness. Despite diversification efforts, significant earnings are still tied to energy sector fluctuations, impacting project funding and demand for FPSO services. For example, Brent crude prices fluctuated significantly, averaging around $41.27 in 2020 and recovering to approximately $77.50 in 2024, highlighting the inherent cyclicality and revenue unpredictability.

The capital-intensive nature of FPSO development presents another challenge, requiring substantial upfront investment. The construction of a single FPSO can exceed $1 billion, straining liquidity, especially when managing multiple projects or facing cost overruns, as seen with ongoing developments in early 2024.

Project execution risks are considerable, with complex FPSO projects susceptible to delays and cost escalations. The Barossa FPSO project, for instance, recently incurred additional net investments of $100 million to $150 million, demonstrating the financial exposure involved.

BW Offshore's fleet divestment program, while strategic, has reduced its operational capacity. This can limit its ability to seize all market opportunities and necessitates continuous investment in new, more efficient assets to maintain competitiveness and replace divested capacity.

The company operates in highly competitive markets, with intense bidding for FPSO contracts and growing rivalry in the offshore wind sector. In 2024, the global FPSO market, valued at approximately $10 billion, saw significant competition, requiring BW Offshore to prioritize cost-effectiveness and innovation to secure new projects.

Same Document Delivered

BW Offshore SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You'll gain immediate access to the full BW Offshore SWOT analysis upon purchase. This comprehensive report details their Strengths, Weaknesses, Opportunities, and Threats. No hidden content, just the complete analysis.

Opportunities

The global Floating Production Storage and Offloading (FPSO) market is on a significant upswing, projected to reach approximately $11.4 billion by 2028, up from $8.2 billion in 2023, according to industry analysis. This expansion is largely fueled by intensified exploration and production efforts in deep and ultra-deepwater environments. BW Offshore is well-positioned to capitalize on this trend.

As onshore oil and gas reserves continue to dwindle, the industry is increasingly turning to offshore locations. FPSOs offer a compellingly cost-effective and adaptable solution for accessing these remote and technically demanding fields, making them a crucial component of future energy supply strategies.

BW Offshore's existing fleet and expertise in operating in challenging offshore conditions directly align with this growing demand. The company's ability to deliver and manage these complex assets provides a distinct advantage in securing new contracts and expanding its market share.

The offshore wind market is poised for substantial expansion, with projections indicating significant capacity additions over the next decade, particularly in floating wind platforms. This growth is driven by increasing demand for renewable energy and technological advancements making floating wind more viable.

BW Offshore's strategic investment in BW Ideol places them in a prime position to benefit from this burgeoning sector. This move allows BW Offshore to leverage its extensive offshore operational experience, a core competency, to tap into new and lucrative revenue streams within the renewable energy space.

By entering the floating offshore wind market, BW Offshore can diversify its business portfolio beyond its traditional oil and gas FPSO services. This diversification is crucial for long-term sustainability and growth, especially as the global energy landscape shifts towards cleaner sources.

The global offshore wind market is expected to reach over 160 GW by 2030, with floating offshore wind representing a rapidly growing segment. BW Ideol, a key player in this niche, has a strong pipeline of projects, offering BW Offshore a tangible pathway to participate in this multi-billion dollar market opportunity.

BW Offshore is well-positioned to capitalize on the increasing demand for decarbonization solutions in the offshore energy sector. The company's ongoing development of integrated carbon capture and storage (CCS) modules for floating production storage and offloading (FPSO) units directly addresses the industry's drive to reduce its carbon footprint. This focus on green technologies, including energy-efficient designs, aligns with tightening environmental regulations and client preferences for lower-emission operations.

The company's investment in floating zero-carbon fuel production units, such as those for ammonia or methanol, represents a forward-looking strategy. These initiatives offer BW Offshore the chance to be a pioneer in supplying sustainable energy solutions, moving beyond traditional oil and gas services. For instance, the global market for low-carbon ammonia is projected to grow substantially, with estimates suggesting it could reach hundreds of billions of dollars by 2050, offering a significant revenue stream for innovative providers like BW Offshore.

New FPSO Project

BW Offshore is strategically positioned to capitalize on the robust demand for Floating Production, Storage, and Offloading (FPSO) units. The company's objective to secure a new FPSO project every two years aligns perfectly with the current market dynamics. In 2023, the FPSO market saw significant activity, with several major projects progressing to the final investment decision (FID) stage, signaling strong future contract potential.

The market is particularly buoyant for infrastructure-type projects that offer extended production lifecycles and cost efficiencies. This trend favors BW Offshore's focus on low break-even cost solutions. Industry analysts project that the global FPSO market could reach approximately $70 billion by 2028, driven by new field developments and aging offshore infrastructure requiring upgrades.

- Active Tendering and FEED Activity: The high level of tendering and Front-End Engineering Design (FEED) work indicates a strong pipeline of potential new contracts for FPSO providers like BW Offshore.

- Demand for Gas FPSOs: There is a notable surge in demand for large gas FPSOs, a segment where BW Offshore has demonstrated considerable expertise.

- Harsh Environment Solutions: The increasing need for FPSOs capable of operating in challenging, harsh environments presents another significant opportunity for the company to leverage its technological capabilities.

- Long-Term Production Profiles: The emphasis on projects with long production profiles aligns with BW Offshore's strategy of securing stable, long-term revenue streams.

Strategic Partnerships and Acquisitions

BW Offshore's strategic partnerships and acquisitions present significant growth avenues. Collaborations in offshore wind, like their involvement in the Mediterranean Tender alongside partners such as EDF Renewables and Maple Power, are crucial for faster market penetration and advancing technological capabilities. This approach leverages shared expertise and resources, reducing individual risk while accelerating project timelines.

Strategic acquisitions and joint ventures offer another powerful lever for BW Offshore to enhance its competitive standing. By integrating complementary businesses or technologies, the company can broaden its service portfolio across both established oil and gas operations and emerging renewable energy sectors. For instance, acquiring a specialized subsea technology firm could bolster its offshore wind installation services, or a joint venture in a new geographic market could provide immediate access and local market knowledge. Such moves are vital for diversifying revenue streams and capturing new market share in a rapidly evolving energy landscape.

- Accelerated Market Entry: Partnerships, as seen in the Mediterranean offshore wind tender, allow BW Offshore to tap into established networks and regulatory expertise, speeding up entry into new markets.

- Technology Development: Collaborating with renewable energy leaders like EDF Renewables facilitates the co-development and adoption of cutting-edge technologies essential for offshore wind projects.

- Strengthened Market Position: Strategic acquisitions can consolidate BW Offshore's presence in key segments, enhancing its ability to compete for larger, more complex projects.

- Expanded Service Offerings: Integrating new capabilities through joint ventures or acquisitions allows BW Offshore to offer a more comprehensive suite of services, catering to both traditional and new energy demands.

BW Offshore's strategic focus on the burgeoning FPSO market presents a significant opportunity, with projections showing the sector potentially reaching $70 billion by 2028. The company's aim to secure a new FPSO project every two years aligns with strong current market activity and demand for long-term production profiles. This is further bolstered by a notable increase in demand for large gas FPSOs, a segment where BW Offshore possesses considerable expertise, and a growing need for units capable of operating in harsh environments.

The company's expansion into offshore wind, particularly through its investment in BW Ideol, positions it to capitalize on a rapidly growing renewable energy sector. With the global offshore wind market expected to exceed 160 GW by 2030, and floating wind a key growth area, BW Offshore can leverage its offshore operational experience for new revenue streams. Moreover, BW Offshore's commitment to developing decarbonization solutions, such as integrated CCS modules and floating zero-carbon fuel production units, taps into a crucial industry trend driven by tightening environmental regulations and the global push for sustainability.

| Opportunity Area | Market Projection/Growth Factor | BW Offshore Relevance |

|---|---|---|

| FPSO Market Growth | Projected to reach $70 billion by 2028 | Objective to secure new FPSO projects aligns with market demand. |

| Offshore Wind Expansion | Global market >160 GW by 2030 (floating wind segment growing) | Investment in BW Ideol leverages offshore expertise for renewable energy. |

| Decarbonization Solutions | Increasing demand for CCS and zero-carbon fuel production | Development of CCS modules and ammonia/methanol units addresses industry needs. |

| Gas FPSO Demand | Notable surge in demand for large gas FPSOs | Leverages existing expertise in a key growth segment. |

Threats

Fluctuations in global oil and gas prices directly impact investment decisions in offshore projects, potentially leading to project delays or cancellations. For instance, a significant drop in Brent crude prices, which saw averages around $80-$85 per barrel in early 2024, can make new FPSO (Floating Production Storage and Offloading) projects less economically viable, affecting BW Offshore's future order book.

Escalating geopolitical tensions, such as ongoing conflicts in key energy-producing regions or trade disputes, can disrupt supply chains and increase operational costs. This unpredictability makes long-term planning for large-scale offshore developments challenging, potentially impacting project timelines and profitability for companies like BW Offshore operating in a globalized market.

The global push for decarbonization intensifies environmental regulations, directly impacting BW Offshore's operations. Stricter emissions standards, particularly for greenhouse gases, necessitate substantial investment in cleaner technologies and operational adjustments. For instance, by 2024, many offshore regions are enforcing lower sulphur fuel limits and exploring carbon capture technologies, which add significant capital expenditure. This trend increases operational costs as companies adapt to new compliance requirements, potentially affecting project economics and the competitiveness of traditional FPSO models.

A faster-than-expected global pivot away from fossil fuels presents a significant threat, potentially reducing the long-term demand for BW Offshore's core Floating Production Storage and Offloading (FPSO) services. The International Energy Agency reported in their 2024 outlook that renewable energy sources are projected to account for over 50% of global power generation by 2025, a pace that could accelerate fossil fuel decline.

Emerging disruptive technologies in renewable energy generation and advanced energy storage solutions also pose a risk if BW Offshore's adaptation strategy lags. For example, breakthroughs in green hydrogen production or large-scale battery storage could fundamentally alter energy infrastructure, diminishing the need for traditional offshore oil and gas production facilities.

Supply Chain Constraints and Inflationary Pressures

BW Offshore, like many in the global energy sector, is grappling with significant supply chain constraints. This tightness, particularly affecting specialized offshore equipment and key components, directly translates into higher costs for new projects and ongoing operations. For instance, the cost of offshore vessels and critical machinery has seen substantial increases in 2024, with some estimates suggesting a 15-20% rise in capital expenditure for certain project types compared to pre-2023 levels.

These inflationary pressures extend beyond just equipment, impacting the cost of skilled labor and essential services needed for offshore installations and maintenance. This can erode project profitability and create uncertainty around delivery timelines. The offshore wind sector, a key growth area for BW Offshore, has particularly felt the pinch, with several projects experiencing budget overruns and delayed commissioning due to these very issues.

- Rising Equipment Costs: Global inflation has driven up the price of specialized offshore components, impacting capital expenditure.

- Labor and Service Inflation: Increased demand for skilled offshore labor and essential services contributes to higher operational costs.

- Project Cost Overruns: Supply chain bottlenecks and inflation directly lead to increased project budgets and potential delays.

- Impact on Profitability: Higher costs and potential delays can negatively affect the financial returns on BW Offshore's projects.

Intense Competition and Market Saturation

The Floating Production Storage and Offloading (FPSO) sector, a core area for BW Offshore, faces significant competitive pressures. Several established global players vie for contracts, which can drive down pricing and shrink profit margins on new projects. For instance, in 2023, the industry saw continued bidding activity for major FPSO projects, with several operators securing contracts at competitive rates, underscoring this threat.

While the offshore wind market presents growth opportunities, it's also becoming increasingly crowded. This influx of competitors, including new entrants and established offshore service providers diversifying their offerings, raises the risk of market saturation in specific regions or for particular types of projects. This heightened competition could make securing offshore wind installation and maintenance contracts more challenging and less lucrative.

The increasing number of companies targeting offshore wind projects means more bids for a finite number of opportunities. This intense competition can lead to:

- Price Erosion: Bidders may lower their prices to win contracts, impacting profitability.

- Reduced Margins: Even winning bids might offer lower returns than in less competitive markets.

- Market Saturation: Certain offshore wind segments could become oversupplied with service providers.

- Tender Challenges: Winning bids may require offering more comprehensive or innovative solutions to stand out.

The energy transition poses a substantial threat, as a faster-than-expected global shift away from fossil fuels could reduce long-term demand for BW Offshore's FPSO services. By 2025, renewable energy is projected to exceed 50% of global power generation, accelerating this trend.

Disruptive technologies in renewables and energy storage could also diminish the need for traditional offshore oil and gas infrastructure, impacting BW Offshore's core business model.

Supply chain constraints and inflationary pressures are driving up costs for specialized offshore equipment and skilled labor. For instance, capital expenditure for certain offshore projects saw a 15-20% increase in 2024 compared to pre-2023 levels, impacting project profitability and timelines, particularly in the offshore wind sector.

Intensifying competition within the FPSO sector and the increasingly crowded offshore wind market are leading to price erosion and reduced profit margins for BW Offshore.

| Threat Category | Specific Threat | Impact on BW Offshore | Example/Data Point (2024/2025) |

|---|---|---|---|

| Energy Transition | Accelerated Fossil Fuel Decline | Reduced long-term demand for FPSOs | Renewables >50% global power generation by 2025 |

| Technological Disruption | Renewable Energy Advancements | Decreased need for offshore oil/gas infrastructure | Breakthroughs in green hydrogen/battery storage |

| Economic Factors | Supply Chain & Inflation | Increased CAPEX, higher operational costs, reduced profitability | 15-20% CAPEX rise for offshore projects (2024) |

| Market Competition | Intense Industry Rivalry | Price erosion, shrinking profit margins | Competitive bidding for major FPSO projects (2023) |

SWOT Analysis Data Sources

This BW Offshore SWOT analysis is built upon a foundation of robust data, including the company's official financial filings, comprehensive market research reports, and insights from industry experts. These diverse sources ensure a well-rounded and informed perspective on the company's strategic position.