BW Offshore PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BW Offshore Bundle

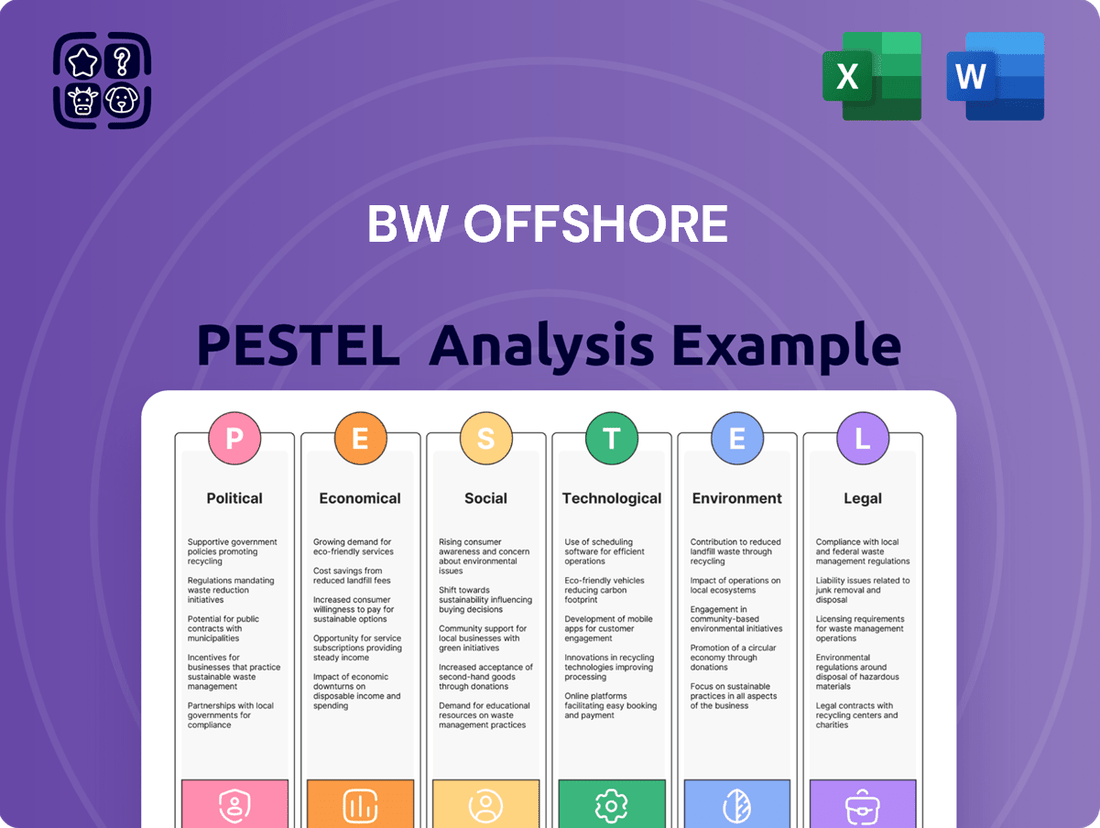

Navigate the complex external environment shaping BW Offshore's future. Our PESTLE analysis meticulously examines political stability, economic fluctuations, social shifts, technological advancements, evolving environmental regulations, and legal frameworks impacting the company. Gain critical insights to anticipate challenges and capitalize on opportunities.

Unlock a strategic advantage with our comprehensive PESTLE analysis of BW Offshore. Understand how global trends in politics, economics, society, technology, environment, and law are creating both risks and opportunities for the offshore industry. Download the full report to arm yourself with actionable intelligence.

Political factors

Political stability in regions where BW Offshore operates Floating Production, Storage, and Offloading (FPSO) units is a critical factor influencing project success. For instance, in regions like Nigeria, which is a significant market for FPSOs, political stability directly correlates with the security of offshore assets and the continuity of operations. Fluctuations in political landscapes can introduce risks that affect contract awards and project financing, as seen in past instances where security concerns led to increased operational costs for energy companies.

Regions rich in oil and gas reserves, often the primary locations for FPSO deployment, can experience heightened geopolitical tensions. BW Offshore's operations in West Africa, for example, are subject to the political climate of the nations involved. Unforeseen political instability or localized conflicts can disrupt supply chains and necessitate enhanced security measures, impacting project timelines and overall profitability. The company's ability to secure long-term contracts, which are vital for predictable revenue streams, is significantly bolstered by stable governance and predictable regulatory frameworks.

Conversely, a stable political environment fosters investor confidence and encourages long-term capital investment in offshore projects. Countries with a history of consistent policy and a commitment to the energy sector provide a more secure environment for BW Offshore to operate and expand its fleet. For example, Brazil, a key market for FPSO deployment, has seen substantial investment in its pre-salt fields, partly due to a relatively stable political and regulatory environment supporting offshore exploration and production activities.

Government policies are a major force shaping BW Offshore's future, especially concerning the global shift away from fossil fuels. Many nations are actively promoting renewable energy, offering substantial incentives and subsidies to encourage the development of offshore wind farms and carbon capture technologies. For example, the EU's Renewable Energy Directive aims for 42.5% renewable energy by 2030, with a push for offshore wind to contribute significantly. This creates new opportunities for BW Offshore to leverage its offshore expertise in these growing sectors.

Conversely, stricter regulations on oil and gas production, driven by climate change goals, could impact BW Offshore's traditional business. While the demand for floating production, storage, and offloading (FPSO) units remains for existing hydrocarbon fields, the pace of new project approvals and exploration activities may slow in regions with aggressive decarbonization targets. The International Energy Agency’s Net Zero Emissions by 2050 scenario suggests a substantial decline in oil and gas investment post-2030, highlighting the need for strategic adaptation.

International sanctions and evolving trade agreements significantly shape BW Offshore's operational landscape. For instance, the ongoing geopolitical tensions and resulting sanctions impacting regions where BW Offshore operates, such as those related to Russia, can disrupt equipment procurement and project execution. In 2024, the global trade environment continues to be influenced by trade disputes and the renegotiation of bilateral and multilateral agreements, potentially affecting BW Offshore's access to critical components and its ability to secure financing for projects in specific markets. Compliance with an increasingly complex web of international regulations remains paramount to mitigate legal risks and maintain access to global supply chains and client portfolios.

Fiscal Regimes and Taxation for Offshore Operations

Changes in national fiscal regimes, including royalties and taxation policies for offshore oil and gas, directly influence BW Offshore's profitability and strategic investment choices. For instance, a shift towards more favorable tax incentives in a key operating region could spur the company to greenlight new projects, knowing that its net returns will be enhanced. Conversely, an increase in production levies or corporate taxes could render certain marginal developments economically unviable, prompting a reassessment of existing or planned offshore operations.

BW Offshore actively tracks these evolving fiscal landscapes across its global footprint. For example, in 2024, several nations with significant offshore potential are reviewing their tax structures. Countries like Brazil and Nigeria have historically adjusted their fiscal terms, impacting the attractiveness of new contract awards. The company's ability to adapt its financial modeling and bidding strategies to these changing tax environments is crucial for maintaining competitiveness and securing profitable contracts.

- Fiscal Regime Impact: BW Offshore's profitability is directly tied to the tax and royalty structures in countries where it operates.

- Investment Decisions: Favorable fiscal terms can unlock new project investments, while unfavorable ones can deter development.

- Global Monitoring: The company continuously monitors tax policy changes in key offshore regions worldwide.

- 2024/2025 Outlook: Emerging trends in 2024/2025 suggest ongoing scrutiny of fiscal terms in established and developing offshore oil and gas markets.

Regulatory Frameworks for Offshore Wind Development

The regulatory environment for offshore wind is a significant political factor for BW Offshore. Evolving frameworks around permitting, grid connections, and environmental impact assessments directly influence project timelines and investment attractiveness. For instance, streamlined permitting processes can significantly de-risk and accelerate development, a crucial element for BW Offshore's strategic growth in this burgeoning sector.

Supportive government policies are vital for attracting the substantial capital required for offshore wind projects. In 2023, global investment in offshore wind reached approximately $70 billion, highlighting the market's potential, but also its reliance on stable regulatory backing. Uncertainty, such as temporary withdrawals of leasing areas, as seen in some US regions, can indeed stall progress and deter investment, impacting companies like BW Offshore.

- Streamlined Permitting: For example, the US Bureau of Ocean Energy Management (BOEM) aims to reduce offshore wind permitting timelines by 30% by 2025.

- Grid Connection Policies: Germany's 2023 offshore wind act includes provisions for faster grid integration, a key enabler for project viability.

- Environmental Regulations: Stricter environmental impact assessments, while necessary, can extend project development phases, requiring robust planning from BW Offshore.

- Leasing Area Availability: Government decisions on the availability of offshore wind leasing areas directly impact future project pipelines and BW Offshore's long-term market access.

Political stability is paramount for BW Offshore's operations, directly impacting project security and continuity in key markets like Nigeria. Geopolitical tensions in regions with oil and gas reserves, such as West Africa, can disrupt supply chains and increase operational costs, highlighting the need for stable governance to secure long-term contracts.

Governments worldwide are increasingly promoting renewable energy, with initiatives like the EU's Renewable Energy Directive aiming for 42.5% renewable energy by 2030, creating new avenues for BW Offshore in offshore wind and carbon capture. Conversely, stricter regulations on fossil fuels, influenced by climate change goals and the International Energy Agency's Net Zero Emissions by 2050 scenario, may slow new oil and gas project approvals, necessitating strategic adaptation.

International sanctions and trade agreements, such as those impacting regions near Russia, can disrupt equipment procurement and project execution in 2024, affecting BW Offshore's access to critical components and financing. Changes in national fiscal regimes, including tax and royalty policies, directly influence profitability; for example, Brazil and Nigeria have historically adjusted fiscal terms impacting contract awards.

The regulatory environment for offshore wind, including permitting and grid connection policies, is crucial for BW Offshore's growth, with the US aiming to reduce offshore wind permitting timelines by 30% by 2025. Supportive government policies are vital, as evidenced by global offshore wind investment reaching approximately $70 billion in 2023, underscoring the market's reliance on stable regulatory backing.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting BW Offshore, detailing how political, economic, social, technological, environmental, and legal forces create both opportunities and threats.

It offers actionable insights and forward-looking perspectives for strategic decision-making, enabling stakeholders to navigate the complex landscape BW Offshore operates within.

A concise, actionable summary of BW Offshore's PESTLE factors, designed to quickly identify and address external pressures impacting strategic decision-making.

Economic factors

Global oil and gas prices have a direct impact on BW Offshore's business. When energy prices are high, like the average Brent crude price of around $82 per barrel in early 2024, it typically encourages more exploration and production. This increased activity boosts the demand for floating production, storage, and offloading (FPSO) vessels, which are central to BW Offshore's operations.

Conversely, periods of lower oil and gas prices can significantly dampen the market for offshore projects. For instance, if prices were to fall below the $60 per barrel mark, many companies might postpone or cancel new developments, directly reducing the need for BW Offshore's services and potentially impacting their project pipeline and profitability.

Global economic expansion is a key driver for BW Offshore's business, directly correlating with energy demand. A healthy global economy, projected to grow by approximately 3.1% in 2024 according to the IMF, fuels increased industrial activity and transportation, both of which require substantial energy. This rising demand for hydrocarbons supports the long-term need for offshore production facilities like Floating Production Storage and Offloading (FPSO) units.

BW Offshore's strategic focus on infrastructure-type FPSO projects with extended production lifespans is well-aligned with this trend. These projects are designed to meet sustained energy needs. For instance, the company secured a significant contract in late 2023 for an FPSO destined for the Grand Canyon field, expected to commence production in 2027, highlighting the ongoing investment in offshore extraction driven by anticipated demand for the foreseeable future.

The International Energy Agency (IEA) forecasts that global oil demand will continue to rise through 2025, albeit at a slower pace. This sustained demand underpins the continued relevance of BW Offshore's core FPSO services. The company's order backlog, which stood at approximately USD 7.4 billion at the end of 2023, reflects the market’s confidence in the need for its specialized offshore infrastructure.

BW Offshore's ability to secure new contracts and fund its growth heavily relies on interest rates and the availability of capital. The significant upfront investment for Floating Production Storage and Offloading (FPSO) newbuilds and conversions means that fluctuating interest rates directly impact project costs. For example, if benchmark rates like the US Federal Funds Rate, which influences global borrowing costs, rise significantly, the cost of financing these large projects increases, potentially making them less attractive.

Higher interest rates can also dampen investor appetite for capital-intensive industries like offshore oil and gas. This reduced appetite can make it more challenging for BW Offshore to access the necessary funds for both new projects and ongoing operations. In 2024 and heading into 2025, the global economic landscape suggests that interest rates, while potentially stabilizing or seeing modest reductions from their peaks, will likely remain elevated compared to the low-rate environment of the preceding decade, impacting the cost of capital for BW Offshore.

Inflation and Supply Chain Costs

Inflationary pressures and the ongoing strain on global supply chains present significant challenges for BW Offshore, directly impacting the cost of materials, equipment, and skilled labor essential for Floating Production Storage and Offloading (FPSO) projects. These rising expenses can compress profit margins for these large-scale, capital-intensive undertakings.

BW Offshore has publicly acknowledged these headwinds, noting that its project execution and cost management strategies have been adapted to better navigate the volatile cost environment. This includes a proactive approach to securing resources and optimizing procurement to mitigate the impact of escalating prices.

- Rising Material Costs: Global commodity prices, particularly for steel and components crucial for offshore infrastructure, have seen upward trends.

- Labor Shortages & Wage Inflation: Specialized offshore engineering and construction labor remains in high demand, leading to increased wage expectations.

- Logistical Bottlenecks: Port congestion and shipping capacity constraints continue to add to the cost and lead times for equipment delivery.

- Project Cost Overruns: Industry-wide, projects have experienced adjustments due to these inflationary pressures, necessitating tighter financial controls and contingency planning.

Investment Trends in Renewable Energy

Global investment in renewable energy is accelerating, with significant capital flowing into offshore wind projects. This trend, projected to continue through 2025 and beyond, presents a dual dynamic for companies like BW Offshore. It signifies a market evolution away from traditional fossil fuels, directly impacting demand for legacy assets.

However, this shift also represents a substantial opportunity. BW Offshore's strategic pivot towards low-carbon energy solutions, particularly in floating offshore wind, positions them to capitalize on this burgeoning market. The company's diversification strategy directly aligns with the increasing demand for sustainable energy infrastructure.

By 2025, the offshore wind sector is expected to see continued robust growth. For instance, projections indicate that global offshore wind capacity could reach over 100 GW by 2030, with substantial investments already committed. This growth trajectory underscores the economic viability and strategic importance of embracing renewable energy technologies.

- Increased Capital Allocation: Global investments in renewable energy, particularly offshore wind, are projected to surpass hundreds of billions of dollars annually by 2025.

- Market Shift: This trend signals a long-term decline in reliance on fossil fuels, influencing demand for traditional offshore infrastructure.

- Strategic Alignment: BW Offshore's diversification into low-carbon solutions and floating offshore wind directly benefits from this global investment surge.

- Growth Projections: The offshore wind market is anticipated to experience a compound annual growth rate of over 15% in the coming years, reaching significant capacity milestones.

Economic growth directly fuels BW Offshore's business by increasing energy demand. The IMF's projection of 3.1% global economic growth for 2024 highlights this link, as expansion drives industrial and transportation needs for hydrocarbons. This sustained demand supports BW Offshore's core FPSO services. The company's substantial order backlog of approximately USD 7.4 billion at the end of 2023 reflects market confidence in ongoing offshore extraction investments.

Interest rates significantly impact BW Offshore's project financing costs. Elevated rates, a trend expected to persist into 2025, increase the expense of capital for newbuilds and conversions. This can reduce the attractiveness of large projects. Higher rates also diminish investor appetite for capital-intensive sectors like offshore energy, potentially hindering BW Offshore's access to necessary funding.

Inflationary pressures and supply chain issues directly increase costs for materials, equipment, and labor in FPSO projects. These rising expenses can squeeze profit margins. BW Offshore is adapting its strategies to manage these volatile costs through proactive resource securing and procurement optimization.

The accelerating global investment in renewable energy, particularly offshore wind, presents both a market shift and an opportunity. While it may impact demand for legacy fossil fuel assets, BW Offshore's strategic move into floating offshore wind positions them to benefit from this significant capital flow. The offshore wind market is poised for robust growth through 2025 and beyond.

Same Document Delivered

BW Offshore PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This BW Offshore PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations. Understand how shifts in global energy policies, economic downturns, evolving societal preferences for sustainability, advancements in offshore technology, regulatory changes, and environmental concerns shape BW Offshore's strategic landscape. This comprehensive report provides the insights you need to navigate these complex external forces.

Sociological factors

Increasing public awareness of climate change is a significant sociological factor impacting BW Offshore. Growing concern about the environmental impact of fossil fuels directly influences regulatory landscapes and investor decisions. For instance, a 2024 survey indicated that 72% of global consumers consider climate change a major threat, pressuring companies towards greener practices.

BW Offshore actively addresses this by highlighting its commitment to emission reduction strategies and substantial investments in sustainable technologies. The company reported a 15% reduction in its Scope 1 and 2 emissions intensity in 2023 compared to its 2020 baseline. These sustainability initiatives are designed to align with evolving global reporting frameworks like GRI and SASB, aiming to bolster stakeholder confidence and attract environmentally conscious investors.

Societal pressure for cleaner energy is significantly influencing BW Offshore's direction, pushing the company towards the energy transition. This growing demand for sustainable solutions is a key driver for their exploration into offshore wind farms and carbon capture technologies. For instance, by 2025, the global offshore wind market is projected to reach over $100 billion, highlighting the scale of this shift. BW Offshore's commitment to this transition is evident in their strategic goal of providing current energy needs while simultaneously developing solutions for a low-carbon future.

The availability of skilled labor is a significant sociological consideration for BW Offshore. As the energy sector shifts, the demand for expertise in traditional offshore oil and gas operations must be balanced with the growing need for skilled workers in renewable energy sectors like floating wind. This transition requires substantial investment in retraining and upskilling initiatives.

By late 2024, the global offshore wind industry is projected to require hundreds of thousands of new workers to meet ambitious deployment targets, highlighting the urgency for BW Offshore to secure and develop talent. For instance, the International Renewable Energy Agency (IRENA) estimated in a 2023 report that the renewable energy sector, including offshore wind, could employ over 43 million people globally by 2030. This presents both a challenge and an opportunity for BW Offshore to leverage its existing offshore experience.

Societal Pressure for ESG Compliance

BW Offshore faces growing societal and investor demands for robust Environmental, Social, and Governance (ESG) compliance. This pressure directly influences how the company operates and communicates its performance, pushing for greater transparency and accountability in its sustainability efforts.

The company is actively integrating sustainability principles into its core operations, recognizing that strong ESG performance is crucial for maintaining its social license to operate and attracting capital. This proactive approach aims to build resilience and a positive reputation in a market increasingly focused on ethical business conduct.

BW Offshore aligns its reporting with globally recognized frameworks, such as the Global Reporting Initiative (GRI) standards, to meet stakeholder expectations. For instance, in 2023, BW Offshore reported a reduction in its Scope 1 and 2 greenhouse gas emissions intensity, demonstrating a commitment to environmental stewardship.

- Investor Demand: In 2024, sustainable investment funds continued to grow, with global sustainable assets projected to reach $50 trillion by 2025, highlighting significant investor interest in ESG-compliant companies like BW Offshore.

- Regulatory Scrutiny: Governments worldwide are enhancing ESG disclosure requirements, with many jurisdictions implementing mandatory climate-related financial disclosures, impacting reporting standards for companies in the offshore energy sector.

- Reputational Impact: A strong ESG record enhances BW Offshore's brand image, aiding in talent acquisition and retention, as employees increasingly seek to work for environmentally and socially responsible organizations.

- Operational Efficiency: Implementing ESG initiatives often leads to operational improvements, such as energy efficiency measures that reduce costs and environmental footprint, a trend observed across the energy industry in the 2024 fiscal year.

Community Engagement and Social License to Operate

BW Offshore’s ability to maintain strong community relationships is paramount for its social license to operate, especially in regions like West Africa. In 2024, the company continued its focus on local content development, aiming to maximize employment and procurement from host nations. For instance, on the FPSO Agogo project in Angola, BW Offshore has been actively working with local suppliers and training initiatives to build capacity. This engagement is vital, as demonstrated by the 2023 report showing that successful community relations can significantly reduce project delays and operational disruptions for offshore energy companies.

Positive community engagement translates into tangible benefits for BW Offshore’s operations. By investing in local infrastructure and social programs, the company fosters goodwill, which can ease regulatory approvals and mitigate potential social risks. For example, community development projects supported by BW Offshore in regions where it operates have historically correlated with lower instances of localized protests that could impact logistics and workforce availability. The company’s commitment to contributing to local job creation, exceeding 70% local employment targets on some projects by 2024, underscores this strategy.

Transparent communication and addressing community concerns proactively are key components of BW Offshore's strategy. This includes regular dialogues with community leaders and stakeholders to understand and respond to issues such as environmental impact and economic benefits. The company’s approach in 2024 emphasized this through enhanced stakeholder mapping and feedback mechanisms, building on lessons learned from previous projects where unmet expectations led to community friction.

The financial implications of a strong social license are considerable. Research from industry bodies in 2023 indicated that companies with robust community engagement strategies experienced, on average, 15% lower operating costs related to social risks compared to peers. This highlights how investing in local partnerships and development, such as BW Offshore's initiatives to support educational programs in coastal communities, directly contributes to long-term project viability and profitability.

Societal expectations regarding corporate responsibility and ethical conduct continue to shape BW Offshore's operations. Growing public awareness of climate change and the demand for sustainable energy solutions are powerful drivers influencing the company's strategic direction and investment in greener technologies.

BW Offshore's commitment to Environmental, Social, and Governance (ESG) principles is increasingly crucial for investor confidence and maintaining its social license to operate. Strong ESG performance, demonstrated through transparent reporting and concrete sustainability initiatives, is vital for attracting capital and talent in the evolving energy landscape.

The company's focus on local content development and positive community engagement is paramount for operational success and mitigating risks. By fostering strong relationships with host communities and investing in local capacity building, BW Offshore aims to ensure smooth project execution and long-term viability.

The global demand for skilled labor in the renewable energy sector, particularly offshore wind, presents both a challenge and an opportunity for BW Offshore. The company must balance the need for traditional offshore expertise with the growing requirement for new skills, necessitating investment in retraining and upskilling programs to secure its future workforce.

Technological factors

BW Offshore benefits from continuous advancements in Floating Production, Storage, and Offloading (FPSO) unit design. These improvements focus on modular construction for faster deployment and energy-efficient technologies to boost operational performance. For instance, newer FPSO designs often include features like double bottoms, which significantly simplify tank cleaning processes and improve safety.

The drive for enhanced efficiency also translates to reduced environmental impact. Innovations such as integrated carbon capture systems are being incorporated into FPSO designs to actively lower emissions. This commitment to technological progress ensures that FPSO operations become more sustainable and cost-effective, aligning with global environmental goals and improving the economic viability of offshore projects.

BW Offshore is actively integrating digitalization and automation into its offshore operations, a move that significantly bolsters safety, operational efficiency, and cost management. This technological shift is crucial for staying competitive in the dynamic energy sector.

The company utilizes sophisticated digital systems for its inventory management, ensuring better tracking and utilization of resources. For instance, efficient inventory control can reduce carrying costs, which are a significant operational expense in the offshore industry.

Furthermore, BW Offshore is investing in advanced analytics and artificial intelligence (AI) to optimize performance across its fleet. By analyzing vast amounts of operational data, AI can predict maintenance needs, enhance energy consumption, and streamline complex business processes, leading to substantial cost savings and improved uptime.

In 2023, the energy sector saw increased investment in digital transformation initiatives, with companies aiming to improve operational resilience and data-driven decision-making. BW Offshore’s commitment to these technologies aligns with this industry trend, positioning it for enhanced operational excellence and profitability in the coming years.

The integration of Carbon Capture and Storage (CCS) technologies on Floating Production Storage and Offloading (FPSO) units represents a significant technological shift in offshore energy production. This trend is driven by the increasing global focus on reducing greenhouse gas emissions from oil and gas operations. BW Offshore is actively investigating and developing strategies to incorporate CCS, aiming to position itself at the forefront of low-carbon energy solutions. The company’s exploration in this area is crucial for adapting to evolving environmental regulations and market demands.

Innovations in Offshore Wind Technology

Technological advancements in offshore wind, especially in floating wind, are a cornerstone of BW Offshore's diversification efforts. These innovations are key to unlocking new markets and project opportunities beyond traditional fixed-bottom installations.

Key innovations include the development of advanced floating foundation designs, such as spar-buoy, semi-submersible, and tension-leg platform (TLP) configurations, engineered for diverse metocean conditions. These designs are also being optimized for seamless integration with next-generation, larger wind turbines, which are critical for improving energy yield and economic viability.

The ongoing evolution of floating offshore wind technology is directly impacting BW Offshore's strategic positioning. For instance, by 2023, the global installed capacity of floating offshore wind was approaching 200 MW, with projections indicating significant growth, potentially reaching several gigawatts by the mid-2030s, driven by technological maturity and cost reductions.

- Floating Foundation Designs: Innovations in spar, semi-submersible, and TLP designs cater to a wider range of water depths and seabed conditions.

- Turbine Scalability: Compatibility with turbines exceeding 15 MW is becoming standard, enhancing power generation per unit.

- Mooring and Anchoring Systems: Advances in robust and cost-effective mooring and anchoring solutions are crucial for the stability and longevity of floating wind farms.

- Grid Integration and Cabling: Improved dynamic cable technology and subsea connection solutions are vital for efficient power export from floating platforms.

Development of New Energy Storage Solutions

The advancement of new energy storage solutions, like offshore blue ammonia production, offers substantial avenues for BW Offshore to broaden its service portfolio. These developments are crucial for the energy transition, and BW Offshore is well-positioned to leverage them.

Collaborations aimed at enhancing the technical and commercial feasibility of these storage technologies directly support BW Offshore's dedication to sustainable energy practices. For instance, by 2025, the global energy storage market is projected to reach a significant valuation, driven by these innovations.

- Market Growth: The energy storage market is expected to see substantial growth, with investments in new technologies like ammonia production increasing.

- Technological Advancements: Innovations in areas like carbon capture and storage (CCS) for blue ammonia production are becoming more commercially viable.

- Strategic Partnerships: BW Offshore's involvement in joint ventures and partnerships accelerates the development and deployment of these solutions.

- Sustainability Focus: These storage solutions align with global decarbonization goals, enhancing BW Offshore's ESG profile.

BW Offshore is significantly leveraging advancements in digitalization and automation to enhance operational efficiency and safety across its fleet. The integration of sophisticated digital systems for inventory management, for example, helps reduce carrying costs by ensuring better resource tracking and utilization.

The company is also investing in advanced analytics and AI to optimize fleet performance, predict maintenance needs, and improve energy consumption. This commitment to technological progress, aligning with the energy sector's increased focus on digital transformation in 2023, positions BW Offshore for improved operational excellence and profitability.

Technological evolution in floating offshore wind, including improved foundation designs and turbine scalability, is a key driver for BW Offshore's diversification strategy. As of 2023, floating offshore wind capacity was approaching 200 MW, with significant growth anticipated, underscoring the market's potential.

BW Offshore is exploring innovations in new energy storage solutions, such as offshore blue ammonia production, to broaden its service offerings and support the energy transition. The global energy storage market is projected for substantial growth by 2025, fueled by these technological advancements and strategic partnerships.

| Technological Factor | Description | Impact on BW Offshore | Relevant Data/Trend |

|---|---|---|---|

| FPSO Design Advancements | Modular construction, energy efficiency, improved safety features (e.g., double bottoms). | Faster deployment, enhanced operational performance, reduced environmental impact. | Newer FPSO designs simplify tank cleaning and improve safety. |

| Digitalization & Automation | Sophisticated digital systems, AI for performance optimization, predictive maintenance. | Increased safety, operational efficiency, cost management, improved uptime. | Energy sector saw increased digital transformation investment in 2023. |

| Floating Offshore Wind Technology | Advanced floating foundation designs (spar, semi-submersible, TLP), turbine scalability. | Unlocking new markets and project opportunities, enhancing energy yield. | Floating offshore wind capacity nearing 200 MW in 2023; significant growth projected. |

| New Energy Storage Solutions | Offshore blue ammonia production, carbon capture and storage (CCS). | Broadening service portfolio, supporting energy transition, enhancing ESG profile. | Global energy storage market projected for significant growth by 2025. |

Legal factors

BW Offshore's global footprint necessitates strict adherence to international maritime law, including conventions like SOLAS and MARPOL, which dictate safety and environmental standards for its fleet. Failure to comply can result in severe penalties, operational disruptions, and reputational damage, impacting its ability to secure new contracts.

National offshore regulations are equally critical, varying significantly by jurisdiction. For instance, Brazil's National Agency of Petroleum, Natural Gas and Biofuels (ANP) imposes stringent requirements on floating production storage and offloading (FPSO) units operating in its waters, impacting BW Offshore's Brazilian operations.

In 2023, the global maritime industry saw increased focus on decarbonization regulations, with the International Maritime Organization (IMO) setting ambitious greenhouse gas reduction targets. BW Offshore must navigate these evolving environmental laws, investing in cleaner technologies for its fleet to maintain compliance and competitive advantage.

Operational permits and licensing are governed by offshore regulations in countries where BW Offshore operates, such as Norway's Petroleum Safety Authority (PSA). These regulations cover everything from drilling safety to environmental impact assessments, directly influencing project execution and cost for BW Offshore's FPSO and floating storage and regasification unit (FSRU) projects.

BW Offshore faces significant operational impacts from stringent environmental regulations and tightening emissions standards, particularly concerning greenhouse gases and wastewater discharges. These rules necessitate ongoing investments in cleaner technologies and potentially affect project feasibility and cost structures.

The company holds certification to ISO 14001, demonstrating a commitment to robust environmental management systems. This framework guides their efforts to systematically reduce their environmental footprint across all operations.

BW Offshore has set targets to lower its carbon intensity, aiming for a 50% reduction in CO2 emissions per production unit by 2030 compared to a 2018 baseline. In 2023, their reported CO2 emissions intensity was 34 kg/boe, a decrease from previous years, reflecting progress towards these goals.

The legal architecture governing Floating Production, Storage, and Offloading (FPSO) leases is paramount for BW Offshore's financial stability. These contracts, often spanning decades, dictate revenue, operational scope, and crucially, how disagreements are settled. BW Offshore's strategy prioritizes lease agreements that eliminate residual value exposure post-contractual term, a move supported by a strong counterparty credit profile, ensuring predictable income.

In 2024, BW Offshore's portfolio includes several long-term FPSO contracts. For instance, the BW Cendor FPSO, operating offshore Malaysia, has a contract extending into the late 2020s with Petronas Carigali. Similarly, the BW Pioneer FPSO, deployed in the US Gulf of Mexico, has a contract with its operator that provides a stable revenue base. These agreements typically include performance guarantees and detailed operating procedures, minimizing legal ambiguities.

Dispute resolution clauses are a vital component of these offshore energy contracts. BW Offshore typically engages in agreements that favor arbitration or mediation, aiming for efficient and cost-effective conflict resolution away from protracted court battles. This approach is critical for maintaining operational continuity and safeguarding revenue streams from potentially disruptive legal challenges.

Permitting Processes for Offshore Projects

Permitting processes for offshore projects, particularly in the oil and gas and renewable energy sectors, are intricate and lengthy, directly impacting project schedules and budgets. For instance, the development of a new offshore wind farm can involve navigating a multitude of regulatory bodies, with approvals sometimes taking several years to secure. This complexity is further amplified by the need to comply with varying environmental, safety, and maritime regulations across different countries.

BW Offshore must contend with these evolving legal frameworks. The duration of these permitting processes can add significant lead time, potentially delaying revenue generation.

- Regulatory Hurdles Navigating diverse and often overlapping regulations from national and international bodies presents a significant challenge.

- Environmental Impact Assessments Rigorous environmental reviews are standard, often requiring extensive data collection and analysis, which adds to the timeline.

- Jurisdictional Differences Requirements vary greatly between countries, demanding tailored approaches for each project location.

Health, Safety, and Environmental (HSE) Laws

BW Offshore operates under a strict framework of Health, Safety, and Environmental (HSE) laws, which are critical for protecting its employees and the environment. The company's commitment to these regulations is fundamental to its operational integrity and risk management. For instance, BW Offshore emphasizes its dedication to achieving zero harm across all its operations, reflecting the rigorous standards expected in the offshore industry.

Adherence to these global HSE standards is not just a legal requirement but a core business principle. The company actively manages risks associated with its offshore activities, ensuring compliance with evolving environmental protection mandates. This focus is particularly relevant given the increasing scrutiny on the environmental impact of the energy sector.

- Zero Harm Commitment: BW Offshore actively pursues a goal of zero harm to people and the environment, a benchmark driven by international HSE standards.

- Regulatory Compliance: The company ensures strict adherence to all applicable national and international HSE laws and regulations governing offshore operations.

- Risk Mitigation: Robust HSE management systems are in place to identify, assess, and mitigate operational risks, safeguarding personnel and assets.

- Environmental Stewardship: BW Offshore demonstrates a commitment to environmental protection, aligning its practices with increasingly stringent environmental legislation and sustainability goals.

BW Offshore's legal obligations are extensive, covering international maritime laws like SOLAS and MARPOL, alongside national offshore regulations which vary significantly by country. These frameworks dictate operational standards, safety protocols, and environmental compliance, with non-adherence leading to penalties and reputational damage.

The company's long-term FPSO leases are governed by complex legal agreements that define revenue, operational scope, and dispute resolution mechanisms, often favoring arbitration to ensure continuity. Navigating these contracts and securing permits, which can take years, directly impacts project timelines and profitability.

| Legal Factor | BW Offshore Relevance | 2024/2025 Impact |

|---|---|---|

| International Maritime Law | Adherence to SOLAS, MARPOL for fleet operations. | Ensures global operational compliance, avoids fines and sanctions. |

| National Offshore Regulations | Compliance with country-specific rules (e.g., Brazil's ANP). | Requires tailored operational strategies per jurisdiction, impacting project execution. |

| Environmental Legislation | Meeting IMO's decarbonization targets, emissions standards. | Drives investment in cleaner tech, affects cost structures and competitive positioning. |

| FPSO Lease Agreements | Long-term contracts with operators, defining revenue and terms. | Provides stable income but requires careful negotiation of dispute resolution and residual value clauses. |

Environmental factors

Climate change is intensifying extreme weather, posing significant risks to offshore operations like those of BW Offshore. Hurricanes, typhoons, and severe storms can damage Floating Production Storage and Offloading (FPSO) units and offshore wind farms, disrupting production and requiring costly repairs. For instance, the economic impact of natural disasters, often linked to climate change, reached record highs in 2023, with insured losses alone exceeding $100 billion, underscoring the increasing exposure for the energy sector.

To counter these threats, BW Offshore must prioritize robust design and operational resilience. This includes engineering assets to withstand higher wind speeds and wave forces, as seen in the increased design standards for offshore structures following major storms. Implementing advanced weather forecasting and early warning systems is crucial for proactive risk mitigation, ensuring the safety of personnel and the continuity of operations in the face of an unpredictable climate.

BW Offshore's commitment to biodiversity protection in marine environments is crucial, especially given the increasing global focus on ocean health. For instance, the UN Decade of Ocean Science for Sustainable Development (2021-2030) highlights the need for scientific understanding and action to protect marine ecosystems. This translates to BW Offshore needing to implement robust environmental impact assessments and mitigation strategies for all its offshore projects.

Adhering to a precautionary principle means that even in the absence of complete scientific certainty, BW Offshore must take preventative measures to avoid potential harm to marine life and habitats. This is particularly relevant in 2024 and 2025 as regulatory bodies worldwide are strengthening environmental protection laws. For example, the European Union's Biodiversity Strategy for 2030 aims for significant improvements in marine protected areas, which could influence operational requirements for companies like BW Offshore.

BW Offshore's environmental management systems (EMS) must be meticulously designed to minimize disturbance during construction, operation, and decommissioning phases. This includes managing noise pollution, preventing chemical spills, and responsibly handling waste to safeguard sensitive marine species and critical habitats. The company's 2023 sustainability report indicated investments in cleaner technologies, a step in line with these protective measures.

BW Offshore places significant emphasis on robust waste management and pollution control, recognizing these as core environmental responsibilities within its offshore operations. The company actively deploys comprehensive systems designed to minimize waste generation, streamline material inventory management, and rigorously ensure that all effluent discharges strictly adhere to stringent regulatory mandates and established industry best practices.

In 2023, BW Offshore reported a 10% reduction in hazardous waste generation across its fleet compared to the previous year, a testament to its ongoing waste minimization initiatives. Furthermore, the company's commitment extends to optimizing its supply chain to reduce packaging waste, contributing to a circular economy approach for materials used in its operations.

Compliance with environmental regulations is paramount, and BW Offshore consistently monitors its operations to guarantee that all discharges, including produced water and drilling fluids, meet or exceed the strict limits set by governing bodies. This proactive approach aims to safeguard marine ecosystems and prevent environmental degradation.

Decarbonization Targets and Net-Zero Commitments

Global and national decarbonization targets are rapidly reshaping the energy sector, pushing companies like BW Offshore towards cleaner operations and the adoption of renewable energy solutions. Many nations have committed to net-zero emissions by mid-century, influencing regulatory frameworks and investment priorities.

BW Offshore is actively responding to these pressures. The company is focused on reducing emissions for its new floating production, storage, and offloading (FPSO) units and is exploring opportunities within the renewable energy sector. This strategic alignment with environmental goals is crucial for long-term sustainability and market competitiveness.

- Net-Zero Commitments: Over 130 countries have announced or are considering net-zero emissions targets, covering over 80% of global emissions as of early 2024.

- Industry Transition: The International Energy Agency (IEA) projects significant investment shifts towards clean energy technologies, with renewables and energy efficiency set to dominate growth through 2030 and beyond.

- BW Offshore's Role: The company's involvement in developing lower-emission FPSOs and investigating renewable energy projects directly addresses these decarbonization imperatives.

Impact of Offshore Wind on Marine Ecosystems

While offshore wind energy is crucial for decarbonization, its expansion presents environmental considerations for companies like BW Offshore. These can include temporary noise pollution during construction affecting marine mammals and potential habitat disruption for benthic species. For instance, the EU's offshore wind expansion targets, aiming for significant capacity increases by 2030, underscore the need for robust environmental impact assessments and mitigation strategies.

BW Offshore's engagement in offshore wind projects necessitates proactive environmental management. This involves careful site selection to avoid sensitive marine areas and the implementation of technologies to minimize underwater noise during foundation installation. By 2025, the global offshore wind market is projected to see substantial growth, making these environmental factors increasingly material for project viability and corporate reputation.

- Noise Pollution: Construction activities, like pile driving, can generate noise levels that may impact marine life, particularly mammals.

- Habitat Alteration: The installation of turbines and associated infrastructure can alter seabed habitats, affecting local ecosystems.

- Marine Life Interaction: Potential risks include collision with vessels, entanglement in equipment, and changes in prey availability.

- Mitigation Efforts: BW Offshore would focus on employing noise reduction techniques and conducting thorough environmental surveys.

Environmental factors, including climate change and regulatory pressures, significantly impact BW Offshore's operations and strategic direction. Intensifying extreme weather events, driven by climate change, pose direct physical risks to offshore assets, necessitating robust engineering and proactive weather management. Additionally, the global push towards decarbonization and enhanced biodiversity protection is reshaping the energy landscape, compelling companies like BW Offshore to invest in cleaner technologies and sustainable practices.

BW Offshore's commitment to minimizing its environmental footprint is evident in its waste management and pollution control efforts. The company focuses on reducing waste generation, optimizing supply chains, and ensuring strict compliance with effluent discharge regulations. For instance, BW Offshore reported a 10% reduction in hazardous waste in 2023, showcasing progress in its sustainability initiatives.

The growing emphasis on decarbonization and renewable energy presents both challenges and opportunities for BW Offshore. With over 130 countries pursuing net-zero targets, the company is aligning its strategy by developing lower-emission FPSOs and exploring renewable energy projects. This pivot is crucial for long-term viability as the energy sector transitions towards cleaner solutions, with significant investment shifts projected toward renewables through 2030.

The expansion of offshore wind energy, while vital for decarbonization, also brings environmental considerations. BW Offshore must manage potential impacts such as noise pollution during construction and habitat alteration. As the global offshore wind market grows substantially by 2025, robust environmental impact assessments and mitigation strategies are paramount for project success and corporate reputation.

| Environmental Factor | Impact on BW Offshore | Mitigation/Response Strategy | Relevant Data/Trend |

|---|---|---|---|

| Climate Change & Extreme Weather | Risk of asset damage, operational disruption | Robust design, early warning systems, resilient operations | Insured losses from natural disasters exceeded $100 billion in 2023 |

| Decarbonization Targets | Pressure to reduce emissions, shift to cleaner energy | Develop lower-emission FPSOs, explore renewable energy projects | Over 130 countries targeting net-zero emissions by mid-century |

| Biodiversity Protection | Need for impact assessments, habitat protection | Precautionary principle, environmental management systems, compliance | EU Biodiversity Strategy 2030 aims for improved marine protected areas |

| Offshore Wind Expansion | Potential noise pollution, habitat alteration | Careful site selection, noise reduction technologies | Global offshore wind market projected for substantial growth by 2025 |

PESTLE Analysis Data Sources

Our BW Offshore PESTLE analysis is constructed using a comprehensive blend of official government publications, reports from international financial institutions, and reputable industry-specific research. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting the offshore energy sector.