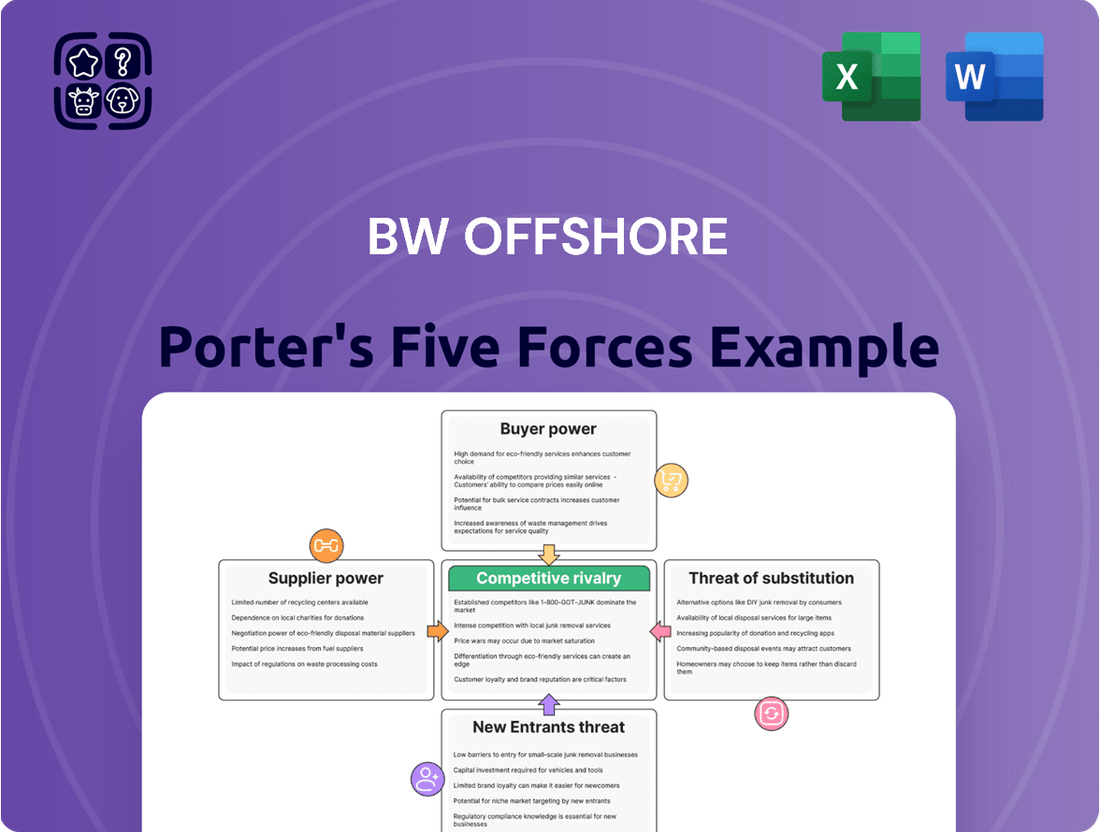

BW Offshore Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BW Offshore Bundle

BW Offshore operates in a dynamic offshore energy sector, where the bargaining power of buyers, particularly major oil and gas companies, significantly influences pricing and contract terms. The threat of new entrants, while potentially moderated by high capital requirements, remains a constant consideration.

The intensity of rivalry among existing players like BW Offshore is substantial, driven by the need to secure scarce projects and maintain fleet utilization. Supplier power, though present, is often balanced by the sheer scale of the offshore industry's supply chain.

Substitute threats, such as alternative energy sources or different project execution models, are also evolving and warrant close monitoring. This brief snapshot only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore BW Offshore’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Suppliers of highly specialized FPSO components, like turret systems and advanced processing modules, hold considerable sway. Their products are critical for FPSO operations, and the limited number of manufacturers capable of producing these complex systems restricts BW Offshore's options. This scarcity often translates to higher prices and less flexible contract terms for BW Offshore.

The reliance on a few key suppliers for proprietary technologies and intellectual property further amplifies their bargaining power. For instance, a supplier holding patents for a crucial subsea component can dictate terms, as BW Offshore may not have readily available substitutes. This situation was evident in 2024 when a major supplier of specialized subsea connectors experienced production delays, impacting several offshore projects and leading to price increases for available inventory.

The bargaining power of shipyards and conversion facilities for BW Offshore is significant due to the limited global capacity for complex Floating Production, Storage, and Offloading (FPSO) conversions and newbuilds. This scarcity of specialized facilities means these yards hold considerable leverage in negotiations. For instance, a report from Clarksons Research in early 2024 indicated a tight market for offshore vessel newbuild slots, with yards prioritizing high-value projects, which can extend delivery timelines for FPSOs.

Demand for these specialized services, particularly for the large-scale projects BW Offshore undertakes, often exceeds the available supply. This imbalance directly translates into longer lead times and higher costs for BW Offshore. The technical expertise and advanced infrastructure necessary for FPSO projects further restrict the number of qualified suppliers, amplifying their pricing power and ability to dictate delivery schedules.

The FPSO sector, now including the burgeoning offshore wind industry, relies heavily on a specialized workforce. This includes skilled engineers, experienced project managers, and adept offshore operational staff. Finding and keeping these professionals is crucial for companies like BW Offshore.

A significant global shortage of these highly experienced individuals is currently impacting the industry. This scarcity is further intensified by multiple large-scale projects happening concurrently across the globe. Consequently, skilled labor wields considerable bargaining power.

This heightened bargaining power translates into increased wage demands from skilled professionals. For BW Offshore, this can create substantial challenges in both attracting new talent and retaining its existing expert workforce. This trend was evident in 2024, with reports indicating a 7% increase in average salaries for specialized offshore engineers year-over-year.

Financing and Capital Providers

BW Offshore's projects, particularly Floating Production Storage and Offloading (FPSO) units, are incredibly capital-intensive, demanding significant upfront funding and long-term financial commitments. This reality places considerable influence in the hands of banks, financial institutions, and investors who provide the necessary project debt and equity. Their ability to dictate the cost of capital and the terms of financing directly impacts BW Offshore's project viability and overall profitability. Securing advantageous financing is therefore a critical factor for success.

The bargaining power of capital providers is amplified by several factors:

- High Capital Requirements: FPSO projects can cost hundreds of millions, even billions, of dollars, making access to capital a bottleneck.

- Risk Assessment: Lenders and investors carefully assess project risks, from technical feasibility to market demand, which influences their pricing of capital.

- Market Conditions: Interest rate environments and overall investor appetite for infrastructure projects can shift the balance of power. For instance, in early 2024, the persistent higher interest rate environment continued to put pressure on borrowing costs for capital-intensive projects.

- Limited Financing Options: While BW Offshore may have relationships with various providers, the pool of entities capable of financing such large-scale projects can be limited, giving powerful players more leverage.

Raw Materials and Commodities

The bargaining power of suppliers for raw materials and commodities, like steel for BW Offshore's FPSOs, is generally moderate. While these are essential inputs, they are often sourced from a wide range of global producers, limiting any single supplier's leverage. However, significant price swings in global commodity markets, as seen with steel prices experiencing volatility in 2024 due to geopolitical events and production adjustments, can influence BW Offshore's procurement costs indirectly. For instance, the average price of hot-rolled coil steel, a key component, saw fluctuations throughout 2024, impacting project budgets.

BW Offshore's reliance on these basic materials means that widespread supply chain disruptions, such as those experienced in previous years affecting shipping and manufacturing, can increase costs. However, the availability of multiple suppliers for standard commodities typically prevents extreme power concentration. This contrasts with the higher bargaining power held by suppliers of highly specialized or proprietary components crucial for FPSO operations.

- Steel Price Volatility: Global steel prices, a key input for FPSO construction, experienced notable fluctuations in 2024, impacting procurement costs for BW Offshore.

- Commodity Market Influence: Broader commodity market trends and supply chain disruptions can indirectly affect the cost and availability of essential raw materials.

- Indirect Relationship: The power of raw material suppliers is generally considered lower than that of specialized equipment manufacturers due to the indirect nature of their contribution to FPSO functionality.

Suppliers of specialized FPSO components, such as advanced turret systems, wield significant bargaining power due to limited manufacturers and proprietary technology. This scarcity can lead to higher prices and less favorable contract terms for BW Offshore. In 2024, production delays from a key subsea connector supplier resulted in price increases.

The bargaining power of shipyards for complex FPSO conversions and newbuilds is substantial given the limited global capacity. Early 2024 reports indicated a tight market for offshore vessel slots, with yards prioritizing higher-value projects, impacting FPSO delivery timelines and costs for BW Offshore.

Skilled labor in the FPSO sector, including specialized engineers and project managers, holds considerable bargaining power due to a global shortage, exacerbated by concurrent large-scale projects. This translated into increased wage demands, with specialized offshore engineer salaries reportedly rising by 7% year-over-year in 2024.

Capital providers, such as banks and investors, exert significant influence over BW Offshore due to the high capital intensity of FPSO projects. The persistent higher interest rate environment in early 2024 continued to pressure borrowing costs, amplifying the leverage of these financing entities.

What is included in the product

This analysis unpacks the competitive intensity within BW Offshore's operational environment, examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the industry's rivalry to understand BW Offshore's strategic positioning.

Instantly identify and mitigate competitive threats by visualizing the intensity of each force, allowing for proactive strategic adjustments.

Customers Bargaining Power

BW Offshore's bargaining power of customers is significantly influenced by its concentrated customer base, primarily consisting of large, global oil and gas companies. These major clients wield substantial purchasing power due to the immense scale and value of their offshore development projects. For instance, a typical Floating Production Storage and Offloading (FPSO) contract can be worth billions of dollars, granting these sophisticated buyers considerable leverage in negotiations.

The limited number of supermajor and national oil companies active in the offshore sector means each potential client represents a substantial portion of BW Offshore's addressable market and potential revenue streams. This concentration allows these key customers to negotiate more aggressively on terms, pricing, and contract duration for critical assets like FPSOs, directly impacting BW Offshore's profitability.

BW Offshore’s FPSO contracts are typically long-term, often spanning many years, which gives the company predictable revenue streams. However, this also means customers are locked in once an FPSO is deployed, making switching providers incredibly costly due to the highly integrated nature of the production setup.

The significant upfront investment and customization required for an FPSO means customers face substantial switching costs. This high barrier to entry for alternative providers gives customers considerable negotiation power before a contract is finalized, influencing the terms BW Offshore can secure.

The project-specific nature of Floating Production Storage and Offloading (FPSO) solutions significantly amplifies customer bargaining power. Each FPSO deployment is essentially a bespoke engineering marvel, meticulously tailored to the unique geological conditions of a specific oil or gas field and the precise operational needs of the client. This means customers aren't just buying a standard product; they are commissioning a highly customized, high-value solution.

This tailor-made approach empowers customers to dictate exact specifications, performance benchmarks, and rigorous quality standards. They can leverage their intimate knowledge of field requirements and their substantial investment to demand favorable terms, influencing everything from the initial design and engineering phases through to the final operational handover. For example, a customer might negotiate specific uptime guarantees or performance metrics that BW Offshore must meet, with penalties for shortfalls.

BW Offshore's ability to meet these highly specific and often evolving demands directly impacts its leverage. The company must showcase exceptional flexibility and a robust capacity for innovative problem-solving to satisfy these unique client expectations. Failure to do so could result in lost contracts or reduced profit margins, as customers can often seek alternative suppliers or re-negotiate terms if their precise requirements are not met. This customer-centric, project-specific dynamic inherently shifts power towards the buyer.

Global Oil and Gas Market Dynamics

The bargaining power of customers in the global oil and gas sector, particularly for FPSO (Floating Production Storage and Offloading) services like those provided by BW Offshore, is closely tied to market cycles and commodity prices. When oil prices are low, Exploration and Production (E&P) companies, the primary customers, often reduce their capital expenditures, leading them to negotiate harder on day rates and contract terms. This increased leverage can directly impact BW Offshore's revenue and profitability. For instance, during periods of sustained low oil prices, E&P companies may delay new projects or seek shorter, more flexible contracts, giving them more power to dictate terms.

Conversely, a strong market characterized by high oil prices and increased investment in new projects tends to shift power back towards FPSO operators. In such environments, demand for FPSO units outstrips supply, allowing companies like BW Offshore to command higher day rates and more favorable contract conditions. The global oil and gas industry saw Brent crude oil prices fluctuate significantly in 2024, impacting customer spending power. For example, while prices averaged around $82 per barrel in early 2024, they experienced volatility that directly influenced E&P companies' ability to commit to long-term, high-cost projects requiring FPSOs.

- Customer Bargaining Power Drivers: Commodity prices, E&P capital expenditure cycles, and the availability of alternative solutions heavily influence customer leverage.

- Impact of Low Oil Prices (2024 Example): In 2024, with oil prices facing downward pressure at times, E&P companies demonstrated a stronger inclination to negotiate lower day rates for FPSO services, potentially reducing BW Offshore's margins.

- Shift in Power During High Prices: When oil prices surged, leading to increased E&P investment, the demand for FPSOs intensified, allowing BW Offshore to negotiate more favorable contract terms and higher rates.

- Strategic Implications for BW Offshore: BW Offshore must navigate these fluctuating customer demands by optimizing operational efficiency and securing long-term contracts during favorable market conditions to mitigate the impact of customer bargaining power.

Availability of Alternative Development Concepts

While FPSOs are frequently the go-to for deepwater and remote offshore oil and gas fields, clients aren't without choices. They can explore other production methods, like fixed platforms for shallower areas, or subsea tie-backs connecting to existing facilities. The mere possibility of these alternatives, even if not as perfectly suited, gives customers bargaining power with FPSO providers.

In 2024, the offshore production landscape continues to evolve, with ongoing investments in subsea technology and the optimization of existing infrastructure. For instance, projects focusing on subsea tie-backs have seen significant activity, offering cost efficiencies and reduced development timelines compared to entirely new FPSO deployments for certain field types.

- Alternative Offshore Production: Customers can evaluate fixed platforms, subsea tie-backs, or other floating solutions.

- Viability of Alternatives: Even less ideal alternatives grant customers negotiation leverage.

- Market Dynamics (2024): Continued investment in subsea technology and infrastructure optimization influences customer choices.

The bargaining power of BW Offshore's customers is substantial due to the industry's concentrated nature and the significant scale of offshore projects. These major oil and gas companies, often supermajors or national oil companies, represent a large portion of BW Offshore's potential revenue, allowing them considerable leverage in negotiations for high-value FPSO contracts, which can be worth billions.

High switching costs, stemming from the bespoke engineering and extensive customization inherent in FPSO solutions, also empower customers. Once an FPSO is deployed, the integration with field infrastructure makes it extremely difficult and costly for clients to change providers, giving them significant influence during the initial contract phase to dictate terms and specifications.

Market cycles and fluctuating oil prices, particularly evident in 2024, directly impact customer leverage. During periods of lower oil prices, Exploration and Production (E&P) companies tend to reduce capital expenditure and negotiate more aggressively on day rates, as seen when Brent crude experienced volatility, averaging around $82 per barrel in early 2024. Conversely, high oil prices and increased E&P investment can shift power back to FPSO operators like BW Offshore.

Furthermore, the availability of alternative offshore production methods, such as fixed platforms or subsea tie-backs, even if less ideal for certain fields, provides customers with an additional layer of bargaining power. The ongoing development and investment in these alternative technologies in 2024, like subsea tie-backs offering cost efficiencies, influence customer choices and their negotiation stance with FPSO providers.

| Customer Type | Project Value (Typical FPSO) | Key Negotiation Levers | Impact on BW Offshore |

|---|---|---|---|

| Supermajor/National Oil Companies | Billions of USD | Scale of purchase, project specifications, long-term contract terms | Significant price and term negotiation power |

| E&P Companies | Varies by project size | Market conditions (oil prices), alternative solutions, capital expenditure budgets | Leverage increases in low-price/low-spend environments |

| All Customers | N/A | High switching costs of customized FPSOs, project-specific needs | Power consolidated during initial contract negotiation |

Same Document Delivered

BW Offshore Porter's Five Forces Analysis

The document you see here is the exact, comprehensive BW Offshore Porter's Five Forces Analysis you will receive upon purchase, offering a detailed examination of competitive forces within the industry. This preview showcases the full scope of the analysis, from the threat of new entrants to the bargaining power of buyers and suppliers, ensuring you get precisely what you need. What you are previewing is the final, professionally formatted report, ready for immediate download and application. You're looking at the actual document, meaning no surprises or placeholders; the complete analysis awaits your instant access after completing your purchase.

Rivalry Among Competitors

The global FPSO market is a concentrated niche where established giants like BW Offshore, SBM Offshore, MODEC, and Yinson fiercely compete. This intense rivalry is driven by the significant capital investment and extended project timelines inherent in FPSO development.

These leading companies vie for limited new project opportunities, leading to aggressive bidding. For instance, in 2023, the total order book for FPSOs was estimated to be over $50 billion, with these key players securing the majority of these contracts, highlighting the concentrated nature of the market.

The offshore production and storage sector, where BW Offshore operates, is characterized by immense capital intensity. Owning and operating Floating Production Storage and Offloading (FPSO) units demands billions of dollars in investment, with new builds often costing upwards of $1 billion. This significant upfront capital expenditure, combined with the highly specialized nature and decades-long operational life of these assets, creates substantial exit barriers.

Because exiting the market is so difficult and costly, companies like BW Offshore are incentivized to remain active and compete fiercely for contracts, even when market conditions are challenging. This necessity to cover high fixed costs intensifies rivalry, as players are less likely to withdraw and instead fight to secure work to maintain their asset utilization and profitability.

In the FPSO (Floating Production, Storage, and Offloading) sector, fierce competition hinges on differentiation through operational excellence and technological advancement. Companies like BW Offshore vie for market share by showcasing a strong history of high fleet uptime, exceptional safety records, and continuous innovation in their offerings. This focus directly impacts their ability to secure new contracts and maintain existing ones, as clients prioritize reliability and cutting-edge solutions.

BW Offshore's strategic emphasis on maintaining high fleet uptime, which historically aims for over 95%, is a cornerstone of its competitive strategy. Furthermore, the company is actively investing in and developing capabilities for the energy transition, including solutions for carbon capture and storage (CCS) and floating wind. This forward-looking approach positions them to meet evolving industry demands and secure future business.

The capacity to consistently deliver complex projects on schedule and within budget is another crucial differentiator. A proven ability to manage project risks effectively and execute efficiently translates into greater client trust and a stronger reputation, which are invaluable assets in this capital-intensive industry. For instance, successful project completions in 2023 and early 2024, such as the delivery of the BW Ideafjord, underscore this capability.

Market Growth and Project Pipeline

The Floating Production Storage and Offloading (FPSO) market is set for substantial expansion, with forecasts indicating robust growth fueled by heightened offshore exploration and a surge in deepwater project advancements. A significant number of projects are slated for execution between 2024 and 2029, promising a dynamic period for the industry.

This anticipated growth, while creating ample opportunities, simultaneously intensifies competitive rivalry. As market participants actively expand their operational capacities and aggressively pursue new contract awards, the landscape becomes increasingly crowded. This dynamic environment naturally encourages strategic alliances and mergers and acquisitions (M&A) as companies seek to bolster their market position and capitalize on emerging trends.

- Projected FPSO Market Growth: Significant expansion anticipated driven by offshore exploration and deepwater developments.

- Key Project Period: Numerous FPSO projects are planned between 2024 and 2029.

- Intensified Competition: Market growth fuels rivalry as companies expand capacity and vie for contracts.

- Strategic Responses: The dynamic market environment encourages partnerships and M&A activity.

Diversification into Renewable Energy

BW Offshore's strategic move into offshore wind projects intensifies competitive rivalry. They now contend with established renewable energy giants like Ørsted and Vestas, companies with deep expertise and existing market share in wind development and manufacturing. This diversification means navigating a landscape where different business models, regulatory frameworks, and technological advancements shape competition, contrasting sharply with their historical focus on oil and gas FPSO operations.

This expansion places BW Offshore in direct competition with companies that have years of experience in securing project financing, managing complex supply chains, and operating large-scale wind farms. For instance, as of early 2024, major offshore wind developers are announcing significant project pipelines; Equinor, a key player, has a substantial offshore wind portfolio and continues to invest heavily. BW Offshore must therefore compete not just on operational efficiency but also on securing access to capital, technology, and prime project locations in this increasingly crowded sector.

- New Competitors: BW Offshore now faces established renewable energy developers and utilities with extensive experience in offshore wind.

- Different Dynamics: The competitive landscape involves different technological requirements, regulatory environments, and investment cycles compared to oil and gas.

- Market Share Impact: Entry into offshore wind means competing for project awards and market share against players with established track records and significant capital backing in renewables.

- Investment Landscape: BW Offshore must adapt to a new investment calculus, where long-term power purchase agreements and renewable energy credits are key financial drivers.

Competitive rivalry in the FPSO market is intense, with a few dominant players like BW Offshore, SBM Offshore, and MODEC vying for a limited number of high-value projects. The immense capital required for FPSO units, often exceeding $1 billion, creates high barriers to entry but also fuels fierce competition among existing firms to secure contracts and maintain asset utilization. In 2023, the global FPSO order book surpassed $50 billion, with these key players securing the lion's share, underscoring the concentrated and competitive nature of the sector.

BW Offshore's expansion into offshore wind projects introduces new, formidable competitors such as Ørsted and Vestas. This diversification requires competing on different metrics, including access to specialized technology, project financing, and navigating distinct regulatory environments. The challenge is compounded as major energy companies like Equinor continue to aggressively invest in their offshore wind portfolios, intensifying the competition for market share in this growing segment.

| Key Competitors (FPSO) | Key Competitors (Offshore Wind) | Market Dynamics | Recent Data Point |

| BW Offshore | Ørsted | High Capital Intensity | Global FPSO order book > $50 billion (2023) |

| SBM Offshore | Vestas | Technological Differentiation | BW Offshore aims for >95% fleet uptime |

| MODEC | Equinor | Operational Excellence | BW Ideafjord delivery (2023/2024) |

| Yinson | Siemens Gamesa | Energy Transition Solutions (CCS, Floating Wind) | Significant investment in offshore wind by major players |

SSubstitutes Threaten

For certain offshore fields, especially those in shallower waters or with simpler hydrocarbon profiles, fixed platforms, tension leg platforms (TLPs), and spar platforms present viable substitutes for Floating Production Storage and Offloading (FPSO) units. These alternatives may become more attractive if the initial capital outlay or the operational intricacies associated with FPSOs are deemed too high for a specific field’s development. For instance, in 2024, the global offshore oil and gas production landscape saw continued investment in fixed platforms for mature, well-understood fields, offering a lower cost alternative where the full flexibility of an FPSO isn't critical.

Advances in subsea technology are enabling direct tie-backs of wells to onshore facilities, presenting a significant threat to BW Offshore's Floating Production Storage and Offloading (FPSO) units. This bypasses the need for an FPSO altogether, particularly for smaller or marginal fields that can be economically linked to existing infrastructure.

For instance, the increasing efficiency and decreasing cost of subsea umbilicals and flowlines, coupled with improvements in subsea processing capabilities, make these direct tie-backs increasingly viable. This trend directly substitutes the core processing and storage functions that FPSOs traditionally provide, potentially reducing demand for new FPSO leases or even leading to the early retirement of existing units if the economics strongly favor tie-backs.

The global energy transition poses a significant threat of substitutes for BW Offshore. The increasing investments in renewable energy sources like solar and wind, including floating offshore wind where BW Offshore also operates, directly compete with traditional fossil fuel production.

A substantial shift in global energy demand away from hydrocarbons, driven by climate concerns and technological advancements, could diminish the need for new floating production storage and offloading (FPSO) projects. For instance, by 2023, renewable energy accounted for over 30% of new power capacity additions globally, a trend expected to accelerate.

Enhanced Oil Recovery and Unconventional Resources

Technological advancements in Enhanced Oil Recovery (EOR) and the rise of unconventional resources pose a significant threat to BW Offshore's reliance on offshore deepwater developments. EOR techniques, such as chemical injection or CO2 sequestration, can unlock production from mature onshore or shallow-water fields, reducing the need for costly offshore solutions. For instance, the U.S. Energy Information Administration (EIA) reported that EOR methods accounted for approximately 40% of total U.S. crude oil production in 2023, highlighting the growing importance of these alternatives.

The development of unconventional resources, particularly shale oil and gas, offers another compelling substitute. These resources can be accessed through hydraulic fracturing and horizontal drilling, often at lower capital costs compared to deepwater projects. The EIA also noted that U.S. tight oil production, a key unconventional resource, reached an average of 8.2 million barrels per day in 2023, demonstrating its substantial contribution to global supply. This increased availability of onshore energy reduces the demand for offshore production, thereby impacting the market for BW Offshore's FPSO services.

- Reduced Demand for FPSOs: As onshore and unconventional resources become more accessible and cost-effective, the demand for new offshore deepwater developments, and consequently FPSOs, may decline.

- Cost Competitiveness: EOR and unconventional oil production often have lower breakeven costs compared to deepwater projects, making them more attractive investment options.

- Energy Security Focus: Nations are increasingly prioritizing energy security through domestic production, which often favors onshore and unconventional sources over expensive offshore ventures.

- Shifting Investment Landscape: Investment capital may divert from deepwater exploration and production to onshore and unconventional projects, impacting BW Offshore's project pipeline.

Demand Reduction for Fossil Fuels

The global push for climate change mitigation presents a significant threat of substitutes for BW Offshore's core business. Increased regulatory pressure and international agreements aimed at reducing carbon emissions directly impact the demand for fossil fuels, the primary commodity serviced by Floating Production Storage and Offloading (FPSO) units.

This macro-level shift towards decarbonization can erode the long-term market viability for hydrocarbon extraction services. For instance, the International Energy Agency (IEA) reported in its 2024 outlook that while fossil fuels still dominate the energy mix, the trajectory for renewable energy sources is accelerating, with solar and wind power capacity additions reaching record levels globally. This growth signifies a direct substitute for energy derived from oil and gas.

- Demand Erosion: Growing adoption of renewable energy sources like solar and wind directly displaces demand for oil and gas.

- Regulatory Impact: Stricter environmental regulations and carbon pricing mechanisms make fossil fuel extraction less economically attractive.

- Technological Advancements: Improvements in battery storage and grid modernization further enhance the competitiveness of renewables.

- Shifting Consumer Preferences: Increasing consumer and corporate demand for sustainable energy solutions pressures the fossil fuel industry.

The threat of substitutes for BW Offshore is multifaceted, encompassing alternative offshore production methods, onshore resource development, and the broader energy transition. Fixed platforms and subsea tie-backs offer more direct competition for certain field types, especially where FPSO flexibility is not paramount. Unconventional resources like shale oil, driven by advancements in extraction technology, present a significant cost advantage over deepwater projects. In 2024, the continued global investment in these onshore alternatives, exemplified by the U.S. EIA's data on tight oil production, directly curtails the market for offshore solutions.

The global energy transition further amplifies this threat. As investments surge into renewable energy sources, particularly solar and wind, they directly displace the demand for fossil fuels. By 2023, renewables accounted for over 30% of new global power capacity, a trend expected to accelerate, diminishing the long-term market for FPSO services.

Technological advancements in Enhanced Oil Recovery (EOR) also provide a competitive edge. EOR techniques can revitalize existing onshore and shallow-water fields, reducing the necessity for costly deepwater FPSO projects. In 2023, EOR methods contributed roughly 40% to U.S. crude oil output, underscoring their growing significance.

| Substitute Type | Key Characteristics | Impact on FPSOs | 2023/2024 Data Point |

|---|---|---|---|

| Fixed Platforms | Lower CAPEX for shallow/simple fields | Reduced demand for FPSOs in specific segments | Continued investment in fixed platforms for mature fields |

| Subsea Tie-backs | Bypasses FPSO for marginal/smaller fields | Directly substitutes processing/storage functions | Increasing efficiency and decreasing cost of subsea technology |

| Unconventional Resources (Shale) | Lower CAPEX, onshore focus | Decreased demand for offshore production | U.S. tight oil production averaged 8.2 mbpd in 2023 |

| Renewable Energy | Displaces fossil fuel demand | Erodes long-term market for hydrocarbon extraction | Renewables over 30% of new global power capacity (2023) |

| Enhanced Oil Recovery (EOR) | Unlocks production from mature fields | Reduces need for new offshore developments | EOR accounted for ~40% of U.S. crude oil production (2023) |

Entrants Threaten

The threat of new entrants in the FPSO market, particularly concerning BW Offshore, is significantly mitigated by the exceptionally high capital investment required. Acquiring or constructing a Floating Production Storage and Offloading unit, or converting an existing vessel, can easily run into hundreds of millions of dollars, sometimes exceeding a billion for newbuilds. For instance, new FPSO projects in 2024 and beyond are consistently valued in the multi-billion dollar range, encompassing vessel costs, topside modules, and subsea infrastructure.

This colossal financial barrier, coupled with the protracted timelines for project execution and the inherent market and operational risks, creates a formidable entry hurdle. New companies often struggle to secure the necessary financing and build the track record required for securing long-term, high-value contracts that are essential for profitability. Established players like BW Offshore benefit from economies of scale and proven operational expertise, further solidifying their competitive position.

The intricate nature of designing, engineering, constructing, and operating Floating Production, Storage, and Offloading (FPSO) units presents a formidable barrier to new entrants. BW Offshore, for instance, relies on decades of accumulated knowledge and proprietary technological solutions that are not easily replicated.

Developing the necessary specialized technical expertise and securing a deep pool of experienced personnel is a substantial undertaking for any potential competitor. This is not a sector where skills can be acquired overnight; it requires significant investment in training and development, or costly acquisitions of established players.

In 2023, the average cost for a new FPSO project could range from $500 million to over $1 billion, reflecting the immense capital and technical commitment involved. This high upfront investment, coupled with the need for specialized engineering capabilities, significantly deters newcomers from entering the market.

BW Offshore's sustained success is partly due to its continuous innovation in areas like turret systems and mooring technology. These advancements, protected by intellectual property and operational know-how, further elevate the technological barrier, making it exceedingly difficult for new firms to compete on equal footing.

The offshore oil and gas sector is heavily regulated, with stringent global and local rules covering environmental protection and operational safety. For instance, the International Maritime Organization (IMO) continually updates its safety conventions, impacting vessel design and operation. New companies entering this market must navigate these complex requirements, incurring substantial upfront costs for compliance and certification, making it difficult to compete with established players who already possess proven track records.

Established Customer Relationships and Track Record

Established customer relationships act as a significant barrier for new entrants in the FPSO market. BW Offshore, for instance, has cultivated deep, long-standing ties with major oil and gas producers through years of successful project delivery and consistent operational performance. This history fosters a high level of trust, making it difficult for newcomers to break into the sector, especially for the substantial, long-term contracts that define FPSO operations.

New companies entering the FPSO space often struggle to replicate this established trust. They lack the proven track record and historical data that demonstrate reliability and competence, which are critical for securing initial, high-value projects. For example, securing a multi-billion dollar FPSO contract typically requires a bidder to showcase decades of experience and a flawless safety and execution record, something nascent competitors simply do not possess.

- Established Relationships: BW Offshore's long-standing ties with major oil and gas clients create a significant hurdle for new market entrants.

- Proven Track Record: Years of reliable project execution and operational excellence build essential trust that new players lack.

- Contract Acquisition Difficulty: The absence of a proven history makes it challenging for new entrants to win high-value, long-term FPSO contracts.

- Risk Aversion: Clients are often risk-averse when awarding complex, capital-intensive FPSO projects, favoring established and proven operators.

Limited Access to Key Resources and Supply Chain

The threat of new entrants for BW Offshore is significantly influenced by the limited access to essential resources and a robust supply chain. Securing suitable shipyards capable of handling complex offshore vessel conversions or newbuilds presents a substantial hurdle. For instance, the global capacity for specialized offshore construction remains concentrated, with major yards often booked years in advance, making it difficult for newcomers to secure slots on favorable terms.

Furthermore, the specialized equipment supply chain, crucial for components like FPSO processing modules, drilling equipment, and advanced navigation systems, is not easily penetrated. Many suppliers have long-standing relationships with established players like BW Offshore, potentially offering preferential pricing or guaranteed delivery schedules that a new entrant would find hard to match. In 2023, the lead times for certain critical offshore equipment components could extend beyond 18 months, further complicating market entry.

The limited global pool of skilled offshore labor also acts as a barrier. Experienced engineers, project managers, and specialized technicians for offshore operations are in high demand. New companies would face intense competition to attract and retain this talent, likely incurring higher labor costs than incumbent firms. Reports from industry associations in 2024 indicate a persistent deficit in qualified offshore personnel, particularly in areas like subsea engineering and marine operations.

- Limited Shipyard Capacity: Access to specialized shipyards for FPSO conversions and newbuilds is constrained, with major projects often requiring booking years in advance.

- Specialized Equipment Supply Chain: Established relationships and long lead times for critical offshore components create a barrier for new entrants.

- Skilled Labor Shortage: The global scarcity of experienced offshore engineers and technicians drives up labor costs for new market participants.

The threat of new entrants to BW Offshore's market is substantially diminished by the sheer scale of capital required, often reaching hundreds of millions or even billions of dollars for a single FPSO project in 2024. This immense financial hurdle, combined with the lengthy project cycles and inherent industry risks, makes it incredibly difficult for newcomers to secure financing and build the necessary credibility for lucrative long-term contracts. Established players like BW Offshore leverage their economies of scale and proven operational expertise, creating a significant competitive moat.

The complex engineering, construction, and operational demands of FPSOs represent another major entry barrier. BW Offshore benefits from decades of accumulated knowledge and proprietary technologies that are not easily replicated. For example, specialized technical expertise in areas like turret systems and mooring technology, often protected by intellectual property, further elevates the technological barrier, making it challenging for new firms to compete effectively.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | FPSO projects in 2024-2025 are valued from $500 million to over $1 billion. | Extremely high, requiring substantial financing and risking project viability. |

| Technical Expertise | Requires specialized knowledge in design, engineering, and operation of complex offshore units. | Difficult to acquire quickly; necessitates significant investment in training or acquisitions. |

| Regulatory Compliance | Strict adherence to global safety and environmental standards (e.g., IMO). | Incurs significant upfront costs for certification and compliance, disadvantaging new firms. |

| Customer Relationships | Long-standing ties with major oil and gas producers built on trust and proven performance. | Challenging for new entrants to establish credibility and secure initial high-value contracts. |

| Resource Access | Limited access to specialized shipyards and a concentrated supply chain for critical components. | New entrants face long lead times (often 18+ months for equipment) and higher costs. |

Porter's Five Forces Analysis Data Sources

Our BW Offshore Porter's Five Forces analysis is built on a foundation of robust data, drawing from company annual reports, investor presentations, and industry-specific market research reports. These sources provide critical insights into competitive landscapes and industry dynamics.