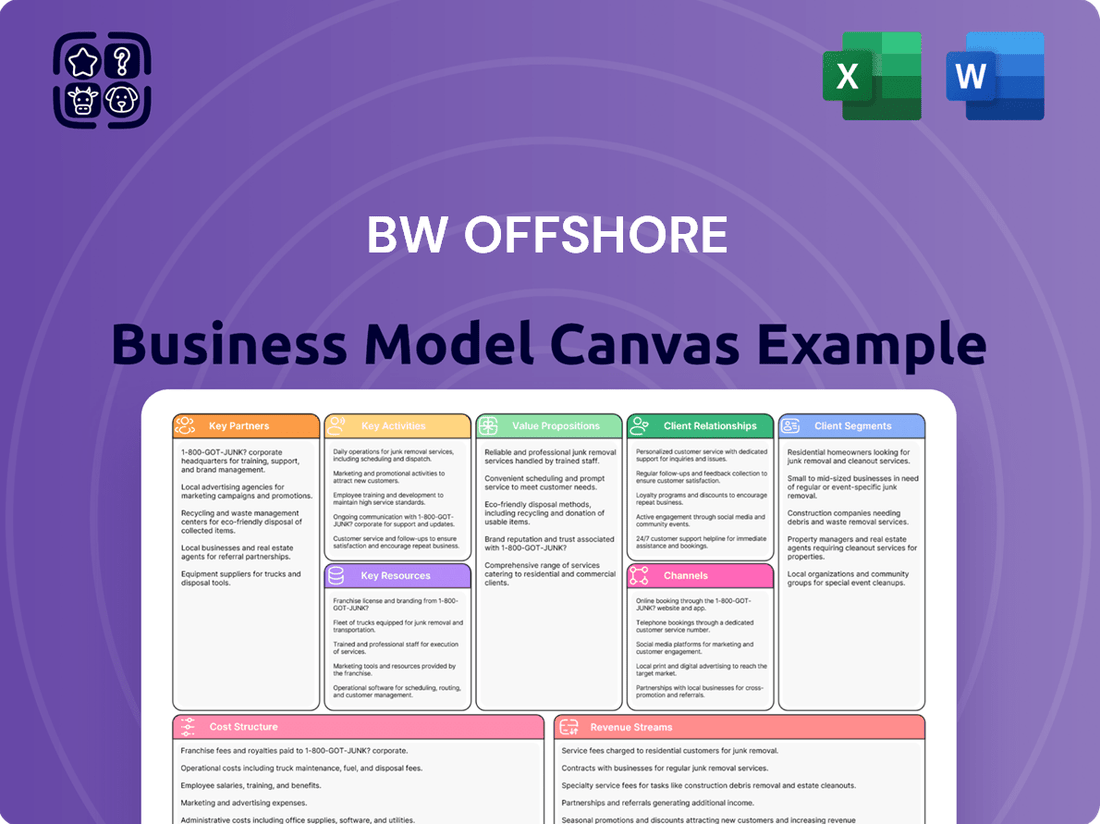

BW Offshore Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BW Offshore Bundle

Unlock the strategic blueprint behind BW Offshore's success with our comprehensive Business Model Canvas. This detailed analysis illuminates their customer segments, value propositions, and key partnerships in the offshore energy sector. Discover their revenue streams and cost structures, providing a clear view of their operational efficiency and market positioning.

Dive deeper into what makes BW Offshore a leader in floating production solutions. This Business Model Canvas offers a granular look at their core activities and resources, crucial for understanding their competitive advantage. Ideal for anyone seeking to understand industry best practices or benchmark their own strategies.

Ready to gain actionable insights into BW Offshore's thriving business model? Our complete Business Model Canvas breaks down every essential element, from customer relationships to revenue generation, offering a clear and concise overview. Download the full version to accelerate your strategic planning and decision-making.

Partnerships

BW Offshore's key partnerships are predominantly with major international and national oil and gas companies. These collaborations are fundamental to securing long-term contracts for their Floating Production Storage and Offloading (FPSO) units, which form the backbone of their revenue. These relationships ensure a stable and predictable income stream, vital for BW Offshore's financial health and operational planning.

These partnerships are not just transactional; they represent deep, integrated relationships where BW Offshore provides comprehensive production solutions. For instance, their collaboration with Santos for the Barossa project and with Murphy Oil Corporation for the BW Pioneer FPSO highlights the significant scale and complexity of these joint ventures. Such projects often span many years, underscoring the stability these partnerships bring.

BW Offshore relies heavily on shipyards and Engineering, Procurement, and Construction (EPC) contractors for the fabrication and assembly of its Floating Production Storage and Offloading (FPSO) units. These partnerships are crucial for accessing specialized facilities, experienced workforce, and advanced construction techniques needed for complex offshore projects.

For instance, the BW Opal FPSO project, delivered in 2024, involved significant collaboration with key shipyards and EPC firms. These collaborations ensure that BW Offshore can efficiently manage the design, engineering, procurement, and construction phases, meeting stringent quality and safety standards for these massive offshore assets.

These strategic alliances provide BW Offshore with the necessary capacity and technical expertise to undertake multiple projects concurrently and manage the lifecycle of their assets, from initial construction to potential upgrades or conversions, ensuring operational readiness and cost-effectiveness.

BW Offshore partners with leading technology and equipment suppliers to integrate cutting-edge systems into its Floating Production Storage and Offloading (FPSO) units. This ensures access to specialized components for hydrocarbon processing, storage, and offloading, crucial for efficient and safe operations. For instance, in 2024, BW Offshore continued to leverage advanced digital solutions from various tech providers to enhance its fleet management capabilities, aiming to optimize uptime and reduce operational costs.

Financial Institutions and Investors

BW Offshore's relationships with banks, financial institutions, and investors are critical for its financial health and growth. These partnerships are the bedrock for securing the substantial capital required for its large-scale Floating Production Storage and Offloading (FPSO) projects. Without this financial backing, the company simply couldn't undertake the complex and capital-intensive development of new offshore production facilities.

These collaborations enable BW Offshore to access a range of financial instruments. This includes project financing specifically for new builds, corporate loans for general working capital and debt management, and equity investments from a diverse investor base. For instance, in 2024, BW Offshore continued to actively manage its debt profile and secure funding for its ongoing projects, demonstrating the vital role of these financial relationships in maintaining liquidity and supporting strategic investments.

- Banks and Financial Institutions: Providing project finance, corporate loans, and credit facilities to fund FPSO construction and operations.

- Investors: Including equity investors, bondholders, and institutional funds that provide capital through share offerings and debt issuances.

- Leasing Companies: Potentially partnering for asset financing and leasing arrangements for specialized equipment.

- Export Credit Agencies: Collaborating to secure favorable financing terms for projects in specific regions or involving equipment from particular countries.

Joint Venture Partners and Renewable Energy Developers

BW Offshore actively engages in joint ventures and strategic alliances with key players in the renewable energy sector, especially those focused on offshore wind development. These collaborations are fundamental to its energy transition strategy, allowing BW Offshore to extend its extensive offshore operational experience into new, sustainable energy markets.

Through these partnerships, BW Offshore aims to co-develop and deliver innovative low-carbon and clean energy solutions, capitalizing on its established project management and engineering capabilities. For instance, in 2024, BW Offshore announced a significant joint venture with a leading renewable energy developer to pursue offshore wind projects in the North Sea, targeting a combined capacity of over 1 GW.

- Strategic Alliances: BW Offshore partners with renewable energy developers to share risks and expertise in the nascent offshore wind sector.

- Market Entry: Joint ventures provide a crucial pathway for BW Offshore to access and gain traction in new renewable energy markets.

- Low-Carbon Solutions: These partnerships are geared towards the development and deployment of cleaner energy technologies, aligning with global decarbonization efforts.

- Capacity Building: By combining BW Offshore's offshore know-how with partners' renewable energy specialization, they aim to build substantial renewable energy capacity, with ongoing projects in 2024 and beyond targeting multi-gigawatt portfolios.

BW Offshore’s key partnerships are crucial for its operational success and financial stability. These include collaborations with major oil and gas companies for FPSO contracts, providing stable revenue streams. Additionally, partnerships with shipyards and EPC contractors are vital for the fabrication and construction of their complex offshore units, ensuring quality and efficiency.

The company also relies on technology and equipment suppliers for advanced systems, enhancing fleet management and operational cost reduction, with digital solutions being a key focus in 2024. Furthermore, strong relationships with banks and investors are essential for securing the significant capital needed for large-scale projects, with ongoing funding efforts in 2024 to support growth and debt management.

| Partnership Type | Key Collaborators | Strategic Importance | Example/Data Point (2024 Focus) |

|---|---|---|---|

| Client Relationships | Major Oil & Gas Companies (e.g., Santos, Murphy Oil) | Securing long-term FPSO contracts, stable revenue | Contracts often span many years, providing predictable income. |

| Supply Chain & Construction | Shipyards, EPC Contractors | FPSO fabrication, construction expertise, quality assurance | BW Opal FPSO project involved significant collaboration with key yards and EPC firms in 2024. |

| Technology & Equipment | Leading technology and equipment suppliers | Integration of advanced systems, fleet management optimization | Continued leveraging of advanced digital solutions in 2024 to enhance operational efficiency. |

| Financial Partnerships | Banks, Financial Institutions, Investors | Capital for FPSO projects, working capital, debt management | Active management of debt profile and securing funding for ongoing projects in 2024. |

What is included in the product

This BW Offshore Business Model Canvas provides a detailed blueprint of their strategy, focusing on their offshore floating production and storage solutions for the oil and gas industry.

It outlines key partnerships, core activities, and resource requirements for delivering value to their diverse customer base of energy producers.

BW Offshore's Business Model Canvas acts as a pain point reliever by offering a structured, visual framework that clarifies complex operational dependencies and potential bottlenecks in their offshore energy services.

It streamlines the identification of inefficiencies and areas for optimization, thereby alleviating the pain of scattered information and reactive problem-solving.

Activities

BW Offshore's primary focus is the intricate design, detailed engineering, and robust construction of Floating Production, Storage, and Offloading (FPSO) units. This encompasses both ground-up newbuild projects and the complex conversion of existing vessels, all tailored to precise client specifications and stringent international maritime and oil & gas regulations.

A prime example of their capability is the BW Opal, a significant FPSO delivered for the Barossa project, highlighting their expertise in managing large-scale, technically demanding offshore developments. This project underscores their ability to deliver advanced solutions for complex field developments.

The company's engineering prowess extends to optimizing vessel performance and ensuring operational efficiency, a critical factor in the economic viability of offshore production. This includes integrating cutting-edge technology to enhance production and safety protocols.

BW Offshore's core activity revolves around the operational excellence and long-term maintenance of its Floating Production Storage and Offloading (FPSO) vessel fleet. This ensures clients experience high commercial uptime, which is crucial for uninterrupted hydrocarbon production. For example, in 2023, BW Offshore reported a fleet-wide uptime of 97.7%, a testament to their robust O&M practices.

Maintaining asset integrity and adhering to stringent safety standards are paramount in these operations. This involves proactive maintenance strategies and skilled personnel to manage the complex systems onboard FPSOs, minimizing downtime and maximizing operational efficiency.

The company's O&M strategy directly impacts its revenue generation and client satisfaction. Efficient operations mean more barrels produced and offloaded, directly contributing to BW Offshore's financial performance and its reputation in the offshore energy sector.

BW Offshore’s project management and execution are critical for delivering complex offshore production units. This involves overseeing the entire lifecycle, from initial concept through to commissioning and the crucial sail-away phase. Effective management ensures these large-scale projects, such as the Barossa FPSO, are completed on schedule and within their financial allocations. A key aspect is the intricate coordination of diverse stakeholders and proactive mitigation of potential project risks.

Business Development and Contract Acquisition

BW Offshore's business development hinges on actively seeking and winning new floating production storage and offloading (FPSO) contracts. This proactive approach is crucial for expanding their fleet and securing future revenue streams. They actively participate in tendering processes and engage in Front-End Engineering Design (FEED) studies to position themselves for upcoming projects.

The company prioritizes projects that offer long-term stability and involve strong, reliable partners. This strategic selection mitigates risk and ensures a more predictable income flow. For example, in 2024, BW Offshore secured a significant contract for the first phase of the ABS project with APA Corporation, underscoring their success in acquiring new business.

- Securing FPSO Contracts: BW Offshore’s core activity involves identifying and winning new FPSO contracts to drive fleet expansion and revenue growth.

- Tendering and FEED Engagement: Active participation in tendering processes and Front-End Engineering Design (FEED) activities are key to securing future project opportunities.

- Strategic Project Selection: The company focuses on projects with robust counterparties and long-term contracts to ensure financial stability and reduce risk.

- 2024 Contract Wins: A notable success in 2024 was securing the ABS project contract with APA Corporation, demonstrating their effectiveness in business development.

Energy Transition Initiatives and R&D

BW Offshore is actively pursuing new ventures in the renewable energy sector, signaling a strong commitment to the energy transition. This includes exploring opportunities in floating offshore wind, a burgeoning area with significant growth potential. The company is also investigating gas-to-power solutions and the development of ammonia as a fuel, reflecting a strategic pivot towards cleaner energy sources.

These initiatives are underpinned by substantial research and development (R&D) and strategic investments. BW Offshore aims to diversify its business portfolio, moving beyond traditional oil and gas services to build future value. For instance, in 2024, the company continued to invest in its floating wind projects, aiming to solidify its position in this evolving market.

- Floating Offshore Wind: Continued development and potential project awards in the floating wind sector.

- Gas-to-Power: Exploring projects that leverage existing infrastructure for cleaner gas-based power generation.

- Ammonia and Carbon Capture: Investigating the feasibility and commercialization of ammonia as a marine fuel and carbon capture technologies.

- R&D Investment: Allocating resources to innovation in renewable energy technologies and sustainable solutions.

BW Offshore’s key activities center on the lifecycle management of Floating Production, Storage, and Offloading (FPSO) units. This includes the sophisticated design, engineering, and construction of new FPSOs, as well as the complex conversion of existing vessels to meet specific client needs and regulatory standards.

The company also excels in the long-term operation and maintenance (O&M) of its FPSO fleet, ensuring high uptime and efficient production for clients. Their commitment to asset integrity and safety is paramount in these ongoing operations, directly impacting revenue and client satisfaction. For example, in 2023, their fleet achieved an impressive 97.7% uptime, showcasing their operational prowess.

Furthermore, BW Offshore actively engages in business development by securing new FPSO contracts, participating in tendering, and conducting Front-End Engineering Design (FEED) studies. Strategic project selection, focusing on long-term stability and strong partners, is crucial for their growth. A significant win in 2024 was the ABS project contract with APA Corporation.

The company is also strategically investing in the energy transition, exploring opportunities in floating offshore wind and gas-to-power solutions, with ongoing R&D in areas like ammonia as a fuel. These diversified efforts aim to build future value and adapt to evolving market demands.

| Key Activity | Description | Supporting Data/Example |

| FPSO Design, Engineering & Construction | Creating and building FPSO units, including new builds and conversions. | BW Opal for the Barossa project demonstrates advanced solution delivery. |

| FPSO Operation & Maintenance (O&M) | Ensuring long-term operational efficiency and uptime of the FPSO fleet. | Fleet-wide uptime of 97.7% in 2023. |

| Business Development & Contract Acquisition | Securing new FPSO contracts through tendering and FEED studies. | Secured ABS project contract with APA Corporation in 2024. |

| Energy Transition Ventures | Investing in and developing renewable energy solutions. | Continued investment in floating wind projects in 2024. |

Delivered as Displayed

Business Model Canvas

The BW Offshore Business Model Canvas you are currently previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the comprehensive analysis you will gain access to. Upon completing your order, you will receive the full, unedited version of this Business Model Canvas, ready for your strategic planning and decision-making. Rest assured, what you see is precisely what you will get, providing complete transparency and immediate usability for your business needs.

Resources

BW Offshore's core physical assets are its diverse fleet of Floating Production Storage and Offloading (FPSO) vessels. These sophisticated units act as mobile offshore production facilities, crucial for extracting and processing hydrocarbons.

The fleet, comprising 11 FPSOs as of early 2024, forms the backbone of the company's integrated production solutions. These vessels are equipped with advanced topside modules and robust mooring systems, enabling operations in challenging offshore environments.

BW Offshore's infrastructure extends beyond the FPSOs to include associated topside processing equipment and mooring systems. This comprehensive setup allows them to offer end-to-end production services, from wellhead to offloading.

In 2023, the company successfully completed the upgrade of the FPSO Catcher, demonstrating their capability to maintain and enhance the performance of their fleet. This ongoing investment in their physical assets ensures continued operational efficiency and reliability for their clients.

BW Offshore's business hinges on its highly experienced workforce. This includes specialized engineers, adept project managers, and seasoned offshore operational personnel, forming a critical human resource base.

With four decades of accumulated experience in offshore operations and complex project execution, the company's personnel provide a significant competitive advantage. This deep well of knowledge is instrumental in navigating the demanding offshore environment and delivering successful projects.

As of the first half of 2024, BW Offshore reported a strong operational performance, with its fleet of Floating Production Storage and Offloading (FPSO) units achieving high availability rates, a direct testament to the expertise of its offshore teams.

BW Offshore's intellectual property, encompassing proprietary FPSO designs and advanced engineering techniques, forms a cornerstone of its competitive advantage. This deep well of knowledge enables the creation of customized and cutting-edge offshore energy solutions, catering to a wide array of global market demands.

The company's operational best practices, refined over years of experience, contribute significantly to its intellectual capital. These methodologies ensure efficient and reliable performance of its FPSO fleet, a key differentiator in the offshore sector.

In 2023, BW Offshore's commitment to innovation was evident, with continued investment in research and development aimed at enhancing its technological capabilities. This focus on proprietary technology underpins its ability to offer high-value solutions in a dynamic energy landscape.

Financial Capital and Strong Balance Sheet

BW Offshore's access to significant financial capital, underpinned by a robust balance sheet and ample liquidity, is a cornerstone of its business model. This financial strength is essential for financing the substantial upfront costs associated with developing and deploying floating production storage and offloading (FPSO) units and other large-scale offshore energy infrastructure projects. As of the first quarter of 2024, the company reported a healthy liquidity position, enabling it to manage its existing debt obligations and confidently pursue new investment opportunities in a dynamic energy market.

This financial capacity directly translates into the company's ability to seize strategic growth prospects. Whether it involves acquiring new assets, investing in technological advancements for its fleet, or undertaking complex engineering and construction phases for new contracts, BW Offshore's strong financial footing provides the necessary resources. The company's ability to secure favorable financing terms further enhances its competitive advantage, allowing it to undertake projects that others might find financially prohibitive.

Key aspects of BW Offshore's financial capital and strong balance sheet include:

- Access to substantial capital: Facilitates the acquisition and development of high-value offshore assets.

- Robust balance sheet: Provides a stable foundation for managing financial risk and undertaking long-term commitments.

- Available liquidity: Ensures operational flexibility and the capacity to meet financial obligations promptly.

- Debt management capabilities: Allows for efficient leverage and strategic use of borrowed funds to finance growth.

Global Supply Chain and Partner Network

BW Offshore’s global supply chain and partner network are foundational to its operations. These established relationships with shipyards, equipment manufacturers, and specialized service providers are crucial for the successful execution of Floating Production Storage and Offloading (FPSO) projects. For instance, securing competitive pricing and timely delivery from key suppliers is paramount in managing project costs and schedules, directly impacting profitability.

The company leverages this network to ensure the efficient procurement and construction of its complex assets. A strong rapport with shipyards allows for optimized construction phases, while reliable equipment suppliers guarantee the quality and performance of essential components. This interconnectedness facilitates BW Offshore’s ability to undertake and deliver projects across diverse geographical locations, a testament to the robustness of its partnership ecosystem.

- Global Reach: BW Offshore operates with a worldwide network, enabling project execution in various regions.

- Key Partnerships: Essential relationships include major shipyards for vessel conversion and construction, and leading equipment suppliers for critical process modules.

- Efficiency Drivers: These partnerships directly contribute to cost-effectiveness and adherence to project timelines in the demanding offshore industry.

- Risk Mitigation: A diversified and trusted partner base helps mitigate supply chain disruptions and ensures quality assurance in project delivery.

BW Offshore's Key Resources are anchored by its substantial fleet of FPSO units, which are its primary physical assets. These vessels, numbering 11 as of early 2024, are complemented by essential processing equipment and mooring systems, forming a complete production infrastructure. The company's human capital, comprising experienced engineers and project managers, leverages four decades of offshore expertise to ensure high operational availability, as demonstrated by strong performance figures in the first half of 2024.

Intellectual property, including proprietary FPSO designs and refined operational practices, provides a significant competitive edge, reinforced by ongoing R&D investments to enhance technological capabilities. Crucially, BW Offshore's robust financial position, with ample liquidity and a strong balance sheet as of Q1 2024, enables the financing of large-scale offshore projects and strategic growth initiatives. This financial strength is further bolstered by a global network of trusted partners and suppliers, ensuring efficient procurement and construction.

| Resource Category | Key Components | Significance | Recent Data/Context |

|---|---|---|---|

| Physical Assets | FPSO Fleet (11 units as of early 2024) | Core revenue-generating assets, enabling integrated production solutions. | FPSO Catcher upgrade completed in 2023. |

| Human Capital | Experienced Engineers, Project Managers, Offshore Personnel | Drives operational efficiency and project execution success. | High fleet availability in H1 2024 attributed to team expertise. |

| Intellectual Property | Proprietary FPSO Designs, Engineering Techniques | Differentiates offerings and enables customized solutions. | Continued investment in R&D in 2023. |

| Financial Capital | Strong Balance Sheet, Ample Liquidity | Funds large-scale projects and supports strategic growth. | Healthy liquidity position reported in Q1 2024. |

| Partnerships & Supply Chain | Shipyards, Equipment Manufacturers, Service Providers | Ensures efficient procurement, construction, and quality. | Global network supports diverse project locations. |

Value Propositions

BW Offshore offers a single point of accountability for the entire lifecycle of offshore hydrocarbon production, from extraction to processing and storage. This integrated approach significantly streamlines project execution for clients, removing the complexity of managing multiple vendors and ensuring a cohesive operational flow. For instance, in 2024, BW Offshore continued to leverage its extensive fleet of Floating Production, Storage, and Offloading (FPSO) units, which are central to these integrated solutions, demonstrating their capability to deliver turnkey production facilities.

BW Offshore’s leasing and operating model significantly lowers client capital expenditure. This means oil and gas companies avoid the massive upfront investment typically required for floating production, storage, and offloading (FPSO) units.

By outsourcing the construction and operation of FPSOs, clients transfer substantial project risks to BW Offshore. This includes risks associated with construction timelines, cost overruns, and operational performance, allowing clients to concentrate on their primary exploration and production efforts.

In 2023, BW Offshore secured contracts valued at approximately $1.5 billion, underscoring the demand for their risk-sharing model. This financial commitment from clients highlights the value proposition of reduced capex and risk transfer.

BW Offshore's commitment to operational efficiency and high uptime is a cornerstone of its value proposition. The company consistently achieves commercial uptime exceeding 99% for its Floating Production Storage and Offloading (FPSO) units. This exceptional reliability ensures clients experience predictable production, directly translating into stable revenue streams and maximizing the economic return on their offshore assets.

Tailored and Flexible Solutions

BW Offshore excels at delivering tailored FPSO solutions, meticulously engineered to address the unique demands of diverse offshore fields, even those situated in challenging, harsh environments. This adaptability is a cornerstone of their value proposition, offering clients the crucial flexibility needed to navigate complex operational landscapes and varying project scales.

Their engineering prowess allows for bespoke solutions, meaning clients aren't forced into one-size-fits-all approaches. For instance, BW Offshore's commitment to customization was evident in their work on projects like the Catcher FPSO, which required specific modifications to handle the North Sea's demanding conditions. This capability ensures optimal performance and efficiency, regardless of the project's intricacies.

The flexibility inherent in BW Offshore's offerings translates directly into client benefits, enabling them to adapt to evolving field characteristics and production profiles. This responsiveness is critical in the dynamic offshore oil and gas sector.

Key aspects of BW Offshore's tailored and flexible solutions include:

- Custom Engineering: Designing FPSOs to precise client and field specifications.

- Harsh Environment Expertise: Proven ability to operate effectively in challenging conditions.

- Project Scope Adaptability: Modifying solutions for diverse project sizes and complexities.

- Operational Efficiency: Ensuring optimized performance through bespoke design.

Expertise in Energy Transition

BW Offshore's expertise in the energy transition extends far beyond its traditional oil and gas roots. They are actively applying their extensive offshore engineering and operational skills to create value in new energy sectors.

This strategic pivot involves developing innovative solutions for low-carbon and clean energy production. For example, BW Offshore is involved in projects related to carbon capture, utilization, and storage (CCUS) and floating offshore wind. In 2024, the company announced a significant milestone in its floating solar project portfolio, aiming to deploy over 1GW of capacity globally.

BW Offshore offers clients clear pathways and practical support to achieve their sustainability goals. This includes providing the assets and expertise needed to transition to cleaner energy sources, thereby helping clients reduce their environmental footprint.

The company's commitment to the energy transition is reflected in its substantial investments and partnerships in renewable energy projects. By 2025, BW Offshore aims to have a significant portion of its revenue generated from these new energy ventures, demonstrating a tangible shift in its business model.

- Leveraging offshore engineering for new energy

- Developing low-carbon and clean energy solutions

- Enabling client sustainability pathways

- Significant project deployments in floating solar and offshore wind

BW Offshore provides integrated offshore production solutions, acting as a single point of accountability for the entire lifecycle. This streamlines operations for clients, removing the complexity of managing multiple vendors and ensuring a cohesive flow. Their extensive fleet of FPSO units, central to these solutions, saw continued deployment in 2024, showcasing their turnkey delivery capabilities.

Customer Relationships

BW Offshore focuses on building enduring relationships with its primary clients, frequently solidifying these through multi-year contracts that can span a decade or more. This approach fosters a symbiotic environment where shared goals and a profound grasp of client operational requirements are paramount.

These strategic alliances are the bedrock of BW Offshore's business model, emphasizing reliability and mutual benefit. For instance, in 2024, BW Offshore secured a significant contract extension for its FPSO Catcher, demonstrating the company's ability to maintain and grow these crucial long-term engagements.

BW Offshore assigns specialized project and operational teams for each Floating Production Storage and Offloading (FPSO) venture, fostering a direct partnership with clients. This dedicated approach ensures clear communication channels and swift resolution of issues, leading to highly efficient operations tailored to specific client needs.

These teams are crucial for navigating the complexities of offshore production, providing continuous support and expertise throughout the project lifecycle. Their focused engagement allows BW Offshore to proactively address operational demands and overcome challenges, maximizing uptime and performance for their clients.

BW Offshore often structures its customer relationships through performance-based agreements. This means their earnings can be directly tied to how well their Floating Production Storage and Offloading (FPSO) units perform, specifically focusing on uptime and overall efficiency.

This approach is designed to strongly align BW Offshore's incentives with those of their clients. By linking compensation to tangible results, the company is motivated to deliver maximum value and operational excellence, ensuring the FPSO meets or exceeds agreed-upon performance benchmarks.

For example, in 2024, BW Offshore's commitment to operational excellence on their FPSO fleet directly impacts their revenue streams through these performance metrics. High uptime and efficient production translate into greater financial returns for the company and optimized output for their clients.

Technical Support and Advisory Services

BW Offshore’s commitment extends beyond initial deployment, offering continuous technical support and expert advisory services. This partnership spans the entire lifecycle of their Floating Production Storage and Offloading (FPSO) units, from the very first design stages through to eventual decommissioning. This proactive approach is crucial for ensuring peak operational performance and swiftly resolving any technical challenges that may arise, thereby safeguarding the asset's integrity.

The company’s technical support focuses on maintaining the high performance standards expected from their FPSO assets. This includes regular maintenance guidance, troubleshooting, and the provision of specialized expertise to address complex operational issues. For instance, in 2024, BW Offshore continued its focus on asset lifecycle management, a key component of their customer relationship strategy, aiming to maximize uptime and efficiency for their clients operating in demanding offshore environments.

- Comprehensive Lifecycle Support: BW Offshore provides technical assistance from the initial design phase through to the decommissioning of FPSO units.

- Operational Optimization: The company offers advisory services to ensure clients achieve optimal performance from their FPSO assets.

- Prompt Issue Resolution: Expert technical support is available to address and resolve any technical challenges encountered during operations.

- Asset Integrity Maintenance: Ongoing support is critical for maintaining the long-term integrity and safety of the FPSO units.

Client-Centric Collaboration on New Ventures

BW Offshore actively partners with clients to co-create and advance new ventures, particularly within the evolving energy transition landscape. This collaborative spirit is key to unlocking innovation and identifying future growth avenues.

In 2024, BW Offshore reported a significant increase in project pipeline discussions, with a notable portion focused on floating solar and carbon capture, utilization, and storage (CCUS) projects. This client-centric engagement strategy directly contributes to their business development efforts.

- Client Collaboration: BW Offshore fosters deep relationships through joint project development, ensuring alignment with client needs and market opportunities.

- Energy Transition Focus: A substantial part of new venture discussions in 2024 involved renewable energy solutions and decarbonization technologies.

- Innovation Partnership: By working closely with clients on novel concepts, BW Offshore stimulates innovation and builds a shared vision for future projects.

- Opportunity Unlocking: This proactive approach to shared development has been instrumental in securing new contracts and expanding their service offerings.

BW Offshore cultivates strong, long-term customer relationships through multi-year contracts and dedicated project teams, ensuring deep understanding and tailored operational support. Performance-based agreements in 2024 directly link their revenue to client success, emphasizing uptime and efficiency.

BW Offshore also actively collaborates with clients on new energy transition ventures, such as floating solar and CCUS, as evidenced by increased pipeline discussions in 2024, fostering innovation and future growth.

| Relationship Aspect | Key Features | 2024 Relevance |

|---|---|---|

| Contract Duration | Multi-year, often decade-plus | Secured extensions, e.g., FPSO Catcher |

| Operational Support | Dedicated teams, lifecycle technical support | Focus on asset integrity and optimization |

| Commercial Structure | Performance-based agreements | Directly impacts revenue via uptime metrics |

| Client Collaboration | Co-creation of new ventures | Increased focus on energy transition projects |

Channels

BW Offshore's direct sales and business development efforts are crucial for securing major FPSO contracts. Their teams engage directly with large oil and gas corporations, building relationships and understanding specific project needs.

This direct approach facilitates complex negotiations, allowing BW Offshore to tailor their FPSO solutions precisely to client requirements. In 2024, BW Offshore continued to focus on these relationships, aiming to secure new projects and extensions in a dynamic offshore market.

The company's business development pipeline actively tracks opportunities, with direct engagement being key to converting leads into signed agreements. This strategy emphasizes deep client understanding and the ability to offer bespoke financial and operational packages.

BW Offshore's engagement in industry conferences and networking events is a vital channel for market insight and business development. For instance, their participation in major oil and gas expos like ONS (Offshore Northern Seas) or ADIPEC (Abu Dhabi International Petroleum Exhibition & Conference) provides direct access to market trends and potential clients. In 2024, these events continue to be crucial for understanding the evolving landscape of energy production and the increasing focus on offshore renewable solutions.

These gatherings are instrumental in building brand visibility and establishing crucial connections within the energy sector. By showcasing their floating production storage and offloading (FPSO) solutions and their growing renewable energy ventures, BW Offshore can directly engage with potential customers and strategic partners. This direct interaction is key to identifying new project opportunities and reinforcing their position as a leading offshore energy contractor.

The ability to network at these events allows BW Offshore to gather intelligence on competitor activities and emerging technologies. This information is invaluable for strategic planning and innovation. For example, discussions at conferences often reveal insights into new project pipelines and regulatory changes that could impact future business, such as the increasing demand for greener offshore solutions.

BW Offshore primarily secures new floating production storage and offloading (FPSO) contracts by actively participating in formal tender processes and responding to Requests for Proposals (RFPs) issued by oil and gas majors. These submissions are crucial, requiring meticulous detail in both technical capabilities and commercial offerings to showcase BW Offshore's proven expertise and competitive value proposition.

In 2024, the global offshore oil and gas sector continued to see significant tender activity, with several major projects seeking FPSO solutions. For instance, as of mid-2024, BW Offshore was actively engaged in bidding for multiple high-value FPSO contracts in regions like West Africa and South America, where the demand for specialized floating production units remains robust.

The success rate in these competitive tender processes is directly tied to the quality and comprehensiveness of the proposals submitted. BW Offshore's strategy involves leveraging its extensive track record, innovative engineering solutions, and a clear understanding of client requirements to differentiate its bids and secure lucrative, long-term contracts.

Strategic Alliances and Joint Ventures

BW Offshore frequently utilizes strategic alliances and joint ventures to navigate the complexities of large-scale offshore projects and the evolving energy landscape. These partnerships are crucial for sharing the substantial capital investment and mitigating the inherent risks associated with such ventures, particularly in the burgeoning new energy sector. For instance, in 2024, BW Offshore announced a joint venture for a floating offshore wind project, demonstrating their commitment to diversifying their portfolio beyond traditional oil and gas.

These collaborations serve as a vital channel to unlock new markets and secure access to a broader client base. By pooling resources and expertise, BW Offshore can effectively leverage the complementary strengths of its partners, thereby expanding its geographical reach and enhancing its competitive positioning. This strategy allows them to tap into regions or project types where they might not have the sole capacity or established presence.

- Market Access: Joint ventures facilitate entry into new geographical markets and client segments, particularly for novel energy projects.

- Risk Mitigation: Sharing financial burdens and operational risks with partners is essential for high-cost, high-risk offshore developments.

- Synergistic Strengths: Collaborations allow BW Offshore to combine its technological capabilities with partners' regional expertise or market access.

- Capital Efficiency: Accessing external capital through partnerships enables the pursuit of larger, more ambitious projects.

Online Presence and Investor Relations

BW Offshore actively manages its online presence via its corporate website, a crucial conduit for information dissemination and stakeholder engagement. This platform offers comprehensive details on the company's operations, financial performance, and strategic direction, ensuring transparency. For instance, as of their Q1 2024 report, BW Offshore highlighted continued progress on key projects, with detailed updates available on their investor relations portal.

The website serves as the primary channel for investor relations, providing easy access to annual reports, quarterly earnings, presentations, and press releases. This commitment to digital accessibility allows investors and interested parties to stay informed about BW Offshore's performance and strategic initiatives, fostering trust and facilitating informed decision-making. The company’s investor portal is regularly updated with information relevant to its 2024 financial year, including guidance and outlook.

- Corporate Website: Central hub for company information, project updates, and financial reports.

- Investor Relations Portal: Dedicated section for annual reports, presentations, and stock information.

- Transparency and Accessibility: Ensures all stakeholders have timely access to critical company data.

- Digital Engagement: Facilitates communication with investors and potential clients.

BW Offshore's channels primarily revolve around direct engagement with major oil and gas clients for FPSO contracts, leveraging industry events for networking and market intelligence, and participating in formal tender processes. Strategic alliances and joint ventures are also key for market access and risk mitigation, especially in new energy ventures. The corporate website and investor relations portal serve as vital information hubs.

In 2024, BW Offshore's direct sales efforts targeted securing extensions for existing FPSO contracts and bidding on new projects, particularly in regions like West Africa where demand remains strong. Their participation in events like ONS and ADIPEC provided insights into the growing offshore renewable energy market, influencing their strategic partnerships. The company's robust tender pipeline saw active engagement in multiple high-value FPSO bids throughout the year.

BW Offshore's 2024 strategy heavily emphasized joint ventures, exemplified by their partnership for a floating offshore wind project, broadening their market reach and capital efficiency. The corporate website consistently updated stakeholders with performance data, with investor relations sections detailing their progress and outlook for the 2024 financial year.

| Channel | Description | 2024 Focus/Activity | Key Benefit |

| Direct Sales & Business Development | Engaging directly with oil & gas majors for FPSO contracts. | Securing new contracts and extensions; tailoring solutions. | Deep client understanding; bespoke offerings. |

| Industry Conferences & Networking | Participating in major energy expos (e.g., ONS, ADIPEC). | Gaining market insights; building brand visibility; identifying new energy opportunities. | Market intelligence; strategic connections. |

| Tender Processes & RFPs | Responding to formal bidding requests from clients. | Actively bidding on high-value FPSO contracts in key regions. | Securing long-term, lucrative agreements. |

| Strategic Alliances & Joint Ventures | Collaborating with partners on large-scale projects. | Entering new markets (especially renewables); sharing capital and risk. | Market access; risk mitigation; capital efficiency. |

| Corporate Website & Investor Relations | Online platform for company information and financial reporting. | Providing transparent updates on operations and financial performance for 2024. | Stakeholder engagement; transparency; investor confidence. |

Customer Segments

International Oil & Gas Companies (IOCs) represent a core customer segment for BW Offshore, seeking integrated Floating Production Storage and Offloading (FPSO) solutions. These giants of the energy sector require robust and reliable platforms for their complex offshore projects spanning the globe.

IOCs typically engage BW Offshore for long-term charter and operation contracts, valuing the company's proven track record in delivering high operational uptime. In 2024, the sustained demand for offshore production assets underscores the critical role BW Offshore plays in enabling these companies to extract resources efficiently and safely.

These clients expect BW Offshore to possess advanced technical capabilities, including sophisticated engineering, maintenance, and safety protocols, to meet the demanding environments of offshore oil and gas exploration. The ability to offer tailored solutions that address specific field characteristics and regulatory requirements is paramount for securing these valuable partnerships.

National Oil Companies (NOCs) are a cornerstone customer segment for BW Offshore, especially in nations rich with offshore hydrocarbon resources. These state-owned entities often seek more than just operational services; they prioritize local content integration and technology transfer to bolster their national energy security and drive economic growth. For instance, in 2024, many NOCs in West Africa and Southeast Asia are actively pursuing partnerships that emphasize capacity building within their domestic workforces.

Smaller to mid-sized independent Exploration and Production (E&P) companies, particularly those concentrating on niche offshore basins, represent a key customer segment for BW Offshore. These companies often find themselves with significant resource potential but limited capital for large-scale offshore infrastructure. For instance, in 2024, the global upstream oil and gas sector saw continued activity from independents looking to optimize their asset portfolios and reduce financial burdens.

BW Offshore's flexible leasing models are particularly attractive to these E&P firms. They offer a way to access essential offshore production facilities without the massive upfront capital expenditure typically associated with purchasing or building such assets. This approach directly addresses their need to lower initial investment and operational complexity, allowing them to focus on their core competency: exploration and production.

This strategy is crucial for independents aiming to monetize discoveries in challenging or less developed offshore regions. By engaging BW Offshore, they can deploy production solutions more rapidly and efficiently, thereby shortening the time to first oil and improving overall project economics. This agility is vital in a market where rapid response to exploration successes can significantly impact long-term profitability.

Renewable Energy Developers

Renewable energy developers, especially those in offshore wind, represent a significant and expanding customer base for BW Offshore. These clients are actively pursuing energy transition projects, requiring specialized offshore capabilities that BW Offshore can provide. The global offshore wind market is experiencing robust growth, with significant investments projected in the coming years. For instance, by 2030, the installed offshore wind capacity worldwide is expected to reach over 400 GW, a substantial increase from current levels.

BW Offshore's established expertise in offshore operations, including floating production, storage, and offloading (FPSO) units, is highly transferable to the needs of renewable energy projects. This expertise allows them to offer tailored solutions for the development and operation of offshore renewable energy assets. Many developers are seeking partners with proven track records in managing complex offshore environments, making BW Offshore a compelling choice for their ventures.

- Target Market Growth: The global offshore wind market is projected to continue its rapid expansion, creating substantial opportunities for service providers like BW Offshore.

- Leveraging Core Competencies: BW Offshore's established offshore engineering and operational skills are directly applicable to the construction and maintenance of offshore renewable energy infrastructure.

- Energy Transition Support: This segment actively seeks partners who can facilitate their transition to cleaner energy sources, aligning with BW Offshore's strategic pivot.

- Project Complexity: Developers often require specialized offshore expertise to navigate the technical and logistical challenges inherent in large-scale renewable energy projects.

Governments and Regulatory Bodies

Governments and regulatory bodies are essential stakeholders for BW Offshore, even though they are not direct customers for Floating Production Storage and Offloading (FPSO) services. Their influence shapes the operational landscape significantly.

BW Offshore actively engages with these entities by ensuring compliance with local content mandates, such as those seen in Brazil where a significant portion of goods and services must be sourced domestically. This approach not only satisfies regulatory requirements but also fosters economic development within host nations.

Adherence to stringent environmental regulations is paramount. For instance, in 2024, offshore operators like BW Offshore are expected to meet evolving standards for emissions reduction and waste management, often exceeding previous benchmarks. This commitment is critical for maintaining operating licenses and corporate reputation.

The company's contribution to local economies through job creation and skills development is a key aspect of its stakeholder relationship management.

- Local Content Compliance: Meeting and exceeding requirements for sourcing local goods and services.

- Environmental Stewardship: Adhering to and often surpassing emission reduction targets and waste management protocols.

- Economic Contribution: Creating jobs and investing in local workforce training and development.

- Regulatory Engagement: Proactive collaboration with authorities to ensure smooth operations and compliance.

BW Offshore's customer base is primarily composed of major International Oil & Gas Companies (IOCs) and National Oil Companies (NOCs). These clients rely on BW Offshore for their extensive experience in providing and operating Floating Production Storage and Offloading (FPSO) units, crucial for offshore hydrocarbon extraction.

The company also serves smaller, independent Exploration and Production (E&P) companies that require flexible and capital-efficient solutions to monetize their discoveries. Furthermore, BW Offshore is increasingly engaging with developers in the burgeoning offshore renewable energy sector, leveraging its offshore expertise for new energy projects.

BW Offshore's ability to offer tailored solutions, long-term operational support, and adherence to stringent safety and environmental standards are key factors in attracting and retaining these diverse customer segments.

Cost Structure

BW Offshore's cost structure is heavily influenced by significant capital expenditures for newbuild Floating Production, Storage, and Offloading (FPSO) units, along with the costs associated with converting existing vessels. These substantial upfront investments are crucial for fleet expansion and renewal. For instance, the company's investment in the *C ONTINENTAL SHELF* FPSO project represented a major capital outlay.

Acquiring vessels also forms a key part of their capital expenditure. These purchases are necessary to maintain and grow their operational capacity in the offshore oil and gas sector. The company's financial reports often detail these acquisition costs as a primary driver of their long-term asset base.

Operations and Maintenance (O&M) expenses are the backbone of BW Offshore's cost structure, encompassing all ongoing costs to keep their Floating Production Storage and Offloading (FPSO) units running smoothly. This includes essential elements like personnel wages for the skilled crews on board, fuel for vessel operations, and the crucial procurement of spare parts to prevent downtime. For example, in 2023, BW Offshore reported operating expenses of $1.01 billion, with O&M being a significant component.

Maintaining a high uptime for their fleet is paramount, directly translating into continuous investment in preventative and corrective maintenance. These efforts are vital to avoid costly production interruptions and ensure client satisfaction. BW Offshore's commitment to operational excellence means these O&M costs are a substantial, recurring investment rather than a discretionary spend.

BW Offshore's cost structure is significantly impacted by its global, highly skilled workforce. This includes not only the specialized offshore crews essential for their floating production storage and offloading (FPSO) operations but also the engineers, technical experts, and corporate staff managing their worldwide business. These personnel costs encompass competitive salaries, comprehensive benefits packages, ongoing training to maintain high safety and operational standards, and recruitment expenses to attract top talent in a competitive industry. For instance, in 2023, BW Offshore reported that personnel and related costs were a material component of their operating expenses, reflecting the specialized nature of their human capital.

Financing and Debt Servicing Costs

BW Offshore’s capital-intensive operations mean financing costs are a major expenditure. These include interest payments on the significant debt used to fund its fleet of floating production storage and offloading (FPSO) units and other offshore assets. Access to favorable financing terms and efficient debt management are paramount to controlling these expenses and maintaining profitability.

For instance, in 2024, BW Offshore has been actively managing its financial structure. The company's financial strategy often involves securing long-term debt facilities to match the long lifespans of its projects. These arrangements are critical for mitigating the impact of interest rate fluctuations and ensuring a stable cost base for its operations.

- Interest Expenses: Significant portion of costs tied to loans and debt facilities for asset acquisition and development.

- Financing Access: Crucial need for competitive interest rates and flexible debt structures.

- Debt Management: Ongoing focus on optimizing the company's capital structure and reducing financial risk.

- 2024 Financial Focus: Continued efforts in refinancing and securing capital to support ongoing projects and potential new ventures.

Project Development and R&D Costs

BW Offshore's commitment to future growth is heavily reliant on significant investments in project development and research and development (R&D). These costs are incurred during the crucial early stages of new ventures, encompassing activities like Front-End Engineering Design (FEED) studies, comprehensive feasibility assessments, and the innovation of new technologies, particularly those supporting the energy transition. For instance, in 2023, the company reported expenses related to ongoing development projects and the exploration of new technological solutions, which are vital for maintaining a competitive edge and adapting to evolving market demands in the offshore energy sector.

These upfront expenditures are foundational for identifying and de-risking future revenue streams. They include costs associated with conceptual studies, detailed engineering design, and the development of proprietary technologies that can enhance operational efficiency or unlock new market opportunities.

- Front-End Engineering Design (FEED): Costs associated with detailed design and planning before final investment decisions are made.

- Feasibility Assessments: Expenses for evaluating the technical and economic viability of new projects and technologies.

- Research and Development (R&D): Investments in innovation for new technologies, including those for the energy transition.

- Technology Integration: Costs related to adapting and integrating novel technologies into existing or new offshore assets.

BW Offshore's cost structure is dominated by its capital-intensive nature, with significant upfront investments in Floating Production, Storage, and Offloading (FPSO) units and vessel acquisitions forming the largest expense categories. Ongoing operations and maintenance (O&M), including personnel, fuel, and spares, represent a substantial recurring cost. Financing costs, driven by debt used for asset acquisition, are also a critical component, with active debt management in 2024 to secure favorable terms.

Project development and R&D expenses, encompassing FEED studies and technological innovation, are crucial for future growth and competitiveness. These investments are essential for securing new contracts and adapting to the evolving energy landscape. For example, in 2023, BW Offshore reported significant expenditures in these areas to support its strategic development pipeline.

Revenue Streams

BW Offshore's core revenue originates from long-term lease and charter agreements for its Floating Production, Storage, and Offloading (FPSO) units. Oil and gas companies pay BW Offshore for the use of these critical offshore production facilities, with contracts often extending over many years.

These FPSO charter rates are typically structured with a combination of fixed daily or monthly fees and variable components tied to production levels or market indices. For instance, BW Offshore’s FPSO contract for the Kudu field offshore Namibia, which commenced in 2024, features a charter rate designed to cover operational costs and provide a return on investment over the project's lifespan.

The company's revenue is directly influenced by the duration and daily rates agreed upon in these contracts. As of early 2024, BW Offshore was operating a fleet of FPSOs with contract values often reaching hundreds of millions of dollars, underscoring the significant revenue potential of each long-term deployment.

Beyond the core lease agreements for its floating production, storage, and offloading (FPSO) units, BW Offshore generates significant income through operational and maintenance (O&M) service fees. These fees are crucial as they cover the day-to-day running of the complex FPSO assets, ensuring their efficient and safe operation.

These O&M contracts are typically structured as reimbursable arrangements, meaning BW Offshore recovers the actual costs incurred in operating and maintaining the vessels. This includes expenses like crew salaries, spare parts, routine inspections, and specialized technical services. For instance, in 2023, BW Offshore reported that its service revenues, which encompass these O&M activities, contributed substantially to its overall financial performance, reflecting the essential nature of these services to its clients.

BW Offshore's revenue from newbuild or major conversion projects is primarily generated through milestone payments. This means the company earns revenue as specific stages of a project are completed, covering design, construction, and final commissioning. This approach aligns revenue recognition with the tangible progress made on complex offshore projects.

For instance, in the Barossa project, BW Offshore recognized revenue upon achieving full practical completion. This signifies a key point where the project's primary objectives are met, triggering the final revenue recognition for that phase of work.

Asset Sales and Disposals

BW Offshore can generate revenue through the strategic divestment of assets. This includes selling off older or less critical floating production, storage, and offloading (FPSO) units. Such sales help the company streamline its fleet and free up capital. For instance, in 2023, BW Offshore completed the sale of the BW Pioneer FPSO, contributing to its financial flexibility.

This revenue stream is crucial for portfolio optimization and generating liquidity. By selling non-core assets, BW Offshore can invest in newer, more efficient technologies or fund new projects. This strategic approach ensures the company remains competitive and adaptable in the evolving offshore energy market.

- Asset Sales: Revenue from selling older or non-core FPSO units.

- Portfolio Optimization: Streamlining the fleet by divesting underutilized assets.

- Liquidity Generation: Accessing capital for new investments or operational needs.

- Example: Sale of BW Pioneer FPSO in 2023 provided financial benefits.

Revenue from Energy Transition Projects

BW Offshore is actively developing new revenue streams by venturing into the renewable energy sector and other low-carbon solutions. This strategic shift is expected to generate income from a variety of offshore wind projects, carbon capture initiatives, and other clean energy endeavors. This diversification is crucial for bolstering future earnings growth.

The company's involvement in projects like the floating offshore wind development in Japan, which aims to provide clean energy to the grid, exemplifies this new revenue focus. Further expansion into areas like carbon capture and storage (CCS) presents additional opportunities for income generation as the global demand for decarbonization solutions increases. For instance, BW Offshore's participation in the Northern Lights CCS project in Norway, a significant undertaking in carbon capture, highlights their commitment and potential for revenue from these advanced solutions.

- Offshore Wind Projects: Revenue generation from the development, construction, and operation of floating offshore wind farms.

- Carbon Capture and Storage (CCS): Income derived from providing infrastructure and services for CCS projects, such as the Northern Lights project.

- Low-Carbon Solutions: Broadly encompassing revenue from other emerging clean energy technologies and services that reduce carbon emissions.

- Diversification Benefits: Enhanced financial stability and growth prospects through a broader and more sustainable revenue base.

BW Offshore's revenue streams are multifaceted, primarily driven by its core FPSO leasing business, operational services, and strategic asset sales, with a growing focus on renewables. The company secures long-term contracts for its FPSO units, providing a stable income base.

Operational and maintenance fees form a significant part of their income, covering the essential running of their complex assets. In 2023, service revenues were a substantial contributor to their financial performance, highlighting the ongoing need for O&M expertise.

BW Offshore also generates revenue through milestone payments for newbuild or major conversion projects, aligning income with project completion. Strategic divestments of older assets, such as the sale of the BW Pioneer FPSO in 2023, contribute to liquidity and portfolio optimization.

Looking ahead, the company is actively cultivating new revenue streams in the renewable energy sector, including offshore wind and carbon capture initiatives, as demonstrated by their involvement in projects like the Northern Lights CCS project in Norway.

| Revenue Stream | Description | Key Activity | 2023/2024 Relevance |

|---|---|---|---|

| FPSO Leasing | Long-term charter agreements for production units. | Contracting FPSO services to oil and gas producers. | Core revenue driver, with contracts often exceeding hundreds of millions of dollars. |

| Operational & Maintenance (O&M) Services | Fees for running and maintaining FPSO units. | Providing day-to-day operational support and technical services. | Substantial contribution to overall financial performance in 2023. |

| Newbuild/Conversion Projects | Revenue from milestone payments during construction and commissioning. | Executing complex offshore engineering and construction projects. | Revenue recognition tied to project progress, as seen in the Barossa project. |

| Asset Sales | Income from divesting older or non-core FPSO units. | Fleet optimization and capital generation. | Example: BW Pioneer FPSO sale in 2023 enhanced financial flexibility. |

| Renewables & Low-Carbon Solutions | Income from offshore wind, CCS, and other clean energy projects. | Developing and operating clean energy infrastructure. | Emerging focus area with potential for future earnings growth, exemplified by Japanese offshore wind and Northern Lights CCS. |

Business Model Canvas Data Sources

The BW Offshore Business Model Canvas is built using a combination of internal financial data, operational performance metrics, and external market intelligence. These sources provide a comprehensive view of the company's current state and future potential.