BW Offshore Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BW Offshore Bundle

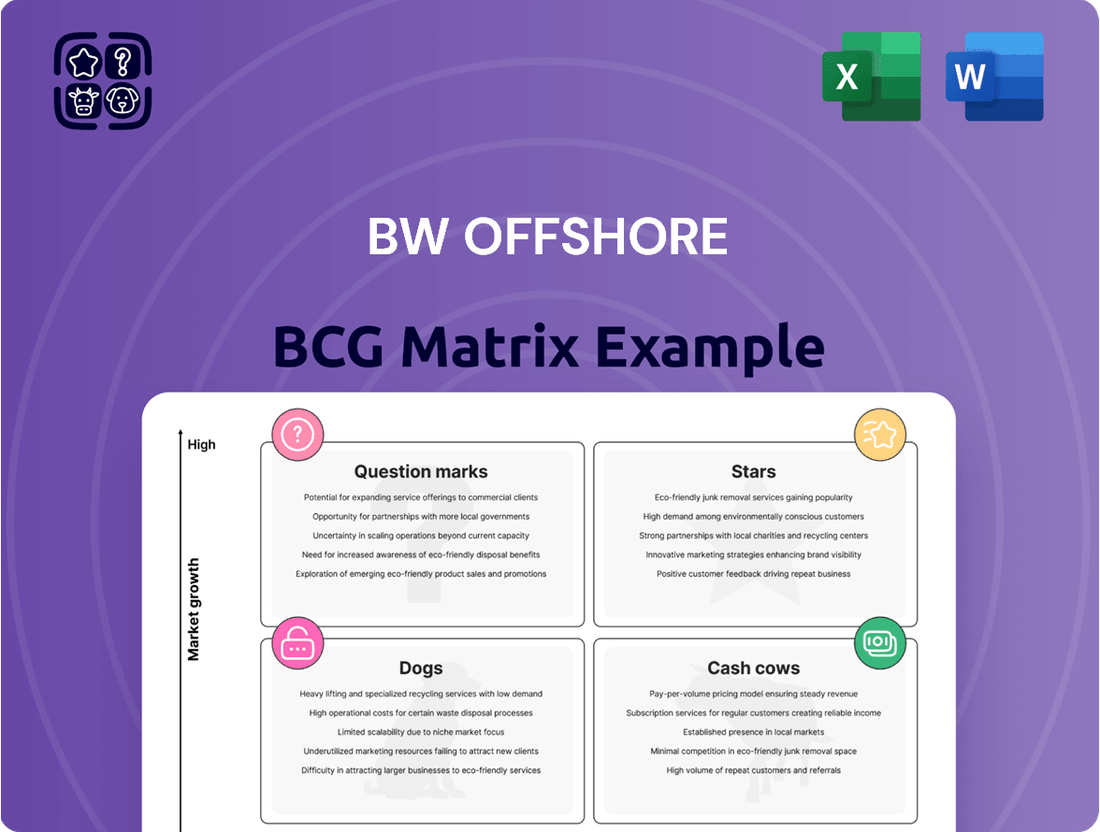

BW Offshore's BCG Matrix offers a powerful framework for understanding their diverse portfolio of floating production, storage, and offloading (FPSO) units and related services. This strategic tool categorizes their offerings into Stars, Cash Cows, Dogs, and Question Marks, providing a visual representation of market share and growth potential. By understanding these placements, investors and strategists can identify areas of strength and potential future investment.

This preview highlights the core value of the BW Offshore BCG Matrix, but the true power lies in the detailed analysis and actionable insights within the full report. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for BW Offshore.

Stars

BW Offshore's strategic focus on newbuild Floating Production Storage and Offloading (FPSO) units, such as the BW Opal destined for the Barossa field, firmly establishes them as a frontrunner in an expanding global market. This commitment to large-scale, long-term projects is a key driver of future revenue and robust cash flow generation, underscoring BW Offshore's high growth trajectory and market dominance.

The BW Opal, a testament to BW Offshore's newbuild capabilities, is projected to commence operations and deliver its first gas in mid-2025. This milestone signifies the commencement of substantial earnings and cash flow contribution from this significant project, further solidifying BW Offshore's strong market position.

The FPSO market is buzzing with activity, with numerous tenders and Front-End Engineering Design (FEED) studies underway. This surge in project initiation signals a strong and sustained demand for floating production storage and offloading units. BW Offshore is strategically positioned to capitalize on this, actively participating in these tenders to bolster its growth pipeline.

BW Offshore's proactive engagement in the current high tendering environment is a key element of its strategy. The company is focused on securing new contracts that align with its high-growth objectives and enhance its market standing. This robust demand is a positive indicator for leading companies in the FPSO sector, pointing towards continued expansion opportunities.

BW Offshore's strategic acquisitions of FPSOs, such as the Nganhurra, highlight a proactive approach to a tightening market. This move capitalizes on the scarcity of available high-quality units, allowing the company to swiftly secure new project opportunities and bolster its standing in the expanding FPSO sector.

By repurposing these assets, BW Offshore offers clients flexible and cost-efficient solutions, a critical advantage in a competitive landscape. For instance, in 2024, the FPSO market saw continued strong demand, with several key projects moving forward, underscoring the strategic value of readily available, adaptable FPSO units.

Deepwater and Complex FPSO Solutions

BW Offshore excels in providing sophisticated FPSO solutions tailored for deepwater and challenging operational conditions, aligning perfectly with the growing demand in this niche market. Their advanced technological capabilities and experience in harsh environments give them a distinct advantage as offshore exploration pushes into more demanding territories.

The company is strategically targeting two new FPSO projects within the next three years, underscoring their commitment to expanding their presence in these high-potential segments. This focus on complex projects reflects a deliberate strategy to leverage their expertise where few competitors can operate effectively.

- Market Position: BW Offshore is a key player in the deepwater and complex FPSO market, a segment experiencing robust growth.

- Growth Strategy: The company plans to secure two new FPSO projects in the coming three years, signaling aggressive expansion.

- Competitive Advantage: BW Offshore's proven ability to deliver high-capacity FPSOs for harsh environments sets them apart from rivals.

- Industry Trend Alignment: Their focus aligns with the industry's shift towards deeper, more technically demanding offshore exploration.

Strong Backlog and Future Revenue Visibility

BW Offshore's substantial firm contract backlog, standing at USD 5.4 billion as of Q1 2025, offers remarkable revenue visibility. This financial strength is crucial for funding new projects and solidifying its position as a leader in the Floating Production Storage and Offloading (FPSO) market. The backlog ensures a consistent flow of high-value projects, contributing directly to predictable cash flows for the company.

- USD 5.4 billion firm contract backlog as of Q1 2025

- Provides strong revenue visibility and supports future growth

- Enables financing of new projects and market leadership maintenance

- Ensures a steady pipeline of high-value FPSO work

BW Offshore's newbuild FPSO projects, like the BW Opal for the Barossa field, position them as leaders in a growing market. Their focus on large, long-term projects ensures future revenue and strong cash flow, highlighting a high growth trajectory and market dominance. The company's strategic acquisitions and repurposing of FPSOs demonstrate adaptability and capitalize on market demand.

| Project | Status | Expected Contribution |

|---|---|---|

| BW Opal (Barossa) | Under Construction, operational mid-2025 | Significant earnings and cash flow from mid-2025 |

| Nganhurra Acquisition | Secured for new projects | Swiftly secures new project opportunities |

What is included in the product

The BW Offshore BCG Matrix offers tailored analysis of the company's product portfolio, highlighting which units to invest in, hold, or divest.

A clear BW Offshore BCG Matrix overview visually clarifies business unit positioning, easing strategic decision-making.

Cash Cows

BW Offshore's existing FPSO fleet operates as a prime example of a cash cow. In 2024, these vessels achieved an impressive commercial uptime exceeding 99%, a testament to their reliability and operational efficiency. This consistent performance translates directly into stable and robust cash flows for the company.

Mature assets like the BW Adolo and BW Catcher are central to this cash cow status. They demand significantly less reinvestment compared to the development of new projects, allowing for a predictable and substantial stream of income. This operational efficiency is the bedrock of their strong financial contribution.

BW Offshore's consistent dividend payments underscore its status as a cash cow. The company returned USD 59 million in total cash dividends in 2024, a significant 22% increase from the prior year. This commitment reflects the robust cash-generating ability of its established offshore production operations, which reliably produce excess cash that can be distributed to shareholders.

BW Offshore's existing fleet primarily operates under long-term lease and operate contracts. This structure is a significant strength, generating stable and predictable revenue over many years. For example, the Barossa project has a 15-year contract, illustrating the long-term nature of these agreements.

These consistent cash inflows are crucial. They provide the financial foundation to manage administrative expenses, invest in research and development for future growth, and strategically allocate capital to other business segments or new opportunities. This stability is a hallmark of their cash cow strategy.

Robust Balance Sheet and Liquidity

BW Offshore's balance sheet is a significant strength, characterized by robust liquidity that supports its strategic objectives. This financial resilience stems directly from the consistent and reliable cash flow generated by its fleet of Floating Production, Storage, and Offloading (FPSO) units. This stable income stream empowers the company to effectively manage its debt obligations, cover operational expenses, and importantly, retain the agility to explore and capitalize on new growth avenues in the offshore energy sector.

The company's financial health is further evidenced by its net cash position. As of March 31, 2025, BW Offshore reported being net cash positive by USD 184.3 million. This positive liquidity buffer is crucial, offering a cushion against market volatility and providing the necessary resources to invest in fleet upgrades, new projects, and potential acquisitions, thereby solidifying its position as a cash cow.

- Robust Liquidity: BW Offshore benefits from strong available liquidity, a direct result of its stable cash generation.

- Financial Flexibility: This strength allows for effective debt management, operational funding, and pursuit of growth opportunities.

- Net Cash Positive: As of March 31, 2025, the company held a net cash position of USD 184.3 million.

- Strategic Advantage: The healthy balance sheet provides the capacity for investment in fleet modernization and new ventures.

Optimized Asset Management

BW Offshore's approach to Optimized Asset Management positions its mature Floating Production Storage and Offloading (FPSO) units as Cash Cows within the BCG Matrix. The company prioritizes extracting maximum value from its existing fleet through stringent operational efficiency and rigorous cost management. This strategy ensures these mature assets remain highly profitable.

This focus on 'milking' these FPSOs means BW Offshore is adept at maximizing gains from these established units, which is a significant contributor to the company's overall financial performance. For example, as of the first half of 2024, BW Offshore reported strong operational uptime across its fleet, a testament to their efficient management.

- High Operational Efficiency: Maintaining superior uptime on FPSO units directly translates to increased revenue generation from existing contracts.

- Disciplined Cost Controls: Implementing strict cost management across operations and maintenance minimizes expenses, thereby boosting net profitability.

- Maximizing Mature Asset Value: BW Offshore's strategy aims to extend the economic life and profitability of its established FPSO fleet.

- Refined Execution Methods: Continuous improvement in project execution and operational processes further enhances the cash-generating capabilities of these assets.

BW Offshore's mature FPSO fleet functions as its primary cash cow, generating consistent and substantial profits. These assets, characterized by high operational uptime, require minimal capital expenditure for maintenance and upkeep relative to their revenue generation. This allows BW Offshore to efficiently extract value and distribute profits.

The company's commitment to maximizing returns from these established units is evident in its financial performance. For instance, during the first half of 2024, BW Offshore achieved an impressive fleet-wide commercial uptime exceeding 99%, a clear indicator of their operational reliability and cost-effectiveness.

This stable cash flow is vital for funding company operations and strategic investments. In 2024, BW Offshore distributed USD 59 million in dividends, a 22% increase from the previous year, directly reflecting the robust cash-generating capacity of its mature FPSO assets.

| Metric | 2024 Performance | Significance |

| Fleet Commercial Uptime | > 99% | Maximizes revenue generation from existing contracts. |

| Total Cash Dividends Paid (2024) | USD 59 million | Demonstrates robust cash generation and shareholder returns. |

| Dividend Increase (YoY) | 22% | Highlights growing profitability from mature assets. |

Full Transparency, Always

BW Offshore BCG Matrix

The BW Offshore BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks or demo content will be present in the final file, ensuring you get a professional and ready-to-use strategic analysis for BW Offshore's business units.

Dogs

Divested FPSO assets like the BW Pioneer, sold in March 2025, and the FPSO Polvo and BW Athena, both divested in 2023, represent the Dogs category in BW Offshore's BCG Matrix. These were older, non-strategic units, no longer fitting the company's long-term vision. Their sale, totaling $250 million in cash proceeds for BW Offshore, aimed to free up capital and cut operational expenses associated with units nearing their economic lifespan or facing limited future prospects.

BW Offshore's sale of its remaining shares in BW Energy in January 2024 for roughly USD 176 million clearly marks the divestment of a non-strategic asset. This action was taken to simplify their portfolio and redirect capital towards their primary FPSO operations and their energy transition projects.

This particular shareholding was not viewed as a long-term strategic commitment for BW Offshore. The divestment generated significant cash, strengthening their financial position for future growth and strategic investments in their core business areas.

Idle or laid-up vessels, like the FPSO Nganhurra acquired strategically, can become a financial drain if they lack a clear redeployment plan. These assets tie up capital and incur holding costs without generating revenue. For instance, if such a vessel remains idle for an extended period, the carrying costs could significantly impact profitability. BW Offshore needs to actively seek new contracts to avoid these assets becoming a cash drain, especially in a volatile market.

Legacy Assets with Limited Future Prospects

Certain older Floating Production, Storage, and Offloading (FPSO) units in BW Offshore's fleet might be classified as Dogs. These assets often have shorter remaining contract durations or incur higher operational expenditures compared to newer, more efficient vessels in the current market. For example, older FPSOs may struggle to compete for new contracts due to their technological age and associated maintenance costs.

These units could generate limited net cash flow. BW Offshore's strategy involves maximizing value from its existing FPSO portfolio. This includes actively seeking profitable redeployment options for these older assets. If such opportunities are scarce, divestment or recycling of these units becomes a more likely scenario to optimize the fleet's overall performance and capital allocation.

- Limited Contract Life: Older FPSOs often have fewer years of service remaining on existing contracts, reducing their long-term revenue potential.

- Higher Operational Costs: Increased maintenance and fuel consumption can make these assets less cost-competitive against modern vessels.

- Potential for Divestment: BW Offshore may consider selling these units if they no longer align with strategic growth or profitability objectives.

- Recycling as an Option: If redeployment or sale isn't feasible, environmentally responsible recycling of the FPSO's components can be pursued.

Underperforming Ventures

Underperforming Ventures, often referred to as Dogs in the BW Offshore BCG Matrix, represent business units or projects that are not generating sufficient returns. These ventures typically struggle with both low market share and operate within industries experiencing minimal or negative growth. For example, BW Offshore might identify specific older floating production storage and offloading (FPSO) units or exploration projects that consistently underperform against profitability benchmarks.

BW Offshore's strategy for these ventures focuses on either divesting them to free up capital or attempting a turnaround through significant restructuring. The company’s commitment to cost control is paramount in managing these underperforming assets. In 2024, BW Offshore continued its efforts to optimize its fleet and operational costs, a move that would directly impact how underperforming ventures are managed.

- Low Market Share: Ventures in this quadrant struggle to capture a significant portion of their respective markets.

- Stagnating or Declining Markets: These ventures operate in segments with little to no future growth potential.

- Divestiture or Restructuring: The primary strategic options are to sell off these units or fundamentally change their operations.

- Capital Drain: They consume resources without providing adequate returns, impacting overall company performance.

BW Offshore's Dogs category includes older, less strategic FPSO units and divested stakes like BW Energy. These assets often have limited contract lives or higher operational costs, making them less competitive. The company's strategy involves seeking redeployment, divestment, or recycling to optimize its fleet and capital allocation.

BW Offshore's sale of its BW Energy stake in January 2024 for approximately USD 176 million exemplifies a Dog divestment, freeing capital for core FPSO operations and energy transition projects.

Older FPSOs like the FPSO Nganhurra, if idle without a clear redeployment plan, can become a financial drain due to carrying costs and lack of revenue generation, impacting profitability.

The sale of FPSO assets such as BW Pioneer (March 2025) and FPSO Polvo and BW Athena (2023) for a combined $250 million cash proceeds, represents a strategic move to offload non-core, aging units with limited future prospects.

| Asset Category | Examples/Status | Strategic Rationale | Financial Impact |

| Dogs (Divested) | BW Pioneer (Sold March 2025), FPSO Polvo & BW Athena (Divested 2023), BW Energy Stake (Sold Jan 2024) | Offloading non-strategic, aging units; simplifying portfolio; redirecting capital | $250M cash (Pioneer, Polvo, Athena); ~$176M cash (BW Energy) |

| Dogs (Idle/Underperforming) | FPSO Nganhurra (Potential idle status), Older FPSOs with limited remaining contracts | Minimize capital tied up; avoid carrying costs; seek redeployment or restructuring | Potential financial drain if idle; impact on profitability; optimize fleet performance |

Question Marks

BW Offshore’s 64% stake in BW Ideol positions it within the burgeoning floating offshore wind sector. This segment, while holding immense long-term promise, is still in its early stages of development. The global offshore wind market is anticipated to expand at a compound annual growth rate of 14.6% between 2025 and 2034, highlighting the significant growth trajectory BW Ideol is operating within.

Despite its leadership in floating wind technology, BW Ideol's current market share is relatively small due to the industry’s infancy. Consequently, significant capital investment is necessary to scale operations and reach full commercial viability, placing this venture in a position that demands substantial resources for future growth.

BW Offshore is exploring innovative floating carbon capture and storage (CCS) concepts, positioning itself within the burgeoning energy transition market. This sector is experiencing significant growth, fueled by global decarbonization mandates and increasing pressure to reduce industrial emissions.

While CCS holds substantial growth potential, BW Offshore's involvement is currently in its nascent phase. The company's strategic focus on developing these floating solutions indicates an early-stage commitment to this critical climate technology, requiring substantial investment in research and development.

Gaining substantial market share in the CCS domain will necessitate strategic alliances and continued technological advancement. BW Offshore is actively seeking partnerships to bolster its capabilities and accelerate its progress in this competitive and rapidly evolving landscape.

BW Offshore is actively investigating other low-carbon energy frontiers, including gas-to-power ventures and floating ammonia production. These are dynamic sectors with significant growth potential, though BW Offshore's current engagement is primarily exploratory.

The company is taking a deliberate approach to these emerging markets, prioritizing commercial readiness before committing substantial resources. For instance, the global ammonia market is projected to reach USD 111.2 billion by 2030, indicating the scale of opportunity.

New Technology Investments

Investments in new technologies, such as integrated carbon capture modules for Floating Production Storage and Offloading (FPSO) units, are crucial for BW Offshore's future in the evolving energy landscape. These ventures are positioned as high-growth potential assets, aligning with the company's ambition to lead in a net-zero energy industry by 2050. However, they currently reside in early development or pilot stages, demanding substantial capital commitment and strategic oversight to foster commercial viability and market leadership.

BW Offshore's strategic focus on these nascent technologies reflects a calculated risk for substantial future returns. For instance, the company has indicated significant investment in its newbuild FPSO projects, which often incorporate provisions for future technological integration. While specific figures for carbon capture module development are proprietary, the broader offshore energy sector saw approximately $75 billion invested in clean energy technologies globally in 2023, underscoring the market's growing commitment to decarbonization solutions.

- High Growth Potential: New technologies like integrated carbon capture offer substantial future revenue streams as the world transitions to net-zero.

- Early Stage Development: These investments are in pilot or early phases, requiring continued R&D and capital infusion before full commercialization.

- Strategic Importance: BW Offshore aims to be a frontrunner in the net-zero energy sector by embracing and developing these advanced solutions.

- Capital Expenditure: Significant upfront investment is necessary, positioning these as question marks on the BCG matrix, needing careful management.

Early-Stage Diversification Ventures

BW Offshore's early-stage diversification ventures, often targeting high-growth renewable and sustainable energy sectors, are positioned as Question Marks within the BCG Matrix. These initiatives, while benefiting from the company's extensive offshore engineering and project management expertise honed in the FPSO market, are nascent in their respective new markets. For instance, BW Offshore's growing involvement in floating solar projects, a sector projected for significant expansion, represents such a venture. The global floating solar market was estimated to be worth around USD 1.4 billion in 2023 and is expected to grow substantially in the coming years, presenting a high market growth opportunity for BW Offshore.

The strategic challenge for these ventures lies in their current low market share, despite the high growth potential of the industries they are entering. BW Offshore must carefully allocate resources to nurture these new ventures. Decisions will involve committing capital to build market share and develop competitive advantages, aiming to transform them into Stars. Alternatively, if these ventures fail to gain traction or show promising growth, the company may need to consider divestment to avoid further resource drain.

- High Market Growth Potential: Ventures in sectors like offshore wind floating solutions or green hydrogen production leverage BW Offshore's existing capabilities in challenging offshore environments.

- Low Initial Market Share: Despite potential, these diversification efforts are new entrants in their respective markets, requiring significant investment to establish a strong presence.

- Strategic Investment Required: BW Offshore faces the critical decision of investing heavily to build market share and competitive strength, or divesting if the ventures do not demonstrate a clear path to success.

- Leveraging Core Competencies: The company is applying its deep understanding of offshore operations, project execution, and asset management to these new and evolving energy markets.

BW Offshore's ventures in emerging energy sectors like floating offshore wind through BW Ideol and carbon capture technology represent Question Marks. These areas offer substantial long-term growth potential, as evidenced by the offshore wind market's projected 14.6% CAGR from 2025 to 2034.

However, these initiatives currently have low market share and require significant capital investment to scale and achieve commercial viability. BW Offshore must strategically decide whether to invest further to develop them into Stars or consider divestment if they do not gain traction.

The company's exploration into gas-to-power and ammonia production also falls into this category, with the global ammonia market poised for growth, reaching an estimated USD 111.2 billion by 2030.

| Venture Area | Market Growth Potential | Current Market Share | Strategic Consideration |

|---|---|---|---|

| Floating Offshore Wind (BW Ideol) | High (14.6% CAGR 2025-2034) | Low (Early stage industry) | Invest to build share or divest |

| Floating Carbon Capture | High (Driven by decarbonization) | Low (Nascent phase) | Significant R&D and capital needed |

| Gas-to-Power / Ammonia Production | High (Ammonia market USD 111.2B by 2030) | Low (Exploratory) | Prioritize commercial readiness |

BCG Matrix Data Sources

Our BW Offshore BCG Matrix leverages comprehensive data from company filings, industry growth forecasts, and operational performance metrics to accurately position its business units.