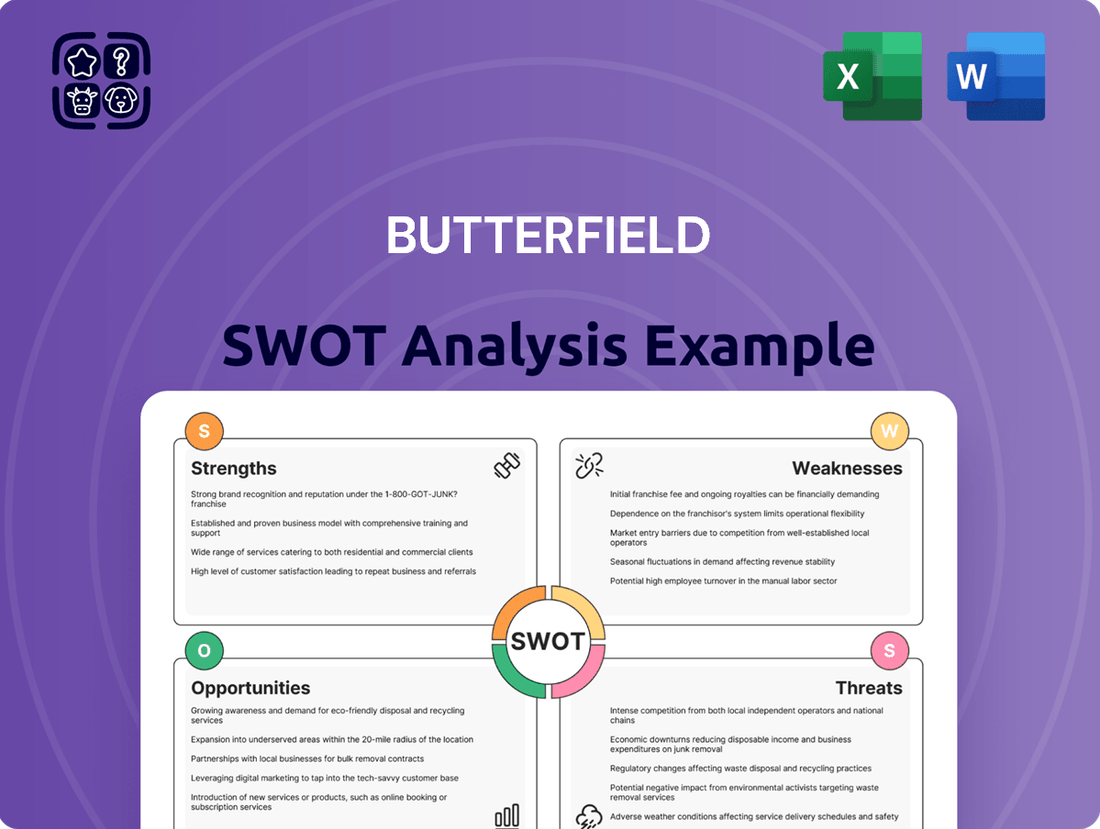

Butterfield SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Butterfield Bundle

Butterfield's current SWOT analysis reveals a company with strong brand recognition and a loyal customer base, but also highlights potential vulnerabilities in its supply chain and increasing competition. Understanding these dynamics is crucial for anyone looking to invest or strategize within this sector.

Want the full story behind Butterfield’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Butterfield boasts a comprehensive service offering, encompassing retail and corporate banking, treasury services, and advanced wealth management. This full-service approach allows them to cater to a broad spectrum of client needs, from everyday banking to complex investment strategies. In 2023, Butterfield reported total client deposits of $14.7 billion, demonstrating significant client trust and engagement across their diverse financial solutions.

Butterfield's strategic international presence, with its headquarters in Bermuda, is a significant strength. The company operates across multiple international financial centers, which diversifies its revenue streams and allows it to serve a global clientele effectively. This global footprint is crucial for its offshore banking and wealth management services, capitalizing on favorable regulatory and tax environments in key jurisdictions.

Butterfield's diverse client base is a significant strength, encompassing individuals, small businesses, large institutions, and high-net-worth clients. This broad reach, evidenced by their operations across multiple jurisdictions, mitigates risk by not over-relying on any single segment. For instance, in the first quarter of 2024, Butterfield reported a solid performance across its various business lines, demonstrating the resilience derived from this diversified customer portfolio.

Integrated Financial Solutions

Butterfield's strength lies in its integrated financial solutions, allowing clients to access a full spectrum of services, from everyday banking to sophisticated wealth management, seamlessly across its network. This unified offering significantly boosts client convenience and fosters loyalty by simplifying their financial lives. As of the first quarter of 2024, Butterfield reported a 9.5% increase in wealth management assets under administration, underscoring the success of its integrated approach.

This comprehensive service model streamlines financial management for a diverse clientele, enhancing their experience and deepening their relationship with the bank. The ability to bundle services not only improves customer retention but also creates cross-selling opportunities, driving revenue growth. For instance, in 2023, Butterfield saw a 7% uplift in the average product holding per customer for those utilizing integrated solutions.

- Seamless Service Access: Clients can manage banking, lending, and wealth management needs through a single, connected platform.

- Enhanced Client Loyalty: The convenience of integrated solutions fosters stronger client relationships and reduces churn.

- Cross-Selling Opportunities: Integrated offerings naturally lead to increased product adoption and deeper client engagement.

- Streamlined Financial Management: Simplifies complex financial needs for individuals and businesses alike.

Expertise in Niche Markets

Butterfield's strategic presence in key international financial centers, such as Bermuda, the Cayman Islands, and Guernsey, has fostered deep expertise in serving the intricate requirements of high-net-worth individuals and corporations in these sophisticated markets. This specialization is particularly evident in their robust trust and fiduciary services, which cater to complex wealth management needs. For instance, Butterfield reported total client deposits of $14.1 billion as of March 31, 2024, reflecting significant client trust in their specialized offerings.

This niche market focus allows Butterfield to develop highly tailored financial solutions, creating a distinct competitive advantage. Their ability to navigate the specific regulatory landscapes and client expectations within these jurisdictions translates into a strong value proposition. In 2023, Butterfield's net interest income reached $652.3 million, demonstrating the profitability derived from their specialized banking operations.

Key strengths stemming from this expertise include:

- Deep understanding of offshore financial regulations and client needs.

- Specialized product development for wealth management and fiduciary services.

- Strong client relationships built on specialized knowledge and tailored solutions.

- Ability to attract and retain high-value clients in competitive international markets.

Butterfield's comprehensive service model, integrating retail and corporate banking with wealth management, allows it to meet a wide array of client needs. This holistic approach fosters client loyalty and creates cross-selling opportunities, as seen in their 7% uplift in average product holding per customer in 2023 for those using integrated solutions. Their first quarter 2024 results showed a 9.5% increase in wealth management assets under administration, highlighting the success of this strategy.

Butterfield's strategic positioning in key international financial centers, such as Bermuda and the Cayman Islands, grants them specialized expertise in catering to high-net-worth individuals and corporations. This focus on niche markets, particularly in trust and fiduciary services, allows for tailored solutions and strong client relationships. Their net interest income in 2023 was $652.3 million, reflecting the profitability of these specialized operations.

| Key Strengths | Description | Supporting Data (as of Q1 2024 or FY 2023) |

| Comprehensive Service Offering | Full-service banking and wealth management capabilities. | Total client deposits: $14.1 billion (Q1 2024). Wealth management AUA: +9.5% (Q1 2024). |

| International Presence | Operations in key financial centers diversify revenue and client base. | Headquartered in Bermuda, with operations in multiple global jurisdictions. |

| Diverse Client Base | Serves individuals, businesses, and institutions, mitigating single-segment risk. | Resilient performance across business lines in Q1 2024. |

| Integrated Financial Solutions | Seamless access to banking and wealth management services. | 7% uplift in average product holding per customer (2023) for integrated users. |

| Niche Market Expertise | Deep understanding of offshore regulations and high-net-worth client needs. | Net interest income: $652.3 million (2023). Strong trust and fiduciary services. |

What is included in the product

Delivers a strategic overview of Butterfield’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, transforming potential threats into opportunities.

Weaknesses

Butterfield operates in numerous international financial centers, each with its own intricate and constantly changing regulations. This includes strict rules around anti-money laundering (AML), sanctions, and data privacy. For instance, in 2024, the Financial Action Task Force (FATF) continued to emphasize enhanced due diligence in high-risk jurisdictions, directly impacting institutions like Butterfield.

Managing these varied regulatory environments demands substantial resources. Significant investments are required for compliance systems, specialized staff, and advanced technology. These costs add to operational expenses and create a persistent risk of failing to meet compliance obligations, which can lead to penalties and reputational damage.

Butterfield's reliance on specific geographic markets, particularly Bermuda and the Channel Islands, presents a notable weakness. While these regions are core to its operations, a significant concentration of its client base and revenue streams in these areas can amplify the impact of localized economic downturns or regulatory shifts.

For instance, as of the first quarter of 2024, the Channel Islands and Bermuda together represented a substantial portion of Butterfield's total assets under management and customer deposits. This geographic concentration means that adverse economic conditions or new regulations specifically targeting these jurisdictions could disproportionately affect Butterfield's overall financial health and profitability.

Butterfield encounters intense rivalry from larger global financial institutions. These behemoths possess significantly more capital, expansive distribution channels, and advanced technological capabilities. This allows them to frequently offer more attractive pricing and a wider array of specialized services, potentially impacting Butterfield's market position.

Cybersecurity and Data Security Risks

As a financial institution, Butterfield faces significant cybersecurity and data security risks. Handling sensitive client information and substantial financial transactions makes it a prime target for cyberattacks. A breach could result in considerable financial losses and severe damage to its reputation, undermining client confidence.

Continuous, substantial investment in sophisticated cybersecurity defenses is therefore essential for Butterfield to mitigate these threats. For instance, the global average cost of a data breach reached $4.35 million in 2022, a figure that underscores the financial implications for any institution.

- Increased threat landscape: The evolving nature of cyber threats demands constant adaptation and investment in new security protocols.

- Regulatory compliance: Adhering to stringent data protection regulations, such as GDPR and similar frameworks, requires robust security infrastructure.

- Client trust: Maintaining client trust is paramount, and any security lapse can lead to significant customer attrition.

- Operational disruption: A successful cyberattack can halt operations, leading to direct financial losses and long-term recovery costs.

Potential for Legacy Technology Infrastructure

Butterfield's long history means it might be operating with older IT systems. These legacy technologies can make it harder to adapt quickly to new digital trends and can be more expensive to maintain. For instance, in 2023, many established financial institutions reported significant IT spending on modernization projects, with some allocating over 15% of their operating expenses to technology upgrades to address these very challenges.

This reliance on older infrastructure could slow down the rollout of innovative digital banking services, potentially putting Butterfield at a disadvantage compared to more agile competitors. The cost and complexity of updating these systems are considerable, often requiring substantial capital investment and careful planning to avoid disrupting daily operations and customer interactions.

- Legacy IT systems can impede agility and increase operational costs.

- Modernization requires significant capital expenditure and can be time-consuming.

- Potential impact on the speed of adopting new digital services.

- Risk of a less seamless customer experience due to outdated technology.

Butterfield's significant geographic concentration, particularly in Bermuda and the Channel Islands, represents a key vulnerability. Adverse economic shifts or regulatory changes within these core markets could disproportionately impact its financial performance and stability. As of Q1 2024, these regions collectively accounted for a substantial portion of the bank's assets under management and customer deposits, highlighting this concentrated risk.

Preview Before You Purchase

Butterfield SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. You can trust that the preview accurately represents the quality and content you will receive. This ensures transparency and a seamless purchasing experience.

Opportunities

Butterfield can significantly boost efficiency and customer satisfaction by adopting cutting-edge digital tools like AI and advanced mobile banking. This digital push is crucial for staying competitive in today's market.

Integrating fintech can streamline operations, cutting down on costs and making banking smoother. For instance, many banks are seeing improved customer retention rates after investing in better digital platforms, with some reporting a 15% increase in mobile banking engagement in 2024.

Emerging wealth markets present a significant opportunity for Butterfield, driven by a global increase in high-net-worth individuals and institutional capital. For instance, Asia's wealth is projected to reach $100 trillion by 2025, according to various financial reports, highlighting substantial untapped potential. Butterfield can capitalize on this by developing specialized financial products and services catering to the unique needs of these growing economies, thereby diversifying its revenue base.

The global push towards Environmental, Social, and Governance (ESG) principles is creating a substantial appetite for investments that align with these values. This trend is a significant opportunity for Butterfield to expand its offerings in sustainable wealth management.

By developing and actively promoting a robust selection of ESG-compliant investment products, Butterfield can tap into a growing segment of socially conscious investors. This strategic move not only caters to current market demands but also positions the bank favorably within the broader global sustainability movement.

In 2024, global ESG assets under management were projected to reach $34 trillion, highlighting the sheer scale of this opportunity. Butterfield can leverage this by offering tailored ESG portfolios and advisory services, attracting a demographic increasingly prioritizing impact alongside financial returns.

Strategic Partnerships and Acquisitions

Butterfield can significantly boost its capabilities and market presence by forming strategic partnerships or acquiring smaller entities. For instance, collaborating with fintech innovators could grant Butterfield access to cutting-edge digital banking solutions, a crucial area given the increasing digital adoption. In 2024, the global fintech market was valued at over $2.4 trillion, highlighting the immense potential for growth through such integrations.

Acquiring specialized wealth management firms or regional banks presents another avenue for expansion. This strategy allows Butterfield to quickly enter new geographic markets or bolster its existing service portfolio. For example, a targeted acquisition in a growing Caribbean market could immediately expand its client base and revenue streams. In the first half of 2024, M&A activity in the financial services sector saw a notable uptick, with several deals focused on digital transformation and market consolidation.

- Fintech Integration: Partnering with fintechs can accelerate digital service development, tapping into a market exceeding $2.4 trillion in 2024.

- Geographic Expansion: Acquiring regional banks or wealth managers offers a swift route into new territories.

- Synergistic Benefits: Such moves can create a stronger competitive edge and broader market reach.

- Service Enhancement: Gaining access to new technologies and specialized expertise can significantly improve Butterfield's offerings.

Leveraging Data Analytics for Personalized Services

Butterfield can unlock significant opportunities by leveraging its extensive client data through advanced analytics. This allows for a granular understanding of individual client behaviors, preferences, and evolving financial needs. For instance, by analyzing transaction patterns and investment histories, Butterfield can anticipate future client requirements, such as retirement planning or wealth transfer, and proactively offer relevant solutions.

This data-driven approach enables the creation of highly personalized financial advice and bespoke product offerings. Imagine a scenario where a client shows a consistent interest in sustainable investments; analytics can identify this and automatically suggest ESG-focused funds or impact investing opportunities. This level of tailored service directly translates to enhanced customer loyalty and satisfaction, as clients feel understood and valued.

The bank's focus on digital transformation and data infrastructure, as highlighted in its 2024 investor reports, provides a strong foundation for these initiatives. By investing in AI and machine learning tools, Butterfield can automate personalized outreach and product recommendations. For example, a 2024 study indicated that financial institutions using personalized digital engagement saw a 15% increase in customer retention rates.

- Deeper Client Insights: Analyzing client data reveals patterns in spending, saving, and investment behavior.

- Personalized Product Development: Tailoring financial products, like specialized savings accounts or investment portfolios, to individual needs.

- Proactive Engagement Strategies: Using predictive analytics to anticipate client needs and offer solutions before they are explicitly requested.

- Enhanced Customer Loyalty: Demonstrating a deep understanding of clients leads to increased satisfaction and long-term relationships.

Butterfield can capitalize on the growing global demand for sustainable and responsible investing by expanding its ESG product offerings. The bank can also leverage its client data through advanced analytics to provide highly personalized financial advice and bespoke product development, fostering deeper client insights and enhancing customer loyalty.

| Opportunity Area | Description | 2024/2025 Data/Projections |

|---|---|---|

| ESG Investing | Expanding sustainable wealth management products. | Global ESG assets projected to reach $34 trillion in 2024. |

| Fintech Integration | Partnering with or acquiring fintech companies for digital solutions. | Global fintech market valued over $2.4 trillion in 2024. |

| Data Analytics | Utilizing client data for personalized services. | Personalized digital engagement can increase customer retention by 15% (2024 study). |

| Geographic Expansion | Acquiring regional banks or wealth managers. | M&A activity in financial services saw an uptick in H1 2024. |

Threats

Global economic downturns, such as the potential for a recession in major markets like the US or Europe, pose a significant threat. High inflation, which saw the US CPI reach 3.4% year-on-year in April 2024, can erode asset values and reduce client spending power. Significant market volatility, evidenced by the S&P 500 experiencing fluctuations throughout 2024, directly impacts Butterfield's investment portfolio performance and client confidence.

Butterfield faces a significant threat from increasing global regulatory scrutiny, particularly concerning tax transparency and anti-money laundering efforts. Ongoing international initiatives aimed at financial crime prevention and potential tax harmonization could diminish the appeal of offshore financial centers, impacting demand for Butterfield's specialized services.

Stricter regulations or shifts in international tax agreements pose a direct risk, potentially increasing compliance costs and reducing the overall attractiveness of jurisdictions where Butterfield operates. For instance, the OECD's Base Erosion and Profit Shifting (BEPS) initiative, which has seen significant progress through 2024, continues to push for greater tax transparency and may lead to changes in how financial institutions structure their operations and report income.

The financial services landscape is undergoing significant transformation, with fintech startups, major technology firms, and agile challenger banks entering the fray. These disruptors frequently utilize advanced technology to deliver niche services, often at more competitive price points or with enhanced digital interfaces. This trend directly challenges Butterfield's established market position and traditional operational frameworks.

Cybersecurity Breaches and Reputational Damage

The increasing complexity of cyber threats poses a persistent and serious danger to Butterfield. A significant breach could result in considerable financial repercussions, hefty regulatory fines, and a severe blow to the company's esteemed reputation and the trust of its clients, which are absolutely critical in the financial services sector.

For instance, the global financial sector experienced an average of 135 cyberattacks per organization in 2023, a notable increase from previous years, highlighting the pervasive nature of these threats. Butterfield, like its peers, faces the risk of substantial financial losses, potentially running into millions, alongside irreparable damage to client relationships and market standing if its defenses are compromised.

- Escalating Threat Landscape: Cybercriminals are continuously developing more sophisticated attack methods, making defense a constant challenge.

- Financial Impact: A major breach could incur direct costs from remediation, legal fees, and regulatory penalties, estimated to be in the tens of millions for financial institutions.

- Reputational Erosion: Loss of client trust following a security incident can lead to significant customer attrition and long-term damage to brand equity.

Attraction and Retention of Skilled Talent

Butterfield faces a significant threat in attracting and retaining skilled talent, particularly within the specialized fields of international banking and wealth management. The competitive environment in key financial centers exacerbates this challenge, making it difficult to secure top professionals.

The demand for expertise in critical areas like cybersecurity, artificial intelligence, and regulatory compliance is particularly high. For instance, the global cybersecurity market was projected to reach $300 billion in 2024, highlighting the intense competition for these specialized skills. Failure to secure these professionals could impede Butterfield's ability to innovate and maintain operational efficiency.

- Highly Specialized Skill Requirements: International banking and wealth management demand niche expertise, creating a smaller talent pool.

- Intense Competition in Financial Hubs: Major financial centers see fierce competition for experienced professionals.

- Shortage in Critical Tech and Compliance Roles: Difficulty in hiring experts in cybersecurity, AI, and compliance can slow progress.

- Impact on Innovation and Operations: A lack of skilled talent can directly hinder the adoption of new technologies and day-to-day effectiveness.

Intensified competition from agile fintech firms and established banks offering digital-first solutions presents a significant threat, potentially eroding Butterfield's market share. The increasing adoption of digital channels by consumers means that a lag in technological investment could alienate clients. For example, digital banking adoption continued to rise through 2024, with many customers preferring seamless online or mobile interactions for their financial needs.

Geopolitical instability and regional conflicts can disrupt global financial markets and impact client confidence. Events in 2024, such as ongoing trade tensions and regional conflicts, underscore the potential for unforeseen market shocks. These disruptions can lead to capital flight from affected regions and increased volatility, directly impacting Butterfield's asset management and banking operations.

Changes in client preferences and behavior, driven by evolving economic conditions and technological advancements, pose a threat. A growing demand for sustainable and ESG-focused investments, which saw considerable growth in 2024, requires adaptation. If Butterfield fails to align its offerings with these shifting client values, it risks losing business to more responsive competitors.

SWOT Analysis Data Sources

This Butterfield SWOT analysis is informed by a comprehensive review of financial reports, internal operational data, and customer feedback surveys to provide a well-rounded perspective.