Butterfield PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Butterfield Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting Butterfield. Our comprehensive PESTLE analysis provides actionable intelligence to help you anticipate market shifts and strategize effectively. Download the full report to gain a competitive advantage.

Political factors

Butterfield's reliance on financial hubs like Bermuda, the Cayman Islands, and the Channel Islands means its operations are directly tied to the political stability and regulatory consistency of these regions. For instance, Bermuda's robust regulatory environment, overseen by bodies like the Bermuda Monetary Authority, has historically provided a stable base for international banking. Any sudden policy changes or leadership instability in these key operating jurisdictions could create significant operational uncertainty for Butterfield, affecting its strategic outlook.

Global initiatives spearheaded by bodies like the OECD and FATF are significantly shaping Butterfield's operations, especially in wealth management and international banking, by targeting tax evasion and money laundering. These efforts demand constant updates to compliance and reporting systems to meet evolving international tax standards.

For instance, the OECD's Common Reporting Standard (CRS) has been in effect since 2017, requiring financial institutions to exchange taxpayer information automatically with tax authorities in other countries. This has increased the cost of compliance for offshore financial centers where Butterfield operates, potentially impacting the profitability of its services by as much as 5-10% due to increased administrative burdens and the need for sophisticated data management systems.

Geopolitical tensions, particularly in regions like Eastern Europe and the Middle East, continue to influence global financial markets. The imposition or threat of international sanctions can disrupt capital flows and affect Butterfield's clients, especially those with international dealings. For instance, the extensive sanctions targeting Russia following its 2022 invasion of Ukraine demonstrated how swiftly financial landscapes can change, impacting banks' ability to conduct transactions and manage assets for affected individuals and entities.

Government Support for Financial Services Sector

Government support significantly impacts Butterfield's operations. Bermuda, a key location, has historically fostered a favorable environment for financial services. For instance, Bermuda's government actively promotes the island as an international financial center, which directly benefits Butterfield through a stable regulatory framework and access to global markets.

Policies encouraging foreign investment and financial innovation are crucial. In 2024, Bermuda continued its efforts to attract international business, with legislative updates aimed at enhancing its competitive edge in the global financial services landscape. This proactive stance by the Bermudian government supports Butterfield's growth by ensuring a robust and adaptable operating environment.

Conversely, shifts in government policy or a less supportive stance could present challenges. For example, changes in international tax regulations or increased compliance burdens imposed by governments could affect profitability and operational efficiency. Butterfield must remain attuned to these evolving political factors across its jurisdictions.

Key government support elements include:

- Regulatory Stability: Consistent and predictable financial regulations in key jurisdictions like Bermuda.

- Investment Incentives: Government programs designed to attract and retain foreign investment in the financial sector.

- Innovation Support: Policies that encourage the adoption of new technologies and financial products.

- International Cooperation: Government engagement in global financial forums to maintain competitive positioning.

Bilateral and Multilateral Agreements

Bilateral and multilateral agreements significantly shape Butterfield's operational landscape. For instance, the continued strength of trade agreements like the EU-UK Trade and Cooperation Agreement, while not directly involving Bermuda, influences the broader global financial services environment. This impacts regulatory alignment and market access for institutions operating across multiple jurisdictions.

Treaties fostering financial services cooperation, such as those between Bermuda and key international financial centers, directly affect Butterfield's ability to conduct cross-border transactions and access new markets. These agreements can streamline regulatory processes, reducing operational friction and enhancing competitive positioning.

Butterfield must actively monitor evolving international accords. For example, the OECD's Base Erosion and Profit Shifting (BEPS) initiative, with its ongoing updates through 2024 and into 2025, impacts how multinational financial institutions are taxed globally. Adapting to these changes is crucial for maintaining profitability and ensuring compliance across all operating regions.

- Trade agreements facilitate market access for financial services, impacting Butterfield's reach.

- Financial services cooperation treaties between international centers streamline cross-border transactions.

- Regulatory harmonization driven by these agreements reduces operational complexity.

- Global tax initiatives like BEPS updates (2024-2025) require continuous adaptation for compliance.

Butterfield's operations are deeply intertwined with the political stability and regulatory frameworks of its key jurisdictions, such as Bermuda and the Cayman Islands. For instance, Bermuda's consistent regulatory environment, managed by the Bermuda Monetary Authority, has historically provided a stable foundation for international banking. Any shifts in government policy or leadership changes in these regions could introduce operational uncertainty for Butterfield, impacting its strategic planning.

Global tax initiatives and anti-money laundering efforts, driven by organizations like the OECD and FATF, significantly influence Butterfield's wealth management and international banking services. Compliance with evolving international tax standards, such as the OECD's Common Reporting Standard (CRS) which has been in effect since 2017, necessitates continuous updates to reporting systems. These updates can increase administrative burdens and data management costs, potentially impacting profitability by an estimated 5-10% due to increased compliance overhead.

Geopolitical tensions and international sanctions can disrupt capital flows and affect clients with international dealings, as seen with sanctions against Russia in 2022. Such events can rapidly alter financial landscapes, impacting Butterfield's ability to conduct transactions and manage assets. Government support, such as Bermuda's proactive promotion of its financial services sector, is crucial, with legislative updates in 2024 aiming to maintain its competitive edge.

Bilateral and multilateral agreements, including ongoing updates to the OECD's Base Erosion and Profit Shifting (BEPS) initiative through 2024-2025, directly shape Butterfield's operational environment and tax compliance strategies. Harmonized regulations and streamlined cross-border transactions through financial services cooperation treaties enhance market access and reduce operational friction.

What is included in the product

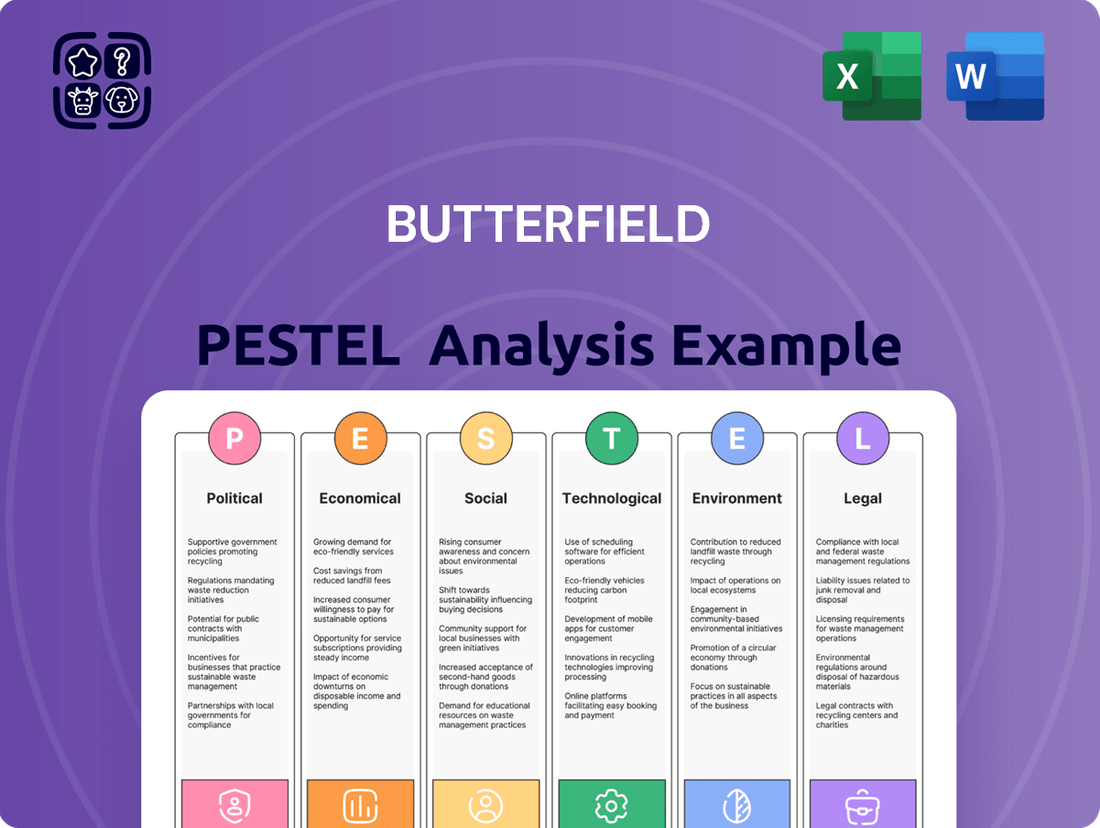

The Butterfield PESTLE Analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company's operating landscape.

This detailed assessment provides actionable insights for strategic decision-making, identifying potential challenges and growth avenues within Butterfield's specific industry and geographic context.

A clear, actionable framework that helps identify and mitigate external threats and opportunities, thereby reducing uncertainty and anxiety in strategic decision-making.

Economic factors

Butterfield's profitability is closely tied to the global interest rate environment, with decisions from central banks like the U.S. Federal Reserve and the Bank of England having a direct impact. For instance, the Federal Reserve maintained its benchmark interest rate between 5.25% and 5.50% through early 2024, a stance that influences borrowing costs and deposit yields for banks worldwide, including Butterfield.

Changes in these benchmark rates directly affect Butterfield's net interest margin, which is the difference between the interest income generated from loans and the interest paid out on deposits. A rising rate environment generally benefits banks by increasing the spread, while a falling rate environment can compress margins. For example, if Butterfield's cost of deposits rises faster than its lending rates, its profitability can be squeezed.

The bank must strategically manage its treasury operations and product portfolio to adapt to sustained periods of either low or high interest rates. This might involve adjusting the duration of its asset and liability portfolios or developing new products that are less sensitive to interest rate volatility. For instance, in a low-rate environment, the bank might focus on fee-based income streams to diversify revenue.

Butterfield's performance is closely tied to economic growth in its key markets. In 2024, North America's GDP growth is projected around 2.3%, while Europe's is anticipated at 1.5%, according to IMF forecasts. These figures directly influence demand for Butterfield's banking and wealth management services.

Strong economic expansion in these regions, particularly in island jurisdictions like Bermuda and the Cayman Islands where Butterfield has a significant presence, typically boosts loan demand and asset values. For instance, a 1% increase in GDP in these smaller economies can translate to a noticeable uplift in wealth management inflows and corporate banking activity for the bank.

Conversely, a slowdown, such as the projected 0.8% growth for the Eurozone in 2025, could dampen client spending and investment, potentially increasing credit risk for Butterfield. The bank's ability to navigate these varied economic landscapes is crucial for its sustained profitability.

Rising inflation in 2024 and early 2025 directly impacts Butterfield's operational expenses. We've seen increases in salary demands, the cost of new technology, and general administrative overhead, which can squeeze profit margins if not carefully managed. For instance, a 5% increase in operating costs, if not passed on through pricing, could significantly reduce net income.

While higher interest rates, often a response to inflation, can boost Butterfield's net interest income, they also create complexities. Managing the value of existing assets and guiding client investment strategies through volatile interest rate environments becomes a critical challenge. The bank needs to balance these opportunities with the risks of asset depreciation and client dissatisfaction.

To navigate these inflationary pressures, Butterfield must focus on robust cost management initiatives. This includes optimizing operational efficiency and strategically adjusting pricing for services. For example, a 1% increase in loan pricing, if feasible, could offset a portion of rising operational costs and help maintain profitability.

Currency Exchange Rate Volatility

Butterfield's international operations expose it to currency exchange rate volatility, impacting the value of its assets, liabilities, and earnings when reported in its base currency. For instance, in early 2024, the US Dollar experienced fluctuations against major currencies like the Euro and Sterling, a trend that would directly influence Butterfield's reported financial performance if significant holdings were exposed. This volatility creates foreign exchange risk for both the bank and its clients involved in cross-border investments.

Managing this risk is paramount. Butterfield likely employs strategies such as currency hedging to mitigate potential losses. Diversifying currency holdings across its international branches also serves as a natural hedge against significant adverse movements in any single currency. For example, a strong US Dollar might benefit Butterfield's US-dollar denominated assets but negatively impact its Euro or Sterling-denominated earnings.

Key considerations for Butterfield in 2024 and 2025 include:

- Monitoring geopolitical events: Global political instability can trigger rapid currency shifts, affecting Butterfield's international balance sheet.

- Implementing robust hedging programs: Proactive use of financial instruments to lock in exchange rates for future transactions is essential.

- Diversifying revenue streams: Reducing reliance on any single currency market can buffer against localized currency downturns.

- Adapting to central bank policies: Interest rate differentials and monetary policy decisions by central banks in the US, UK, and Eurozone significantly influence exchange rates and Butterfield's profitability.

Wealth Creation and Distribution Trends

Global wealth creation is shifting, with emerging markets playing an increasingly significant role. This dynamic directly impacts the demand for wealth management services, as new affluent populations seek expert guidance. For instance, in 2024, Asia continued to be a powerhouse for new wealth, with significant growth in high-net-worth individuals (HNWIs) necessitating tailored financial solutions.

Intergenerational wealth transfer is another critical factor, with trillions expected to pass between generations in the coming years. This presents a substantial opportunity for institutions like Butterfield to engage with inheritors and manage evolving financial needs. The growing concentration of wealth among HNWIs and institutions also means a larger pool of potential clients for specialized wealth management and banking services.

- Emerging Market Growth: Asia's HNWI population saw robust growth in 2024, creating new client segments.

- Intergenerational Transfer: An estimated $80 trillion is projected to transfer to heirs in the US alone over the next two decades, highlighting a key market opportunity.

- Industry Influence: Growth in sectors like technology and sustainable investments is creating new pockets of wealth.

- Demand for Services: Increased wealth concentration fuels demand for sophisticated wealth management, private banking, and investment advisory.

Economic growth directly influences Butterfield's revenue streams, with projected GDP growth in key markets like North America around 2.3% for 2024 impacting loan demand and asset values. Conversely, slower growth in regions like the Eurozone, with a 2025 forecast of 0.8%, could dampen client activity and increase credit risk.

Inflationary pressures in 2024 and early 2025 are increasing Butterfield's operational costs, necessitating careful expense management and potential price adjustments for services. While higher interest rates, a common response to inflation, can boost net interest income, they also introduce challenges in managing asset values and client investment strategies.

Butterfield's international operations are subject to currency exchange rate volatility, impacting reported earnings and requiring strategies like hedging and diversification to mitigate risk. For instance, fluctuations in the US Dollar against the Euro in early 2024 directly affected the value of cross-currency holdings.

| Economic Factor | 2024 Projection/Data | Impact on Butterfield | Key Considerations |

|---|---|---|---|

| Global GDP Growth | North America: ~2.3% (IMF) | Influences loan demand, asset values, and wealth management activity. | Navigating regional economic disparities. |

| Inflation | Rising in key markets | Increases operational costs, potentially impacting profit margins. | Cost management and strategic pricing adjustments. |

| Interest Rates | Fed Funds Rate: 5.25%-5.50% (early 2024) | Affects net interest margin; higher rates can boost income but increase asset risk. | Balancing lending rates with deposit costs and managing asset duration. |

| Currency Exchange Rates | USD fluctuations against EUR, GBP | Impacts value of international assets, liabilities, and earnings. | Hedging strategies and currency diversification. |

Preview the Actual Deliverable

Butterfield PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Butterfield PESTLE analysis covers all key external factors impacting the business. You'll gain valuable insights into political, economic, social, technological, legal, and environmental influences.

Sociological factors

Clients, particularly younger demographics and tech-forward high-net-worth individuals, now expect digital experiences that are as smooth and user-friendly as their everyday apps. This means Butterfield needs to deliver intuitive online and mobile platforms for banking and wealth management.

To keep pace, Butterfield must consistently upgrade its digital offerings, providing easy access to services and personalized financial advice. For example, a significant portion of banking transactions in 2024 are expected to be conducted digitally, highlighting the urgency of this shift.

Not keeping up with these evolving client expectations could result in clients moving to competitors and a weakening of Butterfield's market position. By 2025, digital-native banks are projected to capture a larger market share, underscoring the need for robust digital investment.

Global demographic shifts, like the aging populations in places such as Europe and North America, are significant. For instance, by 2030, it's projected that over 20% of the U.S. population will be 65 or older. This trend, coupled with the anticipated massive intergenerational wealth transfer, estimated to be in the trillions of dollars over the next decade, creates a dual-edged sword for Butterfield.

Butterfield must adapt by offering specialized financial solutions. This includes robust retirement planning tools, sophisticated estate management services, and expert wealth transfer advisory to cater to the needs of both older clients and younger inheritors. Successfully navigating these demographic currents is key to maintaining client relationships and fostering future growth.

For Butterfield, a financial institution, public trust and a solid reputation are absolutely critical, especially given its operations in international financial hubs. Negative perceptions stemming from ethical missteps, data breaches, or compliance failures can significantly harm its brand and erode client confidence. For instance, in 2023, the global financial services sector saw increased scrutiny on data privacy, with regulatory fines for breaches reaching billions of dollars, underscoring the financial impact of reputational damage.

Butterfield must prioritize transparency, uphold rigorous governance standards, and clearly communicate its core values to safeguard its reputation. A strong public image directly influences customer loyalty and attracts new business; a 2024 study by Edelman found that 60% of consumers choose brands based on their ethical behavior and trust.

Talent Acquisition and Retention

The competition for skilled financial professionals, particularly those with expertise in wealth management, digital banking, and compliance, is a significant sociological hurdle. In 2024, the global financial services sector continued to face intense demand for these specialized roles, driving up salary expectations. Butterfield must craft compelling employee value propositions, encompassing competitive remuneration, robust professional development pathways, and a supportive work environment, to secure and retain premier talent across its global footprint.

A highly skilled and motivated workforce is fundamental to maintaining superior service quality and fostering innovation within Butterfield. For instance, the demand for cybersecurity professionals in finance saw a notable increase in 2024, with reported salary hikes of up to 15% in certain regions, underscoring the need for attractive compensation packages to secure essential expertise.

- Intensified Competition: Financial institutions globally are vying for a limited pool of highly specialized talent in areas like fintech and regulatory compliance.

- Evolving Employee Expectations: Modern professionals, especially millennials and Gen Z, prioritize work-life balance, continuous learning, and a strong company culture alongside financial rewards.

- Impact on Service Delivery: A shortage of skilled personnel can directly affect customer service, operational efficiency, and the ability to implement new technologies.

- Global Talent Mobility: As operations span multiple jurisdictions, Butterfield must navigate diverse labor markets and cultural expectations to build a cohesive and effective international team.

Ethical Investing and Social Responsibility

Societal expectations are increasingly pushing financial institutions towards ethical investing and social responsibility. This trend is directly impacting client preferences, with a significant number now actively seeking investment opportunities that align with Environmental, Social, and Governance (ESG) principles. For instance, by early 2025, global ESG assets under management were projected to approach $50 trillion, underscoring the scale of this shift.

Butterfield, like its peers, must adapt to this demand for sustainability. Clients are not just looking for financial returns; they want their investments to reflect their values and expect banks to demonstrate a genuine commitment to sustainable practices. This means integrating ESG considerations is no longer optional but a strategic imperative for client retention and acquisition.

To meet these evolving demands, Butterfield needs to embed ESG factors into its core service offerings and overall corporate strategy. This includes developing and promoting ESG-focused investment products and ensuring that the bank's own operations are conducted with a strong sense of social and environmental responsibility. Failing to do so risks alienating a growing segment of the client base and potentially facing reputational damage.

- Growing ESG Demand: Global ESG assets were projected to reach nearly $50 trillion by early 2025, indicating a substantial client appetite for ethical investments.

- Client Value Alignment: Investors are increasingly prioritizing financial products that reflect their personal ethical and sustainability values.

- Operational Integration: Financial institutions are expected to demonstrate their commitment to sustainability not only through investment products but also through their own operational practices.

- Strategic Imperative: Integrating ESG principles is crucial for Butterfield to remain competitive and meet evolving client and societal expectations in the financial services sector.

Societal expectations are increasingly pushing financial institutions towards ethical investing and social responsibility, directly impacting client preferences for investments aligned with Environmental, Social, and Governance (ESG) principles. By early 2025, global ESG assets under management were projected to approach $50 trillion, highlighting the substantial client appetite for ethical investments.

Butterfield must adapt by embedding ESG factors into its core service offerings and corporate strategy, developing and promoting ESG-focused investment products, and ensuring its own operations reflect social and environmental responsibility. Failing to do so risks alienating clients and facing reputational damage.

The competition for skilled financial professionals, particularly in wealth management and digital banking, remains intense. In 2024, demand for these specialized roles drove up salary expectations, making it crucial for Butterfield to offer compelling employee value propositions to secure and retain top talent globally.

Public trust and a strong reputation are paramount for financial institutions like Butterfield, especially in international hubs. Negative perceptions from ethical missteps or data breaches can severely harm its brand, as evidenced by billions in regulatory fines for breaches in 2023, underscoring the financial impact of reputational damage.

Technological factors

Butterfield's technological landscape is defined by the accelerating pace of digital transformation, necessitating ongoing investment in its core banking infrastructure, online portals, and mobile applications. This commitment extends to adopting cutting-edge digital solutions for client onboarding, streamlining transaction processing, and enhancing wealth management advisory capabilities.

By prioritizing digital service delivery, Butterfield aims to elevate the customer experience, boost operational efficiency, and solidify its competitive standing in the market. For instance, in 2024, many financial institutions reported significant increases in digital transaction volumes, with mobile banking usage often exceeding 70% of customer interactions, underscoring the critical need for robust digital platforms.

Butterfield, as a financial institution, is acutely aware of the ever-present and escalating cybersecurity threats. The sheer volume of sensitive client data and the value of financial transactions it handles make it a prime target for cyberattacks. In 2024, the global cost of cybercrime was estimated to reach $10.5 trillion annually, highlighting the significant financial risks involved.

To counter these threats, Butterfield must invest heavily in robust cybersecurity measures. This includes implementing advanced threat detection systems, employing strong encryption protocols for data at rest and in transit, and conducting regular, comprehensive employee training to mitigate human error, a common vector for breaches. The bank's commitment to protecting against data breaches, fraud, and operational disruptions is non-negotiable.

Ultimately, client trust is the bedrock of Butterfield's operations. Its ability to consistently safeguard sensitive information and ensure the unwavering integrity of its financial systems is directly correlated with maintaining and growing that trust. A single significant breach could have devastating consequences for reputation and client retention.

Butterfield's adoption of AI and Machine Learning is a key technological driver. These technologies offer substantial opportunities to streamline operations, such as automating back-office processes and bolstering fraud detection capabilities. For instance, AI-powered analytics can process vast datasets to identify suspicious transactions with greater speed and accuracy than traditional methods.

Furthermore, AI and ML are instrumental in enhancing client engagement and service delivery. By analyzing client data, Butterfield can offer personalized financial advice, tailored investment recommendations, and more responsive customer support. This data-driven approach not only improves client satisfaction but also provides a significant competitive edge in the dynamic wealth management sector.

The financial services industry, in general, saw significant investment in AI in 2024, with many institutions allocating substantial budgets to AI initiatives. Reports indicate that AI adoption in banking and financial services is projected to grow by over 30% annually through 2025, suggesting a strong market trend towards embracing these advanced technologies for efficiency and client-centricity.

FinTech Innovation and Competition

The financial technology (FinTech) sector continues to reshape the banking landscape, presenting Butterfield with both challenges and avenues for growth. Agile FinTech firms are increasingly offering specialized financial services, from payments to lending, often with a more streamlined customer experience that can disrupt traditional banking models. For instance, the global FinTech market was valued at over $2.4 trillion in 2023 and is projected to grow significantly, indicating the scale of this competitive force.

Butterfield can strategically navigate this evolving environment by embracing innovation. This might involve developing proprietary FinTech solutions to enhance its digital offerings, thereby competing directly with emerging players. Alternatively, forming strategic partnerships with established FinTech companies can provide access to new technologies and customer bases more rapidly. As of early 2024, many traditional banks are actively pursuing such collaborations, recognizing the synergistic potential.

- FinTech Market Growth: The global FinTech market is experiencing robust expansion, with projections indicating continued upward trajectory through 2025 and beyond, driven by digital adoption.

- Competitive Disruption: Specialized FinTechs are challenging incumbent banks by offering niche, technology-driven financial services with enhanced user experiences.

- Strategic Responses: Butterfield can counter these trends through internal innovation, strategic alliances with FinTechs, or targeted acquisitions of promising technologies to bolster its service portfolio and market reach.

- Partnership Trends: A significant trend observed in 2023-2024 is the increasing number of traditional financial institutions forming partnerships with FinTech startups to leverage their technological capabilities.

Blockchain and Distributed Ledger Technology

Blockchain and Distributed Ledger Technology (DLT) are poised to reshape financial services, impacting areas like cross-border payments and trade finance. Butterfield should actively track these advancements and investigate how they can boost efficiency and transaction security. For instance, the global DLT market was valued at approximately $10.7 billion in 2023 and is projected to reach $175.8 billion by 2030, indicating significant growth potential for adoption.

Exploring DLT could offer Butterfield a competitive advantage by streamlining processes and potentially lowering operational costs. The technology's inherent security features, such as immutability and transparency, are particularly attractive for financial institutions. Consider the potential for asset tokenization, which could unlock new liquidity and investment opportunities.

- Cross-border payments: DLT can reduce settlement times and fees, making international transactions faster and cheaper.

- Trade finance: Smart contracts on a blockchain can automate trade processes, reducing paperwork and risk.

- Asset tokenization: Representing real-world assets as digital tokens on a ledger can increase liquidity and accessibility.

Technological advancements are fundamentally reshaping the financial sector, pushing institutions like Butterfield to prioritize digital transformation and cybersecurity. The escalating adoption of mobile banking, with usage often exceeding 70% of customer interactions in 2024, highlights the critical need for robust digital platforms.

AI and Machine Learning are key drivers, offering opportunities to streamline operations, enhance fraud detection, and personalize client services. The financial services industry saw substantial AI investment in 2024, with projected annual growth exceeding 30% through 2025.

The rise of FinTech presents both challenges and opportunities, necessitating strategic responses such as internal innovation or partnerships. The global FinTech market, valued over $2.4 trillion in 2023, continues its significant expansion.

Emerging technologies like Blockchain and DLT offer potential benefits for cross-border payments and trade finance. The DLT market, projected to grow from $10.7 billion in 2023 to $175.8 billion by 2030, underscores the significant growth potential for adoption.

Legal factors

Butterfield operates under strict Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations globally, requiring significant investment in compliance. In 2024, financial institutions worldwide are dedicating billions to AML compliance, with estimates suggesting global spending could reach over $30 billion annually by 2025, reflecting the increasing complexity and enforcement of these rules.

The bank must maintain robust systems and ongoing staff training to identify and report suspicious transactions, aligning with international standards like those set by the Financial Action Task Force (FATF). Failure to comply can lead to substantial fines, with some institutions facing penalties in the hundreds of millions of dollars for AML breaches, alongside severe reputational harm and potential operational limitations.

Butterfield navigates a global landscape of data privacy laws, including GDPR-like regulations in Europe and specific local acts across its operational centers. Compliance demands stringent data governance, secure storage, and clear policies on client data handling. Failure to adhere can result in significant fines and damage to client trust, impacting the company's reputation and operational continuity.

Butterfield operates within a complex legal landscape where traditional banking secrecy principles clash with a global push for financial transparency. This tension is particularly acute for institutions with offshore operations.

The bank must diligently adhere to international regulations like the Common Reporting Standard (CRS) and the US Foreign Account Tax Compliance Act (FATCA). For instance, as of the end of 2023, over 100 jurisdictions had committed to CRS, significantly increasing the automatic exchange of financial account information globally, impacting how Butterfield manages client data and reporting obligations.

Navigating these requirements necessitates robust legal frameworks and adaptive operational procedures to ensure client confidentiality is balanced with compliance. Failure to comply can result in substantial penalties and reputational damage.

Consumer Protection Regulations

Butterfield, as a full-service bank, must navigate a complex web of consumer protection regulations designed to shield its clients. These rules mandate transparency in lending, fair treatment of all customers, and clear product disclosures. For instance, in 2024, regulatory bodies across its operating regions continued to emphasize robust complaint handling procedures and adherence to fair lending statutes, impacting how Butterfield structures its retail and small business offerings.

Compliance with these evolving consumer protection laws is not merely a legal obligation but a cornerstone of maintaining customer trust and brand reputation. Failure to comply can lead to significant penalties and legal challenges. In 2024, fines for consumer protection violations in the financial sector globally continued to be substantial, underscoring the importance of rigorous internal controls and proactive adaptation to regulatory changes.

- Regulatory Scrutiny: Banks like Butterfield face ongoing scrutiny from consumer protection agencies regarding fair lending, data privacy, and transparent fee structures.

- Jurisdictional Variations: Consumer protection laws differ significantly across Butterfield's operating jurisdictions, requiring tailored compliance strategies.

- Customer Trust: Adherence to these regulations is paramount for building and maintaining customer confidence, directly impacting client retention and acquisition.

- Enforcement Trends: In 2024, regulators continued to focus on enforcement actions related to unfair or deceptive practices, with potential for substantial financial penalties.

Regulatory Oversight and Licensing Requirements

Butterfield operates under the watchful eye of various financial regulators across its global footprint, including entities like the Bermuda Monetary Authority. These authorities impose rigorous licensing stipulations, continuous oversight, stringent capital adequacy ratios, and robust governance frameworks. For instance, as of early 2024, Butterfield maintained a Common Equity Tier 1 (CET1) capital ratio well above regulatory minimums, demonstrating its commitment to financial resilience. The bank must consistently adhere to these demanding expectations, subject itself to regular audits, and remain agile in adapting to evolving regulatory landscapes to preserve its operating licenses and overall integrity.

Meeting these compliance obligations is not merely a procedural step but a critical component of Butterfield's operational strategy. Failure to comply can result in significant penalties, reputational damage, and even the suspension of critical banking services. The bank's proactive approach to regulatory engagement and investment in compliance infrastructure is therefore essential for its sustained success and market credibility.

Butterfield must navigate evolving global tax laws and reporting requirements, such as the OECD's Base Erosion and Profit Shifting (BEPS) initiatives, which aim to prevent tax avoidance by multinational enterprises. The increasing implementation of digital tax services and cross-border information exchange agreements, including the Common Reporting Standard (CRS) and FATCA, necessitates robust compliance infrastructure and continuous adaptation. For example, by the end of 2023, over 100 jurisdictions had committed to CRS, significantly impacting financial institutions' data management and client reporting obligations.

The bank is subject to stringent anti-money laundering (AML) and know your customer (KYC) regulations globally, demanding substantial investment in compliance systems and training. In 2024, financial institutions worldwide are expected to spend over $30 billion annually on AML compliance by 2025, reflecting the growing complexity and enforcement of these rules. Failure to comply can result in severe penalties, with some institutions facing fines in the hundreds of millions of dollars for AML breaches, alongside significant reputational damage.

Butterfield operates under a complex web of consumer protection laws across its jurisdictions, requiring transparency in lending, fair customer treatment, and clear product disclosures. Regulators in 2024 continued to emphasize robust complaint handling and fair lending statutes, impacting retail and small business offerings. Adherence to these regulations is crucial for maintaining customer trust and brand reputation, with fines for violations remaining substantial globally.

Environmental factors

Butterfield, with its headquarters in Bermuda and operations across island nations, is particularly exposed to the direct physical impacts of climate change. The increasing frequency and intensity of extreme weather events, such as hurricanes, pose a significant threat to its physical infrastructure and operational continuity. For instance, the Caribbean region, where Butterfield has a strong presence, is projected to see a 20% increase in the intensity of the strongest hurricanes by 2050 compared to the late 20th century.

These weather events can directly damage bank branches, data centers, and other essential facilities, leading to costly repairs and business interruptions. Furthermore, the value of real estate collateral, a key component of the bank's loan portfolio, can be severely impacted by rising sea levels and storm surges, potentially leading to increased loan defaults and credit losses.

Global demand for ESG-compliant investments is surging, with a significant push from high-net-worth individuals and institutional investors. For instance, assets in sustainable funds globally reached an estimated $3.8 trillion by the end of 2023, reflecting this strong client preference.

Butterfield must adapt by embedding ESG principles into its wealth management services and creating new sustainable finance products. This includes offering transparent reporting on ESG metrics, a crucial factor as over 70% of investors consider ESG factors when making investment decisions.

This growing ESG demand also shapes Butterfield's internal investment strategies, pushing the bank to align its own portfolio with sustainable practices and to actively seek out ESG-focused opportunities to meet client expectations and maintain a competitive edge in the evolving financial landscape.

Financial regulators worldwide are stepping up efforts to steer capital towards sustainable ventures. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR) mandates that financial market participants disclose sustainability-related information, impacting how institutions like Butterfield market their products. This regulatory push means Butterfield needs to be acutely aware of new disclosure requirements and potential capital allocation guidelines.

Governments are also incentivizing green lending. In 2024, many nations are offering tax breaks or subsidies for banks financing renewable energy projects, a trend expected to continue into 2025. Butterfield must actively track these incentives to identify opportunities and ensure its lending practices align with national environmental goals, thereby enhancing its competitive positioning.

Climate risk stress testing is becoming a standard supervisory expectation. By 2025, a significant number of central banks are anticipated to incorporate climate scenarios into their regular stress tests, requiring banks to assess their resilience to physical and transition risks. Butterfield's proactive engagement with these evolving risk management frameworks is crucial for maintaining regulatory approval and financial stability.

Reputational Risks from Environmental Practices

Butterfield, like any financial institution, faces reputational risks stemming from its environmental performance and the environmental impact of its financed activities. Growing stakeholder awareness means a bank's environmental footprint, whether in its own operations or through its lending portfolio, is under intense scrutiny. For instance, a significant portion of investor capital is now directed towards ESG (Environmental, Social, and Governance) compliant entities, with a notable increase in sustainable finance commitments globally. In 2024, the global sustainable debt market was projected to reach trillions, highlighting the financial sector's role and the associated reputational stakes.

Maintaining a positive public image is therefore intrinsically linked to demonstrating robust environmental stewardship. This involves not only minimizing its own operational carbon emissions but also actively engaging with clients to promote sustainable practices and ensuring lending policies align with environmental goals. Failure to do so can lead to client attrition and investor divestment, impacting the bank's market standing and profitability.

- Stakeholder Scrutiny: Investors and clients increasingly demand transparency on environmental impact, with a growing preference for institutions demonstrating strong ESG credentials.

- Financing Impact: Reputational damage can arise from financing industries or projects with significant negative environmental consequences, leading to public backlash.

- Sustainability Commitments: Demonstrating a proactive approach to environmental responsibility through operational changes and lending policies is vital for maintaining trust and a favorable brand image.

- Market Trends: The substantial growth in sustainable finance, exceeding trillions globally by 2024, underscores the financial imperative and reputational benefits of strong environmental practices.

Impact on Real Estate and Loan Portfolios

Environmental factors, especially climate change, pose substantial risks to real estate values and loan portfolios. Butterfield must consider how rising sea levels and increased storm frequency, for example, could devalue coastal properties held as collateral. This necessitates integrating robust environmental risk assessments into their credit analysis and overall portfolio management strategies to safeguard asset quality and minimize potential financial losses.

The financial sector is increasingly scrutinizing climate-related risks. For instance, the European Central Bank (ECB) has been pushing banks to conduct climate stress tests, with a significant portion of banks reporting that climate risks could impact their loan portfolios by 2024. Butterfield should align its practices with these evolving regulatory expectations and market trends.

- Climate Change Impact: Rising sea levels and extreme weather events can directly reduce the market value of properties used as loan collateral.

- Portfolio Risk: A significant concentration of loans secured by properties in vulnerable areas could lead to substantial write-downs.

- Mitigation Strategies: Incorporating environmental risk into credit underwriting and stress testing is crucial for maintaining loan portfolio health.

- Regulatory Scrutiny: Financial institutions face increasing pressure from regulators to assess and manage climate-related financial risks.

Butterfield's environmental exposure is significant, particularly concerning climate change impacts on its island-based operations and collateral. The increasing intensity of hurricanes, with projections showing a 20% rise in the strongest storms by 2050 in the Caribbean, directly threatens infrastructure and property values. This necessitates a proactive approach to environmental risk management and adaptation strategies to mitigate potential financial losses.

The growing demand for ESG investments, with global sustainable fund assets reaching an estimated $3.8 trillion by the end of 2023, presents both a challenge and an opportunity for Butterfield. The bank must integrate ESG principles into its offerings and operations to meet client expectations, with over 70% of investors considering ESG factors. This shift requires transparent reporting and the development of sustainable finance products to maintain competitiveness.

Regulatory bodies are increasingly focusing on climate risk, with central banks expected to incorporate climate scenarios into stress tests by 2025. Financial institutions like Butterfield must align with these evolving expectations, including disclosure requirements like the EU's SFDR. Furthermore, government incentives for green lending, such as tax breaks for renewable energy financing in 2024, offer opportunities for strategic alignment and enhanced positioning.

| Environmental Factor | Impact on Butterfield | Data Point/Trend |

| Climate Change & Extreme Weather | Infrastructure damage, increased insurance costs, property devaluation (collateral risk) | Caribbean hurricane intensity projected to increase by 20% by 2050. |

| Rising Sea Levels | Coastal property devaluation, potential for increased loan defaults | Coastal regions are particularly vulnerable to inundation. |

| ESG Investment Demand | Opportunity for new products, need for ESG integration in wealth management | Global sustainable fund assets reached $3.8 trillion by end of 2023. 70%+ investors consider ESG. |

| Regulatory Focus on Climate Risk | Need for climate stress testing, enhanced disclosure requirements | Central banks to incorporate climate scenarios in stress tests by 2025. |

| Green Lending Incentives | Opportunity to finance sustainable projects, enhance competitive positioning | Tax breaks and subsidies for green lending offered by various governments in 2024. |

PESTLE Analysis Data Sources

Our Butterfield PESTLE Analysis is meticulously constructed using a diverse range of credible data sources, including official government publications, reputable financial institutions, and leading market research firms. This ensures that every factor examined is grounded in current, verifiable information.