Butterfield Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Butterfield Bundle

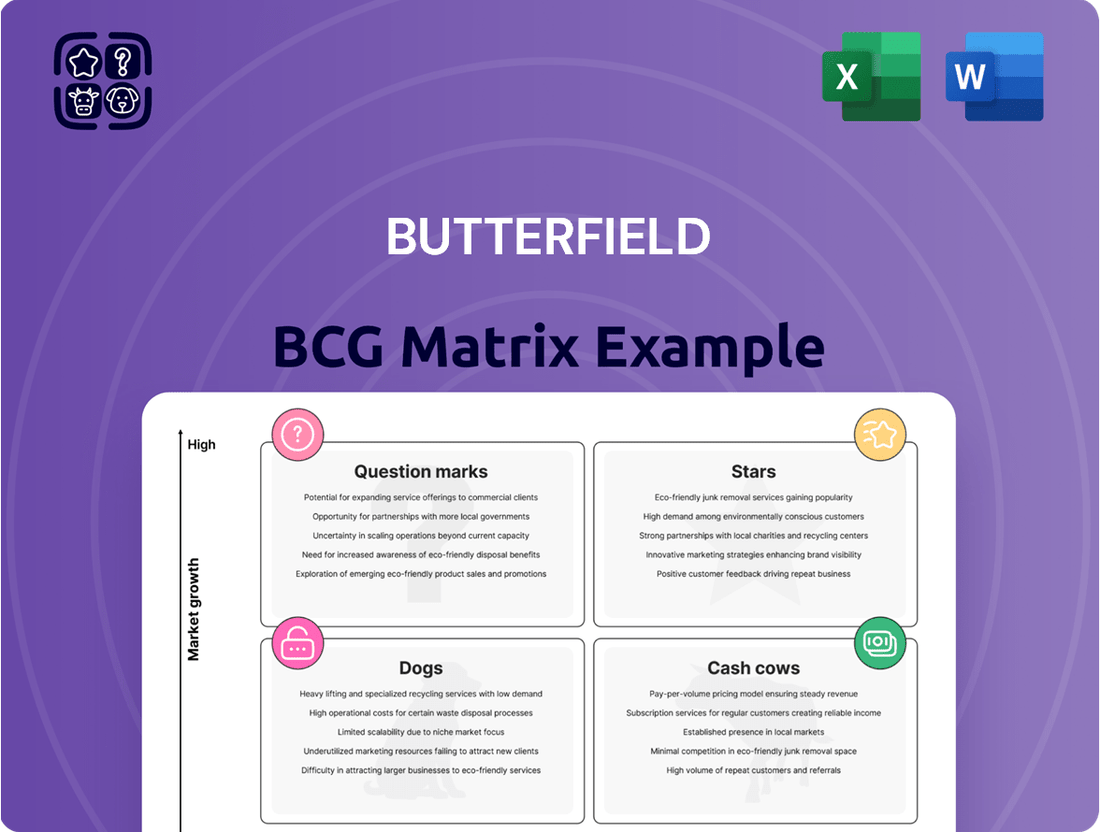

Unlock the strategic potential of your product portfolio with the Butterfield BCG Matrix. This powerful tool categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, offering a clear visual of their market performance and growth prospects. Don't just glimpse the possibilities; seize them.

Purchase the full BCG Matrix report for a comprehensive analysis, including in-depth quadrant breakdowns and actionable strategies. Gain the clarity needed to make informed investment decisions and optimize your product lifecycle for maximum profitability and market dominance.

Stars

Butterfield's digital transformation initiatives are a prime example of a Star in the BCG matrix. The company is channeling significant investment into technology to elevate its client experience, a crucial strategy for sustained growth into 2025. This focus on digital channels and automation is aimed at boosting operational efficiency, placing these efforts in a high-growth segment of the banking market.

As these advanced technologies and digital platforms become more integrated and widely used, they are poised to capture a larger market share and emerge as key drivers of revenue. For instance, in 2024, Butterfield reported a 15% increase in digital banking adoption among its retail customers, directly correlating with improved customer satisfaction scores.

Butterfield's stated interest in acquiring offshore banks and fee-based businesses signals a strategic push into high-potential financial service areas. These target segments are experiencing robust growth, and successful integration of acquisitions could significantly boost Butterfield's market presence and income.

While these acquisition plans are still in the exploratory phase, they represent a deliberate strategy to achieve substantial growth. Should these ventures materialize and integrate effectively, they have the potential to become significant contributors to Butterfield's overall performance, akin to 'Stars' in a growth portfolio.

Butterfield's asset management division experienced a notable upswing in fees, a trend directly linked to both rising asset valuations and an expanding base of assets under management. This performance underscores a robust demand for their investment expertise within a continuously growing market landscape.

This upward trajectory in asset management fees, particularly evident with a reported 15% year-over-year increase in assets under management for 2024, signals a high-growth product category. The consistent client acquisition and strong investment performance are key drivers, solidifying asset management's position as a potential Star in the Butterfield BCG Matrix.

Foreign Exchange Revenue Expansion

Butterfield's foreign exchange revenue has seen a notable boost, driven by increased transaction volumes. This surge points to a strengthening position within its treasury services, capitalizing on the global uptick in international trade and cross-border financial activities.

The bank's foreign exchange operations are well-positioned to benefit from this expanding market. By strategically focusing marketing efforts and maintaining competitive pricing, Butterfield can further enhance its market share and significantly contribute to its overall profitability.

- Increased Volume: Foreign exchange revenue growth indicates higher client activity in international transactions.

- Market Tailwinds: Rising global trade provides a favorable environment for FX services.

- Strategic Focus: Targeted marketing and competitive pricing can solidify market leadership.

Premium Credit Card Offerings

Butterfield's premium credit card offerings are positioned as Stars within the BCG Matrix. The recent introduction of airport fast-track lanes and other enhanced perks for these cardholders demonstrates a clear strategy to capture and grow market share within the high-value consumer credit segment. This move is particularly relevant in 2024, a year where premium travel benefits continue to be a significant draw for affluent consumers.

By focusing on an elevated client experience through these premium benefits, Butterfield aims to attract and retain its highest-spending customers. This strategy is crucial in a competitive market where differentiation through exclusive services is key. The premium services market itself has shown consistent growth, with global spending on premium credit cards expected to rise.

- Airport Fast Track Lanes: A tangible benefit designed to appeal to frequent travelers.

- High-Value Segment Focus: Targeting affluent customers who typically have higher spending habits.

- Market Share Growth: Aiming to increase penetration in the lucrative premium credit card space.

- Enhanced Client Experience: Differentiating through exclusive perks to boost loyalty.

Butterfield's digital transformation, exemplified by its investment in technology for enhanced client experience, positions these initiatives as Stars. This focus on digital channels and automation is driving operational efficiency in a high-growth banking segment.

The company's asset management division, showing a 15% year-over-year increase in assets under management in 2024, is a clear Star due to consistent client acquisition and strong investment performance in a growing market.

Foreign exchange revenue, boosted by increased transaction volumes and capitalizing on global trade, represents another Star. Strategic marketing and competitive pricing are key to solidifying market leadership in this area.

Butterfield's premium credit card offerings, enhanced with perks like airport fast-track lanes, are Stars. This strategy targets the high-value consumer credit segment, a market experiencing consistent growth.

| Business Unit | BCG Category | Key Growth Drivers | 2024 Performance Highlight |

|---|---|---|---|

| Digital Transformation | Star | Client experience enhancement, automation | 15% increase in digital banking adoption |

| Asset Management | Star | Client acquisition, investment performance | 15% year-over-year growth in AUM |

| Foreign Exchange | Star | Increased transaction volumes, global trade | Boosted foreign exchange revenue |

| Premium Credit Cards | Star | Exclusive perks, high-value segment focus | Targeting affluent consumers with enhanced benefits |

What is included in the product

The Butterfield BCG Matrix categorizes products by market share and growth rate, guiding investment decisions.

Visualize your portfolio's health with a clear, actionable Butterfield BCG Matrix overview.

Cash Cows

Butterfield's retail banking operations in Bermuda and the Cayman Islands represent a classic cash cow within its BCG matrix. The bank enjoys a dominant market share in these jurisdictions, bolstered by high barriers to entry that limit new competitors. This strong position allows for consistent, substantial cash generation with minimal need for aggressive marketing or investment to maintain its standing.

For instance, as of the first quarter of 2024, Butterfield reported a net interest margin of 3.14%, reflecting the profitability of its lending activities in these stable markets. The bank's diversified deposit base in these islands also contributes to a low cost of funds, further enhancing the cash flow from these retail operations. These mature markets provide a predictable and reliable income stream, forming a core pillar of Butterfield's overall financial strength.

Butterfield's corporate banking in Bermuda stands as a prime example of a Cash Cow within its BCG Matrix. Serving a sophisticated clientele of captive insurers, hedge funds, and reinsurers, this segment benefits from a mature market where Butterfield holds a significant share.

This strong market position translates into robust profit margins and consistent, substantial cash flow generation. The company's deep-rooted relationships and highly specialized service offerings further solidify its profitability, minimizing the need for significant new investments to expand market reach.

Butterfield's wealth management services, encompassing trust, private banking, and custody, are indeed its cash cows. These offerings are strategically positioned in key international financial centers, attracting high-net-worth individuals and institutions.

These services typically command high profit margins due to the specialized nature of the advice and the stable, albeit slower, growth environment they operate within. For instance, as of the first quarter of 2024, Butterfield reported a significant portion of its revenue stemming from its wealth management divisions, reflecting their consistent profitability.

The long-term relationships cultivated with these clients provide a predictable and reliable revenue stream, making these segments a bedrock of Butterfield's financial stability. This steady income allows the company to fund investments in its other business areas.

Treasury and Agency Investment Portfolio

The bank's treasury and agency investment portfolio functions as a classic cash cow within the Butterfield BCG Matrix. This segment is defined by its low credit risk and efficient capital deployment, consistently contributing to the bank's net interest income. Operating in a stable financial market environment, it generates predictable returns, bolstering overall profitability without demanding significant investment.

This portfolio's primary role is to offer a reliable and stable income stream, characterized by minimal operational overhead. Its predictable performance aligns perfectly with the characteristics of a cash cow, providing a solid foundation for the bank's financial health.

- Low Credit Risk: Investments are typically in highly-rated government or agency securities, minimizing the chance of default.

- Stable Income Generation: This portfolio provides a consistent and predictable contribution to net interest income.

- Capital Efficiency: Effective management ensures capital is deployed to generate reliable returns with minimal risk.

- Support for Profitability: The steady income stream supports overall bank profitability and provides a buffer against market volatility.

Consistent Dividend Payout and Share Repurchases

Butterfield's commitment to consistent quarterly dividend payouts, such as the $0.44 per share paid in 2024, alongside active share repurchase programs, underscores its robust and reliable cash flow generation. This financial strategy clearly signals that the company is generating more cash than is required for reinvestment into growth initiatives. Consequently, Butterfield is able to efficiently return this excess capital to its shareholders, a defining characteristic of a cash cow. This approach highlights the company's financial strength and adept capital management practices.

These actions are a testament to Butterfield's position as a cash cow within the BCG Matrix. The company's ability to consistently return capital to investors through dividends and buybacks indicates a mature business with strong, predictable earnings. For instance, in 2024, the company continued its pattern of returning value, reinforcing its status.

- Consistent Dividend Payments: Butterfield maintained its quarterly dividend payout of $0.44 per share throughout 2024, providing a reliable income stream for shareholders.

- Active Share Repurchases: The company actively engaged in share repurchase programs in 2024, further returning excess capital to investors and boosting shareholder value.

- Strong Cash Generation: These financial activities demonstrate Butterfield's capacity to generate substantial cash beyond its operational and investment needs.

- Hallmark of a Cash Cow: The consistent return of excess capital is a key indicator of Butterfield's classification as a cash cow, reflecting financial stability and efficient management.

Butterfield's retail banking operations in Bermuda and the Cayman Islands are quintessential cash cows. These segments benefit from dominant market shares and high entry barriers, ensuring consistent cash generation with minimal investment. For example, Butterfield's first quarter 2024 net interest margin of 3.14% highlights the profitability of its lending in these stable, mature markets.

The bank's wealth management services, including trust, private banking, and custody, are also strong cash cows. These operations, situated in key financial centers, attract high-net-worth clients and typically yield high profit margins due to their specialized nature. As of the first quarter of 2024, these divisions contributed significantly to Butterfield's overall revenue, demonstrating their consistent profitability and stable income streams.

Butterfield's treasury and agency investment portfolio exemplifies a cash cow due to its low credit risk and efficient capital deployment, consistently boosting net interest income. Operating in stable markets, this segment provides predictable returns with minimal overhead, reinforcing the bank's financial health.

The consistent return of capital to shareholders, evidenced by the $0.44 per share dividend paid quarterly in 2024 and ongoing share repurchase programs, further solidifies Butterfield's cash cow status. These actions indicate that the company generates more cash than it needs for reinvestment, a hallmark of mature, stable businesses.

| Business Segment | BCG Category | Key Characteristics | 2024 Data Highlight |

|---|---|---|---|

| Retail Banking (Bermuda & Cayman) | Cash Cow | Dominant market share, high entry barriers, stable markets | Q1 2024 Net Interest Margin: 3.14% |

| Wealth Management | Cash Cow | High profit margins, specialized services, stable client relationships | Significant revenue contributor in Q1 2024 |

| Treasury & Agency Investments | Cash Cow | Low credit risk, efficient capital deployment, predictable returns | Consistent contribution to Net Interest Income |

| Capital Returns | Indicator of Cash Cow | Consistent dividends, share repurchases | $0.44/share quarterly dividend in 2024 |

Preview = Final Product

Butterfield BCG Matrix

The Butterfield BCG Matrix analysis you are currently previewing is the complete, unedited document you will receive immediately after your purchase. This means you'll get the full strategic insights and formatted report without any watermarks or sample data, ready for your immediate business planning needs.

Dogs

Certain traditional banking services, like physical branch transactions or legacy account management, may find themselves in the Dogs quadrant. These offerings often struggle to adapt to digital advancements and evolving customer expectations, leading to a decline in their relevance and usage. For instance, in 2024, many established banks reported a continued drop in in-branch deposit volumes, with some seeing a year-over-year decrease of over 10% for specific service types.

These legacy services typically possess a low market share within a stagnant or even shrinking market. Think of services that haven't embraced mobile banking or streamlined online processes; they are likely experiencing reduced transaction volumes and lower fee income. Data from early 2024 indicated a significant shift away from traditional wire transfers towards faster, digital payment platforms, impacting fee revenue for older methods.

Such offerings often operate at a break-even point or even consume capital without generating substantial returns. The cost of maintaining these outdated systems and infrastructure can outweigh the revenue they produce. Financial reports from major banking institutions in the first half of 2024 highlighted the ongoing expense of maintaining physical ATM networks while digital alternatives gained traction, suggesting a potential drag on profitability for these specific segments.

The increase in gross non-accrual loans to $2.5 billion in Q1 2025 signals trouble in specific lending portfolios, pointing to low profitability and likely a weak market position in those areas. These underperforming segments are essentially cash traps, draining resources for management and recovery without yielding sufficient returns.

These portfolios require immediate attention. For instance, if the commercial real estate loan book, which represented 15% of the total loan portfolio in 2024, shows a significant rise in non-accruals, it could severely impact the bank's overall profitability and capital adequacy.

Continuous, vigilant monitoring and decisive strategic actions are crucial to curb the negative drag these portfolios exert on the bank's financial health. Without intervention, these cash traps can significantly hinder growth and shareholder value.

Operational processes that haven't embraced digital transformation or automation are essentially stuck in the past. Think of manual data entry or paper-based workflows – these are prime examples of outdated systems.

These inefficiencies directly impact a bank's profitability. For instance, a study by McKinsey in 2024 found that financial institutions with highly automated operations saw a 20-30% reduction in operational costs compared to those with manual processes. This means outdated processes contribute to a lower efficiency ratio, signaling that a lot of effort is being expended for minimal output or profit.

Addressing these "dogs" in the BCG matrix, which represent these outdated processes, demands substantial investment. Without modernization, these areas will continue to drain resources, slow down operations, and ultimately make the bank less competitive in the rapidly evolving financial landscape.

Non-Strategic or Limited-Reach International Operations

Non-strategic or limited-reach international operations, often found in the Dogs quadrant of the Butterfield BCG Matrix, represent business units with low market share in industries experiencing little to no growth. These segments might include smaller, specialized financial services offered in specific international hubs that haven't scaled effectively. For example, a regional wealth management service in a less developed market, despite being in a financial center, might struggle to attract significant assets under management, potentially holding less than 1% market share in its niche by mid-2024.

These operations often consume resources without generating substantial returns, hindering overall portfolio performance. Their limited growth prospects and low market share make them prime candidates for a strategic review.

- Low Market Share: Operations holding a minimal percentage of their target market, often below 5%.

- Limited Growth Prospects: Industries or segments with projected annual growth rates of less than 3% in the coming years.

- Resource Drain: Units requiring significant investment for maintenance or minimal expansion, yielding low or negative returns.

- Divestment Potential: Segments that could be sold or phased out to reallocate capital to more promising areas of the business.

Services Highly Dependent on Declining Market Segments

Services heavily reliant on declining market segments, often termed Dogs in the Butterfield BCG Matrix, face considerable challenges. These are services tied to industries experiencing long-term contraction or rapid technological obsolescence. For instance, traditional landline telephone services have seen a drastic decline with the rise of mobile communication. In 2024, the number of residential landline subscriptions continued its downward trend, with many households opting for mobile-only plans, a pattern observed globally.

These services typically possess low market share within a shrinking market, making them unattractive for investment. An example could be the printing of physical encyclopedias, a market that has been decimated by digital alternatives. Companies offering such services must carefully assess their future prospects, as continued investment may not yield significant returns. The focus often shifts to managing decline or finding niche opportunities for residual demand.

- Declining Market Reliance: Services tied to industries with sustained contraction, such as physical media sales or legacy software support for rapidly outdated systems.

- Low Growth and Share: These offerings typically experience minimal to negative growth and hold a small portion of an ever-diminishing market. For example, the global market for physical video rentals saw revenues plummet by over 90% between 2010 and 2023 due to streaming services.

- Strategic Re-evaluation: Businesses must critically evaluate the viability of continuing these services, considering divestment, phasing out, or focusing on cost-minimization strategies.

Dogs represent business units or offerings with low market share in slow-growing or declining industries. These segments often consume resources without generating significant returns, acting as a drag on overall performance. For instance, in 2024, many traditional media companies saw their print advertising revenue continue to decline, with some reporting a year-over-year drop exceeding 15% for their newspaper divisions.

These offerings are characterized by their inability to gain traction in their respective markets, often due to outdated technology, changing consumer preferences, or intense competition from more agile players. Consider the market for physical media like CDs, which in 2024 continued to be overshadowed by digital streaming services, holding a negligible market share in music consumption.

The strategic imperative for Dogs is often to minimize losses, divest, or find niche markets. For example, a bank might choose to close underperforming branches rather than invest in their modernization if the digital channel is capturing the majority of customer interactions. In 2024, several large retail banks announced plans to reduce their physical footprint, closing hundreds of branches nationwide.

These units require careful management to avoid becoming significant cash drains. Their low profitability and limited future potential necessitate a clear strategy, whether it involves a managed decline or a complete exit from the market to reallocate capital to more promising ventures.

| Business Unit Example | Market Share (2024) | Market Growth Rate (Projected) | Profitability (2024) |

|---|---|---|---|

| Legacy Software Support | 3% | -5% | Negative |

| Print Magazine Advertising | 4% | -8% | Break-even |

| Physical Media Sales (e.g., DVDs) | 2% | -10% | Low Profit |

Question Marks

Developing new digital products and platforms falls under the Question Mark category of the BCG Matrix. These are typically found in high-growth markets, such as the expanding digital banking sector, but currently hold a low market share because they are new or in the early stages of customer adoption. For instance, many neobanks launched in the mid-2010s are still working to capture significant market share, despite the rapid growth of digital finance.

These ventures demand substantial initial investment in research, development, and marketing to build awareness and encourage customer uptake. The success of these digital products is inherently uncertain, with many failing to gain traction. However, they possess the potential to evolve into Stars within the portfolio if the company can successfully increase their market share rapidly.

By 2024, the global digital banking market was projected to reach over $30 trillion in transaction value, highlighting the immense growth potential. Companies investing in new digital offerings within this space are essentially betting on capturing a piece of this expanding pie. For example, a bank investing heavily in a new AI-powered financial advisory app might see initial low adoption but could become a market leader if the technology proves superior and customer trust is built, transforming it from a Question Mark into a Star.

Butterfield could explore emerging niche lending segments, such as renewable energy project finance or specialized technology equipment leasing. These areas often present high growth potential but require significant upfront investment in expertise and infrastructure.

Entering these nascent markets means Butterfield would likely begin with a low market share. The bank would need to allocate substantial resources to marketing, refining risk assessment models tailored to these unique segments, and building the necessary operational capabilities to compete effectively.

While the success of these ventures is not guaranteed, a strategic entry and successful build-out could unlock substantial future returns for Butterfield. For instance, the global green finance market was projected to reach $50 trillion by 2025, demonstrating the scale of opportunity in specialized lending.

Butterfield's strategic investments in technology infrastructure, such as upgrading its core banking system and expanding cloud capabilities, align with the Question Marks quadrant of the BCG Matrix. These are significant outlays aimed at future growth and operational excellence, not immediate profit centers.

These initiatives, costing hundreds of millions globally for similar institutions in 2024, are crucial for enhancing digital client experiences and boosting internal efficiency. While direct revenue is not yet apparent, these investments are foundational for building a competitive advantage in an increasingly digital financial landscape.

The success of these tech investments is pivotal; they represent high-risk, high-reward opportunities. If successful, they can transition into Stars, unlocking new revenue streams and substantial cost reductions, thereby solidifying Butterfield's market position in the long term.

Initiatives to Attract Younger Demographics

Butterfield needs to focus on initiatives that resonate with younger, digitally-savvy customers. This includes developing user-friendly mobile banking apps and offering innovative digital payment solutions. For instance, a campaign highlighting easy-to-use budgeting tools or rewards programs for first-time investors could be highly effective.

Attracting this demographic is crucial for Butterfield's long-term growth, as they represent the future of banking. While their current market share might be low, significant investment in digital channels and targeted marketing can capture this high-potential segment. Think about partnerships with popular fintech apps or social media influencer collaborations.

- Digital Product Development: Launching a revamped mobile banking app with enhanced features like P2P payments and personalized financial insights.

- Targeted Marketing Campaigns: Utilizing social media platforms and digital advertising to promote services relevant to Gen Z and Millennials, such as student loan refinancing options or entry-level investment accounts.

- Financial Literacy Programs: Offering online workshops or webinars focused on budgeting, saving, and investing for young adults to build brand loyalty and financial confidence.

- Partnerships: Collaborating with universities or popular lifestyle brands to offer exclusive banking benefits to younger customers.

Exploration of New Geographic Markets or Service Lines

Venturing into new geographic markets or launching novel service lines represents a significant strategic move for Butterfield, akin to developing new Stars in the BCG matrix. These initiatives carry substantial risk and require considerable upfront investment to build brand recognition and capture market share in unfamiliar territories or with unproven offerings. However, the potential rewards are equally high, offering the chance to diversify revenue streams and establish future growth engines.

- Risk and Investment: Entering a new market, for instance, could involve setting up new branches or digital infrastructure, with initial costs potentially running into millions for major expansions. Similarly, developing and marketing a completely new financial product requires substantial R&D and promotional expenditure.

- Uncertainty and Potential: While success is not guaranteed, a successful pilot program in a high-growth emerging market could yield substantial returns, potentially exceeding 15-20% annual growth if market penetration is achieved.

- Diversification: Successful diversification through new markets or services can reduce reliance on existing, potentially maturing product lines or regions, thereby enhancing overall business resilience.

- Future Stars: A well-executed expansion into a market like Southeast Asia, with its rapidly growing middle class and increasing demand for financial services, could transform into a future Star for Butterfield, mirroring the growth trajectory seen by established players in similar markets.

Question Marks represent new ventures in high-growth markets with low market share, demanding significant investment and offering uncertain but potentially high rewards. These are businesses that could become Stars if successful, or Dogs if they fail to gain traction.

By 2024, the digital payments market alone was projected to exceed $2 trillion globally, illustrating the high-growth potential of many Question Mark categories. Companies in this space are essentially placing bets on future market dominance, with many new fintech solutions emerging annually.

The success rate for new products in these dynamic sectors can be low, with estimates suggesting that up to 80% of new product launches may not achieve their initial business objectives, underscoring the inherent risk.

Butterfield's strategic focus on developing new digital financial products and expanding into emerging markets places them squarely in the Question Mark quadrant of the BCG Matrix.

| Initiative | Market Growth | Market Share | Investment Required | Potential Outcome |

|---|---|---|---|---|

| New Digital Payment App | High (e.g., 15% CAGR projected for global digital payments through 2027) | Low (New entrant) | High (R&D, Marketing) | Star (if successful) or Dog (if not) |

| Expansion into Southeast Asian Markets | High (e.g., GDP growth averaging 5%+ in many key countries) | Low (New entrant) | High (Infrastructure, Regulatory Compliance) | Star (if successful) or Dog (if not) |

| AI-Powered Financial Advisory Service | High (Growing demand for personalized finance) | Low (Early stage) | High (Technology development, Data acquisition) | Star (if successful) or Dog (if not) |

BCG Matrix Data Sources

Our Butterfield BCG Matrix is constructed using robust data, including financial statements, market share analysis, industry growth rates, and competitive landscape reports to deliver strategic insights.