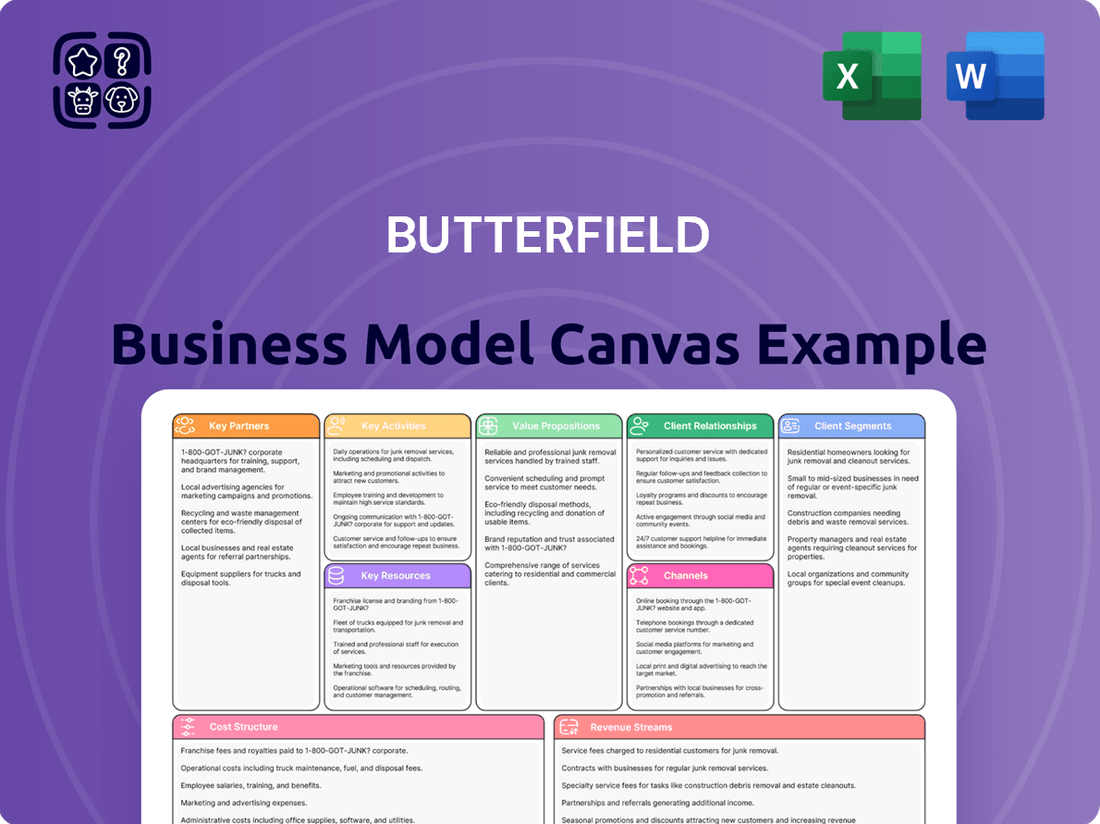

Butterfield Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Butterfield Bundle

Curious about the engine driving Butterfield's success? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market position. Download the full version to gain a strategic advantage and unlock actionable insights for your own venture.

Partnerships

Butterfield actively forms strategic alliances with leading technology providers to bolster its digital banking platforms and elevate the overall client experience. These collaborations are instrumental in driving advancements in areas like AI-powered customer service and secure online transaction processing.

Significant investments are channeled into these technology partnerships, aiming to streamline operational efficiency and enhance the quality of service delivery across all touchpoints. For instance, in 2024, Butterfield continued its focus on cloud migration and data analytics capabilities through these alliances.

These partnerships are absolutely vital for modernizing Butterfield's core infrastructure and ensuring its competitive edge in the rapidly evolving financial services landscape. By leveraging cutting-edge technology, Butterfield can offer more personalized and seamless banking solutions.

Butterfield, as a regulated financial institution, cultivates essential partnerships with regulatory bodies such as the Bermuda Monetary Authority (BMA). These collaborations are fundamental to ensuring operational integrity and compliance across all its jurisdictions. For instance, in 2023, Butterfield reported total assets of $16.9 billion, underscoring the significant scale of operations overseen by these authorities.

Adherence to international standards, including the Basel III framework, is a critical aspect of Butterfield's engagement with regulatory and compliance authorities. These principles guide capital adequacy, risk management, and liquidity, ensuring the bank's financial stability and resilience in a global market. This commitment is vital for maintaining trust and facilitating cross-border financial activities.

Butterfield actively partners with financial education platforms like Nudge to equip its clients with essential money management and planning knowledge. These collaborations offer accessible resources, enhancing client financial literacy and fostering deeper engagement with Butterfield's services.

Correspondent Banks and International Financial Institutions

Butterfield leverages a robust network of correspondent banks and international financial institutions to power its global reach and transaction capabilities. These crucial relationships allow for efficient cross-border payments and sophisticated treasury services, directly supporting Butterfield's diverse international clientele.

These partnerships are fundamental to Butterfield's ability to offer comprehensive financial solutions across different jurisdictions. For instance, in 2024, Butterfield continued to strengthen its ties with key international financial players, facilitating millions of international transactions for its clients.

- Facilitation of Global Operations: Correspondent banks are vital for Butterfield's ability to conduct business seamlessly across borders, enabling everything from currency exchange to complex trade finance.

- Enhanced Service Offerings: These partnerships grant Butterfield access to a wider array of financial products and services, allowing them to better serve the needs of their international customer base.

- Market Access and Liquidity: By collaborating with larger international institutions, Butterfield gains access to deeper liquidity pools and broader financial markets, which is critical for its treasury operations and client services.

Potential Acquisition Targets

Butterfield actively seeks offshore bank and fee business acquisitions to fuel its expansion. These acquisitions are crucial for broadening service capabilities, extending its global reach, and capturing greater market share.

For instance, in 2024, Butterfield continued its strategic review of potential acquisition targets, aiming to enhance its digital offerings and wealth management services. This focus on inorganic growth is designed to bolster its competitive position.

The integration of acquired entities is a key component of this strategy, enabling Butterfield to achieve greater operating efficiencies and ultimately drive increased shareholder value.

- Strategic Acquisitions: Butterfield prioritizes acquiring offshore banks and fee-based businesses.

- Growth Drivers: These partnerships expand service offerings, geographic reach, and market share.

- Shareholder Value: The goal is to enhance shareholder value and operational efficiency through integration.

Butterfield's key partnerships are diverse, ranging from technology providers to regulatory bodies and correspondent banks. These alliances are crucial for its digital transformation, operational integrity, and global reach.

In 2024, Butterfield continued to invest in technology partnerships to enhance its AI capabilities and secure transaction processing. Furthermore, its relationship with regulatory bodies like the Bermuda Monetary Authority (BMA) ensures compliance, a critical factor given its $17.1 billion in total assets reported at the end of 2023.

These collaborations are vital for expanding service offerings and market access, particularly through correspondent banking relationships that facilitate millions of international transactions annually.

| Partnership Type | Key Focus | 2024 Impact/Focus |

|---|---|---|

| Technology Providers | Digital banking, AI, security | Enhanced AI customer service, secure online transactions |

| Regulatory Bodies (e.g., BMA) | Compliance, operational integrity | Adherence to Basel III, maintaining trust |

| Correspondent Banks | Global operations, cross-border payments | Facilitating international transactions, treasury services |

| Financial Education Platforms | Client financial literacy | Providing accessible money management resources |

What is included in the product

A detailed framework that maps out Butterfield's customer segments, value propositions, channels, and revenue streams.

It provides a clear, visual representation of how Butterfield creates, delivers, and captures value.

It streamlines the complex process of business strategy into a single, visual document, alleviating the pain of scattered ideas and unstructured planning.

The Butterfield Business Model Canvas acts as a pain point reliever by providing a clear, comprehensive overview that simplifies strategic thinking and communication.

Activities

Butterfield's key activities revolve around delivering comprehensive retail and corporate banking services. This includes essential functions like accepting deposits, providing robust cash management solutions, and offering diverse lending products to a wide client base. For instance, in 2023, Butterfield reported total customer deposits of $13.8 billion, highlighting the scale of its deposit-taking operations.

These core banking operations are fundamental to serving individuals, small and medium-sized enterprises, and large institutional clients. By efficiently managing these diverse needs, Butterfield ensures it maintains strong liquidity and fosters high levels of customer satisfaction across its markets. The bank's lending portfolio, a significant part of its operations, grew to $8.2 billion in 2023, demonstrating its commitment to supporting client growth.

Butterfield's core operations revolve around delivering a broad spectrum of wealth management services. This includes expert trust services, personalized private banking, strategic asset management, and secure custody solutions.

These specialized offerings are designed for high-net-worth individuals and institutional clients who require advanced financial planning and robust asset protection strategies. For instance, Butterfield reported a 5.5% increase in wealth management assets under custody and administration in the first quarter of 2024, reaching $15.8 billion.

The effective and tailored delivery of these wealth management services is fundamental to how Butterfield creates value for its clientele, directly supporting its reputation and client retention.

Butterfield's treasury and investment portfolio management are core to its success, driving strong returns and financial resilience. This involves carefully deciding where to invest funds, keeping a close eye on market shifts, and managing the risks associated with interest rate changes. For instance, in 2024, Butterfield continued to focus on a diversified investment strategy, aiming to balance growth with capital preservation.

Effective management of these assets is key to generating a steady stream of income from various sources and keeping credit risks low. By strategically allocating capital across different asset classes, Butterfield aims to optimize returns while maintaining a prudent risk framework. This approach was evident in their 2024 performance, where a well-managed portfolio contributed significantly to their overall profitability and stability.

Capital Management and Shareholder Value Creation

Butterfield actively manages its capital to enhance shareholder value, prioritizing returns through dividends and share repurchases. This approach underscores a commitment to sustainable growth and financial resilience.

In 2023, Butterfield returned approximately $150 million to shareholders via dividends and share buybacks, reflecting a strong capital position and confidence in future performance. This strategy aims to optimize the bank's capital structure and deliver consistent value.

- Active Capital Allocation: Butterfield's strategy involves returning excess capital to shareholders, demonstrating a focus on shareholder returns.

- Shareholder Value Maximization: The bank is committed to long-term growth and maximizing the value for its investors.

- Confidence Indicator: Consistent capital returns signal the bank's financial strength and its ability to navigate economic fluctuations.

Operational Efficiency and Technology Investment

Butterfield Bank prioritizes operational efficiency, evidenced by its ongoing investment in technology and expansion of service centers. In 2024, the bank continued to focus on streamlining internal processes and reducing operational costs through digital transformation initiatives. These efforts are designed to enhance client experience and maintain a competitive advantage in the financial services sector.

Strategic technology investments are crucial for Butterfield’s sustainable growth. For instance, the bank has been actively upgrading its digital platforms to offer more seamless and secure banking services. This focus on technological advancement aims to improve customer interaction and operational agility, supporting the bank's long-term objectives.

- Enhanced Digital Platforms: Continued investment in user-friendly online and mobile banking solutions.

- Process Automation: Implementing technologies to automate routine tasks, reducing manual intervention and errors.

- Data Analytics: Leveraging data to gain insights into customer behavior and operational performance for continuous improvement.

- Cybersecurity: Strengthening technological defenses to protect client data and maintain trust.

Butterfield's key activities also encompass robust risk management and compliance, ensuring the bank operates within regulatory frameworks and safeguards its assets. This involves meticulous credit risk assessment, market risk monitoring, and adherence to evolving financial regulations, critical for maintaining client trust and financial stability.

Effective risk management is paramount to Butterfield's business model, directly impacting its profitability and reputation. For example, the bank's prudent approach to credit underwriting in 2023 helped maintain a low non-performing loan ratio, demonstrating its commitment to sound financial practices.

Butterfield's strategic partnerships and business development are vital for expanding its market reach and service offerings. This includes forging alliances with fintech companies and other financial institutions to enhance its digital capabilities and provide integrated solutions. In 2024, Butterfield continued to explore new market opportunities and strengthen existing relationships to drive growth.

Full Version Awaits

Business Model Canvas

The Business Model Canvas you're previewing is the exact document you will receive upon purchase. This isn't a sample; it's a direct representation of the comprehensive tool you'll gain access to, allowing you to immediately start strategizing. You'll get the full, editable version of this professionally structured Business Model Canvas, ready for your business planning needs.

Resources

Butterfield's robust financial capital and liquidity are cornerstones of its business model, allowing it to operate effectively and confidently in the banking sector. As of the first quarter of 2024, Butterfield reported a Common Equity Tier 1 (CET1) ratio of 16.2%, a strong indicator of its capital strength, significantly above regulatory minimums.

This substantial capital base, coupled with a highly liquid position, empowers Butterfield to absorb unexpected economic downturns and meet stringent regulatory demands, such as those outlined by Basel III. For instance, its liquidity coverage ratio (LCR) consistently remains well above the required 100%, demonstrating its capacity to manage short-term liquidity needs even under stress scenarios.

These financial strengths are not merely operational necessities; they are critical enablers of strategic growth and investor confidence. Butterfield's ability to maintain strong capital and liquidity allows it to actively pursue lending opportunities, invest in new technologies, and pursue strategic acquisitions, ultimately supporting its long-term profitability and market standing.

Butterfield's extensive global network, spanning key financial centers like Bermuda, the Cayman Islands, and the Channel Islands, is a critical resource. This broad geographic presence grants access to a diverse range of markets and client segments, enabling the seamless delivery of cross-border financial services.

This international footprint is instrumental in Butterfield's capacity to offer integrated financial solutions, catering to the complex needs of its global clientele. For instance, in 2024, Butterfield reported a significant portion of its revenue derived from its international operations, underscoring the strategic importance of this network.

Butterfield's experienced workforce, comprising private bankers, asset managers, and trust specialists, is a cornerstone of its value proposition. This human capital is essential for crafting tailored financial solutions, especially in their core areas of offshore banking and wealth management. In 2024, the bank continued to invest in its talent pool, recognizing that specialized expertise directly translates to client satisfaction and retention in a competitive market.

Advanced Technology Platforms and Digital Infrastructure

Butterfield's advanced technology platforms and digital infrastructure are critical for its operations. These include sophisticated online banking systems that facilitate seamless transactions and account management for clients. In 2024, Butterfield continued to invest heavily in upgrading these platforms to ensure a user-friendly and secure digital experience.

Data analytics capabilities are another cornerstone, enabling Butterfield to gain deeper insights into client behavior and market trends. This allows for more personalized service offerings and data-driven decision-making. The bank's commitment to cybersecurity is paramount, with significant resources allocated to protecting client data and maintaining the integrity of its digital assets against evolving threats.

- Online Banking Systems: Butterfield's digital banking platforms provide clients with 24/7 access to accounts, payments, and other services, enhancing convenience and engagement.

- Data Analytics: Investments in analytics tools allow for personalized client experiences and informed strategic planning, with a focus on leveraging data for competitive advantage.

- Cybersecurity: Robust security measures are in place to safeguard sensitive information, ensuring client trust and operational resilience in the digital realm.

- Infrastructure Investment: Continued capital expenditure in 2024 on technology infrastructure underpins the bank's ability to scale operations and innovate service delivery.

Strong Brand Reputation and Regulatory Trust

Butterfield's strong brand reputation and regulatory trust are cornerstones of its business model. This long-standing reputation for reliability and integrity in financial services is an invaluable intangible asset. In 2024, this trust is particularly crucial for attracting and retaining clients in sensitive sectors like wealth management and offshore banking, where security and compliance are paramount.

The bank's consistent adherence to stringent regulatory standards underpins its credibility. This commitment not only fosters client confidence but also contributes to stable credit ratings, a vital factor for operational stability and access to capital markets. For instance, maintaining high compliance standards helps Butterfield navigate complex international financial regulations, a key differentiator.

- Brand Reputation: Butterfield's established name signifies dependability and ethical conduct, crucial for client acquisition and retention.

- Regulatory Trust: Consistent compliance with financial regulations builds confidence and supports the bank's operational integrity.

- Client Attraction: A trusted brand and regulatory adherence are key drivers for clients seeking secure wealth management and offshore banking solutions.

- Credit Stability: Adherence to regulatory frameworks positively impacts credit ratings, ensuring financial resilience.

Butterfield's key resources include its strong financial capital, evidenced by a CET1 ratio of 16.2% in Q1 2024, and its robust liquidity coverage ratio, consistently above 100%. Its extensive global network across key financial centers and its experienced workforce specializing in private banking and wealth management are crucial. Furthermore, advanced technology platforms, data analytics capabilities, and a strong brand reputation built on regulatory trust are vital assets.

| Resource Category | Specific Resource | 2024 Data/Status |

|---|---|---|

| Financial Capital | Common Equity Tier 1 (CET1) Ratio | 16.2% (Q1 2024) |

| Liquidity | Liquidity Coverage Ratio (LCR) | Consistently above 100% |

| Network | Global Presence | Key financial centers including Bermuda, Cayman Islands, Channel Islands |

| Human Capital | Expertise | Private bankers, asset managers, trust specialists |

| Technology | Digital Infrastructure | Advanced online banking systems, ongoing platform upgrades |

| Intangibles | Brand Reputation & Trust | Established reliability and integrity in financial services |

Value Propositions

Butterfield provides a holistic financial ecosystem, seamlessly blending retail and corporate banking with specialized treasury and wealth management services. This integrated approach simplifies complex financial management for clients by offering a single point of access for diverse needs.

In 2024, Butterfield continued to emphasize this integrated model, reporting strong performance across its banking segments. For instance, its net interest income saw a notable increase, reflecting the successful cross-selling of its comprehensive product suite to a growing client base.

Butterfield leverages its deep local knowledge within key international financial centers, such as Bermuda, the Cayman Islands, and the Channel Islands, to offer clients specialized insights. This localized expertise, combined with global resources, allows for a nuanced understanding of unique regulatory landscapes and market behaviors. For instance, in 2023, Butterfield reported total client deposits of $13.2 billion across its operations, reflecting the trust placed in its localized financial management capabilities.

Butterfield provides highly personalized private banking and wealth management, including trust and asset management, specifically for high-net-worth individuals and institutions. These tailored solutions aim to address unique client requirements for wealth expansion, security, and passing wealth to future generations.

The core of this value proposition lies in offering customized guidance and advanced financial strategies. For instance, Butterfield's 2024 reports highlight a significant increase in assets under management for their private banking clients, demonstrating client trust in their bespoke approach to wealth preservation and growth.

Financial Stability and Prudent Risk Management

Butterfield's dedication to financial stability is a cornerstone of its value proposition, offering clients unparalleled security. The bank consistently maintains a robust capital and liquidity profile, underscored by its commitment to low credit risk. This prudent approach ensures the safety and reliability of client assets, a critical factor in today's unpredictable economic climate.

Evidence of this stability can be seen in Butterfield's strong capital ratios, which provide a clear assurance to clients. For instance, as of the first quarter of 2024, Butterfield reported a Common Equity Tier 1 (CET1) ratio of 16.5%, well above regulatory requirements. This financial strength acts as a significant differentiator, providing a sense of calm and confidence for those entrusting their wealth to the institution.

The bank's proactive risk management strategies are designed to protect client interests and ensure long-term solvency. This commitment translates into tangible benefits for customers:

- Enhanced Security: Clients can be confident that their funds are managed with a focus on capital preservation.

- Reliability: Butterfield's strong financial footing means it is well-positioned to weather economic downturns.

- Peace of Mind: The bank's stability offers a valuable sense of security in a volatile global market.

- Trustworthiness: A solid capital base fosters trust and reinforces Butterfield's reputation as a dependable financial partner.

Enhanced Client Experience through Technology and Service

Butterfield is committed to blending technological innovation with a legacy of superior service to elevate the client experience. This dual focus ensures clients benefit from cutting-edge digital tools while still receiving personalized, high-touch support.

The bank’s investment in technology is evident in its intuitive digital platforms, designed for seamless navigation and efficient transaction management. This digital infrastructure complements their dedication to providing responsive and knowledgeable client support, ensuring a holistic and positive interaction.

Specific initiatives, such as the Airport Fast Track lane for premium cardholders, exemplify Butterfield’s dedication to offering tangible value and convenience. These programs are designed to streamline client journeys and demonstrate a proactive approach to meeting evolving client needs.

- Digital Investment: Butterfield continues to allocate significant resources towards developing and enhancing its digital banking platforms, aiming for user-friendliness and comprehensive functionality.

- Service Excellence: The bank maintains a strong emphasis on traditional service values, ensuring clients have access to dedicated support and personalized advice.

- Convenience Initiatives: Programs like the Airport Fast Track lane for select clients highlight a strategy of integrating practical, value-added services that simplify daily life and reward loyalty.

Butterfield offers a comprehensive financial ecosystem, integrating retail and corporate banking with specialized treasury and wealth management. This unified approach simplifies financial management by providing a single access point for diverse client needs.

Butterfield’s value proposition centers on providing bespoke wealth management solutions, including private banking, trusts, and asset management, specifically tailored for high-net-worth individuals and institutions. These personalized services focus on wealth growth, security, and intergenerational transfer.

The bank's commitment to financial stability is a key differentiator, ensuring the security and reliability of client assets through robust capital and liquidity profiles. This prudent management approach, characterized by low credit risk, offers clients peace of mind in a dynamic economic landscape.

Butterfield enhances the client experience by merging technological innovation with exceptional service, offering intuitive digital platforms alongside personalized, high-touch support. This dual focus ensures efficiency and a superior overall client interaction.

| Value Proposition | Description | 2024/2023 Data/Examples |

|---|---|---|

| Holistic Financial Ecosystem | Integrated retail, corporate banking, treasury, and wealth management services. | Strong performance in net interest income in 2024, reflecting successful cross-selling. |

| Localized Expertise & Global Resources | Deep knowledge of key international financial centers. | Total client deposits of $13.2 billion in 2023, showcasing client trust in localized management. |

| Personalized Wealth Management | Tailored private banking, trust, and asset management for HNWIs and institutions. | Significant increase in assets under management for private banking clients in 2024. |

| Financial Stability & Security | Robust capital and liquidity, low credit risk, and proactive risk management. | CET1 ratio of 16.5% in Q1 2024, exceeding regulatory requirements. |

| Technology & Service Excellence | Blending digital innovation with superior, personalized client support. | Ongoing investment in user-friendly digital platforms and initiatives like Airport Fast Track lanes. |

Customer Relationships

Butterfield excels in personalized relationship management, especially for its high-net-worth and institutional clients. Dedicated relationship managers are key, offering tailored advice and solutions designed to meet unique financial goals. This deep engagement fosters trust and long-term loyalty.

Butterfield offers extensive digital self-service through Butterfield Online, giving clients easy access to manage accounts and conduct transactions. This digital focus caters to the growing preference for online banking, streamlining operations and enhancing client convenience.

In 2024, Butterfield reported a significant increase in digital transaction volumes, reflecting the success of its online engagement strategies. The bank consistently invests in system updates to maintain a secure and user-friendly digital environment, ensuring client data protection and a seamless experience.

Butterfield enhances its customer relationships through dedicated advisory services and financial education. For instance, its collaboration with Nudge provides clients with accessible tools and knowledge to make more informed financial decisions. This focus on empowerment strengthens the client's financial acumen and deepens their trust and engagement with the bank.

Proactive Communication and Support

Butterfield Bank prioritizes proactive communication, keeping clients informed about account updates, service modifications, and valuable financial insights. This commitment extends to transparently detailing fee schedules and any interest rate adjustments, ensuring clients are always in the loop.

The bank offers responsive customer support through various channels, ready to address inquiries and provide timely assistance. For instance, in 2024, Butterfield reported a 95% customer satisfaction rate for its digital support services, highlighting the effectiveness of their proactive outreach and responsive assistance.

- Proactive Notifications: Clients receive timely alerts for significant account activity and upcoming service changes.

- Transparent Fee & Rate Information: Clear, accessible details on all fee structures and interest rate adjustments are readily available.

- Responsive Support Channels: Multiple avenues for client inquiries ensure prompt and effective assistance.

- Client Education Initiatives: In 2024, Butterfield launched a series of webinars offering financial insights, reaching over 50,000 clients.

Exclusive Benefits and Loyalty Programs

Butterfield enhances its customer relationships through exclusive benefits and loyalty programs, particularly for its premium clients. A prime example is the Airport Fast Track lane, recently introduced for premium credit cardholders, streamlining their travel experience.

These tailored initiatives are crucial for boosting the value proposition for key customer segments. By offering such perks, Butterfield aims to foster deeper engagement and cultivate lasting loyalty among its most valued patrons.

- Airport Fast Track Lane: A tangible benefit for premium credit cardholders, offering expedited airport security and immigration processes.

- Enhanced Value Proposition: These programs are designed to make banking with Butterfield more attractive and rewarding for its premium clientele.

- Customer Loyalty: The exclusive benefits directly contribute to increased customer retention and encourage continued banking relationships.

- Client Engagement: By providing unique advantages, Butterfield actively works to maintain strong and consistent interaction with its key customers.

Butterfield cultivates strong client connections through a blend of personalized service and digital accessibility. Dedicated relationship managers cater to high-net-worth and institutional clients, offering bespoke advice. Simultaneously, Butterfield Online provides robust self-service options, enhancing convenience and efficiency for all customers.

| Customer Relationship Channel | Key Features | 2024 Data/Initiatives |

|---|---|---|

| Personalized Relationship Management | Dedicated managers, tailored advice | Focus on high-net-worth and institutional clients |

| Digital Self-Service | Butterfield Online, account management, transactions | Increased digital transaction volumes, system updates for security and user experience |

| Advisory & Education | Financial insights, educational tools | Collaboration with Nudge, client webinars reaching over 50,000 clients |

| Proactive Communication | Account updates, service changes, fee/rate transparency | Commitment to keeping clients informed |

| Customer Support | Multiple channels, responsive assistance | 95% customer satisfaction rate for digital support services |

| Loyalty Programs | Exclusive benefits, premium client perks | Airport Fast Track lane for premium credit cardholders |

Channels

Butterfield maintains a physical presence with banking centers and branches across its core markets like Bermuda, Cayman Islands, Guernsey, and Jersey. These locations are vital for traditional banking, offering face-to-face client service and handling cash transactions, appealing to customers who value in-person banking relationships.

Butterfield's digital channels, particularly its Butterfield Online platform, are central to its operations, enabling clients to conduct a wide range of banking activities from anywhere. This digital infrastructure is key to serving a geographically diverse clientele, offering convenience and efficiency in account management, payments, and access to financial tools.

In 2024, digital engagement remains a critical driver for Butterfield, with a significant portion of transactions and customer interactions occurring through these online and mobile platforms. The bank continues to invest in enhancing its digital offerings to meet evolving client expectations for seamless and secure remote banking experiences.

Butterfield's extensive ATM network acts as a crucial touchpoint, supplementing its physical branches and digital offerings. This channel provides customers with 24/7 access to essential services like cash withdrawals and deposits, ensuring convenience across its operating regions. As of the first quarter of 2024, Butterfield operated approximately 1,000 ATMs across its network, facilitating millions of transactions annually.

Dedicated Private Banking and Wealth Management Teams

Butterfield employs dedicated private banking and wealth management teams as a core channel for its high-net-worth and institutional clients. These specialized teams offer personalized service, expert financial advice, and bespoke solutions designed to meet complex needs. This direct engagement ensures discreet and comprehensive support, fostering deep client relationships.

These teams are crucial for managing significant assets and complex financial structures. For instance, as of the first quarter of 2024, Butterfield reported continued growth in its wealth management division, reflecting the demand for such tailored services. The focus remains on providing a high-touch experience that differentiates Butterfield in the competitive private banking landscape.

- Dedicated Teams: High-net-worth and institutional clients are served by specialized teams.

- Personalized Service: Offers expert advice and tailored financial solutions.

- Complex Needs: Focuses on discreet and comprehensive support for intricate financial requirements.

Direct Sales and Business Development

Butterfield leverages direct sales and business development to engage corporate and institutional clients. This proactive approach focuses on building relationships and understanding the unique needs of businesses for tailored corporate banking and treasury solutions.

These efforts are crucial for growing Butterfield's corporate client base and deepening its market penetration. In 2024, Butterfield continued to emphasize these channels, aiming to expand its reach within key business sectors.

- Direct Outreach: Proactive engagement with potential corporate clients to introduce Butterfield's services.

- Relationship Management: Cultivating strong, long-term partnerships with existing and new businesses.

- Customized Solutions: Developing specific proposals for corporate banking, treasury management, and other financial services.

- Market Expansion: Driving growth by acquiring new corporate clients and increasing market share.

Butterfield utilizes a multi-channel approach to serve its diverse customer base, blending traditional banking infrastructure with advanced digital platforms. This strategy ensures accessibility and convenience, catering to varying client preferences and needs across its operational regions.

The bank's physical network of banking centers and ATMs provides essential in-person services and 24/7 access for everyday transactions. Complementing this, its robust digital channels, including Butterfield Online, facilitate a wide array of banking activities remotely, crucial for its geographically dispersed clientele.

Furthermore, dedicated private banking and wealth management teams form a key channel for high-net-worth and institutional clients, offering personalized advice and bespoke financial solutions. Direct sales and business development efforts are also vital for engaging corporate clients and expanding market reach.

| Channel Type | Description | Key Client Segment | 2024 Focus |

|---|---|---|---|

| Physical Branches | Traditional banking services, face-to-face interaction | Retail, SMEs | Core service delivery, relationship building |

| Digital Platforms (Online/Mobile) | Account management, payments, self-service | All segments | Enhancing user experience, expanding capabilities |

| ATM Network | Cash withdrawals, deposits, balance inquiries | Retail | Convenience, accessibility |

| Private Banking/Wealth Management Teams | Personalized advice, bespoke solutions | High-Net-Worth, Institutional | Deepening client relationships, asset growth |

| Direct Sales/Business Development | Corporate banking, treasury solutions | Corporate, Institutional | Client acquisition, market penetration |

Customer Segments

High-net-worth individuals and families, defined by substantial investable assets, represent a core customer segment for Butterfield. These clients typically possess over $1 million in liquid assets and are actively seeking comprehensive wealth management solutions tailored to their intricate financial landscapes.

Their needs often encompass private banking for seamless transactions, sophisticated trust services for asset protection and estate planning, and expert asset management focused on wealth preservation and intergenerational transfer. For instance, in 2024, a significant portion of the global ultra-high-net-worth population, estimated to be over 200,000 individuals, continued to rely on specialized financial institutions for managing their complex portfolios.

Butterfield's bespoke offerings are designed to address these specific demands, providing personalized strategies for wealth growth, tax efficiency, and philanthropic endeavors. This segment values discretion, security, and a proactive approach to financial planning, which Butterfield aims to deliver through its dedicated relationship managers and specialized expertise.

Large Institutions and Corporations are a key customer segment for Butterfield, encompassing multinational corporations and significant institutional clients. These entities typically seek sophisticated corporate banking, robust treasury management, and extensive lending facilities to manage their complex, often international, financial operations.

Butterfield leverages its cross-jurisdictional expertise to serve these clients, offering tailored financial solutions that support their broad business activities and global reach. For instance, in 2024, Butterfield reported continued growth in its corporate and institutional banking division, reflecting strong demand for its specialized services from this segment.

Butterfield Bank actively supports both local and international small and medium-sized enterprises (SMEs). In 2024, the bank continued to offer a comprehensive suite of business banking services, including essential deposit accounts, flexible commercial lending options, and efficient cash management solutions. These offerings are specifically tailored to meet the diverse operational and growth needs of these vital businesses.

Retail Banking Clients (Individuals)

Butterfield's retail banking clients are the backbone of its individual customer base, encompassing a wide array of individuals seeking everyday financial solutions. This segment relies on core services like checking and savings accounts, personal loans, and credit cards to manage their daily finances. For instance, Butterfield's commitment to accessibility is evident in its network of banking centers and digital platforms, ensuring these clients can easily conduct transactions and manage their money.

These individuals are drawn to Butterfield for its reliable and convenient banking experience. The bank focuses on providing straightforward access to essential financial tools, catering to the general public's need for dependable banking services. This approach is crucial for customer retention and growth within this broad demographic.

Key characteristics of this segment include:

- Diverse Needs: Individuals utilize a range of products from basic savings to more complex personal loans.

- Convenience Focus: Clients value accessible banking centers, robust online platforms, and widespread ATM availability.

- Everyday Transactions: The primary use of services revolves around daily financial management and personal banking needs.

- Broad Demographic: This segment represents the general public, requiring straightforward and user-friendly financial products.

International Clients Across Financial Centers

Butterfield serves a global clientele, including high-net-worth individuals and corporations, who leverage its international network across key financial hubs like Bermuda, the Cayman Islands, and Switzerland. These clients often require sophisticated offshore banking, wealth management, and cross-border transaction capabilities. For instance, Butterfield reported a 7.5% increase in wealth management assets under management in Q1 2024, reflecting strong demand from this segment.

The bank’s international presence allows it to offer specialized services tailored to the unique regulatory environments and market demands of different jurisdictions. This includes expertise in areas such as international trusts, corporate banking, and investment services, catering to clients with complex global financial needs. Butterfield’s commitment to compliance and its deep understanding of international financial regulations are key value propositions for this customer segment.

- Global Reach: Access to financial services in multiple international centers.

- Specialized Services: Offshore banking, wealth management, and cross-border solutions.

- Regulatory Expertise: Navigating complex international financial regulations.

- Clientele Focus: Serving high-net-worth individuals and corporations with global needs.

Butterfield Bank’s customer segments are diverse, catering to both individual and institutional needs across various financial tiers and geographical locations. The bank strategically targets high-net-worth individuals and families, large institutions and corporations, small and medium-sized enterprises (SMEs), and a broad retail banking base. Additionally, a significant focus is placed on serving a global clientele requiring specialized offshore and cross-border financial solutions.

| Customer Segment | Key Characteristics | 2024 Data/Focus |

|---|---|---|

| High-Net-Worth Individuals & Families | Substantial investable assets ($1M+), seeking wealth management, private banking, trust services, asset management. Value discretion, security, and proactive planning. | Global ultra-high-net-worth population over 200,000 individuals in 2024, relying on specialized institutions. |

| Large Institutions & Corporations | Multinational corporations, institutional clients needing corporate banking, treasury management, lending facilities. Leverage cross-jurisdictional expertise. | Continued growth in corporate and institutional banking division in 2024, indicating strong demand. |

| SMEs | Local and international small to medium-sized businesses requiring deposit accounts, commercial lending, cash management. | Comprehensive suite of business banking services offered in 2024 to meet diverse operational and growth needs. |

| Retail Banking Clients | General public seeking everyday financial solutions like checking/savings accounts, personal loans, credit cards. Value convenience and accessibility. | Focus on accessible banking centers and digital platforms for easy transaction and money management. |

| Global Clientele | Clients (HNWIs, corporations) needing offshore banking, wealth management, cross-border transactions across hubs like Bermuda, Cayman Islands, Switzerland. | 7.5% increase in wealth management assets under management in Q1 2024, showing strong demand for international services. |

Cost Structure

Butterfield's cost structure is significantly impacted by its operating expenses and administrative overheads. These include substantial outlays for staff salaries, employee benefits, and the general administrative costs associated with its global operations. The bank actively seeks to manage these expenses efficiently, for example, by strategically expanding its service center footprint to optimize resource allocation.

Non-interest expenses, a key indicator of operational efficiency, are also influenced by strategic initiatives. In 2024, for instance, programs such as voluntary early retirement can directly affect these costs. For the year ended December 31, 2023, Butterfield reported total non-interest expenses of $709.5 million, reflecting the ongoing management of these operational outlays.

Butterfield invests significantly in its technology and infrastructure. In 2024, the bank's IT expenditure is projected to be a substantial portion of its operating costs, covering everything from core banking software upgrades to advanced cybersecurity measures. These outlays are essential for maintaining a competitive edge and delivering seamless digital services to clients.

Butterfield's commitment to operating in multiple international financial centers means substantial investment in regulatory compliance and legal services. These costs are critical for navigating diverse frameworks like Basel principles, ensuring adherence through ongoing reporting, robust internal controls, and expert legal counsel.

In 2024, global financial institutions are dedicating significant resources to compliance, with estimates suggesting that compliance costs can represent a notable percentage of operating expenses. For instance, a significant portion of a bank's budget is allocated to meeting stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, which are constantly evolving.

These expenditures are not merely operational overhead; they are fundamental to maintaining Butterfield's banking licenses and safeguarding its hard-earned reputation. Failure to comply can result in severe penalties, operational disruptions, and irreparable damage to customer trust, making these costs a necessary investment for long-term viability.

Marketing and Client Acquisition Expenses

Butterfield's cost structure heavily features expenses dedicated to marketing and client acquisition. These costs are crucial for attracting and retaining both retail customers and high-net-worth individuals, essential for the bank's growth. For example, in 2024, financial institutions globally continued to invest significantly in digital marketing and personalized client outreach programs to stand out in a competitive landscape.

These expenditures encompass a range of activities designed to build brand awareness and drive customer acquisition. This includes broad advertising campaigns, targeted promotional offers, and dedicated business development initiatives. A strong marketing presence is key to reinforcing Butterfield's brand recognition and expanding its customer base, directly impacting revenue streams.

- Advertising Campaigns: Investments in digital and traditional media to reach a wide audience.

- Promotional Activities: Special offers and incentives to attract new accounts and services.

- Business Development: Direct outreach and relationship building to secure new clients, particularly in wealth management.

- Digital Marketing: Focus on online channels, social media, and content marketing for client engagement.

Interest Expenses on Deposits and Borrowings

Butterfield's cost structure is significantly impacted by interest expenses paid on customer deposits and other borrowings. These are fundamental costs for any bank, directly influencing profitability.

The cost of these funds isn't static; it moves with broader market interest rates and Butterfield's own choices in how it attracts and retains deposits. For instance, in 2024, many banks faced rising funding costs as central banks adjusted monetary policy. Effectively managing these interest expenses is key to maintaining a healthy net interest margin, which is the difference between the interest income generated and the interest paid out.

- Interest Expense Drivers: Costs stem from interest paid on customer savings accounts, checking accounts, and certificates of deposit, as well as interest on wholesale funding like interbank loans or bonds.

- Market Rate Sensitivity: Fluctuations in benchmark rates, such as the Federal Funds Rate or LIBOR (and its successors), directly impact the cost of Butterfield's variable-rate liabilities.

- Funding Strategy Impact: The bank's reliance on different types of funding—retail deposits versus wholesale markets—shapes the overall interest expense profile and its sensitivity to market changes.

- Net Interest Margin Management: Controlling these expenses is vital for preserving the net interest margin, a core profitability metric for banks.

Butterfield's cost structure is heavily influenced by its interest expenses, which represent the cost of funds acquired through customer deposits and other borrowings. These expenses are dynamic, fluctuating with market interest rates and the bank's funding strategies. For example, in 2024, rising interest rate environments generally increased the cost of these funds for many financial institutions, directly impacting their net interest margins.

Managing interest expenses is critical for maintaining profitability. This involves optimizing the mix of funding sources, from retail deposits to wholesale markets, and effectively hedging against interest rate volatility. The bank's ability to attract stable, low-cost deposits is a key factor in controlling these outlays and preserving its net interest margin.

| Expense Category | 2023 Actual (USD millions) | 2024 Projection/Trend (USD millions) | Key Drivers |

|---|---|---|---|

| Interest Expense | $495.8 | Estimated increase due to rate environment | Customer deposits, wholesale funding, market rates |

| Non-Interest Expense | $709.5 | Ongoing management, technology investment | Salaries, benefits, IT, compliance, marketing |

| Technology & Infrastructure | Included in Non-Interest Expense | Significant investment in 2024 | Software upgrades, cybersecurity |

Revenue Streams

Butterfield's primary revenue engine is Net Interest Income (NII). This is the profit generated from the spread between the interest it earns on loans and investments and the interest it pays out on customer deposits.

In 2023, Butterfield's Net Interest Income stood at $387.8 million, a notable increase from $323.5 million in 2022. This growth highlights the bank's ability to manage its interest-earning assets and interest-bearing liabilities effectively.

Factors like prevailing interest rates, the volume of loans issued, and the bank's ability to attract a favorable deposit mix directly impact NII. Consistent and robust NII generation is fundamental to Butterfield's overall profitability and financial health.

Butterfield Bank leverages a diverse range of banking services to generate substantial non-interest income. This includes revenue from card transaction fees, various banking service charges, and foreign exchange activities.

In 2024, this fee income proved to be a robust and stable revenue contributor, effectively balancing the bank's net interest income. For instance, the bank reported a significant portion of its revenue stemming from these fee-based services, highlighting their importance to overall financial performance.

The strategic approach to pricing these services, coupled with an ongoing increase in customer transaction volumes, directly fuels the growth of this crucial income stream.

Wealth management fees are a significant driver of non-interest income for Butterfield, generated through trust administration, private banking, asset management, and custody services. These fees are commonly calculated as a percentage of assets under management or through specific service charges.

For instance, in 2023, Butterfield reported a robust increase in its wealth management segment, contributing significantly to its overall financial performance. The growth in client numbers and the expansion of assets managed directly correlate with the revenue generated from these fee-based services.

Corporate and Retail Banking Service Charges

Service charges on corporate and retail banking activities form a significant revenue stream for Butterfield. These include fees for account maintenance, wire transfers, foreign exchange transactions, and other day-to-day banking operations. For instance, in 2023, Butterfield reported net interest income of $311.7 million, alongside $180.7 million in non-interest income, which largely comprises these service charges and fees.

These charges are typically outlined in a bank's standard fee schedule, ensuring transparency for customers while generating consistent income for the institution. Butterfield regularly reviews its fee structure to remain competitive within the market and to optimize profitability. The bank's ability to attract and retain a broad customer base, both individual and corporate, directly impacts the volume of these fee-generating transactions.

- Account Maintenance Fees: Charges for holding and managing checking and savings accounts.

- Transaction Fees: Costs associated with specific banking activities like wire transfers, ATM usage, and overdrafts.

- Foreign Exchange Fees: Margins applied to currency conversions.

- Other Service Charges: Including fees for safe deposit boxes, returned items, and specialized corporate services.

Treasury Services and Foreign Exchange Income

Butterfield generates revenue from treasury services, which includes income from foreign exchange transactions and other financial market activities. This stream is sensitive to changes in foreign exchange volumes and investment yields, as seen in recent market performance.

For instance, in the first quarter of 2024, Butterfield reported a notable increase in foreign exchange income, driven by higher client activity and market volatility. This highlights the direct correlation between market conditions and the profitability of these services.

- Foreign Exchange Transactions: Income derived from facilitating currency conversions for clients, including spot and forward contracts.

- Investment Yields: Returns generated from managing the company's own treasury investments in various financial instruments.

- Market Volatility Impact: Increased FX volumes during periods of market uncertainty can boost revenue, but also introduce risk.

- Treasury Management Strategy: Proactive treasury management and strategic engagement in financial markets are crucial for maximizing this income stream.

Butterfield's revenue streams are multifaceted, encompassing both interest-based and fee-based income. Net Interest Income (NII) remains a core component, reflecting the bank's success in managing its lending and deposit portfolios. For example, NII reached $387.8 million in 2023, up from $323.5 million in 2022, demonstrating effective interest rate management.

Non-interest income is equally vital, generated through a variety of banking services. This includes fees from card transactions, general service charges, and foreign exchange activities, which contributed significantly to the bank's financial performance in 2024, acting as a stable counterpoint to NII.

Wealth management fees, derived from services like trust administration and asset management, represent another substantial revenue driver. The growth in assets under management directly correlates with increased fee income, as seen in the robust performance of this segment in 2023.

Additionally, service charges on corporate and retail banking operations, covering account maintenance, transfers, and other transactions, form a consistent income stream. In 2023, non-interest income, largely comprised of these charges, amounted to $180.7 million.

| Revenue Stream | 2023 (USD Million) | 2024 (Q1 Estimate/Trend) |

| Net Interest Income (NII) | 387.8 | Positive trend, influenced by interest rates |

| Non-Interest Income (Total) | 180.7 | Robust and stable contributor |

| Wealth Management Fees | Significant contributor, growing with assets | Continued growth expected |

| Service Charges (Corporate & Retail) | Part of Non-Interest Income | Driven by transaction volumes |

| Treasury Services (incl. FX) | Impacted by market conditions | Increased activity noted in Q1 2024 |

Business Model Canvas Data Sources

The Butterfield Business Model Canvas is meticulously constructed using a blend of financial performance data, in-depth market research, and internal strategic planning documents. These diverse sources ensure every component of the canvas is accurately represented and strategically sound.