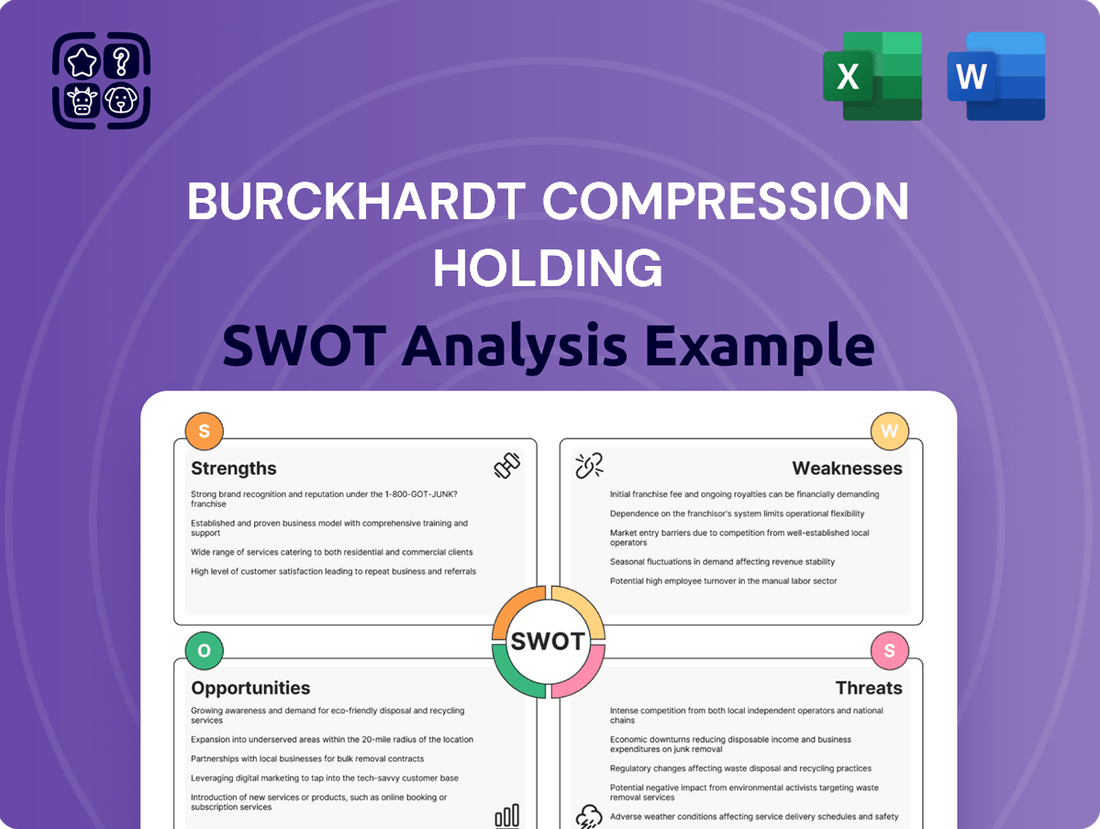

Burckhardt Compression Holding SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Burckhardt Compression Holding Bundle

Burckhardt Compression Holding boasts a strong market position driven by its technological expertise and established reputation in the compressor industry. However, understanding the nuances of its competitive landscape and potential economic headwinds is crucial for informed decision-making.

Want the full story behind Burckhardt Compression Holding's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Burckhardt Compression stands as a preeminent global leader in reciprocating compressor systems, a position that translates into a significant competitive edge. This market dominance is clearly demonstrated by their impressive financial performance, achieving record sales exceeding CHF 1 billion and a net income surpassing CHF 100 million for the first time in fiscal year 2024.

Burckhardt Compression Holding exhibits robust financial performance, marked by consistent growth across key metrics. In fiscal year 2024, the company achieved a significant 12.6% year-on-year increase in sales, reaching CHF 1,095.6 million. This strong top-line growth translated into an impressive 23.2% surge in operating income (EBIT), which climbed to CHF 140.8 million, underscoring the company's enhanced profitability and efficient operations.

Burckhardt Compression's strength lies in its extensive service portfolio, covering the entire lifecycle of its compressor systems. This means they don't just sell compressors; they also provide ongoing maintenance, repairs, and upgrades, which is a significant advantage.

This comprehensive service offering, coupled with an expanding installed base of compressors, creates a robust stream of recurring revenue. As of the first half of 2024, the service business contributed a substantial portion to their overall revenue, demonstrating its stability and importance.

The deep engagement through these services also fosters stronger, long-term relationships with their customers. This customer loyalty is invaluable, providing a competitive edge and a solid foundation for future growth in a market that values reliability and support.

Strong Order Backlog and Customer Relationships

Burckhardt Compression Holding benefits from a substantial order backlog, offering considerable revenue visibility and market stability, a key advantage in the often volatile industrial sector. This strong order book, a testament to their product quality and market position, provides a solid foundation for future financial performance.

The company's deep-rooted customer relationships are another significant strength. These long-standing partnerships, built on trust and reliable service, foster repeat business and provide valuable insights into evolving market needs, enabling Burckhardt Compression to adapt and innovate effectively.

- Robust Order Backlog: As of the first half of fiscal year 2024 (ending September 30, 2023), Burckhardt Compression reported a record order backlog of CHF 1,056.8 million, indicating strong demand for its compression solutions.

- Customer Loyalty: The company consistently secures repeat orders from major clients in the chemical, petrochemical, and industrial gas sectors, highlighting the strength of its customer relationships and the perceived value of its offerings.

- Market Stability: The substantial backlog translates to predictable revenue streams, allowing for better financial planning and resource allocation, even amidst broader economic fluctuations.

Focus on Sustainable Energy Solutions and Innovation

Burckhardt Compression is well-positioned to capitalize on the growing demand for sustainable energy solutions, a significant global megatrend. Their commitment to innovation is evident in their development of cutting-edge technologies for emerging markets such as hydrogen mobility and energy storage. This strategic focus aligns directly with the global shift towards cleaner energy sources, presenting substantial growth opportunities.

The company's investment in digital services further enhances its appeal, offering value-added solutions that complement its core compression technology. For instance, their digital offerings aim to optimize compressor performance and reduce operational costs for clients transitioning to greener energy systems. This forward-thinking approach is crucial for navigating the evolving energy landscape.

- Strategic alignment with global energy transition: Burckhardt Compression's focus on hydrogen and sustainable energy solutions directly addresses the increasing global imperative to decarbonize.

- Innovation in emerging markets: The company is actively developing and deploying technologies for high-growth sectors like hydrogen mobility and energy storage.

- Digital service integration: Enhancing their core offerings with digital services provides added value and optimizes customer operations in the sustainable energy space.

- Future-proofing the business model: By aligning with future energy trends, Burckhardt Compression is building a resilient business model capable of sustained growth.

Burckhardt Compression's market leadership in reciprocating compressors is a core strength, evidenced by record sales of CHF 1,095.6 million in fiscal year 2024. This dominance is further solidified by a substantial order backlog of CHF 1,056.8 million as of the first half of fiscal year 2024, ensuring revenue visibility.

What is included in the product

Delivers a strategic overview of Burckhardt Compression Holding’s internal and external business factors, highlighting its market strengths and potential threats.

Offers a clear visualization of Burckhardt Compression Holding's strategic landscape, simplifying complex market dynamics for focused decision-making.

Weaknesses

Burckhardt Compression operates in markets susceptible to significant fluctuations. The company itself points out that diverse trends across its various business segments and geographical regions contribute to this volatility. For instance, the energy sector, a key market for Burckhardt, can experience rapid shifts due to commodity prices and policy changes.

Geopolitical uncertainties, including trade tariffs and the ever-present risk of currency exchange rate fluctuations, pose a direct threat to Burckhardt Compression's financial results. These external factors can impact order intake, project costs, and the ultimate profitability of international projects, as seen in the 2023 financial year where currency headwinds affected reported earnings.

Burckhardt Compression's reliance on the oil and gas, chemical, and petrochemical sectors presents a significant weakness. For instance, the oil and gas industry, a key market, experienced a notable downturn in 2020, impacting capital expenditure and subsequently demand for compressor solutions. While these sectors are recovering, any future volatility or shifts in energy policy could directly curtail orders for Burckhardt's specialized equipment.

Burckhardt Compression's global footprint in design, manufacturing, and servicing, while a strength, also exposes it to potential supply chain vulnerabilities. Significant disruptions in the availability of critical raw materials or in global logistics networks could impede production timelines and delay customer deliveries, impacting operational efficiency and revenue streams.

Competition in the Reciprocating Compressor Market

The reciprocating compressor market, while experiencing growth, is characterized by moderate concentration with several significant players. This competitive landscape means Burckhardt Compression faces pressure on pricing and market share from established rivals.

To counter this, continuous innovation and differentiation are crucial. For instance, in 2024, the global reciprocating compressor market was valued at approximately USD 7.5 billion and is projected to grow at a CAGR of around 4.5% through 2030, indicating a dynamic environment where staying ahead technologically is paramount.

- Intense Rivalry: Established competitors like Ariel Corporation and Baker Hughes exert significant market influence.

- Pricing Pressure: The presence of multiple capable manufacturers can lead to competitive pricing strategies, impacting profit margins.

- Innovation Demands: Constant investment in R&D is necessary to maintain a competitive edge in terms of efficiency and features.

- Market Share Battles: Companies actively vie for market dominance, requiring strategic sales and marketing efforts.

Investment in New Technologies and R&D

Burckhardt Compression's strategic push into new technologies, particularly hydrogen, necessitates substantial and ongoing investment in research and development (R&D). This commitment is crucial for maintaining a competitive edge and establishing leadership in these nascent markets. For instance, the company's 2023 annual report highlighted significant R&D expenditures, a trend expected to continue through 2024 and 2025 as they scale up hydrogen-related solutions.

These substantial R&D outlays, while vital for future growth, can exert pressure on short-term profitability. Successfully navigating this requires careful financial management to ensure that the investment yields the desired long-term returns without unduly compromising current financial performance.

- High R&D Investment: Significant capital is allocated to developing and refining new technologies, particularly in the hydrogen sector.

- Impact on Profitability: Increased R&D spending may temporarily reduce short-term profit margins.

- Competitive Necessity: Continuous innovation is essential to maintain market leadership in rapidly evolving technological landscapes.

- Scaling Challenges: Bringing new technologies from lab to market requires substantial investment in production and infrastructure.

Burckhardt Compression faces significant competition from established players like Ariel Corporation and Baker Hughes, leading to pricing pressure and constant battles for market share. The need for continuous innovation to maintain a competitive edge requires substantial R&D investment, which can impact short-term profitability. Furthermore, scaling new technologies, such as those for the hydrogen sector, presents considerable financial and operational challenges.

| Weakness | Description | Impact |

|---|---|---|

| Intense Rivalry | Presence of strong, established competitors in the reciprocating compressor market. | Limits pricing power and necessitates continuous efforts to maintain market share. |

| R&D Investment Pressure | High expenditure required for innovation, especially in emerging technologies like hydrogen. | Can strain short-term profitability and requires careful financial management. |

| Scaling New Technologies | Challenges in bringing new technologies from development to full-scale production. | Requires significant capital investment and can impact operational efficiency if not managed effectively. |

What You See Is What You Get

Burckhardt Compression Holding SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Burckhardt Compression Holding's Strengths, Weaknesses, Opportunities, and Threats. You'll gain actionable insights to inform your strategic decisions.

Opportunities

The global hydrogen compressor market is booming, with forecasts pointing to continued strong growth. Burckhardt Compression's strategic focus on green hydrogen and hydrogen mobility applications positions them to capitalize on this expanding sector.

The increasing global commitment to decarbonization is driving the adoption of Carbon Capture, Utilization, and Storage (CCUS) technologies. These systems critically rely on compression for efficient CO2 transport and storage, creating another significant opportunity for Burckhardt Compression's expertise and product offerings.

The demand for marine applications, especially for vessels transporting LPG, ammonia, and LNG, is experiencing robust growth. This expansion is fueled by the increasing global trade in energy resources and the implementation of new regulations that prioritize sustainable shipping practices.

Burckhardt Compression's specialized compressor systems are well-positioned to capitalize on this trend. The company's technology is crucial for the safe and efficient handling of these gases on tankers, making it a key supplier in this expanding market segment.

In 2024, the global LNG shipping market alone saw a significant increase in vessel orders, with projections indicating continued expansion through 2025. This directly translates to a heightened need for the high-performance compressors that Burckhardt Compression provides.

The increasing adoption of smart, connected compressors with Internet of Things (IoT) capabilities presents a substantial growth avenue. This trend fuels the demand for predictive maintenance solutions, allowing for proactive issue identification and minimized downtime.

Burckhardt Compression's introduction of digital services like UP! is a key opportunity. This platform provides real-time diagnostics and automated anomaly detection, directly addressing the market's need for advanced monitoring. Such offerings can establish new, recurring revenue streams through service contracts and bolster customer retention by delivering ongoing value and operational efficiency.

Increasing Focus on Energy Efficiency and Sustainability

The increasing global demand for energy efficiency and sustainability is a significant opportunity for Burckhardt Compression. As industries worldwide strive to reduce their carbon footprint and energy consumption, there's a growing need for advanced compressor solutions. Burckhardt Compression's expertise in developing high-performance, energy-saving compressors directly addresses this trend, positioning them to capitalize on the shift towards greener technologies.

Burckhardt Compression is well-positioned to benefit from this market shift. Their commitment to reducing their own operational emissions, coupled with their product portfolio designed for sustainable energy applications like hydrogen and biogas, aligns perfectly with evolving environmental regulations and corporate sustainability goals. For instance, the company's solutions are crucial for the efficient compression of hydrogen, a key element in the energy transition.

The market for sustainable energy solutions is expanding rapidly. By 2025, the global green hydrogen market is projected to reach significant growth, with compressor technology playing a vital role in its infrastructure. Burckhardt Compression’s ability to provide reliable and efficient compression for these emerging energy sources offers a substantial growth avenue.

Key aspects of this opportunity include:

- Growing demand for energy-efficient industrial processes: Businesses are actively seeking ways to lower operational costs and environmental impact through more efficient machinery.

- Expansion of renewable energy sectors: The growth in hydrogen, biogas, and other renewable energy sources directly increases the need for specialized compression technology.

- Favorable regulatory environments: Government policies and international agreements promoting sustainability create a supportive market for companies like Burckhardt Compression.

- Technological innovation in compression: Continued development of advanced compressor designs that minimize energy usage and emissions further strengthens Burckhardt Compression's competitive advantage.

Geographic Market Expansion, especially Asia Pacific

The Asia-Pacific region is a significant growth frontier for Burckhardt Compression, especially as it continues its rapid industrialization. While Europe and North America are mature markets with established players, Asia Pacific's burgeoning manufacturing sector and ongoing infrastructure development offer substantial opportunities. This expansion is fueled by increasing demand for reliable compression solutions across various industries.

Burckhardt Compression can capitalize on this by:

- Targeting key growth sectors: Focusing on industries like petrochemicals, chemicals, and hydrogen production, which are experiencing significant investment in the APAC region. For instance, in 2024, several APAC countries announced substantial investments in green hydrogen infrastructure, a key market for advanced compressors.

- Leveraging local partnerships: Establishing strong relationships with local distributors and service providers to better understand and cater to regional market needs. This approach has proven effective in markets like China and India, where industrial output continues to climb.

- Adapting product offerings: Tailoring compressor solutions to meet the specific technical requirements and cost sensitivities of the APAC market. This includes offering robust, energy-efficient systems that can handle diverse operating conditions.

- Expanding service and support networks: Building out a comprehensive after-sales service and spare parts network to ensure customer satisfaction and long-term reliability in a geographically vast region.

The accelerating global shift towards decarbonization presents a significant opportunity for Burckhardt Compression, particularly through its expertise in hydrogen and Carbon Capture, Utilization, and Storage (CCUS) technologies. The company's specialized compressor systems are essential for the efficient handling of gases critical to these emerging energy sectors.

The robust growth in marine applications, specifically for vessels transporting LPG, ammonia, and LNG, further bolsters Burckhardt Compression's market position. The increasing global trade in energy resources and stricter environmental regulations for shipping create a sustained demand for their high-performance compressors. For example, the global LNG shipping market experienced a notable surge in vessel orders in 2024, with projections indicating continued expansion through 2025, directly benefiting compressor manufacturers.

Furthermore, the increasing adoption of IoT-enabled, smart compressors offers a substantial growth avenue, driving demand for predictive maintenance solutions. Burckhardt Compression's digital service platform, UP!, which provides real-time diagnostics, directly addresses this market need and can generate recurring revenue streams through service contracts.

The Asia-Pacific region represents a key growth frontier, with its rapid industrialization and increasing demand for reliable compression solutions across sectors like petrochemicals and chemicals. Burckhardt Compression can capitalize on this by targeting key growth sectors and leveraging local partnerships, especially as countries in the region announced substantial investments in green hydrogen infrastructure in 2024.

Threats

The current geopolitical climate, marked by ongoing conflicts and shifting alliances, presents a considerable threat to Burckhardt Compression. Elevated global tensions can disrupt supply chains and increase the cost of raw materials, directly impacting production efficiency and profitability. For instance, the International Monetary Fund (IMF) in its October 2024 World Economic Outlook projected global growth to slow to 2.9% in 2025, down from 3.2% in 2024, citing persistent geopolitical fragmentation as a key drag.

Escalating trade disputes and the potential for increased tariffs on manufactured goods or critical components could significantly hinder Burckhardt Compression's international sales and market access. Such protectionist measures can lead to reduced demand for capital equipment in key markets, forcing downward revisions in revenue forecasts and negatively impacting the company's overall operating environment. The World Trade Organization (WTO) has noted a concerning rise in trade-restrictive measures implemented by member states throughout 2024.

Despite Burckhardt Compression's diversification, its significant exposure to the oil and gas sector remains a key vulnerability. A sharp decline in oil prices, such as the volatility seen in late 2023 and early 2024, can directly dampen capital expenditure by energy companies. This reduced investment often translates to lower demand for new compressor systems and aftermarket services, directly impacting Burckhardt's revenue streams.

Increasingly stringent environmental regulations, particularly those targeting carbon emissions, pose a significant threat to Burckhardt Compression. These policies could impact their traditional fossil fuel sector business, requiring substantial investment to adapt. For instance, the European Union's ambitious Green Deal aims for climate neutrality by 2050, which will likely translate into stricter operational requirements for companies involved in gas compression.

Technological Disruption and Emergence of Alternative Technologies

The industrial compressor market is constantly evolving, and technological disruption remains a significant threat. While Burckhardt Compression's reciprocating compressors are known for their durability, the rise of novel or substantially more efficient compression technologies could challenge their market position. For instance, advancements in magnetic bearing compressors or new diaphragm compressor designs could offer performance gains that require Burckhardt to innovate rapidly to stay competitive.

The pace of technological change is accelerating, impacting the entire industrial equipment sector. Companies that fail to invest in research and development and adapt to emerging trends risk obsolescence. For Burckhardt Compression, this means actively monitoring and potentially integrating new materials or digital control systems that enhance compressor efficiency or reduce maintenance needs. The global compressor market was valued at approximately USD 150 billion in 2024, with a projected compound annual growth rate of over 4% through 2030, indicating a dynamic landscape where technological shifts can significantly alter market share.

Key areas of technological advancement that could impact Burckhardt Compression include:

- Energy Efficiency: Development of compressors with significantly lower energy consumption per unit of gas compressed.

- Digitalization and AI: Integration of predictive maintenance, remote monitoring, and AI-driven optimization for compressor operations.

- Alternative Materials: Use of advanced alloys or composites that improve durability, reduce weight, or enhance performance in extreme conditions.

- New Compression Principles: Emergence of entirely new methods of gas compression that offer distinct advantages over existing technologies.

Economic Slowdowns and Global Recession Risks

A significant global economic slowdown or the onset of a recession poses a substantial threat to Burckhardt Compression. Such conditions typically curb industrial activity across the board, dampening demand for new machinery and essential maintenance services. This directly translates to lower sales volumes and potentially squeezed profit margins for the company.

For instance, the International Monetary Fund (IMF) projected global growth to moderate in 2024 and 2025, citing persistent inflation, high interest rates, and geopolitical tensions as key headwinds. This environment could lead to a pullback in capital expenditures by Burckhardt Compression's key clients in sectors like oil and gas, chemicals, and hydrogen production.

- Reduced Capital Expenditures: Companies facing economic uncertainty tend to postpone or cancel large investment projects, directly impacting orders for Burckhardt Compression's high-value compressors.

- Lower Demand for Services: A slowdown in industrial output also means less activity requiring maintenance and repair services, a crucial revenue stream for the company.

- Increased Pricing Pressure: In a weaker economic climate, customers may become more price-sensitive, forcing Burckhardt Compression to offer discounts, thereby impacting profitability.

- Supply Chain Disruptions: Economic downturns can exacerbate existing supply chain vulnerabilities, potentially leading to delays and increased costs for components.

Intensifying competition from both established players and emerging companies presents a significant threat to Burckhardt Compression's market share and pricing power. New entrants with innovative technologies or lower cost structures could erode its competitive advantage. The global industrial compressor market, valued at approximately USD 150 billion in 2024, is dynamic, with companies needing to continuously adapt to maintain their position.

The company's reliance on specific key markets, particularly for hydrogen and biogas applications, makes it vulnerable to shifts in demand or regulatory changes within those sectors. A slowdown in the adoption of green hydrogen or biogas technologies, for example, could directly impact growth projections. The International Energy Agency (IEA) reported in its 2024 outlook that while hydrogen demand is growing, policy support and infrastructure development remain critical factors influencing market expansion.

Cybersecurity threats pose a growing risk to Burckhardt Compression's operational integrity and intellectual property. A successful cyberattack could disrupt manufacturing processes, compromise sensitive design data, or impact customer service operations. The increasing digitalization of industrial equipment makes such vulnerabilities more pronounced, with the cost of cybercrime globally projected to reach USD 10.5 trillion annually by 2025, according to Cybersecurity Ventures.

Fluctuations in currency exchange rates can negatively impact Burckhardt Compression's financial results, given its international sales and manufacturing footprint. A strengthening Swiss Franc, for instance, could make its products more expensive for foreign buyers. In 2024, the Swiss Franc remained relatively strong against major currencies, posing a persistent challenge for Swiss exporters.

SWOT Analysis Data Sources

This analysis draws from a robust blend of primary and secondary data, including Burckhardt Compression's official financial reports, investor relations materials, and reputable industry analysis platforms.