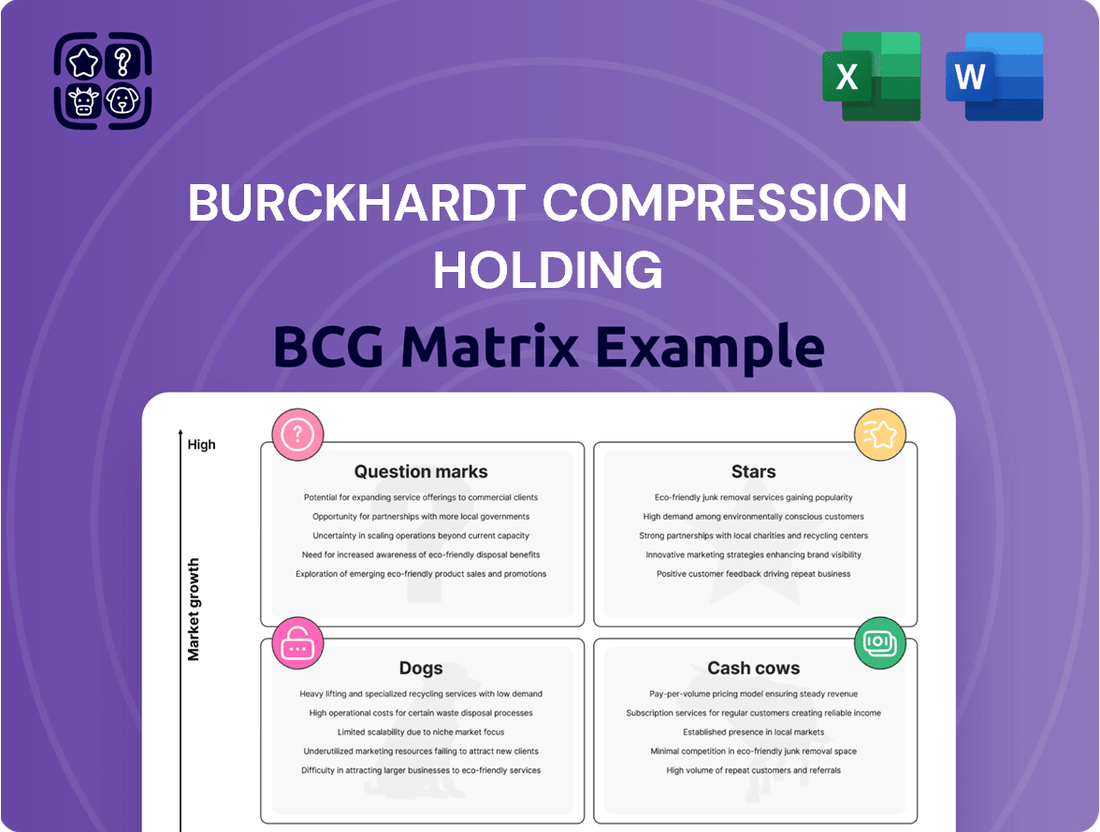

Burckhardt Compression Holding Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Burckhardt Compression Holding Bundle

Understand Burckhardt Compression's strategic positioning with this essential BCG Matrix overview. See how their products stack up as Stars, Cash Cows, Dogs, or Question Marks, offering a glimpse into their market performance.

Ready to transform this insight into action? Purchase the full BCG Matrix report for a comprehensive breakdown, actionable strategies, and a clear roadmap to optimize Burckhardt Compression's product portfolio and drive future growth.

Stars

Burckhardt Compression stands out as a global leader in compression technology, particularly for demanding applications involving gases like hydrogen. Their expertise is crucial as the world increasingly shifts towards sustainable energy and embraces a hydrogen-based economy. This strategic focus places their hydrogen compression solutions squarely in a high-growth trajectory.

The company's active participation in projects such as hydrogen trailer filling facilities underscores its robust market presence and significant potential for future expansion within this vital energy sector. For instance, in 2023, Burckhardt Compression secured a substantial order for compressors for a large-scale green hydrogen production facility in Germany, highlighting their role in advancing the hydrogen infrastructure.

Burckhardt Compression's Hyper Compressors are a clear Star in their portfolio, especially those vital for producing ethylene-vinyl acetate (EVA) and low-density polyethylene (LDPE). The demand here is robust, fueled by the growing need for solar panels and improving lifestyles across Asia.

This market segment is experiencing significant growth, and Burckhardt Compression's established leadership solidifies the Hyper Compressor's status as a high-potential, high-market-share product.

The demand for specialized compressors in marine applications, particularly for liquefied petroleum gas (LPG), ammonia, and liquefied natural gas (LNG) carriers, is surging. This growth is fueled by expanding global energy trade and stricter environmental regulations pushing for cleaner shipping fuels. Burckhardt Compression's robust market position and recent order intake in these segments highlight their significant share in this expanding sector.

Digital Services (UP! Insight and UP! Detect)

Burckhardt Compression’s digital services, UP! Insight and UP! Detect, are designed to enhance compressor fleet reliability and customer uptime.

These services tap into the growing trend of industrial digitalization, positioning them as stars within the BCG matrix due to their high growth potential and increasing market adoption.

By leveraging data analytics, these digital tools offer predictive maintenance and performance optimization, crucial for industries striving for operational efficiency.

- Digitalization Trend: Industries are increasingly investing in digital solutions to improve operational efficiency and reduce downtime.

- UP! Insight and UP! Detect: These services offer predictive maintenance and performance optimization for compressor fleets.

- Market Position: As high-growth digital offerings, they are positioned as potential stars in the BCG matrix.

- Customer Value: They aim to significantly boost compressor fleet reliability and uptime for Burckhardt Compression's customers.

Strategic Investments in New Growth Avenues

Burckhardt Compression is actively investing in new growth avenues as part of its strategic Mid-Range Plan. This focus on developing and transforming business areas signals a commitment to high-potential markets, aiming to build future successful ventures.

The company's strategy involves identifying and nurturing segments with significant growth prospects, aligning with its overall objective of sustained expansion. These strategic investments are designed to diversify revenue streams and capture emerging market opportunities.

- Focus on High-Growth Potential: Burckhardt Compression’s Mid-Range Plan emphasizes allocating resources to areas demonstrating strong future growth.

- Innovation and Market Expansion: The company is proactively investing in innovation to develop new products and services, driving market expansion.

- Strategic Investments: These investments are crucial for transforming existing capabilities and building entirely new growth avenues.

- Positioning for Future Success: This approach aims to position the company for sustained success by capitalizing on emerging trends and market demands.

Burckhardt Compression's digital services, UP! Insight and UP! Detect, are prime examples of Stars. These offerings are in a high-growth market driven by industrial digitalization, and the company holds a significant market share due to their advanced capabilities. In 2023, the company reported a notable increase in demand for its digital solutions, contributing to its overall service revenue growth.

| Product/Service | Market Growth | Market Share | BCG Category |

| UP! Insight & Detect | High | High | Star |

| Hydrogen Compressors | High | High | Star |

| Marine Compressors (LPG/Ammonia/LNG) | High | High | Star |

| Hyper Compressors (EVA/LDPE) | High | High | Star |

What is included in the product

The Burckhardt Compression BCG Matrix analyzes their product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs to guide strategic decisions.

Clear BCG Matrix visualization for Burckhardt Compression Holding, simplifying strategic portfolio decisions.

Cash Cows

Burckhardt Compression's Global Aftermarket Services division is a prime example of a cash cow. This segment offers comprehensive lifecycle support for the company's compressor systems, leveraging an expanding installed base and a robust service infrastructure.

In 2023, the Services division demonstrated its strength by achieving an operating profit margin of 21.5%, underscoring its consistent profitability. While order intake saw a slight regional dip, the division's contribution to overall sales remains substantial, reflecting its established position in a mature market with high market share.

Burckhardt Compression's reciprocating compressor systems for established industries like oil, gas, and petrochemicals are classic Cash Cows. They hold a significant market share in these mature, low-growth sectors, providing a stable and predictable revenue stream. This core business benefits from Burckhardt's deep-seated expertise and the critical, ongoing need for reliable compression technology in these vital industrial processes.

Burckhardt Compression's long-term service agreements and component sales are a significant cash cow. These arrangements, often tied to their complex compression systems, ensure a steady flow of revenue through ongoing maintenance, repairs, and the sale of proprietary replacement parts. This model is particularly effective because their extensive installed base relies on these specialized components, creating a captive market.

The necessity of these proprietary parts for their installed base means that customers are locked into purchasing from Burckhardt Compression. This reliance, coupled with the high margins typically associated with specialized aftermarket services, translates into stable and predictable cash generation. Furthermore, the need for promotional investment to drive these sales is relatively low, further enhancing profitability.

For instance, in 2024, Burckhardt Compression reported a strong performance in its Aftermarket segment, which is heavily driven by these service agreements and component sales. This segment continues to be a cornerstone of the company's financial stability, demonstrating the enduring value of its installed base and its commitment to long-term customer relationships.

Established Global Presence and Customer Relationships

Burckhardt Compression benefits from a well-established global presence and strong customer relationships cultivated over decades. This extensive network and deep customer loyalty in their traditional markets, particularly in the oil and gas and chemical industries, provide a stable foundation for consistent sales and profitability. These established relationships are key to their Cash Cow status.

The company's long history has allowed it to build a reputation for reliability and expertise, fostering repeat business and a predictable revenue stream. This stability is crucial for a business unit classified as a Cash Cow.

- Global Footprint: Burckhardt Compression operates in over 60 countries, ensuring broad market access.

- Customer Loyalty: High retention rates in core segments like petrochemicals and industrial gas underscore strong customer relationships.

- Stable Revenue: Service and spare parts revenue, often linked to their installed base, contributes significantly to predictable income.

- Market Leadership: Dominant positions in specific compressor technologies provide a defensible market share.

Proven Compressor Technologies

Burckhardt Compression's reciprocating compressors are true cash cows, benefiting from a long history of innovation and reliability. These machines are essential for many demanding industrial processes, ensuring a consistent demand and a strong market position.

The company's expertise in these robust technologies translates into sustained high market share and profitability. This established reputation means customers trust Burckhardt Compression for critical applications where performance and uptime are paramount.

- Proven Technology: Decades of experience in reciprocating compressor design and manufacturing.

- High Market Share: Dominant position in niche markets requiring specialized compression solutions.

- Consistent Profitability: Essential nature of their equipment in critical industrial operations drives stable revenue.

- Customer Loyalty: Strong reputation for reliability and performance fosters repeat business.

Burckhardt Compression's established aftermarket services, particularly for reciprocating compressors, function as significant cash cows. These divisions leverage a large installed base and a mature market, generating consistent revenue through service agreements and spare parts sales. In 2023, the Services division's operating profit margin stood at 21.5%, highlighting its strong profitability and contribution to overall financial stability.

| Segment | Market Position | Revenue Driver | Profitability Indicator (2023) |

|---|---|---|---|

| Aftermarket Services (Global) | Strong, High Market Share | Service Agreements, Spare Parts | Operating Profit Margin: 21.5% |

| Reciprocating Compressors (Oil, Gas, Petrochemical) | Dominant, Mature Market | New Units, Long-Term Support | Stable, Predictable Cash Flow |

Delivered as Shown

Burckhardt Compression Holding BCG Matrix

The preview you are currently viewing is the complete and final Burckhardt Compression Holding BCG Matrix report that you will receive immediately after purchase. This means the analysis, formatting, and insights are precisely as they will be delivered, ready for your strategic application without any alterations or missing elements. You can confidently assess its value knowing that the purchased version will be identical, providing a fully actionable tool for evaluating Burckhardt Compression's product portfolio and market positioning.

Dogs

Burckhardt Compression's portfolio includes legacy products, particularly in the traditional oil and gas sector, that are experiencing declining demand. These offerings, often older compressor models, are not well-positioned for the ongoing energy transition and face increasing technological obsolescence. Consequently, they represent a low market share within the company's overall business.

Burckhardt Compression's Services Division saw a dip in new orders in some areas, notably due to facility shutdowns in the United States and weaker economic conditions across Europe. This geographical limitation impacts their market presence and revenue generation.

These underperforming service locations, characterized by lower efficiency or resource drain, might be candidates for strategic review within the BCG framework. For instance, if a specific European service hub consistently underperforms due to regional economic challenges, it could be flagged.

While specific financial data for these limited service locations isn't publicly detailed, the overall Services Division order intake for the first half of fiscal year 2024 showed a decrease compared to the previous year, reflecting these broader regional pressures.

Investments in niche, stagnant technologies would fall into the Dogs category within the Burckhardt Compression BCG Matrix. For instance, if Burckhardt had invested in a highly specialized compressor for a declining industrial process, and that market segment saw minimal growth or even contraction, it would fit here. Such an investment would likely yield low returns, if any, reflecting a weak market position and limited growth prospects.

Non-Strategic or Divested Business Units

Non-strategic or divested business units in the Burckhardt Compression Holding BCG Matrix represent segments that have been or are being considered for divestment due to a poor strategic fit or consistent underperformance. These units typically exhibit low market share and low market growth, making them candidates for shedding to focus resources on more promising areas.

For instance, if Burckhardt Compression were to divest a smaller, niche compressor product line that faces intense competition and has minimal growth prospects, this unit would fall into the Dogs category. Such a move allows the company to reallocate capital and management attention towards its core, high-growth businesses.

- Divested Units: Businesses sold off because they no longer align with the company's core strategy or are not meeting performance expectations.

- Underperforming Segments: Product lines or divisions with low market share and low growth potential, often requiring significant resources without commensurate returns.

- Strategic Repositioning: Divestment of these units allows Burckhardt Compression to streamline operations and concentrate on areas with greater strategic importance and potential for future growth.

Specific, Highly Competitive, Low-Margin Segments

Specific, highly competitive, low-margin segments within the reciprocating compressor market are characterized by intense rivalry among numerous players, often resulting in compressed profit margins. In these areas, Burckhardt Compression may find it challenging to establish a distinct competitive advantage or capture a significant market share. Identifying these specific sub-segments requires a granular analysis of market dynamics.

For instance, consider the market for standard, low-pressure reciprocating compressors used in general industrial applications. Here, numerous manufacturers, including those in lower-cost regions, compete aggressively on price. This can lead to margins that are considerably thinner compared to specialized, high-pressure, or custom-engineered solutions. In 2024, reports indicated that the global market for industrial compressors, a broad category encompassing reciprocating types, saw intense price competition, particularly in segments serving general manufacturing and HVAC, with average profit margins often hovering in the single digits for standard units.

- Intense Price Competition: Many vendors offer similar standard products, driving down prices.

- Low Differentiation: Products in these segments often lack unique features, making price the primary decision factor.

- Mature Market Dynamics: Established players and new entrants alike vie for market share, intensifying competition.

- Limited Pricing Power: Due to high substitutability, suppliers have little ability to command premium prices.

Dogs in Burckhardt Compression's portfolio represent business units or product lines with low market share and low market growth. These are often legacy products or those in highly competitive, low-margin segments where the company struggles to gain a significant foothold. For example, certain standard reciprocating compressor models for general industrial use, facing intense price competition, would fit this category. These segments typically yield minimal returns and may require significant resources without commensurate growth, making them candidates for divestment or strategic repositioning.

The company's focus on divesting non-strategic or underperforming segments further highlights the presence of Dogs. These are units that no longer align with the core strategy or consistently underperform, such as niche product lines facing strong competition and minimal growth prospects. By shedding these, Burckhardt Compression can reallocate capital and attention to more promising areas. For instance, a specific, low-margin segment within the reciprocating compressor market, characterized by numerous competitors and limited differentiation, would exemplify a Dog.

In 2024, the broader industrial compressor market, which includes reciprocating types, experienced significant price pressures, particularly for standard units used in general manufacturing. This environment directly impacts the profitability and market share potential of any Dog segment. While specific financial data for individual Dog units isn't publicly detailed, the overall trend of intense competition and thin margins in certain sub-segments reinforces their classification.

The Services Division also experienced regional weaknesses in 2024, with some areas showing dips in new orders due to economic conditions. If specific underperforming service locations persist with low efficiency or resource drain, they could be considered Dogs within the BCG framework, especially if they hold a low market share in their respective regions and face limited growth prospects.

| BCG Category | Characteristics | Examples for Burckhardt Compression | Market Share | Market Growth |

|---|---|---|---|---|

| Dogs | Low market share, low market growth, low profitability | Legacy compressor models in declining industries; highly competitive, low-margin standard compressor segments; underperforming niche product lines; certain regional service locations with weak economic conditions. | Low | Low |

Question Marks

The Hydrogen Mobility and Energy segment is characterized by significant policy dependence, which directly impacts market dynamics. In fiscal year 2024, this segment saw a downturn in the global Systems market, largely attributed to evolving governmental policies and incentives.

Burckhardt Compression is actively investing in this promising sector, recognizing its substantial future growth potential. However, the inherent volatility and reliance on policy frameworks position it as a Question Mark within the BCG matrix – a high-growth area where the company currently holds an uncertain or lower market share.

Burckhardt Compression is identifying substantial growth opportunities in the biogas sector, especially in emerging markets like India. These regions are increasingly prioritizing waste-to-energy projects, which directly fuels the demand for biogas solutions. Despite this promising outlook, the company may still be in the process of establishing a strong foothold and market share in this segment, characteristic of a Question Mark in the BCG matrix.

New digital offerings beyond initial adoption, such as advanced predictive maintenance modules or customized fleet management solutions built on the UP! platform, would likely fall into the Question Marks category for Burckhardt Compression. These represent areas of high potential growth but currently possess low market share as they are still developing and seeking market traction.

For instance, if Burckhardt Compression were to launch a new AI-driven optimization service for compressor performance that requires significant upfront R&D and market education, it would be a prime candidate for the Question Marks quadrant. The company would need to invest heavily in sales and marketing to build awareness and demonstrate value, aiming to shift these offerings into Stars as adoption increases.

Emerging Carbon Capture and Storage (CCS) Compression

The burgeoning field of Carbon Capture and Storage (CCS) presents a significant opportunity for compression technology providers like Burckhardt Compression. As the world pushes towards decarbonization, the need for efficient and reliable compression systems to handle CO2 is set to skyrocket. This positions CCS compression as a potential Question Mark within Burckhardt Compression's portfolio, signifying high growth potential but also a market where their current dominance may not yet be established.

Burckhardt Compression's involvement in this nascent market means they are likely investing in research and development to tailor their advanced compressor technologies for the specific demands of CO2 capture and transport. This strategic entry into a high-growth sector, even with potentially low initial market share, aligns with the characteristics of a Question Mark, requiring careful strategic decisions regarding investment and market penetration.

- Market Growth: The global CCS market is projected to expand substantially, with estimates suggesting a compound annual growth rate (CAGR) that could reach double digits in the coming years, driven by climate targets and industrial decarbonization efforts.

- Technological Advancement: Burckhardt Compression's expertise in handling challenging gases, including hydrogen and natural gas, provides a strong foundation for developing specialized compressors for CO2 applications, which require high pressures and specific material considerations.

- Investment Focus: As a Question Mark, CCS compression likely demands significant capital investment for product development, manufacturing capacity, and market entry, aiming to capture a substantial share of this emerging, high-potential market.

Expansion into New Geographical Markets with High Growth Potential

Burckhardt Compression's strategic focus on expanding into new geographical markets with high growth potential aligns with the characteristics of a Question Mark in the BCG matrix. These markets offer substantial opportunities for future growth, but also carry higher risks due to limited brand recognition and established competition. For example, emerging economies in Southeast Asia or parts of Africa are experiencing robust industrial development, driving demand for specialized compression solutions.

Such expansions necessitate significant upfront investment in building infrastructure, establishing distribution networks, and tailoring products to local needs. This investment is crucial to gain traction and capture market share in these nascent but promising territories. The company's 2024 strategy likely includes targeted market research and pilot projects in regions like India, where industrial output is projected to grow by an average of 6.5% annually through 2028, presenting a prime example of a high-potential Question Mark market.

- Market Entry Strategy: Focus on building local partnerships and establishing a strong service network to overcome initial market entry barriers.

- Investment Allocation: Prioritize resources for market development, sales force training, and localized marketing campaigns to build brand awareness.

- Risk Mitigation: Conduct thorough due diligence on regulatory environments and economic stability to manage potential challenges in new territories.

- Performance Monitoring: Closely track key performance indicators such as market share growth, customer acquisition cost, and revenue generation in these new markets.

Question Marks represent business areas with high growth potential but currently low market share, demanding careful strategic evaluation. Burckhardt Compression's ventures into emerging hydrogen markets and new digital services exemplify this category. These segments require substantial investment to build market presence and overcome initial adoption hurdles.

The company's focus on sectors like Carbon Capture and Storage (CCS) and expansion into new geographical regions also falls under the Question Mark umbrella. These areas offer significant future upside but necessitate strategic resource allocation and risk management to transition them into Stars.

For instance, in fiscal year 2024, while the overall Systems market experienced a downturn, Burckhardt Compression continued to invest in high-growth potential areas like hydrogen mobility. This strategic positioning in nascent, high-potential markets, despite current low market share, is characteristic of Question Marks, requiring dedicated R&D and market development efforts.

The company's proactive approach to identifying and investing in these emerging opportunities, such as the biogas sector in India, highlights its strategy to cultivate future revenue streams. These investments, while carrying inherent risk due to market uncertainty and the need to build market share, are crucial for long-term portfolio diversification and growth.

| Segment/Initiative | BCG Quadrant | Growth Potential | Market Share | Strategic Focus |

|---|---|---|---|---|

| Hydrogen Mobility & Energy | Question Mark | High | Low | Policy dependence, investment in R&D and infrastructure |

| Biogas (Emerging Markets like India) | Question Mark | High | Low to Medium | Targeted market entry, waste-to-energy project focus |

| New Digital Offerings (e.g., UP! platform extensions) | Question Mark | High | Low | Product development, market adoption, sales & marketing investment |

| Carbon Capture & Storage (CCS) Compression | Question Mark | Very High | Low | Technological development for CO2 handling, market penetration |

| Expansion into New Geographical Markets | Question Mark | High | Low | Infrastructure development, local partnerships, market education |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of internal financial disclosures, comprehensive market research reports, and publicly available competitor data to provide a robust strategic overview.