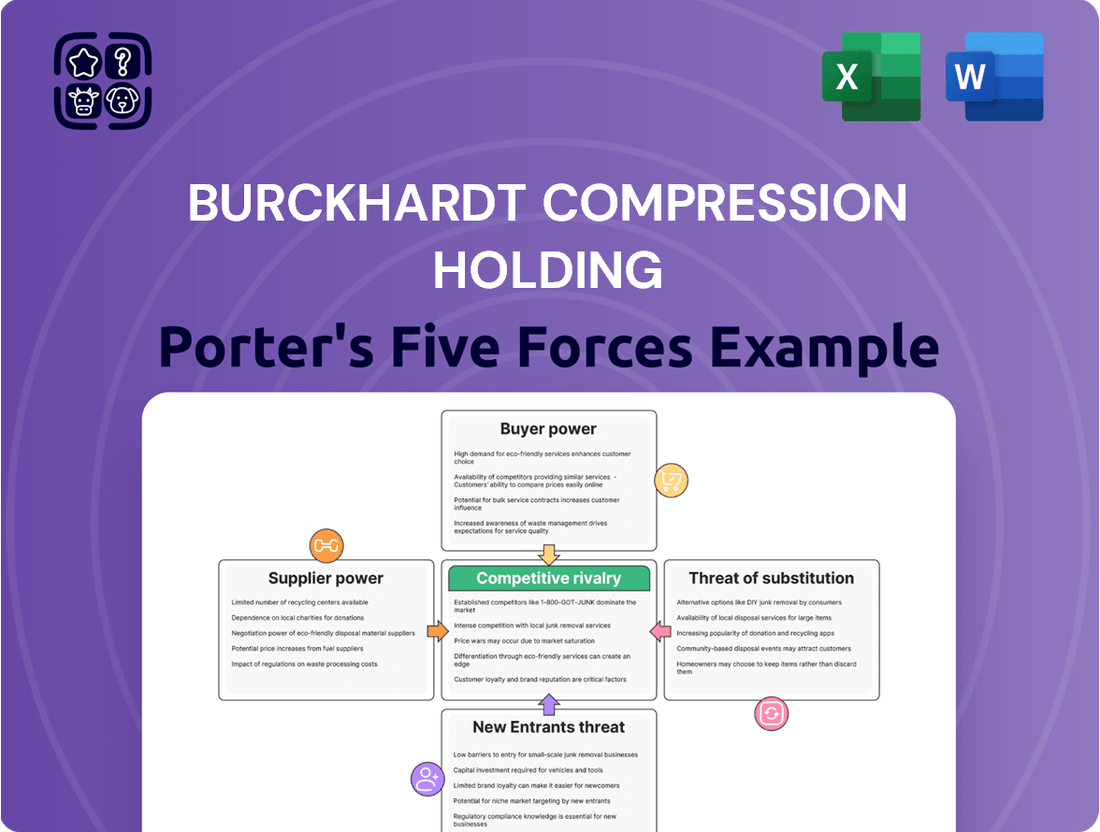

Burckhardt Compression Holding Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Burckhardt Compression Holding Bundle

Burckhardt Compression Holding navigates a complex industrial landscape, where supplier power and the threat of new entrants significantly shape its operational environment. Understanding these forces is crucial for any stakeholder looking to grasp the company's true competitive standing.

The complete report reveals the real forces shaping Burckhardt Compression Holding’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Burckhardt Compression's reliance on suppliers for highly specialized components, like precision-machined parts and advanced sealing technologies, significantly shapes their bargaining power. These unique elements are fundamental to the performance and reliability of their reciprocating compressors, especially in tough industrial settings.

The specialized nature of these components often means a limited pool of suppliers can produce them. This scarcity can give these select suppliers considerable leverage, potentially influencing Burckhardt Compression's production costs and the time it takes to get these critical parts. For instance, in 2023, the global market for precision machining experienced a growth of 4.5%, indicating increased demand and potentially higher costs for specialized services.

Raw material cost fluctuations significantly impact Burckhardt Compression. Suppliers of specialized metals and alloys, crucial for their high-pressure compressors, can leverage their position through price volatility. For example, in early 2024, the price of nickel, a key component in many high-performance alloys, saw increased volatility due to geopolitical factors, directly affecting input costs for manufacturers like Burckhardt.

Burckhardt's ability to manage these fluctuating raw material costs hinges on its contractual arrangements with suppliers and its overall market standing. The company's strong reputation and long-term relationships can provide some leverage in negotiating prices, but significant global commodity market swings are inherently challenging to fully mitigate, potentially impacting profit margins if costs cannot be passed on to customers.

Technological advancements by suppliers significantly impact Burckhardt Compression's bargaining power. As the industrial compressor market increasingly prioritizes energy efficiency and sustainability, suppliers pioneering innovative materials or manufacturing techniques gain leverage.

Burckhardt may find itself needing to adopt these supplier-driven innovations to remain competitive, potentially incurring higher costs for advanced components. For instance, in 2024, the global compressor market saw a growing demand for solutions with reduced carbon footprints, pushing suppliers of specialized alloys and advanced sealing technologies to the forefront.

Supplier Concentration in Niche Areas

In specific, specialized areas of the compressor parts market, Burckhardt Compression may encounter a limited number of suppliers. This concentration means fewer choices for sourcing critical components, potentially increasing the company's reliance on these select providers.

When competition among suppliers is low, especially for highly technical or custom-made parts, Burckhardt Compression could face less favorable pricing and contract terms. For instance, if only a few manufacturers possess the unique capabilities to produce a vital, custom-engineered component, they can command higher prices due to the lack of alternatives.

- Supplier Concentration: In niche segments of the compressor component supply chain, a high concentration of suppliers can limit Burckhardt Compression's sourcing options.

- Increased Dependency: This concentration fosters greater dependency on a few key suppliers for critical parts.

- Pricing Power: Reduced competition among these specialized suppliers can lead to less favorable pricing and terms for Burckhardt Compression.

- Impact on Critical Parts: The effect is particularly pronounced for custom-engineered parts requiring specific expertise and manufacturing capabilities.

Switching Costs for Critical Components

The bargaining power of suppliers for Burckhardt Compression Holding is significantly influenced by switching costs for critical components. For highly integrated or proprietary parts essential to their compressor systems, the expense of changing suppliers can be considerable. This involves not only re-engineering and re-tooling existing production lines but also the rigorous process of re-qualifying new components to meet stringent performance and safety standards.

These substantial switching costs directly limit Burckhardt's operational flexibility. When it becomes costly and disruptive to find alternative sources for key parts, the leverage of current suppliers increases. This dynamic strengthens their bargaining position, as Burckhardt faces significant hurdles and financial implications if they decide to move away from an established supplier.

For instance, in the complex world of high-pressure compressors, a single specialized valve or seal might require extensive testing and validation before it can be reliably integrated. If a supplier of such a component were to significantly increase prices or reduce quality, Burckhardt's options would be constrained by the time and investment needed to secure and approve a replacement. This dependence on specialized, difficult-to-replace parts underscores the supplier's power.

- High Re-engineering Costs: Switching suppliers for proprietary compressor parts can necessitate significant redesign efforts, impacting product development timelines and budgets.

- Significant Re-tooling Investment: New suppliers may require Burckhardt to invest in new tooling or modify existing machinery, adding to the overall cost of switching.

- Extended Re-qualification Periods: Ensuring new components meet demanding industry specifications and performance benchmarks can involve lengthy and costly testing phases.

- Supplier Leverage: The high costs and disruptions associated with changing suppliers empower incumbent suppliers, giving them greater influence over pricing and terms.

The bargaining power of suppliers for Burckhardt Compression is amplified by the limited availability of certain specialized components. For instance, the market for advanced sealing solutions for high-pressure reciprocating compressors is dominated by a few key players, giving them considerable sway over pricing and supply terms. In 2023, the global market for industrial seals, a segment relevant to Burckhardt's needs, was valued at approximately $25 billion, with a projected compound annual growth rate of 4.8% through 2028, indicating a robust but concentrated supplier base.

These specialized suppliers can leverage their unique technological expertise and proprietary manufacturing processes, making it difficult for Burckhardt to find equally capable alternatives. This dependency is particularly acute for custom-engineered parts where significant R&D investment by the supplier is required. The lack of readily available substitutes for these critical parts grants suppliers a stronger negotiating position.

| Supplier Characteristic | Impact on Burckhardt Compression | Example/Data Point |

|---|---|---|

| Limited Supplier Pool (Specialized Components) | Increased supplier leverage, potential for higher costs | Few manufacturers possess expertise in high-pressure sealing technology. |

| Proprietary Technology/Customization | High switching costs, supplier pricing power | Custom-engineered valves requiring unique material science. |

| Raw Material Price Volatility | Impact on input costs, supplier ability to pass on increases | Nickel price fluctuations in early 2024 affected alloy costs. |

| Supplier Innovation in Efficiency/Sustainability | Potential for increased component costs to adopt new tech | Demand for reduced carbon footprint solutions driving innovation in alloys. |

What is included in the product

This analysis delves into the competitive forces shaping Burckhardt Compression Holding's market, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry.

Instantly understand competitive pressures with a dynamic, interactive five forces model, allowing for swift strategic adjustments.

Customers Bargaining Power

Customers in the oil and gas, chemical, petrochemical, and industrial gas sectors experience substantial costs when looking to switch from an existing Burckhardt Compression reciprocating compressor system. This is largely due to the intricate integration of these systems into their complex operational processes. Any change necessitates significant re-engineering, potential disruptions to production, and the acquisition of new, specialized maintenance expertise.

Burckhardt Compression's commitment to offering comprehensive lifecycle services, from initial installation and ongoing maintenance to upgrades and repairs, further solidifies customer loyalty. This holistic approach minimizes the perceived need for customers to explore alternative suppliers, effectively diminishing their bargaining power as they become increasingly reliant on Burckhardt's specialized support throughout the asset's lifespan.

Burckhardt Compression's compressors are absolutely essential for the core functions of its clients, such as moving gas, storing it, and refining processes. This means that when customers are choosing a compressor, they are really looking for something that will work reliably and perform well, day in and day out. Because these machines are so vital to keeping their own operations running smoothly, customers tend to focus more on a supplier's track record and the quality of their long-term support rather than just the initial price tag. This high level of dependence on dependable performance naturally lessens their willingness to switch suppliers based solely on a lower price.

Burckhardt Compression serves a wide array of industrial sectors worldwide, including oil and gas, chemical, petrochemical, and industrial gas. This diversity means that even if one sector faces challenges, demand from others can remain robust.

The global reciprocating compressor market is projected to reach USD 8.56 billion by 2034, indicating significant growth across these end markets. This expansion creates a broad customer base and sustained demand for Burckhardt's specialized solutions.

Demand for Energy Efficiency and Sustainability

Customers are increasingly prioritizing energy efficiency and sustainability in their purchasing decisions. This growing demand is driven by escalating operational costs and a tightening regulatory landscape concerning environmental impact. For Burckhardt Compression, this translates into a stronger position as they can highlight their advanced, eco-friendly compressor technologies.

This focus on sustainability allows Burckhardt to differentiate its products, moving beyond pure price competition. By offering solutions that reduce energy consumption and environmental footprint, the company can potentially justify premium pricing. For instance, in 2024, many industrial sectors reported significant increases in energy costs, making efficiency a key purchasing criterion.

- Growing Demand for Efficiency: In 2024, industries faced an average energy cost increase of 15-20% globally, making energy-efficient equipment a critical investment.

- Regulatory Push: Stricter emissions standards implemented in major markets throughout 2023 and continuing into 2024 incentivize the adoption of sustainable technologies.

- Premium Pricing Potential: Companies demonstrating superior energy savings can command up to a 10% premium on their solutions, as observed in key Burckhardt markets.

- Reduced Price Sensitivity: The focus on long-term operational cost savings and compliance lessens direct customer pressure on initial purchase prices.

Long-Term Service Contracts and Relationships

Burckhardt Compression's commitment to a full lifecycle service for its compressor systems cultivates deep, long-term customer relationships. This focus on ongoing support and maintenance creates recurring revenue streams and strengthens customer loyalty, effectively mitigating individual customer bargaining power by fostering a reliance on Burckhardt's expertise and integrated solutions.

These extensive service agreements, often spanning many years, lock customers into a partnership that extends beyond the initial sale. For instance, in 2023, Burckhardt Compression reported a significant portion of its revenue derived from services and spare parts, underscoring the financial impact of these long-term contracts.

- Long-Term Service Contracts: Burckhardt Compression offers comprehensive service packages that cover the entire lifespan of its compressor systems, from installation to maintenance and upgrades.

- Recurring Revenue Streams: These service contracts generate predictable, ongoing revenue for Burckhardt Compression, reducing reliance on new equipment sales alone.

- Customer Retention: The vested interest customers develop in these long-term relationships and the specialized nature of the services provided can decrease their immediate inclination to switch providers, thereby lessening their bargaining power.

- Reduced Switching Costs: For customers, the cost and complexity of switching to a different service provider for specialized compressor systems are often prohibitive, further solidifying Burckhardt's position.

Customers in critical sectors like oil and gas face substantial switching costs due to the deep integration of Burckhardt Compression's systems, requiring significant re-engineering and new expertise. This dependence, coupled with Burckhardt's comprehensive lifecycle services, fosters loyalty and reduces customers' inclination to seek alternatives, thereby limiting their bargaining power.

The vital role of Burckhardt's compressors in core client operations means reliability and long-term support are prioritized over initial price. This focus on performance and trust further diminishes customer price sensitivity and their ability to negotiate lower prices.

The increasing demand for energy efficiency, driven by rising operational costs and environmental regulations, positions Burckhardt favorably. In 2024, industries saw energy cost increases of 15-20%, making efficient equipment a key purchasing driver. This allows Burckhardt to potentially command premium pricing, up to 10% in some markets, for its sustainable technologies.

| Factor | Impact on Customer Bargaining Power | Supporting Data (2023-2024) |

|---|---|---|

| Switching Costs | Lowers bargaining power | High integration costs, specialized maintenance needs |

| Lifecycle Services | Lowers bargaining power | Recurring revenue from services, customer reliance on expertise |

| Product Essentiality | Lowers bargaining power | Compressors vital for core operations, focus on reliability |

| Energy Efficiency Demand | Lowers bargaining power | 15-20% energy cost increase in 2024, premium pricing potential (up to 10%) |

Preview Before You Purchase

Burckhardt Compression Holding Porter's Five Forces Analysis

This preview showcases the exact, professionally written Porter's Five Forces Analysis of Burckhardt Compression Holding that you will receive immediately after purchase, offering a comprehensive understanding of its competitive landscape. You're looking at the actual document, meaning no placeholders or sample content—what you see is precisely what you get, ready for your strategic planning. Once your purchase is complete, you'll gain instant access to this complete, ready-to-use analysis file, enabling you to leverage its insights without delay.

Rivalry Among Competitors

The reciprocating compressor market is a competitive landscape featuring major global players like Ariel Corporation, Atlas Copco, Siemens AG, and Gardner Denver, all vying with Burckhardt Compression. This robust competition intensifies, especially for lucrative contracts in demanding industrial sectors.

The global reciprocating compressor market is on a strong growth trajectory, with projections indicating it will reach an estimated USD 8.56 billion by 2034. This expanding market size naturally attracts both established companies and new players, intensifying the competitive landscape.

In response to this growth, competitors are channeling significant investment into innovation. Key areas of focus include developing AI-powered diagnostic tools for predictive maintenance and engineering more energy-efficient compressor designs. These advancements are crucial for differentiating products and securing a larger share of the expanding market.

Competitive rivalry in the compressor industry, particularly for specialized equipment like Burckhardt Compression's, often hinges on technological advancement and service quality rather than just price. Companies differentiate themselves through superior compressor efficiency, enhanced reliability, bespoke customization options to meet specific client needs, and robust after-sales support. This focus on value-added features allows firms to sidestep intense price wars.

Burckhardt Compression Holding AG, for instance, strategically targets critical, high-pressure applications where performance and dependability are paramount. Their extensive service network and commitment to lifecycle support further solidify their market position, allowing them to command premium pricing and reduce direct competition based solely on cost. This approach is evident in their strong order intake, with a notable CHF 1,251.4 million reported for the fiscal year 2023, indicating sustained demand for their differentiated offerings.

High Exit Barriers

The reciprocating compressor market presents substantial exit barriers, largely due to the immense capital required for specialized manufacturing facilities and advanced engineering capabilities. Companies like Burckhardt Compression invest heavily in these areas, making it economically challenging to divest or exit the industry. This high cost of entry and exit effectively locks in existing players.

These significant investments, coupled with the need for extensive global service networks and a deep pool of specialized engineering talent, mean that competitors are often compelled to stay in the market, even when facing economic headwinds. This persistence among established firms intensifies ongoing competitive rivalry, as no one can easily retreat.

- High Capital Investment: Building and maintaining state-of-the-art manufacturing plants for complex compressors demands hundreds of millions of dollars.

- Specialized Expertise: The engineering knowledge required for designing and servicing high-pressure reciprocating systems is scarce and takes years to develop.

- Global Service Networks: Establishing and supporting a worldwide network of service centers and spare parts depots represents a considerable ongoing financial commitment.

- Industry Persistence: Consequently, companies are less likely to exit during market downturns, ensuring continuous competitive pressure among remaining players.

Strategic Partnerships and Acquisitions

Key players in the reciprocating compressor market are actively pursuing strategic partnerships and acquisitions to bolster their competitive standing. For instance, in 2024, several major manufacturers announced facility expansions and joint ventures aimed at increasing production capacity and developing new technologies. These moves are indicative of a highly dynamic environment where consolidation and collaboration are essential for gaining a competitive edge and broadening product offerings.

This trend is further evidenced by ongoing merger and acquisition activities. Companies are strategically acquiring smaller, specialized firms to integrate advanced technologies and expand their market reach. This consolidation helps create larger, more diversified entities capable of competing more effectively on a global scale.

- Strategic Moves: Companies are expanding facilities and forming partnerships to enhance market position.

- Portfolio Expansion: Acquisitions are being used to broaden product lines and technological capabilities.

- Competitive Landscape: The market is characterized by an active and evolving competitive environment driven by consolidation.

- Global Reach: Collaboration and M&A activities aim to increase global competitiveness and market penetration.

Competitive rivalry in the reciprocating compressor sector is intense, driven by significant investments in technology and service. Companies differentiate through efficiency, reliability, and customization, rather than solely on price. Burckhardt Compression's focus on high-pressure applications and lifecycle support highlights this strategy, as seen in their CHF 1,251.4 million order intake for fiscal year 2023.

The market is characterized by high exit barriers due to substantial capital requirements for manufacturing and specialized expertise, compelling companies to remain competitive. Strategic partnerships and acquisitions, such as facility expansions and joint ventures announced in 2024, further shape this dynamic landscape, aiming to boost production capacity and technological advancement.

| Competitor | 2023 Revenue (Est. USD Billions) | Key Focus Areas |

|---|---|---|

| Ariel Corporation | 2.0 - 2.5 | Oil & Gas, Industrial Applications |

| Atlas Copco | 14.0 - 15.0 (Total Group) | Broad Industrial, Energy Efficiency |

| Siemens AG | 70.0 - 75.0 (Total Group) | Process Industries, Digitalization |

| Gardner Denver | 3.0 - 3.5 (Industrial Segment) | Upstream Oil & Gas, General Industry |

| Burckhardt Compression | 1.3 - 1.4 (CHF 1,251.4M FY23) | High-Pressure, Critical Applications, Service |

SSubstitutes Threaten

While reciprocating compressors excel in high-pressure scenarios, other technologies like rotary screw, centrifugal, and scroll compressors present viable substitutes in various industrial settings. These alternatives can offer advantages such as uninterrupted operation, reduced upkeep, or more compact designs, thereby creating a competitive pressure in specific market niches.

Innovations in non-compressor technologies pose a significant threat by offering alternative methods to manage gases. For instance, advancements in direct conversion processes or novel material science could bypass the fundamental need for mechanical compression in certain industrial applications, impacting demand for traditional compressor systems.

Emerging energy sectors are particularly susceptible to these disruptive technologies. Solutions that enable direct energy storage or conversion without relying on compression could fundamentally alter the market landscape. For example, research into advanced battery chemistries or novel fuel cell designs might reduce the reliance on compressed hydrogen or natural gas.

While the exact market share impact of these nascent technologies is still developing, the potential for them to disintermediate the need for compressors is a key consideration. Companies are closely monitoring developments in areas like solid-state gas storage and advanced membrane separation, which could offer more energy-efficient or cost-effective alternatives in the future.

The rise of decentralized production and storage models presents a significant threat of substitution for traditional, large-scale compressor systems. For instance, advancements in localized hydrogen production, like on-site electrolysis, could reduce reliance on centralized hydrogen storage and transport, thereby diminishing demand for Burckhardt Compression's high-pressure reciprocating compressors in this emerging sector.

Energy Transition and New Fuel Sources

The global push towards an energy transition, particularly the rise of green hydrogen and carbon capture technologies, presents a nuanced threat of substitutes for Burckhardt Compression. While these advancements create new markets for specialized compressors, they also carry the potential to diminish demand for traditional compression solutions if they evolve to require less high-pressure gas handling. For instance, advancements in direct air capture or novel energy storage methods that bypass traditional gas compression could emerge as viable substitutes.

The increasing viability of alternative energy carriers, beyond hydrogen, could also impact the compressor market. If technologies like advanced battery storage or synthetic fuels gain significant traction and market share, the reliance on compressed gases in the energy mix might lessen. For example, by 2024, the global investment in clean energy technologies, including hydrogen infrastructure, was projected to reach significant figures, indicating a substantial shift in the energy landscape that could redefine the role of compression.

- Green Hydrogen: Growing adoption of green hydrogen as a clean fuel source necessitates specialized compressors, potentially diverting investment from traditional gas compression markets.

- Carbon Capture, Utilization, and Storage (CCUS): CCUS technologies require robust compression solutions, but alternative CO2 mitigation strategies could reduce the long-term demand for these specific applications.

- Energy Storage Innovations: Developments in battery technology and other non-gas-based energy storage methods could reduce the overall need for compressed gas infrastructure in the future energy grid.

- Shifting Energy Carriers: A significant market shift towards energy carriers that do not rely on high-pressure gas compression would directly impact demand for Burckhardt's core offerings.

Cost-Effectiveness of Rental Services

The cost-effectiveness of rental services presents a significant threat of substitutes for industrial compressor manufacturers like Burckhardt Compression. For many medium and small-scale enterprises, the substantial upfront investment and ongoing maintenance expenses associated with purchasing new compressors make renting a far more appealing option. This financial consideration directly impacts the demand for new equipment sales.

This trend is particularly evident in sectors where compressor usage might be intermittent or project-specific. Companies can avoid the capital outlay and depreciation costs by opting for rental agreements, effectively substituting ownership with a service-based solution. For instance, in 2024, the global industrial rental market continued to see robust growth, with many smaller businesses leveraging these services to manage cash flow and operational flexibility.

- Rental services offer a lower barrier to entry for smaller companies.

- This reduces the need for capital expenditure on new compressor purchases.

- The flexibility of rental agreements appeals to businesses with variable compressor needs.

- This directly siphons potential sales from manufacturers.

The threat of substitutes for Burckhardt Compression Holding stems from alternative technologies and methods that can perform similar functions, often at a lower cost or with greater efficiency in specific applications. While Burckhardt excels in high-pressure reciprocating compressors, other compressor types like rotary screw and centrifugal compressors serve as substitutes in less demanding scenarios. Furthermore, entirely different technological approaches to gas handling, such as advanced membrane separation or direct energy conversion, pose a more fundamental threat by potentially eliminating the need for mechanical compression altogether.

Emerging energy sectors, particularly those focused on green hydrogen and carbon capture, are key areas where substitutes are gaining traction. For instance, advancements in battery technology and other non-gas-based energy storage methods could reduce the overall demand for compressed gas infrastructure. In 2024, global investment in clean energy technologies, including hydrogen infrastructure, was substantial, indicating a significant shift that could redefine the role of compression. The increasing viability of alternative energy carriers beyond hydrogen also presents a risk, as a market shift towards these could lessen reliance on compressed gases.

| Substitute Technology | Key Advantages | Potential Impact on Burckhardt Compression |

| Rotary Screw Compressors | Continuous operation, lower maintenance | Substitution in lower-pressure, less demanding applications |

| Centrifugal Compressors | High flow rates, efficiency in specific ranges | Substitution in large-scale, lower-pressure industrial gas handling |

| Membrane Separation | Energy efficiency, reduced footprint for gas purification | Disintermediation of compression in certain gas separation processes |

| Advanced Battery Storage | Non-gas-based energy storage | Reduced reliance on compressed gas for grid-scale energy storage |

Entrants Threaten

Entering the reciprocating compressor market, particularly for large industrial needs, requires significant upfront capital. This includes building advanced manufacturing plants, acquiring specialized equipment, and investing heavily in research and development.

For instance, establishing a new production line for high-pressure compressors can easily run into tens of millions of Swiss francs, a substantial hurdle for potential new entrants aiming to compete with established players like Burckhardt Compression.

These high financial barriers effectively deter many new companies from entering the market, thereby reducing the threat of new competition and reinforcing the position of existing firms.

Developing and manufacturing high-performance reciprocating compressors demands significant technological expertise and ongoing investment in research and development. Burckhardt Compression, with its decades of accumulated knowledge, presents a formidable barrier to entry. For instance, in 2023, the company reported a substantial commitment to R&D, underscoring the continuous innovation required in this sector.

The high cost and complexity associated with precision engineering and advanced manufacturing processes create a steep learning curve for any new competitor. Established firms like Burckhardt have already navigated these challenges, building robust supply chains and efficient production capabilities that are difficult and expensive for newcomers to replicate quickly.

Burckhardt Compression enjoys a significant advantage due to its strong brand recognition and deep-rooted relationships with major clients across vital industries. In sectors where equipment reliability and supplier trust are non-negotiable, these established connections act as a formidable barrier.

Newcomers would find it exceptionally challenging to replicate the trust and loyalty Burckhardt Compression has cultivated. Customers often exhibit a strong reluctance to switch from suppliers with a proven track record for critical machinery, making market entry a steep uphill battle.

Complex Regulatory and Certification Hurdles

The industrial sectors Burckhardt Compression serves, including oil and gas, chemical, and petrochemical, are heavily regulated. These industries demand strict adherence to safety, environmental, and operational certifications. For instance, compliance with standards like ISO 9001 or specific ATEX directives for explosive atmospheres adds significant complexity.

New companies entering this market must invest heavily in understanding and meeting these intricate compliance requirements. This process is not only time-consuming but also incurs substantial costs for testing, documentation, and obtaining necessary approvals. This regulatory labyrinth acts as a substantial deterrent, effectively raising the barrier to entry for potential competitors.

- Stringent Industry Standards: Sectors like oil & gas and chemical processing require adherence to rigorous safety and environmental regulations.

- High Compliance Costs: Navigating and obtaining certifications such as ISO or ATEX involves significant financial investment and time.

- Technical Expertise Required: Understanding and implementing complex regulatory frameworks demands specialized knowledge, which new entrants may lack.

Economies of Scale and Cost Advantages

Existing players like Burckhardt Compression benefit from significant economies of scale in production, procurement, and their extensive global distribution network. This allows them to achieve cost efficiencies that are incredibly difficult for new entrants to match. For instance, in 2023, Burckhardt Compression reported a revenue of CHF 777.1 million, reflecting the scale of their operations.

This established cost advantage provides a substantial competitive edge, making it challenging for newcomers to compete effectively on price while still achieving profitability. New entrants would face immense pressure to invest heavily in manufacturing capacity and supply chain infrastructure to even approach the cost structures of incumbents.

- Economies of Scale: Burckhardt Compression leverages large-scale production to reduce per-unit costs.

- Procurement Power: Bulk purchasing of raw materials and components provides cost savings.

- Global Distribution: An established network lowers logistics expenses compared to new players.

- Cost Advantage: These factors create a significant barrier for new entrants aiming for price competitiveness.

The threat of new entrants into the reciprocating compressor market, particularly for high-demand industrial applications, is considerably low. Burckhardt Compression benefits from substantial capital requirements for manufacturing facilities and advanced R&D, creating a significant financial barrier. For example, establishing a new, specialized compressor production line can cost tens of millions of Swiss francs, a prohibitive sum for most aspiring competitors.

Established players like Burckhardt Compression possess deep technological expertise, built over decades, which is difficult and costly for newcomers to replicate. Their strong brand reputation and existing client relationships in critical sectors such as oil and gas further deter new market entries, as customers prioritize proven reliability and trust for essential machinery.

The stringent regulatory environment in industries served by Burckhardt Compression, including oil & gas and chemical processing, adds another layer of complexity. New entrants must invest heavily in understanding and complying with safety, environmental, and operational certifications like ISO or ATEX, a process that is both time-consuming and expensive.

| Barrier to Entry | Description | Impact on New Entrants |

| Capital Requirements | High cost of advanced manufacturing plants and specialized equipment. | Significantly limits the number of potential new competitors. |

| Technological Expertise | Need for specialized knowledge in precision engineering and R&D. | Steep learning curve and high investment in talent and innovation. |

| Brand Loyalty & Relationships | Established trust with major industrial clients. | Difficult for newcomers to gain market share without a proven track record. |

| Regulatory Compliance | Adherence to strict industry standards and certifications. | Increases costs and time-to-market, acting as a substantial deterrent. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Burckhardt Compression Holding is built upon a foundation of verified data, including the company's annual reports, investor presentations, and industry-specific market research from reputable firms. We also incorporate insights from financial news outlets and competitor disclosures to capture a comprehensive view of the competitive landscape.