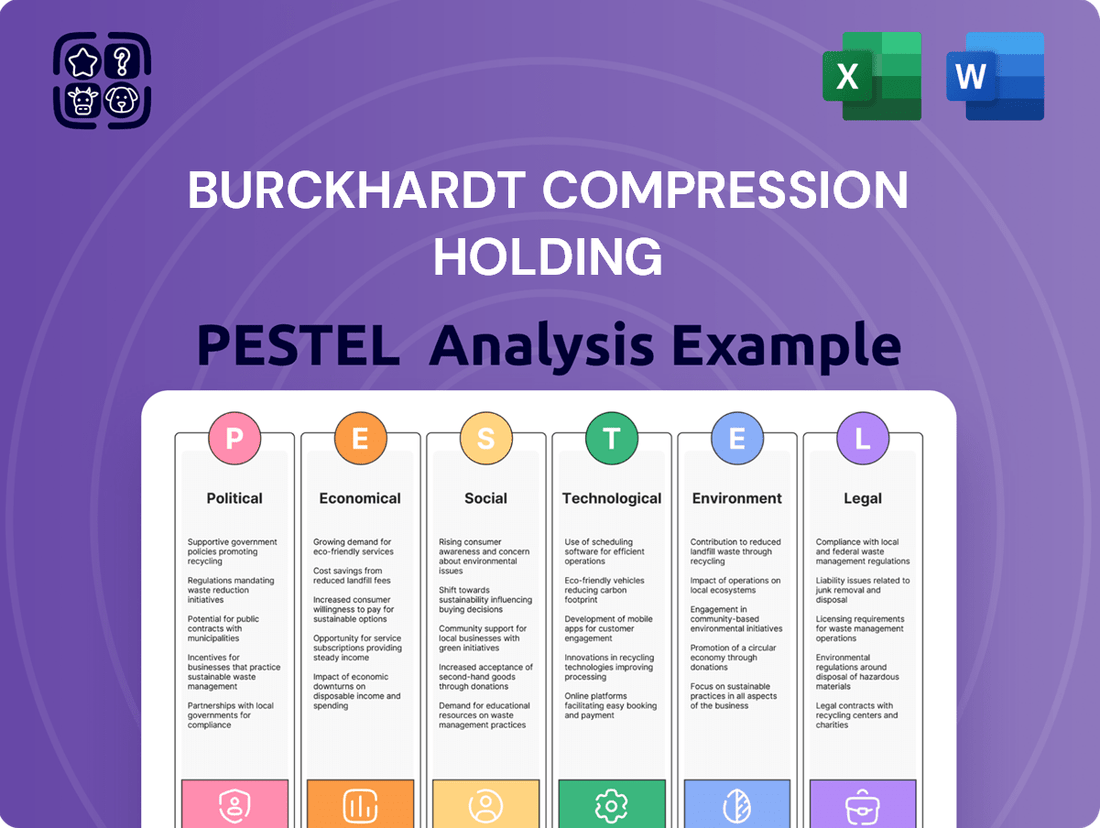

Burckhardt Compression Holding PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Burckhardt Compression Holding Bundle

Gain a crucial competitive advantage with our comprehensive PESTLE analysis of Burckhardt Compression Holding. Understand the political, economic, social, technological, legal, and environmental forces that are shaping its operational landscape and future growth opportunities. This expertly crafted analysis provides the deep-dive insights you need to anticipate market shifts and refine your strategic approach. Download the full version now and unlock actionable intelligence to inform your investment decisions.

Political factors

Geopolitical stability in regions like the Middle East and North Africa, major oil and gas hubs, directly influences the greenlighting of substantial infrastructure investments. For Burckhardt Compression, this translates to project pipelines for new gas pipelines and processing plants, which rely heavily on their specialized compressor technology. For instance, ongoing stability in Saudi Arabia in 2024 supports continued investment in their Vision 2030 energy diversification projects, potentially boosting demand.

Government energy policies are a critical driver. In 2024 and 2025, many nations are navigating the energy transition, with some actively promoting renewables while others maintain strong support for fossil fuels. Policies that favor natural gas as a bridge fuel, for example, could see increased demand for Burckhardt Compression's systems in LNG (Liquefied Natural Gas) liquefaction and regasification. Conversely, aggressive carbon pricing or outright bans on new fossil fuel projects would dampen this demand.

Trade relations and sanctions are also significant. The ongoing geopolitical landscape in 2024 means that market access can shift rapidly. For Burckhardt Compression, disruptions to supply chains or the imposition of sanctions on key customer nations could impact their ability to deliver and service compressor units, affecting revenue streams. For example, any new sanctions impacting major energy producers in 2025 would require careful navigation of their global operations.

Governments worldwide enforce stringent regulations on industrial operations, covering everything from safety protocols to environmental impact and requiring specific operational permits. These rules directly influence how Burckhardt Compression designs and deploys its sophisticated compressor systems, necessitating compliance with diverse national standards.

Navigating these evolving regulatory landscapes across its global markets is crucial for Burckhardt Compression. For instance, in 2024, the European Union continued to refine its industrial emissions directives, potentially impacting the energy efficiency requirements for new compressor installations in member states.

Conversely, policy support for key industrial sectors can significantly boost demand for compressor technology. In 2024, governments in regions like the Middle East announced substantial investments in expanding their petrochemical and hydrogen production capacities, creating new opportunities for Burckhardt Compression's specialized solutions.

Changes in international trade agreements and the imposition of tariffs directly influence the cost structure for Burckhardt Compression. For instance, the ongoing trade tensions between major economic blocs can lead to increased duties on imported components, raising production expenses. This can then translate to higher prices for their advanced compression solutions, potentially impacting competitiveness in key markets.

Trade barriers also present significant challenges to Burckhardt Compression's global sales strategies. For example, if a new tariff is placed on specialized industrial equipment in a significant export market, it could make it more expensive for customers to acquire their compressors, thereby dampening demand. This necessitates careful market analysis and potentially a recalibration of sales approaches to mitigate such impacts.

Conversely, favorable trade policies, such as the reduction or elimination of tariffs on industrial machinery, can unlock substantial growth opportunities. A recent example could be a new trade pact that eases restrictions on technology exports, allowing Burckhardt Compression to more readily supply its cutting-edge compressor technology to emerging markets, thereby expanding its global footprint.

Political Instability in Key Markets

Political instability, including conflicts or civil unrest in key operational or client regions, poses a significant threat to Burckhardt Compression. Such events can directly disrupt ongoing projects, cause delays in crucial investment decisions, and introduce considerable risks to both personnel and company assets. For instance, geopolitical tensions in parts of the Middle East or Eastern Europe, where energy and industrial projects are common, could directly impact Burckhardt Compression's order pipeline.

These disruptions can manifest as project cancellations or postponements, directly affecting order intake and, consequently, revenue streams. The company must therefore maintain a vigilant approach to assessing political risks, particularly when considering new market entries or planning operational strategies in volatile territories. This proactive risk management is essential for safeguarding financial performance and ensuring business continuity.

- Geopolitical Risk Assessment: Burckhardt Compression's reliance on global markets necessitates continuous monitoring of political stability in regions like the Middle East and Asia, where major industrial projects are often concentrated.

- Impact on Order Intake: Political instability in these regions can directly lead to delays or cancellations of large-scale projects, impacting Burckhardt Compression's order backlog, which stood at CHF 1.4 billion as of the first half of 2024.

- Operational Disruptions: Civil unrest or conflicts can impede the delivery of equipment and services, as well as endanger personnel, leading to increased operational costs and potential project delays.

- Strategic Market Entry: A thorough political risk analysis is paramount before entering or expanding operations in markets exhibiting signs of instability, ensuring that potential financial and operational impacts are understood and mitigated.

Government Support for Industrial Decarbonization

Governments globally are stepping up their support for industrial decarbonization, particularly through incentives for carbon capture, utilization, and storage (CCUS) projects. This policy shift presents significant growth avenues for Burckhardt Compression, whose compressors are vital components in managing CO2 and other industrial gases. For instance, the US Inflation Reduction Act of 2022 offers substantial tax credits for CCUS, projected to drive billions in investment by 2030.

Furthermore, evolving policy landscapes that champion the development of hydrogen infrastructure are directly boosting demand for specialized compression technologies. As nations aim to meet ambitious climate targets, such as the European Union's goal of reducing greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, the need for efficient gas handling solutions like those provided by Burckhardt Compression will only intensify.

- Government Incentives: Increased tax credits and subsidies for CCUS and green hydrogen projects globally.

- Policy Frameworks: Supportive regulations for hydrogen production, transport, and storage infrastructure.

- Market Opportunities: Growing demand for compressors essential for CO2 and hydrogen handling in industrial applications.

- Climate Targets: National and international climate goals are accelerating the adoption of decarbonization technologies.

Government energy policies significantly shape demand for Burckhardt Compression's technology. Nations promoting natural gas as a transition fuel, like many in Asia in 2024, are increasing demand for LNG compressors. Conversely, aggressive carbon pricing or fossil fuel bans in regions like the EU could temper this growth, requiring strategic adaptation.

Trade relations and sanctions directly impact market access and operational costs. For instance, new tariffs on industrial equipment in 2025 could make Burckhardt Compression's solutions more expensive in key export markets. Navigating evolving trade agreements and potential disruptions to global supply chains is crucial for maintaining competitiveness and revenue.

Political stability is paramount, as conflicts or unrest in regions with significant energy projects, such as parts of the Middle East, can lead to project delays or cancellations. Burckhardt Compression's order backlog, which stood at CHF 1.4 billion in H1 2024, is susceptible to these geopolitical shifts, necessitating robust risk assessment for market entry.

Government incentives for decarbonization, like the US Inflation Reduction Act's support for CCUS, create substantial opportunities. Similarly, policies championing hydrogen infrastructure, driven by climate targets such as the EU's 2030 goals, are accelerating demand for specialized gas handling compressors.

| Factor | Impact on Burckhardt Compression | 2024/2025 Relevance |

|---|---|---|

| Energy Transition Policies | Demand for gas and hydrogen compressors; potential impact of carbon pricing. | EU's net-zero targets; US IRA driving CCUS investment. |

| Geopolitical Stability | Project pipeline and order intake; risk of delays or cancellations. | CHF 1.4 billion order backlog (H1 2024) vulnerable to regional conflicts. |

| Trade Agreements & Tariffs | Market access, cost of components, and pricing competitiveness. | Ongoing trade tensions; potential for new tariffs on industrial equipment. |

| Regulatory Compliance | Design and deployment of compressor systems; energy efficiency standards. | EU industrial emissions directives; diverse national standards. |

What is included in the product

This PESTLE analysis of Burckhardt Compression Holding provides a comprehensive examination of the external macro-environmental forces impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential opportunities and threats within the global compressor market.

A clear, actionable PESTLE analysis for Burckhardt Compression Holding, presented in a digestible format that highlights key external factors impacting their business.

This analysis serves as a pain point reliever by offering a structured overview of political, economic, social, technological, environmental, and legal influences, enabling proactive strategy development.

Economic factors

The global economic outlook significantly impacts Burckhardt Compression's market. In 2024, projections suggest a moderate global GDP growth of around 2.7%, according to the IMF, which generally supports industrial investment. However, this growth is uneven across regions, with emerging markets often showing stronger expansion than developed economies.

Reduced capital expenditure by key clients in sectors like oil and gas, chemicals, and petrochemicals is a direct consequence of economic slowdowns. For example, a dip in oil prices, which saw Brent crude fluctuate significantly in late 2023 and early 2024, can cause companies in these industries to postpone or scale back new projects, directly affecting demand for large compressor systems.

Conversely, periods of robust economic expansion typically fuel greater industrial investment. As economies grow, there's increased demand for energy and manufactured goods, prompting expansions and upgrades of industrial facilities. This creates opportunities for Burckhardt Compression as clients invest in new, more efficient compressor technologies to meet rising production needs.

Fluctuations in global oil and gas prices directly affect Burckhardt Compression's client base, influencing their investment in new equipment and upgrades. For instance, if oil prices remain low, as seen in periods throughout 2023 and early 2024, clients might scale back on exploration and production activities, leading to a softer demand for compressors.

Conversely, sustained higher commodity prices, such as those experienced in late 2021 and parts of 2022, tend to spur investment in new energy projects and infrastructure. This can translate into increased orders for Burckhardt Compression's specialized compressor solutions.

The International Energy Agency (IEA) projected in early 2024 that while oil demand growth was moderating, geopolitical factors could still introduce significant price volatility. This ongoing uncertainty means Burckhardt Compression must remain agile in responding to shifts in client capital expenditure driven by commodity market dynamics.

Fluctuations in global interest rates directly impact the cost of financing for substantial industrial ventures, thereby shaping clients' capital expenditure decisions. For instance, a rise in the benchmark interest rate, such as the US Federal Funds Rate which was held between 5.25% and 5.50% through early 2025, can significantly increase the cost of borrowing for Burckhardt Compression's clients undertaking large-scale projects.

When borrowing costs escalate due to higher interest rates, the financial viability of these long-term projects diminishes. This can lead to a postponement or even outright cancellation of orders for complex and capital-intensive compressor systems, directly affecting Burckhardt Compression's revenue streams and order backlog.

Furthermore, the availability of affordable capital is a critical determinant for clients engaged in extensive infrastructure development. A tightening credit market or elevated borrowing costs can hinder their ability to secure the necessary funding, potentially slowing down the pace of new project initiation and thus impacting demand for specialized equipment.

Inflationary Pressures and Supply Chain Costs

Persistent inflationary pressures, particularly evident in the 2024-2025 period, directly translate to higher input costs for Burckhardt Compression. This includes the price of essential raw materials like steel and specialized alloys, as well as increased labor and transportation expenses. For instance, global inflation rates remained elevated through early 2025, with many industrial economies experiencing consumer price index (CPI) increases exceeding 3% year-over-year, impacting component sourcing.

Supply chain disruptions continue to pose a significant challenge. Geopolitical tensions and trade policy shifts in 2024 led to extended lead times for critical components and a general uptick in shipping costs. This volatility can force companies like Burckhardt Compression to seek alternative, potentially more expensive, suppliers or to hold larger inventories, further straining working capital.

- Rising Raw Material Costs: Global commodity prices for metals used in compressor manufacturing, such as nickel and copper, saw an average increase of 8-12% in the 12 months leading up to mid-2025.

- Increased Transportation Expenses: Freight rates for ocean and air cargo experienced a volatile but generally upward trend, with some routes showing increases of 15-20% compared to 2023 levels due to capacity constraints and fuel surcharges.

- Labor Cost Inflation: Wage growth in key manufacturing regions for industrial equipment averaged 4-6% annually through 2024, reflecting tight labor markets and general inflationary pressures.

- Supply Chain Volatility: Lead times for specialized electronic components and high-performance alloys extended by an average of 2-4 weeks in 2024, impacting production scheduling and increasing the need for robust inventory management.

Currency Exchange Rate Fluctuations

Burckhardt Compression, as a global enterprise, faces inherent risks from currency exchange rate fluctuations, impacting both its revenue streams and operational costs. For instance, a strengthening Swiss Franc (CHF), Burckhardt Compression's home currency, can render its high-tech compressors and services more expensive for international buyers, potentially dampening demand. Conversely, a weaker CHF can enhance the company's price competitiveness in key export markets, thereby potentially boosting sales volume.

The company's financial performance is directly tied to its ability to navigate these currency volatilities. Effective foreign exchange risk management is therefore crucial for preserving profit margins and ensuring consistent pricing strategies across its diverse global customer base. For example, in 2024, the average EUR/CHF exchange rate hovered around 0.95, a level that would have made exports to the Eurozone relatively costly for a Swiss-based manufacturer.

- Impact on Exports: A stronger local currency (e.g., CHF) makes Burckhardt Compression's products more expensive for international customers, potentially reducing export sales volume.

- Competitiveness Boost: A weaker local currency can improve the price competitiveness of Burckhardt Compression's offerings in foreign markets, potentially increasing sales.

- Profitability Management: Effective management of currency exposures is vital for maintaining stable profit margins and predictable pricing across different geographical regions.

- 2024 Exchange Rate Example: The EUR/CHF exchange rate averaged approximately 0.95 in 2024, illustrating the cost implications for exports to the Eurozone.

Economic factors significantly shape Burckhardt Compression's market landscape. Moderate global GDP growth around 2.7% in 2024, as projected by the IMF, generally supports industrial investment, though this growth is uneven across regions. Economic slowdowns can lead to reduced capital expenditure by key clients in sectors like oil and gas, directly impacting demand for large compressor systems, especially when oil prices fluctuate as they did in late 2023 and early 2024.

Higher interest rates, with the US Federal Funds Rate held between 5.25% and 5.50% through early 2025, increase financing costs for industrial ventures, potentially causing clients to postpone or cancel large projects. Persistent inflation through early 2025, with CPI increases exceeding 3% in many industrial economies, drives up input costs for raw materials, labor, and transportation for Burckhardt Compression. Supply chain disruptions in 2024, due to geopolitical tensions, have extended lead times for components, increasing costs and necessitating robust inventory management.

| Economic Factor | Impact on Burckhardt Compression | Supporting Data (2024-2025) |

|---|---|---|

| Global GDP Growth | Influences overall industrial investment and demand for compressors. | IMF projected ~2.7% global GDP growth in 2024. |

| Commodity Prices (e.g., Oil) | Affects client capital expenditure in energy sectors. | Brent crude prices showed significant fluctuation in late 2023/early 2024. IEA noted moderating oil demand growth but potential volatility. |

| Interest Rates | Impacts the cost of financing for client projects. | US Federal Funds Rate held at 5.25%-5.50% through early 2025. |

| Inflation | Increases raw material, labor, and transportation costs. | CPI increases exceeded 3% year-over-year in many industrial economies through early 2025. |

| Supply Chain Disruptions | Extend lead times and increase costs for components. | Lead times for specialized components extended by 2-4 weeks on average in 2024. |

Preview the Actual Deliverable

Burckhardt Compression Holding PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Burckhardt Compression Holding delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed overview of the external forces shaping its strategic landscape.

Sociological factors

The availability of skilled labor, especially engineers and specialized technicians, is paramount for Burckhardt Compression's success in manufacturing and servicing complex compressor systems. For instance, in 2024, the global demand for mechanical engineers was projected to remain strong, with many developed economies facing an aging workforce and potential shortages in specialized manufacturing roles.

Demographic shifts and evolving educational priorities can exacerbate skill gaps, directly affecting Burckhardt Compression's ability to recruit qualified personnel and maintain operational efficiency. In 2025, reports indicate a continued trend of declining interest in vocational trades in some European countries, potentially limiting the pool of experienced manufacturing workers.

To counter these challenges, Burckhardt Compression's strategic focus on robust training and development programs is essential. These initiatives help bridge existing skill gaps and ensure a pipeline of competent employees capable of handling advanced technologies and complex service requirements.

Societal expectations for industrial safety and occupational health are on the rise worldwide, influencing regulatory bodies and corporate responsibility. Burckhardt Compression faces increasing pressure to ensure its high-pressure compressors and related services adhere to the most rigorous safety standards, safeguarding both its employees and the environment. For instance, the International Labour Organization (ILO) reported in 2024 that occupational accidents and diseases still cause millions of preventable deaths annually, highlighting the critical need for robust safety protocols in industries where Burckhardt operates.

Growing public awareness of climate change is significantly reshaping how people view fossil fuels, a core sector for Burckhardt Compression. This societal shift is directly impacting investment decisions, with a noticeable trend towards prioritizing sustainable energy infrastructure over traditional fossil fuel projects.

This evolving public sentiment fuels a growing demand for cleaner energy alternatives, putting pressure on industries reliant on fossil fuels to adapt. For Burckhardt Compression, this means a strategic imperative to embrace the energy transition to maintain long-term relevance and market position.

For instance, in 2024, global investment in clean energy reached an estimated $2 trillion, a substantial increase that highlights the market's pivot. This trend suggests that companies like Burckhardt Compression must increasingly align their offerings with sustainable energy solutions to capture future growth opportunities.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for corporate social responsibility (CSR) are increasingly shaping how companies like Burckhardt Compression operate. This means a greater emphasis on ethical conduct, sustainability, and transparency across all business activities. For instance, in 2024, a significant majority of investors surveyed by PwC indicated that ESG (Environmental, Social, and Governance) factors, a core component of CSR, are critical to their investment decisions, with over 70% stating they would divest from companies with poor ESG performance.

Burckhardt Compression is therefore expected to demonstrate responsible labor practices, actively engage with the communities where it operates, and uphold strong environmental stewardship throughout its entire value chain. This commitment extends from sourcing raw materials to the end-of-life management of its products. Companies that excel in CSR often find it easier to attract top talent and secure investment capital, as demonstrated by the growing trend of ESG-focused funds attracting billions in assets under management globally throughout 2024 and projected into 2025.

The positive impact of robust CSR performance on brand reputation is substantial. Companies perceived as socially responsible often enjoy higher customer loyalty and a stronger competitive advantage. This enhanced reputation can translate into tangible financial benefits, including improved sales and market share, as consumers and business partners increasingly align their choices with companies that demonstrate a commitment to broader societal well-being.

- Ethical Operations: Adherence to fair labor standards and transparent business dealings are paramount.

- Sustainability Focus: Reducing environmental impact through efficient resource use and emissions control is a key expectation.

- Community Engagement: Active participation and support for local communities where Burckhardt Compression has a presence.

- Investor Alignment: Meeting the growing demand from investors for demonstrable ESG performance and reporting.

Demand for Local Content and Employment

Societies worldwide are increasingly emphasizing the importance of local content and job creation within industrial sectors. This trend directly influences client preferences, with many now favoring companies that actively contribute to the local economy through manufacturing, service provision, or direct employment. For instance, in 2024, several emerging markets have introduced or strengthened policies mandating a minimum percentage of local sourcing and labor for large infrastructure and energy projects.

Burckhardt Compression must therefore strategically assess its global operations and supply chain to align with these evolving demands. This could involve expanding local service centers or even establishing manufacturing facilities in key growth regions. For example, in 2025, the company is reportedly evaluating opportunities to increase its local assembly capabilities in Southeast Asia to better serve the growing demand for hydrogen compression solutions in that market.

- Growing Demand: Societal pressure for local content and employment is a significant factor in many industrial markets.

- Client Preference: Clients often prioritize suppliers demonstrating local manufacturing, service, or job creation contributions.

- Strategic Adaptation: Burckhardt Compression may need to adjust its global footprint and supply chain to meet these local content expectations.

- Market Impact: Policies in emerging markets in 2024 and 2025 are increasingly mandating local sourcing and labor for major projects.

Societal shifts towards sustainability and ethical business practices are increasingly influencing Burckhardt Compression's operational landscape. Growing public concern over climate change is driving demand for cleaner energy solutions, impacting the traditional fossil fuel sector where many of its compressors are utilized. For instance, global investment in clean energy reached an estimated $2 trillion in 2024, signaling a significant market pivot.

Furthermore, expectations for corporate social responsibility (CSR) are intensifying, with investors and consumers prioritizing companies with strong ESG performance. In 2024, over 70% of surveyed investors indicated they would divest from companies with poor ESG metrics, underscoring the financial imperative for Burckhardt Compression to demonstrate ethical conduct and environmental stewardship.

The emphasis on local content and job creation is also a growing societal trend, prompting clients to favor suppliers who contribute to local economies. Many emerging markets introduced or strengthened policies in 2024 mandating local sourcing and labor for major projects, necessitating strategic adaptation from Burckhardt Compression to meet these evolving demands.

Technological factors

Continuous technological advancements in compressor design, materials, and control systems are significantly boosting efficiency, reliability, and lowering operational expenses. Burckhardt Compression's commitment to research and development is crucial for integrating these innovations, keeping its products competitive and aligning with client needs for enhanced performance and energy savings.

For example, in 2023, the company highlighted its focus on optimizing compressors for diverse gas types and operating conditions, a key driver for clients seeking tailored solutions. This dedication to innovation is essential as the market increasingly demands solutions that minimize energy consumption and maximize uptime.

The increasing integration of digitalization and Industry 4.0 principles is transforming industrial operations. For Burckhardt Compression, this means leveraging technologies like the Internet of Things (IoT) for predictive maintenance and remote monitoring of their compressor systems. This allows for proactive issue identification, minimizing downtime and enhancing client operational efficiency.

By embracing these digital advancements, Burckhardt Compression can develop sophisticated data-driven service offerings. These services, such as performance analytics and optimized maintenance scheduling, not only improve customer uptime but also open up new avenues for recurring revenue, thereby strengthening the company's overall value proposition throughout the product lifecycle. For instance, in 2024, the industrial IoT market was projected to reach over $1.1 trillion, highlighting the significant potential for companies like Burckhardt Compression to capitalize on this trend.

The burgeoning fields of carbon capture, utilization, and storage (CCUS) and hydrogen technologies are opening up significant new avenues for reciprocating compressors. Burckhardt Compression, with its deep knowledge in managing diverse gas compositions, is strategically positioned to offer essential compression solutions for these developing, yet fast-expanding, sectors.

The global CCUS market is projected to reach USD 77.4 billion by 2030, demonstrating substantial growth potential. Similarly, the hydrogen economy is a key focus for many nations, with the International Energy Agency reporting that over 30 countries have national hydrogen strategies in place as of early 2024. These trends underscore the critical need for investment in these technologies to secure future expansion opportunities.

Automation and Advanced Manufacturing Techniques

The integration of automation and advanced manufacturing techniques is a significant technological driver for Burckhardt Compression. These advancements, including robotics and AI-driven processes, are poised to boost production efficiency and lower operational costs. For instance, by 2024, the manufacturing sector globally saw an average increase in productivity of 5-10% attributed to automation adoption.

These technologies enable more precise assembly and sophisticated quality control, directly impacting the reliability of Burckhardt Compression's complex machinery. Furthermore, flexible production lines empowered by automation allow the company to more effectively respond to bespoke client demands, a crucial aspect in the specialized compressor market.

Key benefits include:

- Enhanced Production Efficiency: Automation can significantly speed up manufacturing cycles.

- Cost Reduction: Lower labor costs and reduced material waste contribute to savings.

- Improved Product Quality: Precision robotics minimize errors and ensure higher product consistency.

- Increased Flexibility: Automation supports quicker adaptation to customized orders.

Cybersecurity in Industrial Control Systems

As industrial control systems (ICS) become increasingly interconnected through digitalization, the need for robust cybersecurity is paramount for companies like Burckhardt Compression. Protecting these critical systems from cyber threats is essential for maintaining operational continuity, safeguarding sensitive client data, and preserving trust in their advanced compressor technology.

The growing sophistication of cyberattacks poses a significant risk to industrial operations. For instance, reports indicate a substantial rise in ransomware attacks targeting critical infrastructure sectors globally. In 2023 alone, attacks on manufacturing and energy sectors saw an increase of over 40% compared to the previous year, highlighting the urgency for enhanced digital defenses.

Burckhardt Compression must proactively integrate comprehensive cybersecurity measures throughout its product lifecycle and service provisions. This includes implementing secure design principles for new compressor systems and offering ongoing cybersecurity support and updates to clients. Such a commitment is vital to mitigate risks associated with operational disruptions, intellectual property theft, and potential damage to their reputation in the market.

- Increased Connectivity: Digitalization is linking compressor systems, making ICS vulnerable to cyber threats.

- Operational Integrity: Robust cybersecurity is crucial to prevent disruptions and ensure reliable operation.

- Data Protection: Safeguarding sensitive operational data and client information is a key concern.

- Client Trust: Demonstrating strong cybersecurity practices is vital for maintaining client confidence and market reputation.

Technological advancements are reshaping Burckhardt Compression's operational landscape, driving innovation in compressor efficiency and reliability. The company's investment in R&D is key to integrating new materials and control systems, ensuring competitiveness and meeting client demands for energy savings. For example, in 2023, Burckhardt Compression focused on optimizing compressors for various gas types, a critical factor for clients seeking specialized solutions that minimize energy consumption.

Legal factors

Environmental regulations, such as stringent air quality standards and emission controls, directly influence the engineering and operational capabilities of compressor systems. Burckhardt Compression must adhere to a mosaic of national and international environmental statutes, potentially necessitating specialized technologies or operational adjustments to reduce its ecological impact.

For instance, the European Union's Industrial Emissions Directive (IED) sets comprehensive environmental requirements for industrial installations, including those utilizing large compressors. Non-compliance with such directives can result in substantial fines and considerable damage to a company's public image. In 2023, the EU reported over €1.5 billion in fines related to environmental non-compliance across various sectors, highlighting the financial risks involved.

Industrial safety and occupational health laws are critical for Burckhardt Compression, especially given the high-pressure environments its gas compressors operate in. These regulations dictate everything from safe manufacturing processes within their own facilities to the rigorous safety certifications their products must achieve for client use. For instance, in 2023, the European Agency for Safety and Health at Work reported a continued focus on managing risks associated with hazardous substances and machinery, directly impacting compressor design and operation.

Burckhardt Compression operates within a framework of intricate international trade laws and sanctions, necessitating careful navigation of export controls and economic sanctions from various global powers. Failure to comply can lead to severe penalties, including substantial fines and market access limitations.

For instance, the evolving sanctions landscape, particularly concerning Russia and its allies, directly impacts global supply chains and market access for companies like Burckhardt Compression. Adapting trade strategies to these dynamic geopolitical shifts is a constant operational requirement.

Intellectual Property Rights Protection

Protecting its intellectual property, including patents for compressor designs and proprietary technologies, is absolutely critical for Burckhardt Compression's competitive edge. This safeguarding of innovation is paramount in maintaining their market position.

Global legal frameworks for intellectual property rights are quite varied, necessitating a strong and adaptable strategy. This includes diligent patent registration, effective enforcement mechanisms, and proactive measures to combat infringement across different jurisdictions.

- Global Patent Filings: Burckhardt Compression actively manages a portfolio of patents, with a significant portion concentrated in key markets like Europe, North America, and Asia.

- Enforcement Actions: The company has a history of taking legal action against infringements to protect its technological advancements.

- Trade Secret Protection: Beyond patents, Burckhardt Compression also relies on trade secrets for certain proprietary processes and designs, which are protected through internal policies and agreements.

Product Liability and Warranty Laws

Product liability laws hold Burckhardt Compression responsible for any harm caused by defects in its compressors. This necessitates rigorous design, manufacturing, and testing protocols to meet stringent safety regulations globally. For instance, in 2023, the European Union continued to emphasize product safety directives, requiring manufacturers to demonstrate compliance through extensive documentation and testing, a crucial aspect for Burckhardt Compression's market access.

Warranty laws significantly influence customer trust and Burckhardt Compression's financial exposure. These legal frameworks dictate the terms of product guarantees and the scope of after-sales service obligations. Ensuring clear and compliant warranty provisions is vital for maintaining strong customer relationships and managing potential liabilities associated with product performance and repair services.

- Adherence to global product safety standards (e.g., CE marking in Europe, UL certification in North America) is mandatory for Burckhardt Compression.

- Product liability claims can lead to significant financial penalties and reputational damage, underscoring the need for robust quality control.

- Warranty terms must be clearly defined to manage customer expectations and limit potential legal disputes.

Legal factors significantly shape Burckhardt Compression's operations, from environmental compliance to intellectual property protection. Adherence to international trade laws and sanctions is crucial for market access, while product liability and warranty laws necessitate rigorous quality control and clear customer agreements. The company must navigate a complex web of regulations to ensure safe, compliant, and competitive operations globally.

Environmental factors

Global climate change policies, including carbon pricing and net-zero commitments, are accelerating the energy transition. For instance, the European Union's Fit for 55 package aims to cut emissions by 55% by 2030, impacting energy-intensive industries.

These policies present challenges for traditional fossil fuel clients but create significant opportunities for Burckhardt Compression in emerging sectors. The company's compressors are crucial for carbon capture, utilization, and storage (CCUS) projects, a market projected to grow substantially, with global CCUS capacity expected to reach over 250 million tons per annum by 2030.

Furthermore, the increasing focus on hydrogen as a clean energy carrier, driven by government mandates and incentives like the US Inflation Reduction Act, directly benefits Burckhardt Compression. The demand for high-pressure compressors in hydrogen liquefaction and refueling stations is a key growth area, with the global hydrogen market anticipated to reach over $250 billion by 2027.

Growing environmental awareness and stricter government regulations are significantly boosting the demand for energy-efficient compressor systems that also emit less. Clients are increasingly looking for solutions that help them reduce their carbon footprint, making energy efficiency a crucial selling point for companies like Burckhardt Compression.

Burckhardt Compression's focus on innovation in developing these highly efficient systems allows them to meet these evolving client needs and adhere to stringent environmental standards. This commitment to sustainability positions them favorably in a market where environmental performance is becoming a key differentiator, with the global energy efficiency market projected to reach over $2.7 trillion by 2030, according to some projections.

Growing concerns over resource scarcity and the environmental toll of material extraction are reshaping global supply chains. This trend directly impacts companies like Burckhardt Compression, pushing them towards more responsible sourcing and manufacturing. For instance, the increasing demand for critical minerals used in advanced manufacturing, like those potentially found in compressor components, highlights the need for sustainable extraction practices and circular economy principles.

Water Usage and Waste Management Regulations

Burckhardt Compression's industrial activities, encompassing the manufacturing and servicing of compressors, inherently involve significant water consumption and the generation of various waste streams. The company's operations in 2024 are subject to an evolving landscape of environmental regulations.

These regulations, particularly concerning water discharge quality, the disposal of hazardous materials, and mandates for increased recycling, are becoming progressively stricter globally. For instance, in the European Union, the Industrial Emissions Directive (IED) sets stringent limits on pollutants discharged into water bodies, impacting manufacturing processes. Similarly, waste management directives are pushing for higher recycling rates and responsible disposal of industrial byproducts.

- Water Discharge Limits: Compliance with increasingly stringent wastewater discharge standards, such as those under the EU Water Framework Directive, requires advanced treatment technologies.

- Hazardous Waste Disposal: Regulations like the Basel Convention govern the transboundary movement and disposal of hazardous wastes, necessitating careful management of chemical byproducts from manufacturing.

- Recycling Mandates: Growing pressure to adopt circular economy principles means companies like Burckhardt Compression must enhance their waste reduction and material recovery efforts.

To navigate this regulatory environment and reduce its environmental impact, Burckhardt Compression is compelled to deploy and refine comprehensive water management systems and robust waste reduction strategies. This proactive approach is crucial for maintaining operational licenses and demonstrating environmental stewardship.

Biodiversity Protection and Land Use Impact

While Burckhardt Compression doesn't directly operate large industrial sites, the environmental impact of the projects they supply, especially those in ecologically sensitive areas, can create indirect challenges. Scrutiny over biodiversity protection and land use for these projects means Burckhardt Compression might face pressure to ensure their compressor technology minimizes ecological disturbance. This can influence the viability and location choices for their clients' industrial developments.

For instance, projects in regions with high biodiversity value, such as certain natural gas infrastructure or renewable energy installations, are increasingly subject to stringent environmental impact assessments. These assessments often require detailed plans for land restoration and biodiversity offsets. Burckhardt Compression's role as a supplier means their equipment must align with these evolving environmental standards.

- Growing Global Focus on Biodiversity: The Convention on Biological Diversity (CBD) and national environmental agencies are intensifying efforts to protect ecosystems. For example, the Kunming-Montreal Global Biodiversity Framework, adopted in 2022, sets ambitious targets for 2030, including the protection of 30% of land and sea.

- Land Use Restrictions: Development in protected areas or regions with significant ecological value can be restricted or require extensive mitigation measures, potentially increasing project costs and timelines for Burckhardt Compression's clients.

- Supply Chain Responsibility: Companies like Burckhardt Compression are increasingly expected to demonstrate that their products and services contribute to sustainable development, including minimizing environmental footprints throughout the project lifecycle.

Global climate initiatives, such as carbon pricing and net-zero targets, are driving the energy transition, creating opportunities for Burckhardt Compression in sectors like carbon capture and hydrogen. The company's compressors are vital for CCUS projects, with global capacity expected to exceed 250 million tons per annum by 2030. The increasing demand for hydrogen, supported by policies like the US Inflation Reduction Act, also significantly benefits Burckhardt Compression, as high-pressure compressors are essential for hydrogen liquefaction and refueling infrastructure.

Environmental regulations are tightening, impacting manufacturing processes with stricter standards for water discharge and waste management. For instance, the EU's Industrial Emissions Directive mandates advanced treatment technologies for wastewater. Burckhardt Compression must therefore enhance its water management and waste reduction strategies to ensure compliance and demonstrate environmental responsibility.

The growing global emphasis on biodiversity and land use protection can indirectly affect Burckhardt Compression's clients. Projects in ecologically sensitive areas face increased scrutiny, requiring detailed environmental impact assessments and mitigation measures, potentially influencing the siting and execution of industrial developments that utilize the company's technology.

| Environmental Factor | Impact on Burckhardt Compression | Supporting Data/Trend |

|---|---|---|

| Energy Transition | Increased demand for compressors in CCUS and hydrogen sectors. | CCUS capacity projected to exceed 250 million tons per annum by 2030. Global hydrogen market to reach over $250 billion by 2027. |

| Regulatory Compliance | Need for advanced water treatment and waste reduction strategies. | EU Industrial Emissions Directive sets strict limits on water discharge. |

| Biodiversity & Land Use | Potential indirect impact on client project viability due to environmental assessments. | Kunming-Montreal Global Biodiversity Framework aims to protect 30% of land and sea by 2030. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Burckhardt Compression Holding is grounded in comprehensive data from leading economic indicators, international trade agreements, and technological innovation reports. We integrate insights from government publications on environmental regulations and labor laws, alongside market research from industry-specific bodies.