Bunzl SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bunzl Bundle

Bunzl demonstrates significant strengths in its diversified product portfolio and extensive distribution network, but also faces potential threats from supply chain disruptions and evolving regulatory landscapes. Understanding these dynamics is crucial for anyone looking to invest or strategize within this sector.

Want the full story behind Bunzl’s market position, its competitive advantages, and the challenges it navigates? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Bunzl's extensive global distribution network, a core strength, allows it to serve a wide array of markets efficiently. This decentralized model empowers its specialist businesses to tailor services to distinct customer needs across vital sectors such as food processing, healthcare, and retail.

With operations spanning the Americas, Europe, Asia Pacific, and the UK & Ireland, Bunzl benefits from significant geographical diversification. This broad reach not only enhances market penetration but also builds resilience against regional economic downturns, as seen in its consistent revenue growth, with reported revenue of £11.9 billion for the year ending December 31, 2023.

Bunzl's strong acquisition-led growth strategy is a key strength, demonstrated by a record acquisition spend of £883 million in 2024. This consistent approach fuels expansion into new markets and product categories.

The company actively pursues value-accretive acquisitions, which not only broaden its product portfolio and geographical reach but also target higher-margin business segments, directly contributing to revenue and operating profit increases.

Bunzl's business model, centered on distributing essential non-food items like cleaning supplies and safety equipment, proves remarkably resilient. This focus places Bunzl as a vital cog in numerous supply chains, ensuring consistent demand even during economic downturns.

The company has a track record of consistent financial performance, showcasing a strong ability to compound growth. This is achieved through a combination of operational efficiencies and astute margin management, which have contributed to steadily expanding operating margins.

For instance, Bunzl reported a 9.2% increase in revenue to £14.8 billion in 2023, with adjusted operating profit rising by 7.6% to £797.4 million, demonstrating this sustained financial health.

Robust Cash Flow Generation and Shareholder Returns

Bunzl's business model consistently generates strong cash flows, which is a significant strength. This robust cash generation empowers the company to both fund its strategic acquisition pipeline and return capital directly to its shareholders.

A testament to its financial discipline and shareholder focus is Bunzl's impressive 32-year track record of consecutive annual dividend growth. Furthermore, the company has actively utilized share buyback programs, underscoring its commitment to enhancing shareholder value.

- Consistent Cash Flow: Bunzl's operations are highly cash-generative.

- Acquisition Funding: Strong cash flow enables self-funded acquisitions.

- Dividend Growth: Achieved 32 consecutive years of annual dividend increases.

- Shareholder Returns: Engaged in significant share buyback programs.

Diverse Product Portfolio and Sector Exposure

Bunzl's strength lies in its broad and diverse product portfolio, encompassing essential non-food items like foodservice disposables, cleaning supplies, personal protective equipment (PPE), and packaging. This wide offering allows them to cater to a multitude of industries, from healthcare and hospitality to manufacturing and retail.

This diversification is a key advantage, as it significantly reduces the company's dependence on any single product line or market sector. For instance, in 2024, Bunzl reported that its various segments, including Food & Beverage and Healthcare & Personal Care, each contributed substantially to its revenue, demonstrating this balanced exposure.

- Broad Product Range: Specializes in foodservice disposables, cleaning, hygiene, PPE, and packaging.

- Sectoral Reach: Serves diverse industries such as healthcare, hospitality, and manufacturing.

- Reduced Reliance: Diversification mitigates risk associated with single product or industry downturns.

- Cross-Selling Opportunities: Enables offering comprehensive solutions to clients across different needs.

Bunzl's robust financial performance is underpinned by its consistent ability to generate strong cash flows. This financial muscle allows for strategic investments, including a record £883 million spent on acquisitions in 2024, and a commitment to shareholder returns, evidenced by 32 consecutive years of dividend growth.

The company's diversified product portfolio, covering everything from foodservice disposables to PPE, across key sectors like healthcare and retail, reduces reliance on any single market. This broad offering, contributing to a 2023 revenue of £14.8 billion, ensures consistent demand and resilience.

Bunzl's expansive global distribution network, operating across the Americas, Europe, and Asia Pacific, is a significant competitive advantage. This widespread presence, coupled with a decentralized operational model, enables tailored service delivery and effective market penetration, supporting its 2023 revenue growth of 9.2%.

| Metric | 2023 Value (£bn) | 2024 (YTD) Activity |

|---|---|---|

| Revenue | 14.8 | Continued growth expected |

| Acquisitions Spend | N/A | £883 million |

| Dividend Growth | 32 consecutive years | Ongoing commitment |

| Adjusted Operating Profit | 0.797 | 7.6% increase in 2023 |

What is included in the product

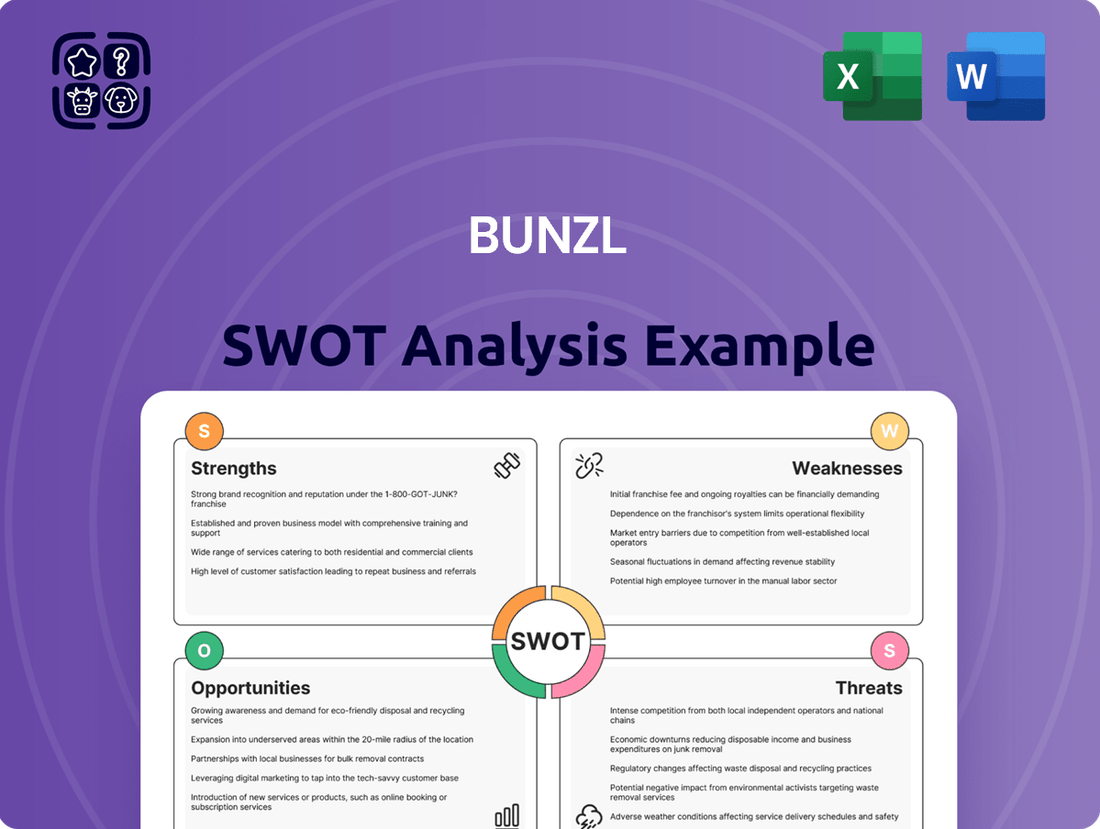

Outlines the strengths, weaknesses, opportunities, and threats of Bunzl, covering its robust distribution network and diverse product portfolio against potential supply chain disruptions and competitive pressures.

Offers a clear, actionable framework to identify and address Bunzl's strategic challenges and opportunities.

Weaknesses

Bunzl's exposure to deflationary pressures presents a significant weakness, notably impacting its North American and Continental European operations. In 2024, this trend directly affected underlying revenue and profitability, demonstrating the tangible financial consequences of falling prices.

While Bunzl has initiatives like cost efficiency programs, a sustained deflationary environment can still squeeze profit margins. This is because the selling prices of goods decrease, and if the cost of goods sold doesn't fall at the same rate, or if volumes don't sufficiently increase, profitability will inevitably suffer.

Bunzl faced significant operational headwinds in its primary North American market during Q1 2025. This region, crucial for its foodservice and grocery segments, saw slower volume recovery than projected.

Further compounding these issues were challenges in growing its own-brand products and the impact of a lost major customer in a specific category. These factors, combined with increased operating expenses, contributed to a substantial drop in adjusted operating profit for the quarter.

Bunzl's reliance on acquisitions, a key growth driver, introduces significant integration risks. The company's strategy involves acquiring a substantial number of businesses, and successfully merging these diverse entities can be challenging. This process demands considerable management focus and resources, potentially diverting attention from core operations and organic growth initiatives.

Sensitivity to Economic Slowdowns

While Bunzl's diversified model offers some protection, it's still susceptible to economic downturns. A significant slowdown, particularly in its key markets during early 2025, could dampen demand for its products, impacting revenue growth. This economic sensitivity can also put pressure on operating margins as customers become more price-conscious.

The company's reliance on sectors like healthcare and food processing, while generally stable, can still experience reduced spending during recessions. For instance, a projected 1.5% contraction in UK GDP for Q1 2025 could translate to softer sales for Bunzl's catering supplies division.

- Economic Sensitivity: Bunzl's performance is linked to overall economic health, with slowdowns impacting demand.

- Margin Pressure: Challenging economic conditions can lead to reduced operating margins due to increased price sensitivity.

- Sectoral Impact: Even stable sectors may see reduced spending during economic contractions, affecting Bunzl's revenue streams.

Dependence on Third-Party Suppliers

Bunzl's reliance on third-party suppliers is a key weakness. The company's model involves aggregating purchasing and distribution, making it highly dependent on its supplier network. For instance, in 2023, Bunzl's cost of sales was £9.2 billion, a significant portion of which is directly tied to supplier pricing and availability.

Any disruption in this supply chain, whether due to geopolitical events, natural disasters, or simply a change in supplier relationships, can directly affect Bunzl's operations. This could manifest as product shortages or increased input costs, impacting their ability to maintain competitive pricing and product availability for their diverse customer base.

Furthermore, the company's success in securing favorable terms with these suppliers is crucial for its cost efficiency. A shift in bargaining power or an inability to negotiate advantageous contracts could erode profit margins, especially in a competitive market where price is often a significant factor.

- Supplier Dependency: Bunzl's business model inherently ties its success to the reliability and pricing of its third-party suppliers.

- Supply Chain Vulnerability: Disruptions at the supplier level can lead to product unavailability and increased costs.

- Negotiation Leverage: Maintaining strong relationships and favorable terms with suppliers is critical for cost control and operational efficiency.

Bunzl's significant exposure to deflationary pressures, particularly in North America and Continental Europe, directly impacted its underlying revenue and profitability in 2024. This environment can compress profit margins if the cost of goods sold does not decrease proportionally with selling prices, or if volume increases are insufficient to offset price declines.

In Q1 2025, Bunzl experienced slower-than-anticipated volume recovery in its key North American market, impacting its foodservice and grocery segments. This, coupled with challenges in growing own-brand products and the loss of a major customer, led to a substantial decrease in adjusted operating profit for the quarter due to increased operating expenses.

The company's growth strategy heavily relies on acquisitions, which introduces considerable integration risks. Successfully merging diverse acquired entities requires significant management attention and resources, potentially diverting focus from core operations and organic growth.

Bunzl's performance is sensitive to economic downturns, as a slowdown, especially in its primary markets during early 2025, could reduce demand and pressure operating margins due to increased customer price sensitivity. Even historically stable sectors like healthcare and food processing might see reduced spending during economic contractions, as evidenced by a projected 1.5% UK GDP contraction in Q1 2025 potentially affecting catering supplies.

What You See Is What You Get

Bunzl SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine excerpt, ensuring you know exactly what you're getting. The full, detailed report is unlocked instantly after your purchase.

Opportunities

Bunzl's robust acquisition pipeline and a clear intention to invest heavily in strategic purchases annually represent a significant growth avenue. This strategy allows for market consolidation, entry into new territories or product lines, and the integration of higher-margin businesses into its existing structure.

Bunzl is actively expanding its private label product lines, which typically offer higher profit margins compared to reselling third-party brands. This strategy aims to capture more value within its existing distribution channels.

Significant investments are being channeled into digital platforms and automation. For instance, Bunzl's ongoing digital transformation initiatives are designed to streamline ordering processes and improve customer engagement, anticipating that a substantial portion of customer interactions will shift to low-touch digital channels.

This dual focus on own brands and digital solutions is expected to enhance operational efficiencies and customer loyalty. By offering more proprietary products and a seamless digital experience, Bunzl is positioning itself for sustained growth and improved profitability in the competitive market.

The global market for sustainable products is experiencing significant growth, driven by consumer preference and increasingly strict environmental regulations. This presents a substantial opportunity for Bunzl to expand its offerings in circular economy-friendly goods and low-carbon solutions.

Bunzl is well-positioned to leverage this trend by helping its customers transition to more sustainable alternatives, potentially through the development of comprehensive reusable packaging systems. For instance, the company's focus on hygiene and cleaning supplies can be a gateway to promoting eco-friendly consumables, aligning with both customer demand and evolving legislative landscapes.

Market Consolidation Potential

The distribution and services sector where Bunzl operates is quite fragmented, offering significant chances for consolidation. This fragmentation means there are many smaller companies that could be acquired.

Bunzl’s consistent strategy of making disciplined acquisitions allows it to snap up these smaller, specialized businesses. By doing so, Bunzl not only grows its market share but also benefits from greater efficiencies through its increased scale. For instance, in 2023, Bunzl completed 12 acquisitions, adding approximately £300 million in annualized revenue, demonstrating this ongoing opportunity.

- Fragmented Market: The industry structure provides ample targets for acquisition.

- Acquisition Strategy: Bunzl’s proven track record of successful integration enhances its ability to grow through M&A.

- Synergies: Consolidation allows for cost savings and operational efficiencies by leveraging Bunzl's existing infrastructure and expertise.

Leveraging Data and Analytics for Operational Excellence

Bunzl can significantly boost its operations by more deeply integrating data and analytics. This means using sophisticated tools to fine-tune its vast supply chain, making deliveries more efficient, and predicting customer needs with greater accuracy. For instance, in 2024, companies leveraging advanced analytics in logistics reported an average of 10% reduction in fuel costs and a 5% improvement in on-time delivery rates.

By optimizing these areas, Bunzl can expect to see a tangible decrease in operational expenses. Furthermore, enhanced demand planning leads to better inventory management, minimizing waste and stockouts. This data-driven approach fosters a more agile and responsive business model, crucial for navigating market fluctuations and delivering consistent value to stakeholders.

- Supply Chain Optimization: Implementing AI-powered route planning can reduce transportation costs by an estimated 8-12%.

- Demand Forecasting Accuracy: Improved analytics can lift forecast accuracy by 15-20%, cutting down on excess inventory.

- Operational Cost Reduction: Data-driven insights can identify inefficiencies, potentially saving millions in operational overhead annually.

- Enhanced Service Levels: Better planning and execution translate to higher customer satisfaction and retention rates.

Bunzl's strategic acquisition approach continues to be a major growth driver, with the company completing 12 acquisitions in 2023, adding approximately £300 million in annualized revenue. This demonstrates a clear opportunity to consolidate the fragmented distribution and services sector by acquiring smaller, specialized businesses, thereby increasing market share and achieving greater operational efficiencies through scale.

The company is also capitalizing on the growing demand for sustainable products, which is projected to see continued expansion due to consumer preferences and stricter environmental regulations. By offering eco-friendly alternatives and reusable packaging solutions, Bunzl can align with market trends and regulatory shifts.

Furthermore, Bunzl's investment in digital platforms and automation is poised to streamline operations and enhance customer engagement. For example, companies utilizing advanced analytics in logistics in 2024 reported an average 10% reduction in fuel costs and a 5% improvement in on-time delivery rates, highlighting the potential for significant operational cost reductions and improved service levels through data-driven insights.

| Opportunity Area | Description | Supporting Data/Example |

|---|---|---|

| Market Consolidation | Acquiring smaller, specialized businesses in a fragmented industry. | 12 acquisitions completed in 2023, adding ~£300m annualized revenue. |

| Sustainability Focus | Expanding offerings in eco-friendly products and circular economy solutions. | Growing consumer preference and regulatory push for sustainable goods. |

| Digital Transformation & Analytics | Leveraging data for supply chain optimization and improved forecasting. | 2024 logistics analytics users saw ~10% fuel cost reduction and 5% better on-time delivery. |

Threats

The distribution sector is notoriously competitive, and Bunzl faces the constant threat of intensified rivalry. This can translate into significant pricing pressure, forcing the company to lower its prices to remain competitive. For instance, in early 2024, reports indicated that suppliers in Bunzl's key markets were experiencing rising input costs, which they were often hesitant to pass on fully to distributors due to competitive pressures, impacting gross margins.

This pressure is particularly acute for non-differentiated products, where customers often prioritize cost above all else. When competitors aggressively undercut prices, it can directly erode Bunzl's profit margins, making it harder to invest in growth or innovation. The ongoing economic climate in 2024, with its mixed signals on inflation and consumer spending, further exacerbates this issue, as businesses look to trim expenses wherever possible.

Significant economic and geopolitical uncertainties represent a notable threat to Bunzl. These global instabilities can directly impact demand for Bunzl's products and services, potentially leading to slower sales growth. For instance, during 2024, many companies experienced volatility in consumer spending due to inflation and interest rate concerns, a trend that continued into early 2025.

Supply chain disruptions, a common consequence of geopolitical tensions and economic slowdowns, also pose a risk. These disruptions can affect Bunzl's ability to source raw materials and deliver finished goods efficiently, potentially increasing costs and impacting delivery times for its customers. The ongoing conflicts and trade policy shifts observed throughout 2024 and into 2025 highlight this persistent vulnerability.

Furthermore, currency fluctuations driven by economic and geopolitical events can negatively affect Bunzl's financial results. As a global business, currency translation losses can erode profits reported in its home currency, especially during periods of significant exchange rate volatility, a challenge that was particularly evident in the financial reporting of 2024.

Bunzl faces significant threats from supply chain disruptions, often exacerbated by climate change-driven weather events and broader global instability. These disruptions can directly impact their ability to fulfill customer orders, as seen in the widespread logistical challenges experienced globally throughout 2024, affecting delivery times and product availability.

Furthermore, the company must navigate considerable cost volatility, particularly concerning raw materials and transportation expenses. For instance, fluctuations in the price of plastics and paper, key inputs for Bunzl, can squeeze profit margins if these increased costs cannot be effectively passed on to customers or mitigated through internal operational efficiencies.

Failure to Successfully Integrate Acquisitions

Bunzl's growth strategy heavily relies on acquisitions, but a major threat lies in the potential failure to successfully integrate these newly acquired businesses. This could result in significant financial underperformance and a failure to achieve expected synergies, as seen in past integration challenges across various industries.

Such integration failures can manifest as:

- Loss of Key Personnel: Talented employees from acquired companies may leave due to cultural clashes or uncertainty, hindering operational continuity.

- Underperformance of Acquired Assets: The acquired businesses might not meet projected revenue or profit targets, dragging down overall financial results.

- Failure to Realize Synergies: Anticipated cost savings or revenue enhancements from the merger might not materialize, diminishing the deal's value.

Regulatory Changes and Environmental Compliance

Bunzl faces increasing scrutiny regarding environmental regulations, impacting its diverse product portfolio. For instance, new EU directives on single-use plastics, which came into effect in stages through 2023 and 2024, could necessitate significant adjustments in Bunzl's product offerings and sourcing strategies, potentially increasing operational costs.

Failure to adapt to these evolving environmental standards, such as those concerning packaging waste and carbon emissions, poses a direct threat. A hypothetical scenario could involve stricter waste management regulations increasing the cost of disposal for non-recyclable products, potentially impacting Bunzl's margins if these costs cannot be passed on or mitigated through innovation.

The company's reputation is also at risk. If Bunzl is perceived as lagging in its sustainability efforts compared to competitors, it could lead to a loss of environmentally conscious customers and business partners. For example, a major corporate client might shift its procurement to suppliers demonstrably meeting higher ESG (Environmental, Social, and Governance) standards, a trend observed to be growing among large enterprises.

Key areas of concern include:

- Evolving Waste Management Legislation: New regulations in key markets like the UK and EU, targeting packaging and product lifecycles, could increase compliance burdens and operational expenses for Bunzl's distribution and manufacturing processes.

- Carbon Footprint Reporting and Reduction Mandates: Growing pressure for transparent carbon reporting and mandated emission reduction targets could require substantial investment in greener logistics and supply chain practices.

- Circular Economy Initiatives: The push towards circular economy principles may necessitate redesigning products and packaging to be more recyclable or reusable, impacting Bunzl's product development and sourcing strategies.

- Chemical Substance Regulations: Stricter controls on chemicals used in products, such as those under REACH in Europe, could affect the composition and availability of certain materials Bunzl utilizes.

Bunzl faces intense competition, especially for undifferentiated products, leading to pricing pressures and potential margin erosion, a situation amplified by economic uncertainty in 2024 and early 2025. Global economic and geopolitical instabilities in 2024 continued to impact consumer spending and create supply chain vulnerabilities, affecting Bunzl's sales and operational efficiency. Currency fluctuations also pose a risk, with translation losses potentially impacting reported profits, a challenge evident in 2024 financial results.

SWOT Analysis Data Sources

This Bunzl SWOT analysis is built upon a foundation of robust data, drawing from official financial reports, comprehensive market research, and expert industry analysis to provide a clear and actionable strategic overview.