Bunzl Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bunzl Bundle

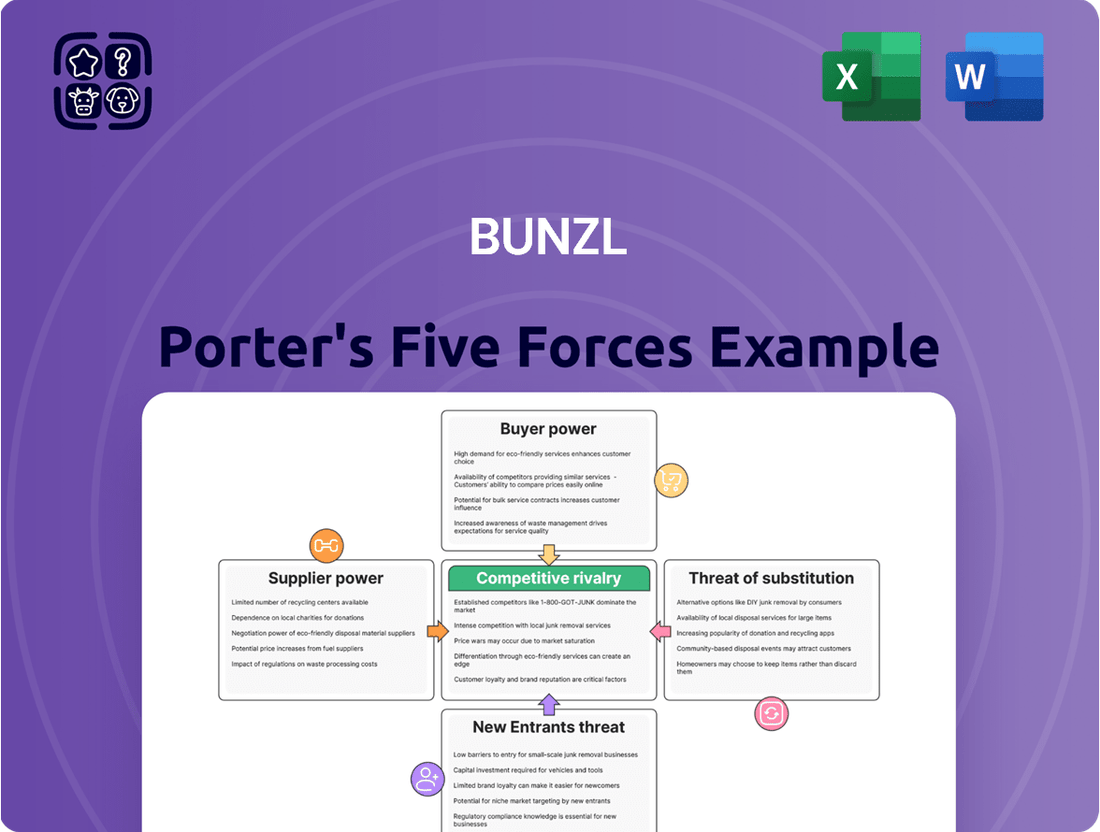

Bunzl's Porter's Five Forces Analysis dissects the competitive landscape, revealing the intense pressures from rivals and the ever-present threat of new entrants. Understanding these forces is crucial for navigating the complexities of their diverse markets.

The complete report reveals the real forces shaping Bunzl’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bunzl's diverse sourcing, from everyday disposables to specialized personal protective equipment (PPE), means supplier power isn't uniform. For highly unique or custom-made items where few suppliers exist, those suppliers gain significant leverage over Bunzl.

However, for more commoditized products, Bunzl's sheer scale as a buyer, with its substantial purchasing volumes, often allows it to negotiate favorable terms and mitigate supplier power. In 2023, Bunzl's revenue reached £12.5 billion, underscoring the significant purchasing clout it wields across many product categories.

For many of the standard items Bunzl procures, the costs to switch suppliers are generally quite low. This is largely due to Bunzl's vast procurement network and its ability to leverage economies of scale across its operations. However, when Bunzl engages suppliers for more complex, integrated supply chain solutions or for custom-designed products, the switching process can become more involved. This might necessitate significant operational adjustments, new training, and potentially re-certification processes, which in turn can elevate the bargaining power of those specific suppliers.

While some large manufacturers might consider direct distribution to customers, the sheer complexity and immense cost of replicating Bunzl's extensive, globally decentralized distribution network typically act as a significant deterrent. Suppliers generally find it more strategic to concentrate on their core manufacturing expertise rather than investing heavily in logistics and supply chain infrastructure.

Bunzl's established role as a powerful consolidator in the market significantly diminishes the incentive for suppliers to bypass its efficient distribution channels. For instance, in 2024, Bunzl reported revenues exceeding £12 billion, underscoring the scale and reach that would be challenging for individual suppliers to match independently.

Importance of Bunzl's Volume to Suppliers

Bunzl's immense global purchasing power across diverse product lines positions it as a highly valuable customer for its suppliers. This scale of demand grants Bunzl significant leverage in negotiating competitive pricing and favorable contract terms. Suppliers often prioritize maintaining strong relationships with Bunzl due to the substantial and consistent business it represents.

For instance, Bunzl's commitment to sourcing a wide array of goods, from packaging materials to cleaning supplies, means that many suppliers rely on the company for a significant portion of their revenue. This dependency naturally shifts bargaining power towards Bunzl.

- Significant Purchasing Volumes: Bunzl's operations span multiple continents and industries, leading to substantial order volumes that are attractive to suppliers.

- Negotiating Leverage: The sheer scale of Bunzl's procurement allows it to command better pricing, payment terms, and service level agreements.

- Supplier Dependence: Many suppliers view Bunzl as a key account, making them more amenable to Bunzl's demands to secure or maintain the business.

Availability of Substitute Inputs

The availability of substitute inputs significantly dilutes supplier bargaining power for Bunzl. For many of the non-food products Bunzl distributes, there are typically multiple manufacturers and a wide range of product specifications available. This abundance of choices means Bunzl can often find comparable products from different suppliers, limiting the leverage of any single provider.

Bunzl's ability to source similar products or adapt to minor specification changes grants it considerable flexibility in its supply chain. This broad market access is a key factor in mitigating the impact of any individual supplier's leverage. For instance, in the cleaning supplies sector, Bunzl can often switch between manufacturers of paper towels or cleaning chemicals if one supplier attempts to impose unfavorable terms.

- Multiple Manufacturers: Bunzl operates in sectors where numerous manufacturers produce similar goods, such as disposable packaging and hygiene products.

- Product Specification Flexibility: The ability to accept minor variations in product specifications allows Bunzl to broaden its sourcing options.

- Reduced Dependence: This flexibility reduces Bunzl's reliance on any single supplier, thereby weakening individual supplier bargaining power.

Bunzl's substantial purchasing power, fueled by its £12.5 billion revenue in 2023, significantly limits supplier bargaining power for many commoditized products. The low cost of switching suppliers for standard items further erodes supplier leverage. However, for specialized or custom-made goods, where supplier options are limited, their bargaining power increases.

What is included in the product

This analysis scrutinizes the five competitive forces impacting Bunzl's market, providing insights into industry rivalry, buyer and supplier power, threat of new entrants, and substitute products.

Identify and mitigate competitive threats with a visual breakdown of industry power dynamics, making strategic planning less daunting.

Customers Bargaining Power

Bunzl's diverse customer base, ranging from large multinationals to smaller enterprises across various industries, generally mitigates the bargaining power of individual customers. While some major clients in sectors like retail or healthcare might account for significant purchase volumes, the overall fragmentation of Bunzl's clientele prevents any single customer from wielding undue influence.

For many of Bunzl's diverse customer base, transitioning to a different distributor or taking procurement in-house presents considerable challenges. These often include the costs associated with integrating new systems, potential disruptions to ongoing operations, and the risk of supply chain inefficiencies during the changeover period.

Bunzl's strategy of providing integrated services and a consolidated procurement approach effectively raises the barriers for customers looking to switch. This built-in stickiness, a key factor in customer retention, directly curtails the bargaining power customers might otherwise exert.

While alternative distributors do exist, few can match Bunzl's extensive global reach, diverse product portfolio, and integrated service approach for essential non-food items. Customers may find niche suppliers for specific product categories, but replicating Bunzl's comprehensive one-stop-shop solution is difficult.

This scarcity of directly comparable and equally broad alternatives significantly limits the bargaining power of Bunzl's customers. For instance, in 2023, Bunzl reported revenue of £12.5 billion, underscoring its substantial market presence and the difficulty for customers to easily switch to a comparable distributor for their entire needs.

Customer Price Sensitivity

Customer price sensitivity significantly impacts Bunzl, especially in sectors like retail and catering where thin margins are common. These businesses often face intense competition, pushing them to scrutinize every cost, including their suppliers of essential items like packaging and cleaning supplies. For instance, a restaurant chain might switch suppliers based on a few cents difference per unit, directly affecting their bottom line.

While Bunzl leverages its scale to offer competitive pricing and adds value through consolidated ordering, supply chain efficiency, and a broad product range, the fundamental pressure for lower prices remains. This means Bunzl must continuously balance cost management with the delivery of these value-added services. In 2024, many businesses across these sectors continued to report increased operational costs, further amplifying their focus on procurement expenses.

- High Price Sensitivity in Key Sectors: Retail and catering clients often operate on tight margins, making them highly responsive to price changes.

- Bunzl's Value Proposition: Bunzl counteracts price sensitivity by offering consolidated services, supply chain efficiencies, and a wide product portfolio, aiming to deliver overall value beyond just the unit price.

- Ongoing Competitive Pressure: Despite value-added services, customers will consistently seek the most competitive pricing available in the market.

- 2024 Cost Environment: Many businesses in 2024 faced elevated operational costs, intensifying their focus on procurement and supplier pricing.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly large ones, is generally low for Bunzl. While theoretically, major clients could try to source products directly from manufacturers or build their own distribution networks, this is a complex undertaking.

Such an endeavor demands substantial capital for infrastructure, specialized logistical knowledge, and the ability to achieve economies of scale. For instance, a large retail chain considering direct sourcing would need to invest heavily in warehousing, transportation fleets, and inventory management systems, costs that often outweigh the potential savings compared to outsourcing to a specialist like Bunzl.

Bunzl's business model thrives on absorbing this complexity for its customers. By offering a comprehensive suite of procurement, distribution, and supply chain management services, Bunzl effectively removes the need for clients to develop these costly capabilities in-house. This value proposition makes direct customer integration a less attractive and often impractical option.

- Low Threat: Customers generally lack the capital and expertise for direct sourcing or in-house distribution.

- High Investment: Backward integration requires significant spending on logistics, warehousing, and technology.

- Bunzl's Value: Bunzl provides outsourced supply chain efficiency, negating the need for customer integration.

The bargaining power of Bunzl's customers is generally considered moderate, influenced by factors like price sensitivity and the availability of alternatives. While Bunzl's scale and integrated services create customer stickiness, intense competition in sectors like retail and catering means clients are highly attuned to pricing. For instance, in 2023, Bunzl's revenue reached £12.5 billion, highlighting its significant market presence, yet the ongoing pressure for cost savings remains a key dynamic.

| Factor | Impact on Bunzl | Customer Action | Bunzl's Counter |

|---|---|---|---|

| Price Sensitivity | High in retail/catering | Seek lower unit costs | Consolidated services, efficiency |

| Switching Costs | Moderate to high | Consider alternatives | Integrated solutions, broad portfolio |

| Availability of Alternatives | Limited for comprehensive needs | Source niche products elsewhere | One-stop-shop approach |

Preview the Actual Deliverable

Bunzl Porter's Five Forces Analysis

This preview showcases the comprehensive Bunzl Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of the company. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, offering no surprises or placeholders. You're looking at the actual, ready-to-use analysis; once your purchase is complete, you’ll gain instant access to this complete file, enabling you to leverage its insights without delay.

Rivalry Among Competitors

The distribution market for non-food essentials is quite fragmented. You'll find a range of players, from massive global companies to specialized regional outfits and even smaller local distributors. This means Bunzl is up against a variety of competitors, some offering a broad selection of goods and others focusing on niche markets or specific product types.

This diversity in the competitive field leads to varied rivalry depending on where Bunzl operates and what products it's distributing. For instance, competition might be more intense in certain geographic regions or for particular product categories where there are many similar suppliers.

In 2024, the global market for janitorial and sanitation supplies, a key area for Bunzl, was valued at over $120 billion, showcasing the sheer scale of the industry and the number of companies vying for market share. This vast market naturally attracts a wide array of participants, from large, established corporations to smaller, agile distributors.

The essential non-food products distribution market generally experiences steady, rather than rapid, growth. This growth is primarily fueled by underlying economic activity and the increasing demand for outsourced services from businesses across various sectors. For instance, in 2023, the global business process outsourcing market was valued at approximately $272 billion, highlighting the trend of companies relying on external providers for non-core functions, which benefits distributors like Bunzl.

In these slower-growth markets, competition for market share naturally intensifies. This heightened competition often translates into more aggressive pricing strategies and enhanced service offerings as companies strive to attract and retain customers. Distributors may differentiate themselves through factors like delivery speed, product customization, or specialized support services.

Bunzl's strategic approach frequently involves the acquisition of smaller competitors. This consolidation strategy allows Bunzl to expand its geographic reach, broaden its product portfolio, and achieve economies of scale, thereby strengthening its market position in a fragmented industry. In 2023, Bunzl completed several acquisitions, further solidifying its presence in key markets.

Bunzl's competitive edge lies in its integrated service model, extending beyond mere product distribution to encompass supply chain efficiency and a significant global footprint. While competitors may offer comparable products, the complexity of replicating Bunzl's decentralized, customer-focused strategy and its array of value-added services presents a substantial barrier.

This strategic differentiation is crucial for navigating fierce price competition, as it shifts client focus towards the total cost of ownership, a metric where Bunzl often excels. For instance, in 2024, Bunzl continued to emphasize its ability to manage complex supply chains for diverse industries, a testament to its service-based differentiation.

Exit Barriers for Competitors

Exit barriers for competitors in the distribution sector are typically moderate. These barriers include significant investments in physical assets such as warehouses and logistics networks, alongside the value of long-standing customer relationships. These factors can trap less profitable companies in the market, leading to sustained competitive pressure.

Bunzl's strategic approach, however, often involves acquiring these smaller, less efficient competitors. This consolidation strategy effectively removes them from the competitive landscape, preventing prolonged price wars and reducing the impact of moderate exit barriers on overall market intensity.

For instance, Bunzl's acquisition activity in 2023 saw significant investment, with the company completing 11 acquisitions, contributing approximately £280 million to revenue. This demonstrates a proactive method of managing competitive rivalry by absorbing potential market entrants or struggling incumbents, thereby influencing the structure of the market.

- Moderate Exit Barriers: Investments in logistics infrastructure and customer relationships can keep weaker competitors in the market.

- Bunzl's Acquisition Strategy: The company frequently acquires smaller players, reducing the number of competitors.

- Market Consolidation: Acquisitions lead to a more consolidated market, mitigating prolonged price competition.

- 2023 Acquisition Activity: Bunzl completed 11 acquisitions in 2023, adding around £280 million in revenue, illustrating its market consolidation efforts.

Intensity of Price Competition

Price competition is a significant driver in the distribution industry, especially for products that are largely undifferentiated. Customers in this space frequently prioritize the lowest price, which naturally puts pressure on profit margins for distributors like Bunzl.

Bunzl actively manages this intense rivalry by concentrating on optimizing its operations and leveraging economies of scale. Furthermore, the company differentiates itself by providing value-added services that allow it to command pricing that reflects its broader offering, rather than just the base product cost.

- Price Sensitivity: In 2023, the distribution sector continued to see customers actively seeking cost advantages, particularly for essential supplies.

- Margin Pressure: This focus on price can compress gross margins, necessitating efficient cost management.

- Bunzl's Strategy: Bunzl's emphasis on operational efficiency and scale aims to offset these pressures, while value-added services provide a crucial differentiator.

- Balancing Act: Maintaining a competitive price point while ensuring high service quality remains a core challenge for Bunzl.

Competitive rivalry within the non-food essentials distribution sector is substantial due to market fragmentation and moderate exit barriers. Bunzl actively manages this by acquiring smaller competitors, a strategy that consolidated its market position, as evidenced by 11 acquisitions in 2023 contributing £280 million in revenue. This reduces competitive intensity and mitigates price wars.

| Factor | Description | Impact on Bunzl | 2023 Data Point |

| Rivalry Intensity | High due to fragmented market | Requires differentiation and efficiency | Global janitorial market > $120 billion |

| Pricing Pressure | Significant for undifferentiated products | Bunzl focuses on operational efficiency and value-added services | Customer price sensitivity remained high in 2023 |

| Exit Barriers | Moderate (assets, customer relationships) | Can trap weaker competitors, leading to sustained pressure | N/A |

| Bunzl's Mitigation | Acquisitions and service integration | Strengthens market position, reduces competition | 11 acquisitions in 2023, adding £280M revenue |

SSubstitutes Threaten

Customers, especially larger ones, might consider bypassing distributors like Bunzl and sourcing directly from manufacturers. This bypass is often less attractive due to the significant complexities in managing numerous suppliers and intricate logistics, which typically negate any perceived cost savings.

For instance, while a major corporation might possess the internal resources for direct procurement, the fragmented nature of many product categories Bunzl serves makes this approach inefficient. Bunzl's consolidated purchasing power and sophisticated supply chain offer economies of scale that individual customers struggle to replicate, making direct sourcing a less compelling option for most.

While some very large corporations might explore producing certain non-food items internally, like bespoke uniforms or specific packaging, this path is typically too expensive and moves away from their primary business focus. For instance, a large retail chain might consider in-house uniform production, but the economies of scale and specialized manufacturing required often make it less efficient than outsourcing.

Bunzl's strength lies in its ability to handle these non-core functions cost-effectively through outsourcing. The company's extensive supply chain and expertise in sourcing and logistics mean that for most businesses, replicating these capabilities in-house would be a significant financial and operational hurdle. In 2024, the global market for outsourced business services continued to grow, underscoring the demand for specialized providers like Bunzl.

Innovation in materials poses a significant threat. For instance, the growing demand for sustainable alternatives, like reusable foodservice items replacing single-use plastics, directly challenges Bunzl's traditional disposable product lines. In 2024, the global market for sustainable packaging alone was projected to reach over $300 billion, highlighting the scale of this shift.

Bunzl needs to proactively integrate these emerging material technologies into its offerings. Failure to adapt could see customers migrating to competitors who offer more eco-friendly or technologically advanced solutions, thereby eroding Bunzl's market share.

Digital Platforms and Marketplaces

The increasing prevalence of B2B e-commerce platforms and online marketplaces presents a significant threat of substitution for Bunzl. These digital channels enable customers to bypass traditional distributors and source non-food products directly from manufacturers or smaller, specialized distributors.

This shift allows buyers to potentially find more competitive pricing or specialized offerings, thereby substituting the need for Bunzl's comprehensive distribution services. For instance, the global B2B e-commerce market was valued at approximately $14.9 trillion in 2023 and is projected to grow substantially, indicating a robust alternative channel for many of Bunzl's customer segments.

To mitigate this threat, Bunzl's investment in its own digital capabilities and e-commerce infrastructure is paramount. By enhancing its online presence and offering seamless digital procurement solutions, Bunzl can directly compete with these emerging platforms and retain its market share.

Key considerations for Bunzl include:

- Expanding online product catalogs and user-friendly interfaces to match the convenience of digital marketplaces.

- Leveraging data analytics to personalize customer experiences and offer tailored solutions, a key differentiator for online platforms.

- Ensuring competitive pricing and efficient delivery logistics to counter the direct-sourcing advantages offered by substitutes.

Shifting Industry Standards or Regulations

Changes in health, safety, or environmental regulations present a significant threat of substitution for Bunzl. For instance, a widespread ban on certain single-use plastics, a category where Bunzl has substantial offerings, could rapidly drive demand towards reusable alternatives. This would directly substitute Bunzl's existing products with new materials or systems.

Bunzl's ability to adapt its product portfolio and supply chain to comply with evolving regulations is therefore critical. For example, if new environmental standards emerge in 2024 or 2025 mandating biodegradable packaging, companies currently using traditional plastics might seek out Bunzl's compliant alternatives or switch to competitors who are quicker to innovate in this space.

- Regulatory Shifts: New laws on materials or waste management can make existing products obsolete, pushing customers to substitutes.

- Environmental Concerns: Growing public and governmental pressure for sustainability, particularly around plastics, directly threatens conventional product lines.

- Adaptation is Key: Bunzl's success hinges on its agility in sourcing and offering compliant, often more sustainable, alternatives to its current customer base.

The threat of substitutes for Bunzl primarily stems from customers bypassing distributors, the rise of B2B e-commerce, and evolving material innovations driven by regulations and sustainability concerns. While direct sourcing and in-house production are complex and often uneconomical for most, the digital landscape and material science advancements offer more accessible alternatives.

The global B2B e-commerce market's significant growth, projected to continue well beyond its 2023 valuation of approximately $14.9 trillion, highlights the increasing viability of online marketplaces as substitutes for traditional distribution. Furthermore, the substantial market for sustainable packaging, exceeding $300 billion in 2024 projections, underscores the direct impact of material innovation on Bunzl's traditional product lines.

Bunzl must actively invest in its digital infrastructure and adapt its product portfolio to embrace sustainable and technologically advanced materials to counter these substitution threats effectively.

| Substitution Threat | Description | Impact on Bunzl | Mitigation Strategy | 2024/2025 Data Point |

|---|---|---|---|---|

| B2B E-commerce Platforms | Online marketplaces offering direct sourcing from manufacturers or specialized distributors. | Potential loss of customers seeking competitive pricing or specialized offerings. | Enhance Bunzl's own digital capabilities and e-commerce presence. | Global B2B e-commerce market valued at ~$14.9 trillion in 2023. |

| Material Innovation (Sustainability) | Demand for eco-friendly alternatives like reusable items replacing single-use plastics. | Erosion of market share for traditional disposable product lines. | Proactively integrate sustainable material technologies into offerings. | Global sustainable packaging market projected over $300 billion in 2024. |

| Regulatory Changes | Bans or restrictions on certain materials (e.g., single-use plastics). | Obsolescence of existing product lines, driving demand for compliant substitutes. | Adapt product portfolio and supply chain to comply with evolving regulations. | Emergence of new environmental standards in 2024/2025. |

Entrants Threaten

The sheer capital needed to build a distribution network comparable to Bunzl's is immense. Think about warehouses, trucks, advanced IT systems, and the cash to keep inventory flowing – it all adds up. For instance, establishing a robust logistics network can easily run into hundreds of millions of dollars.

Newcomers would find it incredibly difficult to match Bunzl's cost advantages derived from its massive scale in purchasing and distribution. Companies like Bunzl leverage their size to negotiate better prices with suppliers and optimize shipping routes, creating significant cost efficiencies that are hard for smaller players to replicate.

These substantial upfront financial commitments and the challenge of achieving comparable economies of scale present a formidable barrier, effectively deterring potential new competitors from entering the market.

Bunzl's strength lies in its decentralized network of specialist businesses, each possessing deep, long-standing relationships with both suppliers and customers. This intricate web of trust and established connections acts as a significant barrier for newcomers. Building comparable distribution channels and networks from the ground up is an arduous and costly undertaking for any potential competitor.

Bunzl's strong brand reputation, built on reliability and efficient supply chains, makes it difficult for new entrants. Customers in sectors like healthcare and food service, where Bunzl operates, often prioritize consistent supply and integrated solutions, fostering significant loyalty. For instance, in 2024, Bunzl reported continued strong performance in its healthcare and personal care segments, underscoring the trust placed in its offerings.

Regulatory Hurdles and Compliance

Bunzl's diverse operations, particularly in healthcare and food processing, are subject to stringent regulations. For instance, in the food sector, compliance with HACCP (Hazard Analysis and Critical Control Points) principles is paramount, with the Global Food Safety Initiative (GFSI) setting benchmarks that new entrants must meet. Similarly, healthcare product suppliers must adhere to FDA regulations in the US or equivalent bodies in other regions, which can involve extensive testing and approval processes. These regulatory complexities create a substantial barrier, requiring significant investment in expertise and infrastructure to navigate effectively.

The cost and time associated with achieving and maintaining compliance across various jurisdictions and product lines can be prohibitive for potential new competitors. For example, obtaining certifications for medical devices or food safety standards can take months, if not years, and involve substantial upfront costs. Bunzl, with its established systems and experience, is better positioned to absorb these costs and manage the ongoing compliance burden, thereby deterring new market entrants.

- Healthcare Compliance: Strict adherence to FDA, EMA, and other national health authority regulations for medical supplies and equipment.

- Food Safety Standards: Meeting GFSI-benchmarked standards like BRCGS or SQF for food packaging and processing supplies.

- Environmental Regulations: Compliance with REACH in Europe and similar chemical safety and waste disposal regulations globally.

- Product Specific Certifications: Obtaining certifications for biodegradability, fire retardancy, or specific material compositions depending on the end-use sector.

Supplier Relationships and Procurement Power

Bunzl's extensive and long-standing relationships with a diverse global supplier base are a significant barrier to new entrants. These established connections grant Bunzl preferential pricing and consistent access to a broad spectrum of products, a competitive advantage that newcomers would struggle to replicate quickly. For instance, in 2024, Bunzl's procurement scale allowed it to negotiate favorable terms, contributing to its robust gross profit margins.

New companies entering the market would find it exceedingly difficult to match Bunzl's procurement power and the trust it has cultivated with suppliers. This lack of established trust translates directly into higher initial costs and potential limitations in product availability for new entrants. Building comparable supplier relationships, as demonstrated by Bunzl's decades of operation, requires substantial investment in time, resources, and consistent performance.

- Supplier Relationships: Bunzl leverages decades of experience in building and maintaining strong ties with numerous global suppliers.

- Procurement Power: These relationships translate into preferential pricing and exclusive product access, difficult for new entrants to match.

- Barriers to Entry: New competitors face significant hurdles in establishing similar supplier trust and achieving comparable cost efficiencies.

- Competitive Landscape: Bunzl's procurement advantage directly impacts its ability to compete on price and product variety, deterring potential new market participants.

The threat of new entrants for Bunzl is considerably low due to the substantial capital investment required for logistics and infrastructure, estimated to be in the hundreds of millions of dollars for a comparable network. Furthermore, achieving Bunzl's economies of scale in purchasing and distribution, which drive significant cost advantages, is a formidable challenge for newcomers. These barriers, combined with established supplier and customer relationships and stringent regulatory compliance, effectively deter new market participants.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024 Context) |

|---|---|---|---|

| Capital Requirements | Building a distribution network (warehouses, trucks, IT) | Very High - Requires hundreds of millions in upfront investment. | Bunzl's extensive global logistics infrastructure represents a massive asset base. |

| Economies of Scale | Purchasing power and distribution efficiencies | High - Difficult to match Bunzl's cost advantages derived from massive volume. | Bunzl's procurement scale in 2024 enabled favorable supplier terms, boosting profit margins. |

| Brand Reputation & Customer Loyalty | Trust in reliability and integrated solutions | High - Customers in healthcare and food service prioritize consistent supply. | Continued strong performance in Bunzl's healthcare segment in 2024 highlights customer trust. |

| Regulatory Compliance | Adherence to health, safety, and environmental standards | High - Complex and costly to navigate across diverse sectors and regions. | FDA and GFSI compliance for medical and food sectors require significant expertise and investment. |

| Supplier Relationships | Established ties and preferential terms | High - Difficult to replicate Bunzl's decades of trust and procurement power. | Bunzl's 2024 procurement scale secured consistent product access and competitive pricing. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bunzl leverages data from company annual reports, investor presentations, and industry-specific market research reports. We also incorporate information from trade publications and financial news outlets to capture current market dynamics.