Bunzl Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bunzl Bundle

Curious about Bunzl's strategic positioning? Our BCG Matrix analysis reveals which business segments are fueling growth and which require careful consideration. Understanding these dynamics is crucial for smart resource allocation and future planning.

Don't settle for a glimpse; unlock the full potential of Bunzl's BCG Matrix. Purchase the complete report to gain detailed insights into each quadrant, enabling you to make informed decisions and drive superior business outcomes.

Stars

The global Personal Protective Equipment (PPE) market is a strong performer, with projected compound annual growth rates (CAGRs) between 5.1% and 8.2% from 2024 to 2033. This upward trend is driven by heightened awareness of workplace safety, more stringent regulations, and consistent demand from both healthcare and industrial sectors.

Bunzl, with a substantial 15.5% of its net sales derived from safety products, is strategically positioned to capitalize on this market expansion. Its established distribution network and history of successful acquisitions provide a solid foundation for continued growth in the PPE segment.

Sustainable and eco-friendly packaging solutions are a significant growth driver in the packaging market, with projected Compound Annual Growth Rates (CAGRs) ranging from 3.89% to 9.0% through 2029. This surge is fueled by a global commitment to environmental responsibility, increasing consumer demand for recyclable, compostable, and bio-based materials.

Bunzl has strategically positioned itself in this high-growth sector, actively pursuing innovation in sustainable packaging. Their efforts are recognized through awards for eco-friendly designs and the development of initiatives like 'Sustain' renewable food packaging, indicating a clear intent to capture greater market share in this evolving segment.

The digital and smart cleaning and hygiene technologies sector is a burgeoning area, with projections indicating a compound annual growth rate (CAGR) of 13.15% from 2025 to 2033. This growth is fueled by innovations like Internet of Things (IoT) enabled cleaning equipment and a heightened global awareness of hygiene standards.

Bunzl's established position in the cleaning and hygiene supply market, which accounts for 10.4% of its net sales, coupled with its professional hygiene services, offers a solid foundation. This allows Bunzl to capitalize on the expanding smart cleaning market by introducing innovative, technology-driven solutions and tailored offerings to capture greater market share.

Foodservice Disposables for Online Delivery & QSR Expansion

The foodservice disposables sector, particularly for online delivery and quick-service restaurants (QSRs), is a significant growth area. Market research indicates compound annual growth rates (CAGRs) between 5.7% and 10.3% are projected through 2032. This expansion is directly fueled by the increasing prevalence of online food ordering and the continued growth of QSRs.

Bunzl's foodservice segment, representing 29.3% of its net sales, is well-positioned to benefit from these market dynamics. The company offers essential packaging solutions that meet the demands for convenience, hygiene, and sustainability.

- Market Growth: Foodservice disposables for online delivery and QSRs are experiencing strong CAGRs, projected between 5.7% and 10.3% through 2032.

- Key Drivers: The surge in online food delivery platforms and the expansion of QSRs are the primary forces behind this market growth.

- Bunzl's Position: With foodservice contributing 29.3% to its net sales, Bunzl is strategically aligned to capture demand for convenient and eco-friendly disposable packaging.

- Competitive Advantage: Bunzl's extensive distribution network enables efficient service to a growing customer base in this high-demand sector.

Market-Leading Acquired Businesses in Growth Sectors

Bunzl actively pursues market-leading businesses in high-growth sectors, a cornerstone of its growth strategy. In 2024 alone, the company invested a record £883 million in acquisitions, demonstrating a strong commitment to expanding its portfolio. This strategic acquisition approach targets companies with established positions in expanding niches, such as Nisbets, a major player in the commercial catering equipment market.

These acquired businesses, once integrated, benefit significantly from Bunzl's vast distribution capabilities. This integration transforms them into high-growth product lines, leveraging their initial strong market standing. The company plans to continue this trend, earmarking around £700 million annually for acquisitions through 2027.

- Acquisition Focus: Targeting market leaders in growth sectors.

- 2024 Investment: Record £883 million spent on acquisitions.

- Future Allocation: Approximately £700 million annually for acquisitions until 2027.

- Synergy: Leveraging acquired businesses within Bunzl's distribution network.

Stars in the Bunzl BCG Matrix represent business units operating in high-growth markets with a high market share. These are the areas where Bunzl is investing heavily, both organically and through acquisitions, to maintain and expand its leadership position. The company's strategic focus on sectors like PPE, sustainable packaging, and smart hygiene technologies aligns perfectly with the characteristics of Star segments.

Bunzl's commitment to acquiring market leaders in these expanding niches, as evidenced by its record £883 million investment in acquisitions in 2024, directly supports its Star businesses. By integrating these companies into its robust distribution network, Bunzl enhances their growth trajectory and solidifies their high market share, ensuring they continue to perform as Stars.

The company’s ongoing acquisition strategy, with a planned annual allocation of around £700 million through 2027, is designed to identify and capture further opportunities in high-growth sectors. This proactive approach ensures that Bunzl continues to build and nurture its Star portfolio, driving future revenue and profitability.

These Star segments are crucial for Bunzl's long-term success, representing the engines of future growth and market dominance. Their strong performance in expanding markets, coupled with Bunzl's strategic support, positions them for sustained success.

| Business Segment | Market Growth Rate | Bunzl's Market Share | Strategic Focus |

|---|---|---|---|

| Personal Protective Equipment (PPE) | 5.1% - 8.2% (2024-2033) | Significant | Acquisition & Expansion |

| Sustainable Packaging | 3.89% - 9.0% (through 2029) | Growing | Innovation & Investment |

| Smart Cleaning & Hygiene | 13.15% (2025-2033) | Established | Technology Integration |

What is included in the product

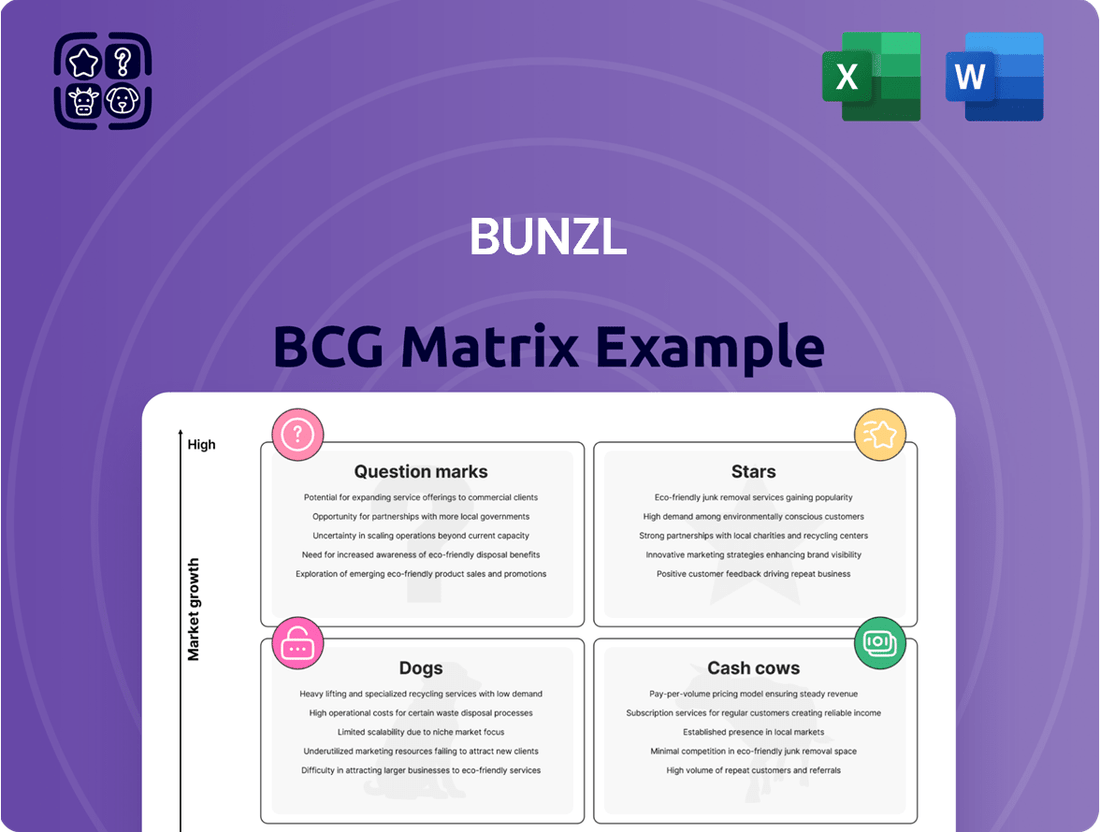

The Bunzl BCG Matrix categorizes business units into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic decisions on investment, holding, or divestment.

Clear visualization of Bunzl's portfolio, easing strategic decision-making.

Cash Cows

Bunzl dominates the distribution of standard packaging, a segment characterized by steady demand from mature industries. This provides a reliable, high-volume revenue stream.

The company's extensive network and established relationships ensure consistent cash flow generation from these essential products, requiring minimal reinvestment for maintenance.

In 2024, Bunzl's traditional packaging distribution likely continued to be a bedrock of its operations, contributing significantly to its overall profitability and financial stability.

Standard Cleaning & Janitorial Consumables are Bunzl's quintessential cash cows. This segment, distributing everyday cleaning chemicals, paper hygiene products, and general janitorial supplies, serves a mature market with established commercial and institutional clients. Bunzl's strong market share here ensures consistent, recurring demand for these essential operational items.

The steady, predictable demand for these consumables translates into robust cash generation for Bunzl. Because the market is mature and the products are necessities, there's minimal need for significant investment in aggressive marketing campaigns or extensive product development, allowing for high cash flow with low capital expenditure. For instance, in 2023, Bunzl's revenue from its Cleaning & Safety division, which heavily features these consumables, reached £4.1 billion, showcasing the enduring strength of this category.

Bunzl's Basic Foodservice Disposables for Mature Catering are firmly positioned as Cash Cows within its BCG Matrix. This segment benefits from Bunzl's vast distribution network, supplying essential, high-volume items like cups, plates, and cutlery to established catering and retail food businesses. The demand here is steady and predictable, making it a reliable generator of cash flow for the company.

Core Healthcare Supply Chain Services

Bunzl's core healthcare supply chain services represent a classic cash cow, providing steady, high-volume demand for essential non-food items to hospitals and clinics. These operations benefit from Bunzl's deep-rooted customer relationships and optimized logistics, ensuring consistent profitability even in mature markets.

The company's extensive distribution network for medical supplies, hygiene products, and cleaning chemicals underpins the daily functioning of healthcare facilities. This reliability translates into predictable revenue streams, a hallmark of a strong cash cow.

- Stable Demand: Essential healthcare supplies ensure consistent, high-volume orders regardless of broader economic fluctuations.

- Operational Efficiency: Bunzl's established infrastructure and expertise drive cost-effective distribution, boosting margins.

- Long-Term Contracts: Many healthcare providers operate on multi-year agreements, offering revenue visibility.

- Market Maturity: While not high-growth, the healthcare sector's consistent need for these products solidifies their cash-generating power.

Mature Distribution Operations in Developed Markets

Bunzl's mature distribution operations in developed markets, such as Continental Europe and the UK & Ireland, represent significant cash cows. These established businesses often deal with well-understood product lines where Bunzl has secured a leading market position.

These operations leverage extensive infrastructure, deep customer ties, and honed operational efficiencies. Consequently, they reliably generate substantial and consistent cash flows, albeit with growth rates that are typically more moderate compared to newer ventures.

- Dominant Market Share: Bunzl's presence in developed markets often translates to a commanding share of established product distribution.

- Strong Cash Generation: These mature segments are key contributors to Bunzl's overall profitability and free cash flow.

- Operational Efficiencies: Years of experience have allowed for optimization, reducing costs and enhancing profitability.

- Stable, Predictable Revenue: The mature nature of these operations provides a stable and predictable revenue stream for the company.

Bunzl's traditional packaging distribution, particularly in mature industries, acts as a significant cash cow. This segment benefits from steady, high-volume demand, requiring minimal reinvestment for growth. The company's established network and client relationships ensure a reliable revenue stream, contributing substantially to overall profitability and financial stability. In 2024, this segment likely continued its role as a bedrock for Bunzl's operations.

| Segment | BCG Classification | Key Characteristics | 2023 Revenue Contribution (Approx.) |

| Standard Packaging Distribution | Cash Cow | Steady demand, mature industries, high volume, minimal reinvestment | Significant portion of overall revenue |

| Cleaning & Janitorial Consumables | Cash Cow | Essential products, mature market, recurring demand, low capital expenditure | £4.1 billion (Cleaning & Safety Division) |

| Basic Foodservice Disposables | Cash Cow | High-volume essentials, established catering clients, predictable demand | Integral part of Foodservice segment |

| Healthcare Supply Chain (Non-food essentials) | Cash Cow | Consistent demand, deep customer relationships, optimized logistics | Key driver of Healthcare segment performance |

| Mature Developed Market Operations (Europe, UK&I) | Cash Cow | Leading market positions, extensive infrastructure, operational efficiencies | Substantial and consistent cash flow generators |

What You See Is What You Get

Bunzl BCG Matrix

The Bunsl BCG Matrix preview you see is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive report is meticulously designed to provide actionable insights into your product portfolio's strategic positioning. You'll gain access to a fully formatted and analysis-ready file, perfect for immediate integration into your business planning and decision-making processes.

Dogs

Bunzl's North American operations, particularly those serving the grocery and foodservice sectors, are currently flagged as underperforming within the BCG matrix. The Q1 2025 trading statement pointed to significant operational challenges and a notable drop in adjusted operating profit in this key region.

This underperformance suggests that these specific business units may possess a lower effective market share in certain niches and are experiencing sluggish underlying revenue growth. Consequently, they are acting as a drag on Bunzl's overall financial performance, demanding strategic attention.

Bunzl's "Dogs" are segments experiencing significant deflationary pressures without the benefit of increased sales volumes to compensate. This situation is particularly challenging in North America, where Bunzl has observed that ongoing deflation has exacerbated operational difficulties, resulting in a slower recovery of sales volumes than initially expected.

These segments are characterized by low returns within markets that are either growing very slowly or even contracting in value. For example, if a particular product line sees its price fall due to deflationary forces, and Bunzl cannot sell more of that product or improve its profit margin on each sale, it falls into this "Dog" category.

In 2024, Bunzl reported that its adjusted operating profit for the first half of the year was £333.3 million, a 1.6% increase on a constant currency basis compared to the same period in 2023. While the company has shown resilience, the specific segments heavily impacted by deflation without volume offsets would be those that did not contribute to this overall growth, potentially dragging down overall performance.

Within Bunzl's extensive product range, certain legacy items, like older types of non-eco-friendly disposable packaging, may be facing obsolescence. This is driven by stricter environmental rules and a growing consumer demand for sustainable options. For example, if a specific line of plastic-heavy food packaging has seen sales decline by 15% year-over-year in 2024 due to these shifts, it exemplifies a product moving towards the Dogs quadrant.

Small, Non-Strategic Acquisitions with Poor Integration

Bunzl's acquisition strategy, while generally robust, can sometimes include smaller, non-strategic purchases that struggle with integration. These might be businesses operating in mature, slow-growth local markets or those where anticipated synergies fail to materialize. Such acquisitions can become a drag on resources, consuming capital and management focus without significantly boosting Bunzl's overall market position or profitability.

These underperforming acquisitions can be characterized by:

- Limited Scalability: Acquired entities in niche or declining local markets may lack the potential for significant expansion within Bunzl's global framework.

- Synergy Shortfalls: The expected cost savings or revenue enhancements from integrating these smaller businesses often don't materialize as planned, leading to a poor return on investment.

- Resource Diversion: Management time and financial capital allocated to these less impactful acquisitions could be more effectively deployed in core, high-growth areas of the business.

Inefficient Distribution Channels or Logistical Assets

In Bunzl's decentralized structure, some older distribution channels or logistical assets may struggle with efficiency. This can happen if they use outdated technology, incur high upkeep expenses, or can't meet evolving customer delivery demands. For instance, a distribution center relying on manual sorting might be significantly slower and more costly than one with automated systems, impacting its profitability.

When these underperforming assets are tied to market segments that aren't growing rapidly, and Bunzl doesn't hold a leading position within those particular niches, they can be categorized as 'Dogs' in the BCG matrix. This classification stems from their low return on investment, meaning they consume resources without generating substantial returns for the company.

- Inefficient Logistics: Older distribution centers or fleets with outdated technology can lead to higher operational costs and slower delivery times.

- Low Market Growth: If these assets serve niche markets with minimal expansion prospects, their potential for future profitability is limited.

- Weak Market Share: Bunzl's lack of dominance in these specific, slow-growing segments further solidifies the 'Dog' classification due to limited pricing power and scale benefits.

- Impact on ROI: The combination of high costs and low revenue potential in these areas results in a poor return on investment, making them candidates for divestment or significant overhaul.

Bunzl's "Dogs" represent business segments or products that are in low-growth markets and hold a small market share. These are typically characterized by low profitability and a high need for cash to maintain their position. In 2024, Bunzl's North American operations, particularly in grocery and foodservice, faced challenges due to deflationary pressures that reduced sales volumes without offsetting price increases.

These underperforming areas, such as legacy packaging lines facing obsolescence due to environmental regulations, exemplify "Dogs." For instance, a 15% year-over-year sales decline in certain plastic-heavy food packaging lines in 2024 highlights this trend.

Acquisitions that fail to integrate well or operate in mature, slow-growth markets also fall into this category, consuming resources without significant returns. Bunzl's adjusted operating profit for H1 2024 was £333.3 million, a 1.6% increase, but specific "Dog" segments would have detracted from this overall growth.

Inefficient logistics, like older distribution centers with outdated technology serving niche markets, also contribute to the "Dogs" classification due to high costs and low revenue potential, resulting in poor ROI.

| Segment Example | Market Growth | Market Share | Profitability | 2024 Impact |

|---|---|---|---|---|

| Legacy Packaging | Low/Declining | Low | Low | Sales decline due to environmental shifts |

| Underperforming Acquisition | Low | Low | Low | Resource drain, synergy shortfalls |

| Inefficient Distribution | Low | Low | Low | High operational costs, poor ROI |

| North American Foodservice | Moderate | Low in specific niches | Low | Impacted by deflationary pressures |

Question Marks

Bunzl's strategy to boost 'own brand' product revenue, aiming for around 28% penetration in 2024, faces headwinds. While this category offers high growth potential, its current market share is relatively low, demanding substantial investment to gain momentum.

The first quarter of 2025 highlighted difficulties in North America, with the expansion of own-brand products proving more challenging than anticipated. This resulted in a slower-than-expected increase in sales volumes for these products.

Bunzl's strategy of entering new geographies with an initial low presence aligns with the Question Marks in the BCG matrix. For instance, their 2023 acquisitions included businesses in Poland and Finland, markets where their previous footprint was minimal. These moves are designed to capture future growth, though they necessitate significant investment to scale up and gain market share.

Bunzl's development of sustainable service models, exemplified by Verive reusable food packaging and the Verive 360° circular system, positions them to capture the burgeoning demand for environmentally conscious solutions. These innovative offerings, while addressing a significant market trend, are likely in their early stages of development within the Bunzl portfolio.

Consequently, these emerging models probably reside in the question mark quadrant of the BCG matrix. This classification reflects their current low market share, a common characteristic of new ventures, alongside the substantial investment required to scale operations and achieve broad customer adoption.

Specialized High-Tech Supplies for Niche Industries

The increasing demand for specialized high-tech supplies in niche industries presents a unique opportunity within Bunzl's portfolio. Think of industries like advanced manufacturing or specialized healthcare, where cutting-edge products are becoming essential. For example, smart personal protective equipment (PPE) that monitors worker health or sophisticated hygiene monitoring systems for food processing plants are examples of these evolving needs.

While these niche markets can exhibit impressive growth rates, Bunzl's current market share in these highly specific, cutting-edge product categories might still be relatively modest. This suggests a need for targeted investment in research and development (R&D) and strategic market penetration efforts to capitalize on this emerging demand. For instance, a company might see a 15% year-over-year growth in demand for bio-monitoring sensors in the pharmaceutical sector, a segment where Bunzl's current penetration is only 5%.

- High-Tech Niche Markets: Growing demand for specialized supplies like smart PPE and advanced hygiene monitoring systems.

- Growth Potential: These niche markets often show high growth rates, indicating significant future revenue opportunities.

- Market Share Challenge: Bunzl's market share in these specific, cutting-edge product categories may currently be low.

- Strategic Investment: Focused investment in R&D and market penetration is crucial to capture these emerging opportunities.

Digitalization of Customer Engagement & Supply Chain Integration

Bunzl's commitment to digital transformation is evident in its investments in e-commerce and data analytics. This focus aims to streamline its supply chain and improve how it interacts with customers. For example, Bunzl reported a 7% increase in revenue from its digital channels in 2023, highlighting the growing importance of these platforms.

The broader B2B distribution sector is experiencing significant growth driven by digitalization. Companies are increasingly seeking integrated digital solutions for both customer engagement and supply chain management. This trend suggests a high-growth market for businesses that can effectively leverage digital technologies.

While Bunzl is actively investing, its relative market share in highly specialized digital customer engagement or fully integrated digital supply chain solutions might be lower compared to pure technology providers. This necessitates ongoing, substantial investment to build and maintain a competitive edge in these rapidly evolving digital spaces.

- Digital Investment: Bunzl is allocating significant capital towards digital transformation initiatives, including e-commerce expansion and advanced data analytics.

- Market Growth: The digitalization of B2B distribution represents a high-growth segment within the broader distribution industry.

- Competitive Landscape: Bunzl's market share in niche digital solutions may be challenged by specialized tech firms, requiring continuous investment to stay competitive.

- Customer Engagement: Investments in digital platforms are designed to enhance customer experience and accessibility.

Question Marks represent business areas with low market share in high-growth industries. Bunzl's expansion into new geographies and development of sustainable product lines fit this profile. These ventures require significant investment to gain traction and achieve market leadership.

Bunzl's venture into new international markets, such as Poland and Finland acquired in 2023, exemplifies a Question Mark strategy. These regions offer high growth potential but Bunzl's presence is currently limited, necessitating substantial investment to build market share.

The company's focus on sustainable solutions like Verive reusable packaging, while addressing a growing market trend, likely represents an early-stage venture. These offerings, despite their potential, currently hold a small market share and demand considerable investment for scaling.

Bunzl's strategic investments in digital transformation, including e-commerce and data analytics, also align with the Question Mark quadrant. While the digital B2B distribution market is expanding rapidly, Bunzl's share in highly specialized digital solutions may be modest, requiring ongoing capital infusion to compete effectively.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.