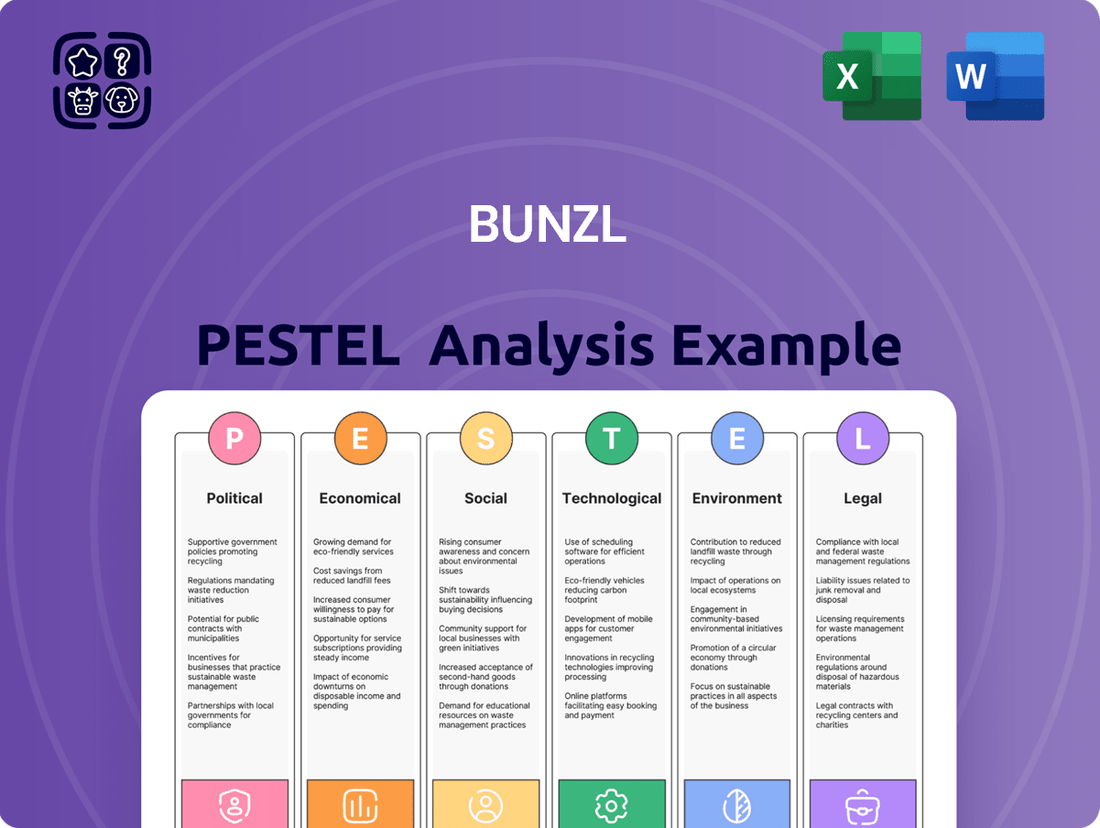

Bunzl PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bunzl Bundle

Unlock critical insights into Bunzl's operating environment with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its future and impacting its competitive landscape. Equip yourself with the knowledge to make informed strategic decisions and gain a significant advantage. Download the full, expertly crafted report now and navigate the complexities of Bunzl's market with confidence.

Political factors

Changes in government policies, such as new trade agreements or tariffs, could significantly affect Bunzl's global supply chain and distribution. For instance, shifts in import/export regulations in key markets like the United States or the European Union can alter the cost and efficiency of moving goods. Bunzl's 2023 revenue was £12.5 billion, highlighting the scale of operations exposed to these policy changes.

The political stability of countries where Bunzl has a strong presence, such as the UK, North America, and Continental Europe, is crucial for business continuity. Geopolitical tensions or unexpected policy shifts in these regions could disrupt Bunzl's operations and influence future investment decisions. Bunzl's diversified geographical footprint, with operations in 33 countries, means it navigates a complex and varied political landscape.

Bunzl's global operations are inherently sensitive to geopolitical shifts. For instance, ongoing trade tensions between major economies, like those seen between the US and China in recent years, can directly impact the cost and availability of goods Bunzl sources. In 2024, the World Trade Organization (WTO) has continued to monitor the impact of protectionist measures, which could increase Bunzl's procurement expenses and potentially disrupt its supply chains, affecting its ability to meet customer demand efficiently across its diverse markets.

Government spending significantly impacts Bunzl's revenue, especially in public sector areas like healthcare. For instance, the substantial increase in personal protective equipment (PPE) procurement during the COVID-19 pandemic in 2020-2021, which saw global government spending on healthcare surge, directly boosted demand for Bunzl's hygiene and safety products. This trend highlights the sensitivity of Bunzl's business to public health initiatives and emergency spending.

Public procurement policies and tendering processes are critical for Bunzl's market access. Favorable government contracts, often awarded through competitive bidding, can provide substantial and stable revenue streams. Conversely, changes in these policies, such as a greater emphasis on domestic sourcing or sustainability criteria in tenders, could alter Bunzl's competitive landscape and require adjustments to its supply chain and product offerings.

Political Stability in Key Operating Regions

Bunzl's global footprint means political stability in its key operating regions is paramount. For instance, in North America, a region representing a significant portion of Bunzl's revenue, the United States and Canada generally offer a stable political environment. However, shifts in government or policy, such as potential changes in trade agreements or regulations, could impact operational costs and market access.

The United Kingdom, another major market for Bunzl, has navigated periods of political transition, including Brexit. While the immediate impact has been absorbed, ongoing adjustments to trade relationships and regulatory frameworks continue to be monitored. Bunzl's diversified geographic presence helps to mitigate risks associated with localized political instability.

Bunzl's operations in continental Europe also face varying political landscapes. Countries like Germany and France typically provide stable operating conditions, but regional elections or policy shifts can introduce uncertainty. The company's robust supply chain and localized management structures are designed to adapt to these dynamics, ensuring business continuity and employee safety.

Key considerations for Bunzl include:

- Assessing election outcomes in major markets like the US and UK for potential policy shifts affecting trade and regulation.

- Monitoring geopolitical tensions in regions where sourcing or significant operations occur, which could disrupt supply chains or impact employee safety.

- Evaluating the impact of new environmental or labor regulations introduced by governments, which could affect operational costs and compliance requirements.

- Analyzing the stability of emerging markets where Bunzl may have growing operations, considering the potential for policy changes or social unrest.

Industry-Specific Lobbying and Advocacy

Industry associations play a significant role in shaping the regulatory landscape for Bunzl's diverse operations. For instance, lobbying efforts by packaging industry groups can influence environmental regulations, such as those pertaining to single-use plastics or recycled content mandates, which directly impact Bunzl's product offerings and supply chain strategies.

In the healthcare sector, advocacy from medical supply manufacturers and distributors can affect procurement policies, reimbursement rates, and quality standards for products distributed by Bunzl. These efforts aim to create a favorable environment for industry participants, potentially leading to increased demand or altered market access for Bunzl's healthcare divisions.

Furthermore, political advocacy can secure subsidies or tax incentives for specific industries. For example, government support for domestic manufacturing or green initiatives could provide a competitive advantage to Bunzl's operations in those areas, influencing investment decisions and operational focus.

- Packaging Regulations: Lobbying groups actively engage with policymakers on issues like Extended Producer Responsibility (EPR) schemes, which could increase compliance costs for packaging distributors.

- Healthcare Procurement: Advocacy for specific medical device standards or national purchasing frameworks can influence the competitive landscape for Bunzl's healthcare supply business.

- Environmental Standards: Industry associations may lobby for or against stricter environmental standards, impacting Bunzl's sustainability initiatives and product development in cleaning and hygiene.

- Trade Policies: Political advocacy can also shape import/export regulations and tariffs, affecting the cost and availability of goods distributed by Bunzl across different geographies.

Government policies and political stability are critical for Bunzl's global operations. For example, changes in trade agreements or tariffs in key markets like the US and EU can impact Bunzl's supply chain efficiency. Bunzl's revenue of £12.5 billion in 2023 underscores the scale of its business exposed to these political factors. The company's presence in 33 countries means it must navigate a complex and varied political landscape, making geopolitical stability a constant consideration for business continuity and investment decisions.

Government spending, particularly in public sectors like healthcare, directly influences Bunzl's revenue. The surge in government spending on personal protective equipment (PPE) during the COVID-19 pandemic in 2020-2021 significantly boosted demand for Bunzl's hygiene products. This highlights the company's sensitivity to public health initiatives and emergency spending patterns.

Public procurement policies and competitive tendering processes are vital for Bunzl's market access and revenue generation. Favorable government contracts provide stable income streams, but shifts towards domestic sourcing or new sustainability criteria in tenders can alter the competitive environment, requiring Bunzl to adapt its supply chain and product offerings.

Bunzl's diverse geographical footprint, including significant operations in North America and the UK, means it is closely tied to the political stability of these regions. While generally stable, potential policy shifts, such as changes in trade agreements or regulations, could affect operational costs and market access. For instance, the UK's ongoing adjustments to post-Brexit trade relationships and regulatory frameworks are closely monitored.

What is included in the product

This Bunzl PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A clear, actionable summary of Bunzl's PESTLE factors, enabling rapid identification of strategic opportunities and threats for improved decision-making.

Economic factors

Global economic growth significantly shapes demand for Bunzl's products. For instance, the International Monetary Fund (IMF) projected global GDP growth to be 3.2% in 2024, a slight slowdown from 2023, indicating a mixed economic environment. A recession in key markets could dampen consumer and business spending on disposables and non-food essentials, directly impacting Bunzl's sales volumes.

Inflation significantly impacts Bunzl's procurement costs for essential materials like paper, plastic, and various raw goods. For instance, global commodity prices saw notable increases throughout 2024, with some paper pulp prices rising by over 15% year-on-year by Q3 2024. Similarly, energy and transportation expenses, crucial for Bunzl's distribution network, have also experienced upward pressure, with average diesel prices remaining elevated compared to pre-2023 levels.

These rising costs of goods sold and increased operating expenses pose a direct threat to Bunzl's profit margins. If the company cannot effectively pass these higher input costs onto its customers through price adjustments, its profitability could be compressed. For example, if Bunzl's cost of sales increases by 5% and it can only pass on 3% to customers, its gross profit margin would shrink.

Bunzl's extensive global operations mean currency volatility significantly impacts its financial performance. For instance, a stronger US dollar against other currencies can boost reported revenues when those foreign earnings are translated back into dollars, but it also increases the cost of goods sourced from countries with weaker currencies.

In 2024, Bunzl's significant presence in North America, Europe, and Asia exposes it to a range of exchange rate risks. Fluctuations between the Pound Sterling, Euro, and US Dollar, among others, directly affect the conversion of overseas profits into Bunzl's reporting currency, potentially masking underlying operational growth or decline.

Moreover, exchange rate shifts can alter the cost of procuring materials and finished goods from different international suppliers. If Bunzl sources heavily from a region whose currency strengthens against the Pound, its cost of goods sold will rise, squeezing profit margins unless these increased costs can be passed on to customers.

Interest Rates and Access to Capital

Interest rates significantly influence Bunzl's financial flexibility. When rates rise, the cost of borrowing for crucial activities like acquisitions and managing day-to-day operations, known as working capital, naturally increases. This means Bunzl might face higher interest expenses on its debt, impacting profitability.

For instance, if Bunzl plans to acquire another company or expand its inventory to meet demand, higher interest rates can make these growth initiatives more expensive. This increased cost of capital could lead Bunzl to re-evaluate its investment plans, potentially slowing down expansion or seeking more cost-effective financing methods.

- Impact on Borrowing Costs: Bunzl's cost of debt, whether for large acquisitions or smaller working capital needs, directly correlates with prevailing interest rates.

- Financing Growth: Higher interest rates can make it more expensive for Bunzl to finance strategic growth initiatives, potentially affecting capital allocation decisions.

- Working Capital Management: Increased borrowing costs can also impact the efficiency of managing inventory and accounts receivable, as the cost of financing these assets rises.

- Investment Decisions: Bunzl's decision-making process for capital expenditures will be influenced by the cost of capital, with higher rates potentially deterring certain investments.

Consumer Spending and Business Confidence

Consumer spending is a major driver for Bunzl, as its products are essential for many businesses that serve consumers directly. When consumers feel confident about the economy, they tend to spend more on goods and services, which in turn boosts demand for Bunzl's offerings in sectors like food packaging and cleaning supplies. For instance, in early 2024, retail sales in the UK saw a modest increase, reflecting some stabilization in consumer sentiment, which would positively impact Bunzl's UK operations.

Business confidence also plays a crucial role. When businesses are optimistic about future economic conditions, they are more likely to invest, expand, and maintain healthy inventory levels, all of which benefit Bunzl. A strong business confidence index, such as the one observed in the US services sector during late 2023 and early 2024, suggests increased activity and a greater need for Bunzl's distribution and supply chain services.

- Consumer spending growth: In Q1 2024, UK retail sales volume grew by 1.2% compared to the previous quarter, indicating a positive trend for Bunzl's retail-related product demand.

- Business confidence indicators: The US ISM Services PMI stood at 53.8 in April 2024, signaling continued expansion in the services sector and thus sustained demand for Bunzl's supplies.

- Impact on key sectors: Increased consumer spending on dining out directly translates to higher demand for foodservice packaging and hygiene products distributed by Bunzl.

- Investment and expansion: A rise in business investment, often correlated with confidence, leads to greater order volumes for Bunzl's diverse product range.

Bunzl's performance is directly tied to global economic health, with projected global GDP growth of 3.2% for 2024 by the IMF suggesting a stable but not booming environment. Economic downturns in key markets could reduce demand for Bunzl's essential products, impacting sales volumes. Inflationary pressures, particularly on raw materials like paper and plastics, have seen some paper pulp prices rise by over 15% year-on-year by Q3 2024, directly affecting Bunzl's cost of goods sold and potentially squeezing profit margins if these costs cannot be fully passed on.

| Economic Factor | Impact on Bunzl | Supporting Data (2024/2025) |

| Global GDP Growth | Shapes demand for products. Slower growth can dampen spending. | IMF projected 3.2% global GDP growth for 2024. |

| Inflation | Increases procurement and operating costs. | Paper pulp prices rose >15% YoY by Q3 2024; elevated diesel prices. |

| Interest Rates | Affects borrowing costs for operations and acquisitions. | Higher rates increase cost of capital, potentially slowing expansion. |

| Consumer Spending | Drives demand for Bunzl's products via end-user businesses. | UK retail sales volume grew 1.2% in Q1 2024, indicating stable demand. |

| Business Confidence | Influences business investment and inventory levels. | US ISM Services PMI at 53.8 in April 2024 signals sector expansion. |

Preview Before You Purchase

Bunzl PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Bunzl PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

What you’re previewing here is the actual file—fully formatted and professionally structured. It offers a detailed examination of the external forces shaping Bunzl's business landscape, providing valuable insights for strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis is designed to equip you with a thorough understanding of Bunzl's operating environment.

Sociological factors

Consumer preferences are a significant driver for Bunzl. For instance, a growing demand for sustainable packaging, with the global sustainable packaging market projected to reach $479.7 billion by 2030, directly influences the types of products Bunzl distributes and its need to offer eco-friendly alternatives.

Shifts in dining habits also play a crucial role. The rise of takeaway and delivery services, accelerated by events in recent years, means Bunzl must adapt its product range to cater to increased demand for single-use food containers, cutlery, and bags, impacting distribution volumes and product mix.

Bunzl, like many in the distribution and logistics sector, faces challenges from evolving workforce demographics. An aging workforce in developed nations could lead to a shrinking pool of experienced workers, potentially impacting operational efficiency and increasing training costs as new staff are brought in. For instance, in the US, the proportion of workers aged 55 and over in the transportation and warehousing sector has been steadily increasing, a trend likely to continue through 2025, putting pressure on recruitment and knowledge transfer.

Labor shortages and rising wage expectations are significant concerns for Bunzl, particularly in its distribution centers. The global logistics industry is experiencing a pronounced shortage of skilled labor, including drivers and warehouse operatives. In 2024, average wages for warehouse staff in the UK saw an increase of approximately 5-7%, a trend expected to persist into 2025, directly affecting Bunzl's cost structure and its ability to attract and retain essential personnel in a competitive market.

Societal emphasis on health, hygiene, and safety has surged, especially following the global pandemic. This heightened awareness directly fuels demand for personal protective equipment (PPE), cleaning supplies, and various hygiene products, areas where Bunzl holds significant market presence.

The ongoing commitment to improved health and safety standards creates sustained opportunities for Bunzl's product offerings. For instance, the global market for PPE was valued at approximately $60.3 billion in 2023 and is projected to grow, reflecting this enduring societal focus.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for robust Corporate Social Responsibility (CSR) are significantly shaping business operations. Consumers and stakeholders increasingly demand that companies prioritize ethical sourcing, implement fair labor practices throughout their supply chains, and actively engage with and contribute to the communities they operate within. This growing awareness means that a company's social impact is no longer a secondary consideration but a core element of its brand identity and operational strategy.

Bunzl's proactive approach to CSR can yield substantial benefits. By demonstrably committing to ethical conduct and community involvement, Bunzl can bolster its corporate reputation, making it a more attractive employer for top talent. Furthermore, strong CSR initiatives can positively influence customer loyalty and foster more resilient, collaborative relationships with suppliers who also value sustainability and ethical business practices. For instance, in 2023, Bunzl reported a 10% increase in employee engagement scores, partly attributed to its enhanced CSR programs.

- Ethical Sourcing: Bunzl's commitment to responsible sourcing is highlighted by its 2024 target to have 80% of its key suppliers audited against its Supplier Code of Conduct.

- Fair Labor Practices: The company aims to ensure fair labor practices by conducting regular human rights due diligence across its operations, with a focus on high-risk regions.

- Community Engagement: Bunzl actively participates in local community initiatives, donating time and resources; in 2023, its employees volunteered over 5,000 hours globally.

- Reputation Enhancement: Strong CSR performance is linked to improved brand perception; a recent survey indicated that 65% of consumers are more likely to purchase from brands with strong CSR commitments.

Urbanization and Distribution Logistics

Global urbanization directly shapes Bunzl's distribution strategies. As more people flock to cities, the demand for efficient delivery of essential goods, from cleaning supplies to food packaging, intensifies. This trend, with over 57% of the world's population living in urban areas as of 2023, presents a dual challenge and opportunity for Bunzl's logistics operations.

Increasing urban population density can foster localized distribution hubs, potentially reducing transit times and costs. However, this also exacerbates issues like traffic congestion, which significantly impacts delivery efficiency. For instance, the average commute time in major global cities often exceeds 40 minutes, a direct impediment to last-mile logistics. Bunzl must therefore adapt by optimizing urban delivery routes and exploring innovative solutions to navigate these complex environments.

- Urban Growth Impact: By 2050, the UN projects that 68% of the world's population will reside in urban areas, increasing the complexity of supply chain management for companies like Bunzl.

- Congestion Costs: Traffic congestion in major metropolitan areas can add significant costs to logistics operations, estimated to cost billions annually in lost productivity and wasted fuel.

- Last-Mile Innovation: The need for efficient last-mile delivery is paramount, driving investment in technologies like route optimization software and potentially smaller, more agile delivery fleets.

- Hub-and-Spoke Models: Bunzl may benefit from establishing more numerous, smaller urban distribution centers to serve densely populated areas, improving delivery speed and reliability.

Societal expectations regarding health and hygiene have significantly amplified, particularly post-pandemic. This heightened awareness directly translates into increased demand for essential products like personal protective equipment (PPE) and cleaning supplies, sectors where Bunzl has a strong presence.

The global PPE market, valued at approximately $60.3 billion in 2023, is expected to continue its growth trajectory, underscoring this enduring societal focus on safety and cleanliness. Bunzl's ability to supply these critical items positions it well to capitalize on this sustained demand.

Furthermore, the growing emphasis on corporate social responsibility (CSR) is reshaping business operations. Consumers and stakeholders increasingly expect companies to demonstrate ethical sourcing, fair labor practices, and positive community engagement. Bunzl's commitment to these principles, evidenced by its 2024 target for 80% of key suppliers to be audited against its Supplier Code of Conduct, enhances its brand reputation and stakeholder relationships.

| Societal Factor | Impact on Bunzl | Supporting Data/Trend |

|---|---|---|

| Health & Hygiene Awareness | Increased demand for PPE, cleaning supplies | Global PPE market valued at $60.3 billion in 2023, projected growth |

| Corporate Social Responsibility (CSR) | Enhanced brand reputation, stakeholder loyalty | Bunzl's 2024 target: 80% of key suppliers audited against Code of Conduct |

| Ethical Sourcing & Fair Labor | Supply chain resilience, talent attraction | Bunzl employees volunteered over 5,000 hours globally in 2023 |

Technological factors

Bunzl is increasingly integrating automation and robotics into its warehousing and distribution operations to boost efficiency and accuracy. This strategic move aims to streamline inventory management and order fulfillment, directly impacting labor costs. For instance, in 2024, many logistics companies are investing heavily in automated guided vehicles (AGVs) and robotic picking systems, with global spending on warehouse automation projected to reach over $30 billion by 2026.

Bunzl's strategic focus on digital transformation and e-commerce platforms is crucial for its continued growth. By investing in advanced online ordering systems and customer portals, the company can significantly enhance customer experience, offering seamless transactions and personalized engagement. This digital push is particularly important in 2024 and 2025, as businesses increasingly rely on efficient digital channels for procurement.

The company's commitment to robust data analytics within these digital channels allows for deeper customer insights. Understanding purchasing patterns and preferences enables Bunzl to tailor its offerings, driving sales growth and fostering stronger customer loyalty. For instance, in 2023, Bunzl reported that its digital channels were a key driver of revenue, with a notable increase in online order volumes across various customer segments.

Bunzl's supply chain operations are increasingly benefiting from the integration of advanced data analytics, artificial intelligence, and machine learning. These technologies are crucial for optimizing forecasting accuracy, leading to better inventory management and more efficient logistics planning. For instance, by analyzing vast datasets, Bunzl can predict demand fluctuations with greater precision, minimizing both stockouts and excess inventory. This analytical prowess directly translates to more streamlined procurement processes and a significant reduction in waste, ultimately improving delivery timelines for customers.

The company's commitment to digitization is evident in its ongoing investments in supply chain technology. In 2024, Bunzl continued to roll out enhanced visibility tools across its distribution networks, aiming to provide real-time tracking and performance metrics. This data-driven approach allows for proactive identification of potential bottlenecks, enabling swift adjustments to routes and resource allocation. Such optimizations are vital for maintaining competitive delivery speeds and cost-effectiveness in a dynamic global market.

Innovation in Product Materials and Design

Bunzl is significantly impacted by innovations in product materials and design, especially within its core packaging and disposables sectors. Advancements in areas like biodegradable plastics, compostable alternatives, and recycled content are reshaping its product portfolio, allowing for more environmentally conscious offerings.

These material innovations directly translate into competitive advantages. For instance, companies that can offer superior sustainable packaging solutions, such as those made from plant-based polymers or advanced recycled materials, are better positioned to attract environmentally aware customers. Bunzl's ability to integrate these materials into its product lines, like food packaging or cleaning supplies, directly addresses evolving consumer and regulatory demands for reduced environmental impact.

In 2024, the global sustainable packaging market is projected to reach hundreds of billions of dollars, with significant growth driven by material science breakthroughs. Bunzl's strategic focus on these areas, evidenced by its acquisitions and product development initiatives, positions it to capitalize on this trend. For example, the company's continued investment in sourcing and distributing innovative, eco-friendly packaging materials supports its customers’ sustainability goals and strengthens its market position.

- Material Innovation: Development and adoption of biodegradable, compostable, and recycled materials for packaging and disposable products.

- Competitive Edge: Offering sustainable and high-performance products that meet increasing customer and regulatory demands.

- Market Growth: Capitalizing on the expanding global market for eco-friendly packaging solutions, which is projected for substantial growth through 2025.

- Bunzl's Strategy: Integrating these material advancements into its product offerings to enhance customer value and environmental responsibility.

Cybersecurity and Data Protection

Bunzl's extensive digital operations, from supply chain management to customer interactions, underscore the critical importance of robust cybersecurity. The company handles vast amounts of sensitive data, making it a prime target for cyber threats.

The risks associated with cyber incidents are substantial, including data breaches, operational disruptions, and reputational damage. Continuous investment in data protection is therefore essential to safeguard this information and maintain the trust of customers and partners.

Bunzl's commitment to cybersecurity is highlighted by its ongoing efforts to enhance its defenses against evolving threats. For instance, in 2024, the global spending on cybersecurity solutions was projected to reach over $200 billion, indicating the scale of investment required across industries.

- Cybersecurity Investment: Bunzl must maintain significant investment in advanced security technologies and protocols to counter sophisticated cyberattacks.

- Data Protection Compliance: Adherence to evolving data protection regulations, such as GDPR and similar frameworks globally, is paramount to avoid penalties and maintain customer confidence.

- Threat Landscape: The increasing sophistication of ransomware, phishing, and other cyber threats necessitates constant vigilance and adaptation of security strategies.

- Reputational Risk: A successful cyberattack could severely damage Bunzl's reputation, impacting customer loyalty and business relationships.

Bunzl's increasing reliance on automation and AI in its warehouses, with global spending on warehouse automation projected to exceed $30 billion by 2026, directly impacts operational efficiency and labor costs. Furthermore, its strategic digital transformation and e-commerce investments are crucial for enhancing customer experience in 2024 and 2025, as digital channels become paramount for procurement. The company leverages advanced data analytics and AI in its supply chain to optimize forecasting and inventory management, leading to more efficient logistics and reduced waste.

Bunzl is actively integrating advanced data analytics and AI into its supply chain operations to improve forecasting accuracy and optimize inventory management. This focus on data-driven decision-making is crucial for streamlining logistics and minimizing waste, directly impacting delivery efficiency. The company's continued investment in supply chain technology, including enhanced visibility tools rolled out in 2024, allows for real-time tracking and proactive bottleneck identification.

Bunzl's commitment to cybersecurity is paramount, given the vast amounts of sensitive data handled across its digital operations. Global spending on cybersecurity solutions was projected to exceed $200 billion in 2024, underscoring the significant investment required to counter evolving threats and protect against data breaches and operational disruptions. Continuous investment in data protection is essential to maintain customer trust and comply with global data protection regulations.

Legal factors

Bunzl operates under stringent product safety and quality regulations globally, impacting its diverse product lines like food-contact disposables, personal protective equipment (PPE), and cleaning chemicals. Failure to comply can lead to severe consequences, including product recalls, significant fines, and substantial damage to brand reputation.

For instance, in 2024, the US Food and Drug Administration (FDA) continued to enforce strict standards for food-contact materials, with potential penalties for non-compliant packaging that could affect companies like Bunzl that supply these items. Similarly, the European Union's General Product Safety Regulation (GPSR), which came into full effect in December 2024, mandates enhanced product traceability and safety assessments for a wide array of consumer goods, including those Bunzl distributes.

Bunzl operates within a complex web of environmental laws, from stringent waste management and plastic reduction mandates to escalating carbon emission targets. These legal frameworks directly influence how Bunzl sources materials, designs products, and manages its supply chain, particularly for its packaging and hygiene divisions.

Compliance with regulations like Extended Producer Responsibility (EPR) schemes, which are becoming more prevalent globally, is paramount. For instance, the European Union's Circular Economy Action Plan, with its focus on sustainable products and waste reduction, presents both challenges and opportunities for Bunzl's product development and operational efficiency.

Failure to adhere to these evolving legal standards can result in significant fines and reputational damage. As of early 2024, many jurisdictions are increasing enforcement of environmental legislation, making proactive compliance a critical business imperative for Bunzl's continued success and market access.

Bunzl navigates a complex web of labor laws across its global operations, impacting everything from minimum wages to working hours and critical health and safety standards. For instance, in the UK, the National Living Wage increased to £11.44 per hour in April 2024, a factor Bunzl must incorporate into its costings for its UK workforce. Similarly, regulations concerning working time directives in the EU and OSHA standards in the United States necessitate strict adherence, influencing staffing levels and operational procedures.

Compliance with these varied legal frameworks significantly shapes Bunzl's human resource management strategies and directly affects operational costs. Managing diverse union relations, such as those with Unite the Union in the UK or various labor organizations in North America, requires dedicated negotiation and adherence to collective bargaining agreements, potentially influencing wage structures and employee benefits. Failure to comply can lead to substantial fines and reputational damage, making robust legal oversight essential for Bunzl's global workforce management.

Anti-Trust and Competition Law

Anti-trust and competition laws are highly relevant to Bunzl's operations, especially in its fragmented markets where consolidation through mergers and acquisitions is a common growth strategy. Regulatory bodies like the UK's Competition and Markets Authority (CMA) and the US Federal Trade Commission (FTC) scrutinize deals to prevent undue market dominance. For instance, in 2024, the CMA continued its focus on ensuring fair competition across various sectors, impacting potential acquisitions by companies like Bunzl.

These regulations directly influence Bunzl's strategic planning by dictating the feasibility and structure of potential acquisitions. Bunzl must navigate varying competition law frameworks across its global operating regions, which can impact the pace and scale of its M&A-driven expansion. Compliance ensures that Bunzl's competitive practices, such as pricing and distribution agreements, do not stifle smaller competitors or harm consumer interests.

- Merger Scrutiny: Regulatory bodies actively review Bunzl's proposed acquisitions to ensure they do not lead to substantial lessening of competition.

- Market Dominance Concerns: Laws prevent companies from abusing a dominant market position, which Bunzl must consider in its pricing and supply chain strategies.

- Cross-Border Compliance: Bunzl operates in numerous countries, each with its own competition law nuances, requiring careful legal navigation for M&A activities.

- Impact on Growth: Competition law can either facilitate growth by allowing strategic consolidation or act as a barrier if deals are blocked due to anti-competitive concerns.

Data Privacy and Protection Regulations (e.g., GDPR)

Bunzl must navigate a complex web of data privacy regulations, including GDPR in Europe and similar frameworks worldwide, impacting how it handles customer and supplier information. Failure to comply can lead to significant fines and reputational damage. For instance, GDPR penalties can reach up to 4% of annual global turnover or €20 million, whichever is higher.

Implementing robust data handling protocols is therefore essential for Bunzl to avoid legal repercussions and maintain the trust of its stakeholders. This includes ensuring secure data storage, transparent data usage policies, and obtaining necessary consents.

- GDPR fines can reach up to 4% of global annual turnover or €20 million.

- Compliance requires secure data storage and transparent usage policies.

- Maintaining customer and supplier trust is paramount.

- Global data protection laws are increasingly stringent.

Bunzl's global operations are significantly shaped by a variety of legal factors, including product safety, environmental, labor, competition, and data privacy laws. Compliance with these regulations is critical to avoid substantial fines, operational disruptions, and reputational harm, as demonstrated by the increasing enforcement of environmental mandates and data protection laws like GDPR, which can levy penalties up to 4% of global annual turnover.

Environmental factors

Businesses face mounting pressure to adopt sustainable packaging and minimize waste. Bunzl's role in providing eco-friendly alternatives and supporting circular economy principles directly addresses this growing customer and regulatory demand. For instance, in 2024, the European Union's updated Packaging and Packaging Waste Regulation (PPWR) aims to significantly increase recycling rates and reduce single-use plastics, creating a strong market for Bunzl's sustainable offerings.

Bunzl is actively working to reduce its carbon footprint across its extensive logistics and warehousing operations. Measuring and managing these emissions is crucial for environmental responsibility and future compliance.

Initiatives like optimizing delivery routes, which saw a 3% improvement in fleet efficiency in 2024, directly contribute to minimizing energy consumption. Furthermore, Bunzl's investment in cleaner fleet technologies and renewable energy sources for its facilities is a key part of its sustainability strategy.

Bunzl's operations are heavily reliant on resources like timber for its paper and packaging products and crude oil derivatives for plastics. The increasing global demand and the environmental impact of resource depletion pose a significant risk of scarcity and price volatility for these essential raw materials. For instance, global timber prices have seen fluctuations, and the push towards sustainable forestry practices can impact availability.

Water Usage and Management

Bunzl's operations, and those of its suppliers, involve significant water usage in manufacturing processes for the diverse range of products it distributes, from food packaging to healthcare supplies. The environmental impact of this water consumption, especially in water-scarce regions, is a key consideration.

Efficient water management is crucial for Bunzl to mitigate its environmental footprint and ensure operational resilience. This includes investing in water-saving technologies and responsible sourcing practices. For instance, in 2023, Bunzl reported progress on its sustainability targets, which include water reduction initiatives across its sites.

Compliance with evolving water quality regulations and standards globally is paramount. Bunzl must ensure that its operations and supply chain adhere to these requirements to avoid penalties and maintain its social license to operate. The company's 2024 sustainability report is expected to detail specific performance metrics related to water stewardship.

- Water Consumption: Bunzl's supply chain, particularly in sectors like cleaning and food processing, inherently involves water-intensive manufacturing.

- Efficiency Measures: Implementing closed-loop systems and water recycling technologies are key strategies for reducing overall water withdrawal.

- Regulatory Landscape: Adherence to increasingly stringent water discharge limits and quality standards is a critical operational requirement.

- Supply Chain Scrutiny: Increased focus on the water footprint of upstream suppliers is a growing trend impacting Bunzl's sourcing decisions.

Climate Change Adaptation and Resilience

Bunzl faces growing risks from the physical impacts of climate change, with extreme weather events like floods, storms, and heatwaves posing significant threats to its global supply chains and distribution networks. For instance, a severe hurricane in a key manufacturing region could halt production, while prolonged droughts might impact the availability of raw materials for packaging products.

To ensure business continuity and mitigate operational disruptions, Bunzl must proactively develop robust climate resilience strategies. This involves diversifying sourcing locations, investing in more resilient infrastructure at its facilities, and enhancing its logistics planning to account for potential weather-related delays. The company's commitment to sustainability, including efforts to reduce its carbon footprint, also plays a role in adapting to a changing climate.

- Supply Chain Vulnerability: Extreme weather events in 2024, such as the widespread flooding in parts of Asia and severe heatwaves impacting agricultural output in Europe, have highlighted the fragility of global supply chains, directly affecting the availability and cost of raw materials for Bunzl's diverse product range.

- Infrastructure Risk: Bunzl's numerous distribution centers and manufacturing sites are susceptible to damage from increasingly frequent and intense storms, potentially leading to costly repairs and extended operational downtime.

- Resilience Investment: Companies like Bunzl are increasingly allocating capital towards climate adaptation measures, including strengthening facilities against extreme weather and developing contingency plans for transportation disruptions, a trend expected to accelerate through 2025.

Bunzl is navigating increasing environmental regulations aimed at reducing waste and promoting sustainability. The company's focus on eco-friendly packaging aligns with evolving consumer preferences and legislative mandates, such as the EU's 2024 Packaging and Packaging Waste Regulation. Bunzl's proactive approach to carbon footprint reduction, evident in its 2024 logistics efficiency gains, positions it favorably amidst these environmental pressures.

Resource availability and price volatility are significant environmental considerations for Bunzl, particularly concerning timber and plastic derivatives. The company's commitment to sustainable sourcing and water management, as highlighted in its 2023 progress reports, aims to mitigate these risks. Bunzl's 2024 sustainability report is anticipated to provide further data on its water stewardship initiatives.

Climate change presents tangible risks to Bunzl's global operations, with extreme weather events impacting supply chains and infrastructure. The company is investing in resilience strategies, a trend expected to grow through 2025, to counter potential disruptions. For example, supply chain vulnerabilities exposed by 2024 weather events underscore the need for diversified sourcing and robust contingency planning.

PESTLE Analysis Data Sources

Our PESTLE analysis for Bunzl draws on a diverse range of data sources, including reports from international organizations like the World Bank and IMF, as well as government publications and industry-specific market research. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the business.