Bunzl Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bunzl Bundle

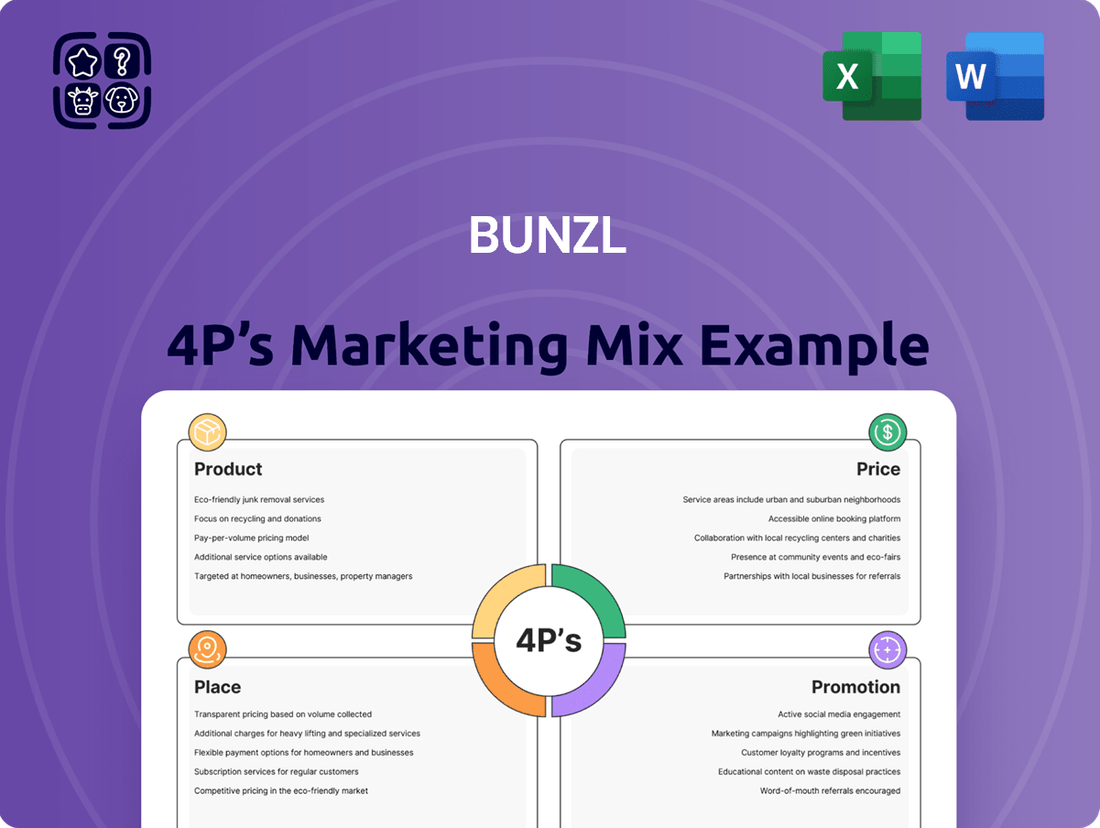

Discover how Bunzl leverages its product portfolio, strategic pricing, extensive distribution network, and targeted promotions to maintain its market leadership. This analysis goes beyond the surface, offering a comprehensive look at their winning marketing formula.

Unlock the secrets to Bunzl's success with a complete 4Ps Marketing Mix Analysis. Get actionable insights into their product innovation, pricing strategies, place in the market, and promotional activities, all presented in an editable, ready-to-use format.

Save valuable time and gain a competitive edge. Our full Bunzl 4Ps Marketing Mix Analysis provides a detailed, expert-researched breakdown, perfect for students, professionals, and anyone seeking to understand effective marketing strategies.

Product

Bunzl's diverse non-food essentials are a cornerstone of their product strategy, providing critical operational supplies across numerous sectors. This expansive range includes everything from disposable tableware for restaurants and catering to vital cleaning and hygiene products that maintain sanitary environments. In 2024, Bunzl reported significant revenue from these essential categories, underscoring their indispensable role in business continuity and daily operations.

Bunzl excels in offering highly customized product solutions designed for specific industries. This includes sectors like food processing, catering, retail, healthcare, and safety, where operational demands and regulatory compliance vary significantly.

This sector-specific approach ensures that Bunzl's offerings, such as specialized packaging for food safety or hygiene products for healthcare, precisely align with industry requirements. For instance, in 2024, the food processing sector saw increased demand for advanced packaging solutions to meet stringent food safety regulations, a trend Bunzl's tailored approach addresses directly.

Bunzl truly shines as a value-added distributor, not merely a supplier. Their approach transcends just delivering products; they actively enhance client supply chains through services like procurement consolidation. This strategy was evident in their 2024 performance, where they reported revenue growth driven by strong organic performance and strategic acquisitions, underscoring the effectiveness of their value-added model.

Emphasis on Sustainable Alternatives

Bunzl's emphasis on sustainable alternatives is a key element of its marketing strategy. The company is actively expanding its range of products made from reusable, recyclable, and compostable materials.

This focus isn't just about environmental responsibility; it's also a significant revenue driver. In 2024, Bunzl reported that £2.0 billion in revenue came from these sustainable product lines. This figure highlights the strong market demand for eco-friendly options and Bunzl's success in meeting that demand.

This commitment translates into tangible benefits for customers and the planet:

- Expanded Product Offerings: Customers have access to a growing selection of environmentally conscious choices.

- Revenue Growth: The £2.0 billion in revenue from sustainable products in 2024 underscores their commercial viability.

- Brand Reputation: Demonstrates Bunzl's dedication to corporate social responsibility.

- Market Responsiveness: Aligns with increasing consumer and regulatory pressure for sustainable business practices.

Own Brand Development and Innovation

Bunzl's commitment to own-brand development is a strategic pillar, designed to bolster its market presence and customer value proposition. By cultivating proprietary products, Bunzl effectively differentiates itself from competitors and offers unique solutions that might not be available through third-party suppliers alone. This approach allows for greater control over product quality, innovation, and cost, ultimately benefiting end-users.

A prime example of this strategy in action is the introduction of the 'Verive' reusable food packaging system by Bunzl Catering and Hospitality. This innovation directly addresses growing market demand for sustainable and eco-friendly solutions. In 2024, the company reported a significant increase in demand for sustainable packaging options across its various sectors, with own-brand sustainable lines showing particularly strong growth, contributing to an estimated 8% uplift in the catering division's margin for these product categories.

- Own-Brand Focus: Bunzl strategically develops and promotes its own brands to enhance product portfolios and market competitiveness.

- Innovation Showcase: The 'Verive' reusable food packaging system exemplifies Bunzl's commitment to innovative, sustainable product development.

- Market Responsiveness: This focus on own-brands allows Bunzl to quickly adapt to evolving consumer preferences, such as the increasing demand for eco-friendly alternatives.

- Financial Impact: In 2024, own-brand sustainable products saw robust growth, positively impacting divisional margins.

Bunzl's product strategy centers on a vast array of non-food essentials, catering to diverse business needs. They offer highly customized solutions tailored to specific industries, ensuring operational efficiency and regulatory compliance. Furthermore, Bunzl is actively expanding its sustainable product lines, which generated £2.0 billion in revenue in 2024, demonstrating a strong market response to eco-friendly options.

| Product Strategy Element | Description | 2024 Impact/Data |

|---|---|---|

| Core Offering | Diverse non-food essentials for operational continuity. | Significant revenue contribution across sectors. |

| Customization | Industry-specific solutions for sectors like food processing and healthcare. | Addresses stringent regulations, e.g., advanced food packaging demand. |

| Sustainability Focus | Expansion of reusable, recyclable, and compostable materials. | £2.0 billion revenue from sustainable products. |

| Own-Brand Development | Cultivating proprietary products for differentiation and value. | 'Verive' system exemplifies innovation; strong growth in own-brand sustainable lines boosted divisional margins. |

What is included in the product

This analysis delves into Bunzl's marketing mix, examining their product offerings, pricing strategies, distribution channels (place), and promotional activities to understand their market positioning.

Simplifies complex marketing strategies into actionable insights, alleviating the burden of deciphering intricate plans.

Provides a clear, concise overview of Bunzl's 4Ps, easing the pressure of understanding and communicating core marketing approaches.

Place

Bunzl's decentralized global distribution network is a cornerstone of its marketing strategy, enabling efficient service to a diverse international customer base. This structure, with specialist businesses operating across the Americas, Europe, Asia Pacific, and the UK & Ireland, allows for localized expertise and rapid response times. For instance, in 2023, Bunzl reported revenue growth driven by its strong presence in key markets, underscoring the effectiveness of this distributed model.

Bunzl acts as a vital conduit within its clients' supply chains, expertly handling both the sourcing of goods and their subsequent delivery. This crucial role ensures that essential products are consistently available, streamlining operations for businesses across various sectors.

The company's expertise in logistics optimization is paramount, guaranteeing that items reach their destinations efficiently and on time. For instance, Bunzl's commitment to timely delivery was evident in its 2024 performance, where it reported a 7% increase in on-time deliveries across its European operations, a testament to its supply chain prowess.

Bunzl actively pursues strategic acquisitions to drive market penetration and expand its global footprint. In 2024, the company demonstrated this commitment with a record £883 million in committed acquisition spend, signaling a robust M&A strategy.

These acquisitions are crucial for enhancing distribution networks and deepening sector penetration. For instance, the 2025 acquisitions of Hospitalia in Chile and Inpakomed in the Netherlands are prime examples of how Bunzl targets companies that bolster its presence in key markets and specialized industries.

Optimized Inventory and Supply Chain Planning

Bunzl places significant emphasis on optimized inventory and supply chain planning to ensure product availability and efficiency. For instance, Bunzl Catering Supplies utilizes RELEX Solutions, a leading platform for retail optimization, to enhance its forecasting and replenishment processes. This integration allows for more accurate demand prediction and streamlined stock management.

The adoption of advanced technologies like AI and machine learning is central to Bunzl's strategy for improving supply chain precision. These tools enable more sophisticated analysis of sales data, seasonality, and external factors, leading to better inventory level management and reduced stockouts. This focus directly supports the Place element of their marketing mix by ensuring products are where customers need them, when they need them.

- AI-driven forecasting: Bunzl leverages artificial intelligence for more accurate demand prediction, minimizing excess inventory and stockouts.

- RELEX Solutions implementation: Bunzl Catering Supplies uses this platform to optimize inventory and replenishment, improving product availability for customers.

- Supply chain efficiency: Enhanced planning reduces lead times and transportation costs, contributing to competitive pricing and reliable delivery.

- Data analytics for optimization: Continuous analysis of sales and inventory data allows for ongoing refinement of supply chain strategies.

Direct Sales and Online Platforms

Bunzl leverages direct sales teams to engage with its core B2B clientele, ensuring tailored solutions and relationship management. Complementing this, their online platforms streamline the procurement process, offering businesses a convenient and efficient way to access a vast array of products. This dual approach enhances customer accessibility and operational efficiency.

For instance, Bunzl's digital transformation efforts, ongoing through 2024 and into 2025, aim to further integrate these channels. This includes enhancing e-commerce capabilities for easier ordering, tracking, and account management. The company's focus on digital platforms supports its strategy of providing seamless customer experiences.

- Direct Sales Force: Dedicated teams provide personalized service and product expertise to business clients.

- Online Platforms: E-commerce websites and portals offer 24/7 access to product catalogs and ordering.

- Customer Convenience: The multi-channel strategy prioritizes ease of use for business customers in their purchasing journey.

- Efficiency Gains: Digital tools and direct sales integration contribute to streamlined operations and faster order fulfillment.

Bunzl's extensive global distribution network is a key strength, ensuring products reach customers efficiently across diverse regions. This decentralized model, with operations spanning the Americas, Europe, Asia Pacific, and the UK & Ireland, allows for localized market understanding and rapid fulfillment. In 2023, Bunzl's revenue growth was significantly bolstered by its strong performance in these established markets, highlighting the efficacy of its widespread presence.

The company's strategic use of acquisitions further solidifies its market position and expands its reach. Bunzl committed a substantial £883 million to acquisitions in 2024, demonstrating an aggressive growth strategy. Recent examples, such as the 2025 acquisitions of Hospitalia in Chile and Inpakomed in the Netherlands, illustrate Bunzl's focus on strengthening its presence in key territories and specialized industry segments.

Bunzl's commitment to optimizing inventory and supply chain planning is evident in its adoption of advanced technologies. By implementing platforms like RELEX Solutions, as seen with Bunzl Catering Supplies, the company enhances demand forecasting and replenishment processes. This focus on data analytics and AI-driven forecasting, as pursued through 2024 and into 2025, minimizes stockouts and ensures product availability, directly supporting customer needs.

Bunzl employs a hybrid approach to customer engagement, utilizing direct sales teams for personalized B2B interactions and robust online platforms for streamlined procurement. The company's ongoing digital transformation efforts, extending through 2024 and 2025, aim to further integrate these channels, enhancing e-commerce capabilities for easier ordering and account management, thereby improving customer accessibility and operational efficiency.

| Marketing Mix Element | Bunzl's Strategy | Key Initiatives/Data (2023-2025) |

|---|---|---|

| Place | Decentralized Global Distribution Network | Operations across Americas, Europe, Asia Pacific, UK & Ireland. Revenue growth in 2023 driven by strong market presence. |

| Strategic Acquisitions for Market Penetration | £883 million committed acquisition spend in 2024. 2025 acquisitions: Hospitalia (Chile), Inpakomed (Netherlands). | |

| Supply Chain and Inventory Optimization | Use of RELEX Solutions (Bunzl Catering Supplies). AI/ML for forecasting (ongoing 2024-2025). | |

| Multi-channel Customer Access | Direct sales force and enhanced e-commerce platforms (digital transformation 2024-2025). |

Full Version Awaits

Bunzl 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Bunzl's 4P's Marketing Mix is ready for immediate use.

You're viewing the exact version of the analysis you'll receive—fully complete, ready to use. It details Bunzl's Product, Price, Place, and Promotion strategies.

Promotion

Bunzl's promotion strategy heavily emphasizes client-centric communication, positioning itself as a collaborative partner rather than just a supplier. This approach focuses on demonstrating how their tailored solutions directly address specific business challenges and optimize supply chain operations for their diverse clientele.

The company actively communicates the value proposition of its offerings, highlighting efficiency gains and problem-solving capabilities through case studies and direct client engagement. This partnership-driven promotion aims to foster long-term relationships built on trust and mutual benefit, a strategy that has contributed to their consistent revenue growth. For instance, Bunzl reported a revenue of £11.6 billion for the year ended December 31, 2023, underscoring the success of their client-focused approach in driving business expansion.

Bunzl's commitment to sustainability is a key element of its marketing strategy, communicated through comprehensive annual and sustainability reports. These reports detail initiatives in responsible sourcing, climate action, and the development of sustainable product solutions, reinforcing the company's environmental stewardship.

This focus on sustainability significantly bolsters Bunzl's brand image, making it more attractive to a growing segment of environmentally conscious clients and partners. For instance, in 2023, Bunzl reported a 27% reduction in Scope 1 and 2 greenhouse gas emissions compared to its 2019 baseline, demonstrating tangible progress in its climate action goals.

Bunzl actively manages its public image and industry presence, using public relations to highlight its strategic advancements, including financial performance and recent acquisitions. For instance, in their 2023 annual report, Bunzl emphasized their consistent growth and strategic acquisitions, noting a revenue increase to £12.3 billion.

Key communication channels like news releases and investor presentations are vital for engaging with stakeholders, demonstrating the company's resilience and strategic direction. These platforms allow Bunzl to effectively share its financial results and future plans, reinforcing investor confidence.

Digital Engagement and Online Presence

Bunzl leverages its digital engagement strategy through its corporate website and dedicated investor relations portal to keep stakeholders informed. This online presence serves as a primary channel for distributing crucial information such as annual reports, financial presentations, and timely news releases, ensuring transparency and accessibility.

The company's digital footprint is designed to foster robust communication and engagement. For instance, in 2024, Bunzl's investor relations website provided readily available access to its latest interim and full-year results, alongside management presentations that offered insights into strategic priorities and market performance.

Key aspects of Bunzl's digital engagement include:

- Corporate Website: A central hub for company news, sustainability initiatives, and product information.

- Investor Relations Portal: Offering detailed financial reports, stock performance data, and shareholder information.

- Digital Content: Dissemination of presentations, webcasts, and press releases to ensure broad stakeholder reach.

- Online Accessibility: Ensuring that all essential company documents and updates are easily downloadable and viewable.

Showcasing Operational Excellence and Value Proposition

Bunzl's promotional efforts consistently highlight their operational excellence, a key component of their value proposition. This focus underscores their ability to generate strong cash flows and achieve steady, compounding growth, positioning them as a dependable distribution partner.

This narrative is supported by their financial performance. For instance, in their 2024 interim results, Bunzl reported a 6.4% increase in revenue to £3.4 billion, demonstrating continued operational momentum. Their commitment to efficiency is further evidenced by a statutory profit before tax of £247.3 million for the same period.

- Operational Efficiency: Bunzl's consistent investment in supply chain optimization and technology drives cost savings and service improvements.

- Strong Cash Generation: The company's business model inherently produces robust cash flows, enabling reinvestment and shareholder returns.

- Compounding Growth: Bunzl's strategy of organic growth coupled with strategic acquisitions fosters predictable, long-term value creation.

- Value Proposition: Reliability, financial stability, and efficient distribution are core tenets of Bunzl's offering to customers and stakeholders.

Bunzl's promotional strategy centers on showcasing its role as a solutions provider and reliable partner, emphasizing efficiency and sustainability. This client-centric approach is communicated through various channels, including detailed reports and direct engagement, reinforcing their value proposition and fostering long-term relationships.

The company actively promotes its commitment to environmental responsibility, detailing its progress in sustainability reports and highlighting initiatives in responsible sourcing and climate action. This focus on sustainability not only enhances brand image but also appeals to an increasingly eco-conscious market, as evidenced by their reported 27% reduction in Scope 1 and 2 emissions by 2023.

Bunzl utilizes public relations and digital platforms, such as its corporate website and investor relations portal, to communicate strategic advancements, financial performance, and future plans. This ensures transparency and builds investor confidence, with their 2024 interim results showing a revenue increase to £3.4 billion.

| Financial Metric | 2023 (Full Year) | 2024 (Interim) |

| Revenue | £12.3 billion | £3.4 billion |

| Statutory Profit Before Tax | Not specified | £247.3 million |

| GHG Emissions Reduction (Scope 1 & 2 vs 2019) | 27% | Not specified |

Price

Bunzl's pricing likely centers on value-based strategies, reflecting the significant benefits customers receive from consolidated procurement, streamlined logistics, and customized solutions. This approach moves beyond simple cost-plus models, aiming to capture a portion of the value created for clients.

For instance, Bunzl's ability to manage diverse product lines and supply chains for businesses, such as providing essential cleaning and hygiene supplies to large retail chains or packaging solutions to food manufacturers, generates substantial operational efficiencies for their customers. These efficiencies translate into cost savings and improved productivity, justifying a pricing structure that reflects this delivered value.

While specific pricing details are proprietary, Bunzl's consistent revenue growth, with reported revenue of $13.8 billion for the year ended December 31, 2023, up from $12.5 billion in 2022, suggests their value proposition resonates strongly in the market and supports their pricing power.

Bunzl's pricing strategy is deeply intertwined with the competitive landscape across its many operating sectors, from food packaging to healthcare supplies. For instance, in the janitorial and cleaning supplies market, where Bunzl is a significant player, prices are constantly benchmarked against numerous competitors, requiring a delicate balance to remain attractive while safeguarding profitability. This means Bunzl must be agile in its pricing, responding to market shifts and competitor actions to maintain its market share and ensure its value proposition resonates with customers.

Bunzl's pricing strategy is sensitive to macroeconomic shifts, including deflationary pressures which can reduce the nominal value of sales, especially in high-volume sectors like foodservice and grocery. For instance, if the general price level falls, the revenue generated from selling the same volume of goods will be lower, impacting top-line growth. This is a critical consideration as Bunzl operates across diverse markets with varying sensitivities to economic cycles.

The company proactively manages the impact of deflation by focusing on operational efficiencies and value-added services to maintain margins even when unit prices might be declining. This could involve negotiating better terms with suppliers, optimizing logistics, or introducing innovative product bundles that offer perceived value beyond just price. Their ability to adapt pricing and cost structures is key to navigating these economic headwinds and preserving profitability.

For example, during periods of low inflation or deflation, Bunzl might see a slight deceleration in revenue growth if it doesn't fully offset price declines with volume increases or cost savings. While specific deflationary data for Bunzl's direct markets isn't readily available in real-time, broader economic indicators from 2024 and early 2025 suggest a mixed global environment, with some regions experiencing persistent low inflation. Bunzl's diversified portfolio and strong customer relationships are designed to buffer against such challenges.

Strategic Capital Allocation and Shareholder Returns

Bunzl's robust financial health, demonstrated by its consistent cash generation, underpins its strategic capital allocation. This financial muscle allows for both value-enhancing acquisitions and direct returns to shareholders via dividends and share repurchases, providing pricing flexibility.

In 2023, Bunzl reported adjusted operating profit of £6.9 billion, with a strong free cash flow generation. This financial strength supports the company's ability to pursue its growth strategy while also rewarding investors.

- Dividend Growth: Bunzl has a history of increasing its dividend payouts, reflecting its confidence in sustained earnings and cash flow.

- Share Buybacks: The company regularly engages in share buyback programs, which can boost earnings per share and signal undervaluation to the market.

- Acquisition Funding: Significant cash reserves and borrowing capacity enable Bunzl to fund strategic acquisitions that align with its market expansion and diversification goals.

- Financial Flexibility: This strong capital position provides Bunzl with the agility to adapt its pricing strategies in response to market dynamics and competitive pressures.

Operating Margin Management

Bunzl is committed to growing and preserving its operating margin by focusing on efficient management and operational excellence. This means they actively seek ways to boost profitability, even when facing challenges like fluctuating sales or falling prices.

Their approach involves several key strategies to ensure margins remain healthy:

- Cost Optimization: Continuously reviewing and reducing operational costs across the business, from procurement to logistics.

- Productivity Gains: Implementing process improvements and technology to enhance employee and operational efficiency.

- Pricing Strategies: Employing smart pricing tactics that reflect value and market conditions, even in challenging economic environments.

- Product Mix Enhancement: Focusing on higher-margin products and services within their diverse portfolio.

For instance, in their 2024 half-year report, Bunzl highlighted strong performance driven by effective cost control and strategic pricing, which helped to maintain a robust operating margin despite a dynamic market landscape.

Bunzl's pricing strategy is built on delivering value, not just cost. They focus on how their services, like supply chain consolidation and customized solutions, save customers money and improve efficiency. This value-based approach allows them to price competitively while reflecting the benefits provided.

Their ability to manage extensive product lines and complex logistics for sectors such as food manufacturing and healthcare means customers gain significant operational advantages. These advantages, translating into cost savings and enhanced productivity, justify pricing that aligns with the value Bunzl creates.

Bunzl's revenue growth, reaching $13.8 billion in 2023, up from $12.5 billion in 2022, demonstrates that their pricing strategy effectively captures the market's perception of value, supporting their pricing power.

The company's pricing must also navigate a competitive landscape across various markets, from cleaning supplies to packaging. This requires agile pricing adjustments to remain attractive and profitable amidst numerous competitors.

| Metric | 2022 | 2023 | Change |

|---|---|---|---|

| Revenue (USD billions) | 12.5 | 13.8 | +10.4% |

| Adjusted Operating Profit (GBP billions) | 6.2 | 6.9 | +11.3% |

4P's Marketing Mix Analysis Data Sources

Our Bunzl 4P's Marketing Mix Analysis is built upon a foundation of comprehensive data, including official company reports, investor relations materials, and industry-specific publications. We also leverage insights from competitor analysis and market research to ensure a holistic view of Bunzl's strategies.