Bruker PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bruker Bundle

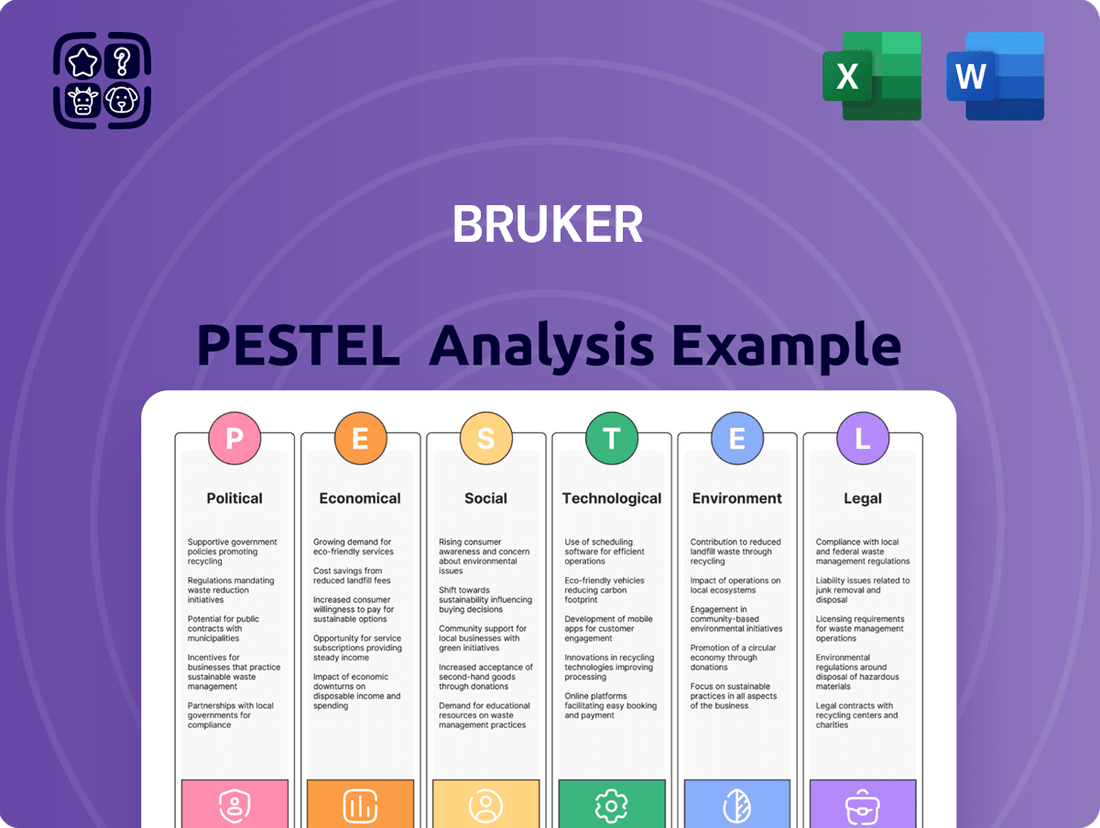

Unlock the critical external factors shaping Bruker's trajectory with our expert-crafted PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements present both opportunities and challenges for the company. Equip yourself with actionable intelligence to refine your market approach and anticipate future trends. Purchase the full PESTLE analysis now for a comprehensive strategic advantage.

Political factors

Government funding is a critical driver for Bruker, particularly through grants supporting life science research and healthcare advancements. In fiscal year 2023, the U.S. National Institutes of Health (NIH) alone allocated over $47 billion to biomedical research, a significant portion of which flows to institutions purchasing advanced scientific instrumentation like Bruker's.

Shifts in government research policies and funding priorities can directly influence the demand for Bruker's high-performance scientific instruments. For instance, increased investment in areas like infectious disease research or personalized medicine, as seen in recent government initiatives, can bolster sales for Bruker's relevant product lines.

Geopolitical tensions and evolving trade policies also pose risks. Tariffs imposed on imported components or finished goods could increase Bruker's cost of goods sold, impacting profitability. Conversely, favorable trade agreements could reduce these costs and potentially expand market access.

Bruker, as a global player, navigates a complex landscape shaped by international trade relations and tariffs. The imposition of new U.S. tariffs and the specter of escalating trade wars present tangible risks, potentially inflating operational costs and fragmenting established global supply chains. These trade tensions directly impact product competitiveness across diverse international markets.

For instance, the ongoing trade friction between the U.S. and China, which saw tariffs on billions of dollars of goods in previous years, continues to create uncertainty. Bruker's response includes strategic pricing adjustments and a proactive re-engineering of its supply chain to build resilience against such geopolitical shifts and maintain its market position.

Government policies concerning healthcare, especially those impacting clinical diagnostics and medical devices, significantly shape Bruker's market potential and its need for regulatory adherence. For instance, in 2023, the U.S. Food and Drug Administration (FDA) continued to refine its regulatory pathways for in-vitro diagnostics, influencing the speed and cost of bringing new technologies to market.

Bruker's strategic acquisitions, such as the 2022 acquisition of ELITechGroup, directly address these evolving healthcare demands and regulatory environments. This move bolstered Bruker's molecular diagnostics offerings, a sector increasingly influenced by global health initiatives and varying national healthcare reimbursement policies, which can impact sales volumes and R&D investment decisions.

Intellectual Property Protection

Intellectual property (IP) protection is a cornerstone for companies like Bruker, which heavily rely on innovation in scientific instrumentation. The strength and enforcement of patent laws globally directly impact their ability to recoup substantial R&D investments and maintain market exclusivity for their cutting-edge technologies. For instance, in 2023, the United States Patent and Trademark Office (USPTO) issued over 300,000 utility patents, highlighting a robust environment for IP protection, which is vital for companies operating in technologically advanced sectors.

Bruker's business model thrives on developing and commercializing proprietary technologies. Strong IP rights, particularly patents, are essential to prevent competitors from replicating their high-performance scientific instruments and analytical solutions. This protection allows Bruker to command premium pricing and fosters continued investment in research, as evidenced by their consistent R&D spending, which has historically represented a significant portion of their revenue, often in the range of 10-12% annually.

The varying landscape of IP enforcement across different jurisdictions presents a key political consideration. While nations like Germany and the USA generally offer strong patent protections, other emerging markets might have weaker enforcement mechanisms. Bruker must navigate these differences, potentially adapting its market entry strategies and licensing agreements to safeguard its innovations effectively. The World Intellectual Property Organization (WIPO) reported a record number of international patent filings in 2023, indicating a global trend towards increased IP awareness and utilization, though enforcement remains a critical differentiator.

- Global IP Enforcement Variability: Bruker faces a complex political landscape where the effectiveness of intellectual property laws differs significantly between countries, impacting their ability to protect innovations in diverse markets.

- R&D Investment Safeguard: Robust patent protection is critical for Bruker to secure its substantial investments in research and development, allowing it to maintain a competitive edge in the high-performance scientific instrument sector.

- Market Exclusivity and Pricing Power: Strong IP rights enable Bruker to ensure market exclusivity for its advanced technologies, thereby supporting premium pricing strategies and fostering continued innovation.

- Navigating Regulatory Frameworks: Bruker must strategically manage its IP portfolio by understanding and adapting to the varying strengths of patent enforcement and regulatory environments worldwide, as seen in the increasing global patent filings reported by WIPO.

Geopolitical Stability

Geopolitical stability is a significant concern for Bruker, given its extensive global footprint. Ongoing tensions in regions like Ukraine, the Middle East, and concerning China present tangible risks to its international operations and intricate supply chains. For instance, the ongoing conflict in Ukraine and broader Eastern European instability can impact raw material sourcing and logistics for Bruker's European manufacturing sites, potentially increasing operational costs.

Market access and the smooth flow of goods are directly threatened by such geopolitical instability. Disruptions can hinder Bruker's ability to deliver critical scientific instruments and services to its customers worldwide, affecting revenue streams. In 2023, Bruker reported that approximately 27% of its revenue was generated from the EMEA region, highlighting the importance of stability in Europe for its financial performance.

- Supply Chain Vulnerability: Bruker's reliance on global suppliers means that regional conflicts can interrupt the availability of components, leading to production delays and increased costs.

- Market Access Restrictions: Geopolitical tensions can result in trade sanctions or altered market conditions, potentially limiting Bruker's access to key customer bases in affected regions.

- Operational Disruptions: Instability can affect transportation routes and the safety of personnel in certain areas, impacting Bruker's ability to maintain its global service and support network.

Government funding significantly impacts Bruker's revenue, with agencies like the NIH directing billions towards research that utilizes advanced instrumentation. For example, in fiscal year 2023, the NIH allocated over $47 billion to biomedical research, a substantial portion of which supports institutions purchasing Bruker's products.

Shifting government research priorities, such as increased investment in infectious disease research, directly boost demand for Bruker's relevant product lines. Furthermore, evolving healthcare policies and regulations, like the FDA's continued refinement of in-vitro diagnostic pathways in 2023, influence market potential and the speed of new technology adoption.

Trade policies and geopolitical tensions create both risks and opportunities. Tariffs can increase costs, while favorable trade agreements can expand market access. Bruker's strategic response to trade friction, such as supply chain re-engineering, aims to mitigate these impacts and maintain competitiveness across global markets.

What is included in the product

This Bruker PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company's operations and strategic direction.

It provides a comprehensive understanding of the external landscape, enabling informed decision-making and proactive strategy development.

The Bruker PESTLE Analysis offers a structured framework that simplifies the complex process of external environmental scanning, reducing the pain of information overload and providing clarity for strategic decision-making.

Economic factors

Bruker's financial performance is significantly influenced by global economic expansion and the level of investment in research and development across key scientific fields. A robust global economy generally translates to increased spending on innovation, which directly benefits companies like Bruker that supply essential tools for scientific discovery.

For instance, projections from the OECD in late 2024 indicated a modest global GDP growth of around 2.7% for 2025. This growth, while not explosive, suggests continued, albeit cautious, investment in R&D within sectors like pharmaceuticals and life sciences, which are core markets for Bruker's advanced analytical instruments.

A downturn in economic activity or a contraction in R&D budgets, perhaps due to geopolitical uncertainties or shifts in government funding priorities, could lead to reduced demand for Bruker's high-ticket scientific equipment. Conversely, periods of strong economic growth and increased R&D outlays, particularly in areas like drug discovery and advanced materials, typically bolster Bruker's revenue streams.

Bruker, with its substantial global presence, is directly impacted by shifts in currency exchange rates. These fluctuations can significantly alter the value of international sales and expenses when translated back into its reporting currency, affecting overall financial performance.

For instance, during 2024 and into 2025, Bruker has experienced foreign currency headwinds. These headwinds represent periods where unfavorable exchange rate movements have reduced the reported value of its international revenues and profits, a common challenge for multinational corporations.

Inflationary pressures are a significant concern for Bruker, directly impacting the cost of essential raw materials and components needed for its sophisticated scientific instruments. For instance, rising energy prices and supply chain disruptions in 2024 continued to exert upward pressure on manufacturing costs across various sectors. This can directly squeeze Bruker's gross profit margins if not effectively managed.

Bruker's strategic response to these rising costs is crucial for its ongoing profitability. The company's ability to implement operational efficiencies, such as optimizing its supply chain and manufacturing processes, alongside carefully considered pricing strategies for its products, will be key. For example, in early 2025, many industrial manufacturers implemented modest price adjustments to offset increased input expenses, a tactic Bruker may also leverage.

Interest Rates and Access to Capital

Fluctuations in interest rates directly impact Bruker's cost of borrowing. With debt levels rising to fund strategic acquisitions, higher rates in 2024 and projected into 2025 could increase their interest expenses, potentially impacting profitability. For instance, if Bruker's average interest rate on its debt were to increase by 1%, it could translate to millions in additional annual costs.

Access to capital remains crucial for Bruker's growth strategy, particularly for pursuing further acquisitions and funding its robust research and development pipeline. The prevailing interest rate environment in 2024 and 2025 will influence the attractiveness and feasibility of new debt issuance or refinancing existing obligations, thereby affecting the overall cost of capital for these critical investments.

- Increased borrowing costs: Rising interest rates in 2024-2025 directly elevate Bruker's expenses on its existing debt and any new financing needed for acquisitions.

- Impact on acquisition strategy: Higher financing costs can make potential acquisitions less attractive or require more favorable terms to maintain expected returns.

- Innovation funding: The cost of capital influences the pace and scale of investment in R&D, a key driver for Bruker's long-term competitiveness.

Market Competition and Pricing Pressure

Bruker faces a highly competitive landscape within the scientific instruments and analytical solutions sector. This intense rivalry often translates into significant pricing pressure, directly affecting their revenue per unit and overall profitability. To counter this, Bruker must consistently innovate and differentiate its offerings to secure and grow its market share.

For instance, in the life science research tools market, which Bruker serves, key competitors like Thermo Fisher Scientific and Agilent Technologies are also investing heavily in R&D. This competitive dynamic means that pricing strategies are carefully calibrated, and any misstep can lead to a loss of valuable customers. Bruker's ability to maintain its market position hinges on its technological advancements and the unique value proposition of its products.

- Intense Rivalry: Bruker competes with major players like Thermo Fisher Scientific and Agilent Technologies, necessitating constant innovation.

- Pricing Pressure: Competition directly impacts pricing, influencing revenue per unit and profit margins.

- Market Share Defense: Continuous differentiation and technological leadership are crucial for retaining and expanding market share.

Global economic conditions directly influence Bruker's sales, with growth in R&D spending in sectors like life sciences and materials science being a key driver. Projections for 2025 suggest continued, albeit moderate, global GDP expansion, which should support demand for Bruker's advanced analytical instruments.

Inflationary pressures and currency exchange rate fluctuations present ongoing challenges. Rising input costs in 2024 and into 2025 have impacted manufacturing expenses, and unfavorable currency movements can affect reported international revenues, as seen in recent quarters.

Interest rates also play a significant role, impacting Bruker's borrowing costs for acquisitions and R&D funding. Higher rates in 2024-2025 increase the expense of debt, potentially influencing investment decisions and overall profitability.

| Economic Factor | Impact on Bruker | 2024-2025 Data/Trend |

|---|---|---|

| Global GDP Growth | Drives R&D spending and instrument demand | Projected ~2.7% global GDP growth for 2025 (OECD) |

| Inflation | Increases raw material and component costs | Continued upward pressure on manufacturing costs observed in 2024 |

| Interest Rates | Affects borrowing costs for acquisitions and R&D | Rising rates in 2024-2025 increase interest expenses |

| Currency Exchange Rates | Impacts value of international sales and expenses | Foreign currency headwinds experienced during 2024 |

What You See Is What You Get

Bruker PESTLE Analysis

The Bruker PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive overview of the external factors influencing Bruker Corporation.

This is a real screenshot of the Bruker PESTLE Analysis product you’re buying—delivered exactly as shown, no surprises, ensuring you get a detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental aspects.

The content and structure shown in the preview is the same Bruker PESTLE Analysis document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

The world's population is getting older, with the number of people aged 65 and over projected to reach 1.6 billion by 2050, according to the UN. This demographic trend significantly boosts the demand for sophisticated healthcare solutions, including advanced diagnostic and research tools. Bruker is well-positioned to capitalize on this, as its technologies are crucial for clinical diagnostics, infectious disease detection, and the burgeoning field of personalized medicine.

This aging demographic necessitates ongoing innovation in healthcare. For instance, the market for in-vitro diagnostics, a key area for Bruker, is expected to grow substantially, driven by the need for early disease detection and monitoring in older populations. The increasing prevalence of chronic diseases among the elderly further fuels the demand for precise analytical instruments that Bruker provides.

Global public health crises, like the COVID-19 pandemic, have dramatically increased the demand for sophisticated diagnostic tools and research equipment. This societal need directly fuels the market for companies like Bruker, which offer solutions for rapid disease identification and in-depth biological study.

Bruker's strategic investments in molecular diagnostics and its growing portfolio for infectious disease research are well-positioned to capitalize on this trend. For instance, in 2023, the global molecular diagnostics market was valued at approximately $25 billion and is projected to grow significantly, with infectious diseases being a major driver.

Societies are increasingly embracing personalized medicine and precision health, a significant shift that demands sophisticated analytical tools. This trend directly fuels the need for advanced technologies like mass spectrometry and spatial biology, areas where Bruker excels.

Bruker's cutting-edge instruments are instrumental in this movement, providing the detailed molecular and cellular insights essential for developing customized treatments and more accurate diagnostics. For instance, Bruker's mass spectrometry solutions are vital for identifying biomarkers that guide therapeutic decisions, a cornerstone of precision health.

The global precision medicine market was valued at approximately USD 60 billion in 2023 and is projected to grow substantially, reaching over USD 120 billion by 2030, highlighting the immense societal and economic impact of this focus. This expansion underscores the critical role of companies like Bruker in enabling these advancements.

Scientific Workforce Development and Education

The availability of a highly skilled scientific workforce is paramount for Bruker, as their advanced analytical and diagnostic instruments require specialized knowledge for operation and interpretation. In 2024, the global demand for scientists and engineers continued to outpace supply, particularly in fields like biotechnology and materials science, directly impacting Bruker's customer base and potential for instrument adoption. The quality of scientific education directly correlates with the ease with which new users can be trained on Bruker's complex systems.

Bruker actively engages in developing this talent pool. For instance, their collaborations with universities often involve providing access to cutting-edge instrumentation for research and education. In 2025, continued investment in training programs, such as workshops and online learning modules, will be crucial for ensuring a steady stream of qualified users who can leverage Bruker's technological advancements effectively.

- Growing STEM Graduate Numbers: In 2024, global STEM graduates saw a modest increase, but specialized analytical science programs remain competitive.

- University-Industry Partnerships: Bruker's commitment to academic partnerships in 2024/2025 aims to bridge the gap between theoretical education and practical instrument application.

- Talent Shortages in Advanced Fields: Specific areas like quantum computing and advanced materials science, relevant to some Bruker technologies, face significant workforce shortages.

Ethical Considerations in Life Science Research

Societal concerns regarding gene editing technologies, like CRISPR, are intensifying, leading to increased calls for stricter ethical guidelines. For instance, a 2024 survey indicated that over 60% of the public expressed reservations about the use of gene editing in humans, impacting potential funding streams for research and development in this area.

These ethical debates directly influence regulatory scrutiny. Governments are actively developing frameworks, with the European Union's proposed AI Act, for example, including provisions for ethical oversight in biotechnological applications, which could affect the adoption of new life science tools. Bruker must navigate these evolving ethical landscapes to ensure its product development aligns with societal expectations and regulatory compliance.

Bruker's responsiveness to these concerns is crucial for maintaining its reputation and market access. The company’s commitment to responsible innovation, particularly in areas like advanced diagnostics and genetic analysis, will be a key differentiator. Public perception, shaped by ethical considerations, can significantly impact investment in life sciences, a sector where Bruker operates.

- Public Opinion: Over 60% of the public expressed reservations about human gene editing in a 2024 survey.

- Regulatory Impact: EU's AI Act and similar global initiatives are increasing ethical oversight in biotech.

- Market Influence: Ethical considerations can shape public funding and the adoption rate of new life science technologies.

- Corporate Responsibility: Bruker's alignment with ethical standards is vital for reputation and market positioning.

Societal shifts toward personalized medicine and precision health are accelerating, requiring advanced analytical tools that Bruker provides. The global precision medicine market, valued at approximately USD 60 billion in 2023, is expected to more than double by 2030, underscoring the demand for technologies like mass spectrometry, where Bruker is a leader.

Public health crises, such as the COVID-19 pandemic, have heightened the need for sophisticated diagnostic and research equipment, directly benefiting companies like Bruker. The molecular diagnostics market, a key area for Bruker, was valued at around $25 billion in 2023 and continues to expand, driven by infectious disease research.

An aging global population, projected to reach 1.6 billion people aged 65 and over by 2050, is increasing demand for healthcare solutions, including advanced diagnostics. This demographic trend fuels the need for precise analytical instruments that support early disease detection and personalized treatment strategies.

Societal concerns and ethical debates surrounding technologies like gene editing are leading to increased regulatory scrutiny and calls for stricter guidelines. For instance, a 2024 survey revealed over 60% public reservation regarding human gene editing, impacting research funding and technology adoption.

Technological factors

Bruker's business thrives on cutting-edge analytical instrument technology, encompassing NMR, mass spectrometry, X-ray, and atomic force microscopy. These sophisticated tools are the backbone of scientific discovery and quality control across numerous industries.

The company consistently pushes the boundaries of innovation. For instance, the introduction of the timsTOF Ultra 2 platform in late 2023, offering enhanced sensitivity and speed for proteomics research, demonstrates this commitment. Similarly, new NMR systems are regularly released, providing researchers with more powerful capabilities.

These technological advancements are not just about new products; they are vital for Bruker to maintain its competitive edge. By addressing the evolving demands of scientific research and industrial applications, such as increased throughput and deeper molecular insights, Bruker secures its market leadership.

The growing adoption of laboratory automation and AI in scientific research offers substantial avenues for Bruker. The company's strategic acquisitions, such as Chemspeed for lab automation solutions, directly address this trend, positioning them to capitalize on the demand for more efficient research workflows.

Bruker's advancements in AI-driven data analysis platforms are also crucial for future expansion. These technologies enable faster, more insightful interpretation of complex scientific data, a key differentiator in a competitive market. For instance, AI is increasingly used to optimize experimental design and identify novel biomarkers, areas where Bruker's instrumentation plays a vital role.

The technological landscape is being reshaped by the rapid expansion of spatial biology and multiomics. This field focuses on examining biological molecules directly within their original tissue environments, offering unprecedented insights. Bruker is strategically positioned to capitalize on this growth, evident in their acquisition of NanoString, a leader in the spatial analysis space, and their existing portfolio of spatial proteomics solutions.

Digitalization of Scientific Workflows

The increasing digitization of scientific workflows is a major technological driver. This means that labs and researchers are moving towards digital environments, relying heavily on software and sophisticated data management systems to handle the vast amounts of information generated. Bruker's success hinges on its ability to provide not just cutting-edge hardware, but also the integrated digital solutions that make this data useful.

This shift demands that Bruker's product development prioritizes software and data analytics capabilities. For instance, in 2023, the global laboratory information management systems (LIMS) market was valued at approximately $1.2 billion, with projections indicating continued strong growth. Bruker's strategy must align with this trend by enhancing its software offerings to improve customer productivity and streamline data analysis.

Key aspects for Bruker include:

- Developing advanced data analysis software: Tools that can interpret complex datasets generated by Bruker's instruments are crucial.

- Ensuring seamless data integration: Solutions that allow for easy data transfer and management across different research stages are essential.

- Investing in cloud-based platforms: Offering secure and accessible cloud solutions for data storage and collaboration will be a competitive advantage.

- Providing AI-powered insights: Incorporating artificial intelligence to help researchers extract deeper meaning from their data can significantly boost value.

Semiconductor Metrology for AI Demands

The burgeoning demand for sophisticated metrology in semiconductor manufacturing, especially for advanced packaging essential for AI chips, creates a substantial technological market for companies like Bruker. Their optical metrology solutions are indispensable for enabling these advanced production techniques.

The semiconductor industry's reliance on precise measurement tools is intensifying. For instance, the global semiconductor metrology and inspection market was valued at approximately $7.5 billion in 2023 and is projected to reach over $12 billion by 2028, with AI driving a significant portion of this growth. Bruker's expertise in this area positions them well to capitalize on this trend.

- AI Chip Advancements: The exponential growth in AI workloads necessitates increasingly complex chip architectures and advanced packaging techniques, requiring highly accurate metrology.

- Optical Metrology's Role: Bruker's optical metrology systems are crucial for ensuring the quality and performance of these intricate semiconductor components during fabrication.

- Market Growth: The increasing complexity of semiconductor manufacturing, fueled by AI, directly translates to higher demand for specialized metrology equipment.

Bruker's technological edge is defined by its advanced analytical instrumentation, including NMR and mass spectrometry, which are critical for scientific research and industrial quality control. The company's commitment to innovation is evident in new product launches like the timsTOF Ultra 2, enhancing proteomics research capabilities. Furthermore, Bruker is strategically integrating AI and automation, exemplified by its acquisition of Chemspeed, to streamline laboratory workflows and provide deeper data insights.

The company is also capitalizing on emerging fields like spatial biology and multiomics, as demonstrated by its acquisition of NanoString, a leader in spatial analysis. This focus on advanced technologies, coupled with a growing emphasis on digital solutions and data analytics, positions Bruker to meet the evolving demands of the scientific community and maintain its market leadership.

The semiconductor industry's demand for sophisticated metrology, particularly for AI chip advancements, presents a significant growth opportunity for Bruker. Their optical metrology solutions are essential for the precise manufacturing required for these complex components.

| Technological Factor | Description | Impact on Bruker | 2023/2024 Data Point | Future Trend |

|---|---|---|---|---|

| Advanced Instrumentation | Development of cutting-edge NMR, mass spectrometry, X-ray, and AFM technologies. | Core competitive advantage, drives product innovation and market leadership. | Introduction of timsTOF Ultra 2 (late 2023) enhanced proteomics capabilities. | Continued demand for higher sensitivity, speed, and resolution in analytical instruments. |

| AI and Automation | Integration of AI for data analysis and automation solutions in labs. | Improves research efficiency, offers deeper data insights, and creates new market opportunities. | Acquisition of Chemspeed for lab automation solutions. | Increasing adoption of AI-driven workflows and automated experimental design in scientific research. |

| Spatial Biology & Multiomics | Focus on technologies for analyzing biological molecules within their native tissue environments. | Opens new avenues for growth in a rapidly expanding research area. | Acquisition of NanoString, a leader in spatial analysis. | Significant growth expected in spatial transcriptomics, proteomics, and other multiomics applications. |

| Metrology for Semiconductors | Precise measurement tools for advanced semiconductor manufacturing, especially for AI chips. | Addresses a critical need in a high-growth industry, leveraging Bruker's expertise. | Global semiconductor metrology and inspection market valued at ~$7.5 billion in 2023. | Rising demand for metrology driven by AI chip complexity and advanced packaging. |

Legal factors

Bruker's clinical diagnostics and medical device segments face stringent regulatory oversight, particularly from bodies like the U.S. Food and Drug Administration (FDA). Adherence to Good Manufacturing Practices (GMP) and robust Medical Device Reporting (MDR) is paramount. Failure to comply can lead to significant financial penalties, product recalls, and severe reputational harm, impacting market access and customer trust.

For instance, the FDA's 2024 enforcement actions highlight the critical nature of regulatory compliance, with significant fines levied against companies for quality system failures. Bruker's commitment to these standards is directly tied to its ability to successfully market and sell its advanced diagnostic solutions, ensuring patient safety and product efficacy.

Bruker's reliance on its advanced scientific instruments and software means that strong intellectual property (IP) laws are crucial for safeguarding its innovations. The company actively pursues patent protection for its technologies, which is essential for maintaining a competitive edge and commanding premium pricing for its unique offerings.

In 2023, Bruker reported significant investments in research and development, totaling $417.9 million, underscoring the importance of patent protection for these ongoing innovations. Potential patent infringement issues or challenges to existing patents could significantly disrupt Bruker's market position and financial performance, requiring substantial resources for legal defense and ongoing patent portfolio management.

As scientific instruments become more integrated with digital systems, Bruker faces increasing scrutiny regarding data privacy and security. Compliance with global regulations like the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA) is paramount, especially as instruments handle sensitive research and customer data. Failure to adhere to these stringent standards could result in significant fines and reputational damage.

Bruker must ensure its instrument software, cloud services, and data management platforms meet robust security protocols. This includes implementing strong encryption, access controls, and audit trails to safeguard proprietary research and personal health information. For instance, the GDPR, which came into full effect in 2018, imposes strict rules on how companies collect, process, and store personal data, with potential fines up to 4% of global annual revenue.

Anti-Corruption and Trade Compliance

Operating worldwide, Bruker navigates a complex web of anti-corruption statutes like the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, alongside stringent international trade compliance rules, including export controls and sanctions. Failure to comply can result in severe financial penalties and legal consequences, impacting global operations and reputation.

For instance, in 2023, companies faced significant fines for trade violations; for example, a major aerospace firm paid $300 million to settle export control violations. Bruker's commitment to robust compliance programs mitigates these risks, ensuring adherence to evolving global regulatory landscapes. This includes rigorous due diligence on partners and strict internal controls to prevent illicit activities.

- FCPA and UK Bribery Act Compliance: Bruker implements policies and training to ensure adherence to anti-bribery laws.

- Export Controls and Sanctions: The company maintains systems to manage compliance with international trade regulations, preventing unauthorized transactions.

- Risk Mitigation: Proactive compliance efforts aim to avoid substantial fines and legal repercussions, safeguarding financial performance and market access.

- 2024/2025 Outlook: Continued global expansion necessitates ongoing vigilance and adaptation to emerging trade and anti-corruption legislation worldwide.

Product Liability and Safety Standards

Bruker, as a provider of scientific instruments, bears significant responsibility for the safety and performance of its products. This includes ensuring that their analytical and diagnostic solutions meet rigorous industry safety standards. Failure to do so can lead to substantial legal repercussions.

Managing product liability is a critical legal consideration for Bruker. This involves implementing robust quality control measures and thorough testing protocols throughout the product lifecycle. In 2023, for instance, the global product liability insurance market saw continued growth, reflecting the increasing awareness and cost of potential claims across various industries, including scientific instrumentation.

To mitigate these risks, Bruker must prioritize adherence to evolving safety regulations and standards. Clear product labeling, comprehensive user manuals, and effective post-market surveillance are essential. These practices help prevent accidents, minimize potential harm to users, and thereby reduce the likelihood of costly legal claims and damage to the company's reputation.

The company's commitment to product safety directly impacts its legal standing and financial health. Proactive risk management in this area is not just a compliance issue but a strategic imperative for maintaining customer trust and long-term business sustainability.

Bruker's product development and sales are heavily influenced by intellectual property laws, necessitating robust patent protection for its innovative technologies. In 2023, Bruker invested $417.9 million in R&D, highlighting the critical need to safeguard these advancements. Potential patent disputes could significantly impact market position and profitability.

The company must also navigate data privacy regulations like GDPR and HIPAA, especially with its increasingly digital product offerings. Ensuring compliance with these data protection laws is crucial to avoid substantial fines and maintain customer trust, with GDPR penalties potentially reaching 4% of global annual revenue.

Bruker operates under global anti-corruption and trade compliance laws, including the FCPA and export controls. The company actively manages these risks through due diligence and internal controls to prevent legal repercussions and financial penalties, exemplified by significant fines levied against other companies for trade violations in 2023.

Product liability and safety standards are paramount, requiring strict quality control and adherence to evolving regulations. Proactive risk management in this area, including clear labeling and user support, is essential for preventing accidents and mitigating costly legal claims, a trend reflected in the growing product liability insurance market.

Environmental factors

Bruker is actively enhancing its sustainable manufacturing processes, aiming to significantly shrink its environmental impact. This commitment translates into concrete actions like waste reduction initiatives and energy conservation measures across its production sites, reflecting a broader industry shift towards ecological responsibility.

In 2023, Bruker reported a 15% reduction in manufacturing waste compared to 2022, alongside a 10% improvement in energy efficiency at its key facilities. These figures underscore their dedication to optimizing resource utilization and aligning with escalating global sustainability mandates.

Bruker's products, like many in the scientific instrumentation sector, carry environmental considerations across their entire lifecycle. From the energy consumed during manufacturing and operation to the materials used and eventual disposal, minimizing this footprint is increasingly important. For instance, in 2023, Bruker highlighted efforts to enhance the energy efficiency of its laboratory instruments, a crucial factor given their continuous operation in many research settings.

A significant area of focus for Bruker involves reducing the environmental impact associated with the usage phase of its products. This includes initiatives like optimizing solvent usage in its diagnostic platforms, aiming to lessen chemical waste and associated disposal challenges. Such efforts are vital as the scientific community, including Bruker's customer base, places a greater emphasis on sustainable laboratory practices.

Climate change is increasingly impacting global supply chains, with extreme weather events like floods and droughts causing significant disruptions. For instance, the severe flooding in Thailand in 2011, a major hub for hard drive manufacturing, led to widespread shortages and price increases. Bruker must actively assess these environmental risks and invest in building greater resilience within its supply chain to ensure continuity of operations and mitigate potential financial losses.

Waste Management and Recycling Initiatives

Bruker's commitment to effective waste management, particularly the recycling of electronic components and hazardous materials integral to its scientific instruments, is a key environmental focus. This addresses the growing regulatory scrutiny and consumer demand for responsible product lifecycle management.

The company's initiatives to reduce single-use plastics across its operations further underscore its dedication to sustainability. For instance, in 2024, many companies in the scientific equipment sector reported significant progress in reducing plastic packaging waste, with some aiming for 20-30% reductions year-over-year.

- Electronic Component Recycling: Bruker likely engages in specialized recycling programs for the complex electronic parts in its analytical and diagnostic instruments, ensuring proper disposal of potentially hazardous substances.

- Hazardous Material Handling: Safe and compliant handling and disposal of materials like solvents or heavy metals used in instrument manufacturing or operation are critical environmental considerations.

- Plastic Reduction: Efforts to minimize single-use plastics in laboratories and internal operations align with broader corporate sustainability goals and reduce environmental impact.

Regulatory Pressure for Environmental Reporting and Compliance

Bruker faces increasing regulatory pressure regarding environmental reporting and compliance. This includes stricter standards for emissions and hazardous waste disposal, necessitating transparent environmental performance data. For instance, in 2023, the EU continued to refine its Corporate Sustainability Reporting Directive (CSRD), which mandates detailed environmental disclosures for a wider range of companies, impacting supply chains and operational data collection.

Adhering to these evolving legal requirements is crucial for Bruker's continued operations and reputation. Their commitment is demonstrated through their ESG reports, which provide insights into their environmental management strategies and performance metrics.

- Growing Demand for ESG Data: Investors and stakeholders increasingly demand robust environmental, social, and governance (ESG) data, pushing companies like Bruker to enhance their reporting capabilities.

- Stricter Emissions Targets: Many jurisdictions are implementing or tightening emissions reduction targets, requiring companies to invest in cleaner technologies and monitor their environmental footprint more closely.

- Evolving Waste Management Laws: Regulations concerning the disposal and management of hazardous waste are becoming more stringent globally, impacting manufacturing processes and material sourcing.

- Increased Scrutiny on Supply Chains: Regulatory bodies are extending their focus to the environmental impact of entire value chains, requiring companies to assess and manage the sustainability practices of their suppliers.

Bruker is actively enhancing its sustainable manufacturing processes, aiming to significantly shrink its environmental impact. This commitment translates into concrete actions like waste reduction initiatives and energy conservation measures across its production sites, reflecting a broader industry shift towards ecological responsibility.

In 2023, Bruker reported a 15% reduction in manufacturing waste compared to 2022, alongside a 10% improvement in energy efficiency at its key facilities. These figures underscore their dedication to optimizing resource utilization and aligning with escalating global sustainability mandates.

Bruker's products, like many in the scientific instrumentation sector, carry environmental considerations across their entire lifecycle. From the energy consumed during manufacturing and operation to the materials used and eventual disposal, minimizing this footprint is increasingly important. For instance, in 2023, Bruker highlighted efforts to enhance the energy efficiency of its laboratory instruments, a crucial factor given their continuous operation in many research settings.

Climate change is increasingly impacting global supply chains, with extreme weather events like floods and droughts causing significant disruptions. Bruker must actively assess these environmental risks and invest in building greater resilience within its supply chain to ensure continuity of operations and mitigate potential financial losses.

| Environmental Factor | Bruker's Action/Focus | Data/Example (2023-2024) |

| Waste Reduction | Optimizing resource utilization, recycling electronic components and hazardous materials. | 15% reduction in manufacturing waste (2023 vs 2022). Efforts to reduce single-use plastics across operations. |

| Energy Efficiency | Implementing energy conservation measures in manufacturing and product design. | 10% improvement in energy efficiency at key facilities (2023). Enhancing energy efficiency of laboratory instruments. |

| Supply Chain Resilience | Assessing and mitigating risks from climate change impacts on supply chains. | Focus on building resilience against disruptions from extreme weather events. |

| Regulatory Compliance | Adhering to evolving environmental reporting and disposal standards. | Responding to stricter standards for emissions and hazardous waste disposal, influenced by directives like the EU's CSRD. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously constructed using a blend of publicly available government data, reputable financial institutions, and leading market research firms. This ensures that every identified trend and potential impact is rooted in verifiable, current information.