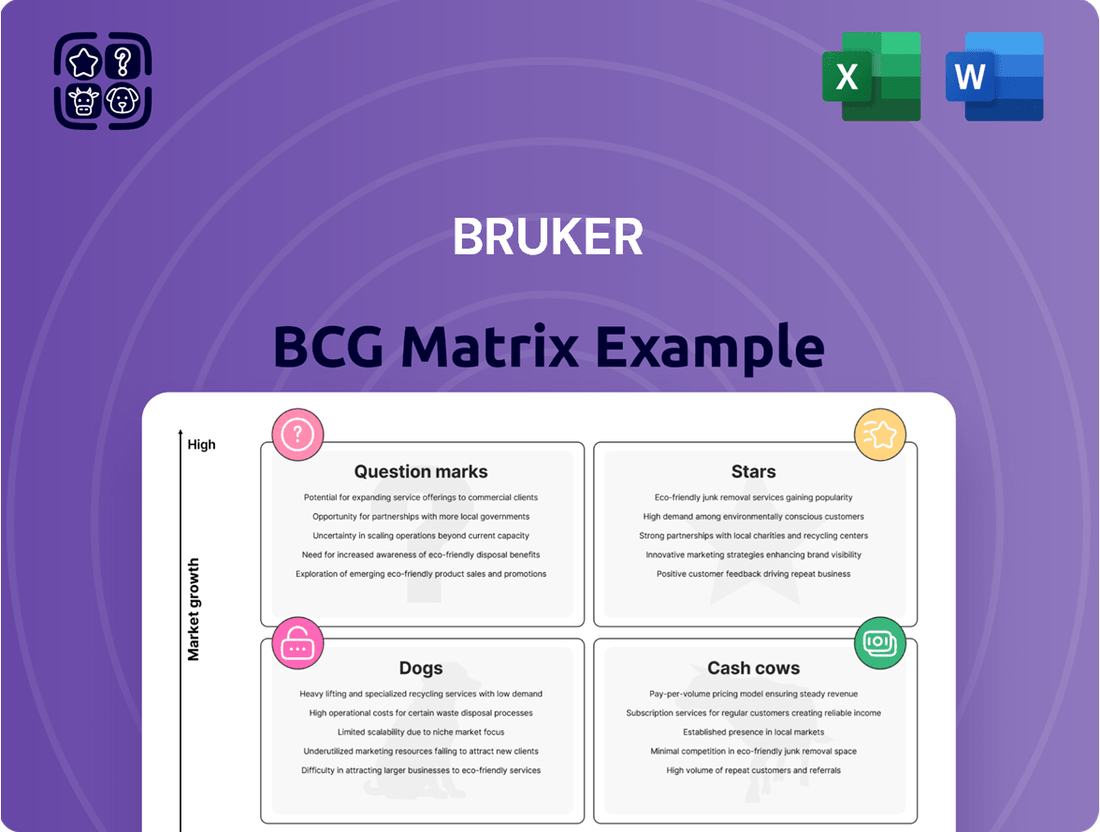

Bruker Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bruker Bundle

Uncover the strategic positioning of this company's product portfolio with a glimpse into its BCG Matrix. See which products are poised for growth, which are generating stable returns, and which may require a closer look.

Ready to transform this data into actionable strategy? Purchase the full BCG Matrix report for a comprehensive breakdown of each product's quadrant placement, coupled with expert recommendations to optimize your market approach.

Stars

Bruker's investment in spatial biology, notably through the acquisition of NanoString, bolsters its offerings in advanced spatial transcriptomics and gene expression analysis.

This strategic move positions Bruker to capitalize on a market anticipated to expand at a robust 19% compound annual growth rate between 2025 and 2030.

The company's spatial biology platforms are therefore poised to be significant growth engines, meeting the escalating demand for high-resolution biological insights.

Bruker's timsTOF-based mass spectrometry systems, including the recently introduced timsOmni and timsUltra AIP, are a significant growth driver, reflecting strong market demand and technological advancement.

These systems are pivotal in fields like proteomics and metabolomics, offering unparalleled sensitivity that is crucial for accelerating drug discovery and improving clinical research outcomes.

The enhanced capabilities of timsTOF platforms are particularly valuable in biologics quality control, a sector experiencing robust expansion and requiring high-precision analytical tools.

Bruker's strategic acquisitions, including ELITechGroup and RECIPE, have significantly bolstered its presence in molecular diagnostics. These moves have introduced a range of platforms and assays, notably for therapeutic drug monitoring, tapping into a substantial and growing market. This diversification is a key driver for Bruker's revenue expansion.

Semiconductor Metrology Systems

Bruker's semiconductor metrology systems, particularly their InSight WLI 3D optical metrology solutions, are showing robust growth, driven by the increasing need for advanced packaging in AI chip production. This segment is clearly a star performer within Bruker's portfolio.

The strong market traction is underscored by a substantial order for 27 systems slated for delivery in 2025. This significant order volume points to Bruker's dominant position in this high-growth, specialized area of semiconductor manufacturing technology.

- High Demand: Growing need for advanced packaging in AI chip manufacturing fuels demand for Bruker's InSight WLI 3D optical metrology systems.

- Market Leadership: A large order for 27 systems in 2025 signifies a strong market position for these specialized metrology solutions.

- Growth Segment: This specialized segment of optical metrology for advanced semiconductor packaging is experiencing high growth.

Lab Automation Platforms

Bruker's strategic acquisitions, such as Chemspeed, have significantly bolstered its position in lab automation platforms. These advanced systems are crucial for enhancing research and development efficiency, directly impacting throughput and the speed of scientific discovery.

These lab automation platforms are vital for Bruker's growth strategy, enabling the company to cater to a wider array of scientific disciplines and market needs. By integrating these capabilities, Bruker is well-positioned to drive innovation and capture future market opportunities.

- Enhanced Throughput: Lab automation platforms can increase sample processing capacity by up to 50% in certain R&D workflows.

- Efficiency Gains: Automation reduces manual labor, leading to an estimated 30% reduction in operational costs for routine tasks.

- Data Integrity: Standardized automated processes minimize human error, improving the reliability and reproducibility of experimental results.

- Market Expansion: Bruker's expanded automation portfolio allows it to serve sectors like pharmaceuticals, biotechnology, and materials science more effectively.

Bruker's semiconductor metrology systems, particularly their InSight WLI 3D optical metrology solutions, are a clear star performer. Driven by the burgeoning need for advanced packaging in AI chip production, this segment is experiencing robust growth. A substantial order for 27 systems scheduled for delivery in 2025 underscores Bruker's strong market position in this specialized, high-growth area.

The timsTOF-based mass spectrometry systems, including the recently launched timsOmni and timsUltra AIP, are also significant growth drivers. These platforms are critical in proteomics and metabolomics, offering the high sensitivity needed to accelerate drug discovery and enhance clinical research.

Bruker's strategic expansion into spatial biology, notably through the acquisition of NanoString, positions it to benefit from a market projected to grow at a 19% CAGR from 2025 to 2030. These advanced platforms are set to become key revenue generators, meeting the increasing demand for detailed biological insights.

| Product/Segment | Key Driver | Growth Indicator | Market Position |

|---|---|---|---|

| Semiconductor Metrology (InSight WLI) | AI Chip Advanced Packaging | 27 systems order for 2025 delivery | Market Leader |

| timsTOF Mass Spectrometry | Proteomics, Metabolomics, Drug Discovery | New platform launches (timsOmni, timsUltra AIP) | Strong Demand |

| Spatial Biology | High-resolution biological insights | 19% CAGR (2025-2030) | Emerging Leader (via acquisition) |

What is included in the product

The Bruker BCG Matrix analyzes product portfolio performance, guiding strategic decisions on investment, divestment, or divestiture.

Visualize strategic positioning with the Bruker BCG Matrix, simplifying complex portfolio analysis for clear decision-making.

Cash Cows

Bruker's established Nuclear Magnetic Resonance (NMR) spectrometer lines are key cash cows. These mature products, widely used in research, provide a steady stream of revenue with lower marketing needs. In 2023, Bruker's Life Science division, which includes NMR, saw revenue grow by 5% to $1.1 billion, demonstrating the segment's stability.

Bruker's X-ray Diffraction (XRD) and X-ray Fluorescence (XRF) instruments represent established cash cows within its portfolio. The company's deep history in X-ray technology signifies a strong market position and mature product lines, likely translating into consistent revenue and profitability.

These instruments are essential tools across numerous industries, from pharmaceuticals and manufacturing to academic research, underpinning their demand. This broad applicability ensures stable sales and robust profit margins, characteristic of cash cow business units.

Bruker's atomic force microscopy (AFM) systems hold a solid position within the nanoanalysis and materials science sectors. These systems, while not experiencing explosive growth, are recognized for their reliable performance and niche applications. This stability is crucial for generating consistent cash flow. For instance, Bruker reported revenue from its Life Science and Diagnostics segment, which includes AFM technologies, growing approximately 5% year-over-year in the first quarter of 2024.

Mass Spectrometry Consumables and Services

Bruker's mass spectrometry consumables and services represent a classic cash cow. Beyond the initial instrument purchase, the ongoing demand for specialized consumables, essential maintenance through service contracts, and software upgrades creates a deeply entrenched, recurring revenue stream. This segment benefits from high customer loyalty due to the critical nature of these products in scientific research and diagnostics.

In 2023, Bruker reported strong performance in its Life Science division, which heavily features mass spectrometry. For instance, the company's revenue from consumables and services often contributes a substantial portion to its overall profitability, demonstrating the predictable and stable nature of this business. This recurring revenue model is key to Bruker's financial stability.

- Recurring Revenue: Sales of consumables, service plans, and software generate consistent income.

- High Customer Loyalty: The critical role of mass spectrometry in research fosters strong customer retention.

- Predictable Cash Flow: This segment provides a reliable and stable financial foundation for Bruker.

- Profitability Driver: Consumables and services typically carry higher profit margins than instrument sales.

Bruker Energy & Supercon Technologies (BEST) Segment

The Bruker Energy & Supercon Technologies (BEST) segment, encompassing superconducting materials and devices, is likely positioned as a mature business within Bruker's portfolio. Despite a slight organic decline observed in Q1 2025, this segment is understood to hold a significant market share within its specialized niche.

This mature standing translates into a consistent, though not rapidly expanding, generation of cash flow for the company. The BEST segment acts as a reliable contributor, underpinning other growth initiatives.

- Market Position: High market share in a niche, mature market.

- Growth Trajectory: Experiencing some organic decline, indicating low growth.

- Cash Flow Contribution: Provides a foundational, stable cash flow.

- Strategic Role: Supports other business segments through its cash generation.

Bruker's established Nuclear Magnetic Resonance (NMR) and X-ray Diffraction (XRD)/X-ray Fluorescence (XRF) spectrometer lines are key cash cows, generating steady revenue with lower marketing needs. These mature products are essential across pharmaceuticals, manufacturing, and research, ensuring stable sales and robust profit margins. For instance, Bruker's Life Science division, which includes NMR, saw revenue grow by 5% to $1.1 billion in 2023.

Mass spectrometry consumables and services represent another significant cash cow, providing recurring revenue through essential supplies and service contracts. This segment benefits from high customer loyalty and typically carries higher profit margins, contributing substantially to Bruker's profitability and financial stability. In the first quarter of 2024, Bruker reported its Life Science and Diagnostics segment, including mass spectrometry, grew approximately 5% year-over-year.

| Product Category | BCG Matrix Position | Key Characteristics | 2023/2024 Data Point |

|---|---|---|---|

| NMR Spectrometers | Cash Cow | Mature, steady revenue, low marketing | Life Science division revenue grew 5% to $1.1B in 2023 |

| XRD/XRF Instruments | Cash Cow | Established, essential across industries, stable sales | Broad applicability ensures consistent demand |

| Mass Spectrometry Consumables & Services | Cash Cow | Recurring revenue, high loyalty, high margins | Life Science & Diagnostics segment grew ~5% Q1 2024 |

Preview = Final Product

Bruker BCG Matrix

The Bruker BCG Matrix preview you are currently viewing is the identical, fully finalized document you will receive immediately after completing your purchase. This ensures that what you see is precisely what you get: a comprehensive, professionally formatted strategic tool ready for immediate application without any watermarks or placeholder content. You can confidently proceed with your purchase, knowing you are acquiring the complete, analysis-ready Bruker BCG Matrix for your business planning needs.

Dogs

Older, less differentiated analytical systems within Bruker's portfolio, particularly those facing increased competition or technological obsolescence, fall into the Dogs quadrant of the BCG matrix. These might include certain legacy mass spectrometry platforms or older generation spectroscopy instruments that haven't kept pace with newer innovations.

Products in this category, while potentially still contributing to revenue, exhibit low market growth rates and a declining competitive edge. For instance, if a specific older NMR system from Bruker saw only a 1% year-over-year market growth in 2024 and its market share remained flat, it would likely be classified as a Dog.

The strategic implication for these Dogs is to consider divestment or a managed decline. Continuing to invest heavily in R&D or marketing for these underperforming assets would be an inefficient use of capital, especially when resources could be redirected to higher-growth areas like Bruker's advanced life science or materials research solutions.

Products heavily reliant on academic funding, especially those sensitive to shifts in U.S. federal research budgets, may represent a "Dog" in Bruker's portfolio. Recent analyses indicate a slowdown in academic research spending, directly impacting demand for specialized scientific instruments and consumables. For instance, segments catering to basic life science research, often funded by agencies like the NIH, have seen slower growth compared to clinical or industrial applications.

Geographically concentrated low-growth offerings in challenged markets represent the 'Dogs' of the BCG matrix. These are products or business units with a low market share in industries that are not growing much, or are even shrinking. Think of them as the underperformers that are struggling to gain traction.

For instance, a company might have a product line that is primarily sold in a specific region, like certain industrial equipment in a European country facing a prolonged economic downturn. In 2024, if that region's GDP growth is projected to be only 1%, and the company's market share for that product is stagnant at 5%, it fits the 'Dog' profile. Such offerings typically generate just enough revenue to cover their costs, but offer little potential for future expansion.

Niche Products with Limited Scalability

Niche products with limited scalability are those specialized offerings that haven't captured substantial market share and exist within slow-growing industries. These products often face challenges in achieving profitability and expanding their reach to make a significant impact on a company's overall financial performance.

For instance, a company might have a highly specialized diagnostic tool for a rare disease. While it serves a critical need for a small patient group, the limited patient population and specialized nature of the product restrict its market size and growth potential. In 2024, such products might represent a small fraction of a larger company's portfolio, perhaps less than 5% of total revenue, with minimal projected growth rates.

- Limited Market Demand: These products cater to a very specific, often small, customer base.

- High Development Costs: Specialization often means significant R&D investment for a small return.

- Low Growth Potential: Operating in mature or declining market segments restricts future expansion.

- Profitability Challenges: The inability to scale production and sales can hinder profitability.

Discontinued or Phasing-Out Technologies

Products based on older technologies, like certain legacy mass spectrometry components or older generation NMR systems, would fit into the Dogs quadrant of the Bruker BCG Matrix. These offerings typically experience low market share and minimal growth as newer, more advanced solutions emerge from both Bruker and its competitors.

For instance, if Bruker's older generation benchtop NMR systems, which were once popular, are now being superseded by more powerful, higher-field strength instruments, they would likely be classified as Dogs. In 2024, the market for such legacy instruments is shrinking, with many users migrating to cloud-based data analysis or newer hardware.

- Low Market Share: Legacy products often hold a small percentage of the overall market as newer technologies gain traction.

- Low Growth Potential: The demand for outdated technologies typically stagnates or declines, limiting future revenue.

- Divestiture Candidates: These products are often considered for sale or discontinuation to reallocate resources to more promising areas.

Dogs in Bruker's portfolio represent products with low market share in low-growth industries. These are often older technologies or niche offerings that struggle to gain traction. For example, a legacy mass spectrometry platform facing intense competition and technological obsolescence would be a prime candidate for the Dog quadrant. In 2024, such products might exhibit single-digit market growth, perhaps around 1-2%, with flat or declining market share.

The strategic approach for these products typically involves a managed decline or divestiture. Continuing significant investment in R&D or marketing for these underperformers diverts capital from more promising growth areas within Bruker's advanced life science or materials research segments. The focus shifts to minimizing losses and freeing up resources.

Products heavily reliant on specific, slow-growing academic research funding, especially those sensitive to budget constraints, can also be classified as Dogs. For instance, instruments catering to basic life science research, often funded by agencies with tighter budgets in 2024, might show slower growth compared to clinical or industrial applications.

Niche products with limited scalability, serving a small customer base in mature or declining markets, also fall into this category. These offerings may contribute minimally to overall revenue, perhaps less than 5% in 2024, with little prospect for significant expansion.

| Bruker Product Category (Example) | Market Growth (2024 Estimate) | Bruker Market Share (Estimate) | Strategic Implication |

|---|---|---|---|

| Legacy Benchtop NMR Systems | 1-2% | Low (e.g., <10%) | Divest or Manage Decline |

| Certain Older Mass Spectrometry Platforms | 0-1% | Low (e.g., <5%) | Divest or Manage Decline |

| Specialized Diagnostic Tools for Rare Diseases | 2-3% | Low (e.g., <5%) | Evaluate for Divestiture or Niche Focus |

Question Marks

While Bruker's existing NanoString integration is a strong performer in the spatial biology market, emerging technologies represent potential future growth areas. These nascent platforms, though not yet commanding significant market share, are positioned within a rapidly expanding sector that promises substantial returns with continued investment and development. Identifying and nurturing these new ventures is crucial for maintaining a competitive edge.

Bruker's focus extends to novel molecular diagnostics, targeting emerging areas with nascent market adoption. These ventures represent high-growth potential but also carry significant risk, aligning with the question mark category of the BCG matrix. For instance, advancements in portable sequencing technologies for infectious disease surveillance in remote areas showcase this strategy.

Bruker's preclinical imaging portfolio is expanding into novel applications, targeting areas with high growth potential but currently in early market adoption. These innovative solutions, while not yet commanding significant market share, represent future growth drivers. For instance, advancements in multimodal imaging systems, combining PET, MRI, and optical techniques, are opening new avenues for research in complex diseases.

The preclinical imaging market is experiencing robust expansion, driven by increasing demand for advanced research tools. In 2024, the global preclinical imaging market was valued at approximately $1.5 billion, with projections indicating a compound annual growth rate (CAGR) of over 7% through 2030. This growth underscores the opportunity for Bruker to capture market share with its developing applications.

Advanced AI-driven Analytical Solutions

Bruker's strategic positioning within the BCG Matrix, specifically concerning its advanced AI-driven analytical solutions, warrants careful consideration. The company's investment in integrating artificial intelligence into its analytical platforms signifies a move towards a high-growth, potentially disruptive market segment. While the exact market share and profitability of these specific AI offerings are still developing, the broader trend indicates significant future potential.

- Market Growth Potential: The global AI in analytics market is projected to reach substantial figures, with some estimates placing it in the hundreds of billions of dollars by the early 2030s, indicating a strong growth trajectory for companies like Bruker investing in this area.

- Bruker's AI Integration: Bruker is actively incorporating AI for enhanced data interpretation, workflow automation, and predictive maintenance across its life science and materials research instruments.

- Nascent Stage of Offerings: Despite the promising market, the specific revenue contribution and profitability of Bruker's AI-centric solutions are likely still in their early stages, requiring further market penetration and adoption.

- Competitive Landscape: The advanced analytics space is competitive, with both established players and emerging AI specialists vying for market share, necessitating continuous innovation from Bruker.

Recently Launched Benchtop FT-NMR Systems with New Capabilities

Bruker's Fourier 80, launched in April 2025, represents a significant innovation in the benchtop FT-NMR market, a sector experiencing robust growth. This spectrometer, dubbed the 'Multi-Talent', offers expanded multinuclear capabilities, positioning it as a versatile tool for a wide range of analytical applications.

While the Fourier 80 boasts impressive features, its long-term market penetration and establishment as a new industry benchmark remain uncertain. The competitive landscape for benchtop NMR systems is dynamic, with numerous players vying for market share. The global NMR spectroscopy market was valued at approximately USD 1.3 billion in 2023 and is projected to grow at a CAGR of around 5-7% through 2030, indicating a substantial opportunity for new entrants.

- Market Position: The Fourier 80 enters a growing but competitive benchtop NMR market, making its future market share a key variable.

- Innovation: Its 'Multi-Talent' capabilities, including advanced multinuclear analysis, offer a strong value proposition.

- Uncertainty: As a recent launch, its ultimate success in displacing existing technologies or setting new standards is yet to be determined.

- Growth Potential: The overall expansion of the NMR market suggests significant upside if the Fourier 80 can capture even a small percentage of new installations.

Question marks in Bruker's portfolio represent emerging technologies or new product lines with high growth potential but currently low market share. These are areas where Bruker is investing for future expansion, acknowledging the inherent uncertainty in their success. The company is strategically placing bets on innovations that could become future stars.

These ventures, while not yet major revenue drivers, are crucial for maintaining Bruker's competitive edge in rapidly evolving scientific fields. For example, Bruker's exploration into novel quantum sensing applications for materials analysis falls into this category.

The success of these question marks hinges on continued research and development, effective market penetration strategies, and the ability to adapt to technological shifts. For instance, Bruker's early-stage development of advanced single-cell genomics tools aims to capture future market demand.

The company's commitment to these areas reflects a forward-looking strategy to diversify its offerings and tap into nascent, high-potential markets. Bruker's investment in AI-driven drug discovery platforms exemplifies this approach, targeting a sector poised for significant growth.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive financial disclosures, in-depth market research, and competitor analysis to provide a robust strategic overview.