Bruker Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bruker Bundle

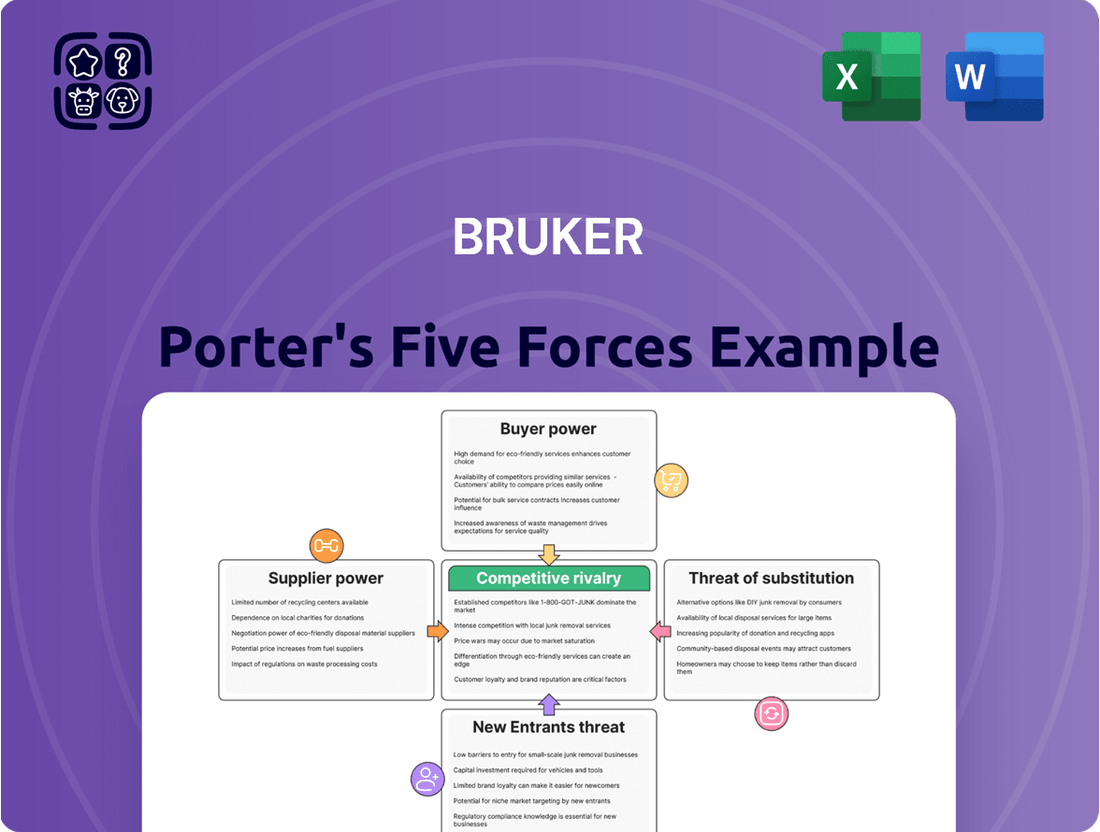

Understanding the competitive landscape for Bruker is crucial for any strategic decision. Our analysis delves into the five key forces that shape its industry, from the bargaining power of buyers and suppliers to the threat of new entrants and substitutes. This initial glimpse highlights the dynamic forces at play.

Ready to move beyond the basics? Get a full strategic breakdown of Bruker’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Bruker's dependence on highly specialized components and raw materials, like the high-purity chemicals and custom-manufactured parts essential for its NMR and mass spectrometry technologies, positions suppliers with considerable bargaining power. The rarity and unique nature of these inputs, coupled with potentially high switching costs for Bruker, amplify supplier leverage.

Suppliers possessing unique technologies or patents vital for Bruker's instrument functionality can wield significant leverage. This is especially true for advanced technologies where a limited number of suppliers have the required know-how or patents, potentially driving up costs or dictating less advantageous terms for Bruker.

For instance, in the highly specialized field of mass spectrometry, which Bruker serves, suppliers of critical detector components or advanced laser technologies might hold patents that restrict competition. Bruker's own extensive patent portfolio, encompassing areas like nuclear magnetic resonance (NMR) and X-ray diffraction, underscores the industry's reliance on intellectual property and the potential power it grants to those who control it.

When the supply market for essential components or advanced technologies is highly concentrated, with only a handful of major players, their leverage significantly amplifies. Bruker, operating in sophisticated scientific instrumentation, likely encounters this scenario. Dependence on a limited number of specialized, high-tech suppliers for critical materials or proprietary technologies can lead to increased costs and less favorable contract terms for Bruker.

Switching Costs for Bruker

Bruker faces significant switching costs when dealing with its suppliers. These costs can include the expense of qualifying new components, which requires rigorous testing to ensure compatibility and performance, as well as the potential need to redesign existing systems to accommodate alternative parts. Furthermore, retraining personnel on new equipment or processes adds another layer of expense and time investment.

These substantial switching costs inherently reduce Bruker's flexibility in supplier selection. When the financial and operational disruption of changing suppliers is high, Bruker is less likely to seek alternative sources, thereby increasing the bargaining power of its existing suppliers. This situation can lead to suppliers dictating terms, potentially impacting Bruker's cost structure and product development timelines.

- Supplier Qualification Costs: The rigorous testing and validation required for new components can be a lengthy and costly process for Bruker.

- System Redesign: Adapting Bruker's complex scientific instruments to new supplier parts often necessitates engineering changes and re-testing.

- Personnel Retraining: Introducing new supplier materials or components may require Bruker's technical staff to undergo new training protocols.

Supplier's Ability to Forward Integrate

While Bruker operates in a highly specialized scientific instrumentation market, the potential for suppliers to forward integrate into manufacturing complete analytical instruments, even if currently limited, can represent a significant threat to Bruker's bargaining power. This capability, even in its early stages, could allow suppliers to bypass Bruker and sell directly to end-users, thereby increasing their leverage in negotiations over components and pricing. For instance, if a key component supplier were to develop the expertise and infrastructure to assemble and market a competing analytical instrument, they would gain considerable power to dictate terms to Bruker.

The threat of forward integration by suppliers, even if not fully realized, can influence current supply agreements. Suppliers may leverage this potential capability to secure more favorable pricing, longer-term contracts, or preferential treatment from Bruker. This dynamic can subtly shift the balance of power, making it more challenging for Bruker to negotiate cost reductions or flexible supply terms. The mere possibility of a supplier entering Bruker's core market can create an undercurrent of pressure on Bruker's procurement strategies.

- Supplier Forward Integration Threat: The potential for suppliers to move into manufacturing complete analytical instruments, thereby competing directly with Bruker.

- Increased Supplier Leverage: This capability could allow suppliers to bypass Bruker and sell directly to customers, enhancing their bargaining position.

- Impact on Pricing and Terms: Even a nascent threat of forward integration can influence negotiations on component prices and supply agreement conditions for Bruker.

Bruker's suppliers hold significant bargaining power due to the specialized nature of components and raw materials required for its advanced scientific instruments. This leverage is amplified by the rarity of certain inputs, high switching costs for Bruker, and the proprietary technologies or patents held by a concentrated supplier base. For example, in 2024, the demand for high-purity superconducting materials for NMR magnets remained robust, with limited suppliers capable of meeting Bruker's stringent quality standards.

The high switching costs associated with qualifying new suppliers, potential system redesigns, and retraining personnel further solidify supplier power. These factors make it operationally and financially challenging for Bruker to shift to alternative sources, thereby giving existing suppliers a stronger hand in negotiations over pricing and contract terms.

The threat of forward integration by suppliers, where they could potentially manufacture complete analytical instruments, looms as a factor influencing current supply agreements. Even a perceived capability for this can lead suppliers to demand more favorable terms, impacting Bruker's cost structure and strategic flexibility.

| Factor | Impact on Bruker | Example/Data (2024) |

|---|---|---|

| Specialized Inputs | High Supplier Power | Limited availability of certain rare earth elements for advanced detectors. |

| Proprietary Technology | High Supplier Power | Key patents on laser sources for mass spectrometry systems. |

| Switching Costs | High Supplier Power | Estimated 6-12 months for full component qualification and integration testing. |

| Supplier Concentration | High Supplier Power | Few global manufacturers for high-performance vacuum pumps used in mass spectrometers. |

| Forward Integration Threat | Potential for increased Supplier Power | Emerging niche players in component manufacturing exploring full system assembly. |

What is included in the product

This analysis dissects the competitive forces impacting Bruker, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its markets.

Gain instant clarity on competitive pressures with a visually intuitive spider chart, simplifying complex market dynamics for faster, more informed strategic adjustments.

Customers Bargaining Power

Bruker's diverse customer base, spanning life sciences, pharma, biotech, materials science, and clinical diagnostics, means no single customer segment holds significant sway. These specialized entities have unique, often stringent, performance and accuracy needs, making it difficult for them to easily switch to alternative suppliers or exert broad pricing pressure. For instance, a leading pharmaceutical company relying on Bruker's advanced mass spectrometry for drug discovery has highly specific technical requirements that limit readily available alternatives.

Bruker's customers face substantial switching costs. For instance, acquiring Bruker's advanced mass spectrometry systems, which can range from hundreds of thousands to millions of dollars, necessitates significant capital investment. Beyond the initial purchase, there are also costs associated with retraining staff on new interfaces and ensuring seamless integration with established laboratory information management systems (LIMS), making a change a complex and expensive proposition.

For Bruker's customers, the performance, accuracy, and reliability of scientific instruments are paramount for their research, development, and diagnostic processes. These factors directly impact the quality and validity of their scientific outcomes, making them less likely to compromise on these critical aspects for a lower price.

While customers may negotiate on price, their primary focus is often on the instrument's capabilities and the quality of results it delivers. This focus on superior performance can limit their power to drive down prices if Bruker's offerings are demonstrably better than competitors, as the cost of inaccurate or unreliable data can be far greater than the instrument's purchase price.

Customer Price Sensitivity vs. Value Perception

While large pharmaceutical companies or well-funded research institutions might possess some bargaining power due to their purchasing volume, many of Bruker's customers are less focused on minor price variations. Instead, they prioritize the sophisticated functionalities and enduring value derived from Bruker's advanced scientific instruments. This emphasis on technological superiority and consistent, reliable support helps to temper pure price-driven negotiations.

The perceived value of Bruker's innovation and dependable service significantly influences customer behavior, often outweighing a slight price premium. For instance, in 2023, Bruker reported revenue of approximately $2.2 billion, indicating a strong market position where customers are willing to invest in their leading-edge solutions. This suggests that the bargaining power of customers is somewhat limited when faced with solutions that offer clear advantages in research and development outcomes.

- Customer Focus on Value: Many customers prioritize Bruker's advanced technology and long-term benefits over small price differences.

- Mitigation of Price Power: The perceived value of innovation and reliable support reduces the impact of pure price sensitivity.

- Market Position: Bruker's substantial revenue, around $2.2 billion in 2023, reflects a market where customers invest in high-value solutions.

Consolidating Customer Segments

In markets where customers consolidate, such as large hospital networks or research consortiums, their collective buying power can increase. This trend can translate into greater leverage when negotiating prices or terms for scientific instruments and solutions.

However, for Bruker, the impact of customer consolidation on direct price pressure might be somewhat mitigated by the specialized nature of its offerings. Customers are often more focused on the advanced capabilities and reliability of Bruker's high-performance scientific instruments rather than solely on price.

Instead of just price, consolidated customer segments are likely to exert influence through demands for integrated solutions and comprehensive service contracts. This means Bruker needs to provide not just individual instruments but also seamless workflows and robust support to meet the evolving needs of these larger entities.

- Customer Consolidation: Bruker serves diverse customer groups, including academic institutions, pharmaceutical companies, and industrial laboratories. Consolidation within these sectors, like the formation of larger hospital systems or global research alliances, can amplify customer bargaining power.

- Specialized Product Nature: Bruker's portfolio consists of highly specialized and often mission-critical analytical and diagnostic instruments. This specialization inherently reduces the ease with which customers can switch to alternative suppliers, thereby tempering direct price-based bargaining.

- Demand for Integrated Solutions: As customers consolidate, they often seek more holistic approaches. This translates into a greater demand for Bruker to offer not just individual instruments but also integrated workflows, software solutions, and application support that enhance overall research or diagnostic capabilities.

- Importance of Service Contracts: The sophisticated nature of Bruker's technology makes ongoing service and maintenance crucial. Consolidated customer groups are likely to prioritize comprehensive service contracts and long-term support agreements, which become a significant factor in their purchasing decisions, potentially outweighing pure price negotiations.

Bruker's customers generally have limited bargaining power. This is largely due to the highly specialized nature of Bruker's scientific instruments and the significant switching costs involved. Customers prioritize performance, accuracy, and reliability, making them less susceptible to solely price-driven negotiations.

| Factor | Impact on Bargaining Power | Bruker's Position |

| Switching Costs | High | Customers face substantial costs for retraining, integration, and capital investment when changing suppliers. |

| Product Differentiation | High | Bruker's instruments offer advanced features and performance, making direct comparison and substitution difficult. |

| Customer Price Sensitivity | Low to Moderate | The critical nature of research and diagnostic outcomes often outweighs minor price differences. |

| Customer Concentration | Moderate | While some customer segments consolidate, the specialized nature of products limits the impact of bulk purchasing power on price. |

Same Document Delivered

Bruker Porter's Five Forces Analysis

This preview shows the exact Bruker Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual, comprehensive document detailing Bruker's competitive landscape, including threats of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and intensity of rivalry. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

The analytical instrumentation market is highly concentrated, with a few major players like Thermo Fisher Scientific, Agilent Technologies, Waters, and Danaher dominating, alongside Bruker. This oligopolistic structure means competition is fierce among these established giants, directly impacting pricing and innovation strategies.

Competitive rivalry in the scientific instrument sector is intense, fueled by a relentless pursuit of innovation and substantial research and development spending. Companies are constantly striving to introduce more sophisticated and sensitive instruments to capture market share.

Bruker Corporation exemplifies this trend, allocating a significant portion of its financial resources to R&D. In 2023, Bruker reported R&D expenses of approximately $494 million, which represented about 11% of its total revenue. This commitment underscores the critical role of developing cutting-edge products to stay ahead in this dynamic market.

Competitive rivalry in the life science and diagnostics sector is fierce, with companies like Bruker strategically acquiring others to bolster their technology and market presence. In 2024 and continuing into 2025, Bruker has been particularly active, acquiring NanoString to strengthen its spatial biology offerings, ELITech to expand in molecular diagnostics, and Chemspeed to enhance its lab automation capabilities. These moves directly intensify competition by broadening the competitive landscape and offering customers more integrated solutions.

Global Market Presence and Regional Dynamics

The scientific instrument market is truly global, with North America, Europe, and Asia-Pacific being major hubs of activity. Competition is intense in these key regions.

Companies often adapt their strategies to meet specific regional needs and navigate diverse regulatory landscapes, making localized approaches crucial for success.

- North America: A dominant market, particularly for life sciences and diagnostics, with significant R&D spending.

- Europe: Strong presence in analytical and materials testing segments, driven by industrial and academic research.

- Asia-Pacific: Rapidly growing market, especially in China and India, fueled by increasing healthcare investments and manufacturing advancements.

- Global Competition: Major players like Thermo Fisher Scientific, Agilent Technologies, and Danaher Corporation compete across all these regions, often with tailored product portfolios and sales strategies.

Intellectual Property and Patent Litigation

Intellectual property is a significant battleground in the scientific instrument industry, influencing competitive rivalry. Companies like Bruker actively use patents to shield their technological advancements and secure market advantages. This often leads to patent litigation, a common tactic to defend innovations or challenge competitors' offerings.

Bruker has experienced its share of patent disputes, highlighting the critical role of intellectual property in product differentiation and maintaining a competitive edge. For instance, in 2023, Bruker was involved in patent litigation concerning its magnetic resonance imaging (MRI) technology, underscoring the high stakes in protecting proprietary innovations.

- Patent Protection: Bruker leverages its patent portfolio to safeguard its proprietary technologies in areas like mass spectrometry and magnetic resonance.

- Litigation as a Tool: Patent litigation is a strategic element used by Bruker and its competitors to enforce IP rights and influence market dynamics.

- Impact on Rivalry: Successful patent defense or infringement claims can significantly alter the competitive landscape, affecting market share and product development strategies.

The competitive rivalry within the analytical instrumentation market is exceptionally high, driven by a few dominant players including Bruker, Thermo Fisher Scientific, Agilent Technologies, and Danaher. This intense competition necessitates continuous innovation and significant R&D investment, as companies vie for market share through technological advancements and strategic acquisitions.

Bruker's active acquisition strategy, such as the 2024 acquisitions of NanoString, ELITech, and Chemspeed, directly escalates competitive pressures by integrating new technologies and expanding market reach. This aggressive expansionist approach is mirrored by competitors, creating a dynamic environment where product differentiation and intellectual property protection are paramount.

The global nature of the scientific instrument market means competition is fierce across major regions like North America, Europe, and Asia-Pacific, with companies tailoring strategies to regional demands and regulatory frameworks.

Intellectual property, particularly patents, serves as a critical battleground. Bruker's involvement in patent litigation, such as disputes over MRI technology in 2023, highlights how IP is strategically used to defend innovations and challenge rivals, directly impacting market dynamics and product development.

| Company | 2023 R&D Expense (USD Millions) | % of Revenue (approx.) | Key Competitors |

|---|---|---|---|

| Bruker | 494 | 11% | Thermo Fisher Scientific, Agilent Technologies, Danaher |

| Thermo Fisher Scientific | N/A (reported as part of larger segments) | N/A | Bruker, Agilent Technologies, Danaher |

| Agilent Technologies | 1,090 (2023) | 9.7% (2023) | Bruker, Thermo Fisher Scientific, Danaher |

| Danaher | N/A (reported as part of larger segments) | N/A | Bruker, Thermo Fisher Scientific, Agilent Technologies |

SSubstitutes Threaten

While Bruker excels in high-end analytical tools like Nuclear Magnetic Resonance (NMR) and mass spectrometry, simpler or less precise analytical methods can sometimes serve as substitutes for specific, less demanding applications. For instance, basic spectroscopy or even wet chemistry techniques might suffice where extreme sensitivity or molecular detail isn't paramount. This threat intensifies if these alternatives offer a significantly lower price point or a more user-friendly experience, potentially diverting customers seeking cost-effectiveness over cutting-edge precision.

While some large research institutions or pharmaceutical companies might explore developing their own analytical solutions, the significant investment required for high-performance instrumentation like Bruker's makes this a limited threat. The sheer complexity and specialized expertise needed to create comparable instruments are substantial barriers. For instance, the development costs for advanced mass spectrometry systems can easily run into millions of dollars, a prohibitive expense for most entities seeking to substitute existing commercial offerings.

Customers can bypass the need for Bruker's instruments by outsourcing their analytical testing to Contract Research Organizations (CROs). This trend is significant, as the global CRO market was valued at approximately $50 billion in 2023 and is projected to grow substantially, indicating a strong preference for service-based solutions over capital investment in equipment.

Software-based or Data Analysis Alternatives

Advancements in computational modeling and AI-driven data analysis present a potential, though often indirect, threat of substitution for certain analytical functions. For instance, sophisticated simulation software might reduce the reliance on some physical experiments in specific research niches. However, for empirical validation and critical diagnostic applications, physical instrumentation like that offered by Bruker remains fundamentally irreplaceable.

While software can augment analysis, it cannot replicate the direct measurement capabilities of advanced instruments. For example, in the pharmaceutical industry, regulatory bodies still mandate physical testing for drug efficacy and safety, a process where software alone cannot substitute for laboratory equipment. The global market for laboratory information management systems (LIMS), a related software area, was projected to reach over $1.6 billion in 2024, highlighting the growth in analytical support software, but not its direct replacement of core instrumentation.

- Computational modeling can supplement, but not fully replace, physical analysis in many scientific disciplines.

- AI-driven data analysis enhances insights from physical measurements rather than substituting the measurement process itself.

- Regulatory requirements often necessitate empirical data obtained through physical instrumentation.

- The growth in analytical support software underscores the continued demand for the physical instruments they analyze data from.

Evolving Research Paradigms

Shifts in scientific research paradigms, such as the increasing adoption of AI-driven discovery or new omics technologies, could potentially reduce the demand for traditional analytical instruments that Bruker offers. For instance, advancements in computational biology might offer alternative pathways for data analysis, lessening the reliance on specific hardware.

Bruker actively counters this threat by investing heavily in research and development, aiming to stay at the forefront of technological innovation. In 2023, Bruker reported R&D expenses of $424.5 million, representing approximately 9.3% of its total revenue. This commitment allows the company to adapt its product portfolio and develop solutions that align with emerging scientific methodologies and user needs, ensuring continued relevance in a dynamic research landscape.

Strategic acquisitions also play a crucial role in Bruker's mitigation strategy. By acquiring companies with expertise in cutting-edge areas, Bruker can rapidly integrate new technologies and expand its offerings. This proactive approach helps to preemptively address potential threats from substitutes by incorporating or developing competing technologies internally.

Bruker's focus on high-performance, integrated solutions also creates a barrier against simpler, less sophisticated substitutes. By offering comprehensive workflows and advanced analytical capabilities, the company aims to provide value that single, standalone substitute technologies may struggle to match.

The threat of substitutes for Bruker's high-end analytical instruments is generally low due to the specialized nature and high performance required in many scientific applications. While simpler or less precise methods can suffice for less demanding tasks, the complexity and cost of developing comparable technology create significant barriers. Outsourcing analytical testing to CROs is a notable substitute, with the global CRO market valued around $50 billion in 2023, but it doesn't eliminate the need for underlying analytical capabilities.

Advancements in computational modeling and AI can supplement but rarely replace the empirical data generated by physical instruments, especially in regulated environments. Bruker's substantial R&D investment, totaling $424.5 million in 2023, and strategic acquisitions are key to mitigating this threat by staying ahead of technological shifts and integrating new capabilities.

| Substitute Type | Description | Impact on Bruker | Mitigation Strategy |

|---|---|---|---|

| Simpler Analytical Methods | Basic spectroscopy, wet chemistry | Low for high-precision needs | Focus on integrated, high-performance solutions |

| In-house Development | Creating own analytical solutions | Very Low | High R&D investment, complex technology barriers |

| Outsourcing (CROs) | Contract Research Organizations | Moderate | Develop comprehensive workflows, offer value beyond basic testing |

| Computational Modeling/AI | Software-based analysis | Low for empirical data needs | Integrate AI/software into instrument offerings |

Entrants Threaten

The high-performance scientific instrument market, where companies like Bruker operate, demands significant upfront capital. We're talking about substantial investments in research and development to create cutting-edge technologies, building state-of-the-art manufacturing facilities, and acquiring highly specialized, precision equipment. For instance, developing a new generation of mass spectrometers or nuclear magnetic resonance (NMR) systems can easily run into tens or hundreds of millions of dollars.

This immense financial hurdle acts as a formidable barrier to entry for potential new competitors. The sheer cost of establishing the necessary infrastructure and technological capabilities means that only well-funded entities can realistically consider entering this space. This high capital requirement effectively deters smaller players or those without access to significant financial backing from challenging established market leaders.

New companies entering the scientific instrument market, particularly those looking to challenge established leaders like Bruker, face a significant hurdle in acquiring or developing the necessary technological expertise. This isn't a market where a quick startup can easily replicate advanced capabilities; it demands deep scientific knowledge and years of hands-on experience.

Bruker itself demonstrates this commitment by investing a substantial portion of its revenue, around 11%, back into research and development. This continuous investment fuels innovation and maintains their technological edge, making it incredibly difficult for new entrants to catch up without comparable resources and a long-term vision.

The sheer scale of R&D required means that potential new competitors must either possess an existing high level of technical proficiency or be prepared for a lengthy and costly development process. Without this, they simply cannot match the product quality, performance, and breadth of offerings that customers expect from industry veterans.

Established companies like Bruker benefit from strong intellectual property and extensive patent portfolios. These protections are crucial barriers for new entrants, as they would need to invest heavily to develop or license around existing technologies. For instance, Bruker's significant R&D spending, which reached $247.8 million in 2023, directly contributes to strengthening this IP moat.

Brand Reputation and Customer Relationships

Bruker has cultivated a formidable brand reputation, particularly within demanding sectors like life sciences and pharmaceuticals. Their established presence and proven track record create a significant barrier for newcomers. New entrants would face an uphill battle in replicating the deep trust and loyalty Bruker enjoys from its critical customer base.

The company’s long-standing customer relationships are a key differentiator. These deep-seated connections, built over years of reliable service and product performance, are not easily disrupted. For instance, in 2023, Bruker reported a customer retention rate exceeding 90% across its core business segments, underscoring the strength of these bonds.

- Strong Brand Equity: Bruker's name is synonymous with quality and innovation in its target markets.

- Customer Loyalty: Decades of successful partnerships translate into high customer retention.

- Switching Costs: For customers in regulated industries, changing suppliers involves significant validation and qualification efforts, making it costly and time-consuming.

Regulatory Hurdles and Compliance

The scientific and diagnostic instrument markets are heavily regulated, particularly for clinical applications. New companies must contend with intricate and lengthy approval processes, significantly increasing the cost and time to market. For instance, in 2024, the FDA's review times for certain medical devices averaged over six months, a substantial barrier for startups.

These regulatory hurdles act as a significant deterrent to new entrants. Successfully navigating agencies like the FDA or EMA requires specialized expertise and substantial financial investment, often running into millions of dollars for comprehensive validation and compliance testing. This complexity makes it challenging for smaller, less-resourced companies to compete.

- Stringent Standards: Markets like clinical diagnostics demand adherence to rigorous quality and safety standards, such as ISO 13485.

- Costly Approvals: Obtaining regulatory clearance can cost hundreds of thousands to millions of dollars, depending on the product's complexity and intended use.

- Time-Consuming Processes: Regulatory review cycles can extend for many months or even years, delaying market entry and revenue generation.

- Expertise Required: Companies need dedicated regulatory affairs teams with deep knowledge of evolving international compliance requirements.

The threat of new entrants in the high-performance scientific instrument market is considerably low, primarily due to the immense capital requirements for research, development, and manufacturing. For example, developing advanced analytical instruments can cost tens to hundreds of millions of dollars, a significant barrier for potential newcomers. This financial hurdle, coupled with the need for deep technological expertise and established intellectual property, deters many aspiring competitors.

Furthermore, strong brand equity and high customer loyalty, cultivated over years of reliable performance, create substantial switching costs for existing clients. For instance, Bruker reported a customer retention rate exceeding 90% in 2023. Navigating complex and lengthy regulatory approval processes, which can cost millions and take many months, also presents a formidable challenge for new companies seeking market entry in 2024.

| Barrier Type | Description | Example Data (Bruker) |

|---|---|---|

| Capital Requirements | High upfront investment in R&D and manufacturing facilities. | R&D spending of $247.8 million in 2023. |

| Technological Expertise | Need for deep scientific knowledge and years of experience. | Investment of ~11% of revenue in R&D fuels innovation. |

| Intellectual Property | Extensive patent portfolios protect existing technologies. | Strengthened IP moat through continuous R&D investment. |

| Brand Reputation & Loyalty | Established trust and long-standing customer relationships. | Customer retention rate exceeding 90% in 2023. |

| Regulatory Hurdles | Complex and costly approval processes for market entry. | FDA review times averaging over six months for certain devices in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data from industry-specific market research reports, company annual filings, and trade association publications.

We leverage information from financial databases, competitor websites, and economic indicators to thoroughly assess the competitive landscape.