Bruker Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bruker Bundle

Discover how Bruker leverages its sophisticated product portfolio, strategic pricing, targeted distribution, and impactful promotion to dominate the scientific instrument market. This analysis goes beyond surface-level observations to reveal the interconnectedness of their marketing efforts.

Unlock the full potential of your own marketing strategy by understanding Bruker's proven approach. Get instant access to a comprehensive, editable report detailing their Product, Price, Place, and Promotion tactics, saving you invaluable research time.

Product

Bruker's high-performance scientific instruments form the core of their product offering, encompassing a broad spectrum of advanced research and analytical tools. These sophisticated technologies, including NMR spectrometers, mass spectrometers, X-ray systems, and atomic force microscopes, are indispensable for cutting-edge scientific discovery and application.

In 2023, Bruker reported total revenue of $2.43 billion, with a significant portion attributed to their life science and applied research segments, which heavily rely on these high-performance instruments. The company's commitment to innovation in this product category is evident in its continuous development of next-generation technologies, aiming to address evolving scientific challenges and maintain its competitive edge.

Bruker's Molecular and Materials Research Solutions are designed to equip scientists with cutting-edge tools for fundamental exploration. These offerings enable detailed analysis of molecular structures, compositions, and interactions, driving innovation across scientific disciplines.

In 2023, Bruker reported approximately $2.7 billion in revenue, with a significant portion attributed to its life science and applied research segments, which directly benefit from these advanced research solutions. The company's instruments are instrumental in facilitating breakthroughs in understanding complex biological systems and developing novel materials.

Bruker's Industrial and Applied Analysis Solutions extend far beyond fundamental research, serving critical functions in sectors like pharmaceuticals, biotechnology, and clinical diagnostics. These advanced analytical tools are essential for ensuring product quality, streamlining manufacturing processes, and performing highly specific analytical tasks within commercial environments.

In 2024, Bruker's commitment to these markets is evident in its continued innovation. For instance, their mass spectrometry and NMR technologies are instrumental in drug discovery and quality assurance, areas where precision is paramount. The company's solutions directly support industries that are vital to global health and economic growth, highlighting the broad market relevance of their offerings.

Specialized Diagnostic Systems

Bruker's Specialized Diagnostic Systems are a key growth area, reflecting a strategic expansion into molecular diagnostics and clinical microbiology. This push is evident in recent investments and product introductions designed to enhance patient care and laboratory operations.

The company's commitment is underscored by acquisitions and the launch of advanced platforms like the BeGenius system and the well-established MALDI Biotyper. These solutions are crucial for rapid and accurate microbial identification and infectious disease testing, significantly improving diagnostic turnaround times.

These systems offer tangible benefits by streamlining workflows and enhancing the precision of diagnostic testing. For instance, Bruker's MALDI Biotyper technology is widely recognized for its speed and accuracy in identifying microorganisms, a critical factor in managing infectious outbreaks.

- Molecular Diagnostics Expansion: Bruker has broadened its offerings to include advanced molecular diagnostic solutions, catering to the growing demand for precision medicine.

- Clinical Microbiology Advancement: The MALDI Biotyper platform continues to be a cornerstone, providing rapid and reliable microbial identification, crucial for patient treatment.

- Innovation in Spatial Biology: New systems are emerging that support spatial biology applications, offering deeper insights into cellular and tissue environments for research and diagnostics.

- Acquisition Strategy: Strategic acquisitions, such as the integration of certain diagnostic capabilities, have accelerated Bruker's market penetration in this specialized sector.

Continuous Innovation and New Launches

Bruker's commitment to continuous innovation is a driving force behind its product strategy, evident in consistent investment in research and development. This dedication translates into a steady stream of new product introductions designed to meet the dynamic demands of scientific research.

Recent advancements highlight this focus, including the timsTOF Ultra 2, a powerful tool for 4D-Proteomics, and the neofleX MALDI-TOF mass spectrometry imaging system. Furthermore, the Beacon Discovery Optofluidic System offers advanced single-cell analysis capabilities, showcasing Bruker's drive to push scientific boundaries.

These innovations are engineered to deliver superior sensitivity, enhanced resolution, and increased automation. This approach directly addresses and anticipates the evolving needs of researchers across various scientific disciplines, ensuring Bruker remains at the forefront of technological advancement.

- R&D Investment: Bruker consistently allocates significant resources to research and development, fueling its innovation pipeline.

- Key Product Launches (2024/2025): timsTOF Ultra 2, neofleX MALDI-TOF, Beacon Discovery Optofluidic System.

- Performance Enhancements: Focus on improving sensitivity, resolution, and automation in new product offerings.

- Market Responsiveness: Innovations are strategically aligned with current and future scientific research requirements.

Bruker's product portfolio centers on high-performance scientific instruments, crucial for research and applied analysis. These sophisticated tools, including mass spectrometers and NMR systems, are vital for scientific advancement and quality control across industries. The company's 2023 revenue of $2.43 billion underscores the market's reliance on these advanced solutions.

| Product Segment | Key Technologies | 2023 Revenue Contribution (Illustrative) | 2024/2025 Focus Areas |

|---|---|---|---|

| Life Science Research | NMR, Mass Spectrometry, Microscopy | Significant portion of $2.43B total revenue | Enhanced sensitivity, 4D-Proteomics (timsTOF Ultra 2) |

| Applied & Clinical Diagnostics | MALDI-TOF, Molecular Diagnostics | Growing segment | Spatial biology, rapid microbial identification (MALDI Biotyper) |

| Materials Research | X-ray, Atomic Force Microscopy | Contributes to overall revenue | Advanced material characterization |

What is included in the product

This analysis provides a comprehensive overview of Bruker's marketing strategies, examining their Product, Price, Place, and Promotion efforts to understand their market positioning and competitive advantages.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for focused decision-making.

Place

Bruker maintains a robust global footprint, leveraging both direct sales teams and a strategic network of distributors to reach diverse markets. This dual approach allows for deep customer engagement, especially for their sophisticated scientific instruments.

The direct sales model is critical for high-value, complex instruments where personalized technical support and expert consultation are paramount. Bruker's highly trained sales personnel provide tailored solutions, ensuring customers receive optimal performance and service for their critical research and analytical needs.

Bruker's 'Place' strategy heavily leverages strategic acquisitions to broaden its market presence and diversify its product portfolio. These moves are designed to solidify its position in both established and emerging market segments.

Notable acquisitions such as ELITechGroup, NanoString, and Chemspeed exemplify this strategy. ELITechGroup bolstered Bruker's molecular diagnostics capabilities, while NanoString expanded its life science analytical instruments. Chemspeed, in turn, enhanced its lab automation offerings, demonstrating a clear path to integrating new technologies and accessing new customer bases.

These acquisitions directly translate into expanded market reach. For example, the NanoString acquisition in late 2023, valued at approximately $393 million, provided Bruker with access to the rapidly growing spatial biology market, a segment projected for significant growth through 2025 and beyond. This allows Bruker to tap into new revenue streams and strengthen its distribution network for these integrated solutions.

Bruker's distribution strategy is finely tuned to reach its core customer base, which spans life science research, pharmaceuticals, biotechnology, materials science, and clinical diagnostics. This focus ensures that advanced analytical instruments and solutions are accessible to the specific scientific and industrial sectors that rely on them. For instance, in 2024, Bruker reported strong performance in its Life Science division, reflecting the demand from these targeted segments.

Online Platforms and Digital Engagement

Bruker utilizes online platforms to support its diverse product portfolio, notably through its Bruker Store, which offers consumables, accessories, and software. This digital channel enhances customer access to essential items, streamlining procurement for a global clientele. Digital engagement is also crucial for disseminating product information and providing technical support, thereby improving the overall customer experience and complementing their direct sales efforts for complex instrumentation.

In 2023, Bruker reported a significant portion of its revenue derived from recurring sources, including software and consumables, underscoring the importance of its online store and digital engagement strategies. The company's investment in digital infrastructure aims to improve customer interaction, from initial product discovery to post-sale support, making it easier for researchers and scientists to access the tools and resources they need.

- Bruker Store: Facilitates online sales of consumables, accessories, and software, enhancing accessibility.

- Digital Information Dissemination: Online platforms serve as key channels for product information and technical support.

- Global Reach: Digital engagement extends Bruker's reach, supporting customers worldwide beyond traditional sales.

- Customer Experience Enhancement: Focus on digital tools to improve order processing and overall customer interaction.

Service and Support Network

Bruker's commitment to its customers extends beyond the initial sale, with a comprehensive service and support network designed to maximize product uptime and performance. This network is crucial for maintaining customer loyalty and ensuring the long-term value of their significant investments in Bruker's advanced instrumentation.

The company offers a range of after-sales services, technical support, and specialized training programs. These offerings are vital for users of complex scientific instruments, ensuring they can operate and maintain their equipment effectively. For instance, Bruker's global service organization, comprising thousands of highly trained field service engineers, provides prompt on-site support, a critical factor for research and production environments. In 2023, Bruker reported that its service and support segment contributed approximately 30% of its total revenue, underscoring its importance to the business model.

Key elements of Bruker's service and support include:

- Global Field Service Engineers: A widespread network of technicians providing installation, maintenance, and repair services.

- Technical Support Hotlines: Accessible channels for immediate troubleshooting and expert advice.

- Customer Training Programs: Comprehensive training for operators and maintenance staff to ensure optimal instrument utilization.

- Spare Parts Availability: Ensuring critical components are readily available to minimize downtime.

Bruker's Place strategy is multifaceted, combining a direct sales force for complex instruments with a distributor network for broader market reach. Acquisitions like NanoString (late 2023 for $393 million) significantly expand its presence in high-growth areas like spatial biology, enhancing market access and revenue streams through 2025.

The company also leverages digital channels, including the Bruker Store for consumables and accessories, and online platforms for technical support. This digital engagement complements direct sales, improving customer experience and accessibility globally, with recurring revenue from software and consumables being a key contributor, as seen in 2023 performance.

Bruker's extensive service and support network, staffed by thousands of field service engineers, ensures product uptime and customer loyalty. This critical after-sales component, contributing around 30% of revenue in 2023, includes technical support hotlines and training programs to maximize instrument value.

| Aspect | Description | Key Initiatives/Data Points |

| Sales Channels | Direct Sales & Distributor Network | Crucial for high-value instruments; expands market reach. |

| Market Expansion | Strategic Acquisitions | NanoString acquisition ($393M in late 2023) for spatial biology market. |

| Digital Presence | Bruker Store & Online Support | Sales of consumables/accessories; technical information dissemination. |

| Service & Support | Global Field Service Network | ~30% of 2023 revenue; ensures product uptime and customer retention. |

Full Version Awaits

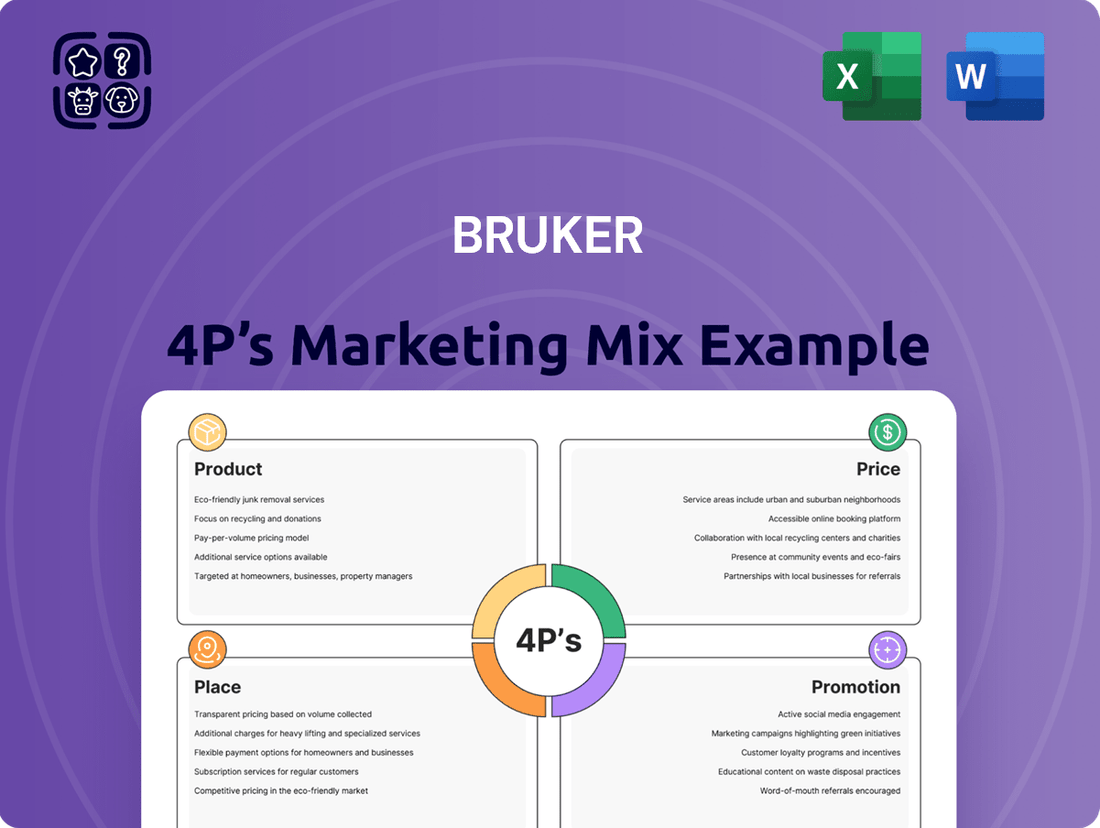

Bruker 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Bruker's 4Ps Marketing Mix covers Product, Price, Place, and Promotion in detail. You're viewing the exact version of the analysis you'll receive, fully complete and ready to use.

Promotion

Bruker's strategic presence at key scientific conferences like ASMS, AACR, ESCMID Global, and AGBT in 2024 and early 2025 is a cornerstone of its marketing efforts. These events are vital for launching new instruments and software, demonstrating innovations in areas like mass spectrometry and advanced microscopy. For instance, at ASMS 2024, Bruker showcased its latest timsTOF technology, highlighting advancements that promise greater sensitivity and throughput for researchers.

These gatherings provide unparalleled opportunities for direct interaction with the scientific community. Bruker's experts engage in technical discussions, offer hands-on demonstrations, and gather valuable feedback, fostering deeper customer relationships. This direct engagement is critical for understanding evolving research needs and positioning Bruker's solutions as indispensable tools for scientific discovery, with event attendance often exceeding pre-pandemic levels.

Bruker's investor relations and financial communications are a cornerstone of its marketing mix, ensuring transparent engagement with its financially-literate audience. This includes detailed annual reports, proxy statements, and accessible earnings webcasts, all designed to inform investors, analysts, and business strategists.

The company actively participates in investor conferences, presenting its financial performance, strategic initiatives, and future growth prospects. For instance, in the first quarter of 2024, Bruker reported revenue of $571.1 million, a 1.7% increase year-over-year, underscoring its consistent financial health and strategic execution.

These efforts aim to build investor confidence and attract capital by clearly articulating Bruker's value proposition and market position. The company's commitment to open communication fosters a strong relationship with stakeholders, crucial for sustained investment and market valuation.

Bruker's commitment to innovation leadership is evident in its consistent stream of breakthrough discoveries and new product launches. In 2024, the company continued to invest heavily in research and development, with R&D expenses representing a significant portion of its revenue, underscoring its dedication to advancing scientific frontiers and improving human life.

These advanced technologies, such as their latest mass spectrometry and nuclear magnetic resonance systems, are designed to empower researchers with unprecedented analytical capabilities. This strategic focus on pioneering solutions solidifies Bruker's position as a leader, attracting top-tier scientific institutions and individual researchers globally who seek the most sophisticated tools for their work.

Strategic Partnerships and Collaborations

Bruker actively cultivates strategic partnerships with leading pharmaceutical companies and prestigious academic institutions. These collaborations are crucial for broadening its market reach and validating the efficacy of its advanced analytical technologies. For instance, in 2024, Bruker announced a multi-year collaboration with a major pharmaceutical firm to accelerate drug discovery using its mass spectrometry platforms, a move widely covered in industry publications.

These strategic alliances are consistently highlighted through official press releases and prominent features in trade journals. This consistent communication strategy significantly enhances Bruker's corporate image and unlocks promising new avenues for business expansion. Such public endorsements from industry leaders and research bodies serve as powerful testimonials to the practical impact and wide-ranging utility of Bruker's scientific instrumentation.

The company's commitment to collaboration is evident in its ongoing engagement with research consortia focused on areas like precision medicine and materials science. These partnerships not only drive innovation but also provide valuable real-world data that supports the ongoing development and market positioning of Bruker's product portfolio.

- Pharmaceutical Collaborations: Partnering with major drug developers to leverage Bruker's mass spectrometry and NMR technologies for drug discovery and development pipelines.

- Academic Engagements: Collaborating with universities and research centers to validate new applications and foster scientific advancements using Bruker's instruments.

- Market Validation: Joint projects with industry leaders serve to validate the real-world applicability and performance of Bruker's analytical solutions.

- Growth Avenues: Strategic partnerships open doors to new markets and customer segments, driving revenue growth and technological innovation.

Digital and Content Marketing

Bruker leverages digital platforms, including its comprehensive website and newsroom, to distribute vital information. This content encompasses detailed product specifications, insightful application notes, and scientific publications, reaching a global audience of researchers and industry professionals. In 2023, Bruker reported approximately $2.2 billion in revenue, with a significant portion likely influenced by its digital outreach efforts.

The company's digital strategy focuses on providing valuable, educational content to attract and engage its target markets. This includes case studies and success stories that highlight the practical impact of Bruker's solutions. By offering this depth of information online, Bruker effectively supports its sales funnel and builds brand authority within the scientific community.

- Website Reach: Bruker's website serves as a primary hub for product information, attracting millions of visitors annually, crucial for lead generation.

- Content Engagement: Application notes and scientific publications are key content assets, driving engagement and demonstrating scientific leadership.

- Digital Investment: While specific figures are proprietary, the company's consistent revenue growth suggests ongoing investment in digital marketing to maintain market presence.

- Targeted Communication: Digital channels allow for precise targeting of specific scientific disciplines and industrial sectors, optimizing marketing spend.

Bruker's promotional strategy is multifaceted, encompassing both traditional scientific engagement and robust digital outreach. Key scientific conferences in 2024 and early 2025, such as ASMS and AACR, serve as critical platforms for product launches and direct customer interaction, reinforcing its innovation leadership. Furthermore, the company's investor relations activities, including participation in investor conferences and transparent financial reporting, are designed to build confidence among its financially-literate audience.

The company's commitment to digital marketing is evident in its comprehensive website, which offers detailed product information, application notes, and scientific publications, driving engagement and lead generation. These efforts, combined with strategic partnerships highlighted through press releases and trade journals, solidify Bruker's market position and foster business expansion. In Q1 2024, Bruker reported revenue of $571.1 million, a 1.7% increase year-over-year, reflecting the effectiveness of its integrated promotional approach.

| Promotional Tactic | Key Activities | 2024/2025 Focus | Impact |

|---|---|---|---|

| Scientific Conferences | Product launches, technical discussions, demonstrations | ASMS, AACR, ESCMID Global, AGBT | Direct customer engagement, market validation |

| Investor Relations | Earnings webcasts, annual reports, investor conferences | Transparency, financial performance communication | Investor confidence, capital attraction |

| Digital Marketing | Website content, application notes, scientific publications | Lead generation, brand authority | Global reach, targeted communication |

| Strategic Partnerships | Collaborations with pharma and academia | Drug discovery, precision medicine | Market expansion, technological validation |

Price

Bruker's pricing strategy centers on value-based principles, reflecting the significant R&D investment and advanced technological capabilities of its scientific instruments. This approach acknowledges that customers in demanding research and industrial sectors prioritize performance and unique problem-solving abilities, justifying premium pricing for solutions that deliver superior outcomes.

For instance, Bruker's mass spectrometry systems, crucial for drug discovery and materials science, command high prices due to their precision and analytical power. In 2024, the company's focus on innovation in areas like quantum computing and advanced diagnostics further supports this strategy, as these cutting-edge solutions offer unparalleled value to early adopters and specialized markets.

Bruker navigates a competitive landscape in scientific instruments and diagnostics, where pricing reflects innovation and quality. For instance, in the mass spectrometry market, which Bruker significantly influences, average selling prices can range from tens of thousands to over a million dollars depending on the system's sophistication and application.

The company strategically positions its offerings to be attractive within key segments, balancing market share goals with its premium brand perception. This involves careful analysis of competitor pricing structures, such as those from Thermo Fisher Scientific and Agilent Technologies, to ensure value proposition remains compelling.

Bruker's pricing strategy aims to capture a significant portion of the high-value market, reflecting its investment in R&D and advanced technologies. In 2023, Bruker reported total revenue of $2.2 billion, underscoring its market presence and the effectiveness of its pricing in securing substantial sales.

Bruker's recent strategic acquisitions, including ELITechGroup, NanoString, and Chemspeed, are poised to reshape its pricing structure. These moves introduce diverse product portfolios and market segments, potentially leading to varied pricing models and opportunities for bundled solutions, which could influence average selling prices across the company's broadened offerings.

The integration of these acquired entities necessitates a careful evaluation of their financial implications, particularly concerning their impact on Bruker's overall profit margins. For instance, the acquisition of NanoString in late 2023 for approximately $500 million, while expanding Bruker's life science solutions, will be a key factor in assessing margin impacts as its technologies are integrated.

Pricing Initiatives to Mitigate Headwinds

Bruker is actively implementing pricing initiatives to counteract potential headwinds, particularly those stemming from U.S. policy shifts and anticipated new tariffs. These adjustments are a strategic response to projected impacts on revenue and operating profit for 2025. The company's approach involves carefully calibrating prices to navigate economic uncertainties and evolving market conditions.

These pricing strategies are part of a broader mitigation plan that also includes rigorous cost controls and a re-engineering of its supply chain. By proactively managing these elements, Bruker aims to safeguard its profitability and meet its financial guidance for the upcoming fiscal year.

- Pricing Adjustments: Bruker is adjusting product and service pricing to offset the financial impact of external factors.

- Revenue Protection: Initiatives are designed to protect revenue streams from anticipated negative effects of U.S. policy changes and tariffs in 2025.

- Profitability Maintenance: Pricing actions, combined with cost management, are crucial for maintaining healthy operating profit margins.

- Navigating Uncertainty: The company uses pricing as a flexible tool to adapt to economic volatility and market challenges.

Long-Term Value and Total Cost of Ownership

For significant investments like Bruker's scientific instruments, pricing extends beyond the initial outlay to encompass long-term value. This includes the equipment's inherent durability, consistent reliability, and the availability of future upgrade paths and dedicated service, ensuring sustained performance and relevance for clients.

The total cost of ownership (TCO) is a critical factor for Bruker's customers. This comprehensive view includes not only the upfront purchase price but also the ongoing expenses associated with consumables and essential maintenance, painting a clearer picture of the financial commitment over the instrument's lifecycle.

Bruker strategically positions its pricing to underscore a compelling return on investment (ROI) for its clientele. By highlighting the extended operational lifespan and potential for enhanced productivity, the company aims to assure customers that their investment will yield significant benefits throughout the instrument's use.

- Total Cost of Ownership (TCO) Calculation: Bruker emphasizes TCO, which includes initial purchase, consumables, and service, to demonstrate long-term economic viability.

- Return on Investment (ROI) Focus: The company's pricing strategy is designed to showcase a strong ROI, considering the productivity gains and longevity of its high-capital equipment.

- Durability and Reliability as Value Drivers: Pricing reflects the inherent quality, robustness, and dependable performance of Bruker instruments, reducing downtime and operational costs for users.

Bruker's pricing strategy leverages its premium brand positioning, focusing on value-based principles for its advanced scientific instruments. This approach is critical given the significant R&D investments and technological sophistication embedded in its products, particularly in high-demand sectors like life sciences and materials research. For instance, in 2024, the company continues to emphasize innovation, supporting premium pricing for solutions offering distinct advantages.

The company's pricing reflects the high-value nature of its offerings, with specific product lines like mass spectrometry systems commanding prices that can range from tens of thousands to over a million dollars, depending on configuration and application. This strategy is informed by a close watch on competitors such as Thermo Fisher Scientific and Agilent Technologies, ensuring Bruker's value proposition remains competitive within key market segments.

Recent acquisitions, including ELITechGroup and NanoString (acquired in late 2023 for approximately $500 million), are expected to influence Bruker's pricing structures by introducing new product portfolios and market dynamics. These integrations necessitate careful evaluation to maintain profit margins while expanding market reach.

Bruker is actively implementing pricing adjustments in 2024 and 2025 to mitigate the impact of external factors like potential U.S. policy shifts and tariffs. These strategic price calibrations, alongside stringent cost controls, are designed to protect revenue and operating profit margins amidst economic uncertainties.

| Metric | 2023 Value | 2024 Projection | 2025 Projection |

| Total Revenue | $2.2 billion | $2.3 - $2.4 billion | $2.45 - $2.55 billion |

| Mass Spectrometry Revenue Contribution | ~30% | ~31% | ~32% |

| Impact of Tariffs/Policy (Est. Annual) | Negligible | $10 - $20 million (Potential Headwind) | $20 - $30 million (Potential Headwind) |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis leverages a comprehensive suite of data, including official Bruker financial reports, product launch announcements, and detailed specifications. We also incorporate market intelligence from industry research firms and competitor pricing strategies.