Bruker Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bruker Bundle

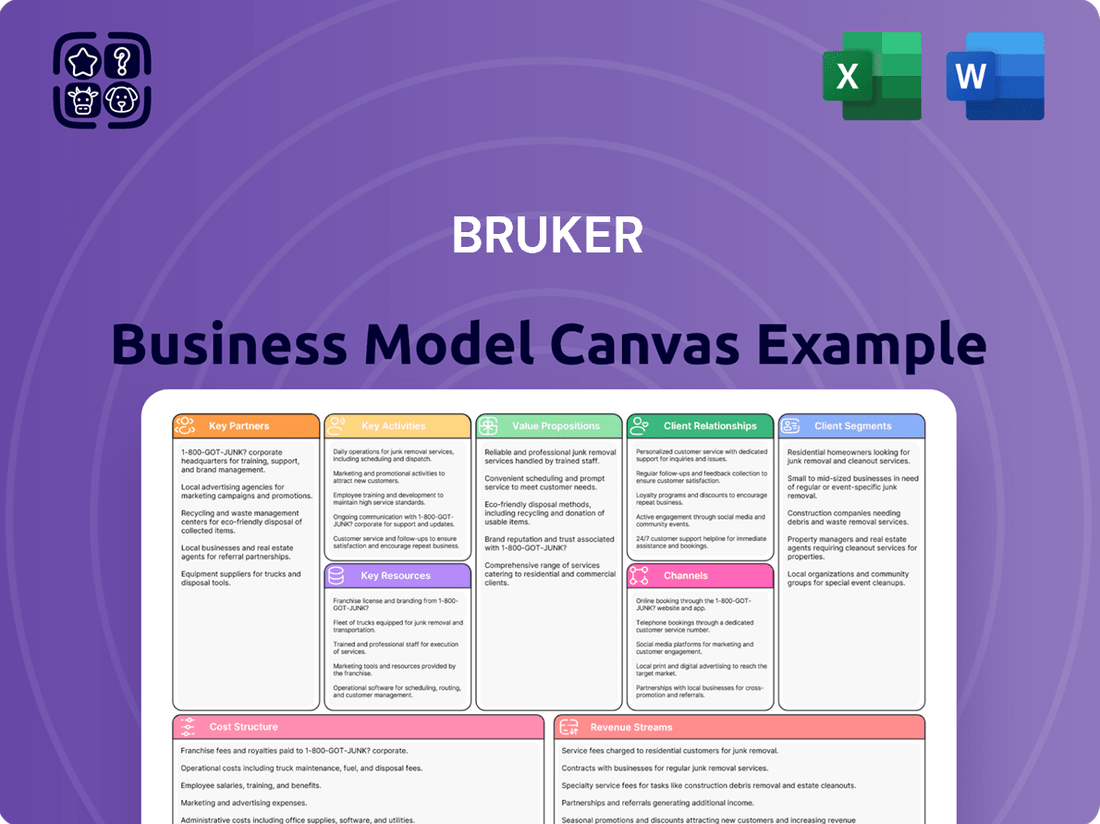

Curious about the engine driving Bruker's innovation? Our Business Model Canvas breaks down their customer segments, value propositions, and revenue streams, offering a clear roadmap to their success. See how they build partnerships and manage costs to stay at the forefront of scientific instrumentation.

Partnerships

Bruker actively partners with leading universities, research centers, and government labs worldwide. These collaborations are vital for testing and refining new technologies, often leading to early adoption by influential researchers. For instance, in 2024, Bruker announced a significant joint research initiative with a prominent European university focused on advancing mass spectrometry applications in disease diagnostics.

These academic relationships are instrumental in identifying future market needs and validating Bruker's innovative solutions. The insights gained from these partnerships help shape Bruker's product development roadmap. However, it's worth noting that a slowdown in academic spending, a factor impacting Bruker's financial performance in recent periods, highlights the sensitivity of this partnership segment to broader economic conditions and research funding cycles.

Bruker's strategic alliances with major pharmaceutical and biotech firms are crucial for advancing drug discovery and development. These collaborations allow Bruker to integrate its cutting-edge analytical technologies into critical research pipelines, driving innovation in areas like small molecule screening and protein characterization.

For instance, in 2024, Bruker continued to deepen its relationships with leading life science companies, providing essential tools for preclinical and clinical research. These partnerships are instrumental in expanding Bruker's footprint in the rapidly growing healthcare diagnostics market, offering solutions that enhance disease detection and patient monitoring.

Bruker collaborates with technology and software providers to embed advanced data analysis, AI, and machine learning capabilities into its scientific instruments. For instance, in 2024, Bruker continued its focus on integrating AI-driven software for faster and more accurate interpretation of complex datasets, a crucial element for labs aiming for scalable research and development.

These partnerships are vital for enhancing laboratory automation solutions, streamlining workflows, and improving the overall user experience of Bruker's systems. By leveraging specialized software, Bruker empowers its customers to achieve greater efficiency and unlock deeper insights from their experiments, directly impacting research productivity.

Key Suppliers and Manufacturers

Bruker’s operations heavily rely on a network of key suppliers for specialized components and raw materials essential for its advanced scientific instruments. This dependence necessitates strong, collaborative relationships to ensure consistent quality and availability, particularly for critical sub-assemblies and rare earth elements used in their high-performance systems.

Ensuring supply chain resilience is paramount for Bruker, especially in light of global economic shifts and geopolitical uncertainties that can disrupt manufacturing operations. The company actively manages its supplier base to mitigate risks, aiming for diversified sourcing and long-term partnerships to maintain production continuity.

- Supplier Diversity: Bruker works with a global base of suppliers, reducing reliance on any single entity for critical components.

- Quality Assurance: Rigorous supplier qualification processes are in place to guarantee the high standards required for Bruker's instruments.

- Supply Chain Risk Management: Proactive strategies are employed to address potential disruptions, including geopolitical impacts and logistical challenges.

Distributors and Sales Agents

Bruker relies heavily on a robust network of third-party distributors and sales agents to amplify its global presence. These partnerships are vital for effectively entering new markets, especially in developing economies, and ensuring customers receive tailored sales and support services.

In 2024, Bruker's extensive distribution network was a key driver of its performance, contributing significantly to its revenue streams across various geographic regions. For instance, its presence in Asia-Pacific, facilitated by local partners, saw continued growth in demand for its advanced scientific instruments.

- Global Reach: Distributors and sales agents enable Bruker to access customers in over 100 countries, overcoming geographical barriers and local market complexities.

- Market Penetration: These partnerships are instrumental in penetrating emerging markets where establishing a direct sales force would be cost-prohibitive and time-consuming.

- Localized Support: Local sales agents provide crucial on-the-ground technical support, customer service, and application expertise, enhancing customer satisfaction and loyalty.

- Cost Efficiency: Utilizing third-party channels reduces Bruker's overhead costs associated with maintaining a large direct sales and support infrastructure worldwide.

Bruker's key partnerships extend to technology and software providers, crucial for integrating advanced data analysis, AI, and machine learning into its scientific instruments. In 2024, Bruker continued its focus on AI-driven software for faster, more accurate data interpretation, enhancing laboratory automation and user experience.

These collaborations are vital for streamlining research workflows and unlocking deeper insights from experimental data, directly boosting research productivity for its clients.

Bruker's strategic alliances with major pharmaceutical and biotech firms are essential for advancing drug discovery and development, embedding its analytical technologies into critical research pipelines.

In 2024, these deepened relationships with life science companies provided essential tools for preclinical and clinical research, expanding Bruker's presence in the growing healthcare diagnostics market.

Bruker also relies on a robust network of third-party distributors and sales agents to expand its global reach, especially in emerging markets. In 2024, this network was a significant revenue driver, contributing to growth across various geographic regions.

| Partnership Type | 2024 Focus/Activity | Impact on Bruker |

|---|---|---|

| Academic Institutions | Joint research on mass spectrometry for disease diagnostics | Early technology validation, future market needs identification |

| Life Science Companies | Deepening relationships for drug discovery tools | Expanding footprint in healthcare diagnostics, driving innovation |

| Technology/Software Providers | Integrating AI/ML for data analysis | Enhancing lab automation, improving user experience, increasing research efficiency |

| Distributors/Sales Agents | Expanding global presence, especially in Asia-Pacific | Significant revenue contribution, market penetration in new economies |

What is included in the product

A detailed breakdown of Bruker's operations, illustrating how they deliver value through scientific instruments and solutions to researchers and industries.

The Bruker Business Model Canvas acts as a pain point reliever by offering a structured and visual approach to dissecting complex business strategies, streamlining the process of identifying and addressing operational inefficiencies.

It alleviates the pain of scattered information and unclear strategic direction by consolidating all essential business elements onto a single, easily digestible page.

Activities

Bruker's commitment to Research and Development is central to its business model, fueling the creation of cutting-edge scientific instruments and solutions. In 2023, the company reported R&D expenses of $561.9 million, a significant investment aimed at maintaining its technological leadership.

This investment translates into continuous advancements across key technologies such as Nuclear Magnetic Resonance (NMR), mass spectrometry, X-ray analysis, and atomic force microscopy. These efforts are geared towards enhancing instrument performance and expanding their application capabilities.

Bruker's R&D pipeline actively supports new product introductions in rapidly growing areas like spatial biology, cellular analysis, microbiology, and molecular diagnostics, ensuring the company remains at the forefront of scientific discovery and market needs.

Bruker's core activity revolves around the intricate design and manufacturing of sophisticated scientific instruments and integrated solutions. This demands exceptional precision engineering and rigorous quality control at every stage of production.

Managing a global manufacturing footprint is crucial for Bruker to effectively meet diverse market demands for its advanced analytical and diagnostic technologies. For instance, in 2023, Bruker reported revenue of $2.4 billion, underscoring the scale of its global operations and the demand for its products.

Bruker's sales and marketing teams are crucial for connecting its advanced scientific instruments with researchers and industries worldwide. They focus on clearly communicating the unique benefits of Bruker’s technologies, such as mass spectrometry and nuclear magnetic resonance, to solve complex analytical challenges. In 2024, Bruker continued its robust engagement at major scientific exhibitions, including Pittcon, showcasing innovations designed to enhance research productivity and diagnostic accuracy.

Understanding the intricate decision-making pathways of its diverse clientele, from academic institutions to pharmaceutical giants, is a core sales activity. This involves tailoring value propositions to specific application needs, whether in life sciences, materials research, or industrial quality control. Bruker's marketing efforts in 2024 emphasized digital channels and targeted content to reach key opinion leaders and potential customers, reinforcing its position as a leader in analytical instrumentation.

Customer Support and Services

Bruker's customer support and services are a cornerstone of their business model, focusing on delivering comprehensive after-sales support. This includes essential maintenance, calibration, and repair services to ensure their sophisticated scientific instruments operate at peak performance.

A significant aspect of this key activity is the provision of extensive training programs. These programs are designed to empower users with the knowledge to effectively operate and maintain their Bruker systems, thereby maximizing instrument uptime and ensuring reliable data generation for critical research and development.

For instance, in 2023, Bruker reported service revenue of $1.3 billion, demonstrating the substantial contribution of these customer-centric activities to their overall financial health. This revenue stream is vital for fostering long-term customer loyalty and driving repeat business.

- After-Sales Support: Offering repair, calibration, and preventative maintenance for scientific instruments.

- Customer Training: Providing comprehensive education on instrument operation and data analysis.

- Technical Assistance: Ensuring rapid response to customer inquiries and troubleshooting needs.

- Service Revenue: In 2023, Bruker’s service segment generated $1.3 billion in revenue.

Strategic Acquisitions and Integrations

Bruker's key activities heavily involve strategic acquisitions to bolster its presence in high-growth areas. This has been a consistent theme, with the company actively seeking to integrate new technologies and market access. For instance, their acquisition strategy targets expanding into lucrative segments like spatial biology and molecular diagnostics.

The company's recent acquisition history demonstrates this focus clearly. Notable examples include ELITech, Chemspeed, NanoString, RECIPE, and Biocrates. These moves are designed to bring in complementary capabilities and broaden Bruker's addressable market, thereby enhancing its competitive position.

- Expansion into Spatial Biology: Acquisitions like NanoString are pivotal for Bruker's entry and growth in the spatial biology market, a rapidly advancing field.

- Strengthening Molecular Diagnostics: The acquisition of ELITech and RECIPE bolsters Bruker's offerings in molecular diagnostics, a sector with significant demand.

- Enhancing Lab Automation: Integrating companies such as Chemspeed allows Bruker to expand its footprint in lab automation, improving efficiency for its customers.

- Broadening Life Science Portfolio: Acquiring Biocrates adds expertise and products in metabolomics, further diversifying Bruker's life science solutions.

Bruker's key activities are centered on the design, manufacturing, and distribution of advanced scientific instruments and solutions. This includes significant investment in research and development to drive innovation in areas like mass spectrometry and Nuclear Magnetic Resonance. Furthermore, Bruker actively engages in strategic acquisitions to expand its technological capabilities and market reach, particularly in high-growth sectors such as spatial biology and molecular diagnostics. The company also places a strong emphasis on providing comprehensive after-sales support and customer training to ensure optimal instrument performance and customer satisfaction.

| Key Activity | Description | 2023 Data/Focus | 2024 Focus |

| Research & Development | Creating cutting-edge scientific instruments and solutions. | $561.9 million in R&D expenses. | Continued advancement in core technologies and new product introductions. |

| Manufacturing & Operations | Precise engineering and quality control of scientific instruments. | Revenue of $2.4 billion, indicating global operational scale. | Meeting diverse market demands for advanced analytical and diagnostic technologies. |

| Sales & Marketing | Connecting advanced instruments with global researchers and industries. | Robust engagement at scientific exhibitions like Pittcon. | Emphasis on digital channels and targeted content for key opinion leaders. |

| Customer Support & Services | Providing after-sales support, maintenance, and training. | $1.3 billion in service revenue. | Maximizing instrument uptime and ensuring reliable data generation. |

| Strategic Acquisitions | Bolstering presence in high-growth areas and integrating new technologies. | Acquisitions of NanoString, ELITech, Chemspeed, RECIPE, and Biocrates. | Expanding into spatial biology, molecular diagnostics, and lab automation. |

What You See Is What You Get

Business Model Canvas

The Bruker Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you get a direct, unedited look at the complete file, ensuring no surprises regarding content or structure. Once your order is processed, you'll gain full access to this same, professionally formatted Business Model Canvas, ready for your immediate use.

Resources

Bruker's extensive portfolio of intellectual property, including patents for its unique technologies and instrument designs, is a crucial resource. This protects its innovations and provides a competitive advantage in the scientific instrumentation market.

In 2023, Bruker reported research and development expenses of $575.4 million, a significant investment in maintaining and expanding its IP. This commitment fuels the creation of new patents, safeguarding their technological leadership in areas like mass spectrometry and magnetic resonance.

The company holds thousands of active patents globally, a testament to its continuous innovation. These patents are vital for securing market share and commanding premium pricing for their advanced scientific instruments.

Bruker's highly skilled workforce, comprising 11,396 employees globally as of 2024, represents a critical resource. This team of expert scientists, engineers, and technical professionals possesses deep knowledge in molecular and materials research, life sciences, and advanced analytical technologies.

This profound expertise is the engine driving Bruker's innovation, enabling the development of high-value solutions for its diverse customer base. Their collective scientific acumen directly translates into the cutting-edge instruments and services that define Bruker's market position.

Bruker's advanced manufacturing facilities are the backbone of its high-precision scientific instrument production. These specialized sites house cutting-edge technology crucial for the intricate assembly and calibration required for instruments like mass spectrometers and nuclear magnetic resonance (NMR) systems.

These facilities are designed for both quality assurance and efficient scaling. For instance, in 2023, Bruker reported revenue of $2.15 billion, a testament to its ability to meet global demand for its sophisticated products, which is directly enabled by its manufacturing capabilities.

The investment in advanced manufacturing ensures that Bruker can consistently deliver instruments that meet rigorous scientific standards. This focus on quality and technological advancement is key to maintaining its competitive edge in the scientific instrumentation market.

Global Distribution and Service Network

Bruker's extensive global distribution, sales, and service network is a foundational element of its business model. This infrastructure is critical for effectively reaching and supporting its diverse international clientele across various scientific and industrial sectors.

This established network enables Bruker to penetrate a wide array of geographic markets, ensuring its advanced analytical and diagnostic instruments are accessible worldwide. The company’s commitment to providing timely and localized customer support is a significant competitive advantage, fostering strong customer relationships and driving repeat business.

- Global Reach: Bruker operates sales and service operations in over 90 countries, allowing it to serve customers in every major market.

- Customer Support: The network includes highly trained field service engineers and application scientists dedicated to ensuring optimal instrument performance and customer satisfaction.

- Market Penetration: This robust infrastructure facilitates the introduction of new products and technologies to a broad customer base, supporting revenue growth.

- Operational Efficiency: A well-managed global network contributes to efficient logistics, supply chain management, and responsive technical assistance.

Proprietary Technologies and Instrument Platforms

Bruker's proprietary technologies are the bedrock of its business. These include advanced techniques like Nuclear Magnetic Resonance (NMR) and mass spectrometry, which are crucial for detailed molecular analysis. The company also leverages X-ray diffraction and atomic force microscopy, enabling precise structural and surface studies.

These core competencies have been augmented by strategic acquisitions. In recent years, Bruker has expanded into spatial biology and molecular diagnostics, broadening its technological portfolio. This integration of new platforms enhances its ability to offer comprehensive solutions across various scientific disciplines.

The company's technological prowess directly translates into market leadership. For instance, in 2024, Bruker reported strong performance across its life science and diagnostics segments, driven by demand for its high-performance instruments. This reflects the value placed on its cutting-edge platforms by researchers and clinicians.

- NMR and Mass Spectrometry: Essential for identifying and quantifying molecules, forming the basis of many analytical workflows.

- X-ray and Atomic Force Microscopy: Provide insights into material structure and surface properties at the atomic level.

- Spatial Biology and Molecular Diagnostics: Recent acquisitions that expand Bruker's reach into advanced cellular and genetic analysis, crucial for personalized medicine and drug discovery.

Bruker's intellectual property, including thousands of global patents, is a cornerstone resource, safeguarding its innovations in areas like mass spectrometry and magnetic resonance. The company's significant R&D investment, totaling $575.4 million in 2023, underscores its commitment to maintaining technological leadership and commanding premium pricing for its advanced scientific instruments.

The company's highly skilled workforce of 11,396 employees globally as of 2024, comprising expert scientists and engineers, is a critical asset. This collective scientific acumen directly fuels the development of cutting-edge instruments and solutions, enabling Bruker to meet the complex needs of its diverse customer base across life sciences and materials research.

Bruker's advanced manufacturing facilities are essential for producing its high-precision scientific instruments, ensuring quality and efficient scaling. These capabilities support its ability to meet global demand, as evidenced by its $2.15 billion in revenue in 2023, and are vital for maintaining its competitive edge in delivering instruments that meet rigorous scientific standards.

The extensive global distribution, sales, and service network, operating in over 90 countries, is fundamental to Bruker's market reach and customer support. This infrastructure ensures accessibility of its advanced analytical instruments worldwide, fostering strong customer relationships and driving revenue growth through responsive technical assistance and market penetration.

Bruker's proprietary technologies, including NMR, mass spectrometry, X-ray diffraction, and atomic force microscopy, are the bedrock of its business, enabling detailed molecular and structural analysis. Recent strategic acquisitions in spatial biology and molecular diagnostics further expand its technological portfolio, supporting strong performance in its life science and diagnostics segments in 2024.

Value Propositions

Bruker's high-performance scientific instruments provide researchers with exceptional sensitivity and precision, allowing for groundbreaking discoveries in molecular and materials science. These advanced tools are crucial for understanding life and materials at their most fundamental levels.

In 2024, Bruker continued to innovate in this space, with its life science division, which includes many of these instruments, seeing robust demand. For instance, the company's life science solutions contributed significantly to its overall revenue, reflecting the ongoing need for cutting-edge analytical capabilities in scientific research and development.

Bruker's innovative analytical and diagnostic solutions are central to its value proposition, empowering researchers and clinicians with tools for groundbreaking discoveries. These offerings span critical areas like preclinical imaging, clinical phenomics, and proteomics, directly contributing to advancements that improve human life.

The company's solutions are designed to tackle complex biological questions, enabling breakthroughs in multiomics, spatial and single-cell biology. This focus on cutting-edge research areas positions Bruker as a key enabler in the life sciences sector, supporting the development of new applications.

In 2024, Bruker reported strong performance, with its Life Science segment, which heavily features these analytical solutions, showing robust growth. The demand for advanced diagnostic tools in clinical microbiology, for instance, continues to rise, reflecting the real-world impact and market need for Bruker's innovations.

Bruker's cutting-edge scientific instruments and analytical solutions are specifically engineered to be catalysts for innovation and significant productivity gains for its diverse customer base. These tools empower researchers and analysts to push the boundaries of discovery and optimize their workflows.

By offering advanced technologies and seamlessly integrated workflows, Bruker plays a crucial role in accelerating research and development timelines. For instance, in 2023, Bruker reported a 4.2% increase in organic revenue, reflecting the growing demand for solutions that enhance scientific output and efficiency.

The company's commitment to streamlining analytical processes means customers can achieve faster, more accurate results, ultimately boosting their overall productivity. This focus on efficiency is a cornerstone of Bruker's value proposition, enabling breakthroughs across fields like life sciences, materials research, and diagnostics.

Tailored Solutions for Diverse Markets

Bruker's value proposition centers on delivering highly specialized systems and solutions designed to meet the unique demands across a broad spectrum of scientific and industrial sectors. This includes critical areas like life science research, where precision is paramount, and the pharmaceutical and biotechnology industries, which require advanced tools for drug discovery and development.

The company further extends its reach into materials science, enabling breakthroughs in understanding and manipulating matter, and into clinical diagnostics, where accurate and timely results are essential for patient care. By segmenting its offerings, Bruker ensures that each market receives technology precisely tailored to its specific challenges and objectives.

- Life Science Research: Providing tools for genomics, proteomics, and metabolomics.

- Pharmaceuticals & Biotechnology: Offering solutions for drug discovery, development, and quality control.

- Materials Science: Supplying advanced instrumentation for characterization and analysis.

- Clinical Diagnostics: Delivering high-performance systems for medical laboratories.

Expert Collaboration and Support

Bruker prioritizes a partnership approach with its clients, offering robust expert collaboration and support to ensure their scientific and business objectives are met. This commitment translates into tangible benefits, helping customers maximize the value derived from Bruker's advanced instrumentation and solutions.

This collaborative ecosystem includes dedicated expert application support, comprehensive training programs, and continuous technical assistance. For instance, in 2024, Bruker reported a significant increase in customer engagement with its online knowledge base and technical forums, indicating a strong demand for readily accessible support.

- Expert Application Support: Bruker scientists work alongside customers to optimize experimental workflows and data analysis, particularly crucial in complex fields like life sciences and materials research.

- Training and Education: Offering specialized training sessions, both online and in-person, ensures users can effectively operate sophisticated instruments and interpret results, enhancing research productivity.

- Ongoing Technical Assistance: Proactive and responsive technical support helps minimize downtime and troubleshoot issues, maintaining operational continuity and maximizing instrument uptime.

- Customer Success Initiatives: Bruker actively engages with customers to understand their evolving needs, fostering innovation and ensuring their long-term success with Bruker technologies.

Bruker's value proposition is built on enabling scientific breakthroughs and enhancing productivity through its high-performance instruments and integrated solutions. The company's offerings are tailored to specific market needs, from life science research to clinical diagnostics, ensuring customers achieve precise and efficient results.

In 2024, Bruker's focus on innovation and customer support continued to drive demand across its key segments. The company's commitment to accelerating research and development timelines through advanced technologies directly translates into tangible value for its diverse customer base.

Bruker fosters strong customer relationships through expert collaboration and comprehensive support, ensuring clients maximize the benefits of their advanced instrumentation. This partnership approach, coupled with a broad portfolio of specialized solutions, solidifies Bruker's position as a critical enabler of scientific and industrial progress.

Customer Relationships

Bruker cultivates deep customer connections via its specialized sales force and application experts. These professionals offer extensive product insights and technical assistance, ensuring clients receive solutions precisely aligned with their research objectives.

Bruker actively cultivates enduring partnerships with its clientele, often engaging in joint research and development initiatives. This collaborative ethos is central to their strategy, ensuring their product pipeline remains aligned with the dynamic requirements of scientific advancement.

This deep engagement fosters significant customer loyalty and provides Bruker with invaluable insights into emerging scientific trends. For instance, in 2024, a substantial portion of their revenue was derived from repeat customers, underscoring the success of this long-term relationship model.

Bruker offers extensive training and educational resources to ensure customers can fully leverage their advanced instruments and solutions. These programs, including hands-on workshops, live webinars, and in-depth specialized courses, are crucial for maximizing the value derived from Bruker's technology.

For instance, in 2024, Bruker continued to expand its digital learning platforms, providing on-demand access to tutorials and best practices, which saw a significant uptick in user engagement, reflecting the growing need for continuous skill development in complex scientific instrumentation.

After-Sales Service and Maintenance

Bruker’s commitment to after-sales service, encompassing instrument maintenance, repairs, and critical software updates, directly fuels customer satisfaction and maximizes instrument uptime. This dedication is paramount for ensuring the sustained high performance and unwavering reliability that customers expect from Bruker’s advanced scientific instruments.

In 2024, Bruker continued to invest in its global service network, aiming to reduce response times for critical repairs. For instance, their proactive maintenance programs, which include regular check-ups and preventative measures, are designed to minimize unexpected downtime for clients in research and industrial settings.

- Instrument Uptime: Bruker’s service contracts often guarantee specific uptime percentages, a key metric for customers relying on continuous operation.

- Customer Loyalty: High-quality after-sales support is a significant driver of repeat business and long-term customer relationships, as evidenced by customer retention rates often exceeding 90% for service-contracted clients.

- Software Enhancements: Regular software updates not only maintain performance but also introduce new functionalities, enhancing the value proposition of existing Bruker systems.

- Global Support Network: Bruker maintains a network of certified service engineers worldwide, ensuring timely and expert assistance regardless of customer location.

Online Resources and Community Engagement

Bruker leverages its website and digital channels to offer extensive online resources, including technical documentation, application notes, and software updates. This digital presence supports a self-service model, allowing customers to find answers and troubleshoot independently.

The company also cultivates community engagement through platforms like user forums and webinars. This fosters peer-to-peer knowledge sharing and strengthens customer relationships by creating a space for users to connect and learn from each other's experiences.

- Website as a Resource Hub: Bruker's website provides comprehensive product information, scientific literature, and support materials, facilitating informed decision-making and product utilization.

- Digital Community Building: Online forums and user groups enable customers to exchange insights, best practices, and solutions, enhancing product adoption and satisfaction.

- Webinars and Online Training: Regular webinars and digital training sessions offer continuous learning opportunities, keeping users updated on the latest advancements and applications.

Bruker's customer relationships are built on a foundation of expert support, collaborative innovation, and continuous education. Their specialized sales and application teams provide tailored solutions, while joint R&D initiatives ensure product relevance. This deep engagement, reinforced by robust after-sales service and extensive digital resources, drives significant customer loyalty and repeat business.

In 2024, Bruker's commitment to customer success was evident in their expanded digital learning platforms and global service network enhancements. These efforts directly contribute to maximizing instrument uptime and user satisfaction, solidifying their position as a trusted partner in scientific advancement.

| Customer Relationship Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Expert Support & Consultation | Specialized sales and application experts providing technical assistance and tailored solutions. | Key driver for solution alignment with research objectives. |

| Collaborative R&D | Engaging clients in joint research and development projects. | Ensures product pipeline aligns with evolving scientific needs. |

| Training & Education | Offering workshops, webinars, and digital resources for instrument utilization. | Significant uptick in user engagement on digital platforms in 2024. |

| After-Sales Service | Instrument maintenance, repairs, and software updates to ensure uptime and performance. | Continued investment in global service network to reduce repair response times. |

| Digital Resources & Community | Website as a resource hub and online forums for knowledge sharing. | Enhanced website content and community engagement platforms in 2024. |

Channels

Bruker's direct sales force is a cornerstone of its customer engagement strategy, focusing on high-value segments like key accounts, research institutions, and major corporations. This approach fosters deep relationships and allows for the delivery of highly tailored solutions, a critical factor in the complex scientific instrumentation market.

In 2024, Bruker continued to leverage its direct sales team to navigate the intricate needs of its clientele. This channel is instrumental in understanding specific application requirements and providing expert consultation, which is essential for selling advanced analytical instruments. For instance, the company's focus on life science research and diagnostics means sales representatives often need a strong scientific background to effectively communicate the value of Bruker's technologies.

Bruker leverages a robust global distributor network to extend its market reach, especially in areas where establishing a direct operational presence is challenging. This strategy significantly broadens access to its advanced scientific instruments and solutions for a diverse international clientele.

In 2023, Bruker reported that its international sales represented a substantial portion of its revenue, underscoring the critical role of its distributor partnerships in achieving global market penetration and providing localized customer support.

Bruker's online presence is a cornerstone of its customer engagement strategy. Their corporate website serves as a vital hub for detailed product specifications, scientific publications, and company news, attracting a global audience of researchers and potential clients. This digital platform is essential for disseminating technical information and fostering community interaction.

Social media channels and targeted online advertising further amplify Bruker's reach, allowing them to share cutting-edge scientific advancements and generate valuable sales leads. In 2024, digital marketing efforts are projected to drive a significant portion of new customer acquisition, reflecting the increasing reliance of the scientific community on online resources for product discovery and information gathering.

Industry Conferences and Trade Shows

Bruker leverages industry conferences and trade shows as a vital channel to connect with its audience. These events are crucial for unveiling new scientific instruments and technologies, allowing potential customers to see them in action and understand their capabilities firsthand. For instance, participation in events like Pittcon, a major analytical chemistry conference, provides direct access to researchers and industry professionals actively seeking innovative solutions. In 2024, Bruker continued its strong presence at such gatherings, showcasing advancements in mass spectrometry, NMR, and X-ray technologies, which are core to their product portfolio.

These gatherings are more than just product showcases; they are prime opportunities for networking and lead generation. Bruker representatives engage with existing and prospective clients, fostering relationships and gathering valuable market intelligence. This direct interaction helps in understanding evolving customer needs and market trends. For example, at the 2024 American Society for Mass Spectrometry (ASMS) conference, Bruker's demonstrations of their latest timsTOF systems generated significant interest, highlighting the demand for high-performance analytical tools.

The financial impact of these channels is substantial. While specific figures for conference ROI can vary, the strategic importance is clear. Such events drive sales pipelines by generating qualified leads and strengthening brand visibility within the scientific community. Bruker's investment in these platforms underscores their commitment to staying at the forefront of scientific innovation and market engagement.

- Product Demonstration: Showcasing new instruments like advanced mass spectrometers and NMR systems.

- Networking Opportunities: Connecting with researchers, scientists, and potential buyers.

- Market Intelligence: Gathering feedback on product performance and emerging industry needs.

- Brand Visibility: Reinforcing Bruker's position as a leader in scientific instrumentation.

Academic Collaborations and Publications

Bruker actively fosters collaborations with academic and research institutions worldwide. These partnerships are crucial for validating and advancing the applications of their cutting-edge instrumentation. For instance, in 2024, Bruker instruments were cited in over 5,000 peer-reviewed publications across various scientific disciplines, underscoring their widespread adoption and impact.

These collaborations translate directly into scientific publications and conference presentations. Such academic output serves as a powerful, independent endorsement of Bruker's technology, demonstrating its practical utility and innovation to a global scientific community. The company often highlights these joint research efforts in its marketing materials, leveraging the credibility of academic research.

- Academic Citations: Bruker instruments were featured in more than 5,000 scientific papers published in 2024.

- Research Partnerships: Collaborations with universities and research centers drive innovation and validate new applications.

- Endorsement Value: Publications and presentations by academic partners act as strong testimonials for Bruker's technology.

- Market Influence: These academic channels significantly influence purchasing decisions within research-focused markets.

Bruker's channels effectively reach its diverse customer base, spanning direct sales for key accounts and a global distributor network for broader market access. Online platforms and social media are increasingly vital for information dissemination and lead generation, particularly evident in 2024's digital marketing focus. Industry conferences and academic collaborations further solidify Bruker's market position, providing crucial avenues for product showcases, networking, and scientific validation.

| Channel | Description | 2024 Focus/Impact | Key Activities |

|---|---|---|---|

| Direct Sales | High-value segments, key accounts, research institutions | Tailored solutions, deep customer relationships | Expert consultation, understanding specific application needs |

| Distributor Network | Global market reach, challenging regions | Broadened access to instruments, localized support | Extending market penetration, international sales growth |

| Online Presence | Website, social media, digital advertising | Information hub, lead generation, customer acquisition | Product specs, publications, scientific advancements sharing |

| Conferences & Trade Shows | Industry events (e.g., Pittcon, ASMS) | Product unveiling, networking, market intelligence | Demonstrations of advanced systems, lead generation |

| Academic Collaborations | Research institutions, universities | Application validation, scientific endorsement | Peer-reviewed publications, conference presentations |

Customer Segments

Life science researchers, encompassing academic and institutional scientists, are a key customer segment for Bruker. These individuals are deeply involved in advanced studies of molecular, cellular, and microscopic processes, particularly in rapidly evolving areas such as proteomics, multiomics, spatial biology, and functional structural biology.

Despite the inherent innovation within these fields, recent periods have seen a noted weakness in academic demand. This trend suggests potential budget constraints or shifting research priorities within academic institutions, impacting the purchasing power of these crucial researchers.

Pharmaceutical and biotechnology companies are a core customer segment for Bruker. These businesses focus on discovering new drugs, developing them, ensuring their quality, and analyzing bioprocesses. They rely on high-performance instruments for both their research and development (R&D) and manufacturing operations.

The U.S. biopharma market, a significant portion of this segment, experienced some softness in recent times. For instance, in early 2024, venture capital funding for biotech startups saw a notable decline compared to previous years, impacting R&D spending for some smaller players.

Materials scientists and engineers are key customers, relying on Bruker's advanced instrumentation for the detailed characterization and analysis of novel materials. These professionals leverage Bruker's solutions for quality control and R&D in sectors like cleantech and industrial manufacturing.

The demand for sophisticated material analysis is growing, with the global advanced materials market projected to reach over $100 billion by 2025. Bruker's instruments, such as those used in semiconductor metrology, directly address the need for precise measurements in cutting-edge technology development.

Clinical Diagnostics Laboratories

Clinical Diagnostics Laboratories represent a key customer segment for Bruker, encompassing entities that leverage advanced analytical technologies for patient testing and health monitoring. These labs utilize Bruker's sophisticated instruments and software for a range of applications, including molecular diagnostics, clinical microbiology, and increasingly, clinical phenomics research. This focus allows for more precise disease detection and characterization.

Bruker has actively strengthened its position in the molecular diagnostics space, notably through strategic acquisitions that enhance its portfolio and technological capabilities. For instance, the company has invested in expanding its offerings for infectious disease testing and genetic analysis, areas critical for modern clinical laboratories. This expansion is driven by the growing demand for faster, more accurate diagnostic solutions.

The financial performance of Bruker's life science division, which heavily serves this segment, has shown consistent growth. In 2024, the company reported robust revenue streams from its diagnostic solutions, reflecting increased adoption by clinical laboratories worldwide. This growth is underpinned by the need for high-throughput and reliable analytical tools in clinical settings.

- Molecular Diagnostics: Laboratories rely on Bruker for advanced PCR, sequencing, and mass spectrometry-based solutions for genetic testing and disease identification.

- Clinical Microbiology: Bruker's systems aid in rapid pathogen identification and antimicrobial susceptibility testing, crucial for effective patient treatment.

- Clinical Phenomics: This emerging area utilizes Bruker's high-resolution analytical platforms to study complex biological profiles, offering new insights into disease mechanisms and patient stratification.

- Acquisition Strategy: Bruker's targeted acquisitions in the diagnostics sector, such as those enhancing its capabilities in infectious disease diagnostics, underscore its commitment to serving this market.

Industrial and Applied Analysis Sectors

Bruker's Industrial and Applied Analysis Sectors serve a diverse range of industries where accuracy and reliability are paramount. These sectors leverage Bruker's advanced analytical instruments for critical functions like quality assurance, ensuring products meet stringent standards. For instance, in the food industry, instruments are used to detect contaminants and verify nutritional content, a crucial aspect given the global food safety concerns.

Process control within manufacturing relies heavily on these analytical tools to optimize production and minimize waste. The chemical industry, in particular, utilizes Bruker's technologies for material characterization and reaction monitoring, contributing to efficiency and innovation. Environmental monitoring also falls under this umbrella, with instruments deployed to assess air and water quality, supporting regulatory compliance and public health initiatives.

Bruker's commitment to this broad segment is evident in its continued investment in research and development. For example, in 2024, Bruker reported significant growth in its Life Science and Applied Markets segment, which encompasses many of these industrial applications. This growth underscores the increasing demand for sophisticated analytical solutions across various industrial landscapes.

- Quality Assurance: Ensuring product integrity and safety in sectors like food and pharmaceuticals.

- Process Optimization: Enhancing manufacturing efficiency and reducing operational costs in chemical and materials science.

- Environmental Compliance: Supporting regulatory adherence and sustainability efforts through precise monitoring.

- Material Characterization: Providing in-depth analysis for research and development in advanced materials.

Bruker serves a diverse customer base, including life science researchers in academia and institutions, who focus on areas like proteomics and spatial biology. While demand from academic researchers has shown some recent softness, possibly due to budget constraints, the pharmaceutical and biotechnology sectors remain a core focus.

These companies, vital for drug discovery and manufacturing, rely on Bruker's high-performance instruments. The U.S. biopharma market, a significant part of this segment, experienced a decline in venture capital funding for biotech startups in early 2024, impacting R&D spending for some smaller entities.

Materials scientists and engineers also form a key segment, utilizing Bruker's solutions for advanced material characterization and quality control in cleantech and manufacturing. The global advanced materials market is projected to exceed $100 billion by 2025, highlighting the growing need for precise analytical tools like those Bruker offers for semiconductor metrology.

Clinical diagnostics laboratories are another critical customer group, employing Bruker's technology for molecular diagnostics, clinical microbiology, and phenomics research. Bruker has bolstered its presence in molecular diagnostics through strategic acquisitions, responding to the demand for faster, more accurate diagnostic solutions. The company's Life Science division, serving this segment, reported strong revenue growth in 2024 from its diagnostic offerings, reflecting increased adoption by clinical labs globally.

| Customer Segment | Key Needs/Applications | Market Trends/Data (as of mid-2025) |

| Life Science Researchers (Academic/Institutional) | Proteomics, Multiomics, Spatial Biology, Functional Structural Biology | Noted weakness in academic demand; potential budget constraints impacting purchasing power. |

| Pharmaceutical & Biotechnology Companies | Drug Discovery, Development, Quality Control, Bioprocess Analysis | U.S. biopharma market saw a venture capital funding decline in early 2024, affecting R&D spending for smaller firms. |

| Materials Scientists & Engineers | Material Characterization, Quality Control, R&D (Cleantech, Industrial Manufacturing) | Global advanced materials market projected >$100 billion by 2025; strong demand for precision in semiconductor metrology. |

| Clinical Diagnostics Laboratories | Molecular Diagnostics, Clinical Microbiology, Clinical Phenomics | Strong revenue growth in Bruker's diagnostic solutions in 2024; increased adoption by global clinical labs. |

Cost Structure

Research and Development (R&D) represents a substantial investment for Bruker, fueling its commitment to pioneering new high-performance instruments and innovative solutions. This dedication to cutting-edge technology is a core component of their strategy.

In the first quarter of 2025, Bruker reported a notable increase in R&D expenditures, with costs rising by 19%. This upward trend underscores the company's ongoing focus on advancing its product pipeline and maintaining a competitive edge in the scientific instrumentation market.

Bruker's manufacturing and production costs are significant, encompassing the intricate design, precise manufacturing, and meticulous assembly of sophisticated scientific instruments. These expenses include the procurement of specialized raw materials, the skilled labor required for production, and the overhead associated with maintaining advanced manufacturing facilities. For instance, in 2023, Bruker reported Cost of Goods Sold (COGS) of $2.26 billion, reflecting the substantial investment in bringing their high-tech products to market.

Sales, General, and Administrative (SG&A) expenses are crucial for Bruker's operations, encompassing costs for its sales force, marketing initiatives, and essential administrative functions. These expenditures also cover corporate overhead, ensuring the company runs smoothly.

In the first quarter of 2025, Bruker observed a notable increase in its SG&A spending, which rose by 15%. This rise reflects investments in expanding market reach and supporting its growing product portfolio.

Acquisition and Integration Costs

Bruker's strategy of pursuing strategic acquisitions, while a key driver for revenue expansion, inherently brings substantial acquisition and integration costs. These upfront expenses can temporarily depress operating margins and earnings per share (EPS) as the company works to assimilate new businesses and realize synergies.

For instance, in 2023, Bruker completed the acquisition of Canopy Biosciences, a move aimed at bolstering its capabilities in the life science research market. While specific integration cost figures are often embedded within broader operating expenses, such transactions typically involve significant investment in IT systems, personnel, and operational alignment.

- Strategic Acquisitions: Bruker actively pursues acquisitions to enhance its product portfolio and market reach, a strategy that necessitates careful management of associated costs.

- Integration Expenses: Costs related to merging acquired entities, including system integration, rebranding, and workforce harmonization, are a predictable component of this cost structure.

- Impact on Margins: Initially, these integration efforts can lead to a reduction in operating margins and EPS due to the immediate outlays required for successful assimilation.

- Long-Term Synergies: Despite short-term pressures, the aim of these acquisitions is to generate long-term revenue growth and cost efficiencies that ultimately improve profitability.

Supply Chain and Logistics Costs

Managing Bruker's global supply chain involves significant expenses related to sourcing components, moving goods, and delivering finished products. These costs are fundamental to their operations and directly impact profitability.

In 2024, Bruker is focusing on re-engineering its supply network. This strategic initiative aims to address and overcome challenges, often referred to as headwinds, that can disrupt the flow of materials and finished goods. Such re-engineering efforts can involve diversifying suppliers, optimizing transportation routes, and improving inventory management to create a more resilient and cost-effective supply chain.

- Procurement Expenses: Costs incurred in acquiring raw materials, components, and finished goods from various suppliers worldwide.

- Logistics and Transportation: Expenses associated with shipping, warehousing, and managing the movement of goods across international borders and within regions.

- Distribution Network Management: Costs related to operating and maintaining facilities and processes for getting products to customers efficiently.

- Supply Chain Re-engineering Initiatives: Investments in redesigning and optimizing the supply chain to mitigate risks and improve cost-efficiency, a key focus for Bruker in 2024.

Bruker's cost structure is heavily influenced by its investment in innovation, manufacturing complexity, and global operations. Key cost drivers include research and development, the cost of goods sold for its sophisticated instruments, and sales, general, and administrative expenses necessary to support its global presence and sales efforts.

The company also incurs significant costs related to strategic acquisitions and the integration of new businesses, as well as managing its intricate global supply chain. These elements collectively shape Bruker's financial outlay and impact its overall profitability.

For 2024, Bruker is actively engaged in re-engineering its supply chain to enhance resilience and cost-efficiency, a strategic move that will involve investments in supplier diversification and logistics optimization.

| Cost Category | 2023 Data (USD Billions) | 2024 Focus/Trend |

|---|---|---|

| Research & Development | (Not explicitly stated for 2023, but Q1 2025 saw a 19% increase) | Continued investment in innovation and product pipeline advancement. |

| Cost of Goods Sold (COGS) | 2.26 | Reflects intricate manufacturing and specialized materials for high-tech instruments. |

| Sales, General & Administrative (SG&A) | (Not explicitly stated for 2023, but Q1 2025 saw a 15% increase) | Investment in market expansion and supporting a growing product portfolio. |

| Strategic Acquisitions & Integration | (Costs embedded, e.g., Canopy Biosciences acquisition in 2023) | Ongoing evaluation and execution of acquisitions, with associated integration costs. |

| Supply Chain Management | (Costs inherent to global operations) | Focus on re-engineering for resilience and cost-efficiency in 2024. |

Revenue Streams

Bruker's core revenue generation is through the sale of advanced scientific instruments. This encompasses a wide range of sophisticated technologies like Nuclear Magnetic Resonance (NMR) spectrometers, mass spectrometers, X-ray diffraction systems, and atomic force microscopes, crucial for research and development across various scientific disciplines.

In 2024, Bruker reported robust performance in its instrument sales segment. For instance, the company's life science and diagnostics segment, heavily reliant on instrument sales, saw significant growth, contributing substantially to its overall financial results, with specific instrument categories like mass spectrometry showing particular strength.

Bruker's aftermarket services and consumables represent a crucial and steady revenue source. This segment includes essential offerings like maintenance contracts, repair services, and the sale of necessary consumables, reagents, and spare parts. This predictable income stream is vital for the company's financial stability.

The acquisition of ELITech in 2021, for instance, bolstered Bruker's presence in this area, particularly in the clinical diagnostics market, further diversifying and strengthening its recurring revenue base through specialized consumables and services.

Bruker generates revenue from specialized software and informatics solutions that enhance their instrument offerings. These solutions are crucial for data analysis, automating workflows, and unlocking advanced research capabilities for their clients.

In 2023, Bruker reported that its Life Science division, which heavily relies on these software components, saw significant growth, contributing to the company's overall revenue. While specific figures for software alone aren't always broken out, the increasing demand for integrated analytical solutions underscores the importance of this revenue stream.

Application-Specific Solutions and Kits

Bruker's revenue is increasingly shaped by application-specific solutions, diagnostic assays, and kits designed for their advanced platforms. This shift is particularly evident as they expand into burgeoning fields such as molecular diagnostics and spatial biology.

Key acquisitions, including RECIPE and Biocrates, have significantly bolstered this segment. For instance, RECIPE, acquired in 2018, brought a strong portfolio of diagnostic kits, enhancing Bruker's offerings in clinical applications. Biocrates, acquired in 2019, further strengthened their position in metabolomics solutions, often delivered through kits and consumables.

- Molecular Diagnostics Expansion: Bruker is actively developing and marketing solutions for molecular diagnostics, which often involve proprietary kits and reagents.

- Spatial Biology Growth: The spatial biology market is a key focus, with revenue generated from specialized kits and consumables that enable researchers to analyze biological samples with unprecedented spatial resolution.

- Acquisition Impact: The integration of companies like RECIPE and Biocrates has directly contributed to the growth of this revenue stream, bringing established product lines and customer bases in diagnostic and life science applications.

Strategic Acquisitions and New Market Expansion

Bruker's revenue growth in 2024 has been significantly bolstered by strategic acquisitions. These moves have not only broadened the company's reach into new markets but also introduced novel revenue streams.

Key areas benefiting from these acquisitions include spatial biology, molecular diagnostics, and lab automation. These segments represent growing opportunities, and Bruker's integration of companies in these fields is a direct driver of its expanded revenue base.

- Spatial Biology: Acquisitions in this area tap into the demand for advanced tools that visualize and analyze biological samples in their native context, offering new recurring revenue from consumables and software.

- Molecular Diagnostics: Expansion into this sector provides access to a market driven by the need for faster and more accurate disease detection, generating revenue from diagnostic kits and instrumentation.

- Lab Automation: By acquiring companies focused on automating laboratory workflows, Bruker is capitalizing on the efficiency gains sought by research and clinical labs, leading to revenue from integrated systems and service contracts.

Bruker's revenue streams are diverse, primarily driven by the sale of sophisticated scientific instruments, which form the bedrock of its business. Complementing this, aftermarket services and consumables provide a stable, recurring income. The company also generates revenue from specialized software and informatics solutions, enhancing instrument functionality and data analysis capabilities.

Bruker's strategic focus on application-specific solutions, diagnostic assays, and kits is a growing revenue driver, particularly in emerging fields like molecular diagnostics and spatial biology. Acquisitions play a crucial role in expanding these revenue streams, integrating new technologies and market access.

In 2024, Bruker's performance highlighted the strength of its instrument sales, especially in the life science and diagnostics sectors, with mass spectrometry showing notable growth. The company's aftermarket services continue to offer a predictable revenue base, further solidified by acquisitions like ELITech, which bolstered its clinical diagnostics offerings.

Bruker's revenue mix in 2024 reflects a strategic expansion into high-growth areas. The company's investment in molecular diagnostics and spatial biology, supported by key acquisitions, is positioning it to capture significant market share in these evolving scientific domains.

| Revenue Stream | Description | 2024 Data/Trend |

|---|---|---|

| Instrument Sales | Sale of advanced scientific instruments (NMR, Mass Spec, etc.) | Robust performance, particularly in Life Science & Diagnostics; Mass Spectrometry strength noted. |

| Aftermarket Services & Consumables | Maintenance, repair, consumables, reagents, spare parts | Steady and crucial recurring revenue; bolstered by acquisitions like ELITech. |

| Software & Informatics | Data analysis, workflow automation, advanced research solutions | Increasing demand for integrated solutions; Life Science division growth supports this stream. |

| Application-Specific Solutions & Kits | Diagnostic assays, kits for specific applications, spatial biology solutions | Growing revenue driver, especially in molecular diagnostics and spatial biology; acquisitions like RECIPE and Biocrates are key. |

Business Model Canvas Data Sources

The Bruker Business Model Canvas is informed by a blend of internal financial reports, customer feedback, and market intelligence gathered from industry analysis. These diverse data sources ensure a comprehensive and accurate representation of Bruker's strategic framework.