Brockhaus Technologies SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brockhaus Technologies Bundle

Brockhaus Technologies demonstrates significant strengths in its innovative product pipeline and established market presence. However, understanding the full scope of its opportunities and potential threats is crucial for informed decision-making.

Discover the complete picture behind Brockhaus Technologies' market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Brockhaus Technologies AG’s focused investment strategy targets high-margin, high-growth companies in fintech and security tech. This specialization cultivates deep industry expertise and allows for precise resource allocation, aiming for enhanced portfolio performance and efficient expansion. For instance, in 2023, the company reported a significant increase in its investment portfolio value, driven by strategic acquisitions within these niche technology areas.

Brockhaus Technologies' strength lies in its active management, offering portfolio companies more than just capital. They provide crucial operational expertise and leverage a robust strategic network, directly impacting growth and strategic goals.

This hands-on approach, evident in their support for companies like the German industrial tech firm SGB-SMIT, which saw revenue growth accelerate post-acquisition, distinguishes Brockhaus from passive investors. This deep involvement fosters better integration and unlocks significant value creation potential.

Brockhaus Technologies is showing impressive financial strength. Preliminary revenue for 2024 reached €205 million, marking a solid 10% jump from the previous year. This upward trend is expected to continue, with projections for 2025 revenue between €225 million and €235 million, signaling a robust financial outlook and a healthy future earning potential.

The company anticipates sustained organic growth and maintains high profitability, even when facing broader economic headwinds. This resilience points to a well-managed business model and a strong competitive position within its markets, ensuring continued financial health.

High Adjusted EBITDA Margin

Brockhaus Technologies demonstrates robust profitability with a high adjusted EBITDA margin. For 2024, the company reported a preliminary adjusted EBITDA margin of 32%.

Looking ahead, Brockhaus Technologies forecasts its adjusted EBITDA to reach between €50 million and €55 million for fiscal year 2025. This strong performance highlights the company's ability to efficiently manage costs and generate substantial profits from its operations, particularly within its portfolio of acquired businesses. The consistent high margin indicates effective operational strategies and a healthy business model.

- Strong Profitability: Achieved a 32% adjusted EBITDA margin in 2024.

- Future Growth: Forecasts €50-€55 million in adjusted EBITDA for 2025.

- Operational Efficiency: High margins suggest effective cost control and profitability in acquired businesses.

Strategic Transformation of Key Subsidiaries

Brockhaus Technologies is strategically repositioning its subsidiary, Bikeleasing, to evolve beyond its core bicycle leasing service. This transformation involves expanding into a multi-benefit platform, a move that is expected to unlock new revenue avenues and bolster long-term growth. The company is also introducing new ventures, such as Probonio.de and Bike2Future.de, further diversifying its offerings and demonstrating a commitment to innovation.

This strategic pivot is crucial for adapting to changing market demands and securing a more robust future. For instance, in 2023, Bikeleasing saw significant growth, with the number of leased bicycles increasing by over 30%, highlighting the strong market appetite for such services. The expansion into a multi-benefit platform aims to leverage this momentum by offering complementary services, potentially capturing a larger share of the employee benefits market.

- Diversification of Revenue: Transitioning Bikeleasing to a multi-benefit platform diversifies income sources beyond traditional bicycle leasing.

- New Initiative Launch: The introduction of Probonio.de and Bike2Future.de signals Brockhaus Technologies' proactive approach to market expansion and innovation.

- Adaptability and Growth: This strategic evolution demonstrates the company's ability to adapt to market trends and pursue sustainable growth through portfolio enhancement.

Brockhaus Technologies AG's focused investment strategy in high-margin fintech and security tech allows for deep industry expertise and efficient resource allocation, enhancing portfolio performance. Their active management approach provides operational expertise and a strong strategic network, driving growth in portfolio companies, as seen with SGB-SMIT's accelerated revenue growth post-acquisition.

The company exhibits strong financial health, with preliminary 2024 revenue reaching €205 million, a 10% increase from the prior year, and projections for 2025 revenue between €225 million and €235 million. This financial robustness is underpinned by sustained organic growth and high profitability, even amidst economic challenges.

Brockhaus Technologies demonstrates robust profitability, achieving a 32% adjusted EBITDA margin in 2024 and forecasting €50-€55 million in adjusted EBITDA for 2025. This highlights effective cost management and strong profit generation from its acquired businesses.

The strategic repositioning of its subsidiary, Bikeleasing, into a multi-benefit platform, alongside new ventures like Probonio.de and Bike2Future.de, diversifies revenue streams and showcases adaptability to market demands. Bikeleasing's over 30% growth in leased bicycles in 2023 underscores the market's appetite for these services.

| Key Strength | Metric/Example | Impact |

| Focused Investment Strategy | Fintech and Security Tech Specialization | Deep industry expertise, efficient resource allocation, enhanced portfolio performance. |

| Active Management | Operational Expertise & Strategic Network | Drives growth and strategic goals in portfolio companies (e.g., SGB-SMIT). |

| Financial Performance | 2024 Revenue: €205M (+10% YoY) | Signals robust financial health and expected continued growth. |

| Profitability | 2024 Adj. EBITDA Margin: 32% | Indicates effective cost control and strong profit generation. |

| Strategic Diversification | Bikeleasing Multi-Benefit Platform Expansion | Unlocks new revenue avenues and adapts to market trends. |

What is included in the product

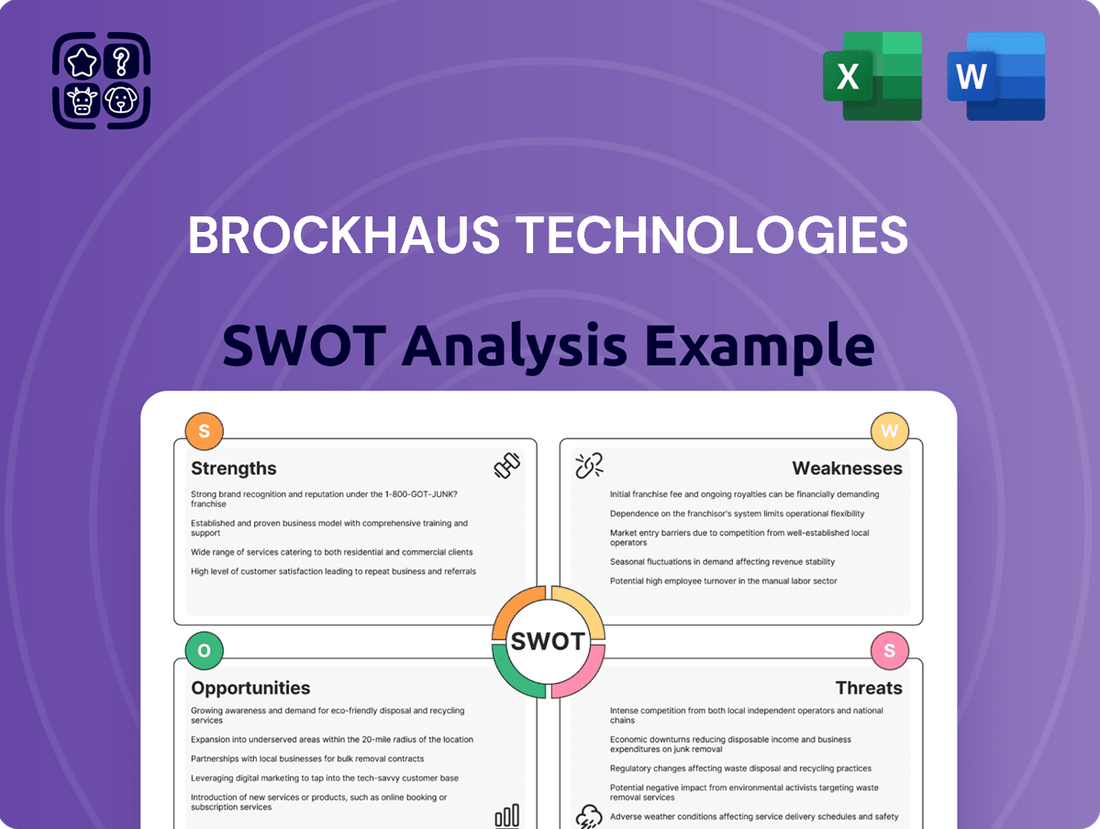

Analyzes Brockhaus Technologies’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Brockhaus Technologies' SWOT analysis offers a clear, actionable framework to identify and address potential business challenges, transforming uncertainty into strategic advantage.

Weaknesses

Brockhaus Technologies experienced significant non-cash impairments in its 2024 financial reporting. Notably, a €40 million reduction in goodwill for the Security Technologies segment (IHSE) was recorded, alongside impairments on other intangible assets.

These non-cash charges had a material impact, reducing consolidated net income and equity. Consequently, retained earnings have been depleted, preventing the proposal of a dividend for 2025.

Brockhaus Technologies' financial reporting faced a significant hurdle with the postponement of its 2024 annual and consolidated financial statements. This delay stemmed from the need for outstanding audit evidence and an ongoing investigation into a specific transaction at a foreign subsidiary of IHSE, a situation that can understandably create investor apprehension regarding transparency and the robustness of internal controls.

Brockhaus Technologies faces a notable weakness with its projected decline in adjusted EBITDA for 2025. Despite anticipated revenue growth, the company's adjusted EBITDA is expected to fall by 15% to 23% compared to the 2024 figures. This profitability dip is largely attributed to substantial increases in personnel and operating expenses stemming from ambitious strategic growth plans.

These increased costs are directly linked to investments in new platforms and market expansion. For instance, the company's 2025 forecast indicates a rise in R&D and marketing spend, impacting short-term margins. This suggests a potential profitability squeeze as Brockhaus Technologies prioritizes long-term market positioning over immediate earnings.

Challenges in Specific Segments/Initiatives

Brockhaus Technologies faces headwinds in specific operational areas. The Q1 2025 financial report highlighted a significant 20% drop in newly brokered bikes for Bikeleasing, though this was partially mitigated by increased resale revenue.

Furthermore, the Security Technologies segment, specifically IHSE, saw its revenue decline by 10.6% in the same quarter.

The Bike2Future platform also encountered early-stage operational hurdles and unforeseen revenue shortfalls during 2024, impacting its initial growth trajectory.

- Bikeleasing: 20% decrease in new bike brokering in Q1 2025.

- Security Technologies (IHSE): 10.6% revenue decline in Q1 2025.

- Bike2Future: Experienced ramp-up issues and revenue shortfalls in 2024.

Negative Price to Earnings Ratio

Brockhaus Technologies AG's negative Price to Earnings (P/E) ratio of -46.12 as of July 28, 2025, highlights a significant weakness. This negative P/E is a direct indicator that the company has experienced net losses over the past year, signaling a current lack of profitability. Such a situation can deter potential investors who prioritize earnings growth and financial stability.

The negative P/E ratio suggests that the company's earnings per share (EPS) are negative. For instance, if a company has a net loss of €10 million and 1 million shares outstanding, its EPS would be -€10. When the share price is positive, a negative EPS results in a negative P/E ratio, which is generally viewed unfavorably in valuation metrics.

- Negative P/E Ratio: As of July 28, 2025, Brockhaus Technologies AG's P/E ratio stands at -46.12.

- Indication of Losses: A negative P/E ratio typically signifies that the company has reported a net loss in the preceding twelve months.

- Investor Concern: This lack of profitability can be a significant concern for investors, potentially impacting the company's stock valuation and ability to attract capital.

- Future Profitability Uncertainty: The negative P/E ratio raises questions about the company's short-term financial health and its path to future profitability.

Brockhaus Technologies faces a significant profitability challenge with a projected 15% to 23% decline in adjusted EBITDA for 2025, despite expected revenue growth. This is driven by substantial increases in personnel and operating expenses, particularly in R&D and marketing, as the company invests in new platforms and market expansion.

Operational weaknesses are evident across key segments. Bikeleasing saw a 20% decrease in newly brokered bikes in Q1 2025, and the Security Technologies segment (IHSE) experienced a 10.6% revenue decline in the same period. Furthermore, the Bike2Future platform encountered early-stage operational hurdles and revenue shortfalls in 2024.

The company's financial health is underscored by a negative P/E ratio of -46.12 as of July 28, 2025, indicating net losses and raising concerns about current profitability and future investor appeal.

| Metric | Value | Period | Impact |

| Adjusted EBITDA Projection | -15% to -23% decline | 2025 vs 2024 | Profitability squeeze due to increased costs |

| Bikeleasing New Brokering | -20% | Q1 2025 | Reduced core business activity |

| IHSE Revenue | -10.6% | Q1 2025 | Segment-specific revenue decline |

| P/E Ratio | -46.12 | July 28, 2025 | Indicates net losses, investor concern |

Preview Before You Purchase

Brockhaus Technologies SWOT Analysis

The preview you see is the actual Brockhaus Technologies SWOT analysis document you'll receive upon purchase—no surprises, just professional quality.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Brockhaus Technologies SWOT analysis.

You’re viewing a live preview of the actual Brockhaus Technologies SWOT analysis file. The complete version becomes available after checkout, providing comprehensive insights.

Opportunities

Brockhaus Technologies' strategic pivot of Bikeleasing into a comprehensive multi-benefit platform, incorporating offerings like Probonio.de and Bike2Future.de, is a prime opportunity. This diversification allows for the creation of multiple revenue streams, moving beyond just bicycle leasing to encompass broader HR solutions and mobility services.

This expansion into new benefit categories significantly broadens Brockhaus Technologies' addressable market. By offering a wider array of HR benefits, the company can attract a more diverse customer base, including businesses looking for integrated employee wellness and mobility programs, thus increasing market share.

The success of Bikeleasing in 2023, which saw a significant increase in leased bicycles, underscores the growing demand for employee mobility benefits. This momentum can be leveraged by the multi-benefit platform to introduce and scale new offerings, potentially mirroring the strong adoption seen in the bicycle leasing segment.

Brockhaus Technologies' Security Technologies segment, through its subsidiary IHSE, is poised for significant growth with a new product generation slated for launch in Q4 2024. This strategic move, coupled with IHSE's achievement of NIAPC certification for the NATO product catalog, signals a strong commitment to innovation and market expansion within the defense and security sectors.

These technological advancements are not just incremental updates; they represent a fundamental leap forward, potentially unlocking new revenue streams and solidifying IHSE's competitive edge. The NATO certification, in particular, is a critical enabler, opening doors to lucrative government contracts and international markets that demand stringent security and interoperability standards, a key factor in the evolving cybersecurity landscape of 2024-2025.

Brockhaus Technologies can pursue strategic acquisitions to bolster its portfolio of high-growth technology companies. Its robust liquidity position, evidenced by a strong balance sheet in 2023, provides the financial flexibility for these crucial growth initiatives and add-on acquisitions. These moves can significantly expand its market reach and diversify its technological offerings.

Leveraging Strong Cash Reserves

Brockhaus Technologies' substantial cash position, reaching €53.7 million in 2023 despite some asset impairments, offers significant strategic advantages. This robust financial cushion provides the company with considerable flexibility to pursue growth opportunities.

These strong cash reserves can be strategically deployed for various purposes, including funding promising new ventures, making accretive acquisitions to expand market reach or technological capabilities, or acting as a buffer against unforeseen economic headwinds. This financial strength positions Brockhaus Technologies favorably for continued development and resilience in the dynamic market landscape.

- Financial Flexibility: The €53.7 million in cash and cash equivalents as of 2023 allows for agile responses to market opportunities.

- Investment Capacity: Reserves can fuel organic growth through R&D or expansion into new markets.

- Acquisition Potential: Strong liquidity enables strategic acquisitions to enhance the company's portfolio and competitive edge.

- Economic Resilience: Cash reserves provide a vital safety net to navigate potential economic downturns and maintain operational stability.

Growth in HR Benefit & Mobility Platform Segment

The HR Benefit & Mobility Platform segment, encompassing Bikeleasing, Probonio, and Bike2Future, demonstrated resilience with a 10.9% revenue increase in the first quarter of 2025, largely propelled by bicycle resale activities. This segment is poised for further expansion as the peak bicycle season approaches, offering a significant growth avenue for Brockhaus Technologies.

Key opportunities within this segment include:

- Capitalizing on Seasonal Demand: The anticipated increase in bicycle sales during warmer months presents a prime opportunity to boost platform revenue.

- Expanding Resale Channels: Further optimizing and broadening the bicycle resale channels can create additional revenue streams and enhance customer loyalty.

- Leveraging Cross-Selling: Opportunities exist to cross-sell other mobility-related benefits or services to existing users of the HR Benefit & Mobility Platforms.

- Market Penetration: Continued focus on acquiring new corporate clients and individual users within the employee benefits and mobility sectors will drive substantial growth.

Brockhaus Technologies' strategic expansion of its HR Benefit & Mobility Platform, including Bikeleasing, Probonio, and Bike2Future, presents a significant opportunity for revenue diversification and market share growth. The platform's 10.9% revenue increase in Q1 2025, driven by bicycle resale, highlights its strong potential, especially with the upcoming peak bicycle season.

The Security Technologies segment, particularly IHSE, is well-positioned for growth with a new product generation launching in Q4 2024 and its NIAPC certification for the NATO product catalog. This opens doors to lucrative defense contracts and international markets, capitalizing on the evolving cybersecurity landscape.

Brockhaus Technologies' substantial cash reserves, totaling €53.7 million in 2023, provide the financial flexibility to pursue strategic acquisitions, invest in R&D, and expand into new markets, bolstering its competitive edge and resilience.

| Segment | Key Opportunity | 2023/2024 Data Point |

|---|---|---|

| HR Benefit & Mobility Platform | Leverage seasonal demand and expand resale channels. | 10.9% revenue increase in Q1 2025. |

| Security Technologies (IHSE) | Capitalize on new product launches and NATO certification. | New product generation slated for Q4 2024. |

| Financial Strength | Fund strategic acquisitions and organic growth. | €53.7 million in cash and cash equivalents (2023). |

Threats

Brockhaus Technologies faces ongoing operational hurdles within its subsidiaries, which represent a significant threat. For instance, Bike2Future experienced initial ramp-up difficulties and unexpected revenue shortfalls, impacting its contribution to the group.

Furthermore, customer delivery delays at IHSE have directly affected its revenue and earnings. These persistent operational issues, if not swiftly and effectively managed, could impede the group's overall growth trajectory and profitability.

Brockhaus Technologies anticipates a challenging 2025 with a forecast of substantially increased operating expenses, particularly in personnel and other administrative areas, driven by its strategic transformation initiatives. This upward cost pressure is expected to lead to a projected dip in adjusted EBITDA for the year.

The primary concern here is the potential erosion of profit margins. If the anticipated revenue growth fails to outpace these escalating expenditures, the company's profitability could be significantly impacted, requiring careful cost management and aggressive revenue generation strategies.

Brockhaus Technologies operates in fintech and security tech, areas known for fierce rivalry. Established giants and nimble startups constantly vie for market dominance, creating a challenging environment.

This intense competition can lead to downward pressure on pricing, potentially impacting Brockhaus Technologies' profit margins. Additionally, it necessitates higher spending on research and development to stay ahead, and makes acquiring talent or other companies more expensive.

For instance, the global fintech market was valued at approximately $1.1 trillion in 2023 and is projected to grow significantly, indicating a crowded but expanding space. Similarly, cybersecurity, a key area for Brockhaus, saw global spending reach over $200 billion in 2023, attracting numerous players.

Economic Downturn and Market Sensitivity

Brockhaus Technologies faces significant headwinds from economic downturns, as highlighted in their Q1 2025 financial disclosures. A challenging economic climate, especially impacting consumer discretionary spending, directly threatens demand for services like bicycle leasing. This sensitivity means that a slowdown in consumer confidence or disposable income can lead to reduced revenue streams.

The company's reliance on consumer-facing segments makes it particularly vulnerable to market fluctuations. For instance, a contraction in the broader economy could see a sharp decline in uptake for their mobility solutions. This economic sensitivity is a critical threat that requires careful management and strategic planning to mitigate potential revenue shortfalls.

- Economic Sensitivity: The company's Q1 2025 report indicates operation within a challenging economic environment.

- Demand Impact: Economic downturns can directly reduce demand for consumer-focused services, such as bicycle leasing.

- Revenue Risk: Market sensitivities, particularly in discretionary spending sectors, pose a direct risk to Brockhaus Technologies' revenue generation.

Reputational Risk from Audit Issues and Impairments

The postponement of Brockhaus Technologies' 2024 financial statements, a direct result of an ongoing investigation at a subsidiary, poses a significant threat to its reputation. This delay, alongside substantial non-cash impairments, erodes investor trust and casts a shadow over the company's financial health. Such events can invite heightened regulatory scrutiny and potentially hinder future capital raising or strategic acquisition efforts.

Specifically, the company disclosed in its Q1 2024 report that the investigation into its subsidiary, which led to the financial statement delay, could have material impacts. This uncertainty, coupled with impairments that could reach tens of millions of Euros, directly feeds into reputational risk.

- Delayed Financial Reporting: The inability to release audited 2024 financial statements creates transparency issues.

- Non-Cash Impairments: Significant impairments signal potential overvaluation of assets or poor past investment decisions, impacting market perception.

- Investor Confidence Erosion: These combined factors can lead to a loss of confidence from existing and potential investors, affecting share price and access to capital.

- Future Transaction Hindrance: A tarnished reputation and financial uncertainty can make future fundraising rounds or M&A activities more challenging and costly.

Brockhaus Technologies faces significant threats from escalating operating expenses, particularly in personnel and administration, as it undergoes strategic transformation. These increased costs are projected to reduce adjusted EBITDA in 2025, potentially squeezing profit margins if revenue growth doesn't compensate.

Intense competition in fintech and security tech markets, with global fintech valued at approximately $1.1 trillion in 2023 and cybersecurity spending exceeding $200 billion in 2023, can lead to price pressures and increased R&D investment needs.

The company's vulnerability to economic downturns, as noted in Q1 2025 disclosures, poses a threat to demand for its consumer-focused services like bicycle leasing, directly impacting revenue streams.

The delayed release of Brockhaus Technologies' 2024 financial statements due to an investigation at a subsidiary, coupled with substantial non-cash impairments, significantly damages its reputation and investor trust, potentially hindering future capital access.

SWOT Analysis Data Sources

This Brockhaus Technologies SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry commentary to provide a robust and actionable assessment.