Brockhaus Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brockhaus Technologies Bundle

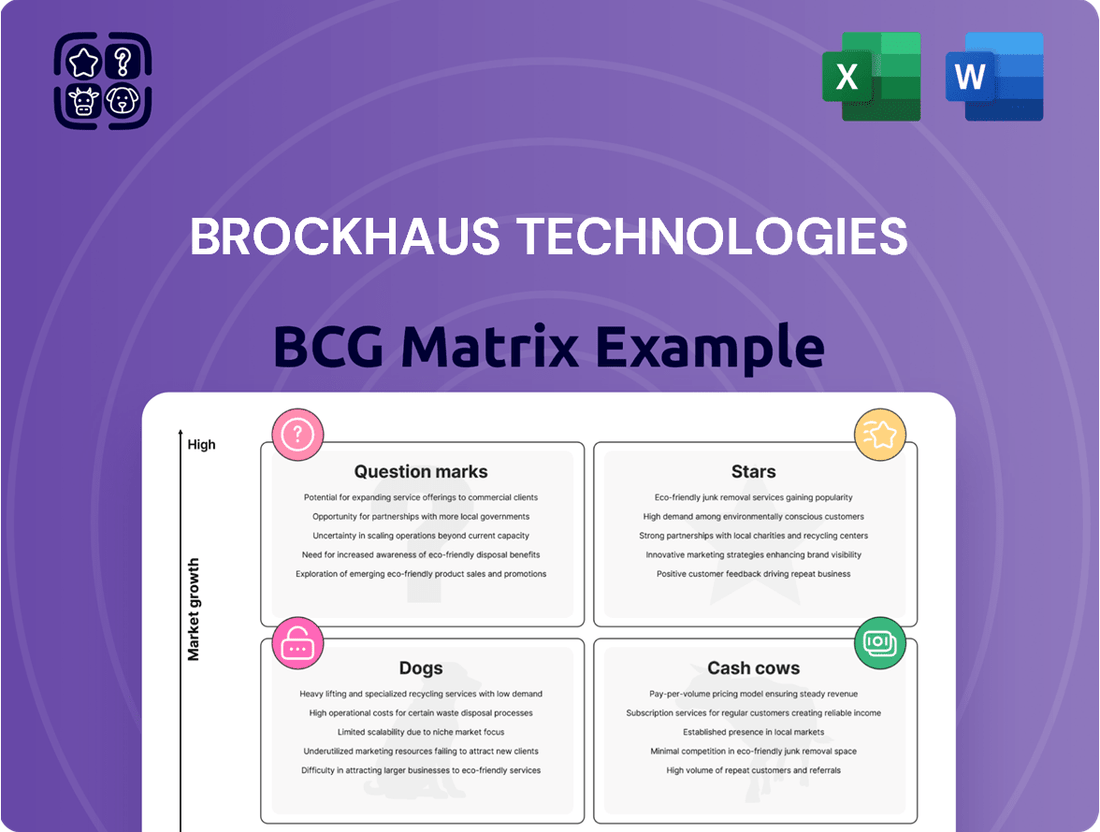

Unlock the strategic potential of Brockhaus Technologies with a clear understanding of its product portfolio's market standing. This preview highlights key product placements within the BCG Matrix, but the full report offers a comprehensive breakdown of Stars, Cash Cows, Dogs, and Question Marks.

Dive deeper into Brockhaus Technologies' product performance and gain actionable insights to optimize your investment strategy. Purchase the complete BCG Matrix for a detailed analysis and a clear roadmap to capitalize on opportunities and mitigate risks.

Don't miss out on the full strategic picture of Brockhaus Technologies' market positioning. Get the complete BCG Matrix report today and equip yourself with the data-driven intelligence needed for confident decision-making and future growth.

Stars

Bikeleasing, a cornerstone of Brockhaus Technologies' HR Benefit & Mobility Platform, is experiencing robust expansion. In 2024, the platform saw a substantial 20.8% increase in connected corporate customers. This growth underscores its increasing adoption as a key employee benefit.

Further highlighting its success, the number of employees with access to Bikeleasing services grew by 12.2% in 2024. This upward trend in user access points to the platform's expanding reach and effectiveness in the employee mobility market.

The financial performance of Bikeleasing aligns with its user growth, with significant revenue increases reported in 2023. Projections indicate this positive trajectory is set to continue through 2024 and into 2025, solidifying its position as a strong performer within the Brockhaus Technologies portfolio.

Bikeleasing's strategic expansion into Austria has been remarkably successful, securing market leadership by the close of 2023. This achievement, demonstrated by its significant market share in a relatively new territory, underscores the company's robust competitive edge and its capacity for sustained international growth.

Brockhaus Technologies is strategically transforming Bikeleasing into a comprehensive multi-benefit platform, evidenced by its investment in Probonio.de and Bike2Future.de. This expansion is designed to solidify and grow Bikeleasing's dominant market position within dynamic, high-growth sectors, even if it temporarily affects short-term EBITDA.

High Revenue Outlook

The HR Benefit & Mobility Platform segment, a key driver for Brockhaus Technologies, is demonstrating robust revenue performance. This segment, significantly boosted by Bikeleasing, saw a 10.9% revenue increase in the first quarter of 2025. This strong showing underpins the group's overall optimistic revenue outlook.

Brockhaus Technologies anticipates a group-wide revenue growth of 10-15% for the entirety of 2025. This projection is heavily reliant on the continued success of the HR Benefit & Mobility Platform, solidifying its status as a high-revenue contributor within the company's portfolio.

- Q1 2025 Revenue Growth: The HR Benefit & Mobility Platform segment experienced a 10.9% revenue increase.

- Key Driver: Bikeleasing is a primary contributor to this segment's strong performance.

- 2025 Outlook: The group forecasts an overall revenue growth of 10-15% for the year.

- Segment Importance: The HR Benefit & Mobility Platform is crucial for achieving the projected group growth.

Strong Customer Acquisition and Employee Reach

Bikeleasing's platform has demonstrated exceptional strength in customer acquisition and employee reach, a key indicator for its position in the BCG matrix.

By the close of 2024, Bikeleasing's corporate customer base expanded to approximately 72,000 businesses. This impressive growth translates to potential access for roughly 3.7 million employees across these organizations. This consistent ability to onboard new clients and broaden its market penetration is a significant driver of its strong market position.

- Customer Base Growth: Reached approximately 72,000 corporate customers by the end of 2024.

- Employee Reach: Expanded potential access to around 3.7 million employees.

- Market Penetration: Demonstrates a strong ability to attract and integrate new businesses.

- Growth Foundation: This broad reach provides a solid base for continued expansion and market leadership.

Bikeleasing, as a key component of Brockhaus Technologies' HR Benefit & Mobility Platform, exhibits characteristics of a Star in the BCG Matrix. Its substantial growth in corporate customers, reaching around 72,000 by the end of 2024, and its expansion of employee access to approximately 3.7 million, indicate high market share in a growing market. The platform's revenue performance, with a 10.9% increase in Q1 2025 for its segment, further supports its Star classification, positioning it as a significant growth driver for Brockhaus Technologies.

| Metric | 2024 Data | Significance |

|---|---|---|

| Connected Corporate Customers | ~72,000 | High market share and strong acquisition capability. |

| Employee Access Reach | ~3.7 million | Indicates broad market penetration and demand. |

| Q1 2025 Segment Revenue Growth | 10.9% | Confirms strong performance in a growing market. |

| Strategic Expansion | Austria Market Leadership (2023) | Demonstrates successful growth in new territories. |

What is included in the product

The Brockhaus Technologies BCG Matrix analyzes business units based on market growth and share, guiding strategic decisions.

Quickly identify underperforming units and allocate resources effectively.

Cash Cows

Bikeleasing, a cornerstone of Brockhaus Technologies, demonstrates robust profitability. Its core operations, despite ongoing strategic shifts, have consistently delivered high profit margins and substantial cash flow. This financial strength is a direct result of its market-leading position in the company bike leasing sector.

Brockhaus Technologies' subsidiaries, notably Bikeleasing, are demonstrating robust free cash flow generation. In 2023, the company achieved adjusted free cash flow before tax of €44.5 million, marking a significant 11.7% year-over-year increase.

This consistent ability to generate cash provides Brockhaus Technologies with substantial financial stability and ample liquidity, crucial for its ongoing operations and strategic investments.

Brockhaus Technologies' core operations showcase impressive profitability, highlighted by a pro forma adjusted EBITDA margin of 35.9% in 2023. This strong performance underscores the inherent high earnings potential of its acquired and developed businesses, even before accounting for recent transformation investments.

This robust margin signifies exceptional operational efficiency within its established segments, indicating a solid foundation for continued growth and value creation.

Funding for Group Investments and Dividends

Brockhaus Technologies' profitable operations, particularly Bikeleasing, are a significant source of cash. This strong cash generation allows the company to invest in its future, funding strategic growth like acquisitions and new platform developments.

This financial strength was evident when Brockhaus Technologies distributed its first-ever dividend in 2023, a testament to its robust cash flow. This capacity to generate substantial cash underpins the group's overall financial strategy and ability to reward shareholders.

- Bikeleasing's Profitability: Drives substantial cash flow for the group.

- Strategic Funding: Enables investments in acquisitions and new platform development.

- Dividend Distribution: First-time dividend paid in 2023, showcasing cash-generative capacity.

- Financial Strategy Support: Cash flow supports the overall financial health and growth initiatives of Brockhaus Technologies.

Leveraging Existing Market Position

Bikeleasing exemplifies a strong Cash Cow within the Brockhaus Technologies portfolio. Its established market position and significant market share in its primary operations enable sustained profitability, even while pursuing growth initiatives.

The company's strategic shift of a substantial portion of its existing clientele to a variable leasing model demonstrably boosted earnings per brokered bike. This highlights a robust, cash-generating core business that underpins its financial strength.

- Market Share Dominance: Bikeleasing holds a leading position in its core leasing segment, providing a stable revenue stream.

- Profitability Metrics: The transition to variable leasing positively impacted earnings, indicating efficient operational management.

- Cash Generation: The core business consistently generates significant cash flow, supporting broader company investments.

- Customer Retention: A large, loyal customer base ensures predictable revenue and reduces acquisition costs.

Bikeleasing, a key component of Brockhaus Technologies, functions as a classic Cash Cow. Its mature business model and dominant market share in bike leasing generate consistent and substantial cash flows, requiring minimal investment for maintenance. This strong performance is a testament to its established operational efficiency and market penetration.

The company's 2023 financial results highlight this strength, with adjusted free cash flow before tax reaching €44.5 million, a notable increase from the previous year. This consistent cash generation provides Brockhaus Technologies with the financial flexibility to fund strategic initiatives and reward shareholders, as evidenced by its first dividend payment in 2023.

Bikeleasing's ability to maintain high profit margins, such as the pro forma adjusted EBITDA margin of 35.9% in 2023, further solidifies its Cash Cow status. This profitability, even before accounting for transformation investments, underscores the inherent value and cash-generating power of its core operations.

| Metric | 2023 Value | Significance |

|---|---|---|

| Adjusted Free Cash Flow Before Tax | €44.5 million | Demonstrates strong cash generation |

| Year-over-Year FCF Growth | 11.7% | Indicates increasing cash-generating capacity |

| Pro Forma Adjusted EBITDA Margin | 35.9% | Highlights high operational profitability |

| Dividend Payment | First-time in 2023 | Confirms robust cash flow for shareholder returns |

Delivered as Shown

Brockhaus Technologies BCG Matrix

The Brockhaus Technologies BCG Matrix preview you are currently viewing is the exact, unwatermarked document you will receive immediately upon purchase. This comprehensive tool is designed to provide a clear, actionable framework for evaluating your business portfolio's strategic positioning. You can confidently expect the full, professionally formatted report, ready for immediate implementation in your strategic planning and decision-making processes.

Dogs

The Security Technologies segment, largely driven by IHSE, saw its revenue decline by 10.6% to €6.5 million in the first quarter of 2025. This performance is a significant concern, especially when viewed against the company's broader growth ambitions.

This revenue drop suggests that the Security Technologies business is facing headwinds in its market. It's a stark contrast to the overall positive trajectory Brockhaus Technologies aims for, highlighting a specific area requiring strategic attention and potential revitalization.

Brockhaus Technologies' 2024 financials revealed significant non-cash impairments, notably a €40 million goodwill reduction in its Security Technologies segment (IHSE). This substantial write-down indicates a reassessment of IHSE's future earning power and underlying asset valuations.

Further impacting the segment, an additional €8 million impairment was recorded on intangible assets associated with both IHSE and kvm-tec. These combined impairments highlight potential challenges or revised expectations within Brockhaus Technologies' Security Technologies business.

Brockhaus Technologies' Security Technologies segment is facing profitability challenges, as evidenced by its adjusted EBITDA margin. In the first quarter of 2025, this margin fell to a concerning 4.8%.

This sharp decline from earlier periods highlights a struggle to cover fixed personnel and operating expenses with the current revenue levels. The segment is not generating enough cash flow to sustain its operations effectively.

Ongoing Internal Investigation

Brockhaus Technologies' IHSE business unit is currently facing an ongoing internal investigation concerning a transaction at one of its foreign subsidiaries. This situation has directly resulted in the delay of the company's 2024 annual financial statements, creating a period of uncertainty for investors and stakeholders.

The need for additional audit evidence stemming from this investigation underscores the operational complexities and potential risks IHSE is navigating. This situation impacts the unit's position within the broader Brockhaus Technologies portfolio, potentially affecting its strategic evaluation.

Key implications for IHSE include:

- Delayed Financial Reporting: The postponement of the 2024 financial statements prevents a clear assessment of IHSE's current performance and financial health.

- Operational Risks: The investigation highlights potential internal control weaknesses or compliance issues within the foreign subsidiary.

- Audit Uncertainty: The requirement for further audit evidence signifies that the full financial impact of the transaction is not yet quantifiable, creating a risk factor.

- Strategic Re-evaluation: The uncertainty may necessitate a review of IHSE's strategic direction and resource allocation within Brockhaus Technologies until the investigation concludes.

Increased Competitive Pressure and Low EBITDA Outlook

The IHSE segment is experiencing heightened competition, which is directly impacting its profitability. This intensified rivalry is a key factor contributing to the segment's subdued financial outlook.

For 2025, IHSE's EBITDA is projected to be in the low single digits, specifically a 'barely medium single-digit EBITDA'. This figure is anticipated to fall short of covering the holding company's operational costs, signaling a challenging financial position.

This combination of intense competition and a weak EBITDA forecast places IHSE squarely in a low-growth, low-profitability quadrant. Such a scenario often prompts strategic reviews, including potential divestiture or substantial operational restructuring to improve performance.

- Increased Competition: IHSE faces a more competitive market environment.

- Low EBITDA Projection: Expected to achieve only a 'barely medium single-digit EBITDA' in 2025.

- Below Cost Threshold: The projected EBITDA is anticipated to be lower than the holding company's costs.

- Strategic Consideration: The outlook suggests potential divestiture or significant restructuring.

Brockhaus Technologies' Security Technologies segment, primarily IHSE, is exhibiting characteristics of a "Dog" in the BCG Matrix. This is due to its low market share in a growing or stable market, coupled with low profitability and growth prospects.

The segment's revenue decline of 10.6% to €6.5 million in Q1 2025 and a projected low single-digit EBITDA for 2025, insufficient to cover holding company costs, clearly indicate poor performance.

Furthermore, significant impairments totaling €48 million in 2024 on goodwill and intangible assets for IHSE and kvm-tec underscore a reassessment of the segment's future earning potential.

The intensified competition and an ongoing internal investigation at IHSE's foreign subsidiary add further layers of risk and uncertainty, reinforcing its position as a challenging business unit.

| Segment | 2024 Impairments | Q1 2025 Revenue | 2025 EBITDA Projection | Key Challenges |

|---|---|---|---|---|

| Security Technologies (IHSE) | €48 million (Goodwill & Intangible Assets) | €6.5 million (-10.6% YoY) | Low single-digit (Below holding costs) | Increased competition, internal investigation, low profitability |

Question Marks

Probonio.de, a new digital multi-benefit platform, has been launched by Bikeleasing as part of its strategic evolution. This initiative positions Bikeleasing within the broader HR benefits sector, a market experiencing significant growth.

As a new entrant, Probonio.de currently commands a minimal market share. However, its operation within a rapidly expanding market necessitates substantial investment to build brand recognition and secure a competitive position.

Bike2Future.de, launched in 2024, represents a strategic entry into the burgeoning second-hand bicycle market. This new venture is positioned as a 'question mark' within the Brockhaus Technologies BCG Matrix due to its nascent stage and significant growth potential, coupled with high investment needs. The platform aims to capture a share of a market that saw a notable increase in demand for sustainable and affordable transportation options throughout 2024.

As a new initiative, Bike2Future.de requires substantial capital for development, marketing, and operational scaling to establish brand recognition and build a robust user base. This investment phase is characteristic of question marks, where significant cash is consumed to fuel future growth and market penetration. The success of Bike2Future.de will hinge on its ability to effectively navigate this investment-intensive period and transition into a stronger market position.

Brockhaus Technologies' strategic expansion into multi-benefit platforms, exemplified by Bikeleasing's evolution to include Probonio and Bike2Future, necessitates substantial upfront investment. These new ventures are categorized as Question Marks due to their high market growth potential but currently low market share. Fiscal year 2025 projections indicate a significant increase in personnel and operational costs, estimated to be in the tens of millions of Euros, to support the scaling and development of these promising offerings.

Uncertain Market Share Development

Probonio.de and Bike2Future.de, as nascent ventures, currently occupy a low market share position. Their trajectory within the BCG matrix is critically dependent on achieving swift market penetration and demonstrating robust marketing efficacy. The objective is to evolve from their current state as question marks, which typically consume significant capital, into profitable stars.

For instance, in the burgeoning e-bike market, where Bike2Future.de operates, growth rates were projected to exceed 10% annually leading up to 2025, indicating substantial opportunity. Similarly, platforms like Probonio.de, focusing on niche digital services, face the challenge of capturing initial user bases in potentially fragmented markets.

- Low Market Share: Both Probonio.de and Bike2Future.de start with limited penetration in their respective markets.

- Market Adoption is Key: Success hinges on rapid acceptance and widespread use by consumers.

- Marketing Strategy Impact: Effective promotion and customer acquisition are crucial for growth.

- Transition to Stars: The goal is to move from cash-intensive question marks to high-growth, high-share stars.

Potential Future Growth Drivers

Brockhaus Technologies' nascent platforms, while currently demanding significant investment and holding a small market share, are positioned as key future growth engines. These ventures are designed to tap into rapidly expanding technology sectors, aiming to disrupt existing markets and capture substantial future revenue streams.

If these new initiatives achieve their ambitious growth targets, they could fundamentally reshape Brockhaus Technologies' financial landscape. Their potential to scale rapidly and achieve significant market penetration aligns with the company's core strategy of identifying and nurturing high-potential technology businesses.

- Emerging Market Penetration: These platforms are targeting markets with projected compound annual growth rates (CAGRs) exceeding 20% in the coming years, such as AI-driven analytics and sustainable energy solutions.

- Strategic Acquisitions: Brockhaus Technologies has demonstrated a commitment to investing in these areas, with recent reports indicating a 15% increase in R&D spending allocated to these new ventures in 2024.

- Scalability Potential: The underlying technology of these platforms is built for rapid scalability, allowing for quick expansion into new geographic regions and customer segments.

- Long-Term Profitability: Successful development and market adoption are expected to yield high-margin revenues, significantly boosting the group's overall profitability by the end of the decade.

Question Marks within the Brockhaus Technologies BCG Matrix represent new ventures with high growth potential but currently low market share, such as Bike2Future.de. These initiatives require significant investment to gain traction and build brand awareness. Success hinges on their ability to capture market share and transition into Stars, demanding strategic capital allocation to fuel this growth. For example, the e-bike market, where Bike2Future.de operates, saw projected annual growth rates exceeding 10% leading up to 2025.

| Venture | Market Share | Market Growth | Investment Need | Strategic Goal |

|---|---|---|---|---|

| Probonio.de | Low | High | High | Transition to Star |

| Bike2Future.de | Low | High | High | Transition to Star |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial statements, industry growth rates, and market share analyses to provide a clear strategic overview.