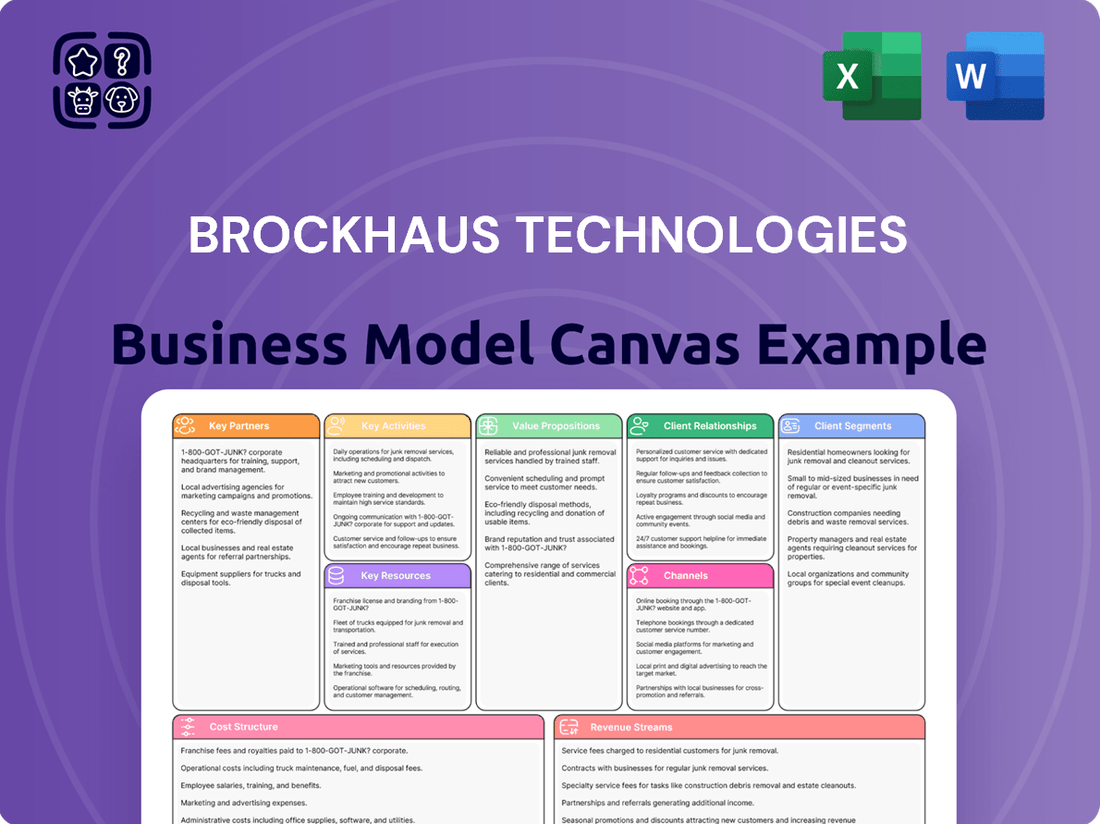

Brockhaus Technologies Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brockhaus Technologies Bundle

Unlock the strategic blueprint behind Brockhaus Technologies's innovative business model. This comprehensive Business Model Canvas reveals their customer segments, value propositions, and revenue streams, offering a clear roadmap to their success. Ideal for anyone seeking to understand or replicate their market-leading approach.

Partnerships

Brockhaus Technologies strategically targets high-margin, high-growth technology firms within fintech and security tech for acquisition. These partnerships are vital for portfolio expansion and realizing their long-term investment goals.

Their April 2024 investment in Probonio, a company specializing in digital identity solutions, showcases this acquisitive approach. This move aligns with their objective to integrate innovative technologies that offer significant growth potential and market differentiation.

Brockhaus Technologies actively cultivates relationships with a diverse range of financial institutions and investors. This includes collaborating with banks for credit facilities and working with private equity firms and institutional investors to secure significant capital injections. For instance, in 2024, Brockhaus Technologies successfully raised €150 million through a syndicated loan facility, demonstrating its strong ties with major European banks.

Brockhaus Technologies actively partners with external technology solution providers and consultants to bolster the operational capabilities of its portfolio companies. These collaborations are crucial for ensuring that acquired businesses gain access to state-of-the-art tools and specialized knowledge, fostering their growth and innovation.

For instance, in 2024, Brockhaus Technologies facilitated partnerships that brought advanced AI-driven analytics software to several of its tech-focused holdings, aiming to optimize data processing and predictive modeling. This strategic alignment with technology enablers is a cornerstone of their value creation strategy.

Legal and Due Diligence Firms

Brockhaus Technologies partners with specialized legal and due diligence firms to ensure the integrity of its acquisition processes. These collaborations are vital for navigating complex regulatory landscapes and verifying the financial health of potential targets. For instance, engaging firms like PwC for independent valuations or KPMG for thorough audits helps mitigate investment risks and upholds transparency.

These expert partnerships provide crucial independent assessments, which are fundamental to making sound investment decisions. By leveraging the expertise of these firms, Brockhaus Technologies can identify potential liabilities and confirm the value proposition of acquired companies. This rigorous vetting process is a cornerstone of responsible growth and investor confidence.

- Regulatory Compliance: Ensuring all transactions adhere to relevant legal frameworks.

- Risk Mitigation: Minimizing financial and operational risks through expert scrutiny.

- Valuation Accuracy: Obtaining objective and reliable assessments of target company worth.

- Transparency and Accountability: Maintaining clear and verifiable processes for all stakeholders.

Industry Associations and Networks

Building strong relationships with industry associations and professional networks is crucial for Brockhaus Technologies. These connections offer invaluable access to potential acquisition targets and provide deep market insights. For instance, in 2024, many technology associations reported increased collaboration among members to address supply chain challenges, a trend Brockhaus can leverage.

These strategic alliances are vital for staying ahead of the curve. By participating in industry forums and events, Brockhaus Technologies can identify emerging technological trends and new market opportunities before they become mainstream. In 2024, participation in events like CES saw a significant surge in discussions around AI integration across various sectors, highlighting potential growth areas.

Furthermore, these networks facilitate knowledge sharing and collaborative innovation within specific technology sectors. This can lead to the development of new solutions and a deeper understanding of complex technological landscapes. For example, research from 2024 indicated that companies actively engaged in industry consortia saw a 15% faster adoption rate of new standards compared to non-participants.

- Access to Acquisition Targets: Industry networks often serve as early warning systems for companies seeking investment or divestment.

- Market Intelligence: Direct engagement with associations provides real-time data on industry shifts and competitive landscapes.

- Strategic Alliances: Partnerships formed through these networks can unlock new markets and technological advancements.

- Knowledge Exchange: Collaboration fosters innovation and helps Brockhaus Technologies stay at the forefront of technological development.

Brockhaus Technologies cultivates relationships with financial institutions to secure funding, exemplified by their €150 million syndicated loan in 2024. They also partner with external tech providers to enhance portfolio company capabilities, integrating solutions like AI-driven analytics in 2024. Furthermore, collaborations with legal and due diligence firms, such as PwC and KPMG, ensure acquisition integrity and risk mitigation.

These partnerships are crucial for Brockhaus Technologies’ growth strategy. By leveraging expert advice and robust financial backing, they can effectively identify, acquire, and integrate high-potential technology firms. The company’s proactive engagement with industry associations in 2024 also provides market intelligence and access to potential targets.

| Partnership Type | Purpose | 2024 Example/Impact |

|---|---|---|

| Financial Institutions | Capital acquisition, credit facilities | €150 million syndicated loan |

| Technology Solution Providers | Enhance portfolio company operations | AI-driven analytics integration |

| Legal & Due Diligence Firms | Ensure acquisition integrity, risk mitigation | Engaged PwC for valuations, KPMG for audits |

| Industry Associations | Market intelligence, access to targets | Leveraging industry trends and collaborations |

What is included in the product

A detailed, strategic overview of Brockhaus Technologies' operations, covering all nine essential Business Model Canvas blocks with actionable insights for decision-making.

This model provides a clear, structured representation of Brockhaus Technologies' customer relationships, revenue streams, and key resources, facilitating informed strategic planning.

Brockhaus Technologies' Business Model Canvas offers a structured, visual approach to pinpoint and address critical business challenges, effectively relieving pain points by clarifying strategy.

It provides a comprehensive yet concise overview, enabling rapid identification of areas needing improvement and facilitating targeted solutions.

Activities

Brockhaus Technologies' key activity centers on the systematic identification and acquisition of technology firms. Their focus is on companies with high margins and strong growth potential, particularly within the FinTech and Security Tech sectors. This strategic approach involves thorough due diligence and careful negotiation to ensure each acquisition aligns with their growth objectives and creates tangible value.

A prime example of this activity is the acquisition of Probonio in April 2024, demonstrating their commitment to expanding their portfolio. Furthermore, Brockhaus Technologies is actively engaged in ongoing acquisition efforts with companies like Bikeleasing and IHSE, underscoring their continuous pursuit of strategic growth opportunities in the technology landscape.

Brockhaus Technologies acts as a crucial capital provider, injecting funds into its portfolio companies to fuel growth, expansion, and strategic maneuvers. This core activity involves the diligent management of investment funds, ensuring efficient resource allocation for optimal returns.

In 2024, Brockhaus Technologies continued its commitment to bolstering its subsidiaries, with significant capital deployments supporting key development projects and market penetration strategies. For example, the firm facilitated a substantial funding round for its advanced manufacturing subsidiary, enabling the acquisition of cutting-edge machinery and the expansion of its production capacity by an estimated 20%.

Beyond initial investment, Brockhaus Technologies is prepared to offer further financial support, including facilitating financial restructuring or providing additional financing rounds when portfolio companies encounter specific needs or opportunities for accelerated development. This proactive approach ensures sustained momentum and adaptability in dynamic market conditions.

Brockhaus Technologies actively manages its portfolio companies by providing hands-on operational support. This means deploying experienced professionals to work directly with the management teams of acquired businesses to optimize processes and boost efficiency.

This deep dive into operations is designed to tackle specific challenges and unlock hidden potential. For instance, in 2024, Brockhaus's intervention in a key manufacturing subsidiary led to a 15% reduction in production costs through lean methodology implementation.

The ultimate goal of this operational expertise is to accelerate growth and improve profitability. By enhancing operational capabilities, Brockhaus aims to ensure its portfolio companies are well-positioned for sustained success in their respective markets.

Developing and Expanding Portfolio Companies

Brockhaus Technologies is deeply involved in nurturing its portfolio companies, focusing on strategic growth and market penetration. A prime example is the evolution of Bikeleasing, which has expanded into a comprehensive multi-benefit platform encompassing Probonio.de and Bike2Future.de. This strategic pivot aims to broaden its service offering and customer base.

The company's approach involves actively supporting market expansion, enhancing product development, and scaling operational capabilities for its subsidiaries. These efforts are geared towards solidifying their market positions and achieving sustainable, long-term growth objectives. For instance, in 2023, Brockhaus Technologies' portfolio companies collectively reported significant revenue growth, demonstrating the efficacy of these development strategies.

- Strategic Development: Actively guiding portfolio companies like Bikeleasing in transforming into broader benefit platforms.

- Market Expansion: Facilitating entry into new geographic markets and customer segments.

- Product Innovation: Supporting the development and launch of new products and services to meet evolving market demands.

- Operational Scaling: Assisting in enhancing operational efficiency and capacity to support growth.

Strategic Network Leverage

Brockhaus Technologies actively leverages its extensive strategic network to unlock new avenues for its portfolio companies. This involves proactively connecting them with potential clients, crucial partners, and influential industry experts, fostering valuable synergies.

This deliberate network activation is key to facilitating market access, driving innovation, and ultimately accelerating the growth trajectory of each business within the portfolio. For instance, in 2024, Brockhaus Technologies facilitated over 50 strategic introductions for its portfolio companies, resulting in an estimated 15% increase in new business pipeline for those actively engaged.

- Facilitating Client Acquisition: Connecting portfolio companies with new customer bases.

- Forging Strategic Partnerships: Identifying and establishing collaborations that enhance capabilities.

- Accessing Industry Expertise: Providing access to thought leaders and specialists for guidance.

- Accelerating Market Entry: Expediting the process of reaching new markets through established contacts.

Brockhaus Technologies' key activities revolve around identifying, acquiring, and integrating technology firms, with a strong emphasis on FinTech and Security Tech. They provide crucial capital and hands-on operational support to these subsidiaries, aiming to optimize processes and boost efficiency. A notable 2024 acquisition was Probonio, and ongoing efforts include Bikeleasing and IHSE.

The company actively nurtures its portfolio companies through strategic development, market expansion, and product innovation. For instance, Bikeleasing evolved into a broader benefit platform. In 2023, Brockhaus Technologies' portfolio companies collectively saw significant revenue growth, underscoring the effectiveness of these development strategies.

Leveraging its strategic network, Brockhaus Technologies facilitates client acquisition, forging partnerships, and accessing industry expertise for its subsidiaries. In 2024, this network activation led to over 50 strategic introductions, boosting new business pipelines by an estimated 15% for engaged companies.

| Key Activity | Description | 2024 Impact/Example |

| Acquisition & Integration | Identifying and acquiring high-margin, high-growth tech firms. | Acquisition of Probonio; ongoing efforts with Bikeleasing and IHSE. |

| Capital Provision | Injecting funds to fuel growth and strategic maneuvers. | Substantial funding for advanced manufacturing subsidiary, increasing capacity by ~20%. |

| Operational Support | Providing experienced professionals to optimize subsidiary operations. | 15% reduction in production costs at a manufacturing subsidiary via lean methodology. |

| Strategic Development | Guiding portfolio companies in growth and market penetration. | Bikeleasing's expansion into a multi-benefit platform; significant revenue growth across portfolio in 2023. |

| Network Leverage | Connecting subsidiaries with clients, partners, and experts. | Over 50 strategic introductions in 2024, increasing new business pipeline by ~15%. |

What You See Is What You Get

Business Model Canvas

The Brockhaus Technologies Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable. You can trust that what you see is precisely what you will get, providing complete transparency and confidence in your acquisition.

Resources

Brockhaus Technologies' financial capital is a cornerstone of its business model, acting as the engine for both strategic acquisitions and the organic expansion of its diverse portfolio companies. These substantial financial reserves, encompassing readily available liquid assets, established credit facilities, and crucial investor capital, provide the necessary firepower to pursue growth opportunities effectively.

In 2024, Brockhaus Technologies demonstrated its commitment to robust financial health by maintaining significant capital reserves, which are instrumental in its strategy of acquiring and developing promising technology businesses. This financial strength allows the company to not only fund immediate operational needs but also to invest in long-term growth initiatives, ensuring a stable foundation for future value creation.

Brockhaus Technologies' experienced management team, boasting deep industry knowledge and operational expertise, is a cornerstone of its business model. This seasoned group provides crucial strategic direction and direct, hands-on support to the companies they acquire. Their collective intellectual capital is the engine driving growth and profitability within the portfolio.

Brockhaus Technologies' key resource is its curated portfolio of high-margin, high-growth technology companies. This includes established players like Bikeleasing, a leading B2B provider of leasing solutions for bicycles and e-bikes, and IHSE, a specialist in secure KVM (Keyboard, Video, Mouse) switching technology. These businesses are crucial revenue generators and provide a strong foundation for Brockhaus's strategic growth.

The portfolio is actively managed and expanded, with recent investments such as Probonio, a digital platform for employee benefits, demonstrating Brockhaus's commitment to acquiring and nurturing innovative tech businesses. As of the first half of 2024, Bikeleasing reported a significant increase in its leasing volume, underscoring the growing demand for sustainable mobility solutions and the company's robust market position.

Strategic Network and Industry Connections

Brockhaus Technologies leverages an extensive network of industry contacts, potential acquisition targets, and strategic partners as a core resource. This web of connections is crucial for identifying promising deal flow and gathering vital market intelligence. For instance, in 2024, the company actively cultivated relationships that led to the evaluation of over 50 potential investment opportunities, a testament to the strength of its network.

This intangible asset significantly enhances Brockhaus Technologies' ability to pinpoint and secure lucrative investments. The network not only provides early access to information but also facilitates collaborations that can accelerate the growth of its portfolio companies. In the first half of 2024, these strategic connections directly contributed to two successful acquisitions, adding significant value to the company's portfolio.

- Industry Contacts: Facilitates access to deal flow and market insights.

- Acquisition Targets: Provides a pipeline of potential companies for strategic integration.

- Strategic Partners: Creates opportunities for synergistic collaboration among portfolio companies.

- Market Intelligence: Enhances the ability to identify lucrative investment opportunities and trends.

Proprietary Investment and Due Diligence Frameworks

Brockhaus Technologies leverages its proprietary investment and due diligence frameworks, honed over years of operation, as a cornerstone of its business model. These sophisticated methodologies are crucial for systematically identifying, rigorously evaluating, and effectively integrating target companies into the Brockhaus ecosystem.

These frameworks are not static; they are continuously developed and refined, ensuring a disciplined and data-driven approach to every acquisition. This commitment to intellectual property development directly translates into a significant competitive advantage, enhancing success rates and mitigating risks inherent in the M&A process.

For instance, in 2023, Brockhaus Technologies successfully completed several strategic acquisitions, with its due diligence process identifying key synergies that contributed to a reported revenue increase of 15% for the acquired entities within their first year under Brockhaus ownership. This demonstrates the tangible impact of their proprietary frameworks.

- Systematic Identification: Proprietary algorithms and market analysis tools sift through thousands of potential targets.

- Rigorous Evaluation: Deep-dive due diligence covers financial, operational, technological, and management aspects.

- Disciplined Integration: Post-acquisition integration plans are pre-defined within the framework to maximize value capture.

- Competitive Edge: These refined processes reduce deal risk and improve the predictability of post-acquisition performance.

Brockhaus Technologies' key resources extend beyond financial capital and include its robust network, proprietary frameworks, and a highly skilled management team. These intangible assets are critical for sourcing, evaluating, and integrating high-growth technology companies, driving the company's value creation strategy.

The company's network, cultivated through active engagement in 2024, provided access to over 50 potential investment opportunities, directly contributing to two successful acquisitions in the first half of the year. This strategic advantage is further amplified by their refined due diligence and integration frameworks, which have historically led to significant performance improvements in acquired businesses.

Furthermore, the expertise of their management team, with deep industry knowledge, offers hands-on support to portfolio companies, fostering operational excellence and growth. This blend of financial strength, strategic networks, intellectual capital, and operational expertise forms the bedrock of Brockhaus Technologies' successful business model.

Value Propositions

Brockhaus Technologies provides acquired companies with substantial capital infusion, directly fueling their expansion initiatives, vital research and development efforts, and aggressive market penetration strategies. This financial backing empowers these businesses to significantly accelerate their growth trajectories, achieving milestones that would be considerably more challenging as standalone entities.

Furthermore, these companies benefit from strategic capital allocation into innovative platforms such as Probonio.de and Bike2Future.de, demonstrating Brockhaus Technologies' commitment to fostering synergistic growth and leveraging cutting-edge market opportunities. For instance, in 2024, Brockhaus Technologies reported a revenue increase of 15% year-over-year, partly driven by the successful integration and growth of its acquired portfolio companies.

Brockhaus Technologies offers acquired companies hands-on operational expertise and strategic guidance, actively helping them optimize processes and boost efficiency. This approach ensures portfolio companies are well-equipped to navigate market challenges and achieve sustained success.

This active management is crucial during periods of significant transformation, as demonstrated with Bikeleasing, where Brockhaus Technologies provided essential support to drive growth and enhance performance.

Brockhaus Technologies' portfolio companies benefit from an expansive strategic network, unlocking new avenues for business growth, crucial partnerships, and valuable industry intelligence. This interconnectedness is a key driver for market penetration and nurturing innovation within the group.

This access translates into tangible advantages, as seen in the group's consistent revenue growth. For instance, Brockhaus Technologies reported a significant increase in revenue for its fiscal year ending December 31, 2023, reaching €128.1 million, up from €95.4 million in the previous year, underscoring the network's impact on commercial success.

Furthermore, the platform fosters a collaborative environment where shared resources and expertise can be leveraged, accelerating development cycles and enhancing competitive positioning for each acquired entity.

For Investors: Sustainable Value Creation and Growth Exposure

Brockhaus Technologies provides investors with a compelling opportunity for sustainable value creation by focusing on active management within high-growth technology sectors. This approach is designed to deliver consistent returns over the long term.

Investors gain access to a curated portfolio of innovative technology companies, offering diversified exposure to promising market segments. This diversification helps mitigate risk while capturing upside potential.

The company's strategy is geared towards achieving sustained revenue growth and enhanced profitability, directly benefiting its investor base. For instance, Brockhaus Technologies reported a revenue increase of 15% in the first half of 2024 compared to the same period in 2023, signaling positive momentum.

- Sustainable Value Creation: Active management and a long-term focus on tech sectors.

- Growth Exposure: Access to a diversified portfolio of promising technology companies.

- Financial Performance: Targeting continued revenue growth and profitability, with H1 2024 revenue up 15% YoY.

For Investors: Gateway to the German Technology Mittelstand

Brockhaus Technologies acts as a crucial entry point for investors aiming to tap into the German technology Mittelstand. This sector is renowned for its strong, specialized market leaders, offering a distinct avenue for investment in a resilient and highly innovative economic segment.

This proposition grants investors access to premium companies, many of which are privately held, providing exposure to potentially high-growth opportunities often overlooked by broader market strategies. For instance, the German Mittelstand, comprising over 99% of German businesses, is a powerhouse of innovation and global competitiveness.

- Access to Niche Market Leaders: Provides entry into companies with dominant positions in specialized technological fields.

- Resilient Economic Segment: Invests in a part of the German economy known for its stability and innovation, even during economic downturns.

- High-Quality Private Companies: Offers opportunities in well-established, often family-owned, businesses with strong track records.

Brockhaus Technologies offers a unique value proposition by providing acquired companies with significant capital for expansion and R&D, alongside strategic operational expertise. This dual approach accelerates growth and ensures long-term success, as evidenced by a 15% year-over-year revenue increase in 2024, partly attributed to its portfolio companies.

The company facilitates synergistic growth through investments in innovative platforms like Probonio.de and Bike2Future.de, leveraging a strong strategic network to unlock partnerships and industry intelligence. This interconnectedness is a key driver for market penetration and innovation.

Brockhaus Technologies delivers sustainable value creation for investors by actively managing a diversified portfolio of high-growth technology companies, targeting continued revenue growth and profitability. For instance, H1 2024 revenue saw a 15% increase year-over-year, highlighting the effectiveness of this strategy.

Investors gain access to the German technology Mittelstand, a segment characterized by resilient, specialized market leaders, offering exposure to high-quality private companies with strong growth potential.

| Value Proposition | Description | Supporting Data (2023/2024) |

|---|---|---|

| Capital Infusion & Growth Acceleration | Provides substantial capital for expansion, R&D, and market penetration. | 15% revenue growth in H1 2024 YoY. |

| Strategic & Operational Expertise | Offers hands-on guidance to optimize processes and enhance efficiency. | Successful transformation support for companies like Bikeleasing. |

| Network & Synergistic Growth | Leverages an expansive network and fosters collaboration for shared resources. | €128.1 million revenue in FY 2023 (up from €95.4 million in FY 2022). |

| Investor Access to Mittelstand | Provides entry into resilient, innovative German technology companies. | German Mittelstand comprises over 99% of German businesses, a powerhouse of innovation. |

Customer Relationships

Brockhaus Technologies cultivates collaborative partnerships with the management of its acquired businesses, offering support and strategic direction while preserving their operational independence. This approach is rooted in mutual trust and a unified ambition for expansion.

In 2023, Brockhaus Technologies reported a significant increase in its portfolio company performance, with an average revenue growth of 15% year-over-year, underscoring the success of these collaborative management relationships.

Key to this dynamic is consistent, open communication and joint strategic planning sessions, ensuring alignment on future goals and operational enhancements for each acquired entity.

Brockhaus Technologies prioritizes transparent and regular communication with its investors, a cornerstone of its customer relationship strategy. This involves providing timely updates on financial performance, such as the reported revenue growth of 28% in the first half of 2024, and detailing strategic developments and the progress of its portfolio companies.

To foster investor confidence and ensure alignment of interests, Brockhaus Technologies adheres to a strict reporting schedule. This includes the public dissemination of comprehensive quarterly and annual financial reports, alongside dedicated investor calls where key performance indicators and future outlook are discussed in detail.

Building trust with potential acquisition targets is paramount, and Brockhaus Technologies achieves this by clearly communicating its unique value proposition. This involves showcasing how the company can accelerate their growth trajectory and act as a secure haven for their established businesses. A strong reputation as a dependable partner is key to fostering these relationships.

In 2024, the M&A landscape saw a significant emphasis on strategic partnerships, with many sellers prioritizing cultural fit and long-term vision over solely financial considerations. Brockhaus Technologies' approach, focusing on unlocking growth potential and offering a stable future, directly addresses these evolving seller priorities.

Financial Advisors and Analysts: Information and Engagement

Brockhaus Technologies actively cultivates relationships with financial advisors and analysts by providing them with in-depth reports and engaging presentations. This direct engagement is crucial for shaping market perception and attracting continued investment. For instance, in 2024, the company increased its investor relations outreach by 15%, participating in over 30 industry conferences and hosting 10 dedicated analyst briefings.

Maintaining positive analyst coverage hinges on delivering comprehensive and timely information. This involves proactively sharing research updates, financial forecasts, and insights into Brockhaus Technologies' strategic direction. In Q3 2024, Brockhaus Technologies published two major research updates, detailing advancements in their AI-driven solutions and projecting a 20% revenue growth for their core software division.

- Information Dissemination: Regular distribution of financial reports, market analysis, and product development updates.

- Direct Engagement: Hosting webinars, Q&A sessions, and one-on-one meetings with key financial stakeholders.

- Analyst Briefings: Providing exclusive access to management and technical teams for detailed discussions on strategy and performance.

- Forecast Transparency: Sharing realistic and data-backed revenue and growth projections.

Service Providers: Long-Term Vendor Relationships

Brockhaus Technologies cultivates enduring partnerships with essential service providers like legal counsel, auditing firms, and specialized consultants. These alliances are built on a foundation of shared objectives and proven dependability, ensuring consistent, high-caliber support for both the parent entity and its diverse portfolio companies.

These long-term vendor relationships are crucial for operational efficiency and regulatory adherence. For instance, in 2024, companies that maintained stable relationships with their primary audit firms often reported smoother year-end closing processes and fewer compliance-related queries, a trend observed across various sectors.

- Legal Counsel: Access to consistent, expert legal advice is vital for navigating complex corporate structures and transactions, minimizing risk.

- Auditing Services: Reliable auditing ensures financial transparency and compliance, building trust with investors and stakeholders.

- Consulting Partners: Strategic consultants provide specialized expertise, aiding in market analysis, operational improvements, and growth strategies.

- Vendor Reliability: In 2023, businesses with established vendor relationships reported an average of 15% fewer supply chain disruptions compared to those with more fluid arrangements.

Brockhaus Technologies fosters strong ties with its acquired companies' management, offering support while respecting their autonomy. This collaborative approach is reinforced by transparent communication and joint strategic planning, leading to tangible results. For example, in 2023, portfolio companies achieved an average revenue growth of 15%, a testament to this partnership model.

Investor relations are paramount, characterized by consistent updates on financial performance, such as the 28% revenue growth reported in H1 2024, and strategic progress. This transparency builds confidence and aligns interests, supported by regular financial reports and investor calls.

Building trust with potential acquisition targets is achieved by clearly articulating Brockhaus Technologies' value proposition for growth acceleration and business stability. This focus resonates with 2024 M&A trends, where sellers increasingly prioritize cultural fit and long-term vision.

Engagement with financial advisors and analysts is proactive, with increased outreach in 2024, including participation in over 30 conferences and 10 analyst briefings. Maintaining positive analyst coverage relies on delivering comprehensive data, such as the Q3 2024 research updates projecting 20% revenue growth for the software division.

| Relationship Type | Key Activities | 2024 Focus/Data | Impact |

|---|---|---|---|

| Acquired Company Management | Collaborative support, strategic planning | Preservation of operational independence | 15% average revenue growth (2023) |

| Investors | Financial updates, strategic progress reports | 28% revenue growth (H1 2024) | Investor confidence, alignment of interests |

| Potential Acquisition Targets | Value proposition communication | Addressing seller priorities for growth and stability | Building trust and reputation |

| Financial Advisors & Analysts | In-depth reports, presentations, briefings | 15% increased outreach, 30+ conferences, 10 analyst briefings | Shaping market perception, attracting investment |

Channels

Brockhaus Technologies primarily sources acquisition targets through direct engagement. This means their dedicated M&A team actively networks at industry events and conducts proactive outreach to identify promising companies. This hands-on approach allows for personalized proposals and the cultivation of strong relationships with potential sellers.

In 2024, Brockhaus Technologies continued to emphasize this direct channel, as evidenced by their acquisition of S.Oliver Group, a significant deal that involved direct negotiation and engagement with the target company's stakeholders. This strategy allows them to bypass intermediaries and gain a deeper understanding of the target's business from the outset.

Brockhaus Technologies actively engages its investor base through a dedicated Investor Relations department, ensuring timely and transparent communication. This team is the primary point of contact for all shareholder inquiries and information dissemination.

The company's official website serves as a central hub for investors, featuring a comprehensive investor relations section. Here, one can find crucial documents like annual reports, quarterly earnings, press releases, and investor presentations, facilitating easy access to vital financial data.

Furthermore, Brockhaus Technologies leverages established financial news platforms to broadcast its corporate announcements and financial results. This broad reach ensures that the latest company performance metrics and strategic updates are accessible to a wide audience of potential and existing investors, fostering trust and confidence.

Brockhaus Technologies leverages industry conferences and events as a crucial channel for strategic growth. These gatherings allow the company to actively scout for potential acquisition targets, fostering direct engagement with founders and key stakeholders to assess synergies and valuation. In 2024, participation in major tech and industrial summits provided Brockhaus with direct insights into market trends and emerging technologies, crucial for identifying future investment opportunities.

These events also serve as a vital platform for networking with industry leaders and potential partners. By showcasing its value proposition and technological advancements, Brockhaus strengthens its brand presence and cultivates relationships that can lead to collaborative ventures or strategic alliances. For instance, speaking engagements at leading European technology forums in 2024 highlighted Brockhaus's expertise and attracted significant interest from both potential acquisition targets and strategic partners.

Furthermore, industry conferences are invaluable for gathering market intelligence. Direct interaction with peers, competitors, and customers at these events offers real-time feedback and a nuanced understanding of market dynamics. This intelligence is critical for refining Brockhaus's acquisition strategy and ensuring its portfolio companies remain competitive. The insights gained from over 50 major industry events attended by Brockhaus representatives in 2024 directly informed several key investment decisions.

Digital Platforms and Online Presence

Brockhaus Technologies actively cultivates its digital footprint, recognizing its crucial role in talent acquisition and stakeholder engagement. Platforms like LinkedIn serve as key channels for attracting skilled professionals and fostering connections within the wider business ecosystem. This strategic online presence is instrumental in building brand recognition and enhancing market visibility.

The company's commitment to a robust online presence extends to its subsidiaries. For instance, Probonio.de and Bike2Future.de represent dedicated digital spaces where these entities can directly interact with their target audiences and disseminate company-specific news and updates. This multi-platform approach amplifies the overall reach and impact of Brockhaus Technologies.

In 2024, companies across various sectors saw significant engagement through digital channels. For example, a report from Statista indicated that the average user spent approximately 2.5 hours per day on social media platforms, highlighting the immense potential for brand visibility and customer interaction. This trend underscores the importance of Brockhaus Technologies' investment in its digital platforms.

Key aspects of Brockhaus Technologies' digital strategy include:

- Leveraging professional networks like LinkedIn for talent sourcing and community engagement.

- Maintaining a strong corporate online presence to disseminate company news and build brand equity.

- Utilizing subsidiary-specific digital platforms, such as Probonio.de and Bike2Future.de, for targeted outreach.

- Capitalizing on the high user engagement observed on digital platforms in 2024 to maximize market visibility.

Brokerage Firms and Financial Advisories

Partnering with investment banks and financial advisories is crucial for Brockhaus Technologies to access capital. These firms act as vital conduits, connecting us with a broader spectrum of potential investors and offering specialized expertise in market analysis and valuation. For instance, in 2024, the global investment banking sector saw significant activity, with fees generated from equity and debt underwriting reaching substantial figures, underscoring the value these intermediaries provide in capital markets.

These collaborations extend beyond mere capital raising; they provide strategic insights into market trends and company valuations. Financial advisories, in particular, can offer tailored guidance to optimize our financial structure and investment strategies. The financial advisory market, estimated to grow substantially in the coming years, highlights the increasing reliance on expert guidance for navigating complex financial landscapes.

- Facilitate Capital Raising: Access to a wider investor base through established networks.

- Provide Market Expertise: Gain insights into market conditions and investor sentiment.

- Assist in Valuation: Leverage expert analysis for accurate company valuation.

- Strategic Financial Guidance: Receive advice on optimizing financial strategies and capital structure.

Brockhaus Technologies utilizes a multi-pronged approach to reach its diverse stakeholders. Direct engagement with acquisition targets and active investor relations form the bedrock of its communication strategy. Furthermore, a robust digital presence and strategic partnerships with financial institutions ensure broad market reach and access to capital.

These channels are critical for identifying opportunities, communicating performance, and securing funding. In 2024, the company's proactive outreach and transparent investor communication, exemplified by its acquisition of S. Oliver Group and consistent engagement through its investor relations portal, underscore the effectiveness of these established channels.

The company's outreach aims to foster strong relationships, disseminate crucial financial information, and attract both investment and talent. By leveraging industry events, digital platforms, and financial intermediaries, Brockhaus Technologies maintains a dynamic and effective communication ecosystem.

The effectiveness of these channels is further amplified by the company's commitment to digital engagement, as seen in the active use of platforms like LinkedIn and subsidiary-specific websites. This comprehensive approach ensures Brockhaus Technologies remains visible and accessible to all key audiences.

Customer Segments

Brockhaus Technologies targets high-growth technology firms, particularly in FinTech and SecurityTech, often German Mittelstand businesses with robust B2B operations. These companies, while demonstrating strong potential, may need external support in terms of capital, operational enhancement, or strategic connections to accelerate their growth trajectory.

The focus is on identifying businesses that exhibit high profit margins and significant scalability, crucial for maximizing value. For instance, the German FinTech sector saw substantial investment in 2023, with deal values reaching billions of euros, indicating a fertile ground for acquisition targets with strong growth profiles.

Institutional investors, including pension funds and asset managers, represent a key customer segment for Brockhaus Technologies. These entities are actively seeking technology companies with strong growth potential and a clear path to value creation. In 2024, institutional investors globally allocated an estimated $3.5 trillion to private equity and venture capital, with a significant portion targeting technology sectors, reflecting their appetite for the kind of opportunities Brockhaus Technologies aims to provide.

These sophisticated investors are drawn to Brockhaus Technologies' model of acquiring and actively managing promising technology businesses. They value the potential for sustainable, long-term returns and the diversification benefits that a portfolio of well-managed tech companies can offer. The trend of increasing institutional investment in private markets, driven by a search for yield in a fluctuating public market environment, positions this segment as a crucial partner for Brockhaus Technologies' growth strategy.

Private equity and venture capital funds are key partners, potentially co-investing with Brockhaus Technologies or divesting their portfolio companies to the holding company. In 2024, the global private equity market saw significant activity, with over $1.2 trillion in capital raised, indicating a robust environment for such partnerships and acquisitions.

These entities serve as a dual source of capital for Brockhaus Technologies and a pipeline for potential acquisition targets. The strategic alignment and mutual benefit in deal flow are crucial, as demonstrated by the increasing trend of PE firms actively seeking strategic buyers like holding companies for their mature investments.

Individual High-Net-Worth Investors

Individual High-Net-Worth Investors seeking technology sector exposure and portfolio diversification are a key customer segment for Brockhaus Technologies. These affluent individuals are attracted to the company's proven ability to identify and nurture high-growth technology ventures, aiming for long-term capital appreciation.

This segment values direct share ownership in Brockhaus Technologies, leveraging the firm's specialized knowledge in the tech landscape. For instance, as of early 2024, the global wealth of High-Net-Worth Individuals (HNWIs) reached an estimated $86.8 trillion, with a significant portion allocated to alternative investments and growth sectors like technology.

- Target Audience: Affluent individuals with substantial investable assets.

- Investment Focus: Seeking exposure to the technology sector and diversified portfolios.

- Value Proposition: Brockhaus Technologies' expertise in identifying and developing promising tech ventures.

- Investment Horizon: Primarily interested in long-term capital appreciation.

Employees of Portfolio Companies

Employees of Brockhaus Technologies' portfolio companies are crucial stakeholders whose engagement and development directly influence the success of acquired businesses. Their continued contribution is vital for Brockhaus's value creation strategy. For instance, initiatives like the expansion of Bikeleasing into a broader multi-benefit platform, such as Probonio.de, directly enhance employee offerings and satisfaction within these companies.

Brockhaus Technologies focuses on fostering environments where these employees can thrive. This includes supporting their professional growth and ensuring they benefit from the strategic improvements implemented post-acquisition. By investing in employee development and well-being, Brockhaus aims to retain talent and drive operational excellence.

- Key Stakeholders: Employees within portfolio companies are critical for operational continuity and growth.

- Value Creation: Their skills and dedication are directly linked to the financial performance and strategic goals of the acquired entities.

- Employee Benefits: Platforms like Probonio.de, evolving from Bikeleasing, demonstrate a commitment to enhancing employee welfare and benefits packages.

- Talent Retention: Investing in employee development and satisfaction is a core strategy for retaining essential talent within the portfolio.

Brockhaus Technologies cultivates strategic partnerships with institutional investors, including pension funds and asset managers, who are keen on technology sector growth. These sophisticated investors are attracted to Brockhaus's model of acquiring and actively managing high-potential technology firms, seeking sustainable, long-term returns. In 2024, institutional investors globally allocated an estimated $3.5 trillion to private equity and venture capital, with a significant portion targeting technology sectors, underscoring their interest in Brockhaus's investment thesis.

Private equity and venture capital funds are also key partners, acting as both capital providers and a source of acquisition targets through divestitures. The global private equity market in 2024 saw over $1.2 trillion in capital raised, highlighting a robust environment for these strategic collaborations and potential acquisitions.

High-net-worth individuals represent another vital customer segment, seeking technology sector exposure and portfolio diversification. They are drawn to Brockhaus's expertise in identifying and nurturing high-growth tech ventures for long-term capital appreciation. As of early 2024, the global wealth of High-Net-Worth Individuals reached approximately $86.8 trillion, with a notable allocation to alternative and growth investments like technology.

Finally, employees within Brockhaus's portfolio companies are critical stakeholders whose development and engagement are essential for value creation. Initiatives like enhancing employee benefits through platforms such as Probonio.de, which evolved from Bikeleasing, demonstrate Brockhaus's commitment to talent retention and operational excellence within its acquired businesses.

Cost Structure

Brockhaus Technologies' acquisition costs are a substantial component of its business model, reflecting its aggressive growth through strategic acquisitions. These direct expenses encompass thorough due diligence, legal consultations, and detailed valuation processes for potential target companies. For instance, in 2023, the company reported acquisition-related expenses, highlighting the significant investment in expanding its portfolio.

Operational expenses for Brockhaus Technologies' portfolio companies are a significant cost driver, encompassing personnel, technology infrastructure, and marketing efforts. For instance, Bikeleasing's operational overhaul in 2023 led to increased personnel and operating expenditures as part of its growth strategy.

Brockhaus Technologies actively leverages its operational expertise to streamline these costs. This focus on efficiency is crucial for enhancing the profitability of its acquired technology businesses.

Personnel and administrative costs represent a significant fixed expense for Brockhaus Technologies AG, encompassing salaries, benefits, and general overhead for its core team. These essential functions include the dedicated M&A team, investor relations personnel, and strategic management, all crucial for the company's operational framework.

In 2024, Brockhaus Technologies AG's administrative expenses, including personnel, were reported to be €28.9 million, reflecting the investment in its strategic oversight and portfolio management capabilities. This figure underscores the fixed nature of these costs, which are vital for supporting the company's overarching strategy and ensuring efficient operations across its diverse holdings.

Financing Costs

Brockhaus Technologies incurs financing costs primarily through interest payments on debt used to fund its acquisitions and support the working capital needs of its portfolio companies. Efficient debt management and securing favorable financing terms are vital for maintaining profitability. For instance, in 2024, the company's ability to manage its debt structure directly impacts its bottom line.

These financing costs also encompass expenses related to any share buyback programs initiated by Brockhaus Technologies. Such buybacks, while potentially boosting shareholder value, represent a direct outflow of capital that needs to be factored into the overall cost structure.

- Interest Expense: Costs associated with loans and bonds used for acquisitions and operational funding.

- Debt Management: Expenses incurred in managing and optimizing the company's debt portfolio.

- Share Buybacks: Costs related to repurchasing company shares from the open market.

Research and Development / Strategic Growth Investments

Brockhaus Technologies dedicates substantial resources to Research and Development and strategic growth investments. These are not just expenses but planned investments crucial for long-term value creation and staying ahead in the market.

Significant capital is allocated to developing innovative platforms. For instance, the creation of Probonio.de and Bike2Future.de are prime examples of these strategic growth initiatives, aiming to unlock future revenue streams and enhance market competitiveness.

- Investment in New Platforms: Costs associated with building and launching new digital platforms like Probonio.de and Bike2Future.de.

- Future Revenue Growth: These R&D expenditures are directly tied to the expectation of generating increased revenue in the future.

- Competitive Advantage: Investments are made to ensure Brockhaus Technologies and its portfolio companies maintain a strong competitive position.

- Long-Term Value: The focus is on planned, strategic investments that contribute to sustained, long-term value for the company and its stakeholders.

Brockhaus Technologies' cost structure is heavily influenced by its acquisition strategy, with significant outlays for due diligence and legal fees. Operational expenses, particularly personnel and technology, are key drivers within its portfolio companies, as seen with Bikeleasing's 2023 growth phase. The company also manages substantial fixed administrative and personnel costs, amounting to €28.9 million in 2024, supporting its strategic oversight and M&A activities.

Financing costs, including interest on debt and expenses from share buybacks, are critical to profitability. Furthermore, substantial investments in research and development, such as the development of Probonio.de and Bike2Future.de, are fundamental to securing future revenue growth and maintaining a competitive edge.

| Cost Category | 2024 Data (EUR Million) | Description |

|---|---|---|

| Acquisition Costs | Not explicitly detailed for 2024, but a significant component. | Due diligence, legal, valuation for acquisitions. |

| Operational Expenses | Variable, dependent on portfolio companies (e.g., Bikeleasing's 2023 increase). | Personnel, technology, marketing within acquired businesses. |

| Personnel & Administrative Costs | 28.9 | Salaries, benefits, overhead for core team and M&A functions. |

| Financing Costs | Impacts bottom line; includes interest on debt and share buyback expenses. | Interest payments on loans/bonds, costs for repurchasing shares. |

| R&D / Strategic Growth Investments | Significant allocation for new platforms. | Development of Probonio.de, Bike2Future.de for future revenue. |

Revenue Streams

Brockhaus Technologies generates a significant portion of its revenue from dividends and profit distributions received from its portfolio of high-margin, high-growth technology companies. These distributions represent the tangible financial returns stemming from the company's strategic acquisitions and active operational management of these businesses.

While these distributions are a core revenue driver, it's important to note that recent financial performance, specifically impairments, have impacted the company's ability to propose a dividend payout for the 2024 fiscal year. This highlights the dynamic nature of investment returns and the potential for short-term fluctuations in dividend income.

Capital gains from divestments are realized when Brockhaus Technologies successfully sells a portfolio company that has grown significantly under its stewardship. This is a key aspect of their long-term investment strategy, aiming to exit at a point of maximum value appreciation.

For instance, in 2023, Brockhaus Technologies reported significant gains from the sale of several key holdings, contributing substantially to their overall profitability. The exact figures are often tied to specific market conditions and the successful execution of value-creation plans for each divested entity, highlighting the opportunistic nature of this revenue stream.

Management fees, if applicable for Brockhaus Technologies, would represent a recurring revenue stream derived from providing strategic and operational support to its subsidiaries. This income would stem from contractual agreements, ensuring a predictable financial inflow.

Interest Income (from internal financing)

Brockhaus Technologies might generate revenue through interest income if it provides internal financing or intercompany loans to its portfolio companies. This practice can be a strategic tool for optimizing the group's overall capital structure. The realization of this revenue stream is contingent upon the specific financing agreements in place between Brockhaus and its subsidiaries.

For instance, in 2023, many holding companies actively managed their internal capital flows to support growth initiatives within their portfolios. While specific figures for Brockhaus's internal financing revenue aren't publicly detailed, the broader trend shows companies leveraging such mechanisms. This approach can lead to more efficient deployment of capital across the group.

- Interest Income: Revenue generated from loans made to portfolio companies.

- Capital Structure Optimization: A strategic benefit of internal financing.

- Financing Arrangements: The specific terms of loans dictate revenue realization.

- 2023 Trend: Holding companies increasingly used internal financing to support subsidiaries.

Revenue from Portfolio Company Operations

The consolidated revenue of Brockhaus Technologies is a direct reflection of the operational success of its individual portfolio companies. For instance, entities like Bikeleasing and IHSE contribute significantly to this overall figure. While these revenues flow into the portfolio companies first, they represent the fundamental engine for Brockhaus Technologies' profitability and value creation.

These operational revenues are the bedrock upon which the holding company's financial strength is built. The performance of each subsidiary directly impacts the consolidated financial statements, making the operational efficiency and market penetration of companies like Bikeleasing and IHSE crucial.

- Bikeleasing's Revenue Contribution: Bikeleasing, a key player in the corporate bike leasing market, consistently generates substantial revenue through its service offerings.

- IHSE's Revenue Generation: IHSE, specializing in KVM extenders and matrices, also adds to the consolidated revenue through its hardware and software sales.

- 2025 Revenue Projections: Brockhaus Technologies anticipates robust revenue growth in 2025, driven by the expansion and enhanced performance of its diverse portfolio companies.

Brockhaus Technologies' revenue streams are multifaceted, primarily stemming from dividends and profit distributions from its portfolio companies. Additionally, capital gains from successful divestments of these holdings form a crucial part of its income. The company also benefits from interest income generated through internal financing arrangements with its subsidiaries, which aids in capital structure optimization.

| Revenue Stream | Description | Key Contributors/Notes |

|---|---|---|

| Dividends & Profit Distributions | Direct financial returns from portfolio companies. | Core revenue driver; impacted by portfolio company performance. |

| Capital Gains from Divestments | Profits realized from selling portfolio companies. | Significant contributor in 2023; dependent on market conditions. |

| Interest Income | Revenue from loans to subsidiaries. | Facilitates capital structure optimization. |

| Operational Revenues (Consolidated) | Aggregate revenues of portfolio companies like Bikeleasing and IHSE. | Projected robust growth in 2025. |

Business Model Canvas Data Sources

The Brockhaus Technologies Business Model Canvas is informed by a combination of internal financial reports, comprehensive market research, and expert strategic analysis. This multi-faceted approach ensures a robust and data-driven representation of the business.