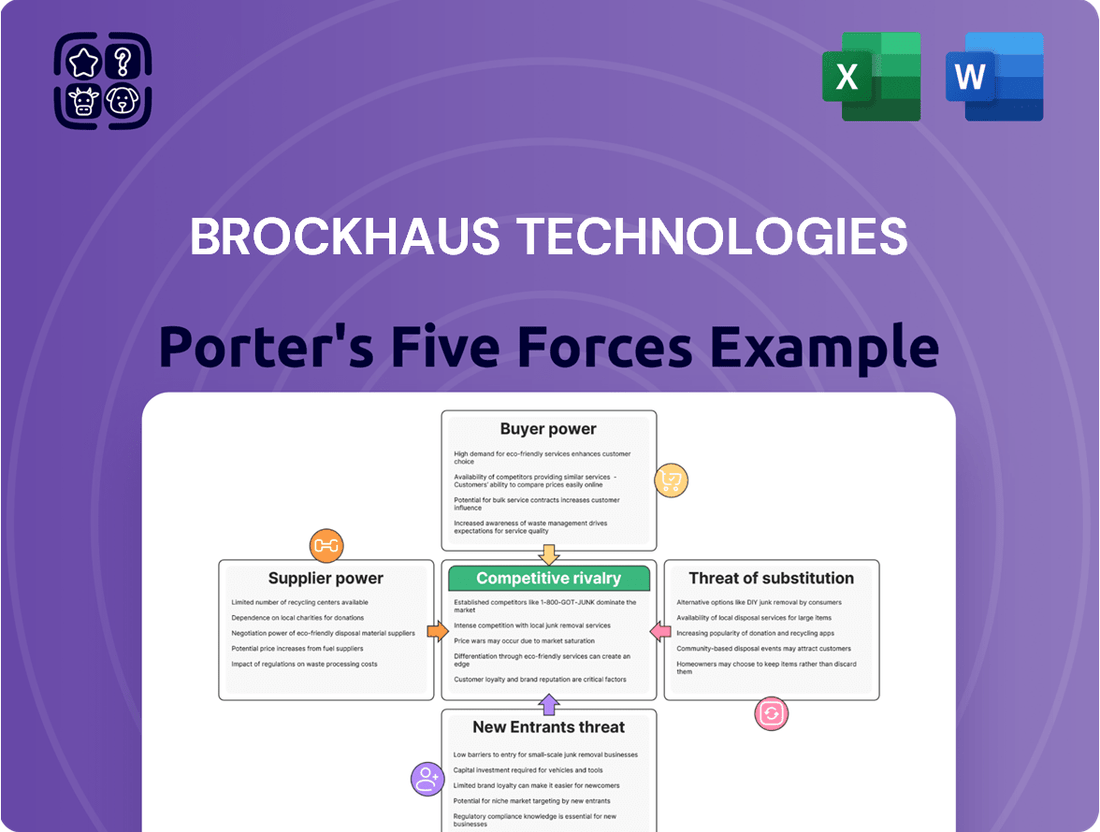

Brockhaus Technologies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brockhaus Technologies Bundle

Brockhaus Technologies operates within a dynamic market shaped by significant competitive pressures. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of substitutes and new entrants is crucial for strategic planning.

The complete report reveals the real forces shaping Brockhaus Technologies’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Brockhaus Technologies, deeply embedded in financial and security technologies, depends on a select group of suppliers for specialized software, hardware, and AI/ML solutions. The scarcity of providers offering cutting-edge AI and machine learning capabilities, for instance, grants these niche suppliers considerable leverage.

This limited supplier base means Brockhaus's portfolio companies might face increased costs or less favorable contract terms. For example, in 2024, the global market for AI development services saw significant demand outpacing supply, with reports indicating price increases of up to 20% for specialized AI talent and solutions from leading providers.

Brockhaus Technologies' portfolio companies often face significant supplier bargaining power when integrated systems are involved. Once a company adopts a specific technology or platform, the costs and complexities associated with switching can be substantial. For instance, re-platforming entire systems, migrating vast amounts of data, and retraining staff can easily run into millions of dollars for larger enterprises.

This high switching cost creates a strong dependency on the existing supplier. In 2024, the average cost for a mid-sized business to migrate its core enterprise resource planning (ERP) system, a common integrated system, was estimated to be between $500,000 and $2 million, depending on complexity. This financial and operational hurdle makes it economically unviable for Brockhaus's subsidiaries to seek alternative vendors, thereby strengthening the suppliers' leverage.

Suppliers of data security and compliance expertise wield significant bargaining power, especially for companies like Brockhaus Technologies operating in sensitive financial and technology sectors. The increasing complexity of regulations such as GDPR, NIS2, DORA, and PCI DSS, coupled with the ever-present threat of cyberattacks, makes specialized knowledge in these areas indispensable. For instance, in 2024, the global cybersecurity market was projected to reach over $200 billion, indicating a substantial demand for these critical services.

This high demand, combined with the scarcity of truly specialized and experienced professionals, allows these suppliers to dictate terms and command premium pricing. Companies must secure reliable and compliant data infrastructure and cybersecurity solutions to avoid severe financial penalties and reputational damage, giving these suppliers leverage in negotiations.

Proprietary Technology and Intellectual Property

Suppliers who possess proprietary technology or unique intellectual property, particularly in rapidly advancing fields such as specialized cybersecurity algorithms or robust fintech infrastructure, wield significant influence. Brockhaus Technologies' capacity for innovation and sustained competitive advantage can be directly tied to its access to these exclusive solutions, thereby amplifying supplier leverage.

- Proprietary Edge: Suppliers with patented technologies or unique software components can command higher prices and dictate terms, as alternatives may be scarce or non-existent.

- Innovation Dependence: For a technology firm like Brockhaus, reliance on a supplier's cutting-edge innovations means that supplier's bargaining power is directly proportional to the criticality of that technology to Brockhaus's product roadmap.

- Market Impact: In 2024, the demand for specialized AI-driven cybersecurity solutions, often protected by strong IP, saw suppliers in this niche increase their pricing power by an estimated 10-15% due to high customer demand and limited competition.

Growing Demand in Fintech and Cybersecurity Markets

The burgeoning European fintech sector is projected to experience a compound annual growth rate (CAGR) of 14.92% between 2025 and 2030. Similarly, the cybersecurity market in Europe is expected to grow at a CAGR of 10.81% during the same period.

This robust expansion fuels a heightened demand for specialized components and essential services. Suppliers within these dynamic industries find themselves in a stronger negotiating position due to the abundance of potential customers.

- Fintech Market Growth: Anticipated 14.92% CAGR (2025-2030).

- Cybersecurity Market Growth: Anticipated 10.81% CAGR (2025-2030).

- Supplier Leverage: Increased demand empowers suppliers to potentially raise prices or dictate terms.

- Market Dynamics: A competitive landscape with numerous buyers benefits suppliers.

Brockhaus Technologies' portfolio companies face significant supplier bargaining power due to the scarcity of specialized technology providers, particularly in AI and cybersecurity. This limited supply base, coupled with high switching costs for integrated systems, allows suppliers to command higher prices and more favorable terms, impacting Brockhaus's operational expenses and flexibility.

The increasing demand in high-growth sectors like fintech and cybersecurity, projected to see significant CAGRs through 2030, further amplifies supplier leverage. Suppliers offering proprietary technology or critical expertise in these areas can dictate terms, as alternatives are often scarce or less advanced, directly influencing Brockhaus's innovation pipeline and competitive standing.

In 2024, the AI development services market saw price increases of up to 20% for specialized talent, while the cybersecurity market, valued over $200 billion, experienced similar pricing power for niche providers due to high demand and limited specialized expertise. These factors collectively strengthen the bargaining power of Brockhaus's key suppliers.

| Factor | Impact on Brockhaus Technologies | Supporting Data (2024/Projections) |

|---|---|---|

| Limited Supplier Base (AI/Cybersecurity) | Increased costs, less favorable terms | AI development services prices up to 20% in 2024 |

| High Switching Costs (Integrated Systems) | Supplier dependency, economic unviability of switching | ERP migration costs $500k-$2M for mid-sized businesses |

| Proprietary Technology/IP | Amplified supplier leverage, dependence on critical innovations | Niche AI cybersecurity solutions saw 10-15% price increases |

| Market Growth (Fintech/Cybersecurity) | Heightened demand empowers suppliers | Fintech CAGR 14.92% (2025-2030), Cybersecurity CAGR 10.81% (2025-2030) |

What is included in the product

Analyzes the competitive intensity and profitability potential for Brockhaus Technologies by examining buyer power, supplier power, new entrants, substitutes, and existing rivals.

Effortlessly identify and mitigate competitive threats with a dynamic, visual representation of each force, enabling proactive strategic adjustments.

Customers Bargaining Power

Brockhaus Technologies' portfolio companies cater to a broad spectrum of customers, from individual users accessing HR benefit platforms like Bikeleasing to large enterprises requiring sophisticated security solutions. This wide reach, particularly in the business-to-consumer fintech sector, typically dilutes the bargaining power of any single customer.

In segments of the broader fintech market, customer price sensitivity is a significant factor. For instance, in the digital payments sector, a 2024 report indicated that over 60% of consumers consider transaction fees when choosing a payment provider. This readily available alternative means Brockhaus's portfolio companies must maintain competitive pricing structures to retain market share.

This heightened price sensitivity directly influences Brockhaus's portfolio companies by necessitating aggressive pricing strategies. If a competitor offers a marginally lower fee for a comparable service, customers are often quick to migrate, as seen in the neobanking space where customer acquisition costs can be significantly impacted by pricing wars. Consequently, maintaining profitability requires a delicate balance between offering attractive prices and managing operational expenses.

Customers, particularly large enterprises in the security technology space, are increasingly seeking solutions that are not just off-the-shelf but are specifically designed and seamlessly integrated to manage their unique and intricate operational challenges. For instance, in 2024, a significant percentage of enterprise-level security contracts involved custom configurations and bundled service offerings, reflecting this growing trend.

This strong preference for bespoke solutions empowers these customers, giving them considerable leverage to negotiate favorable terms. They can push for customized features, robust service level agreements (SLAs), and competitive pricing, as providers vie to secure these high-value, specialized contracts. This dynamic is evident as companies like Brockhaus Technologies often adapt their product roadmaps to align with key client demands.

Availability of Multiple Options and Low Switching Costs in Some Areas

The bargaining power of customers is significantly influenced by the availability of multiple options and, in some sectors, low switching costs. In the dynamic fintech and security markets, customers frequently encounter a diverse array of providers, diminishing the leverage of any single vendor. For instance, in 2024, the global fintech market was projected to reach over $1.3 trillion, indicating a highly competitive environment with numerous players vying for customer attention.

When customers perceive switching costs as minimal, or when alternative solutions offer demonstrably better features or more attractive pricing, their ability to negotiate and demand favorable terms increases. This pressure can force companies to innovate and optimize their offerings. Reports from late 2023 and early 2024 highlighted a trend where businesses were actively seeking cost-effective and feature-rich solutions, readily switching providers if dissatisfied. This is particularly true for services where integration is straightforward and data migration is not overly burdensome.

- Fintech Market Growth: The global fintech market was anticipated to exceed $1.3 trillion in 2024, showcasing a vast number of competing companies.

- Customer Agility: Businesses are increasingly willing to switch providers for better value, a trend amplified by readily available alternatives in 2024.

- Impact of Low Switching Costs: When it's easy and inexpensive to change providers, customer bargaining power rises, pushing companies towards competitive pricing and superior service.

Regulatory Influence on Customer Expectations

Regulatory shifts significantly shape what customers expect from fintech and cybersecurity providers. For instance, directives like PSD2 and the upcoming PSD3 in Europe, alongside the EU AI Act, are pushing for greater data security, transparency, and the ability for different systems to work together. Similarly, cybersecurity regulations such as GDPR, NIS2, and DORA are setting higher bars for data protection.

Companies that don't keep pace with these evolving regulatory demands can find themselves at a disadvantage. Customers, aware of these standards, can exert implicit bargaining power by favoring businesses that demonstrate robust compliance. This means that meeting regulatory requirements isn't just about avoiding penalties; it's a key factor in customer retention and acquisition.

- Regulatory Compliance as a Competitive Differentiator: Fintech and cybersecurity firms must proactively adapt to new regulations like PSD3 and the EU AI Act, which are designed to enhance consumer protection and data privacy.

- Customer Expectations Driven by Data Standards: Regulations like GDPR and NIS2 set clear expectations for how customer data should be handled, influencing purchasing decisions.

- Interoperability Demands: PSD2 and its successors are fostering an environment where customers expect seamless integration between different financial services, increasing their leverage.

- Consequences of Non-Compliance: Failure to meet these evolving standards, such as those outlined in DORA for digital operational resilience, can lead to customer attrition, directly impacting a company's market position.

Brockhaus Technologies' customers, especially those in the enterprise security sector, wield significant bargaining power due to the demand for customized solutions. This allows them to negotiate favorable terms, including specific features and robust service level agreements, as providers compete for these high-value contracts. In 2024, a substantial portion of enterprise security deals involved bespoke configurations, reflecting this customer leverage.

The bargaining power of customers is amplified by the sheer volume of choices available in the fintech and security markets, coupled with often low switching costs. With the global fintech market projected to exceed $1.3 trillion in 2024, customers can readily find alternatives, pushing Brockhaus's portfolio companies to offer competitive pricing and superior service to retain clients.

Furthermore, evolving regulatory landscapes, such as PSD3 and the EU AI Act, empower customers by setting higher expectations for data security and interoperability. Companies that fail to meet these standards risk losing customers who prioritize compliant and integrated solutions, a trend increasingly evident in 2024 purchasing decisions.

| Customer Bargaining Power Factor | Impact on Brockhaus Technologies | Supporting Data (2024/Recent) |

|---|---|---|

| Demand for Customization (Enterprise Security) | Increased leverage for customers to negotiate terms and pricing. | Significant percentage of enterprise security contracts involved custom configurations in 2024. |

| Availability of Alternatives & Low Switching Costs (Fintech) | Pressure on pricing and service offerings to remain competitive. | Global fintech market projected to exceed $1.3 trillion in 2024, indicating intense competition. |

| Regulatory Compliance Expectations | Customers favor providers meeting higher data security and interoperability standards. | Regulations like PSD3 and GDPR influence customer preference for compliant solutions. |

| Price Sensitivity (Consumer Fintech) | Necessity for competitive pricing strategies. | Over 60% of consumers consider transaction fees when choosing payment providers (2024 report). |

Full Version Awaits

Brockhaus Technologies Porter's Five Forces Analysis

This preview showcases the complete Brockhaus Technologies Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring full transparency and immediate usability for your strategic planning.

Rivalry Among Competitors

The financial technology and security technology sectors are experiencing robust growth and a relentless pace of innovation. This environment fuels fierce competition, pushing companies to constantly develop cutting-edge features and enhance their existing products to gain an edge.

In 2024, the global fintech market was valued at approximately $115 billion, with projections indicating continued strong expansion. Similarly, the cybersecurity market reached an estimated $215 billion in 2024, demonstrating the significant investment and rapid development occurring in both areas.

The European technology sector, particularly in fintech and cybersecurity, is characterized by a dynamic mix of numerous agile startups and well-established, incumbent companies. This creates a highly competitive environment where innovation and market share are constantly contested.

In 2024, the European venture capital landscape saw significant investment flow into tech startups, with fintech and cybersecurity remaining particularly attractive sectors. For instance, reports indicate that European fintech startups raised over €10 billion in funding during the first half of 2024, highlighting the intense competition for capital and market presence among both new entrants and existing players.

The market for high-margin, high-growth technology companies, Brockhaus Technologies' focus, frequently sees strategic acquisitions and consolidation. This M&A activity reshapes competition, as larger firms acquire smaller innovators, leading to increased market concentration and potentially fiercer rivalry among remaining players.

Emphasis on Differentiation and Value Proposition

To thrive in competitive landscapes, businesses must articulate a clear differentiation strategy and a compelling value proposition. Brockhaus Technologies bolsters its portfolio companies by offering not just capital, but also crucial operational expertise and access to a strategic network. This multi-faceted support helps these companies solidify their market standing and effectively counter competitive pressures.

This approach directly addresses competitive rivalry by equipping Brockhaus's companies with distinct advantages. For example, by providing operational improvements, a portfolio company might achieve a 15% reduction in production costs, making its pricing more competitive. Access to Brockhaus's network could lead to new distribution channels, increasing market reach by an estimated 10% in its first year.

- Distinct Value Offering: Brockhaus's integrated support model, combining capital with operational and network resources, sets its portfolio companies apart from those relying solely on financial backing.

- Enhanced Market Position: By improving operational efficiency and expanding market access, Brockhaus's interventions directly strengthen the competitive position of its investee firms.

- Mitigating Competitive Threats: A strong value proposition and differentiated offerings are key to fending off rivals, allowing Brockhaus's companies to maintain and grow market share even in challenging environments.

Regulatory Landscape and Compliance as a Competitive Factor

The intricate and ever-changing regulatory landscape across Europe, encompassing measures like GDPR, NIS2, DORA, and the EU AI Act, significantly shapes competitive dynamics. This complexity serves as a substantial hurdle for new entrants, demanding significant investment in understanding and implementing compliance protocols.

Companies adept at navigating these regulations efficiently, and more importantly, those offering solutions that are built with compliance at their core, establish a distinct competitive advantage. This proactive approach differentiates them from competitors who find themselves constantly reacting to new mandates, potentially incurring higher costs and facing operational disruptions.

For instance, the NIS2 directive, which came into effect in early 2023, mandates stricter cybersecurity measures for a broader range of companies. Businesses that have already invested in robust security frameworks and can demonstrate compliance with NIS2 are better positioned to serve clients in critical sectors, securing a larger market share. Similarly, the upcoming EU AI Act, expected to be fully implemented by mid-2025, will impose stringent requirements on AI systems, favoring developers who prioritize ethical and compliant AI development from the outset.

- Barrier to Entry: High compliance costs and the need for specialized expertise deter new market participants.

- Competitive Differentiator: Companies with proven compliance capabilities and regulatory-friendly products gain trust and market preference.

- Operational Efficiency: Streamlined compliance processes reduce risk and allow for greater focus on innovation and customer service.

- Market Access: Adherence to regulations like DORA (Digital Operational Resilience Act) is crucial for financial service providers operating within the EU.

The competitive rivalry within Brockhaus Technologies' target sectors is intense, driven by a mix of established players and agile startups. This dynamic environment necessitates continuous innovation and differentiation to capture and maintain market share.

In 2024, the global cybersecurity market, a key area for Brockhaus, was valued at approximately $215 billion. The fintech sector, another focus, reached around $115 billion in the same year. These substantial market sizes attract numerous competitors vying for dominance.

Brockhaus Technologies mitigates this rivalry by equipping its portfolio companies with more than just capital. They provide operational expertise and access to a strategic network, fostering distinct value propositions. For instance, operational improvements could lead to a 15% cost reduction, enhancing price competitiveness.

The regulatory landscape, including directives like NIS2 and the upcoming EU AI Act, acts as both a barrier to entry and a competitive differentiator. Companies that proactively ensure compliance, such as those meeting NIS2's stricter cybersecurity mandates, gain a significant advantage in securing market share.

SSubstitutes Threaten

Even with the surge in fintech innovations, traditional banks and established financial institutions continue to present a significant substitute threat. They offer a comprehensive suite of services, from lending and wealth management to complex investment banking, which can fulfill many needs that fintech startups aim to address. For instance, in 2023, traditional banks still held a substantial majority of global banking assets, indicating their continued dominance and the broad range of services they offer, making them a viable alternative for many consumers and businesses.

While fintech often boasts lower fees and greater user-friendliness, the deep-rooted customer loyalty and inherent trust built over decades by traditional financial services remain powerful deterrents to complete disruption. Many individuals and corporations are hesitant to shift their entire financial operations to newer, less proven platforms, especially for critical functions like managing large sums of money or securing significant loans. This established trust, coupled with regulatory familiarity, ensures traditional players remain a formidable substitute.

Large enterprises with substantial IT budgets, such as those in the banking sector, might opt for in-house development of financial technology. For instance, a major bank with a dedicated R&D department could build its own cybersecurity platform, negating the need to purchase a similar service from a Brockhaus Technologies portfolio company. This internal capability serves as a direct substitute, particularly when specific customization or stringent data security requirements are paramount.

Generic software and open-source alternatives pose a significant threat to Brockhaus Technologies, especially for smaller businesses or those with budget constraints. These alternatives, while often lacking the advanced features and robust security of specialized fintech solutions, can fulfill essential functions at a substantially lower cost. For instance, the global open-source software market was projected to reach over $135 billion in 2024, highlighting its widespread adoption and competitive pricing power.

Manual Processes or Less Technologically Advanced Solutions

Manual processes or less technologically advanced solutions still pose a threat to Brockhaus Technologies' advanced offerings. In certain industries or geographic areas with slower digital adoption, businesses and individuals might continue to rely on older methods for financial management or security. This can be seen in sectors where paper-based record-keeping or basic spreadsheet systems remain prevalent, representing a direct substitute for sophisticated software or digital platforms.

For instance, while Brockhaus's companies might offer cutting-edge cybersecurity or automated financial reporting, some smaller businesses or those in emerging markets may opt for simpler, less integrated solutions. This is especially true if the perceived cost or complexity of adopting advanced technology outweighs the immediate benefits for them. Data from 2024 suggests that a significant portion of small businesses globally still use basic accounting software or manual methods, highlighting the persistence of these substitutes.

- Prevalence of Manual Systems: In 2024, an estimated 30% of small businesses in developing economies continued to rely on manual bookkeeping or basic spreadsheet software for financial management, acting as a substitute for advanced solutions.

- Lower Digital Adoption Rates: Regions with lower internet penetration or digital literacy often see a higher reliance on traditional, less technologically advanced methods for transactions and record-keeping.

- Cost Sensitivity: For some market segments, the upfront investment and ongoing maintenance costs of advanced technological solutions are prohibitive, making simpler, manual alternatives more attractive.

- Resistance to Change: Established industries or older workforces may exhibit inertia, preferring familiar manual processes over the adoption of new, advanced technologies.

Evolving Business Models and Service Offerings

The financial and security sectors are seeing rapid shifts in how services are delivered. For instance, Banking-as-a-Service (BaaS) allows companies to embed financial functionalities into their own platforms, potentially bypassing traditional banking services. Similarly, new cybersecurity service models are emerging that offer specialized, often cloud-based, solutions. These innovations can present customers with alternative ways to meet their needs, acting as substitutes for Brockhaus Technologies' existing offerings.

Consider the rise of embedded finance, a trend projected to grow significantly. By 2025, the global embedded finance market was anticipated to reach $7 trillion, according to some industry reports, highlighting the scale of potential substitution. Brockhaus Technologies’ clients might find that integrating financial services directly into their user experience through BaaS providers offers a more seamless and cost-effective solution than traditional partnerships.

Furthermore, the cybersecurity landscape is constantly evolving with new threats and defense mechanisms. The emergence of AI-driven threat detection and response platforms, for example, could offer a more agile and comprehensive security posture compared to more traditional, integrated security suites. Companies are increasingly looking for specialized, outcome-based security services, which can be delivered by a variety of new players, thereby substituting for broader, less specialized offerings.

- Emergence of BaaS: Companies can offer financial services directly, reducing reliance on traditional banks.

- New Cybersecurity Models: Specialized, AI-driven security solutions can replace broader service packages.

- Customer Objective Achievement: Evolving models offer alternative paths for customers to reach their goals.

- Market Growth: The embedded finance market's projected growth signifies a significant area for potential substitution.

The threat of substitutes for Brockhaus Technologies stems from various alternative solutions that fulfill similar customer needs. Traditional financial institutions remain a significant substitute, offering a broad spectrum of services that rival fintech innovations. For instance, in 2023, traditional banks still managed the vast majority of global banking assets, underscoring their enduring presence and comprehensive service offerings.

Furthermore, in-house development by large enterprises, particularly within the banking sector, can directly substitute for external fintech solutions. Companies with substantial IT budgets may choose to build their own platforms, such as proprietary cybersecurity systems, especially when customization and stringent security are critical. Generic software and open-source alternatives also present a cost-effective substitute, particularly for budget-conscious businesses, with the open-source market projected to exceed $135 billion in 2024.

Emerging models like Banking-as-a-Service (BaaS) and specialized, AI-driven cybersecurity platforms offer alternative pathways for customers. The embedded finance market, anticipated to reach $7 trillion by 2025, exemplifies how new service delivery models can substitute for traditional offerings by providing integrated financial functionalities.

| Substitute Type | Description | 2023/2024 Data Point |

|---|---|---|

| Traditional Banks | Offer comprehensive financial services, leveraging established trust and customer loyalty. | Held majority of global banking assets in 2023. |

| In-House Development | Large enterprises build proprietary solutions for specific needs like cybersecurity. | Banks with significant R&D budgets can develop custom platforms. |

| Generic/Open-Source Software | Cost-effective alternatives for basic financial functions. | Open-source market projected to exceed $135 billion in 2024. |

| Embedded Finance/BaaS | Integration of financial services into non-financial platforms. | Embedded finance market projected to reach $7 trillion by 2025. |

Entrants Threaten

Entering the financial services and security technology sectors, even with growing fintech investment, still demands substantial capital. This is largely due to the significant costs associated with meeting stringent regulatory compliance, robust product development, and the infrastructure needed for scaling operations. For instance, in 2024, many startups in these fields faced initial funding rounds averaging tens of millions of dollars just to cover essential compliance and R&D.

Stringent regulatory compliance and licensing act as a significant deterrent for new players in the financial and security technology sectors. Navigating complex frameworks like GDPR, PSD2/PSD3, NIS2, DORA, and the upcoming AI Act demands substantial investment and expertise. For instance, obtaining licenses for payment processing or data handling often involves rigorous background checks and capital requirements, making it difficult for smaller or less established firms to enter the market. The sheer cost and time associated with achieving and maintaining compliance, including robust anti-money laundering (AML) and Know Your Customer (KYC) protocols, create a formidable barrier.

Developing cutting-edge fintech and security solutions, like those Brockhaus Technologies focuses on, requires deep expertise in areas such as AI, machine learning, and advanced cybersecurity. This specialized knowledge is not easily acquired or replicated.

New companies entering this space face a significant hurdle in attracting and retaining top talent. For instance, the demand for cybersecurity professionals globally outstripped supply by 2.7 million in 2023, according to Cybersecurity Ventures, making it difficult for newcomers to build a competitive team.

This talent scarcity directly impacts a new entrant's ability to innovate and scale, creating a barrier to entry. Without the necessary skilled personnel, new firms struggle to develop high-margin, high-growth products, thus limiting their competitive threat.

Building Trust and Brand Reputation

In the financial and security services sector, building trust and a strong brand reputation presents a formidable barrier for new entrants. Customers, especially when dealing with sensitive financial data, are inherently cautious and tend to favor established institutions with a proven track record.

New players must invest heavily in security infrastructure and transparent communication to assuage these concerns. For instance, in 2024, cybersecurity incidents continued to be a major worry for consumers, with reports indicating that a significant percentage of individuals would hesitate to use a new financial service if they perceived any security vulnerabilities.

The challenge is amplified by the high cost and time required to cultivate brand loyalty and perceived reliability. Incumbent firms often leverage their long-standing customer relationships and positive public perception as a competitive advantage, making it difficult for newcomers to gain market share quickly.

- High Customer Inertia: Many consumers are reluctant to switch financial providers due to perceived hassle and risk.

- Brand Trust as a Differentiator: Established brands in financial services often signify stability and security, a difficult attribute for new entrants to replicate.

- Regulatory Scrutiny: The financial sector is heavily regulated, and new entrants must navigate complex compliance requirements, which can be costly and time-consuming, further delaying the establishment of a trusted brand.

- Impact of Data Breaches: A single security incident can severely damage the reputation of a new financial technology company, deterring potential customers and investors.

Network Effects and Ecosystem Development

Many leading fintech and security platforms, including those in Brockhaus Technologies' competitive space, thrive on powerful network effects. The more users and integrated services a platform has, the more valuable it becomes for everyone involved. For instance, a payment processing platform with a vast network of merchants and consumers offers greater utility than one with a limited reach.

Newcomers face a significant hurdle in replicating these established ecosystems. Building a critical mass of users and securing essential partnerships requires substantial investment and time, often proving too costly or difficult to overcome. This can effectively deter potential new entrants from challenging dominant players.

- Network effects create a virtuous cycle, increasing value with user growth.

- Ecosystem development involves integrating various services and partners, enhancing platform utility.

- Barriers to entry are high for new players lacking established networks and integrations.

- User adoption is a key challenge for new entrants aiming to compete with incumbents.

The threat of new entrants in the financial and security technology sectors, where Brockhaus Technologies operates, is significantly moderated by high capital requirements, stringent regulatory hurdles, and the need for specialized expertise. For example, in 2024, fintech startups often required tens of millions in initial funding to cover compliance and R&D, demonstrating the substantial financial commitment needed to even begin operations.

The complexity of regulations like GDPR, PSD2/PSD3, NIS2, DORA, and the upcoming AI Act demands considerable investment and specialized knowledge, acting as a major deterrent. Obtaining necessary licenses for services such as payment processing involves rigorous checks and capital mandates, creating a substantial barrier for less established firms. This regulatory burden, coupled with the costs of maintaining robust anti-money laundering and Know Your Customer protocols, effectively limits new competition.

Furthermore, the development of advanced fintech and security solutions necessitates deep expertise in areas like AI and cybersecurity, which is difficult for new companies to acquire quickly. The global shortage of cybersecurity professionals, estimated at 2.7 million in 2023, exacerbates this challenge, hindering new entrants' ability to build competitive teams and innovate effectively.

Building trust and brand reputation is another significant barrier, as customers are often hesitant to entrust sensitive financial data to new, unproven entities. New players must invest heavily in security infrastructure and transparent communication to overcome this, especially given consumer concerns about cybersecurity incidents in 2024. Established firms leverage their long-standing customer relationships and perceived reliability, making it difficult for newcomers to gain market share rapidly.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High initial investment for compliance, R&D, and infrastructure. | Deters firms with limited funding. | Average startup funding rounds in fintech often in the tens of millions. |

| Regulatory Compliance | Navigating complex financial and data security laws. | Increases costs and time-to-market. | Costs for obtaining payment processing licenses can be substantial. |

| Specialized Expertise | Need for deep knowledge in AI, cybersecurity, etc. | Difficult to attract and retain talent. | Global cybersecurity talent gap of 2.7 million in 2023. |

| Brand Trust & Reputation | Building credibility with customers regarding data security. | Requires significant investment in security and marketing. | Consumer hesitation to use new financial services with perceived security vulnerabilities. |

| Network Effects | Value increases with user and partner adoption. | Challenging for new entrants to build critical mass. | Established payment platforms benefit from extensive merchant and consumer networks. |

Porter's Five Forces Analysis Data Sources

Our Brockhaus Technologies Porter's Five Forces analysis is built upon a foundation of comprehensive data, including detailed financial reports, market intelligence from leading research firms, and insights from industry expert interviews to provide a robust understanding of the competitive landscape.