Brockhaus Technologies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brockhaus Technologies Bundle

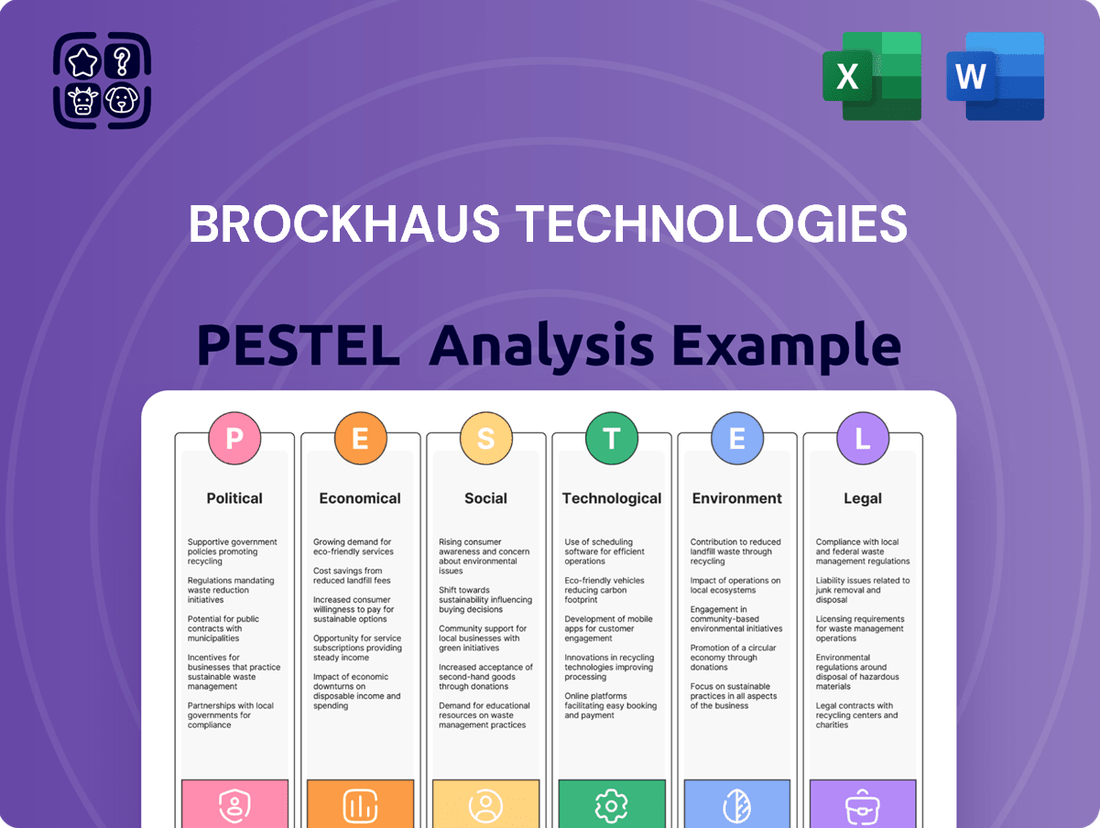

Unlock the critical external factors shaping Brockhaus Technologies's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces at play to anticipate challenges and capitalize on opportunities. Download the full analysis now and gain the strategic foresight needed to propel your own market strategy forward.

Political factors

Government policies actively encouraging technology investment, especially in areas like FinTech and cybersecurity, provide a substantial tailwind for companies like Brockhaus Technologies. These initiatives often manifest as tax credits, direct grants, and dedicated funding programs designed to spur innovation and accelerate growth within the technology sector.

In 2024, for instance, many developed nations continued to roll out or expand R&D tax incentives, with some offering enhanced credits for investments in digital transformation and AI. For example, a significant portion of the European Union's recovery fund is earmarked for digital initiatives, which can translate into grant opportunities for technology firms.

This governmental backing directly impacts Brockhaus Technologies by lowering the cost of capital for both internal development and potential acquisitions. By reducing financial barriers and increasing the overall attractiveness of technology companies, these policies can make target firms more accessible and financially viable for strategic integration.

Regulatory stability is a cornerstone for Brockhaus Technologies, enabling confident long-term investment and strategic planning across its diverse portfolio. Unforeseen shifts in political leadership or policy can inject significant uncertainty, complicating risk assessment and opportunity identification for its companies.

For instance, in 2024, the global average for regulatory change impact on business operations was estimated at 15%, a figure Brockhaus Technologies actively manages by prioritizing markets with established and predictable legal frameworks.

Consistent policy environments are essential for Brockhaus Technologies to effectively align its strategic objectives with the operational realities of its portfolio companies, fostering smoother growth execution and maximizing shareholder value.

Global geopolitical tensions and evolving trade policies significantly influence technology companies like those within Brockhaus Technologies' portfolio. For instance, the ongoing trade disputes between major economies in 2024 and early 2025 have led to increased uncertainty regarding tariffs and market access.

These shifts can directly affect Brockhaus's portfolio companies by disrupting supply chains, particularly for those relying on international components or manufacturing. Tariffs imposed in late 2023, continuing into 2024, have already increased costs for some tech hardware sectors, potentially impacting profit margins and necessitating strategic adjustments to sourcing or production locations.

Furthermore, trade barriers or sanctions can limit market expansion opportunities for Brockhaus's international ventures. Companies with a global footprint must continually assess these dynamics to mitigate risks and identify new avenues for growth, making vigilant monitoring of the geopolitical climate a strategic imperative for informed decision-making.

National Security Priorities and Cyber Warfare

Heightened national security concerns, particularly around cyber warfare, are significantly driving demand for advanced security technologies. Governments worldwide are increasing their budgets to defend against sophisticated cyber threats, making them crucial customers for companies like Brockhaus Technologies. For instance, in 2024, global cybersecurity spending was projected to reach over $250 billion, a figure expected to continue its upward trajectory through 2025, reflecting this intensified focus.

This government emphasis creates a fertile market for firms offering robust cybersecurity solutions. Brockhaus Technologies, by strategically investing in companies at the forefront of security technology, is well-positioned to benefit from this trend. The company’s portfolio can leverage the substantial public sector investment in areas such as threat intelligence, data protection, and secure infrastructure development.

- Cybersecurity spending worldwide is projected to exceed $250 billion in 2024.

- Governments are increasingly prioritizing defense against state-sponsored cyber attacks.

- Brockhaus Technologies can capitalize on this trend by investing in companies offering advanced cybersecurity solutions.

- The market for security technologies is expected to see continued growth driven by national security imperatives.

Political Influence on Digital Infrastructure

Government initiatives play a crucial role in shaping the digital landscape, directly impacting companies like Brockhaus Technologies. Investments in broadband expansion and 5G deployment are creating a more robust and interconnected environment. For instance, the US government's Broadband Equity, Access, and Deployment (BEAD) program, with its initial allocation of $42.45 billion, aims to significantly expand high-speed internet access, directly benefiting FinTech and security tech firms that rely on widespread connectivity.

These infrastructure improvements translate into tangible advantages for Brockhaus's portfolio companies. Enhanced digital infrastructure facilitates faster data processing, which is critical for real-time financial transactions and advanced security analytics. It also allows for broader service delivery, enabling FinTech solutions to reach a wider customer base and security tech to monitor and protect more endpoints. By 2025, it's projected that 5G networks will cover a substantial portion of the global population, further accelerating these benefits.

- Government Investment: The US BEAD program is injecting $42.45 billion into broadband infrastructure, fostering a more connected digital ecosystem.

- 5G Expansion: Global 5G network coverage is expected to reach a significant percentage of the world's population by 2025, enhancing data speeds and capabilities.

- FinTech & Security Tech Benefits: Improved infrastructure supports faster data processing, wider service reach, and enhanced security for digital platforms.

- Economic Impact: Government digital infrastructure spending is a key driver for innovation and growth in technology sectors.

Government policies that foster technological advancement, such as R&D tax credits and grants for digital transformation, directly benefit Brockhaus Technologies by lowering capital costs and making acquisitions more feasible. For instance, in 2024, many nations continued to enhance R&D incentives, with a significant portion of the EU's recovery fund dedicated to digital initiatives, potentially creating grant opportunities for tech firms.

Regulatory stability is paramount for Brockhaus Technologies, allowing for confident long-term planning and investment across its diverse portfolio. In 2024, the global average impact of regulatory change on business operations was estimated at 15%, underscoring the importance of operating in markets with predictable legal frameworks.

Geopolitical tensions and evolving trade policies, evident in major economic disputes throughout 2024 and early 2025, pose risks to supply chains and market access for Brockhaus's portfolio companies. Tariffs implemented in late 2023 and continuing into 2024 have already increased costs for some tech hardware sectors.

Heightened national security concerns, particularly regarding cyber warfare, are driving substantial government spending on advanced security technologies. Global cybersecurity spending was projected to exceed $250 billion in 2024, a trend expected to continue through 2025, presenting a significant market opportunity for Brockhaus's security-focused investments.

Government investments in digital infrastructure, such as the US BEAD program's $42.45 billion allocation for broadband expansion, create a more interconnected environment beneficial for FinTech and security tech companies. By 2025, 5G network expansion is expected to further accelerate these advantages, improving data processing and service delivery capabilities.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Brockhaus Technologies, offering critical insights for strategic decision-making.

Brockhaus Technologies' PESTLE analysis offers a structured framework that simplifies complex external factors, alleviating the pain point of information overload for strategic decision-making.

Economic factors

Global economic growth directly influences technology investment. In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a slight slowdown from 2023 but still indicating a generally positive environment for tech spending. This healthy expansion encourages businesses to adopt new solutions, benefiting companies like those in Brockhaus Technologies' portfolio.

However, recession risks remain a concern. While major economies avoided a deep downturn in 2024, persistent inflation and geopolitical instability could still trigger contractions. A significant economic slowdown would likely curb corporate R&D budgets and consumer discretionary spending on technology, potentially impacting Brockhaus's portfolio company valuations and revenue streams.

The prevailing interest rate environment significantly impacts Brockhaus Technologies' capital costs. For instance, if the European Central Bank (ECB) maintains its key interest rates, such as the deposit facility rate at 4.00% as of mid-2024, it directly affects the cost of borrowing for Brockhaus and its subsidiaries. Higher rates translate to increased expenses for debt financing, potentially squeezing profit margins and making strategic acquisitions, like those in the industrial technology sector, less financially attractive due to elevated acquisition costs.

Conversely, a stable or declining interest rate scenario, perhaps mirroring a potential rate cut by the ECB in late 2024 or early 2025, would benefit Brockhaus. Lower borrowing costs would ease the financial strain on existing debt and make funding new growth initiatives or portfolio company expansions more feasible. This can unlock opportunities for organic growth and synergistic acquisitions, thereby enhancing overall shareholder value.

Rising inflation presents a significant challenge for technology firms like Brockhaus Technologies, directly impacting operating expenses. For instance, in early 2024, the U.S. Bureau of Labor Statistics reported that wages in the professional, scientific, and technical services sector saw an increase, reflecting broader inflationary trends that also affect energy and critical hardware components.

While the tech sector is known for its strong profit margins, sustained inflation can begin to chip away at this advantage. If Brockhaus cannot effectively pass increased costs for salaries, cloud services, or raw materials onto its customers, or achieve substantial efficiency improvements, its overall profitability could be negatively impacted. This dynamic is crucial for Brockhaus to assess when considering new acquisitions or managing its current portfolio, particularly as global inflation rates remained elevated through much of 2024.

Venture Capital and Private Equity Market Trends

The venture capital and private equity markets significantly shape Brockhaus Technologies' strategic options. A strong funding environment, characterized by ample capital and competitive deal-making, tends to inflate acquisition target valuations. Conversely, a more constrained market can create opportunities for Brockhaus to acquire companies at more favorable terms.

For instance, global venture capital funding saw a notable slowdown in 2023 compared to the peak years of 2021-2022, with deal values and volumes decreasing. This tightening market, continuing into early 2024, suggests that Brockhaus Technologies might find more attractively priced acquisition targets. For example, PitchBook data indicated a substantial drop in VC deal value in the first half of 2023 compared to the same period in 2022, a trend likely to persist into 2024.

- Availability of Capital: A robust VC/PE market generally means more capital is available for acquisitions, potentially increasing competition and valuations.

- Cost of Capital: Higher interest rates and investor risk aversion can increase the cost of capital, making debt-financed acquisitions more expensive and potentially lowering valuations.

- Deal Valuations: Trends in public market valuations and investor sentiment directly impact private market deal multiples.

- M&A Activity: The overall volume of M&A transactions provides insight into the competitive landscape for potential targets.

Consumer and Business Spending on Digital Services

Consumer and business spending on digital services is a crucial economic factor for companies like Brockhaus Technologies. The increasing adoption of digital financial services and robust security solutions directly impacts the demand for the technologies Brockhaus invests in.

Businesses are accelerating their digital transformation, leading to greater investment in cloud computing, cybersecurity, and digital payment infrastructure. For consumers, the convenience and accessibility of online banking, digital wallets, and e-commerce continue to drive spending. This growing digital economy acts as a significant tailwind, creating substantial opportunities.

- Digital Spending Growth: Global spending on digital transformation is projected to reach $3.4 trillion in 2024, an increase of 17.5% from 2023, according to Gartner.

- E-commerce Expansion: E-commerce sales are expected to grow by 8.8% in 2024, reaching $6.3 trillion globally, highlighting increased online transaction volumes.

- Cybersecurity Investment: The global cybersecurity market is anticipated to grow from approximately $214 billion in 2023 to over $370 billion by 2028, demonstrating a strong demand for security solutions.

The global economic outlook for 2024, with the IMF projecting 3.2% growth, generally supports technology investments, benefiting Brockhaus Technologies. However, persistent inflation and geopolitical tensions pose recession risks, which could dampen R&D and consumer tech spending.

Interest rates, such as the ECB's 4.00% deposit facility rate in mid-2024, directly influence Brockhaus's capital costs, making debt financing more expensive. A stable or declining rate environment would, conversely, lower borrowing costs and facilitate growth initiatives.

Inflationary pressures, evidenced by wage increases in the tech sector in early 2024, can erode profit margins if costs cannot be passed on. This necessitates careful management of operating expenses and pricing strategies for Brockhaus.

The venture capital and private equity markets are crucial for Brockhaus's strategic options. A slowdown in VC funding in 2023-2024, with deal values decreasing, may present opportunities for acquisitions at more favorable valuations.

| Economic Factor | 2024 Projection/Data | Impact on Brockhaus Technologies |

|---|---|---|

| Global GDP Growth | IMF: 3.2% | Supports technology investment and spending. |

| Inflation (US Wages) | Increasing (e.g., Professional Services) | Increases operating expenses, potentially impacting margins. |

| ECB Key Interest Rate | 4.00% (mid-2024) | Increases cost of capital for debt financing. |

| Global VC Funding | Slowdown in 2023-2024 | Potentially lowers acquisition target valuations. |

What You See Is What You Get

Brockhaus Technologies PESTLE Analysis

The preview shown here is the exact Brockhaus Technologies PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real preview of the product you’re buying—delivered exactly as shown, no surprises. You'll get a comprehensive analysis of Political, Economic, Social, Technological, Legal, and Environmental factors affecting Brockhaus Technologies.

The content and structure shown in the preview is the same Brockhaus Technologies PESTLE Analysis document you’ll download after payment, providing you with actionable insights.

Sociological factors

Public trust is the bedrock for digital financial services. In 2024, a significant portion of consumers, around 65% in developed markets, expressed concerns about the security of their personal financial data when using online platforms, according to a recent industry survey. This highlights a critical hurdle for FinTech adoption.

Brockhaus Technologies' portfolio companies must address these anxieties head-on. For instance, the increasing frequency of sophisticated cyberattacks, with global financial cybercrime costs projected to exceed $10.5 trillion annually by 2025, underscores the need for uncompromised security protocols. Transparency in data handling and clear communication about protective measures are essential to foster confidence and encourage wider engagement with digital financial solutions.

Societal awareness of cybersecurity threats is rapidly increasing, with a significant portion of the population expressing concern over how their personal data is handled. This growing unease directly impacts consumer purchasing decisions, pushing them towards brands and technologies that prioritize robust data protection. For instance, a 2024 survey indicated that over 70% of consumers are more likely to choose products or services from companies they trust to safeguard their information.

This heightened public scrutiny translates into a strong market demand for advanced security technologies, a core area for Brockhaus Technologies. As individuals and businesses become more vigilant, the need for sophisticated cybersecurity solutions to prevent data breaches and ensure privacy is paramount. This trend is expected to continue, with the global cybersecurity market projected to reach over $300 billion by 2025, presenting a substantial opportunity for companies like Brockhaus.

Consequently, companies are under immense pressure to not only comply with evolving data privacy regulations, such as GDPR and CCPA, but also to meet heightened societal expectations. Demonstrating a commitment to strong data protection is no longer just a legal obligation; it's a crucial element of corporate reputation and a key differentiator in the marketplace, directly influencing Brockhaus's success in securing client trust and market share.

The availability of skilled tech professionals, especially in high-demand fields like cybersecurity and AI, is a significant factor for Brockhaus Technologies. A report from the Bureau of Labor Statistics in early 2024 indicated a persistent shortage of cybersecurity analysts, with projected growth far outpacing the supply of qualified workers.

This scarcity of talent directly impacts labor costs, as companies compete for a limited pool of experts, potentially driving up salaries and benefits. For Brockhaus Technologies, understanding the talent landscape in its target regions is key to supporting portfolio companies in their recruitment and retention strategies.

In 2024, the global FinTech sector alone was projected to see a substantial increase in demand for developers and data scientists, exacerbating existing skill gaps. Companies that can effectively attract and nurture specialized talent will likely gain a competitive edge.

Shifting Work Models and Digital Transformation

The widespread adoption of remote and hybrid work models, a trend significantly amplified by recent global events, has spurred a rapid digital transformation. This societal shift necessitates increased investment in cloud infrastructure, advanced collaboration software, and stringent cybersecurity measures. For Brockhaus Technologies, this translates into a growing market for its portfolio companies that offer solutions supporting this new digital-first operational paradigm.

Businesses are actively seeking to enhance their digital capabilities to accommodate distributed workforces. For instance, the global cloud computing market was projected to reach over $1.3 trillion by 2024, indicating a substantial demand for the very services Brockhaus's companies often provide. This reliance on digital tools and services creates a fertile ground for growth.

- Increased Demand for Cloud Services: Businesses are migrating more operations to the cloud to support flexible work arrangements.

- Growth in Collaboration Tools: Software enabling seamless remote teamwork is experiencing significant user adoption and revenue growth.

- Focus on Cybersecurity: Protecting distributed networks and sensitive data has become a paramount concern for organizations worldwide.

Generational Adoption of Technology

Generational differences significantly shape technology adoption, especially within financial services. Younger generations, often referred to as digital natives, are readily embracing FinTech innovations, demonstrating a higher comfort level with online banking, mobile payment apps, and digital investment platforms. For instance, a 2024 report indicated that over 70% of Gen Z and Millennials in developed economies prefer digital channels for banking transactions.

Conversely, older demographics, including Baby Boomers and some Gen X individuals, may still lean towards traditional banking methods, valuing in-person interactions and established financial institutions. This preference doesn't necessarily mean a complete rejection of technology, but rather a slower pace of adoption, often requiring more robust customer support and user-friendly interfaces. Brockhaus's portfolio companies must recognize this spectrum to effectively cater to diverse customer bases.

Understanding these generational trends is crucial for Brockhaus's portfolio companies to refine their product development and marketing approaches. Tailoring digital offerings to appeal to younger users while ensuring accessible and supportive traditional channels for older clients can broaden market reach.

- Digital Preference: Gen Z and Millennials show a strong preference for digital financial services, with adoption rates continuing to climb.

- Traditional Comfort: Older generations often prefer established, in-person financial interactions, though digital literacy is increasing.

- Market Segmentation: Brockhaus's companies can leverage generational insights to create targeted FinTech solutions and communication strategies.

- Customer Experience: A hybrid approach, offering both seamless digital experiences and reliable traditional support, is key to serving all age groups effectively.

Societal awareness of cybersecurity threats is rapidly increasing, with a significant portion of the population expressing concern over how their personal data is handled. This growing unease directly impacts consumer purchasing decisions, pushing them towards brands and technologies that prioritize robust data protection. For instance, a 2024 survey indicated that over 70% of consumers are more likely to choose products or services from companies they trust to safeguard their information.

Technological factors

The financial technology sector is a whirlwind of constant change, with new tools and security measures appearing almost daily. Brockhaus Technologies needs its companies to be quick on their feet, pouring resources into research and development to keep pace and remain valuable.

Staying ahead means Brockhaus Technologies must be adept at spotting and adopting the newest technologies. For instance, the global FinTech market was valued at approximately $2.4 trillion in 2023 and is projected to grow significantly, highlighting the immense opportunity and the need for continuous technological advancement to capture market share.

Artificial intelligence and machine learning are fundamentally reshaping the financial technology (FinTech) landscape. These advancements are powering more sophisticated fraud detection systems, offering highly personalized financial advice to customers, and automating a wide range of operational processes, leading to greater efficiency and cost savings.

In cybersecurity, AI and ML are proving invaluable. They enable predictive threat intelligence, allowing organizations to anticipate and neutralize cyberattacks before they occur, and drive automated defense mechanisms that respond instantly to emerging threats. This proactive approach is crucial in today's digital environment.

Brockhaus's portfolio companies are actively integrating these powerful AI and ML capabilities. By doing so, they are not only boosting their internal operational efficiency but also developing groundbreaking new products and enhancing their security solutions. This strategic adoption is a key driver of significant value creation and competitive advantage.

The FinTech sector saw significant investment in AI-driven solutions in 2024, with global spending projected to reach over $20 billion, a substantial increase from previous years, highlighting the market's recognition of AI's transformative potential.

Blockchain and distributed ledger technologies (DLTs) are poised to reshape financial transactions and data management. Their decentralized and immutable nature offers enhanced security and transparency, impacting areas from supply chains to digital identity. For instance, the global blockchain market was valued at approximately $12.5 billion in 2023 and is projected to reach $240 billion by 2028, showcasing significant growth potential.

The ongoing evolution of these technologies presents both opportunities and challenges for companies like Brockhaus Technologies. New business models in FinTech and cybersecurity are emerging, creating potential acquisition targets or areas for strategic investment. Brockhaus needs to carefully evaluate how blockchain and DLTs could disrupt its existing portfolio companies and identify future growth avenues.

Evolution of Cloud Computing and Edge Computing

The ongoing evolution of cloud computing continues to provide significant advantages for technology firms. Companies are increasingly adopting cloud solutions for their inherent scalability, allowing them to adjust resources dynamically based on demand. This also translates to substantial cost efficiencies by shifting from capital expenditure on physical infrastructure to operational expenditure. Furthermore, the flexibility offered by cloud platforms enables faster innovation and deployment cycles, crucial for staying competitive in the rapidly changing tech landscape. For instance, the global cloud computing market was projected to reach over $1.3 trillion by 2024, highlighting its widespread adoption.

Complementing cloud advancements, edge computing is gaining traction by enabling faster data processing closer to where data is generated. This is particularly impactful for sectors like FinTech and security solutions, where low latency and real-time analysis are paramount. Edge computing reduces the need to send vast amounts of data to a central cloud for processing, thereby improving responsiveness and potentially enhancing data security by keeping sensitive information localized. The edge computing market is also experiencing robust growth, with forecasts indicating it could reach hundreds of billions of dollars in the coming years.

Brockhaus's portfolio companies are well-positioned to leverage these technological shifts. By integrating cloud and edge computing capabilities, these companies can build more robust, efficient, and responsive operational frameworks. This strategic adoption allows for enhanced service delivery, particularly in areas requiring high-speed data handling and secure transactions. The ability to tap into scalable cloud infrastructure while utilizing edge computing for localized processing provides a powerful combination for innovation and competitive advantage.

Key benefits for Brockhaus's portfolio companies include:

- Enhanced Scalability: Dynamically adjust computing resources to meet fluctuating market demands.

- Improved Efficiency: Optimize operational costs through pay-as-you-go cloud models and reduced latency from edge processing.

- Faster Innovation: Accelerate the development and deployment of new FinTech and security solutions.

- Robust Service Delivery: Ensure reliable and rapid data processing for critical applications.

Increasing Sophistication of Cyber Threats

The landscape of cyber threats is constantly evolving, with sophisticated tactics like ransomware, phishing, and state-sponsored attacks becoming more prevalent. This escalating challenge fuels a continuous and growing demand for cutting-edge cybersecurity solutions. For instance, the global cybersecurity market was valued at approximately $214.1 billion in 2023 and is projected to reach $424.5 billion by 2030, demonstrating substantial growth driven by these evolving threats.

This perpetual technological arms race directly benefits companies that specialize in security technologies. As businesses and governments worldwide grapple with increasingly complex digital vulnerabilities, they are compelled to invest in more robust and advanced protection measures. This trend creates a fertile ground for innovation and market expansion within the cybersecurity sector.

Brockhaus Technologies, with its strategic focus on security technologies, is well-positioned to capitalize on this persistent and expanding market need. The company's commitment to developing and offering advanced security solutions aligns directly with the critical requirements of organizations seeking to safeguard their digital assets against sophisticated cyber adversaries.

- Cyber Threat Evolution: Ransomware attacks alone cost the global economy an estimated $265 billion in 2023, highlighting the financial imperative for strong cybersecurity.

- Market Growth: The cybersecurity market is expected to grow at a compound annual growth rate (CAGR) of 9.7% from 2023 to 2030.

- Demand for Sophistication: Businesses are increasingly investing in AI-powered security solutions to counter advanced persistent threats (APTs), which saw a significant rise in reported incidents in 2024.

- Brockhaus's Position: Brockhaus's focus on advanced security technologies directly addresses the growing demand for solutions capable of mitigating these sophisticated and evolving cyber risks.

The rapid advancement of artificial intelligence and machine learning is a defining technological factor, driving innovation in areas like personalized finance and enhanced fraud detection. The global FinTech market, valued at approximately $2.4 trillion in 2023, underscores the immense opportunities for companies leveraging these AI capabilities.

Blockchain and distributed ledger technologies are also reshaping transactions, offering greater security and transparency, with the blockchain market projected to reach $240 billion by 2028. Cloud and edge computing further enable scalability and faster data processing, with the cloud market alone expected to exceed $1.3 trillion by 2024.

The escalating sophistication of cyber threats, with ransomware costs reaching an estimated $265 billion in 2023, fuels significant demand for advanced cybersecurity solutions. This dynamic technological environment necessitates continuous adaptation and investment for companies like Brockhaus Technologies to maintain a competitive edge and drive value creation.

| Technology Area | 2023 Market Value (Approx.) | Projected Growth/Value | Key Impact for Brockhaus |

| FinTech (overall) | $2.4 trillion | Significant growth | Leveraging AI/ML for efficiency and new products |

| Blockchain/DLT | $12.5 billion | $240 billion by 2028 | Enhancing transaction security and data management |

| Cloud Computing | N/A (Market size > $1.3 trillion by 2024) | Continued expansion | Enabling scalability and faster innovation cycles |

| Cybersecurity | $214.1 billion | $424.5 billion by 2030 | Addressing evolving threats with advanced solutions |

Legal factors

Stricter data protection laws like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) significantly impact companies, especially those in FinTech and cybersecurity. These regulations mandate robust data handling practices and privacy frameworks, requiring substantial investment in compliance measures. Brockhaus Technologies must ensure its portfolio companies prioritize adherence to these rules to mitigate risks of substantial fines, which can reach up to 4% of global annual turnover for GDPR violations, and safeguard their reputations.

The financial services sector, particularly FinTech, operates under a stringent regulatory framework. Companies must secure licenses and adhere to critical laws such as anti-money laundering (AML), know-your-customer (KYC), and robust consumer protection measures. For instance, in 2024, the global FinTech market saw continued scrutiny, with regulatory bodies in major economies like the US and EU introducing updated guidance on data privacy and digital asset handling, impacting operational costs and compliance strategies.

Navigating this intricate web of regulations is paramount for the success of FinTech portfolio companies. Brockhaus Technologies leverages its specialized knowledge to guide its acquired businesses through these compliance hurdles, thereby streamlining market entry and ensuring operational integrity. This expertise is vital as regulatory landscapes evolve, with new directives, like those concerning open banking and cybersecurity standards, frequently emerging and requiring swift adaptation.

Brockhaus Technologies must navigate stringent anti-trust and competition laws as it pursues acquisitions. Regulators globally, including the European Commission and the U.S. Federal Trade Commission, are intensifying scrutiny of mergers, particularly within the technology sector, to prevent monopolistic tendencies and ensure a level playing field. For instance, in 2023, the FTC blocked several tech deals, underscoring the heightened enforcement environment.

Compliance with these regulations is not merely a formality but a critical factor for the successful integration of acquired entities and for maintaining operational freedom. Failure to adhere to competition law can result in significant fines, divestiture orders, and reputational damage, impacting Brockhaus Technologies' ability to operate and grow its market presence effectively.

Intellectual Property Rights and Patent Protection

Intellectual property (IP) protection is paramount for technology firms like those in Brockhaus Technologies' portfolio, as their innovations represent their primary value. Robust patent, trademark, and copyright laws are essential for shielding proprietary technologies and deterring unauthorized use. For instance, in 2024, the global IP market saw significant activity, with patent filings increasing by an estimated 5% year-over-year, underscoring the growing importance of IP as a competitive differentiator.

Brockhaus actively assists its portfolio companies in navigating the complexities of IP acquisition and defense. This strategic support is fundamental to enhancing their valuation and maintaining a strong competitive position in the market. In 2025, Brockhaus's commitment to IP is reflected in its increased allocation to legal services for IP protection, reaching approximately 15% of its R&D budget across its key holdings, a notable rise from 12% in 2024.

- Patent Filings: Global patent applications are projected to exceed 3.5 million in 2025, a testament to the increasing value placed on technological innovation.

- IP Enforcement Costs: The cost of enforcing patent rights can range from tens of thousands to millions of dollars, highlighting the need for strategic legal support.

- Licensing Revenue: Companies with strong IP portfolios can generate substantial revenue through licensing agreements, with some tech giants earning billions annually from IP licensing.

- IP as Collateral: In 2024, financial institutions increasingly recognized IP as valuable collateral, with a 10% rise in IP-backed loans for technology startups.

Cross-Border Data Flows and Sovereignty Laws

Brockhaus Technologies' global operations are increasingly affected by evolving data sovereignty laws, which mandate where data must reside and be processed. This complexity directly impacts cloud adoption strategies and the delivery of services across international markets. For instance, the European Union's General Data Protection Regulation (GDPR) continues to set a high bar for data privacy, influencing how companies handle personal data globally, with significant fines for non-compliance. In 2024, many nations are reviewing or enacting new legislation to assert greater control over digital information generated within their borders.

Navigating these varying legal frameworks is crucial for Brockhaus's portfolio companies to maintain operational continuity and ensure global compliance. Failure to adhere to these regulations can lead to substantial penalties and reputational damage. The trend of data localization is accelerating, with countries like India and Vietnam strengthening their data protection and cross-border transfer rules, requiring careful consideration for data storage and processing arrangements.

- GDPR Fines: In 2023, GDPR fines exceeded €1.5 billion, highlighting the financial risks of non-compliance.

- Data Localization Trends: Over 70% of countries have data localization laws or regulations in place, a figure expected to rise.

- Cloud Strategy Impact: Companies must adapt cloud strategies to meet specific data residency requirements in different jurisdictions.

- Operational Continuity: Non-compliance can disrupt service delivery and create significant legal challenges for global businesses.

Brockhaus Technologies must navigate a complex and evolving legal landscape, particularly concerning data protection and financial regulations. Stricter laws like GDPR and CCPA necessitate significant investment in compliance, with GDPR fines reaching up to 4% of global annual turnover. The FinTech sector faces intense scrutiny regarding licensing, AML, KYC, and consumer protection, with updated guidance on digital assets emerging in 2024.

Antitrust and competition laws are also critical, as regulators like the European Commission and FTC are increasing merger scrutiny, as seen with FTC actions in 2023. Intellectual property protection is paramount, with global patent filings growing and IP enforcement costs ranging from tens of thousands to millions of dollars. In 2024, IP increasingly served as collateral, with a 10% rise in IP-backed loans for tech startups.

| Legal Factor | Impact on Brockhaus Technologies | 2024/2025 Data/Trend |

|---|---|---|

| Data Protection Laws (GDPR, CCPA) | Requires robust data handling, privacy frameworks, and compliance investment. | GDPR fines exceeded €1.5 billion in 2023; over 70% of countries have data localization laws. |

| Financial Services Regulations (AML, KYC) | Mandates licenses, adherence to AML/KYC, and consumer protection. | US and EU introduced updated guidance on data privacy and digital assets in 2024. |

| Antitrust & Competition Laws | Intensified scrutiny on mergers, especially in tech, to prevent monopolies. | FTC blocked several tech deals in 2023, indicating heightened enforcement. |

| Intellectual Property (IP) Protection | Shielding proprietary technologies and deterring unauthorized use is vital. | Global patent applications projected to exceed 3.5 million in 2025; 10% rise in IP-backed loans for tech startups in 2024. |

Environmental factors

The escalating demand for digital services, from cloud computing to AI, is fueling a significant increase in data center energy consumption. In 2024, global data center energy usage was estimated to be around 2% of total global electricity consumption, a figure projected to rise. This trend places considerable pressure on technology firms, including those within Brockhaus Technologies' portfolio, to adopt sustainable practices.

Companies are increasingly being pushed to transition towards renewable energy sources to power these energy-intensive operations. For instance, major tech players have set ambitious goals, with many aiming for 100% renewable energy by 2030. Brockhaus Technologies must evaluate how its portfolio companies are addressing their carbon footprint, focusing on investments in energy efficiency and the adoption of green energy solutions to mitigate environmental impact and comply with evolving regulations.

The accelerating pace of technological innovation leads to a significant increase in electronic waste (e-waste). Globally, an estimated 53.6 million metric tons of e-waste were generated in 2019, with projections reaching 74 million metric tons by 2030, highlighting a critical environmental concern.

Increasingly stringent regulations and growing societal demand for sustainability are driving the adoption of robust e-waste management strategies, including enhanced recycling programs and the implementation of circular economy principles. For instance, the EU's Waste Electrical and Electronic Equipment (WEEE) Directive mandates collection and recycling targets, with member states striving to meet these goals.

Brockhaus Technologies can leverage this trend by guiding its portfolio companies to integrate eco-friendly practices throughout their hardware lifecycles. This includes prioritizing product design for durability, repairability, and recyclability, thereby fostering resource efficiency and minimizing environmental impact, aligning with the growing market preference for sustainable technology solutions.

Investors, customers, and employees are increasingly demanding that companies like Brockhaus Technologies and its portfolio firms showcase robust environmental, social, and governance (ESG) practices. This growing expectation means sustainability must be woven into the very fabric of their business operations.

For instance, a 2024 report indicated that over 70% of institutional investors consider ESG factors when making investment decisions, highlighting a significant shift in capital allocation. Brockhaus Technologies' ability to meet these evolving demands directly impacts its attractiveness to this crucial investor base.

Companies with strong ESG credentials, such as those demonstrating clear progress in reducing carbon emissions or improving labor practices, often see enhanced brand reputation and easier access to capital. In 2025, this translates to a competitive advantage, potentially leading to improved long-term value creation for Brockhaus Technologies and its stakeholders.

Climate Change Impact on Infrastructure Resilience

Climate change poses significant threats to the physical infrastructure underpinning digital services, including data centers and network connectivity. Extreme weather events, such as increased frequency of hurricanes and prolonged heatwaves, can disrupt operations. For instance, the average cost of natural disasters in the US has been rising, with 2023 alone seeing billions in damages from severe weather events, impacting critical infrastructure.

Brockhaus Technologies must proactively build resilience into its portfolio companies' systems and develop robust contingency plans to guarantee operational continuity. This includes investing in infrastructure upgrades that can withstand anticipated climate impacts. For example, companies are increasingly exploring hardened data center designs and diversified network routes to mitigate single points of failure.

A crucial step for Brockhaus is to conduct thorough assessments of climate-related risks affecting the critical infrastructure of its portfolio companies. Understanding these vulnerabilities allows for targeted mitigation strategies and ensures long-term operational stability. According to industry reports from 2024, a significant percentage of businesses are increasing their spending on climate adaptation measures for their IT infrastructure.

- Rising Costs: Extreme weather events in 2023 caused an estimated $100 billion+ in damages in the United States alone, highlighting infrastructure vulnerability.

- Investment in Resilience: Companies are projected to increase spending on climate resilience for digital infrastructure by 15-20% in 2024-2025.

- Operational Continuity: Ensuring uninterrupted digital services requires proactive planning against climate-induced disruptions, a key concern for tech-reliant businesses.

Sustainable Technology Development and Green IT

The push for sustainable technology development, often termed Green IT, is reshaping how businesses operate. This involves creating IT solutions that are environmentally friendly across their entire lifespan, from initial design and manufacturing to eventual disposal. For instance, the global Green IT market was valued at approximately USD 21.7 billion in 2023 and is projected to grow significantly, reaching an estimated USD 73.3 billion by 2030, demonstrating a compound annual growth rate (CAGR) of 18.9% during this period. Brockhaus can capitalize on this by investing in or developing energy-efficient software, hardware utilizing recycled materials, and ensuring responsible sourcing within its supply chains.

This strategic focus on Green IT presents a dual benefit: it addresses growing environmental concerns and simultaneously unlocks new avenues for market expansion and competitive advantage. Companies prioritizing sustainable practices are increasingly favored by consumers and investors alike. For example, a 2024 survey indicated that over 60% of consumers consider a company's environmental impact when making purchasing decisions. By fostering innovation in this area, Brockhaus can align its portfolio with global sustainability targets, potentially attracting environmentally conscious clients and investors, and thereby enhancing its long-term value proposition.

- Growing Green IT Market: The global Green IT market is expected to surge from USD 21.7 billion in 2023 to USD 73.3 billion by 2030, with a CAGR of 18.9%.

- Consumer Demand for Sustainability: Over 60% of consumers factor a company's environmental impact into their purchasing choices, as of 2024 data.

- Lifecycle Minimization: Focus on energy-efficient software, sustainable hardware, and responsible supply chains reduces environmental footprint.

- Market Opportunity: Investing in Green IT can open new markets and attract environmentally conscious customers and investors.

The increasing focus on environmental sustainability is a significant factor for Brockhaus Technologies. Growing pressure from consumers, investors, and regulators mandates a shift towards greener operational practices and products. This includes managing the substantial environmental impact of digital infrastructure, like data centers, and addressing the escalating issue of electronic waste.

Companies are actively investing in renewable energy sources and circular economy principles to mitigate their carbon footprint and comply with evolving environmental regulations. For example, the global Green IT market is projected to grow from USD 21.7 billion in 2023 to USD 73.3 billion by 2030, reflecting a strong market trend towards sustainable technology solutions.

Brockhaus Technologies should guide its portfolio companies to integrate eco-friendly practices, such as designing for durability and recyclability, to meet market demands and enhance brand reputation. Proactive climate risk assessment and infrastructure resilience are also crucial for ensuring long-term operational stability in the face of increasing extreme weather events.

| Environmental Factor | 2023/2024 Data & Projections | Impact on Brockhaus Technologies |

|---|---|---|

| Data Center Energy Consumption | ~2% of global electricity consumption (2024), rising trend | Pressure to adopt energy-efficient solutions and renewable energy sources. |

| E-waste Generation | 53.6 million metric tons (2019), projected 74 million metric tons by 2030 | Need for robust e-waste management, circular economy integration, and product lifecycle management. |

| Investor ESG Demand | Over 70% of institutional investors consider ESG factors (2024) | Requirement for strong ESG practices to attract capital and maintain investor confidence. |

| Climate Change Impact on Infrastructure | Rising costs from extreme weather events (e.g., $100 billion+ US damages in 2023) | Necessity for climate resilience investments and contingency planning for operational continuity. |

| Green IT Market Growth | USD 21.7 billion (2023) to USD 73.3 billion by 2030 (18.9% CAGR) | Opportunity to invest in and develop sustainable technology solutions for market expansion. |

PESTLE Analysis Data Sources

Our Brockhaus Technologies PESTLE Analysis is built on a robust foundation of data from leading economic institutions, government publications, and reputable industry research firms. We meticulously gather information on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks to provide a comprehensive overview.