Broadridge Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Broadridge Financial Bundle

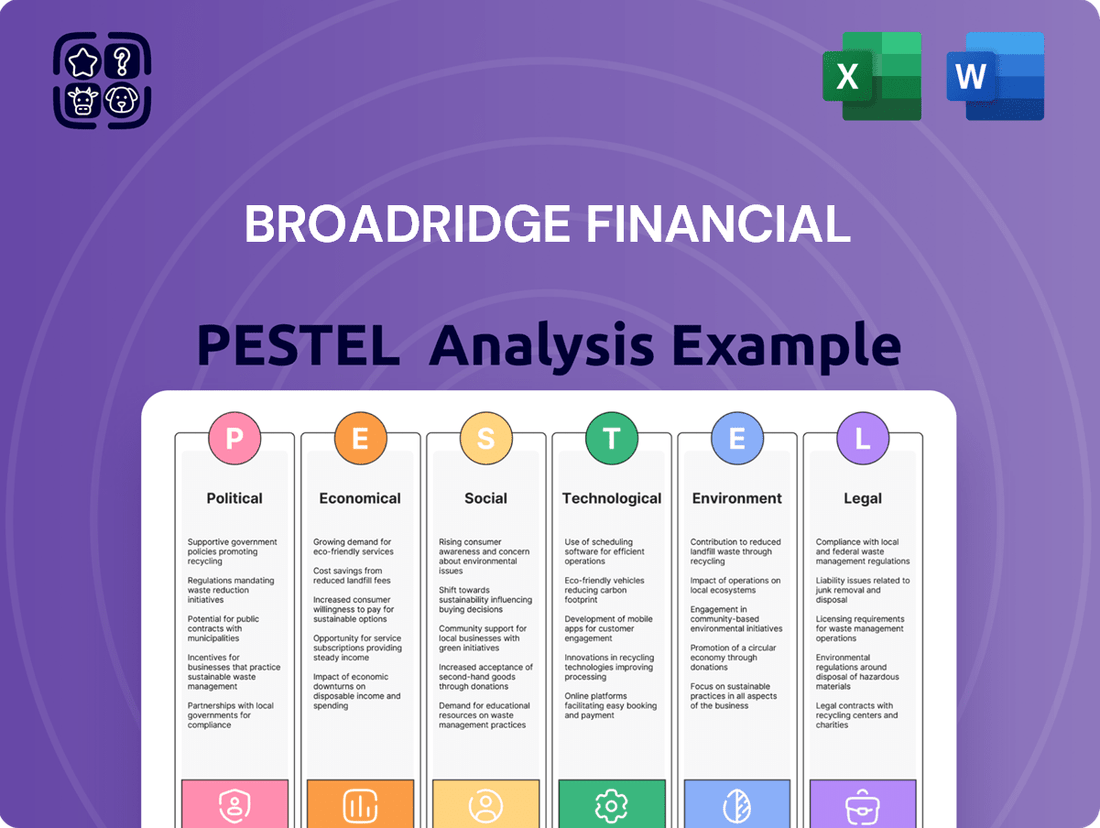

Navigate the complex external forces shaping Broadridge Financial's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing their operations and strategic direction. Gain a critical edge in your own market strategy by leveraging these expert-level insights. Download the full version now for actionable intelligence that empowers smarter decision-making.

Political factors

The financial services sector is experiencing significant regulatory shifts, with new compliance requirements frequently introduced. For instance, in 2024, the SEC continued its focus on areas like cybersecurity and data privacy, impacting how firms manage client information and technology infrastructure.

These evolving regulations directly influence Broadridge's operational strategies and service offerings. Companies must invest in updated systems and processes to adhere to new mandates, such as those related to digital asset reporting or enhanced anti-money laundering (AML) protocols.

Broadridge plays a crucial role in assisting its clients through this dynamic regulatory environment. By providing compliant solutions and expertise, the company helps financial institutions manage the complexities of adapting to new rules, ensuring they can operate efficiently and securely.

New administrations often express a desire to reduce regulatory burdens and spur innovation, a trend observed in recent policy discussions. This governmental focus could encourage fintech firms to pursue bank charters or experiment with novel operating models. For Broadridge, this presents a dynamic environment where client needs for adaptable solutions and support through evolving competitive landscapes will be paramount.

Global geopolitical rivalries and escalating trade tensions are noticeably accelerating a trend away from full globalization and towards more regionalized trade blocs. This is evidenced by a rising number of trade restrictions being implemented worldwide, impacting how businesses operate across borders.

These evolving trade dynamics are actively reconfiguring global supply chains, which in turn can significantly influence economic growth trajectories. For the financial services industry, these shifts translate into altered market conditions and investment opportunities.

As a global fintech leader, Broadridge Financial must closely monitor these macro trends. For instance, the World Trade Organization reported a 30% increase in trade-restrictive measures implemented by G20 economies between October 2022 and October 2023, directly impacting cross-border financial flows and client activity.

Cross-Border Regulatory Harmonization

The global financial landscape is increasingly shaped by efforts to harmonize cross-border regulations. Initiatives like the EU Instant Payments Regulation, which aims to standardize instant payment services across the European Union, directly impact how firms like Broadridge facilitate international transactions for their clients. This regulatory push requires significant operational adjustments and technological integration.

Broadridge is actively supporting financial institutions in achieving compliance with these evolving international standards. For instance, their solutions are designed to enable the rapid adoption of instant payment capabilities, ensuring clients can meet new regulatory deadlines and operational requirements. This positions Broadridge as a key enabler for businesses navigating complex global compliance landscapes.

- EU Instant Payments Regulation: Mandates standardized instant payment services across the EU, impacting cross-border transaction processing.

- Broadridge's Role: Facilitates client compliance with new international regulatory frameworks and deadlines.

- Market Impact: Harmonization efforts drive demand for integrated solutions that streamline global financial operations.

Increased Regulatory Oversight on Technology Providers

Broadridge's U.S. operations, as a key technology provider for financial institutions, face significant scrutiny from regulatory bodies like the FFIEC. This oversight is intensifying, particularly concerning cybersecurity and how financial firms manage their vendors. For instance, in 2024, the FFIEC continued its emphasis on third-party risk management, issuing guidance that reinforces the need for robust due diligence and ongoing monitoring of service providers.

This heightened regulatory focus translates into more demanding contractual obligations for Broadridge with its clients. Meeting these stringent requirements, especially around data protection and operational resilience, can lead to increased costs associated with compliance and the necessary technological investments. The financial services sector saw a 15% increase in cybersecurity spending by financial institutions in 2024 compared to the previous year, reflecting this trend and the pressure on vendors to match these efforts.

Consequently, Broadridge must consistently allocate resources to advanced systems and comprehensive compliance frameworks. This ongoing investment is crucial to not only meet but anticipate the evolving regulatory landscape and maintain client trust. The company's commitment to these areas is vital for its continued success and ability to serve the highly regulated financial services industry.

Political stability and government policies significantly influence the financial services industry. In 2024, continued government focus on financial market stability and consumer protection, as seen in various legislative proposals, directly impacts how firms like Broadridge operate and innovate.

Changes in trade policies and international relations can reshape global financial flows and investment strategies. For instance, the ongoing geopolitical shifts and the rise of regional trade blocs, as highlighted by a 30% increase in trade-restrictive measures by G20 economies between late 2022 and late 2023, necessitate adaptable business models.

Regulatory environments are constantly evolving, requiring substantial investment in compliance and technology. The FFIEC's intensified focus on third-party risk management in 2024, for example, pushes vendors like Broadridge to enhance their security and operational resilience, mirroring the 15% rise in cybersecurity spending by financial institutions that year.

Government initiatives promoting digital transformation and open banking, such as the EU Instant Payments Regulation, create both opportunities and challenges. Broadridge's role in facilitating client compliance with these harmonized cross-border standards is critical for enabling seamless global financial operations.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Broadridge Financial, offering a comprehensive view of its operating landscape.

It provides actionable insights and strategic recommendations to navigate these external forces effectively.

A clear, actionable summary of Broadridge's PESTLE analysis, highlighting key external factors that can be leveraged to mitigate risks and inform strategic decisions.

Economic factors

The global economic landscape is actively transforming, shaped by powerful trends like deglobalization, the push for decarbonization, escalating debt levels, rapid digitalization, and evolving demographics. These interconnected forces, often termed the 'Five D's', present a complex environment for policymakers and investors alike, directly impacting market dynamics and the strategies employed by clients.

For instance, the International Monetary Fund (IMF) projected in its October 2024 World Economic Outlook that global growth would reach 3.2% in 2024, a figure consistent with the previous year, but warned of persistent inflationary pressures and geopolitical risks. This backdrop underscores the need for adaptable investment approaches.

Broadridge Financial's strategic planning is deeply rooted in understanding and responding to these fundamental shifts. By aligning its long-term vision with these macro-economic currents, the company aims to effectively navigate the evolving financial services sector, capitalizing on emerging opportunities while mitigating potential challenges.

Financial market projections suggest a potential reduction in the federal funds rate by the close of 2025. This shift could impact bond yields and the flow of investments. For instance, the Federal Reserve's stance on monetary policy, as observed in their 2024-2025 outlook, will be a key determinant.

However, persistent trend inflation and substantial fiscal deficits are anticipated to push bond yields higher. This creates a complex environment where opposing forces are at play. For example, inflation in the US hovered around 3.4% in early 2024, a figure that could influence future rate decisions.

Broadridge's core business, encompassing securities processing and data analytics, is inherently sensitive to these economic currents. Fluctuations in interest rates and inflation directly affect trading volumes and the demand for sophisticated financial data solutions.

Asset managers are facing significant headwinds from market volatility and intense competition, leading to ongoing fee compression. This challenging landscape underscores the need for operational efficiency and cost-effective solutions within the financial services industry.

Broadridge Financial Solutions, in particular, benefits from its strong recurring revenue model. In fiscal year 2023, approximately 80% of Broadridge's revenue was recurring, offering a substantial degree of stability and predictability even amidst market fluctuations and competitive pressures.

Increased Investment in Financial Technology

Financial institutions are channeling significant resources into their IT infrastructure, with a notable increase in budgets allocated for technology innovation. For instance, a recent industry survey indicated that over 70% of financial services firms plan to boost their IT spending in 2024-2025, with a keen focus on digital transformation initiatives.

This heightened investment is driven by the economic imperative to enhance operational efficiency, improve customer experiences, and manage risk more effectively through advanced technological solutions. The push for automation and digital workflows is a key component of these spending increases.

As a leading global fintech provider, Broadridge is well-positioned to capitalize on this trend. The company's suite of solutions, designed to address automation, efficiency, and risk mitigation, directly aligns with the strategic priorities of financial firms increasing their technology expenditures.

- Increased IT Budgets: Financial institutions are raising IT budgets, with a significant portion earmarked for tech innovation in the next two years.

- Digital Transformation Drive: This spending surge underscores a powerful economic incentive for digital transformation across the financial services sector.

- Broadridge's Advantage: Broadridge, a global fintech leader, is poised to benefit as clients seek its advanced solutions for automation, efficiency, and risk reduction.

Client Demand for Efficiency and Cost Reduction

In today's economic landscape, financial institutions like banks, broker-dealers, and asset managers are intensely focused on cutting costs and minimizing risk. This pressure directly fuels their demand for solutions that streamline operations and enhance efficiency. For instance, in Q1 2024, many financial firms reported significant efforts to optimize their technology spend, with a particular emphasis on automation to drive down operational expenses.

Broadridge's core business model is built around automating and simplifying intricate financial processes, which directly aligns with these client priorities. Their platforms handle everything from trade processing to customer communications, offering a clear path for clients to reduce manual effort and associated costs. This focus on operational simplification is a key driver of Broadridge's sustained relevance.

The persistent need for efficiency and cost savings means that Broadridge's automated solutions remain highly sought after. Their ability to help clients optimize workflows and manage expenses solidifies their value proposition. As of late 2024, industry reports indicate that financial services firms are allocating an increasing portion of their IT budgets towards solutions that promise tangible cost reductions and improved operational agility.

- Client Focus: Financial institutions are prioritizing efficiency and cost reduction due to economic pressures.

- Broadridge's Solution: The company's offerings automate complex processes, directly addressing this client need.

- Market Demand: Continued demand for these solutions highlights Broadridge's value in operational optimization and cost management.

- 2024 Data: Financial firms in early 2024 actively sought to reduce technology spending through automation.

Economic factors significantly influence Broadridge Financial's operations and client demand. Persistent inflation and potential shifts in interest rates, as anticipated by the IMF's 2024 projections, directly impact trading volumes and the need for sophisticated financial data solutions.

Financial institutions are responding to these economic pressures by increasing IT budgets, with over 70% planning to boost spending in 2024-2025, focusing on digital transformation and automation to drive efficiency and reduce costs.

Broadridge's recurring revenue model, which constituted approximately 80% of its revenue in fiscal year 2023, provides a stable foundation against market volatility, while its automation-focused solutions align perfectly with clients' cost-saving imperatives.

| Economic Factor | Impact on Broadridge | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Global Growth Projections | Influences overall market activity and investment volumes. | IMF projected 3.2% global growth for 2024, consistent with 2023. |

| Inflation and Interest Rates | Affects bond yields, investment flows, and demand for data analytics. | Persistent inflation expected; potential federal funds rate reduction by end of 2025. US inflation around 3.4% in early 2024. |

| IT Spending by Financial Institutions | Drives demand for Broadridge's technology and automation solutions. | Over 70% of firms planned IT spending increases in 2024-2025 for digital transformation. |

| Focus on Efficiency & Cost Reduction | Increases demand for Broadridge's operational streamlining services. | Financial firms actively optimizing tech spend via automation to cut operational expenses in Q1 2024. |

What You See Is What You Get

Broadridge Financial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Broadridge Financial PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic positioning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed breakdown of how external forces shape Broadridge's business landscape.

The content and structure shown in the preview is the same document you’ll download after payment. Explore key insights and actionable intelligence for informed decision-making regarding Broadridge Financial.

Sociological factors

Investor expectations are shifting, with a clear demand for more intuitive, efficient, and engaging communication channels. This trend is particularly evident as individual investor ownership in the U.S. stock market reached its highest point in over a decade in 2024, with many actively participating in corporate governance.

This heightened engagement translates to a greater desire for personalized, digital-first interactions and a need for companies to provide clear, accessible information. Broadridge's investor communication solutions are instrumental in bridging this gap, enabling companies to meet these evolving demands and foster stronger shareholder relationships.

The demand for digital and personalized experiences is reshaping the financial services landscape. Both individual investors and large institutions are actively seeking more tailored and accessible digital platforms, compelling financial firms to prioritize innovation. Broadridge's own research and development efforts, including studies on next-generation technologies, underscore this shift, with significant capital being channeled into enhancing customer journeys through sophisticated analytics and artificial intelligence.

This societal evolution directly influences Broadridge's strategic direction, driving its commitment to modernizing wealth management solutions and investor communications. For instance, a 2024 survey indicated that 75% of investors expect personalized communication from their financial providers, a figure that has steadily climbed over the past few years. This expectation necessitates that firms like Broadridge invest heavily in data analytics and AI to deliver customized insights and seamless digital interactions, ensuring they remain competitive in an increasingly digital-first world.

The financial sector is experiencing a seismic shift driven by technology, especially AI and automation. This requires a profound cultural change within firms, making the acquisition and retention of skilled digital talent a top priority. Broadridge, as a key technology enabler, plays a dual role: transforming its own workforce and guiding clients through this crucial human capital evolution.

By 2024, the demand for AI and machine learning specialists in finance is projected to surge by over 50%, according to industry reports. This trend underscores the need for financial organizations to cultivate 'superhuman' capabilities by integrating technology with continuous employee development, a core area where Broadridge offers essential support.

Increasing Importance of ESG Considerations

Environmental, Social, and Governance (ESG) factors are now a major focus for investors and stakeholders. Companies are increasingly expected to report on ESG metrics, with a significant portion of institutional investors integrating ESG into their investment decisions. For instance, a 2024 survey indicated that over 80% of large asset managers consider ESG factors in their portfolio construction.

This growing emphasis directly impacts how companies operate and report their performance. Broadridge is actively developing tools and services to assist businesses in managing and disclosing their sustainability data, aligning with the societal demand for greater corporate accountability and transparency. This trend is particularly evident in the corporate governance and reporting sectors.

The integration of ESG considerations is reshaping corporate strategies and influencing investor sentiment. For example, companies with strong ESG profiles often experience a lower cost of capital. The market for ESG-focused investment products continues to expand rapidly, with global ESG assets projected to reach trillions by 2025, underscoring its growing significance.

- Investor Demand: Over 80% of large asset managers incorporate ESG into investment decisions as of 2024.

- Corporate Response: Broadridge is enhancing solutions for sustainability data management and reporting.

- Market Growth: Global ESG assets are on track to reach significant multi-trillion dollar figures by 2025.

- Impact on Governance: ESG trends are driving changes in corporate governance practices and disclosure requirements.

Democratization of Investing

The ongoing democratization of investing is significantly boosting demand for Broadridge's Governance solutions. This societal movement is making financial markets and their associated information more accessible to a broader range of individual investors.

Broadridge is well-positioned to capitalize on this trend. Its digital and simplified investor communication and shareholder governance tools directly address the needs of this growing and increasingly involved investor base.

- Increased Retail Participation: In 2024, retail investors continued to be a significant force, with platforms reporting substantial year-over-year growth in new account openings. For instance, some major online brokerages saw a 15-20% increase in active retail accounts by early 2025 compared to the previous year.

- Demand for Digital Engagement: Surveys from late 2024 indicated that over 70% of individual investors prefer digital channels for receiving company information and proxy materials, aligning with Broadridge's digitized offerings.

- Focus on Shareholder Rights: As more individuals participate, there's a heightened awareness of shareholder rights and governance. Broadridge's ability to streamline proxy voting and corporate communications supports this heightened engagement, with over 90% of proxy materials being delivered electronically in 2024.

Societal shifts are profoundly impacting financial services, with a growing demand for personalized digital experiences. As of 2024, over 75% of investors expect tailored communications from financial providers, pushing firms like Broadridge to invest heavily in AI and data analytics to enhance customer journeys.

The increasing democratization of investing is also a key factor, making financial markets more accessible. Broadridge's streamlined digital tools for investor communication and governance directly cater to this expanding, more engaged investor base, with over 90% of proxy materials delivered electronically in 2024.

Furthermore, Environmental, Social, and Governance (ESG) considerations are paramount, with over 80% of large asset managers integrating ESG factors into their investment decisions by 2024. Broadridge is actively developing solutions to support businesses in managing and disclosing their sustainability data, aligning with this societal push for greater corporate accountability.

| Sociological Factor | Trend Description | Impact on Broadridge | Supporting Data (2024/2025) |

|---|---|---|---|

| Investor Expectations | Demand for personalized, digital-first communication. | Drives investment in AI and analytics for customer engagement. | 75% of investors expect personalized communication. |

| Democratization of Investing | Increased accessibility of financial markets to individuals. | Boosts demand for simplified digital governance and communication tools. | Retail investor participation remains high; 70% prefer digital channels for company info. |

| ESG Focus | Growing importance of sustainability in investment decisions. | Necessitates development of tools for ESG data management and reporting. | 80% of large asset managers incorporate ESG; global ESG assets projected to reach multi-trillions by 2025. |

Technological factors

The financial services sector is witnessing a significant surge in AI and Generative AI (GenAI) adoption, with a substantial portion of firms allocating moderate to considerable investments. This trend is driven by the potential to revolutionize client interactions, refine investment strategies, and streamline operational efficiencies.

GenAI is becoming deeply embedded in financial workflows, enhancing client experience through personalized interactions, improving decision-making with advanced analytics, and boosting employee productivity by automating routine tasks. Broadridge is actively integrating AI into its offerings, developing solutions for enhanced customer service, sophisticated portfolio construction, and robust compliance management.

Financial institutions are significantly increasing their investment in blockchain and distributed ledger technologies (DLT), seeing them as key enablers for innovation, especially within capital markets. This surge in spending underscores a major industry shift towards asset tokenization and the development of novel digital financial infrastructures.

For example, global investment in blockchain technology in financial services was projected to reach over $12 billion by 2024, with a significant portion allocated to DLT applications. Broadridge is strategically positioned to capitalize on this trend, offering solutions designed to support the real-time, continuous global transaction capabilities that DLT promises.

Cybersecurity is now a paramount concern for financial services, driven by a surge in sophisticated cyberattacks and the potentially devastating financial fallout from data breaches. Reports indicate that the average cost of a data breach in the financial sector reached $5.90 million in 2023, a figure that continues to climb.

Consequently, financial institutions are significantly boosting their spending on advanced cybersecurity technologies and bolstering their operational resilience strategies. Global spending on cybersecurity is projected to exceed $200 billion in 2024, reflecting this heightened emphasis.

Broadridge plays a vital role by offering essential infrastructure and innovative solutions that empower its clients to fortify their operations and protect sensitive data against these ever-evolving digital threats.

Ubiquitous Cloud Computing and Data Management

Cloud platforms and applications are now a cornerstone of the financial sector, powering digital transformation initiatives. This widespread adoption is driven by the need for scalable infrastructure and agile service delivery. Broadridge, for instance, leverages these cloud technologies extensively in its solutions, recognizing their critical role in modern financial operations.

Simultaneously, the financial industry is heavily focused on data harmonization and quality. Breaking down data silos is paramount for firms aiming to optimize their technology investments and unlock the full potential of artificial intelligence. High-quality, accessible data is essential for driving sophisticated analytics and personalized client experiences.

Broadridge's strategic alignment with these trends is evident in its product development. The company's offerings are designed to harness the power of cloud computing while providing robust data management solutions. This approach directly addresses the industry's demand for efficient data utilization and advanced technological capabilities.

- Cloud adoption in finance: By 2024, it's estimated that over 80% of financial institutions will have adopted cloud solutions for critical operations, a significant increase from previous years.

- Data quality initiatives: A 2025 survey indicated that 70% of financial firms identified improved data quality as a top priority for enhancing AI and analytics capabilities.

- Broadridge's cloud-native approach: Broadridge continues to invest in and expand its cloud-native platforms, enabling clients to benefit from increased agility and scalability in their data processing and service delivery.

Continuous Digital Transformation and Next-Gen Technologies

Broadridge's strategic direction is firmly rooted in the ongoing digital transformation sweeping through financial services. This means continuously updating their platforms, making client communications fully digital, and providing advanced technology solutions that go beyond basic services.

The company is actively investing in cutting-edge technologies. For instance, Broadridge is exploring quantum computing, digital assets including cryptocurrencies, and blockchain technology. These investments are designed to help their clients navigate and thrive in a rapidly evolving digital environment, fostering innovation and growth.

In 2024, the financial services sector continued to prioritize digital transformation, with spending on cloud infrastructure and data analytics expected to rise significantly. Broadridge's focus on these areas positions them to capitalize on this trend.

Key technological areas of focus for Broadridge include:

- Modernization of core financial infrastructure.

- Digitization of client and regulatory communications.

- Development of solutions for digital assets and blockchain.

- Leveraging AI and machine learning for enhanced client services.

Technological advancements are reshaping the financial landscape, with AI and cloud computing at the forefront. Broadridge is actively integrating these technologies to enhance client services and operational efficiency. For example, 80% of financial institutions are expected to adopt cloud solutions for critical operations by 2024, while 70% of firms prioritize data quality for AI capabilities in 2025.

| Technology Area | Industry Trend | Broadridge Focus |

|---|---|---|

| Artificial Intelligence (AI) | Increased adoption for client interaction and strategy refinement. | Developing solutions for enhanced customer service and portfolio construction. |

| Cloud Computing | Cornerstone of digital transformation, enabling scalability. | Leveraging cloud-native platforms for agility and scalability. |

| Blockchain/DLT | Key enabler for innovation, especially in capital markets. | Offering solutions for real-time transaction capabilities. |

| Cybersecurity | Paramount concern due to rising sophisticated attacks. | Providing infrastructure to fortify operations and protect data. |

Legal factors

The financial services sector faces a dynamic and intricate web of global regulations. These shifts directly impact Broadridge's operations and financial performance, necessitating ongoing adaptation and compliance investments. For instance, the SEC's Regulation Best Interest, implemented in 2020, and ongoing discussions around ESG disclosures continue to shape client needs and Broadridge's service offerings.

Fintech firms like Broadridge are navigating an increasingly complex web of data protection and privacy regulations globally. For instance, the General Data Protection Regulation (GDPR) in Europe and similar frameworks in the US, such as the California Consumer Privacy Act (CCPA), impose strict rules on how customer data is collected, processed, and stored. Failure to comply can result in significant fines; in 2023, GDPR penalties reached over €1.5 billion across various sectors.

The imperative to safeguard sensitive financial and investor information necessitates ongoing investment in robust technological safeguards and policy updates. Broadridge's commitment to these evolving standards is crucial for maintaining client confidence and operational integrity. The company's adherence to these stringent requirements directly impacts its ability to offer secure and trustworthy financial technology solutions.

New and stricter Anti-Money Laundering (AML) legislation, such as the EU's comprehensive package adopted in 2024, is significantly reshaping the operational landscape for fintech companies. These harmonized rules, alongside the creation of new oversight bodies like the Anti-Money Laundering Authority (AMLA), introduce substantial compliance burdens.

As an entity classified as an 'obliged person' under AML statutes, Broadridge Financial must proactively adapt its existing processes and develop new solutions to meet these increasingly stringent global standards, ensuring robust defense against financial crime.

Digital Operational Resilience Requirements

The EU's Digital Operational Resilience Act (DORA), effective January 17, 2025, mandates stringent digital security and operational resilience for financial entities, directly impacting technology service providers like Broadridge. This legislation requires comprehensive risk assessments, critical operations identification, and robust business continuity and disaster recovery plans. Failure to comply can result in significant penalties, underscoring the critical nature of adherence for market participants.

DORA necessitates that firms like Broadridge demonstrate resilience through regular testing of their ICT systems and processes. This includes identifying and mapping all critical and important functions, as well as third-party dependencies. Broadridge's commitment to high availability and disaster recovery is therefore crucial for its clients to meet these new regulatory obligations.

- DORA's Scope: Affects over 20,000 financial entities in the EU, including significant implications for their technology partners.

- Testing Mandates: Requires financial entities to conduct advanced threat-led penetration testing at least annually for critical ICT functions.

- Third-Party Risk: DORA imposes direct obligations on ICT third-party providers, requiring them to cooperate with financial entities in their resilience assessments.

Rise in Securities Class Action and ESG Litigation

The legal environment is becoming more complex, with a notable uptick in securities class action lawsuits. In 2024, there was a significant rise in new federal filings, indicating increased litigation activity.

Environmental, Social, and Governance (ESG) focused shareholder actions are a key driver of this trend. Investors are increasingly using collective legal actions to ensure companies adhere to ESG mandates, making compliance a critical concern.

This surge directly impacts companies like Broadridge, whose class action services are seeing heightened demand. Clients are actively seeking solutions to manage these intricate legal challenges effectively and optimize shareholder value.

- Securities Class Action Filings: New federal filings saw a notable increase in 2024.

- ESG Litigation Growth: Shareholder actions related to ESG principles have surged significantly.

- Investor Activism: Investors are leveraging collective actions to enforce ESG standards.

- Demand for Services: Broadridge's class action solutions are in high demand to address these legal complexities.

The evolving legal landscape presents both challenges and opportunities for Broadridge. New regulations like the EU's Digital Operational Resilience Act (DORA), effective January 2025, mandate stringent cybersecurity and operational resilience for financial entities, directly impacting technology providers. Similarly, updated Anti-Money Laundering (AML) legislation, such as the EU's comprehensive package adopted in 2024, increases compliance burdens for firms like Broadridge, classified as 'obliged persons'.

Additionally, a notable rise in securities class action lawsuits, particularly those driven by ESG concerns, has increased demand for Broadridge's class action services. In 2024, federal filings saw a significant uptick, highlighting the growing need for companies to manage complex litigation effectively.

These legal shifts underscore the critical importance of robust compliance frameworks and proactive adaptation for Broadridge to maintain client trust and operational integrity in the financial services sector.

| Regulatory Focus | Key Legislation/Trend | Impact on Broadridge | Data/Timeline |

| Digital Resilience | DORA (EU) | Mandates enhanced cybersecurity, risk assessment, and testing for ICT providers. | Effective January 17, 2025. |

| Financial Crime Prevention | Updated AML Directives (EU) | Increases compliance obligations and oversight for financial service providers. | Package adopted in 2024. |

| Litigation Trends | Securities Class Actions (US) | Increased demand for class action administration and management services. | Notable rise in federal filings in 2024. |

| Investor Demands | ESG Shareholder Actions | Drives need for compliance and transparent reporting to mitigate litigation risk. | Significant surge in ESG-related litigation. |

Environmental factors

Broadridge is demonstrating a strong commitment to environmental responsibility by actively pursuing net-zero emissions. In 2024, the company submitted its detailed plan to the Science Based Targets initiative (SBTi), a crucial step in validating its ambitious goals.

The company's overarching objective is to achieve net-zero greenhouse gas (GHG) emissions across its entire value chain by 2050. This timeline directly aligns with the urgent global imperative to mitigate the impacts of climate change and underscores Broadridge's dedication to sustainable business practices.

Broadridge is actively promoting digitization to help clients shrink their environmental impact. A key focus is transitioning investor communications from paper to digital formats, which significantly cuts down on paper usage and the associated waste from mail processing.

This strategic shift directly benefits the environment by reducing the carbon footprint associated with physical mail for both Broadridge and its extensive client base. For instance, in 2023, the financial services industry continued to see a significant push towards digital statements, with many firms reporting double-digit percentage increases in e-delivery adoption rates.

Broadridge is actively integrating eco-friendly practices throughout its operations and supply chain. This commitment is demonstrated through initiatives focused on responsible energy consumption and waste reduction in its facilities. For example, in fiscal year 2023, Broadridge reported a 15% reduction in its Scope 1 and Scope 2 greenhouse gas emissions compared to its 2019 baseline, showcasing tangible progress in its environmental stewardship.

Sustainability Data Management and Reporting Solutions

The increasing global emphasis on environmental, social, and governance (ESG) factors has spurred a significant demand for robust sustainability data management and reporting solutions. Broadridge’s partnership with Novisto directly addresses this by offering a platform designed to streamline the collection, auditing, and reporting of ESG data. This move is critical as investors increasingly scrutinize companies' sustainability performance, with a significant portion of institutional investors now integrating ESG considerations into their investment decisions. For instance, in 2024, surveys indicated that over 70% of institutional investors consider ESG factors when making investment choices.

This collaboration empowers businesses to navigate the complexities of evolving investor expectations and a growing web of global regulations. Companies are facing mounting pressure to provide transparent and reliable sustainability disclosures. The platform aims to simplify this by centralizing data and ensuring its integrity, which is vital for maintaining investor confidence and avoiding potential regulatory penalties. By 2025, it's projected that over 90% of major global stock exchanges will have some form of ESG reporting requirements in place.

- Increased Investor Demand: Over 70% of institutional investors in 2024 factored ESG into their investment decisions.

- Regulatory Landscape: By 2025, an estimated 90% of major stock exchanges will mandate some ESG reporting.

- Data Integrity: The platform focuses on simplifying the collection and auditing of ESG data to meet stringent reporting standards.

- Market Trend: The partnership reflects a broader industry trend towards greater transparency in corporate sustainability practices.

Associate Engagement in Environmental Initiatives

Broadridge actively cultivates associate engagement in environmental initiatives, exemplified by its 'BeGreen' Associate Network. This internal group, established in 2023, serves as a crucial platform for educating, encouraging, and empowering employees to embrace sustainable mindsets and practices across the organization.

The BeGreen network has been instrumental in driving tangible environmental actions. For instance, in 2024, it organized over 50 global events focused on sustainability leadership and community engagement, directly involving thousands of associates in efforts to reduce the company's environmental footprint.

- BeGreen Network Launch: Established in 2023 to foster environmental responsibility among associates.

- Global Event Participation: Spearheaded 50+ sustainability events globally in 2024, increasing associate involvement in environmental causes.

- Focus Areas: Educating, encouraging, and empowering employees to adopt green practices and mindsets.

- Impact: Aims to embed sustainability into the company culture through active associate participation.

Broadridge's environmental strategy is deeply integrated with its business operations, focusing on reducing its carbon footprint and promoting digital solutions. The company's commitment to net-zero emissions by 2050, validated by its 2024 submission to the Science Based Targets initiative (SBTi), highlights a forward-thinking approach to sustainability.

The push towards digital investor communications, a core part of Broadridge's offering, directly combats paper waste and associated emissions, aligning with industry trends that saw significant e-delivery adoption increases in 2023.

Broadridge's operational efficiency is also seeing environmental gains, with a 15% reduction in Scope 1 and 2 GHG emissions achieved by fiscal year 2023 compared to a 2019 baseline.

The company's partnership with Novisto addresses the growing demand for ESG data management, a critical area as over 70% of institutional investors in 2024 considered ESG factors, and by 2025, 90% of major stock exchanges are expected to have ESG reporting mandates.

| Environmental Metric | 2023 Performance | 2024 Initiatives | Target |

|---|---|---|---|

| Net-Zero Commitment | SBTi plan submission | 2050 | |

| Scope 1 & 2 GHG Emissions | 15% reduction vs. 2019 | Continued reduction efforts | Net-Zero by 2050 |

| Digital Investor Communications | Increased e-delivery adoption | Promoting paperless solutions | Reduce paper waste |

| ESG Data Management | Partnership with Novisto | Streamlining ESG reporting | Enhance transparency |

PESTLE Analysis Data Sources

Our PESTLE analysis for Broadridge Financial is built upon a robust foundation of data from official government publications, reputable financial news outlets, and leading industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the financial services sector.