Broadridge Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Broadridge Financial Bundle

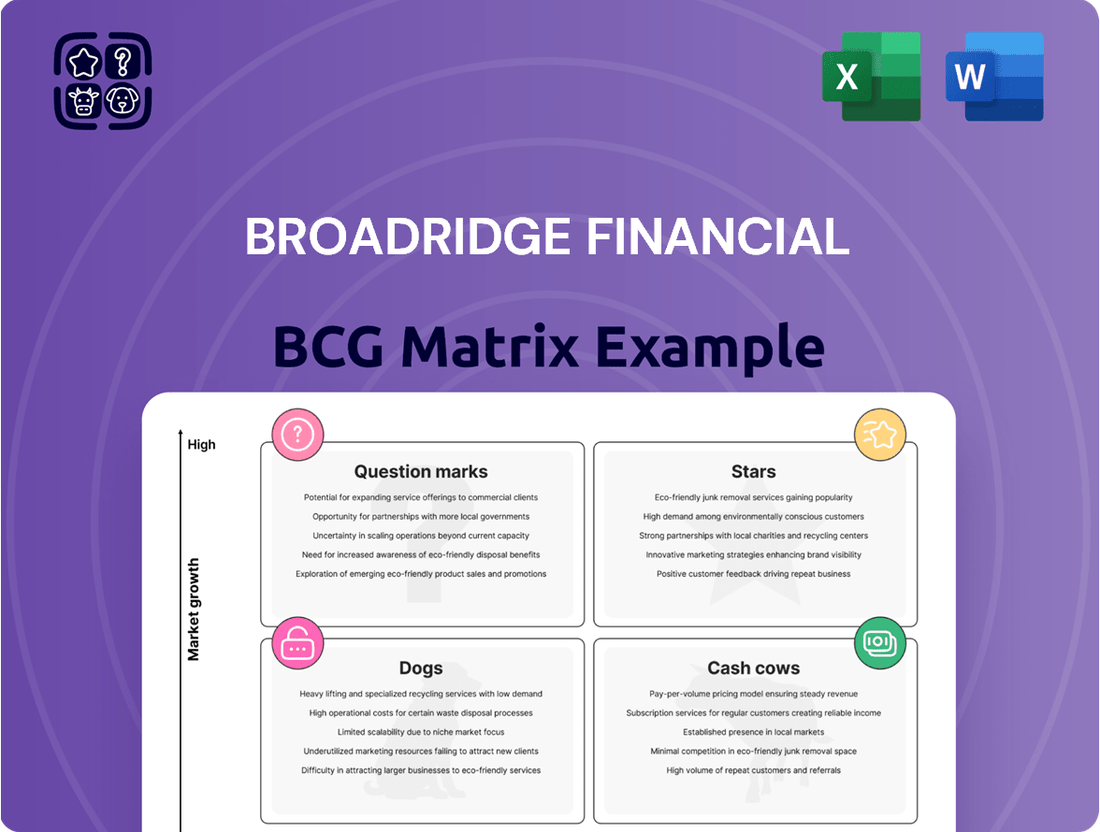

Unlock the strategic potential of Broadridge Financial's product portfolio with our comprehensive BCG Matrix analysis. Understand which offerings are driving growth (Stars), generating consistent revenue (Cash Cows), requiring careful consideration (Question Marks), or potentially hindering progress (Dogs). This preview offers a glimpse into the powerful insights available.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Broadridge's Investor Communication Solutions (ICS) stands as a significant pillar, demonstrating robust recurring revenue growth and underpinning the investing and governance landscape. Its regulatory and data-driven offerings are particularly well-positioned, capitalizing on the expanding accessibility of investing and the imperative for financial institutions to navigate evolving regulations, securing a dominant market share in an expanding sector.

The Capital Markets segment is a powerhouse, with recurring revenue soaring past $1 billion in fiscal 2024. This impressive growth is fueled by the strong demand for Broadridge's Trading and Connectivity Solutions (BTCS) and the successful integration of new global post-trade clients.

This performance highlights Broadridge's dominant standing in a dynamic market. As trading volumes continue to climb and the need for efficient, scalable infrastructure intensifies, Broadridge's innovative approach to simplifying trading operations solidifies its leadership in this rapidly expanding sector.

Broadridge's modernization of wealth and investment management platforms is showing promising results, driven by new client acquisitions and the successful implementation of their core wealth platform for initial clients. This strategic push is vital as financial institutions worldwide are upgrading their wealth services to meet changing client expectations and leverage new technologies, positioning Broadridge in a rapidly expanding market. In 2024, the company reported a 7% increase in revenue for its Investor Communication Solutions segment, which includes wealth management offerings, reflecting this growing momentum.

Digital Asset Solutions (e.g., ClearFi)

Broadridge Financial's introduction of Digital Asset Solutions, featuring ClearFi in October 2024, firmly places them in the burgeoning cryptocurrency and digital asset sector. This segment is experiencing substantial expansion as financial institutions increasingly adopt digital asset strategies and navigate a complex regulatory landscape.

The digital asset space is a prime candidate for a 'Star' in the BCG Matrix. Its high growth potential is driven by the increasing adoption of digital assets by institutional investors and the ongoing development of regulatory frameworks. Broadridge's move here signifies a strategic bet on capturing significant market share in this nascent, high-growth market.

- Market Growth: The global digital asset market is projected to reach $5.1 trillion by 2030, according to some industry estimates, showcasing immense growth potential.

- Institutional Adoption: A significant portion of financial institutions are exploring or actively engaging with digital assets, with a notable increase in investment in blockchain technology and digital asset infrastructure.

- Regulatory Clarity: As regulations become clearer, institutional participation is expected to accelerate, further fueling market growth and creating opportunities for solutions like ClearFi.

- Innovation Focus: Broadridge's emphasis on investor education and transparency within this new asset class underscores its commitment to fostering a more accessible and understandable digital asset ecosystem.

Generative AI Initiatives and Integration

Generative AI is a significant area of investment for Broadridge, reflecting a broader trend where financial services firms are boosting their spending on this technology. This increased investment is driven by the potential for GenAI to significantly improve how employees work, streamline reporting processes, and lower overall operational expenses.

Broadridge is actively integrating AI into its product suite, exemplified by its internal AI tool, BroadGPT. This strategic integration highlights Broadridge's commitment to harnessing the power of high-growth AI technologies to foster efficiency and innovation throughout the financial services sector.

- Increased GenAI Spending: A notable percentage of financial services firms are escalating their investments in Generative AI.

- Productivity Gains: GenAI is seen as a key driver for enhancing employee productivity within financial institutions.

- Reporting Enhancement: The technology offers substantial improvements in the quality and efficiency of financial reporting.

- Cost Reduction: Firms are leveraging GenAI to identify and realize opportunities for reducing operational costs.

- Broadridge's AI Integration: Broadridge is embedding AI, like BroadGPT, into its solutions to lead in technological adoption.

Broadridge's Digital Asset Solutions, powered by ClearFi, represent a strategic move into a high-growth sector. The company's focus on investor education and transparency within this emerging asset class positions it to capture significant market share. The digital asset market is experiencing substantial expansion, driven by increasing institutional adoption and evolving regulatory clarity.

What is included in the product

Strategic assessment of Broadridge's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

The Broadridge Financial BCG Matrix offers a clear, one-page overview, simplifying complex portfolio analysis for executives.

Cash Cows

Broadridge's print and mail investor communication services are a prime example of a Cash Cow. This segment, while operating in a mature market with limited growth potential due to increasing digitization, consistently generates significant and stable cash flow. This is largely due to their essential role in regulatory compliance and Broadridge's entrenched position and extensive distribution network.

Despite the shift towards digital, these services remain vital for many companies, ensuring shareholder information reaches its intended recipients reliably. Broadridge's dominance in this space allows them to command a strong market share, translating into predictable revenue streams that help fund other, more growth-oriented initiatives within the company.

For instance, in fiscal year 2024, Broadridge reported steady performance in its Investor Communication Solutions segment, which includes these print and mail services. While specific segment breakdowns are often proprietary, the overall resilience of this business underscores its Cash Cow status, providing a reliable financial foundation.

Broadridge's established middle and back-office securities processing solutions are undeniably a Cash Cow. Their dominance in this space, characterized by a substantial market share, underscores their critical role for financial institutions. These services are essential for the smooth operation of banks and broker-dealers, making them indispensable.

The predictable, recurring revenue generated by these solutions, coupled with high client loyalty, highlights their Cash Cow status. Financial firms depend on Broadridge to streamline and automate intricate processes, ensuring efficiency even within a mature, slower-growing market segment.

Broadridge's regulatory and compliance reporting services are a prime example of a cash cow within their business portfolio. The ever-changing landscape of financial regulations, from evolving data privacy laws to new reporting mandates, guarantees a persistent and growing need for these services. Broadridge's established position and extensive knowledge in this area allow them to command a significant market share.

These offerings are characterized by their consistent, predictable revenue streams. Because the demand is driven by regulatory necessity rather than aggressive marketing, the need for substantial new investment in promotion is minimal. This stability and low reinvestment requirement mean these services are a significant contributor to Broadridge's overall cash flow, supporting other business initiatives.

Established Data and Analytics Solutions (Non-Growth Focused)

Broadridge's established data and analytics solutions, distinct from their high-growth 'data-driven fund solutions,' function as a Cash Cow within their business portfolio. These offerings cater to mature market segments, consistently delivering valuable insights and reporting.

These established solutions generate stable cash flow for Broadridge, requiring minimal new investment to maintain their market position. This allows the company to effectively leverage these mature offerings for predictable revenue streams.

- Consistent Revenue Generation: These solutions provide ongoing value to clients in established financial sectors, ensuring a steady income for Broadridge.

- Low Investment Requirement: Unlike growth-stage products, these established offerings do not necessitate substantial capital outlays for expansion, maximizing profitability.

- Mature Market Focus: They serve clients in segments where Broadridge has a strong, recognized presence and a deep understanding of client needs.

- Stable Cash Flow: The predictable nature of these offerings allows Broadridge to rely on them for consistent financial returns, supporting other business initiatives.

Broker-Dealer Investor Communication Solutions

Broadridge's investor communication solutions for broker-dealers are a cornerstone of their business, fitting squarely into the Cash Cow quadrant of the BCG Matrix. These services, which include proxy voting, regulatory communications, and trade confirmations, are critical for broker-dealers to operate efficiently and comply with regulations.

This segment generates substantial and predictable recurring revenue for Broadridge. In fiscal year 2024, Broadridge reported strong performance in its Investor Communication Solutions segment, driven by these essential services. The company consistently maintains a high market share in this mature but vital industry, underscoring its stability and established position.

- High Market Share: Broadridge holds a dominant position in the broker-dealer investor communication market, ensuring a consistent client base.

- Recurring Revenue: The nature of these services provides a stable and predictable stream of income, essential for cash flow generation.

- Operational Efficiency: Broadridge focuses on optimizing its existing infrastructure and processes to maximize profitability from this established business.

- Essential Services: These communication solutions are non-discretionary for broker-dealers, guaranteeing ongoing demand.

Broadridge's established securities processing solutions are a classic Cash Cow, generating consistent and significant cash flow. These services, vital for the operational backbone of financial institutions, benefit from high client stickiness and a mature market where Broadridge holds a dominant market share.

The predictable, recurring revenue from these solutions requires minimal reinvestment, allowing Broadridge to allocate capital to higher-growth areas. For instance, Broadridge's fiscal year 2024 performance highlighted the resilience of its middle and back-office processing, a testament to its Cash Cow status.

These offerings are characterized by their essential nature, ensuring smooth transactions and regulatory compliance for banks and broker-dealers. This indispensability translates into stable demand and predictable earnings, a hallmark of a strong Cash Cow.

| Business Segment | BCG Matrix Classification | Key Characteristics | Fiscal Year 2024 Relevance |

| Securities Processing (Middle & Back-Office) | Cash Cow | High market share, recurring revenue, mature market, low reinvestment needs | Continued strong performance and revenue generation |

| Investor Communication Solutions (Print & Mail) | Cash Cow | Essential service, regulatory necessity, established distribution, stable cash flow | Steady contribution to overall segment revenue |

| Regulatory & Compliance Reporting | Cash Cow | Persistent demand due to evolving regulations, high client dependency, predictable income | Underpins consistent revenue streams |

Full Transparency, Always

Broadridge Financial BCG Matrix

The Broadridge Financial BCG Matrix preview you see is the identical, final document you will receive upon purchase, ensuring complete transparency and immediate usability. This comprehensive report is fully formatted and analysis-ready, mirroring the exact content and professional design that will be delivered to you. You can confidently use this preview as a direct representation of the strategic insights and actionable data contained within the purchased file. No watermarks or demo content are present; what you preview is precisely what you will download and implement in your business planning.

Dogs

Legacy print-heavy customer communications within Broadridge's portfolio, particularly those with slow digital adoption, can be classified as Dogs in the BCG matrix. While Broadridge leads in overall customer communications, these specific print-centric areas face a challenging future as the financial industry accelerates its digital transformation.

These segments are likely to exhibit low growth and may see declining market share as clients increasingly favor digital channels. A prime example of managing such a segment is Broadridge's closure of one print operation within Customer Communications in 2023, which was accompanied by a restructuring charge, highlighting the strategic decisions needed to address these legacy areas.

Outdated or niche proprietary systems within Broadridge's portfolio, if not modernized or integrated, could be considered Dogs. These systems often struggle with low market share and minimal growth, potentially consuming resources without substantial returns. For instance, a legacy system supporting an increasingly obsolete financial product might fit this category.

Services heavily reliant on manual processes are categorized as Dogs within Broadridge's BCG Matrix. These offerings face significant headwinds in a market increasingly embracing automation.

For instance, manual trade settlement or client onboarding, while still existing, are becoming exceptions rather than the norm. In 2024, the financial services industry continued its aggressive push towards straight-through processing (STP), with many firms reporting STP rates exceeding 95% for core trade execution.

As automation accelerates, these manual-intensive services are likely to experience declining demand and shrinking market share. This can lead to reduced profitability and may prompt Broadridge to consider divesting or undertaking substantial re-engineering efforts to modernize these offerings.

Non-Strategic, Underperforming Small Acquisitions

Non-strategic, underperforming small acquisitions, often termed 'Dogs' in the BCG Matrix framework, represent a challenge for companies like Broadridge. These are typically smaller businesses acquired for reasons other than core strategic alignment, which have subsequently failed to integrate smoothly or capture meaningful market share. Their limited growth prospects and low market penetration mean they often become resource drains rather than contributors to overall company performance.

If these smaller acquisitions do not demonstrate a clear path to integration with Broadridge's core strategic growth areas, they become prime candidates for divestiture. This proactive approach ensures that capital and management attention are redirected towards initiatives with higher potential returns, rather than being consumed by underperforming assets. For instance, if a small fintech acquisition made in 2023, intended to bolster a specific service line, only achieved 2% of its projected market share by mid-2024 and required significant ongoing investment, it would fit this 'Dog' category.

- Low Market Share: Acquisitions that fail to gain traction, securing less than 5% market share within their respective segments.

- Limited Growth Trajectory: Businesses exhibiting an annual growth rate below 3%, significantly lagging industry averages.

- Resource Drain: Operations that consistently consume disproportionate management time and financial resources without generating commensurate returns.

- Strategic Misalignment: Entities that do not contribute to Broadridge's overarching strategic objectives or future growth pillars.

Highly Specialized, Stagnant Advisory Solutions

Certain highly specialized advisory solutions might be found in the Dogs quadrant. These are offerings that cater to a niche, possibly shrinking, client base. They haven't kept pace with evolving market demands or been integrated into Broadridge's wider platform ecosystem. For instance, a legacy system offering advice on an outdated regulatory framework with minimal adoption in 2024 would fit here.

These solutions typically exhibit low growth and a low market share. This strategic position necessitates a thorough re-evaluation of their relevance and potential within Broadridge's overall portfolio. Without significant adaptation or a clear path to revitalization, they represent a drain on resources.

- Low Market Growth: Solutions targeting segments with declining client numbers or investment activity.

- Limited Integration: Offerings that operate in isolation, failing to connect with Broadridge's broader digital or advisory platforms.

- Stagnant Revenue: Advisory services that have seen little to no revenue growth in recent years, potentially declining.

- High Maintenance Costs: Specialized solutions that require ongoing investment for upkeep without commensurate returns.

Services heavily reliant on manual processes, such as manual trade settlement or client onboarding, are categorized as Dogs within Broadridge's BCG Matrix. These offerings face significant headwinds as the financial services industry continued its aggressive push towards straight-through processing (STP) in 2024, with many firms reporting STP rates exceeding 95% for core trade execution.

As automation accelerates, these manual-intensive services are likely to experience declining demand and shrinking market share, potentially leading to reduced profitability. This might prompt Broadridge to consider divesting or undertaking substantial re-engineering efforts to modernize these offerings.

Certain highly specialized advisory solutions that cater to a niche, possibly shrinking, client base and haven't kept pace with evolving market demands are also considered Dogs. For instance, a legacy system offering advice on an outdated regulatory framework with minimal adoption in 2024 would fit here, exhibiting low growth and low market share.

These solutions necessitate a thorough re-evaluation of their relevance and potential within Broadridge's overall portfolio. Without significant adaptation or a clear path to revitalization, they represent a drain on resources, characterized by low market growth, limited integration, stagnant revenue, and high maintenance costs.

Question Marks

Broadridge's expansion into new global markets, particularly through acquisitions like Acolin in Europe or the acquisition of Kyndryl's SIS business in Canada to expand wealth management and capital markets solutions, represents a strategic push into emerging markets. These ventures are in growing markets, but Broadridge's market share is still developing, requiring significant investment to establish a dominant position and realize their full potential.

Broadridge actively cultivates a broad network of fintech partnerships, focusing on emerging technologies. These collaborations, particularly in areas like quantum computing and advanced blockchain applications, represent significant future growth avenues. For instance, Broadridge's 2024 initiatives in exploring quantum-resistant cryptography for enhanced data security underscore this forward-looking strategy.

Broadridge is actively developing solutions focused on hyper-personalization and next-generation client experiences, likely utilizing advanced data analytics and AI. These initiatives target a rapidly expanding market shaped by increasingly sophisticated client demands for tailored interactions and services. While the market potential is significant, Broadridge's specific offerings in this nascent space may currently hold a low market share, necessitating considerable investment for future growth and competitive positioning.

Specific Blockchain and Distributed Ledger Technology (DLT) Applications

Within Broadridge's extensive financial technology offerings, nascent applications of blockchain and Distributed Ledger Technology (DLT) represent areas with significant future growth potential but currently limited market penetration. These specific use cases, while not yet mainstream, are crucial for Broadridge to explore and invest in to establish early leadership.

These emerging DLT applications are characterized by high growth prospects but a low current market share, necessitating strategic capital allocation to validate their utility and facilitate scaling. For instance, consider the potential for DLT in streamlining complex post-trade settlement processes, which currently involve numerous intermediaries and manual reconciliation. Broadridge is actively exploring how DLT can reduce settlement times and counterparty risk in these areas.

Specific nascent applications include:

- Tokenized Securities Issuance and Trading: While the market for tokenized assets is still developing, Broadridge is investigating DLT's role in creating, managing, and trading digital representations of traditional securities, offering potential for increased liquidity and fractional ownership.

- Digital Identity and KYC/AML Solutions: Leveraging DLT for secure and verifiable digital identities can revolutionize Know Your Customer (KYC) and Anti-Money Laundering (AML) processes, reducing redundancy and enhancing compliance efficiency across financial institutions.

- Decentralized Finance (DeFi) Infrastructure: Broadridge is evaluating how to integrate its services with emerging DeFi protocols, providing the underlying infrastructure for a more decentralized financial ecosystem, though regulatory clarity remains a key factor.

AI-driven Automation for Niche Back-Office Functions

Broadridge is actively exploring AI-driven automation for niche back-office functions, recognizing the potential for significant operational efficiency gains in specialized areas. These efforts are positioned within a high-growth segment of the financial services technology market.

While the market for highly specific automation solutions is still developing, Broadridge's strategic focus here represents a forward-looking approach. This segment, though potentially having limited immediate market share, requires dedicated investment to foster innovation and achieve scalability.

- Emerging Market: Targeting niche back-office functions with AI automation represents an investment in an emerging market with substantial long-term growth potential.

- Operational Efficiency: The primary driver is to unlock significant operational efficiencies within specialized financial processes.

- Focused Investment: Success in these niche areas necessitates targeted investment in technology development and market penetration strategies.

- Scalability Challenges: Developing and scaling AI solutions for highly specific functions requires overcoming unique technical and market adoption hurdles.

The integration of AI-driven automation into niche back-office functions positions Broadridge within a high-growth market segment. While these specialized solutions may currently have limited market share, they require dedicated investment to foster innovation and achieve scalability, aiming for significant operational efficiencies.

These initiatives represent an investment in an emerging market with substantial long-term growth potential, driven by the pursuit of significant operational efficiencies within specialized financial processes. Success hinges on targeted investment in technology development and market penetration strategies, though scalability challenges for highly specific AI functions persist.

Broadridge's exploration of AI for niche back-office automation aligns with a strategy to capture growth in specialized areas, requiring focused investment despite potential scalability hurdles and current market share limitations.

The company's strategic focus on these emerging DLT applications, such as tokenized securities and digital identity solutions, highlights a commitment to innovation in areas with high growth prospects but low current market share, necessitating strategic capital allocation for validation and scaling.

| Area of Focus | Market Potential | Current Market Share | Investment Required | Key Drivers |

|---|---|---|---|---|

| AI Automation (Niche Back-Office) | High Growth | Low | Significant | Operational Efficiency |

| DLT Applications (Tokenized Securities, Digital Identity) | High Growth | Low | Strategic Capital Allocation | Liquidity, Compliance Efficiency |

| Global Market Expansion (e.g., Europe, Canada) | Growing | Developing | Substantial | Market Share Growth |

| Fintech Partnerships (Quantum Computing, Blockchain) | Future Growth | Nascent | Focused R&D | Technological Advancement |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of proprietary market data, public financial disclosures, and industry-specific growth projections to provide a comprehensive view.