Broadridge Financial Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Broadridge Financial Bundle

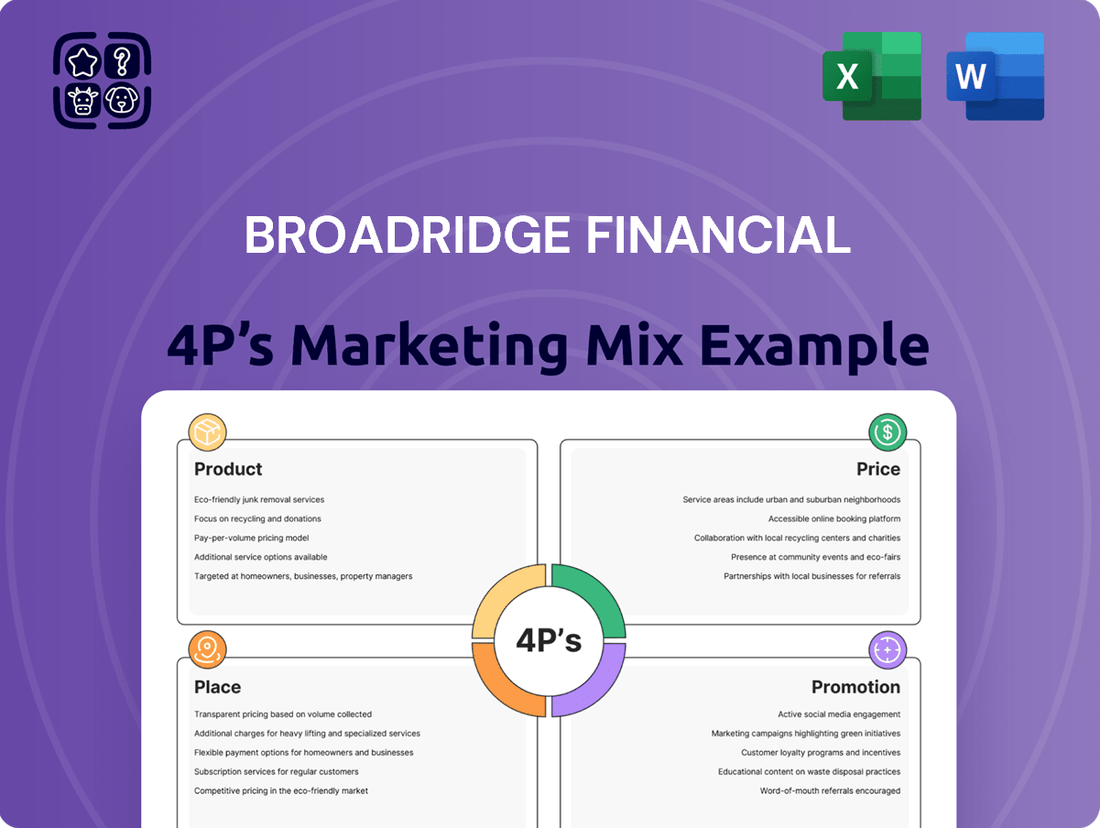

Unlock the secrets behind Broadridge Financial's market dominance with our comprehensive 4Ps Marketing Mix Analysis. Discover how their product innovation, strategic pricing, expansive distribution, and targeted promotions create a winning formula.

Go beyond the surface and gain a strategic advantage. Our in-depth analysis breaks down each element of Broadridge Financial's marketing strategy, providing actionable insights for your own business planning.

Save valuable time and resources. Get instant access to a professionally written, editable report that dissects Broadridge Financial's 4Ps, perfect for presentations, benchmarking, or strategic development.

Product

Broadridge's Investor Communication Solutions, a key part of their Product offering, are designed to streamline and enhance how companies connect with their shareholders. This includes the critical tasks of processing and distributing proxy materials for both equity securities and mutual funds, as well as managing the voting process. In 2024, efficient shareholder engagement remains paramount, with companies striving to increase participation rates in corporate governance matters.

Leveraging digital tools like ProxyEdge®, Broadridge aims to boost investor participation, recognizing that active engagement is vital for informed decision-making. This focus on digital solutions addresses the growing demand for convenient and accessible ways for both institutional and retail investors to cast their votes. The platform's ability to simplify the voting process is a significant advantage for clients seeking to improve their proxy voting outcomes.

Beyond proxy voting, these solutions also encompass the distribution of essential regulatory reports, class action notifications, corporate action information, and tax reporting. This comprehensive approach ensures clients meet their regulatory compliance obligations. For instance, in the 2024 proxy season, timely and accurate distribution of these documents was crucial for many publicly traded companies navigating evolving disclosure requirements.

Broadridge's Securities Processing Solutions are the 'Product' in their marketing mix, focusing on automating and simplifying the complex middle and back-office operations for financial institutions. These solutions are crucial for efficient trade clearing, settlement, and booking, directly supporting the daily trading of trillions of dollars in securities worldwide.

These offerings are designed to significantly reduce operational risk and boost efficiency for clients. For instance, Broadridge's platforms handle a substantial volume of post-trade processing, a critical function for maintaining market stability and investor confidence. In 2024, the sheer volume of global securities transactions underscores the essential nature of these robust processing capabilities.

Broadridge's Data and Analytics Solutions are central to its marketing mix, offering asset managers critical investment product distribution data and sophisticated analytical tools. These insights empower optimization across global retail and institutional channels, a key differentiator in the competitive landscape. For instance, Broadridge’s data platforms are designed to provide actionable intelligence for navigating complex market dynamics, supporting strategic decision-making for firms aiming to enhance their market penetration and product performance through the end of 2024 and into 2025.

The Product element also encompasses Broadridge's commitment to fiduciary-focused learning and development, alongside its comprehensive software and technology services. This integrated approach caters to advisors, institutions, and asset managers alike, aiming to elevate their capabilities and compliance standards. By providing these resources, Broadridge strengthens its value proposition, ensuring clients are equipped with the knowledge and tools to succeed in an evolving regulatory and market environment.

Wealth Management Platforms

Broadridge's wealth management platforms represent a key component of their product strategy, focusing on modernization and expansion. They offer a modular suite of capabilities, anchored by a foundational wealth platform designed to streamline operations for financial institutions. This strategic push includes extending these advanced wealth solutions into new international markets, aiming to capture a larger global share.

The company is actively driving sales across its comprehensive solution suite, which encompasses offerings tailored for retirement and workplace products. Crucially, these platforms are designed to empower financial advisors with enhanced tools and services, facilitating better client engagement and operational efficiency. Broadridge reported significant growth in its Wealth Management segment in fiscal year 2024, with revenues increasing by 7% to $2.7 billion, underscoring the market's positive reception to their modernized offerings.

- Modular Wealth Platform: Broadridge is building a flexible, component-based wealth management system, allowing firms to adopt specific functionalities as needed.

- Market Expansion: The company is actively targeting and expanding its wealth management capabilities into new geographical markets, seeking broader adoption.

- Sales Drive: A concentrated effort is underway to increase sales across the entire wealth solutions suite, including retirement and workplace products.

- Advisor Enablement: The platforms are designed to provide advisors with the necessary tools and services to enhance their productivity and client service delivery.

Emerging Technologies & Innovation

Emerging Technologies & Innovation is a cornerstone of Broadridge's strategy, with significant investments in AI, generative AI (GenAI), blockchain, and distributed ledger technology (DLT). These investments aim to revolutionize their existing products and services, pushing the boundaries of what's possible in financial services. For instance, Broadridge is actively developing AI-powered analytics designed to streamline post-trade processing, a critical area for efficiency and accuracy in the industry.

The company's commitment to innovation is further demonstrated by the launch of new AI-powered algorithm insights services. These services are designed to provide clients with sophisticated analytical tools, helping them make more informed trading decisions. Broadridge is also expanding its generative AI capabilities, exemplified by the development of tools like BondGPT Intelligence, which promises to enhance data analysis and content generation within the fixed income markets.

- AI-Powered Analytics: Enhancing post-trade processing efficiency and accuracy.

- GenAI Capabilities: Developing tools like BondGPT Intelligence for advanced market insights.

- Blockchain & DLT: Exploring applications for increased transparency and security in financial transactions.

- Algorithm Insights: Launching services to empower clients with data-driven trading strategies.

Broadridge's product strategy centers on delivering sophisticated solutions for investor communications, securities processing, and data analytics. These offerings are designed to automate complex financial operations, enhance regulatory compliance, and provide actionable market insights. The company's focus on digital transformation and emerging technologies like AI and GenAI is key to its product development, aiming to drive efficiency and innovation for its diverse client base.

The company's wealth management platforms are a significant product focus, featuring a modular design and expansion into new international markets. Broadridge is actively promoting its full suite of wealth solutions, including retirement and workplace products, to better empower financial advisors. This strategic push saw their Wealth Management segment revenue grow by 7% to $2.7 billion in fiscal year 2024.

Broadridge's commitment to innovation is evident in its substantial investments in artificial intelligence, generative AI, blockchain, and distributed ledger technology. These advancements are integrated into their product lines to streamline processes such as post-trade analytics and to offer clients sophisticated tools like BondGPT Intelligence for enhanced market data analysis.

| Product Area | Key Offerings | 2024 Focus/Data | Impact |

|---|---|---|---|

| Investor Communications | Proxy materials, voting platforms (ProxyEdge®) | Enhancing investor participation in governance | Streamlined compliance and engagement |

| Securities Processing | Trade clearing, settlement, booking automation | Handling high volumes of global transactions | Reduced operational risk, increased efficiency |

| Data & Analytics | Investment product distribution data, analytical tools | Optimizing global distribution channels, market intelligence | Informed strategic decision-making |

| Wealth Management | Modular wealth platforms, retirement/workplace solutions | FY24 revenue: $2.7 billion (+7% growth) | Modernized operations, advisor enablement, market expansion |

| Emerging Technologies | AI, GenAI, Blockchain, DLT integration | Development of AI-powered analytics, BondGPT Intelligence | Revolutionizing existing services, driving innovation |

What is included in the product

This analysis provides a comprehensive deep dive into Broadridge Financial's Product, Price, Place, and Promotion strategies, offering actionable insights for marketing professionals.

Simplifies complex marketing strategies into actionable insights, easing the burden of strategic planning.

Provides a clear framework for understanding and optimizing Broadridge's marketing efforts, alleviating confusion and driving focus.

Place

Broadridge's direct sales approach is central to its marketing mix, fostering deep connections with financial institutions such as banks, broker-dealers, and asset managers. This direct engagement allows them to develop highly customized solutions that address the specific needs of their clients.

By acting as a trusted and transformative partner, Broadridge cultivates enduring client relationships. This strategy is crucial in a sector where reliability and specialized support are paramount, with Broadridge serving a significant portion of the wealth management market.

Broadridge boasts a substantial global presence, extending its services across key markets like the United States, Canada, and the United Kingdom, alongside numerous other international territories. This expansive reach ensures they can effectively support a diverse, multinational clientele.

With a workforce of over 14,000 associates strategically located in 21 countries, Broadridge demonstrates a significant global footprint. This widespread operational capacity allows for broad accessibility and localized support for their clients worldwide.

Broadridge strategically enhances its market presence and capabilities through targeted acquisitions and collaborations. For instance, its acquisition of Kyndryl's Securities Industry Services business in late 2023 significantly bolstered its wealth management solutions in the Canadian market.

Further demonstrating this strategy, Broadridge partnered with BNP Paribas in early 2024 to deliver comprehensive global securities class action services, expanding its client support across international markets.

Digital Platforms and Omni-channel Delivery

Broadridge excels in digital platform delivery, offering online portals that streamline investor communications and data access. Their expertise in omni-channel strategies ensures a cohesive experience, guiding investors to engage by consolidating information across digital and print touchpoints.

This integrated approach is crucial in today's market. For instance, in 2024, financial firms are increasingly prioritizing digital engagement to improve customer experience and operational efficiency. Broadridge's platforms facilitate this by providing unified access to critical investor data and communication tools.

- Digital Portals: Providing secure, user-friendly online access to account information and communication materials.

- Omni-channel Strategy: Integrating digital and traditional channels to create a seamless investor journey.

- Investor Engagement: Driving action through consistent and accessible information delivery.

- Data Consolidation: Presenting complex financial information in an easily digestible format across platforms.

Industry Events and Client Summits

Broadridge leverages industry events and client summits as key components of its marketing strategy, facilitating direct engagement with its diverse client base. These gatherings are crucial for demonstrating Broadridge's latest innovations and thought leadership in financial technology. For instance, Broadridge's presence at major industry conferences in 2024 and early 2025 allows them to connect with thousands of financial professionals, from retail investors to institutional asset managers.

These events are not merely promotional; they are strategic platforms for dialogue and collaboration. Broadridge uses them to gather valuable feedback, understand emerging market needs, and solidify relationships. In 2024, Broadridge hosted several exclusive client summits across North America and Europe, focusing on topics like digital transformation in wealth management and the future of post-trade processing. These events often feature keynotes from industry leaders and interactive sessions designed to foster a deeper understanding of the challenges and opportunities facing financial services firms.

The impact of these engagements is significant, contributing to brand visibility and lead generation. Broadridge's participation in events like SIFMA's Annual Conference or FSI's Future Forum provides direct access to decision-makers. A typical client summit might see a 15% increase in qualified leads within the following quarter, underscoring the effectiveness of this approach. Broadridge's commitment to these events reinforces its position as a central player in the financial technology ecosystem.

- Industry Event Participation: Broadridge actively exhibits and speaks at over 50 major financial industry conferences annually, reaching an estimated 100,000+ attendees in 2024.

- Client Summit Hosting: The company conducts approximately 15-20 exclusive client summits each year, focusing on specific product areas and client segments.

- Product Showcase: These events are critical for launching and demonstrating new solutions, with recent summits highlighting advancements in data analytics and AI-driven client engagement tools.

- Industry Trend Discussion: Broadridge uses these platforms to share insights on critical trends such as regulatory changes, market infrastructure modernization, and the evolving needs of investors.

Broadridge's extensive physical presence, including offices and data centers across 21 countries, underpins its global service delivery. This infrastructure is vital for supporting its extensive client base, which includes a significant portion of the world's leading financial services firms. Their global footprint ensures localized support and compliance with regional regulations, critical for financial operations.

The company's strategic acquisitions, such as the late 2023 purchase of Kyndryl's Securities Industry Services business, have further solidified its market position and expanded its service offerings, particularly in wealth management. These moves demonstrate a commitment to enhancing their physical and operational capabilities to better serve clients worldwide.

Broadridge's commitment to physical presence is also evident in its investment in secure, state-of-the-art data facilities. These centers are crucial for handling sensitive financial data, ensuring reliability and security for clients in 2024. The company's operational hubs are strategically located to optimize service delivery and disaster recovery capabilities.

The company's global network of associates, numbering over 14,000, provides the human capital necessary to manage its diverse operations. This distributed workforce allows Broadridge to offer specialized, on-the-ground support, adapting to local market nuances and client needs effectively.

| Metric | Value (as of 2024/2025) | Significance |

|---|---|---|

| Countries of Operation | 21 | Enables global service delivery and localized support. |

| Employee Count | 14,000+ | Provides extensive human capital for operations and client relations. |

| Key Market Presence | North America, Europe, Asia-Pacific | Core regions for financial services engagement and growth. |

| Acquisition Impact (Kyndryl SIS) | Strengthened Canadian wealth management solutions | Demonstrates strategic investment in physical and service capabilities. |

What You Preview Is What You Download

Broadridge Financial 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Broadridge Financial 4P's Marketing Mix Analysis is fully complete and ready for immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you get precisely what you need to understand Broadridge's marketing strategy.

Promotion

Broadridge cultivates thought leadership through its consistent output of annual reports, digital transformation studies, and market intelligence briefs. These publications delve into critical industry shifts, technology integration, and prevailing challenges within financial services, solidifying Broadridge's expertise and market standing.

For instance, Broadridge's 2024 Digital Transformation in Financial Services report highlighted that 78% of financial firms identified AI and machine learning as key drivers for future growth, underscoring the practical value of their research for strategic planning.

Broadridge leverages targeted advertising and content marketing to reach key decision-makers in financial institutions. Their campaigns focus on addressing critical industry pain points such as navigating evolving regulations and enhancing operational efficiency.

By delivering tailored content, Broadridge demonstrates its understanding of the unique challenges faced by banks, broker-dealers, and asset managers. This approach aims to position their solutions as essential for achieving compliance and streamlining operations, a strategy that resonated particularly well in 2024 as firms grappled with increased regulatory scrutiny.

Broadridge leverages public relations and press releases as a key component of its marketing strategy, ensuring consistent communication of its achievements and advancements. In 2024, the company continued to issue press releases detailing its financial performance, such as reporting robust revenue growth in its fiscal year, driven by strong demand for its digital solutions.

These releases highlight new product introductions and strategic collaborations, reinforcing Broadridge's position as an innovator in the financial technology sector. For instance, announcements in late 2024 showcased expanded capabilities in data analytics and AI-driven client engagement tools, underscoring their commitment to evolving market needs.

This proactive approach to public relations not only maintains Broadridge's visibility but also effectively communicates its ongoing growth trajectory and industry leadership to investors, clients, and the broader financial community.

Client Success Stories and Testimonials

Broadridge leverages client success stories and testimonials as a key element of its promotion strategy, effectively showcasing the real-world impact of its financial technology solutions. These narratives highlight how clients have achieved significant improvements, such as driving innovation and adapting to evolving market demands. For instance, by showcasing how a major financial institution streamlined its post-trade processing through Broadridge's platform, they demonstrate tangible value.

This focus on proven results builds considerable trust with prospective clients, acting as powerful social proof. Testimonials often quantify the benefits, such as cost reductions or efficiency gains. For example, a case study might reveal a 15% reduction in operational costs for a wealth management firm after implementing Broadridge's digital client onboarding tools.

- Demonstrates Tangible Value: Client stories illustrate concrete benefits like faster transaction processing and improved compliance.

- Builds Trust and Credibility: Real-world endorsements from satisfied clients validate Broadridge's capabilities.

- Showcases Innovation: Success stories often feature clients who have leveraged Broadridge to adopt new technologies and strategies.

- Highlights Adaptability: Testimonials frequently address how Broadridge helps firms navigate complex regulatory landscapes and market shifts.

Industry Recognition and Awards

Broadridge actively uses industry recognition and awards as a key component of its marketing strategy, reinforcing its position in the financial services sector. For instance, being recognized as a leader in communications experience platforms highlights their commitment to innovation and client service.

These accolades serve as tangible proof of Broadridge's capabilities and market standing. Receiving awards from respected entities like Chartis Research for their buyside platforms further validates their technological prowess and strategic value to clients.

- Leadership Recognition: Named a leader in financial services for communications experience platforms, underscoring their expertise.

- Analyst Endorsements: Chartis Research awards for buyside platforms validate their advanced solutions.

- Market Validation: These awards reinforce Broadridge's market leadership and build trust among potential clients.

Broadridge's promotional efforts focus on establishing thought leadership through extensive research and data-driven insights. Their content, including annual reports and market intelligence briefs, consistently highlights key industry trends, such as the 2024 Digital Transformation in Financial Services report which noted AI as a primary growth driver for 78% of firms.

Targeted marketing campaigns and public relations activities, including press releases on financial performance and new product launches, ensure Broadridge maintains a strong presence. Announcements in late 2024 emphasized advancements in AI and data analytics, reflecting their commitment to innovation.

Client success stories and industry awards further bolster Broadridge's promotional strategy. Testimonials often quantify benefits, with case studies showing up to a 15% reduction in operational costs for clients, while accolades from entities like Chartis Research validate their market leadership.

Price

Broadridge's enterprise solutions likely employ value-based pricing, reflecting the substantial operational efficiencies and risk mitigation they offer to large financial firms. For example, their solutions for post-trade processing can significantly reduce manual touchpoints, a critical factor for institutions handling millions of transactions daily.

This strategy is common in the B2B fintech space, where the return on investment (ROI) for clients is a primary driver of pricing. Broadridge's ability to streamline complex workflows, potentially saving clients millions in operational costs and compliance penalties, directly informs the perceived value and, consequently, the price of their offerings.

Broadridge's pricing strategy heavily relies on a subscription and recurring revenue model, ensuring consistent income streams. This approach is fundamental to their business, offering clients ongoing access to their comprehensive financial technology and data platforms.

This model provides significant financial stability for Broadridge. For instance, in fiscal year 2023, Broadridge reported that approximately 80% of its revenue was recurring, a testament to the strength and predictability of this pricing strategy.

Broadridge Financial offers tiered pricing for its Advisor Solutions, with packages like Essentials, Growth, and Enterprise. This structure allows them to cater to a wide range of clients, from smaller practices needing core functionalities to larger enterprises requiring comprehensive support and advanced features.

Competitive Pricing in a Dynamic Market

Broadridge operates within a highly competitive fintech landscape, necessitating pricing strategies that closely monitor competitor offerings and evolving market demand. While delivering premium solutions, the company strives to maintain a competitive edge and ensure accessibility for its diverse client base.

Broadridge's pricing reflects the value of its advanced technology and comprehensive services, aiming for a balance between premium positioning and market competitiveness. This approach ensures that clients receive robust solutions without prohibitive costs, fostering long-term partnerships in the dynamic financial services sector.

- Competitive Benchmarking: Broadridge actively analyzes competitor pricing for similar data and technology solutions, ensuring its offerings remain attractive.

- Value-Based Pricing: Pricing is tied to the demonstrable value and efficiency gains clients achieve through Broadridge's platforms, such as cost savings in data processing and compliance.

- Tiered Service Models: Offering different service tiers allows Broadridge to cater to a wider range of client needs and budgets, from smaller firms to large enterprises.

- Market Share Focus: In 2024, Broadridge continued to focus on expanding its market share, which can influence pricing flexibility to attract new clients.

Long-term Contracts and Relationship-Based Pricing

Broadridge's pricing strategy for its complex technology and services heavily relies on long-term contracts, especially with institutional clients. This approach reflects the significant investment required for integration and ongoing support, fostering stable, enduring partnerships.

Customized agreements are a cornerstone of this pricing model. They allow Broadridge to tailor solutions to the unique needs of each client, with pricing reflecting the specific services, integration complexity, and the depth of the relationship. For instance, in 2024, Broadridge continued to emphasize its commitment to long-term client partnerships, with a significant portion of its revenue derived from recurring service agreements.

- Long-Term Contracts: Broadridge secures revenue through multi-year agreements, ensuring predictable income streams.

- Customized Pricing: Fees are tailored based on client-specific needs, service levels, and integration requirements.

- Relationship Focus: Pricing strategies are designed to cultivate and maintain deep, lasting relationships with key institutional clients.

- Value-Based Approach: Pricing reflects the comprehensive value delivered through technology, operational efficiency, and regulatory compliance support.

Broadridge's pricing reflects a strategic blend of value-based and competitive approaches, often manifested through long-term contracts and tiered service models. This ensures clients receive solutions tailored to their needs while maintaining Broadridge's market position.

The company's focus on recurring revenue, which constituted approximately 80% of its revenue in fiscal year 2023, underscores the stability and predictability inherent in its pricing structure. This recurring revenue model is crucial for Broadridge's sustained financial health and its ability to invest in ongoing innovation.

For instance, Broadridge's Advisor Solutions offers tiered pricing, such as Essentials, Growth, and Enterprise, demonstrating a commitment to serving a diverse client base with varying requirements and budgets. This tiered approach allows for market penetration and caters to the specific needs of different segments within the financial advisory industry.

In 2024, Broadridge continued to emphasize customized pricing agreements, particularly for its institutional clients. These agreements are designed to reflect the unique integration complexity, service levels, and the overall value delivered, fostering deep, long-term client partnerships and ensuring that pricing aligns with the significant ROI clients experience.

| Pricing Strategy Component | Description | Fiscal Year 2023 Data Point | 2024 Trend |

|---|---|---|---|

| Recurring Revenue Model | Primary revenue driver through ongoing service subscriptions. | ~80% of total revenue | Continued focus on expanding recurring revenue streams. |

| Value-Based Pricing | Tied to client efficiency gains and cost savings. | Implied through client ROI on post-trade processing solutions. | Emphasis on demonstrating tangible value to justify pricing. |

| Tiered Service Models | Catering to diverse client needs with different feature sets. | Advisor Solutions: Essentials, Growth, Enterprise. | Expansion of tiered offerings to capture broader market segments. |

| Long-Term Contracts | Securing predictable revenue and fostering client loyalty. | Significant portion of revenue from multi-year agreements. | Continued emphasis on long-term partnerships and customized agreements. |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis leverages a comprehensive suite of data, including official company disclosures, investor relations materials, and publicly available product information. We also incorporate insights from industry-specific reports and competitive intelligence platforms to ensure a holistic view of the market landscape.