Broadridge Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Broadridge Financial Bundle

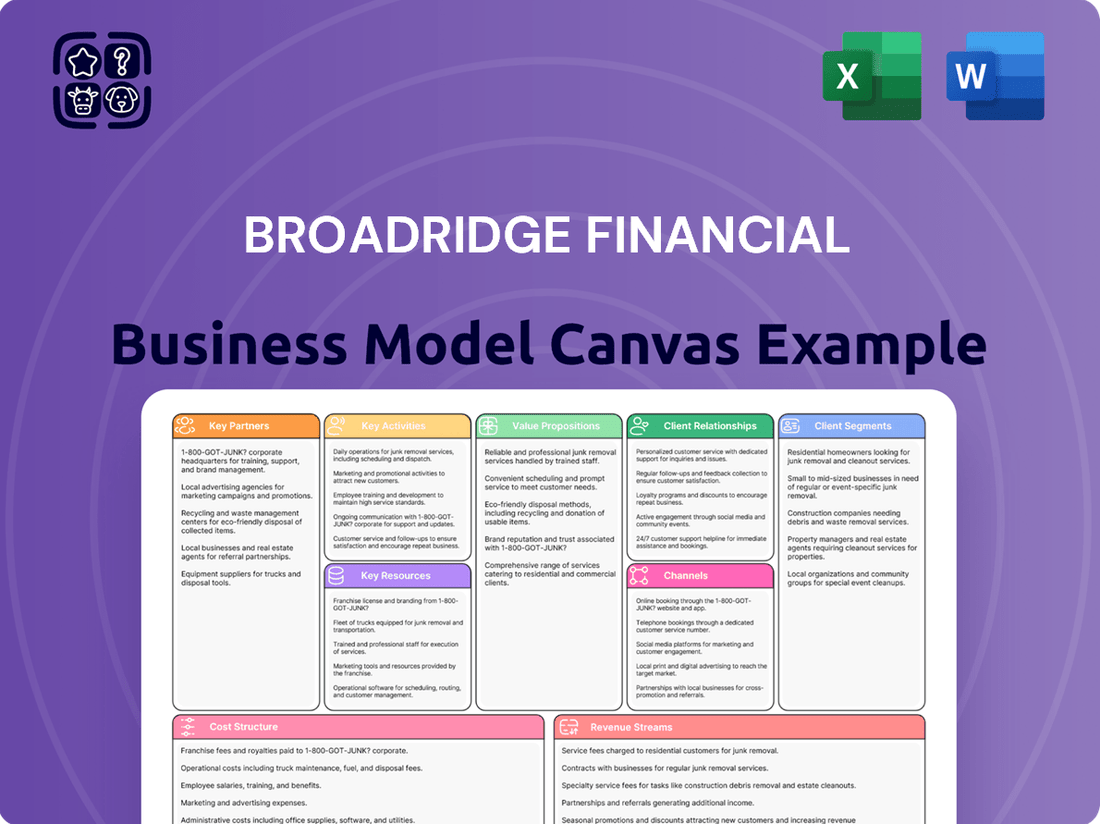

Discover the strategic engine powering Broadridge Financial's market dominance. This comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success.

Ready to dissect Broadridge Financial's operational genius? Our full Business Model Canvas provides an in-depth look at their value propositions, cost structure, and competitive advantages, making it an invaluable tool for strategic planning.

Unlock the secrets behind Broadridge Financial's resilience and growth with the complete Business Model Canvas. This professionally crafted document is your key to understanding their market positioning and future opportunities.

Partnerships

Broadridge actively collaborates with technology and fintech innovators, particularly those specializing in artificial intelligence and blockchain. These partnerships are crucial for embedding advanced solutions, like quantum computing integrated with AI for sophisticated risk management and trading, directly into Broadridge's service portfolio.

Broadridge actively partners with a wide array of financial institutions, including major banks and broker-dealers. These collaborations are fundamental to extending its market reach and delivering its suite of solutions to a broader client base.

A prime example of this strategy is Broadridge's partnership with BNP Paribas Securities Services. This collaboration specifically focuses on enhancing global custody services, particularly in the area of global securities class action services, aimed at maximizing asset recovery for their shared clients.

Broadridge partners with regulatory bodies and compliance solution providers to ensure its offerings meet stringent financial industry standards. This is crucial given the ever-changing regulatory environment, with significant compliance costs for financial institutions. For instance, in 2024, the financial services sector continued to grapple with increased regulatory scrutiny, particularly around data privacy and anti-money laundering (AML) requirements.

These collaborations enable Broadridge to develop and deliver solutions that help clients efficiently navigate complex compliance landscapes, such as the SEC's Regulation Best Interest or evolving ESG reporting mandates. By staying ahead of regulatory shifts, Broadridge empowers its clients to mitigate risks and maintain operational integrity, a key factor as compliance spending in financial services is projected to remain substantial in 2024.

Data and Analytics Providers

Access to high-quality data and advanced analytics is fundamental to Broadridge's success, powering everything from market intelligence to investor insights. These partnerships are crucial for delivering the sophisticated analytical tools our clients rely on for informed decision-making.

By collaborating with leading data and analytics providers, Broadridge ensures its clients have access to cutting-edge information. For instance, in 2024, the financial data market saw significant growth, with firms increasingly investing in AI-driven analytics platforms to gain a competitive edge.

- Access to real-time market data

- Leveraging AI for predictive analytics

- Enhancing client reporting and insights

- Ensuring data accuracy and compliance

Consulting and Advisory Firms

Strategic alliances with consulting and advisory firms are crucial for Broadridge, enabling them to deliver integrated solutions that extend beyond their technological offerings. These collaborations allow Broadridge to tap into specialized expertise, enhancing the value proposition for their clients by addressing a wider range of business needs.

These partnerships are instrumental in driving market penetration and fostering deeper adoption of Broadridge's comprehensive suite of solutions within client organizations. By leveraging the established trust and reach of consulting partners, Broadridge can more effectively introduce and embed its services.

For instance, in 2024, many financial institutions continued to seek external guidance on digital transformation and regulatory compliance. Consulting firms specializing in these areas often partner with technology providers like Broadridge to co-deliver enhanced services. This synergy allows for a more robust approach to client challenges, directly impacting solution uptake and client satisfaction.

- Holistic Solution Delivery: Consulting firms bring complementary expertise, allowing Broadridge to offer end-to-end solutions.

- Market Expansion: Partnerships facilitate access to new client segments and deeper penetration within existing ones.

- Enhanced Client Value: Combining technology with strategic advice creates more comprehensive and impactful client outcomes.

Broadridge's key partnerships extend to technology and fintech innovators, crucial for integrating advanced solutions like AI and blockchain into their offerings. They also collaborate extensively with financial institutions, including major banks and broker-dealers, to broaden their market reach. A notable example is the partnership with BNP Paribas Securities Services to enhance global custody services.

Furthermore, Broadridge actively partners with regulatory bodies and compliance solution providers to ensure adherence to evolving financial industry standards. In 2024, the financial services sector faced significant regulatory scrutiny, particularly regarding data privacy and anti-money laundering (AML), making these partnerships essential for clients navigating compliance costs.

Access to high-quality data and advanced analytics is also a cornerstone, facilitated by partnerships with leading data providers. The financial data market in 2024 saw substantial growth, with firms investing in AI-driven analytics platforms for a competitive edge.

| Partner Type | Focus Area | Impact |

| Fintech Innovators | AI, Blockchain, Quantum Computing | Embedding advanced solutions, risk management |

| Financial Institutions | Market Reach, Service Delivery | Broader client base access |

| Regulatory Bodies | Compliance, Data Privacy, AML | Navigating complex regulatory landscapes |

| Data Providers | Real-time Data, AI Analytics | Informed decision-making, competitive edge |

What is included in the product

A comprehensive Business Model Canvas for Broadridge Financial, detailing their B2B focus on providing technology and outsourcing solutions to financial services firms, highlighting their value proposition of operational efficiency and regulatory compliance.

Addresses the complexity of financial services operations by providing a structured, visual representation of Broadridge's capabilities, simplifying the understanding of their value proposition.

Offers a clear, actionable framework for financial institutions to identify and address operational inefficiencies, transforming complex processes into manageable components.

Activities

Broadridge's primary focus is on constantly building and improving its financial technology offerings. This means they're heavily investing in areas like artificial intelligence and digital assets to bring fresh ideas to capital markets and wealth management.

They create tools designed to streamline complicated processes, cut down on risk, and boost how efficiently their clients operate. For instance, in 2024, Broadridge continued to emphasize AI-driven solutions for areas like regulatory compliance and client onboarding, aiming to deliver tangible efficiency gains.

Broadridge excels at processing and automating investor communications, a core activity that streamlines proxy voting, shareholder reports, and regulatory filings for thousands of companies. This automation significantly reduces manual effort and potential errors for their clients.

In 2024, Broadridge continued to be a leader in this space, handling billions of investor communications annually. Their platforms manage complex data flows, ensuring timely and accurate delivery of critical information to shareholders and regulatory bodies, a testament to their robust operational capabilities.

Broadridge provides the essential technology backbone for securities processing, enabling trillions of dollars in daily trades across the globe. Their operations support everything from trade execution to settlement, ensuring smooth functioning for financial markets. In 2024, Broadridge continued to be a vital player in this space, handling immense transaction volumes.

Delivering Data and Analytics Services

Broadridge actively collects, analyzes, and delivers crucial data and analytics to its clients. This empowers them to make smarter decisions and gain valuable market intelligence, supporting areas like distribution insights and retirement product strategies.

In 2024, Broadridge's commitment to data-driven solutions is evident. The company provides critical insights that help financial firms navigate complex markets and optimize their operations.

- Data Collection and Aggregation: Broadridge gathers vast amounts of financial data from diverse sources.

- Advanced Analytics and Insights: The company leverages sophisticated tools to transform raw data into actionable intelligence.

- Client-Specific Reporting: Tailored analytics are delivered to meet the unique needs of each client.

- Market Intelligence: Broadridge provides insights into market trends, customer behavior, and competitive landscapes.

Client Relationship Management and Support

Broadridge's core activities include cultivating and sustaining robust relationships with a wide array of financial institutions. This encompasses banks, broker-dealers, asset and wealth management firms, and corporate issuers, ensuring their ongoing needs are met.

This dedication to client satisfaction involves proactive support and continuous adaptation to evolving client requirements. For instance, Broadridge's focus on client retention is reflected in its consistent performance, with the company often highlighting strong renewal rates in its investor communications, a testament to its effective relationship management.

Key aspects of this client relationship management include:

- Providing continuous technical and operational support to ensure seamless service delivery across Broadridge's platforms.

- Proactively gathering client feedback to inform product development and service enhancements, aiming to exceed expectations.

- Developing tailored solutions and communication strategies to address the specific challenges and opportunities faced by different client segments.

- Maintaining high levels of client engagement through regular touchpoints, training, and industry insights.

Broadridge's key activities revolve around developing and enhancing its financial technology. This includes a strong focus on AI and digital assets for capital markets and wealth management, as seen in their 2024 emphasis on AI-driven solutions for compliance and onboarding to boost efficiency.

They streamline complex financial processes, aiming to reduce risk and improve client operations. Processing and automating investor communications, such as proxy voting and shareholder reports, is a core function, with Broadridge handling billions of these communications annually in 2024.

Broadridge also provides the technological infrastructure for securities processing, facilitating trillions in daily trades. Their data collection, analysis, and delivery of market intelligence empower clients to make informed decisions, with a commitment to data-driven solutions evident in 2024.

Cultivating strong relationships with financial institutions is paramount, involving proactive support and adapting to client needs. This is underscored by consistent client retention and strong renewal rates, reflecting their effective relationship management strategies.

| Key Activity | Description | 2024 Focus/Data Point |

| Technology Development & Enhancement | Building and improving fintech offerings, including AI and digital assets. | Emphasis on AI for compliance and onboarding. |

| Process Automation | Streamlining financial operations and investor communications. | Handling billions of investor communications annually. |

| Securities Processing Infrastructure | Providing the backbone for trade execution and settlement. | Facilitating trillions in daily global trades. |

| Data & Analytics Delivery | Collecting, analyzing, and delivering market intelligence. | Providing critical insights for market navigation and operational optimization. |

| Client Relationship Management | Cultivating and sustaining relationships with financial institutions. | Focus on client retention and strong renewal rates. |

Full Document Unlocks After Purchase

Business Model Canvas

The Broadridge Financial Business Model Canvas preview you see is the identical document you will receive upon purchase. This means the structure, content, and formatting are exactly as presented, ensuring no surprises and immediate usability. You'll gain full access to this comprehensive analysis, ready for your strategic planning needs.

Resources

Broadridge's proprietary technology platforms, such as its Investor Communication Solutions (ICS) and Global Technology and Operations (GTO) segments, are the backbone of its operations, enabling efficient and automated financial services delivery.

These platforms are critical for managing complex processes like proxy voting and shareholder communications, areas where Broadridge holds significant market share, processing billions of investor communications annually.

In fiscal year 2023, Broadridge reported revenue of $6.1 billion, with a substantial portion driven by the efficiency and scalability of its technology infrastructure.

A highly skilled workforce, especially in financial technology, is crucial for Broadridge. This includes software engineers and industry specialists who develop and maintain their complex solutions.

In 2024, Broadridge continued to prioritize attracting top talent by fostering an engaging and diverse workplace. This focus is key to their ability to innovate and deliver cutting-edge financial technology services.

Broadridge's extensive client network, encompassing major financial institutions like banks, broker-dealers, and asset managers, is a cornerstone of its business model. This deeply embedded relationship network, cultivated over years, acts as a significant intangible asset, directly fueling new business acquisition and ensuring a stable stream of recurring revenue.

In fiscal year 2024, Broadridge reported that over 90% of its revenue was recurring, a testament to the stickiness and value derived from these established client relationships. This vast network provides unparalleled access to market insights and facilitates the seamless integration of its solutions across the financial ecosystem.

Intellectual Property and Patents

Broadridge's intellectual property is a cornerstone of its business model, safeguarding its innovative fintech solutions. This includes a robust portfolio of patents, trade secrets, and unique methodologies that differentiate it in the market.

The company's commitment to R&D fuels its IP development, ensuring it remains at the forefront of financial technology. For instance, Broadridge reported significant investments in technology and development, underscoring the importance of its proprietary assets. In fiscal year 2023, Broadridge's investments in technology and development totaled $559 million, a testament to its focus on innovation and IP creation.

This strong intellectual property base provides a significant competitive advantage, reinforcing Broadridge's market position and enabling it to offer specialized, high-value services to its clients in the financial services industry.

Key aspects of Broadridge's intellectual property strategy include:

- Patents: Protecting novel technologies and processes that enhance operational efficiency and client experience.

- Trade Secrets: Guarding confidential information, algorithms, and proprietary data crucial to its service delivery.

- Proprietary Methodologies: Developing and owning unique approaches to data management, communication, and regulatory compliance.

- Software and Data: Building and maintaining extensive software platforms and data repositories that are central to its offerings.

Data Infrastructure and Analytics Capabilities

Broadridge's robust data infrastructure and advanced analytics capabilities are foundational to its business model. These resources allow the company to efficiently process and analyze enormous volumes of financial data, transforming raw information into valuable, actionable insights for its diverse client base. This analytical power is critical for delivering data-driven solutions and up-to-the-minute market intelligence.

These capabilities are not just about handling data; they are about extracting meaning and driving client success. By leveraging sophisticated analytics, Broadridge empowers financial services firms to make more informed decisions, optimize their operations, and better understand market trends. For instance, their ability to process real-time transaction data is crucial for operational efficiency in capital markets.

- Data Processing Power: Broadridge manages trillions of data points annually, supporting complex financial transactions and regulatory reporting for a significant portion of the global financial industry.

- Advanced Analytics Suite: The company offers predictive analytics, AI-driven insights, and data visualization tools that help clients identify opportunities and mitigate risks.

- Market Intelligence Generation: Their infrastructure enables the creation of proprietary market intelligence reports and custom analytics, providing a competitive edge to users.

- Scalability and Security: The data infrastructure is designed for extreme scalability to accommodate growing data volumes and ensures the highest levels of security and compliance for sensitive financial information.

Broadridge's proprietary technology platforms, like ICS and GTO, are central to its operations, enabling efficient financial service delivery. These platforms are vital for managing complex tasks such as proxy voting and shareholder communications, areas where Broadridge holds a dominant market position, processing billions of investor communications each year.

The company's extensive client network, including major banks, broker-dealers, and asset managers, is a critical asset. This deeply integrated network, built over years, serves as a significant intangible asset, driving new business and ensuring consistent recurring revenue. In fiscal year 2024, over 90% of Broadridge's revenue was recurring, highlighting the loyalty and value derived from these established client relationships.

Broadridge's intellectual property, encompassing patents, trade secrets, and unique methodologies, safeguards its innovative fintech solutions and provides a distinct market advantage. The company's ongoing investment in research and development, which totaled $559 million in fiscal year 2023, fuels the creation and protection of these proprietary assets.

The company's robust data infrastructure and advanced analytics capabilities are foundational, allowing for the processing and analysis of vast financial data volumes. This empowers clients with actionable insights, driving informed decision-making and operational optimization. Broadridge manages trillions of data points annually, supporting critical financial transactions and regulatory reporting.

Value Propositions

Broadridge excels at automating and simplifying intricate, labor-intensive tasks within financial services. This directly alleviates operational burdens for their clients, leading to significant efficiency gains. For instance, in 2024, Broadridge's solutions were instrumental in processing billions of investor communications, a task that would otherwise require extensive manual effort.

By reducing this complexity and manual input, Broadridge empowers its clients to reallocate valuable resources. This strategic shift allows firms to focus more on core business objectives and innovative growth rather than getting bogged down in day-to-day operational complexities.

Broadridge's offerings significantly reduce operational risk for financial firms, a critical concern given the complexity of market operations. For instance, in 2024, regulatory fines for financial institutions globally continued to be substantial, emphasizing the need for robust compliance solutions.

The company's technology ensures adherence to a constantly shifting regulatory landscape, from MiFID II to evolving data privacy laws. This proactive approach helps clients avoid costly penalties and reputational damage, offering peace of mind in a high-stakes industry.

By automating and streamlining processes, Broadridge mitigates the risk of human error, a common source of compliance breaches. This focus on accuracy and control is vital for maintaining client trust and operational integrity.

Broadridge's commitment to streamlining operations through advanced technology directly translates into substantial cost savings for its clients. By automating and optimizing complex processes, such as customer communications and trade processing, firms can significantly reduce manual labor and associated expenses.

In 2024, Broadridge's solutions are estimated to help financial services firms cut operational costs by up to 20% through enhanced automation and digital transformation initiatives. This efficiency gain allows clients to reallocate resources towards growth and innovation, directly boosting their profitability.

Enhanced Investor Engagement and Communication

Broadridge offers tools that help companies and wealth managers talk to their investors more effectively and quickly. This makes shareholders feel more involved and improves their overall experience.

For instance, Broadridge's Investor Communication Solutions are designed to streamline the delivery of important information, like annual reports and proxy materials. In 2024, the focus on digital delivery and personalized communication has become even more critical for maintaining strong investor relations.

- Improved Shareholder Engagement: Broadridge's platforms enable direct and personalized communication channels, fostering a stronger connection between issuers and their investors.

- Enhanced Investor Experience: By simplifying access to information and providing interactive tools, Broadridge elevates the way investors receive and process corporate data.

- Digital Transformation in Communications: The trend towards digital proxy voting and electronic delivery of shareholder materials, a key area for Broadridge, saw significant adoption in 2024, with many companies reporting higher participation rates through these channels.

Access to Advanced Technology and Data Insights

Clients gain access to Broadridge's cutting-edge fintech, including AI and blockchain-driven solutions, and powerful data and analytics for informed decision-making.

This allows clients to leverage advanced capabilities without the need for extensive internal development, such as utilizing AI for predictive analytics in trading, which saw a significant uptick in adoption across financial institutions in 2024.

Broadridge's investment in technology, evidenced by their ongoing development in areas like distributed ledger technology for post-trade processing, positions them to offer clients a competitive edge.

- AI-Powered Analytics: Enabling predictive insights and enhanced operational efficiency.

- Blockchain Solutions: Streamlining settlement and improving transparency in transactions.

- Data Aggregation: Providing a unified view of market data for comprehensive analysis.

- Scalable Infrastructure: Supporting clients through market volatility and growth.

Broadridge provides essential technology and operations solutions that are critical for the functioning of the financial industry. Their services automate complex processes, reduce operational risk, and drive significant cost savings for clients, allowing them to focus on growth and innovation.

| Value Proposition | Description | 2024 Impact/Data Point |

|---|---|---|

| Operational Efficiency & Automation | Simplifies and automates labor-intensive financial operations, reducing manual effort and enhancing speed. | Processed billions of investor communications in 2024, a task that would otherwise demand extensive manual resources. |

| Risk Mitigation & Compliance | Ensures adherence to evolving regulatory requirements and reduces the risk of human error in critical processes. | Helped financial firms navigate complex regulations, a crucial factor as global regulatory fines remained substantial in 2024. |

| Cost Reduction | Drives substantial cost savings through automation and process optimization, freeing up capital for strategic investments. | Estimated to help financial services firms cut operational costs by up to 20% in 2024 through digital transformation. |

| Enhanced Investor Engagement | Facilitates more effective and timely communication between companies and their shareholders, improving investor relations. | Supported digital proxy voting and electronic delivery of shareholder materials, with increased participation rates observed in 2024. |

| Access to Advanced Technology | Provides clients with cutting-edge fintech, including AI and blockchain, for improved decision-making and competitive advantage. | Saw increased adoption of AI for predictive analytics in trading among financial institutions in 2024. |

Customer Relationships

Broadridge prioritizes client success through dedicated account management, ensuring a deep understanding of each client's unique requirements. These teams act as direct liaisons, facilitating seamless integration and maximizing the value derived from Broadridge's offerings. This focus on personalized engagement cultivates robust, long-term partnerships.

Broadridge Financial Solutions cultivates deep consultative relationships, offering expert advice and strategic guidance to help financial institutions navigate complex industry shifts and enhance operational efficiency. This approach moves beyond simple service provision to deliver tangible value and actionable insights.

In 2024, Broadridge continued to emphasize this advisory role, with a significant portion of its revenue stemming from recurring service fees that reflect ongoing client engagement and the value derived from its strategic counsel. Their client retention rates underscore the success of these deep, consultative partnerships.

Broadridge excels in offering robust customization and integration services, ensuring its sophisticated financial solutions mesh perfectly with a client's unique existing infrastructure and operational workflows. This deep level of tailoring is crucial for fostering enduring, sticky client relationships.

By adapting its offerings to precisely meet specific client needs, Broadridge demonstrates a commitment that goes beyond standard service. For example, in 2024, Broadridge reported that over 85% of its clients utilized some form of customization or integration, highlighting the critical role these services play in client retention and satisfaction.

Training and Education Programs

Broadridge offers robust training and education programs designed to ensure clients effectively utilize their sophisticated financial technology solutions. These programs are crucial for maximizing the return on investment in Broadridge's platforms. For instance, in fiscal year 2023, Broadridge invested significantly in client enablement, with a focus on digital learning modules and personalized coaching to enhance user proficiency.

These educational initiatives empower clients to not only master Broadridge's offerings but also to stay ahead of evolving industry trends and regulatory changes. By providing access to best practices and advanced feature utilization, Broadridge fosters deeper client engagement and satisfaction. This commitment to client success is a cornerstone of their customer relationship strategy.

Key aspects of Broadridge's training and education include:

- On-demand digital learning modules covering platform functionalities and industry insights.

- Live webinars and workshops featuring product experts and industry thought leaders.

- Certification programs to validate client expertise in using Broadridge solutions.

- Dedicated account management support for tailored training needs and ongoing guidance.

Feedback Mechanisms and Continuous Improvement

Broadridge actively solicits client feedback through multiple avenues, including regular surveys, user forums, and direct engagement with account managers. This proactive approach ensures their solutions remain aligned with the dynamic needs of the financial services industry.

This dedication to incorporating client input fuels a cycle of continuous improvement. For instance, in 2024, Broadridge launched several enhancements to its investor communications platform directly based on feedback received from major financial institutions regarding regulatory reporting efficiency.

- Client Feedback Channels: Surveys, user forums, direct account management interactions.

- Impact of Feedback: Drives product enhancements and ensures market relevance.

- 2024 Initiatives: Platform improvements in investor communications and regulatory reporting efficiency.

- Outcome: Strengthened client loyalty and a more robust service offering.

Broadridge fosters deep client loyalty through a multifaceted approach, emphasizing dedicated account management and consultative partnerships. This strategy ensures clients receive tailored support and strategic guidance, moving beyond transactional interactions to build enduring relationships. Their commitment to understanding and addressing unique client needs is a cornerstone of their operational philosophy.

Channels

Broadridge leverages a dedicated direct sales force and business development teams to cultivate deep relationships with key clients, primarily large financial institutions and corporate issuers. These teams are crucial for understanding complex client needs and presenting highly customized solutions.

In 2024, Broadridge's sales and business development efforts focused on expanding its market share in areas like digital investor communications and data analytics, reflecting the increasing demand for these services from major financial players.

This direct engagement model allows Broadridge to effectively demonstrate the value proposition of its broad suite of financial technology solutions, fostering long-term partnerships and driving significant revenue growth.

Broadridge offers secure online portals and digital platforms, a key component of its business model. These channels are crucial for clients to manage investor communications, access vital data, and utilize advanced analytics. This digital infrastructure ensures clients can efficiently interact with Broadridge's services.

These digital channels provide convenient self-service options, allowing clients to manage their accounts and information with ease. This focus on digital accessibility enhances client experience and operational efficiency, reflecting a commitment to modern financial service delivery.

Broadridge actively engages in and organizes industry conferences, webinars, and investor days. This participation is key for demonstrating their innovative solutions, sharing valuable insights, and fostering connections with both existing and prospective clients. In 2024, Broadridge continued to leverage these platforms to enhance market visibility and facilitate crucial networking opportunities within the financial services sector.

Strategic Partnerships and Alliances

Broadridge leverages strategic partnerships to extend its market presence and access new client segments. These alliances often involve co-developing solutions or engaging in joint marketing efforts, effectively creating indirect channels for customer acquisition.

For instance, in 2024, Broadridge continued to deepen its relationships with major financial institutions and technology providers. These collaborations are crucial for integrating its offerings and reaching a wider audience, particularly in areas like digital transformation and data analytics.

- Market Expansion: Partnerships enable Broadridge to enter new geographic regions or penetrate underserved market niches by combining resources and expertise.

- Enhanced Offerings: Collaborations allow for the creation of more comprehensive and innovative solutions that address evolving client needs, such as integrated wealth management platforms.

- Cost Efficiency: Sharing development costs and marketing expenses through alliances can lead to greater operational efficiency and a stronger competitive position.

- Accelerated Growth: By tapping into the established networks and client bases of its partners, Broadridge can achieve faster revenue growth and market share gains.

Referral Networks and Client Testimonials

Referral networks and client testimonials are crucial channels for Broadridge. Positive client experiences foster strong relationships, leading to organic growth through word-of-mouth referrals and compelling testimonials. These authentic endorsements act as powerful marketing tools, attracting new clients by showcasing the tangible benefits of Broadridge's services.

Satisfied clients transform into brand advocates, actively promoting Broadridge's solutions. This organic marketing approach is highly cost-effective and builds trust. For instance, Broadridge's focus on client success directly fuels these channels.

- Client Advocacy: Broadridge leverages satisfied clients as a primary channel for new business through referrals.

- Trust Building: Testimonials from happy clients enhance credibility and reduce customer acquisition costs.

- Relationship Focus: Nurturing strong client relationships is key to unlocking these valuable referral networks.

- Organic Growth: Positive experiences translate into powerful, organic marketing that drives client acquisition.

Broadridge utilizes a multi-faceted channel strategy, combining direct sales with digital platforms and strategic partnerships to reach its diverse client base. This approach ensures comprehensive market coverage and efficient service delivery.

The company's direct sales force and business development teams are instrumental in nurturing relationships with large financial institutions, focusing on customized solutions. In parallel, secure online portals and digital platforms offer clients self-service capabilities, enhancing operational efficiency and client experience.

Strategic partnerships and industry engagement, including conferences and webinars, further expand Broadridge's reach and market visibility. Referral networks and client testimonials also play a vital role, driving organic growth through strong client advocacy.

| Channel Type | Description | 2024 Focus/Activity | Key Benefit |

|---|---|---|---|

| Direct Sales & Business Development | Dedicated teams building relationships with key clients. | Expanding market share in digital investor communications and data analytics. | Deep client understanding and customized solutions. |

| Digital Platforms & Portals | Secure online channels for client interaction and service management. | Enhancing self-service options and digital accessibility. | Operational efficiency and improved client experience. |

| Industry Engagement (Conferences, Webinars) | Participation in events to showcase solutions and network. | Leveraging platforms for market visibility and networking. | Demonstrating innovation and fostering connections. |

| Strategic Partnerships | Collaborations with financial institutions and technology providers. | Deepening relationships for integrated offerings and wider reach. | Market expansion and enhanced solution offerings. |

| Referral Networks & Testimonials | Leveraging satisfied clients for word-of-mouth marketing. | Focus on client success to fuel organic growth. | Cost-effective client acquisition and trust building. |

Customer Segments

Banks and broker-dealers depend on Broadridge for essential technology and communication services, streamlining securities processing, investor outreach, and regulatory adherence. These financial powerhouses leverage Broadridge to efficiently manage their intricate back-office functions, a crucial aspect of their operations. In 2023, the global financial services sector saw significant investment in digital transformation, with firms allocating substantial resources to enhance operational efficiency and client experience, areas where Broadridge excels.

Asset and wealth managers are a cornerstone customer segment for Broadridge. They leverage Broadridge's sophisticated platforms to streamline investor communications, access data-driven fund solutions, and implement advanced wealth management technology. This focus on technology helps them significantly enhance client experiences and boost operational efficiency. In 2024, the global asset management industry managed an estimated $130 trillion in assets, highlighting the immense scale and importance of this sector.

Broadridge empowers these firms by providing critical tools for portfolio optimization, facilitating efficient trading operations, and strengthening risk management capabilities. These services are vital for navigating the complexities of modern financial markets and ensuring client satisfaction. The demand for digital solutions in wealth management continues to grow, with reports indicating that by 2025, over 80% of wealth management firms will have adopted advanced digital client portals.

Public companies and corporate issuers are a key customer segment for Broadridge, utilizing its services for essential shareholder communications and proxy voting processes. In 2024, Broadridge continued to be a vital partner for these entities, facilitating compliance with evolving corporate governance regulations and enabling effective investor engagement.

These issuers rely on Broadridge to manage complex tasks such as distributing proxy materials and tabulating votes, ensuring transparency and participation in corporate decision-making. The company's solutions help public companies navigate the intricate landscape of shareholder relations, a critical aspect of maintaining market confidence and regulatory adherence.

Mutual Funds and Exchange-Traded Funds (ETFs)

Broadridge offers specialized solutions for mutual funds and ETFs, focusing on critical areas like investor communications and data analytics. These services are designed to help these entities navigate complex distribution channels and meet stringent regulatory demands.

This segment leverages Broadridge's deep understanding of the fund industry, providing essential support for compliance and client engagement. For instance, Broadridge's data analytics capabilities help asset managers understand investor behavior and optimize distribution strategies.

In 2024, the global ETF market continued its robust growth, with assets under management reaching new highs, underscoring the demand for efficient operational and communication solutions. Broadridge's role in streamlining these processes is vital for fund providers aiming to capture this expanding market share.

Key benefits for mutual funds and ETFs include:

- Enhanced Investor Communications: Ensuring timely and accurate delivery of prospectuses, reports, and other essential shareholder documents.

- Data-Driven Insights: Providing analytics to understand distribution effectiveness and investor trends.

- Regulatory Compliance: Facilitating adherence to evolving financial regulations through streamlined reporting and communication.

- Operational Efficiency: Automating key processes to reduce costs and improve accuracy in fund administration.

Financial Advisors and Investment Professionals

Financial advisors and investment professionals leverage Broadridge's comprehensive suite of solutions to optimize their client engagement strategies. These tools are designed to automate and enhance critical functions such as client acquisition, personalized communication, and ongoing relationship management, thereby boosting advisor efficiency. In 2024, the demand for digital client engagement tools is projected to remain high, with firms seeking to improve client retention.

Broadridge empowers these professionals to manage their marketing outreach and prospecting activities more effectively. By providing data-driven insights and communication platforms, advisors can better understand client needs and tailor their offerings. This focus on enhanced productivity directly translates to stronger client relationships and improved business growth for individual advisors and investment firms.

- Streamlined Client Marketing: Broadridge offers tools to automate and personalize client marketing campaigns, improving reach and engagement.

- Enhanced Prospecting: The platform provides data and analytics to identify and target potential clients more effectively.

- Improved Communication: Advisors can utilize Broadridge's services for consistent and impactful client communication, fostering stronger relationships.

- Increased Productivity: By automating routine tasks, advisors gain more time to focus on client service and strategic advice.

Broadridge serves a diverse range of financial market participants, from large institutions to individual advisors. These entities rely on Broadridge for critical operational and communication solutions that enhance efficiency and regulatory compliance. The company's ability to cater to these varied needs underscores its central role in the financial ecosystem.

The firm's customer base includes banks, broker-dealers, asset and wealth managers, mutual funds, ETFs, and public companies. Each segment leverages Broadridge for distinct but equally vital services, demonstrating the breadth of its offerings. For instance, banks utilize Broadridge for securities processing, while public companies depend on it for shareholder communications.

In 2024, the financial services industry continued its digital transformation journey, with significant investments in technology to improve client experience and operational efficiency. Broadridge's solutions are pivotal in enabling these advancements across its various customer segments. The global digital transformation market within financial services was projected to reach over $100 billion in 2024, highlighting the demand for services like those provided by Broadridge.

| Customer Segment | Key Needs | Broadridge Solutions |

|---|---|---|

| Banks & Broker-Dealers | Securities processing, investor outreach, regulatory adherence | Technology platforms for back-office functions |

| Asset & Wealth Managers | Investor communications, data-driven fund solutions, wealth management technology | Sophisticated platforms for client experience and efficiency |

| Public Companies & Issuers | Shareholder communications, proxy voting, corporate governance | Proxy material distribution, vote tabulation, investor engagement tools |

| Mutual Funds & ETFs | Investor communications, data analytics, regulatory compliance | Distribution channel navigation, compliance support, analytics |

| Financial Advisors | Client engagement, marketing, prospecting, relationship management | Digital tools for client acquisition and communication |

Cost Structure

Broadridge invests heavily in research and development to stay ahead, particularly in areas like artificial intelligence and blockchain. These investments are crucial for developing new solutions and enhancing existing ones. For example, in fiscal year 2024, Broadridge reported that its technology and development expenses were a significant portion of its overall operating costs, reflecting its commitment to innovation.

Broadridge's cost structure heavily features personnel expenses. In fiscal year 2023, the company reported selling, general, and administrative expenses of $1.4 billion, a significant portion of which is dedicated to its extensive workforce. This includes the salaries, benefits, and ongoing training for their specialized teams in technology, operations, and client support, essential for maintaining their complex service offerings.

Attracting and retaining highly skilled talent, particularly in the competitive fintech landscape, represents a substantial and ongoing investment for Broadridge. The need for expertise in areas like data analytics, cloud computing, and regulatory compliance drives up recruitment and retention costs, directly impacting the company's operational expenditures.

Operating and maintaining Broadridge's vast data centers and IT infrastructure, including significant cloud service investments, is a substantial cost driver. These expenditures are crucial for ensuring the unwavering reliability and robust security of their platforms, which handle critical client data processing on a global scale.

Sales, Marketing, and Client Support Expenses

Broadridge's commitment to market presence and client satisfaction is reflected in its significant investment in sales, marketing, and client support. These costs are crucial for acquiring new customers and ensuring existing ones remain engaged and happy.

In fiscal year 2024, Broadridge reported operating expenses that encompass these vital functions. For instance, their selling, general, and administrative expenses, which include sales, marketing, and client support, are a substantial part of their cost structure, directly impacting their ability to grow and maintain their customer base.

- Sales Force Compensation: This includes salaries, commissions, and bonuses for the teams responsible for generating revenue and expanding market reach.

- Marketing Campaigns: Investments in advertising, digital marketing, content creation, and public relations to build brand awareness and attract potential clients.

- Industry Event Participation: Costs associated with exhibiting at and sponsoring key financial industry conferences and trade shows to network and showcase offerings.

- Client Support: Expenses for customer service teams, technical support, and account management to ensure client retention and foster long-term relationships.

Regulatory Compliance and Legal Costs

Broadridge navigates the complex financial services landscape, leading to substantial expenditures in regulatory compliance and legal matters. These costs are essential for maintaining operational integrity and adhering to evolving global standards.

In 2024, Broadridge's commitment to compliance is reflected in its significant investments in legal counsel and dedicated compliance teams. The company must stay abreast of regulations like the Securities and Exchange Commission (SEC) rules, FINRA requirements, and international data privacy laws such as GDPR. These efforts are critical to avoid penalties and maintain client trust.

- Legal Fees: Costs associated with external legal experts and internal legal departments handling regulatory interpretation and defense.

- Compliance Department Expenses: Salaries, training, and technology for staff ensuring adherence to all applicable laws and regulations.

- Reporting and Auditing: Expenditures for mandatory financial reporting, audits, and the systems needed to support them.

- Risk Management Tools: Investment in software and processes to monitor and mitigate compliance-related risks.

Broadridge's cost structure is significantly influenced by its substantial investments in technology and development, aiming to maintain a competitive edge. Personnel expenses, encompassing a large, skilled workforce, represent another major cost. Furthermore, the company incurs considerable expenses related to sales, marketing, and client support to drive growth and ensure customer satisfaction.

Operating and maintaining its extensive IT infrastructure, including data centers and cloud services, is a key cost. Compliance and legal expenditures are also substantial due to the highly regulated nature of the financial services industry.

| Cost Category | Description | Fiscal Year 2024 Impact (Illustrative) |

|---|---|---|

| Technology & Development | R&D for AI, blockchain, new solutions | Significant portion of operating expenses |

| Personnel Expenses | Salaries, benefits for tech, ops, support staff | $1.4 billion in SG&A (FY23) reflects workforce costs |

| Sales, Marketing & Client Support | Customer acquisition and retention efforts | Key component of SG&A, driving growth |

| Infrastructure | Data centers, IT maintenance, cloud services | Essential for platform reliability and security |

| Compliance & Legal | Adherence to regulations, legal counsel | Ongoing investment in legal and compliance teams |

Revenue Streams

A significant portion of Broadridge's income is generated through recurring subscriptions for its software and ongoing service contracts. This model creates a reliable and predictable revenue flow for the company. In fact, recurring revenues saw a healthy 7% increase during the third quarter of fiscal year 2025.

Broadridge generates revenue through transaction-based fees, charging for services like securities processing, trade confirmation, and proxy voting. These fees naturally fluctuate with the volume of market activity, impacting both their capital markets and wealth management segments. For instance, in fiscal year 2024, Broadridge reported that approximately 30% of its total revenue was directly tied to these volume-sensitive transaction fees.

Broadridge generates income from specific, time-bound activities like managing mutual fund shareholder communications and facilitating equity proxy voting processes. These revenues are inherently tied to market activity and corporate governance events, meaning they can fluctuate. For instance, the first nine months of fiscal year 2025 saw a notable 15% rise in these event-driven revenues, highlighting their sensitivity to and participation in active corporate environments.

Data and Analytics Sales

Broadridge leverages its extensive financial data to create a significant revenue stream through direct sales to clients. This data provides crucial market intelligence, enabling informed decision-making. In 2024, the demand for specialized financial data and analytics continued to surge, with firms seeking to gain a competitive edge through deep market insights.

This offering extends to data-driven fund solutions, allowing clients to access curated datasets and analytical tools tailored to investment strategies. Broadridge’s ability to aggregate and analyze vast amounts of financial information positions it as a key provider in this space.

- Data and Analytics Sales: Broadridge sells access to its comprehensive financial data and analytics, providing valuable market intelligence and supporting data-driven fund solutions.

- Market Intelligence: Clients utilize this data to understand market trends, identify opportunities, and refine their investment strategies, contributing to their performance.

- Revenue Generation: This segment represents a key revenue driver, capitalizing on the increasing reliance of financial institutions on robust data for operational efficiency and strategic planning.

Consulting and Professional Services Fees

Broadridge earns significant revenue from consulting and professional services fees. These fees are generated by assisting clients with the implementation, customization, and ongoing advisory aspects of Broadridge's technology solutions. This revenue is particularly strong for clients requiring complex integrations or highly tailored functionalities, ensuring they can maximize the value derived from Broadridge's platforms.

These services are crucial for clients navigating intricate financial processes or seeking to optimize their operational efficiency. Broadridge’s expertise helps clients adapt solutions to their unique business needs, fostering deeper client relationships and recurring revenue opportunities.

- Implementation Fees: Broadridge charges for the setup and deployment of its software and services, ensuring smooth integration into client systems.

- Customization Services: Revenue is generated by tailoring Broadridge's offerings to meet specific client requirements and workflows.

- Advisory and Consulting: Clients pay for expert guidance on leveraging Broadridge's solutions for strategic advantage and operational improvement.

Broadridge’s revenue streams are diverse, encompassing recurring subscriptions, transaction-based fees, event-driven services, data sales, and professional consulting. This multi-faceted approach ensures a stable financial foundation while capitalizing on market dynamics and client needs.

The company's reliance on recurring revenue, which grew 7% in Q3 FY2025, provides a predictable income base. Transaction fees, accounting for roughly 30% of FY2024 revenue, fluctuate with market activity, while event-driven revenues, up 15% in the first nine months of FY2025, reflect corporate actions.

| Revenue Stream | Description | FY2024/FY2025 Relevance |

| Recurring Subscriptions & Services | Ongoing fees for software and service contracts. | 7% increase in Q3 FY2025. |

| Transaction-Based Fees | Charges for processing, trade confirmation, proxy voting. | Approx. 30% of FY2024 revenue. |

| Event-Driven Services | Fees for specific activities like proxy voting and shareholder communications. | 15% rise in first nine months of FY2025. |

| Data & Analytics Sales | Revenue from selling financial data and market intelligence. | Growing demand for data-driven insights in 2024. |

| Consulting & Professional Services | Fees for implementation, customization, and advisory. | Strong for clients needing complex integrations. |

Business Model Canvas Data Sources

The Broadridge Financial Business Model Canvas is constructed using a blend of internal financial statements, client engagement data, and market intelligence reports. These sources provide a comprehensive view of our operational performance and strategic positioning.